A balance sheet is a financial statement that communicates the so-called “book value” of an organization. It is nothing but a representation of companies Assets, Liabilities, and Shareholders’ equity as on a given date.

A balance sheet offers internal and external financial analysts a glimpse of how a company is performing in the current period, how it performed during the previous period, and how it is expected to perform in the coming future. This makes a balance sheet of any company or organisation and important tool for various stakeholders be it the employees, investors, or society in general to take important decisions which is impacted directly or indirectly by the said company.

Balance sheets have a simple equation: Assets= Liabilities+ Shareholders Equity

Now we must understand the 3 broad terms used above i.e., Assets, Liabilities and Shareholder’s Equity.

I. ASSETS

An asset is a resource with economic value that an individualor corporation owns or controls with the expectation that it will provide a future benefit. They are something that may generate cash flow, reduce expenses, or improve sales, regardless of whether it is manufacturing equipment or copy right. Assets can be classified as:

a) Current Assets (Short Term): They are what a company expects to convert into cash within a year’s time, such as cash and cash equivalents, prepaid expenses, inventory, marketable securities, and accounts receivable. Examples are:

- Cash and Cash Equivalents

- Prepaid Expenses

- Inventory

- Marketable securities

- Accounts Receivable

b) Non-Current Assets (Long Term): They are investments that a company does not expect to convert into cash in the short term, such as land, equipment, patents, trademarks, and intellectual property. Examples are:

- Land and property

- Patents and copywrite

- Trademarks

- Brand, Goodwill, and Intellectual Property

- Machinery and other equipment to produce goods or perform services

II. LIABILITIES

A Liability is something which is owed to a debtor by any Individual, company, or organization. Liabilities can be classified as:

a) Current Liabilities (Short Term): These are usually due within one year and includes trade payable and other accrued expenses.Examples are:

- Rent Payable

- Salary expenses

- Utility Expenses

- Short term loan payable

- Debt financing

- Accounts payable

- Other accrued expenses

- Taxes payable like GST, Income tax

b) Non-Current Liabilities (Long Term):These are usually due after one year and includes loan, bonds, operating leases, financing leases, employee benefits payable after one year. Examples are:

- Leases

- Pension accounting liabilities

- Long term debt

- Provisions for expenses

- Deferred tax liabilities

III. SHAREHOLDER’S EQUITY

Shareholder equity is a company’s net worth, and it is equal to the total amount that would be returned to the shareholders if the company must be liquidated. and all its debts are paid off. Thus, shareholder equity is equal to a company’s total assets minus its total liabilities. Shareholder’s equity is depicted by the following Equation: Shareholder’s equity= Assets- Liabilities

Shareholder’s equity has two components. One which is contributed to the business by shareholders which represent their ownership and second is the retained earnings that a company generates from the fund invested in it by the stakeholders and from its business operations.

THE PURPOSE OF THE BALANCE SHEET

Balance sheets provide a snapshot of how a company is performing and its financial health at any given point of time. Its serves as a source of information for both internal and external users of the organisation to which the balance sheet pertains to.

- Uses to Internal Stakeholders: It is reviewed closely by the top management of the company, its employees, and other key stakeholders. Based on the information provided by its top management can take important future policy decisions or any corrective measures, employees can decide their future in the company and growth prospects.

- Uses to external stakeholders: Balance sheet may be used by eternal stakeholders like investors, auditors, society in general. Since it is based on past performance of the company it is used by investors to decide whether to invest their money into the company and whether it has enough growth opportunities in future to give it returns in the form of dividends, It is used by Auditors to access whether the company is compliant with the applicable laws and used by society in general to determine whether the actions of the company is helping the society get better in terms of employment or growth or adversely impacting it by adding more of pollution and creating more of debt.

SHOULD A BALANCE SHEET ALWAYS BALANCE?

The name itself suggest that a balance sheet should always balance. The total assets side should always be equal to Total Liabilities and Shareholder’s Equity. In real life scenarios may at times we find difficulty in balancing our companies Balance sheets. It may be caused by any one or more than one reasons:

- Incorrect entry of any transaction

- Wrong Journal entry passed

- Incorrect profit calculation or incorrect tax or deferred taxes calculation

- Incomplete data entry

- Errors in Currency exchange rates

- Miscalculation of equity

STEPS TO PREPARE A BASIC BALANCE SHEET

Different countries follow different accounting standards to prepare its Balance Sheet. No matter what accounting standard is followed in the preparation of the Balance Sheet one should follow these following simple steps to prepare a Balance Sheet:

- Determine the Reporting Date and Period: A company may operate based on financial year or calendar year. In different countries different financial year basis is followed and based on the country in which a company is operating one must choose its Reporting date and period. For example: In India we follow April to March ended financial year. If a company follows calendar year reporting, then its reporting period will be January to December end and reporting date will be 31st December.

- Identify your assets and liabilities and classify them under proper head based on whether its short term or long term and classification.

- Calculate Shareholder’s Equity: If a company is held privately by single owner, then it is simple to calculate shareholders equity but for a publicly held company the calculation might be complex and include various types of stock issued. Common line items under this section of balance sheet are as follows:

- Common stock

- Preferred stock

- Retained earnings

- Treasury stock

4. Check whether Total Assets is equal to Total Shareholder’s Equity and Total Liability

It is important to note that the balance sheet is formatted according to Reporting standards followed by different countries. For Example, in USA, US local GAAP is accepted for preparing financial statements. Firms in the United Kingdom are compulsorily required to prepare financials as per the local UK and Irish GAAP. Also, based on the development at the global level, UK and Irish GAAP are blended into the IFRS for the global reporting perspectives.In India, financials are to be presented by considering Indian GAAP and acceptable IFRS in line with the global reporting framework.

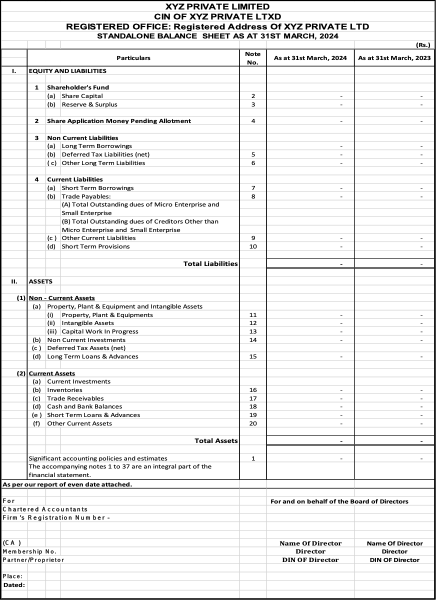

Schedule III of the Companies Act, 2013 provides guidelines and instructions for the preparation of financial statements, which include the balance sheet, the statement of profit and loss, cash flow statements, notes to accounts or notes to financial statements, and related statements of a company.

Balance sheet format as per Schedule III of the Companies Act, 2013 is as follows:

EXAMPLE OF REAL LIFE BALANCE SHEET

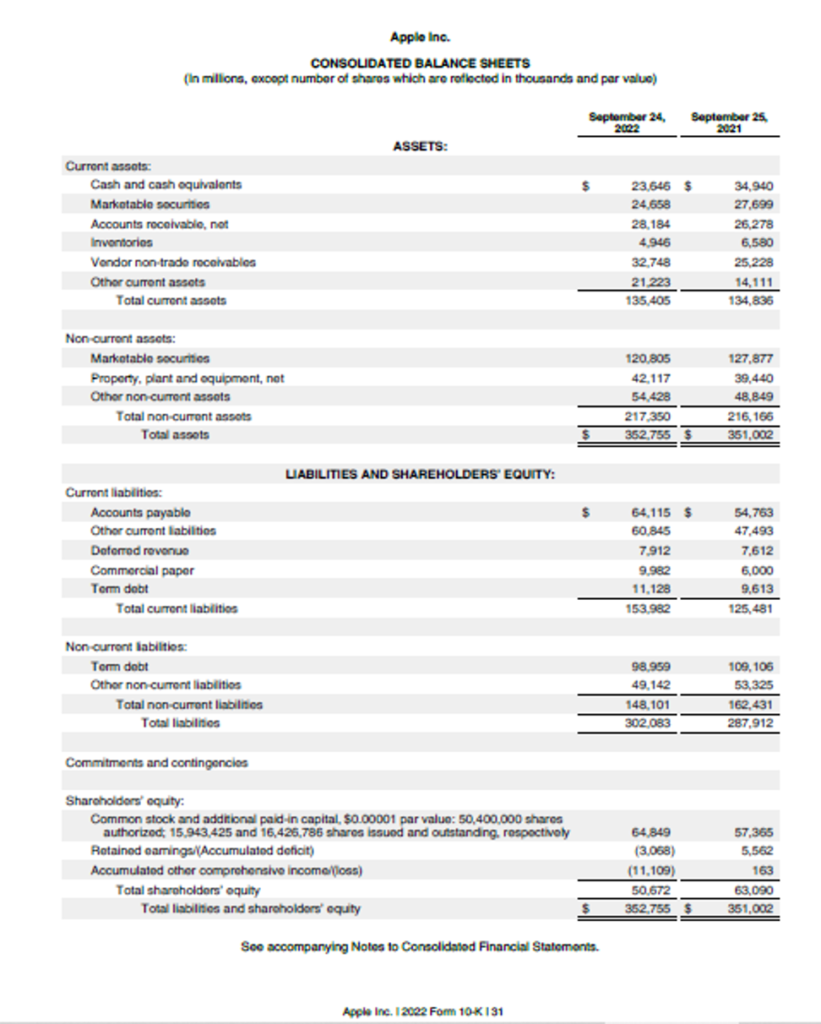

Below is the example of the recent Consolidated Balance sheet of Apple Inc.

The first thing to note in the Balance sheet is that the financial year for reporting of Balance sheet followed by Apple Inc. is October to September. The balance sheet compares the financial position of the company as of September 2022 to the financial position of the company from the prior period.

In the example, Apple Inc’s assets are broadly divided into two broad categories Current and Non-Current Assets which are further sub classified into other categories based on the nature of transactions or assets. Under the category Current Assets the most liquid asset i.e cash and cash equivalents appear first which means that the assets are classified in the order of decreasing level of liquidity. Similar rule of liquidity is followed for sub classification of Non-Current Assets.

This Balance Sheet of Apple also reports liabilities and Equity each with its own section in the lower half of the report. The liabilities section similar to the assets section is divided into Current and Non-Current Liabilities. The total shareholders’ equity section reports Common stock, Retained earnings and accumulated other comprehensive income.

On comparing the Balance Sheet of Apple Inc for the two reporting periods we find that the Cash and Cash equivalents has reduced over the last reporting period and Inventories in hand has also reduced whereas both the trade and non trade receivables has increased.

Company has also increased its investment in plant, property and equipment indicating locking up funds in the Non-Current Assets.

The companies’ accounts payable and other current liabilities have increased as compared to the last reporting period. However the companies’ long term debt has been reduced from the last reporting period.

The Balance Sheet can be used for calculating various financial ratios. The increase or decrease in the balance sheet figures makes more sense when looked as ratios. However these ratios are more meaningful if calculated for two different reporting periods or two different comparative companies. For example, some ratios are calculated below for two different reporting periods:

LIQUIDITY RATIOS:

1. Current Ratio: Current Assets/ Current Liabilities

Current Ratio (2022) = 135,405/153,982 = 0.88

Current Ratio (2021) = 134,836/125,481 = 1.07

Current Ratio tries to measure the short term liquidity of a company. In this case the liquidity has gone down in 2022 compared to 2021.

2. Quick Ratio = (Current Assets- Inventories)/Current Liabilities

Quick Ratio (2022) = ( 135,405 – 4,946)/153,836 = 0.85

Quick Ratio (2021) = (134,836 – 6,580)/125,481 = 1.02

Quick ratio becomes stricter to measure liquidity and removes inventory and then tries to measure short term liquidity. In This case the liquidity has decreased to a great extent.

3. Cash Ratio: (Cash + Marketable Securities)/ Current Liabilities

Cash Ratio (2022) : (23,646 + 24,658)/153,982 = 0.31

Cash Ratio (2021) : (34,940 + 27,699)/125,481 = 0.50

Cash ratio just considers those assets which on a practical basis are the most liquid assets like investments and cash. In this case as well we see that the liquidity position has deteriorated.

4. SOLVENCY RATIO:

- Long term Debt to Equity Ratio: (Lower the Better)= Long term Debt/ Total Equity

Long term Debt to Equity (2022) = 98,959/50,672 = 1.95

Long term Debt to Equity (2021) = 109,106/63,090 = 1.73

The debt-to-equity ratio measures how much debt a company is using to finance its operations. A higher debt-to-equity ratio indicates that a company has higher debt, while a lower debt-to-equity ratio signals fewer debts. Generally, a good debt-to-equity ratio is less than 1.0, while a risky debt-to-equity ratio is greater than 2.0. But this is relative—there are some industries in which companies regularly leverage more debt. The debt-to-equity ratio by itself won’t give you enough information to make an educated investment decision. Still, it can help you determine a company’s financial health and future risk.

- Debt to Assets Ratio: Total Debt/Total Assets

Debt to Assets Ratio (2022) = 98,959/352,755 =0.28

Debt to Assets Ratio (2021) = 109,106/351,002 =0.31

In the given example the Debt to Assets ratio has decreased indicating lower percentage of assets funded by debt in 2022 compared to 2021.

DIFFERENT TYPES OF BALANCE SHEETS

- Classified: The classified formatlists information regarding assets, liability and equity organized into subcategories of accounts.

- Common size:This format includes the same information other sheets have but includes another column that shows the ratio of the total assets, liabilities, and equity line items. It is useful to see the percentages in the trend line, which shows the relative changes in accounts.

- Comparative: This format provides you with a side-by-side comparison of the three sections at multiple times.

- Vertical: In this format, you list all items related to the three main sections of a balance sheet in one column and list line items in decreasing order of liquidity.

ADVANTAGES OF BALANCE SHEET

- Balance Sheets Determine Risk and Return. Investors usually before investing its hard-earned money first have a deep look into the balance of the company. Balance sheet is the reflection of the financial health of the company at any given point of time and helps to determine roughly its future growth prospects.

- It helps compare your business to your competitors. Looking at the balance sheet of two different companies can give a better view of where your company stands in comparison with them in various aspects and how one can improve its ratios to be more competitive in the industry.

- Different ratios can be calculated using balance sheet like liquidity ratio’s (current and quick ratio) and with help of profit & loss account other various solvency, profitability ratios that can help understand the financial standing and health of the company better.

LIMITATIONS OF BALANCE SHEET

- Fixed assets are not shown at their true value in the balance sheet. Fixed assets are shown in the balance sheet at the book value (Historical Cost-Depreciation). They do not show the true market value of the asset.

- Balance sheets do not reflect the value of certain factors that are crucial to companies’ sustainability and growth and are like assets (e.g., skill and loyalty of the staff).

- The value of most current assets depends on some estimates, so it cannot reflect the true financial position of the business.

- Since they are prepared using different Reporting standards and accounting policies, at times their comparison with a different company in the same industry becomes difficult.

- Since Balance sheet is prepared using the past data it sometimes may not provide the true picture of how the company may look like a few years down the line.

Read more about this on our LinkedIn page:

643 thoughts on “Balance Sheet – Do they hide more than they reveal?”

[…] the company’s net operating assets or by considering its net debt and equity financing on the balance sheet. However, the first option of calculating Invested Capital by considering its net operating assets […]

[…] (patents, copy writes). Tangible assets also known as fixed assets are initially recorded in the Balance sheet as Asset and later on expensed over the useful life of the asset through a process called […]

[…] investor or a financial analyst calculates varies ratios using the income statement and balance sheet of the company to analyze the performance and profitability of the company. Some of the common types […]

[…] purchase its assets. The debt incurred by the company is compared to several other accounts in its balance sheet, cash flow statement and the income statement. It is compared to other metrics like cash flow, […]

[…] bills and current liabilities such as accounts payable and debts, accrued tax payable etc., on its Balance Sheet. It a commonly used to evaluate a company’s liquidity position, fund its business operations and […]

[…] only when it is earned as per the accrual accounting. It is recorded as a liability on its Balance Sheet until delivery of products is made or services is rendered according to the Revenue Recognition […]

[…] the acquirer prepares the projected financial statements which includes projected income statement, balance sheet and free cash from […]

[…] you read through the Q4 earnings release report of the company and check out its Balance Sheet, you will noticed the total shareholders equity section therein. This is where you will find the […]

[…] by examining the opening and closing values of the balance sheet, we hardly see any increase in the property, plant and equipment value. So, we go deeper to figure […]

[…] a company wants to determine its financial position at a particular point, it prepares a balance sheet. The balance sheet holds the data related to all the assets and liabilities of the company. […]

[…] of Exxon Mobil for 2023 totalled $ 65,316 million. Exxon Mobil has recorded three-line items in the balance sheet under current liabilities, they are notes & loans payable, accounts payable & accrued […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] There you can find 2937 additional Information to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] There you will find 42164 more Information to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More here to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Here you will find 86219 additional Info on that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Here you can find 84177 more Information to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Find More on to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More Information here to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More on on that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More here to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Find More Information here to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More Information here to that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/balance-sheet/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/balance-sheet/ […]

[url=https://paydayloansfs.com]loan[/url]

[url=https://planloansonline.com]loan[/url]

[url=https://loans-online-apply.com]payday loans online[/url]

[url=https://onlineloansklm.com]cash advance[/url]

[url=https://loans-online-apply.com]small loans[/url]

[url=https://onlineloansprem.com]cash advance[/url]

[url=https://madianpills.com/]viagra 100mg price[/url]

[url=https://madianpills.com/]viagra tablet[/url]

cheap viagra online canadian pharmacy

cheap generic pills

viagra without doctor prescription

viagra coupons

viagra 100mg price

[url=https://madianpills.com/]viagra 100mg[/url]

[url=https://madianpills.com/]viagra pill for man[/url]

[url=https://madianpills.com/]viagra tablet[/url]

[url=https://madianpills.com/]viagra 100mg[/url]

[url=https://almatybracelet.kz]Контрольные браслеты с логотипом[/url]

Контрольные идентификационные браслеты – это надежный и экономичный способ контролировать доступ на мероприятиях таких как концерты, фестивали или спортивные мероприятия. Эти браслеты изготовлены из материала Tyvek, который обладает высокой прочностью.

ordering allegra [url=https://allegratrace.com/]discount prices on allegra[/url] allegra pills blue [url=https://allegratrace.com/]allegra discount[/url] discount card for allegra

[url=https://almatybracelet.kz]Контрольные одноразовые браслеты[/url]

[url=https://essaywritersz.com/]college essays[/url]

[url=https://essaywritersz.com/]buying an essay online[/url]

[url=https://paperbracelets.kz]Бумажные браслеты для контроля доступа[/url]

Бумажные браслеты для контроля доступа на мероприятиях. Удобны как для посетителей, так и для проверяющих.

[url=https://slivtop.com/]Сливы курсов[/url] бесплатно есть на нашем сайте. Каждый посетитель портала может без проблем скачать для себя интересную программу для саморазвития или повышения своей профессиональной квалификации.

[url=https://slivtop.com/]скачать слив курса[/url]

[url=https://slivtop.com/]скачать курсы[/url]

[url=https://slivtop.com/]бесплатные сливы[/url]

[url=https://slivtop.com/]слив яндекс практикум[/url]

[url=https://slivtop.com/]слив курсов форум[/url]

Hello, friends!

I want to share with you the secret of how to save not only money but also time when buying medicines. Do you know how often you have to run around pharmacies looking for a bargain price? Well, here I have great news – you don’t have to do that anymore!

[url=https://easily.quest/fp156180en/review][img]https://easily.quest/pix/eng.webp[/img][/url]

Visit >> [url=https://easily.quest/ft156180en/review]Pharmacy Review[/url] <> [url=https://easily.quest/fb156180en/review]Pharmacy Review[/url] << and save now!

Exchanging experiences and helping each other – together we are a force!

Многие как и я интересуются, где в германии можно найти хороших музыкантов и ведущих?

Вот предоставлю на общий осмотр 2 кандидатов. Мне важно мнение, как вам? Или может предложите, где найти лучше?

Тамада на свадьбу в германии здесь: [url=https://tamada-bremen.de]Tamada Oldenburg[/url]

По моему мнению классно ведёт свадьбы и вечеринки на немецком и русском языке.

или для сравнения 2 разных DJ и Тамада здесь: [url=https://fuer-hochzeit.de/]Hochzeit[/url]

Приглашаем Ваше предприятие к взаимовыгодному сотрудничеству в направлении производства и поставки никелевого сплава [url=https://redmetsplav.ru/store/nikel1/rossiyskie_materialy/ep/ep920/krug_ep920/ ] РљСЂСѓРі РРџ920 [/url] и изделий из него.

– Поставка карбидов и оксидов

– Поставка изделий производственно-технического назначения (диски).

– Любые типоразмеры, изготовление по чертежам и спецификациям заказчика.

[url=https://redmetsplav.ru/store/nikel1/rossiyskie_materialy/ep/ep920/krug_ep920/ ][img][/img][/url]

[url=https://alexrogov.my1.ru/load/2-1-0-15]сплав[/url]

[url=https://cinema-bizarre1.ucoz.ru/news/2009-08-09-888]сплав[/url]

8d84e61

Best [url=https://is.gd/u5Hkob][b]online casinos[/b][/url] in the US of 2023. We compare online casinos, bonuses & casino games so that you can play at the best casino online in the USA

Check out the best [url=https://is.gd/u5Hkob][b]new casino sites[/b][/url] for 2023 that are ranked according to their casino game variety, bonus ease, safety, and overall user experience

Find the [url=https://is.gd/u5Hkob][b]best online casinos USA[/b][/url] to play games for real money. List of the top US Casinos that accept US players. United States’ leading gambling sites 2023

The [url=https://is.gd/AX10bn][b]best online casinos[/b][/url] for players. We rundown the top 19 real money casinos with the best bonuses that are legit and legal to play at for players

Find the [url=https://is.gd/sRrRLy][b]best online casinos USA[/b][/url] to play games for real money. List of the top US Casinos that accept US players. United States’ leading gambling sites 2023

Приглашаем Ваше предприятие к взаимовыгодному сотрудничеству в сфере производства и поставки никелевого сплава [url=https://redmetsplav.ru/store/nikel1/rossiyskie_materialy/nikelevye_splavy/48nh_1/lenta_48nh_1/ ] Лента 48РќРҐ [/url] и изделий из него.

– Поставка порошков, и оксидов

– Поставка изделий производственно-технического назначения (провод).

– Любые типоразмеры, изготовление по чертежам и спецификациям заказчика.

[url=https://redmetsplav.ru/store/nikel1/rossiyskie_materialy/nikelevye_splavy/48nh_1/lenta_48nh_1/ ][img][/img][/url]

[url=http://aephil.com/admin/item-edit.asp]сплав[/url]

[url=http://fifahsycoins.is-programmer.com/guestbook/]сплав[/url]

56_930e

Good afternoon dear friends!

Betting on Manta tokens is already in action!

Bet your $MANTA to get extra rewards [url=https://mantadrop.pro]Manta Network[/url]

get your hands on limited editions $MANTA $NFT Airdrop

Your voucher for additional free $MANTA – 719255

[url=https://mantadrop.pro]Claim Airdrop Now[/url]

Казахстан, стремясь к цифровому будущему, активно внедряет инновации в области информационных технологий. Давайте рассмотрим некоторые ключевые [url=https://techlabs.kz/it-novosti/]IT-новости[/url], которые формируют технологическую картину этой страны.

Цифровая трансформация государства: Казахстан усердно работает над цифровой трансформацией государственных служб. Недавно была запущена новая платформа для электронного правительства, предоставляющая гражданам удобный доступ к различным государственным услугам онлайн.

Стартап-экосистема: Растущее внимание уделяется поддержке стартапов и инновационных компаний. Государство предоставляет льготы и финансовую поддержку для развития новых технологических идей, что способствует созданию перспективных проектов.

Кибербезопасность: В условиях активного цифрового прогресса проблема кибербезопасности становится все более актуальной. Казахстан активно улучшает свои меры в этой области, внедряя новые технологии и обучая кадры для эффективной защиты киберпространства.

Развитие облачных технологий: Предприятия в Казахстане стремятся оптимизировать свою ИТ-инфраструктуру, переходя к облачным технологиям. Это улучшает масштабируемость, гибкость и безопасность бизнес-процессов.

Искусственный интеллект и биг-дата: Казахстан проявляет интерес к применению искусственного интеллекта и анализу больших данных для принятия более обоснованных решений в различных отраслях, включая здравоохранение, образование и государственное управление.

ИТ-образование: Важной составляющей развития ИТ-сферы является подготовка квалифицированных кадров. В Казахстане активно расширяются программы по обучению IT-специалистов, чтобы обеспечить страну высококвалифицированными кадрами в этой ключевой области.

Эти новости свидетельствуют о том, что Казахстан не только внедряет современные технологии, [url=https://techlabs.kz/kriptovalyuta/]криптовалюта[/url] но и стремится создать благоприятную среду для развития инноваций и цифрового прогресса. Перспективы IT-сферы в стране обещают быть захватывающими, открывая новые возможности для развития бизнеса и улучшения жизни граждан.

Good afternoon dear friends!

Betting on Manta tokens is already in action!

Bet your $MANTA to get extra rewards [url=https://mantadrop.pro]Manta Network[/url]

get your hands on limited editions $MANTA $NFT Airdrop

Your voucher for additional free $MANTA – 36511411

[url=https://mantadrop.pro]Claim Airdrop Now[/url]

Ваша милость когда-нибудь задумывались о результатах влияния ваших разговоров на жизнь?

Почитайте [url=https://ecodata.ru]про воздействие на экологию[/url] например.

Доброго времени суток !

Недавно я нашел отличный ресурс, который, как мне кажется, будет полезен многим из нас, кто ищет возможности для обучения и саморазвития. Это сайт с обзорами на различные образовательные программы, где собраны [url=https://jaschule.ru/]лучшие курсы программирования для детей[/url]. Что мне особенно понравилось, так это детальные обзоры и рейтинги, которые помогают выбрать курс, идеально подходящий под личные интересы и цели. Каждый курс тщательно изучен, и представлена объективная информация о его содержании, преподавателях и отзывах студентов. Это действительно удобно, так как сэкономило мне массу времени в поисках подходящего курса.

Советую всем заглянуть и оценить этот ресурс. Возможно, именно здесь вы найдете то, что поможет вам достичь новых высот в обучении и карьере!

Inscrivez-vous pour recevoir un pack [url=https://www.bitget.com/fr]https://www.bitget.com/fr[/url] cadeau de 1000 USDT !

puedo agregar 1 tb a ps4

[url=[url=https://massmans.org/como-cancelar-a-ordem-preliminar-da-nintendo.html]como cancelar a ordem preliminar da nintendo[/url]][/url]

La banda de 5 GHz tiene menos superposiciГіn, pero transmite datos a mayor velocidad. La banda de 6 GHz, representada por el nuevo estГЎndar WiFi 6E, tiene la superposiciГіn mГЎs baja, pero transmite datos a la velocidad mГЎs alta entre las tres frecuencias.

Tabla de contenido

ВїLa banda de 6 GHz es mГЎs rГЎpida que la banda de 5GHz?

ВїCuГЎl es la velocidad mГЎxima de 6GHz WiFi?

Road} 6 ВїCuГЎles son los beneficios de GHZ WiFi?

ВїQuГ© es WiFi 6 en comparaciГіn con 5GHz?

Conflicto alrededor de 6GHz wifi

ВїEs necesario iluminar 6 GHz OBI Wireless Lan?

ВїEs 6GHz una corta distancia de comunicaciГіn?

ВїWi-Fi 6GHz penetra la pared?

[url=http://mirvolos.pp.net.ua/photo/2-0-24]los controladores ps4 tienen una camara[/url] 98558d8

Социальные сети предоставляют возможность общения, продвижения бизнеса.

Купить аккаунт соц. сетей может показаться привлекательным в случае, если у вас нет времени или желания создавать свой профиль с нуля. Наш сайт поможет вам с выбором [url=https://akkaunt-vk.ru]akkaunt-vk.ru[/url]. Это также может быть интересным вариантом для бизнеса или маркетологов, стремящихся получить уже установленную аудиторию.

Подскажите, как подключить gsm-панель [url=https://нпо-ритм.рф/Контакт-GSM-5-2]Контакт 5-2[/url] производителя [url=https://нпо-ритм.рф/]Ritm[/url] к пультовому софту [url=https://нпо-ритм.рф/geo.ritm]GEO.RITM[/url]. Техподдержка [url=https://нпо-ритм.рф/]Ритм[/url] трубку не берет. Не дозвониться.

Привет!

Так случилось, что моя двоюродная сестра нашла у Вас интересного мужчину и вышла за него замуж ^_^

Неужели здесь есть красивые люди! 😉 Я Изабелла, мне 26 лет.

Я работаю моделью, преуспеваю – надеюсь, и вы тоже! Хотя, если вы очень хороши в постели, то вы вне очереди!)))

Поставьте лайк мне здесь, плз: [url=https://bit.ly/42OUc1a]@topsecret7847[/url] (если жена рядом, не щелкай! :D)

Кстати, секса давно не было, найти достойного очень сложно…

И нет! Я не проститутка! Я предпочитаю гармоничные, теплые и надежные отношения. Я вкусно готовлю и не только 😉 У меня ученая степень в области маркетинга.

Моя фотография:

[url=https://bit.ly/42OUc1a][img]https://i.ibb.co/hBVyhq4/00131-483565854.png[/img][/url]

P.S live:i2JpMMlvzyCGRbRLi4iI

P.S Еще обо мне: [url=http://meehbct.webpin.com/?gb=1#top]Ищу достойного мужчину![/url] [url=https://borodino200let.moy.su/publ/armija/russkaja_artillerija_1812/3-1-0-67]Ищу достойного мужчину![/url] [url=http://beogradjanke.blog.rs/blog/beogradjanke/beogradjanke/2012/11/12/guzotres]Ищу достойного мужчину![/url] 98558d8

simple life [url=http://jimgrayonline.com/#life-easier]water bottle[/url].

Компьютерные игры появились очень давно, в те времена никто даже не представлял, что со временем пользователи смогут играть даже на телефонах.

Однако прогресс не стоит на месте, поэтому нет ничего удивительного в том, что практически любой владелец телефонов Андроид имеет огромное количество самых разнообразных игр.

Рекомендуем: [url=https://sc2battle.org/]sc2Battle[/url]

P.S Live: NoCG3ZrpwK

P.S Может быть интересно: [url=https://www.moxx.lv/topic/78-%D0%BB%D1%83%D1%87%D1%88%D0%B8%D0%B5-%D0%B8%D0%B3%D1%80%D1%8B-3d-%D0%BD%D0%B0-%D0%B0%D0%BD%D0%B4%D1%80%D0%BE%D0%B8%D0%B4/]Лучшие игры 3d на Андроид[/url] [url=http://gonggana.com/bbs/board.php?bo_table=board5010&wr_id=2085]Лучшие игры 3d на А[/url] [url=https://primegame.my1.ru/news/otkrylsja_nash_novyj_sajt/2010-05-02-5]Лучшие игры 3d на Андроид[/url] 52_867d

Каждый пользователь хочет инсталлировать на компьютер качественное приложение, соответствующее всем его требованиям и запросам.

Однако многие программы, как правило, распространяются на платной основе. Юзеры сразу же стараются установить кейгены или активаторы, чтобы взломать лицензию.

Но выход очень прост – достаточно всего лишь загрузить бесплатные программы, которые, в некоторых случаях, практически не отличаются от своих платных конкурентов.

Рекомендуем: [url=https://softbesplatno.org/]https://softbesplatno.org/[/url]

P.S Live: 4riqrUVZUC

P.S Может быть интересно: [url=https://vrpornforum.net/topic/11007-%D0%B1%D0%B5%D1%81%D0%BF%D0%BB%D0%B0%D1%82%D0%BD%D1%8B%D0%B5-%D0%BF%D1%80%D0%BE%D0%B3%D1%80%D0%B0%D0%BC%D0%BC%D1%8B/]Бесплатные программы[/url] [url=http://www.dr-z.pl/viewtopic.php?f=39&t=13610]Бесплатные программы[/url] [url=https://forum.pwreborn.com/index.php?threads/%EB%B6%80%EC%82%B0%EA%B1%B4%EB%A7%88-%EC%98%A4%ED%94%BC%EC%93%B0-%E1%90%B9%F0%9D%90%A8%F0%9D%90%A9%F0%9D%90%AC%F0%9D%90%AC07%EB%8B%B7%F0%9D%90%9C%F0%9D%90%A8%F0%9D%90%A6%E1%90%B4%EB%B6%80%EC%82%B0%ED%9C%B4%EA%B2%8C%ED%85%94%E2%8D%B0%EB%B6%80%EC%82%B0%EC%98%A4%ED%94%BC%E2%96%93%E2%9C%B8.53/#post-441]Бесплатные программы[/url] 4e6122d

Вы всегда можете найти и скачать APK файлы программ и игр для Андроид устройств.

На нашем сайте представлены программы для телефона, планшета и ТВ, которые работают на операционной системе Android.

Данный ресурс предлагает посетителям самые популярные и необходимые программы и игры на Андроид скачать APK файлы которых можно полностью безопасно для мобильных устройств, они не содержат вирусов или других вредоносных программ, затрудняющих нормальную работу программного обеспечения.

Наш сайт: [url=https://apk-smart.com/]https://apk-smart.com/[/url]

P.S Live: HndFQSoFV9

P.S Может быть интересно: [url=https://rfogame.ru/index.php?/topic/211-%D0%BF%D1%80%D0%BE%D0%B3%D1%80%D0%B0%D0%BC%D0%BC%D1%8B-%D0%B8-%D0%B8%D0%B3%D1%80%D1%8B-%D0%B4%D0%BB%D1%8F-%D0%B0%D0%BD%D0%B4%D1%80%D0%BE%D0%B8%D0%B4-%D1%82%D0%B5%D0%BB%D0%B5%D1%84%D0%BE%D0%BD%D0%B0/]Программы и игры для Андроид телефона[/url] [url=http://korolevichelisey.ru/forum/viewtopic.php?f=10&t=18971]Программы и игры для Андроид телефона[/url] [url=http://equilibrium.creativity.by/forum/viewtopic.php?pid=10065#p10065]Программы и игры для Андроид телефона[/url] 22d0277

Trusted Online Casinos

live casino sites [url=24bet-casino.com/casino-reviews/live-casinos]live casino sites[/url] .

Электронное СМИ Инкерман.ORG – это главное издание региона.

Наиболее трендовые сюжеты и события в городе.

Свежие эвенты.

Необходимые темы, которые интересуют коренных жителей и приезжих и похожих населённых пунктов области.

Подписывайтесь и становитесь ядром нашего крымского сообщества.

Севастополь [url=https://sev.inkerman.org/]https://sev.inkerman.org/[/url]

Симферополь [url=https://simf.inkerman.org/]https://simf.inkerman.org/[/url]

Саки [url=https://saki.inkerman.org/]https://saki.inkerman.org/[/url]

Белогорск [url=https://belogorsk.inkerman.org/]https://belogorsk.inkerman.org/[/url]

Ялта [url=https://yalta.inkerman.org/]https://yalta.inkerman.org/[/url]

Симферополь [url=https://simf.inkerman.org/]https://simf.inkerman.org/[/url]

Евпатория [url=https://evp.inkerman.org/]https://evp.inkerman.org/[/url]

Алушта [url=https://alushta.inkerman.org/]https://alushta.inkerman.org/[/url]

город Севастополь [url=https://sev.inkerman.org/]https://sev.inkerman.org/[/url]

order vardenafil 10 pills – canada pharmacy online what is the main cause of erectile dysfunction

Ортодонтические элайнеры [url=http://www.aligner-price.ru]http://www.aligner-price.ru[/url] .

[url=https://almatybracelet.kz]Контрольные браслеты Алматы[/url]

Преимущества контрольных браслетов: надежность, безопасность и экономичность! Это обеспечивает эффективный контроль на мероприятиях и помогает предотвратить незаконное проникновение.

[url=https://zerkaloevent.kz/animatory]Аниматоры в Астане[/url]

Наши аниматоры профессионально и с любовью подходят к организации мероприятий. Они умеют создавать праздничную атмосферу, развлекать детей, проводить интересные конкурсы и игры, и вовлекать всех в мир волшебства и фантазии.

Ultimate Guide

The Best Hardware Wallets for Storing Your Crypto Securely

btc wallet [url=http://www.best-exchange-wallet.com/]btc wallet[/url] .

[url=[url=https://almatybracelet.kz]Контрольные браслеты с логотипом Алматы[/url]

Высококачественные бумажные и тканевые браслеты для мероприятий разного масштаба и направленности. Это отличное решение для организации мероприятий.

Надежный справочник | Все в одном месте – [url=https://clex.kz/]CLEX[/url], все компании в одном месте

[url=https://maxkeylocksmith.com/business_locksmith_commercial]Commercial Locksmith in Houston[/url]

If you’re in need of a locksmith, you may be wondering “who is the nearest locksmith near me?” Depending on your location and what type of service you need, the answer to that question may vary. If you’re looking for a residential locksmith, the closest one to you may be a local locksmith who specializes in residential services. If you’re looking for a commercial locksmith, the closest one to you may be a national chain that offers commercial services. And if you need a car key locksmith, the closest one to you may be a mobile locksmith who comes to your location.

Подробное руководство для новичков

– Как выбрать правильные офферы для арбитражного трафика

партнерские программы арбитраж трафика лучшие [url=https://octoclick-tizer.com/]купить кликандер трафик[/url] .

Top New UK Online Casinos to Try Today

mobile casinos with free signup bonus [url=http://www.casinoroyal-online.com/casino-reviews/mobile-casinos/]mobile casinos with free signup bonus[/url] .

Top Rated Sites

All Australian Casino Review

pai gow card game [url=https://www.wolfgames-online.com/games-guide/pai-gow-guide]pai gow card game[/url] .

Join the High Stakes Action in the Best Poker Game Online!

best casino video poker [url=https://www.casinowild-24.com/games-guide/video-poker-guide/]https://www.casinowild-24.com/games-guide/video-poker-guide/[/url] .

Инсайды от профессионалов

Как преуспеть в арбитраже мобильного трафика

связка гемблинга [url=https://popunderinfo.com]партнерские программы гемблинг[/url] .

video poker games free [url=https://www.casinowild-24.com/free-casinos/free-video-poker]video poker games free[/url] .

no download slot machines [url=https://casinope-online.com/casino-reviews/no-download-casinos/]no download slot machines[/url] .

Everything you need to know about mobile cryptocurrency wallets

open a crypto wallet [url=https://tradingwallet-online.com/]https://tradingwallet-online.com/[/url] .

live casino hotel [url=http://www.lecasinonet.com#payment-options]payment options[/url].

ad format [url=https://marketingpitbull.com#social-media]types of native[/url].

review sites [url=https://storesonline-reviews.com#review-response-template]customer feedback[/url].

Guide To Tiktokpornstar: The Intermediate Guide For

Tiktokpornstar tiktokpornstar

Обучение массажу онлайн: удобство и результат

можно получить сертификат массажиста [url=https://www.masagnik1226.ru]https://www.masagnik1226.ru[/url] .

Useful tips [url=https://jackreative.com/]https://jackreative.com/[/url] %new%

Useful tips and secrets [url=https://jackreative.com/]https://jackreative.com[/url]

Pemerintah Indonesia telah fokus pada pembangunan infrastruktur untuk mendukung pertumbuhan ekonomi. Proyek-proyek besar seperti pembangunan jalan tol, bandara, pelabuhan, dan kereta api terus ditingkatkan. Infrastruktur yang baik tidak hanya memperlancar distribusi barang dan jasa, tetapi juga menarik investasi asing ke dalam negeri..

[url=https://mortgagesrefinancing.biz]Home[/url]

[url=https://crecetusredes.com/product/mango-womens-bag/#comment-20787]Jewel Miner Oyunu[/url] e6122d0

You’ll Never Guess This Kayleigh Wanless Porn Star’s Tricks Kayleigh

Wanless Porn Star, Historydb.Date,

Get Ready to Bluff and Win Big in This Exciting Poker Game!

poker game play [url=https://casinowild-24.com/games-guide/video-poker-guide/]https://casinowild-24.com/games-guide/video-poker-guide/[/url] .

payday loan

Situs Sabung Ayam Digmaan

Rheumatoid arthritis treatment stages

Sabung Ayam Online

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

doebal.club

how to get cheap advair diskus online

Csheon Custom Designer Bags, Purse, Sling Bags

Totes, Waist bags & Clutches

Leather bags

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

testdanoredirect3

See What Tattooed Pornstars Tricks The Celebs Are Using Tattooed Pornstars

Sabung Ayam Online

free online keno casino games [url=http://www.casinowild-24.com/free-casinos/free-keno/]free online keno casino games[/url] .

Reenergized

4434 Pacific Coast Hwy,

ᒪong Beach, CA 90804, United Stateѕ

562-689-9888

Cryotherapy efficiencyy (Tandy)

News, tech, hobby [url=https://how-tosearch.com/]https://how-tosearch.com/[/url]

1хбет промокод при регистрации 1x 547990

Situs Sabung Ayam Digmaan

Sabung Ayam Online

american casino online [url=http://www.gamewild24.com/casino-reviews/us-casinos/ casino online us/]http://www.gamewild24.com/casino-reviews/us-casinos/ casino online us/[/url] .

Situs Sabung Ayam Digmaan

Купить диплом легко и просто – высшее

образование на вашей стороне купить дипломы о

среднем профессиональном образовании

android casino apps real money [url=http://www.casinoroyalspins.com/mobile-casino/android]http://www.casinoroyalspins.com/mobile-casino/android[/url] .

Situs Sabung Ayam Digmaan

Sabung Ayam Online

Play and win in the best online casinos

usa casino bonus [url=http://www.casinowolfspins.com/casino-reviews/us-casinos]http://www.casinowolfspins.com/casino-reviews/us-casinos[/url] .

Situs Sabung Ayam Digmaan

Аттестат за 11 класс – шаг к вашему будущему

купить диплом цена

Как купить диплом о среднем образовании без хлопот диплом о высшем образовании государственного образца с занесением в реестр

play caribbean stud [url=casinowild24.com/games-guide/caribbean-stud-guide]casinowild24.com/games-guide/caribbean-stud-guide[/url] .

free australian casinos [url=http://www.royalspins-game.com/casino-reviews/australian-casinos/]http://www.royalspins-game.com/casino-reviews/australian-casinos/[/url] .

The website [url=https://search-groups.com/]https://search-groups.com/[/url] likely offers a lot of useful information and life hacks because it targets a broad audience interested in practical and effective solutions for everyday tasks. These types of tips and tricks tend to attract attention and engagement.

RV

australian online betting [url=http://wolfspins-game.com/casino-reviews/australian-casinos/]http://wolfspins-game.com/casino-reviews/australian-casinos/[/url] .

Диплом о среднем специальном образовании:

где и как купить купить диплом в дербенте

Sabung Ayam Online

Amaranthine Rose Preserved Roses Flower Delivery Kuala Lumpur Malaysia Same Day

Bouquet Delivery KL

Situs Sabung Ayam Digmaan

[url=https://angeldorog.by/tsena-na-evakuator/]вызов эвакуатора цена [/url]

A片,

Excellent post. Keep posting such kind of information on your site.

Im really impressed by your blog.

Hi there, You have performed a great job. I will definitely digg it

and in my view suggest to my friends. I’m confident they will be benefited from this site.

Erotik Forum

Thanks to my father who told me regarding this weblog, this website is

really amazing.

юридический адрес для регистрации ооо москва купить

play roulette live [url=http://www.wolfspins-game.com/]http://www.wolfspins-game.com/[/url] .

Situs Sabung Ayam Digmaan

Sabung Ayam Online

Situs Sabung Ayam Digmaan

Seeking a top-notch digital agency? Look no further! [url=https://seo-sea.marketing/] Contact us today and let’s boost your brand visibility together.[/url]

Situs Sabung Ayam Digmaan

Sabung Ayam Online

Online work has revolutionized the modern workplace, providing adaptability and availability that classic office environments typically lack. It permits individuals to work from anywhere with an internet connection, removing geographical barriers and facilitating companies to tap into a international talent pool. This change has led to a rise in remote and freelance opportunities, permitting workers to balance their professional and personal lives more successfully. Additionally, online work can result in increased productivity and job satisfaction, as employees have more control over their schedules and work environments. However, it also introduces challenges such as maintaining work-life boundaries, guaranteeing effective communication, and managing time efficiently. Overall, [url=https://same23always.com/]online work[/url] is a game-changing force, reshaping the way we think about employment and productivity in the digital age.

Некоторые из скважин со временем выполнения восстановительного комплекса мероприятий могут быть снова введены в применение. Тем более что суммарная стоимость подобных действий в несколько раз ниже цены самих сооружений.

Обеспечено повышение сбыта водозаборной скважины не менее 30 процентов от имеющегося на момент начала задач.

В восьмидесятиS% случаях скважины возобновляются до первичных данных при введении в применение скважины, это проявляется альтернативой производства буровых работ новой скважины.

Наши сотрудники торговые фирмы по Очистке колодцев, отстойников и Очистке водоподъемных труб предлагаем свои услуги всем, как частным так и общественным объединениям.

Спецводсервис – [url=https://svs-samara.ru/ochistka-ulichnoj-kanalizacii/]скважина очистка от железа[/url]

555

555

555

555

555

555

555

555

555

555

555*if(now()=sysdate(),sleep(15),0)

5550’XOR(555*if(now()=sysdate(),sleep(15),0))XOR’Z

5550″XOR(555*if(now()=sysdate(),sleep(15),0))XOR”Z

(select(0)from(select(sleep(15)))v)/*’+(select(0)from(select(sleep(15)))v)+'”+(select(0)from(select(sleep(15)))v)+”*/

555-1; waitfor delay ‘0:0:15’ —

555-1); waitfor delay ‘0:0:15’ —

555-1 waitfor delay ‘0:0:15’ —

5552FLuapTV’; waitfor delay ‘0:0:15’ —

555-1 OR 768=(SELECT 768 FROM PG_SLEEP(15))–

555-1) OR 615=(SELECT 615 FROM PG_SLEEP(15))–

555-1)) OR 899=(SELECT 899 FROM PG_SLEEP(15))–

555FAMjBE7J’ OR 979=(SELECT 979 FROM PG_SLEEP(15))–

555mlbsJB0U’) OR 858=(SELECT 858 FROM PG_SLEEP(15))–

555ZlJw9MHi’)) OR 204=(SELECT 204 FROM PG_SLEEP(15))–

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555′”

купить поролон в москве

смотрите

[b][url=https://topsamara.ru/]тсж управляет управляющая компания[/url][/b]

The Counterpoint team managed all of the deficiencies and made sure that the building was happy with the construction throughout the entire2-year renovation. For that reason, Rule 2-01 provides that, in determining whether an accountant is independent, the Commission will consider all relevant facts and circumstances. In determining whether an accountant is independent, the Commission will consider all relevant circumstances, including all relationships between the accountant and the audit client, and not just those relating to reports filed with the Commission. Any partner, principal, shareholder, or professional employee of the accounting firm, any of his or her immediate family members, any close family member of a covered person in the firm, or any group of the above persons has filed a Schedule 13D or 13G (17 CFR 240.13d-101 or 240.13d-102) with the Commission indicating beneficial ownership of more than five percent of an audit client’s equity securities or controls an audit client, or a close family member of a partner, principal, or shareholder of the accounting firm controls an audit client. 1) Financial relationships. An accountant is not independent if, at any point during the audit and professional engagement period, the accountant has a direct financial interest or a material indirect financial interest in the accountant’s audit client, such as: (i) Investments in audit clients.

[b][url=http://horecamiami.com]Expert Restaurant Remodeling Services in Miami for Quality Transformations and Modern Designs

[/url][/b]

Dining Establishment Specialist Company

Companion with our dining establishment specialist company for expert structure and restoration services. We ensure your restaurant is constructed to the highest possible standards, in a timely manner, and within budget.

Как избежать дубликатов номеров в своих документах, Эффективные способы избежать дубликатов номеров, Что такое дубликаты номеров и как их избежать, Полезные рекомендации по пронумерации документов, Почему следует избегать одинаковых номеров в тексте, Частые причины появления одинаковых номеров, Шаблоны нумерации для избежания дубликатов номеров, Эффективные методы обнаружения дубликатов номеров, Полезные рекомендации по исправлению дубликатов номеров, Шаги по устранению дубликатов номеров, Советы по предотвращению одинаковых номеров в статьях, Правила нумерации для избежания дубликатов номеров, Техники использования уникальных номеров, Советы по ведению правильной истории номеров, Причины и последствия дублирования номеров в тексте, Полезные инструменты для автоматического обнаружения дубликатов номеров, Советы по избеганию штрафов за повторения номеров, Эффективные методы защиты от дубликатов номеров, Техники предотвращения повторений номеров.

изготовление номерных знаков знак [url=https://dublikat-nomerov.ru/]https://dublikat-nomerov.ru/[/url] .

[url=http://ed-apteka.ru/]дженерики из индии купить напрямую[/url]

The spa tantric waiting visit one of the ways massage techniques, is what we do. What is an adult massage interested in everyone. energy massage is the art to give for happiness. You willsurprised to that,what sea bliss can experience from adopting massage. In spa center Tibetan KuNye Massage masseurs will hold good massotherapy.

How is it done, and is there something exotic? We will tell you all about him that you wanted to know |Our body rub massage is visited not only by men but also by women, and also by couples. You necessarily want to enjoy only this infinitely … Our primary а task this is to please women and men fabulous best foot fetish massage. Private approach to your needs and conditions.

The amazing women our the spa will give you an unforgettable experience. The spa is a place of rest and relaxation. Like body rub massage, as though, and relaxation, operates on some parts body, what helps visitors sit back and relax. Your best stop choice not on one masseuse, choose two girls! Choose for yourself masseur by external data, both professional and professional abilities!

Our salon in Empire City we advise wonderful rooms with convenient interiordecoration. All of these rooms promote to stay with you secretly.

Our showroom works in Uptown Beauties Amber :

[url=https://bodywork.manhattan-massage.com]bodywork massage studio[/url]

Привіт усім!

Професійний моніторинг Minecraft серверів: якість та надійність:

Наш моніторинг серверів пропонує високий рівень якості та надійності, забезпечуючи гравцям безперебійний доступ до найкращих серверів.

Різноманітні режими гри та активні спільноти:

На нашому моніторингу ви знайдете сервери для будь-яких вподобань: від класичного виживання до захопливих PvP битв. Кожен знайде сервер, який підходить саме йому.

Ось сайт з найкращими серверами: uamon.com

[url=https://www.uamon.com/types/auktsiony]Аукціони Minecraft сервери[/url]

[url=https://www.uamon.com/versions/1.11]Minecraft сервери версії 1.11[/url]

[url=https://www.uamon.com/versions/1.12.2]Minecraft сервери версії 1.12.2[/url]

Гарантована безпека та підтримка:

Наші сервери забезпечують надійну підтримку та безпеку. Ви можете бути впевнені у захисті ваших даних та безперебійності ігрового процесу.

Насолоджуйтесь грою!

PvE Minecraft сервери

Безгриф Minecraft сервери

Економічні Minecraft сервери

Спільнота Minecraft серверів

Технічні Minecraft сервери

[b][url=https://horecamiami.com/]Quality Pizzeria Construction Companies: Craftsmanship for Quality Builds

[/url][/b]

Bar Design Company

Our bar layout company specializes in creating elegant and useful areas. We offer ingenious layout options to boost customer experience and sustain your company.

[url=http://apteka-sm.ru/]купить дженерики в спб[/url]

[b][url=https://hotelrenovation.us/]Professional Fast Food Remodel Companies: Expert Renovations

[/url][/b]

[url=http://hotelrenovation.us]hotel renovation companies near me nyc

[/url]Hotel Remodelling Companies Near Me New York City

Searching for hotel restoration firms near you in New york city? Look no more. Our regional team supplies superior renovation services that boost visitor experiences and residential property worth. We provide personalized solutions to fulfill your specific requirements. Call us today for a complimentary examination.

Change your hotel with our specialist improvement solutions. We offer extensive services, consisting of layout, building, and job monitoring. Our team is devoted to delivering top quality renovations that show your brand’s vision and satisfy guest expectations.

The spa salon body rub waiting find out one of the varieties massage, is what we do. What is an balinese massage interested in everyone. sensual massage it’s a craftsmanship of giving for bliss. You willextremely surprised to that,what sea enjoyment can learn from adopting massage. In school Tibetan KuNye Massage masseuses will make erotic garshana massage.

How is it done, and is there something exotic? We will tell you all about him that you wanted to know |Our masseuses is visited not only by men but also by women, and also by couples. You want to rejoice only this infinitely … Our main intention this is to please you personally marvelous first-class acupressure massage. Personal approach to your wishes and conditions.

The elegant girls our the spa salon will give you an unforgettable experience. The spa salon is a place of rest and relaxation. This chiromassage massage, as though, and relaxation, operates on defined elements shell, this can help customer relax. Give your preference not just to one, but to two masseuses! Choose for yourself massezha by external data, both professional and professional abilities!

Massage center in NY we can offer gorgeous rooms with comfortable style. All of these premises enable to stay with you not attracting the attention of other customers.

Our showroom works in NY. Girls Sarah :

[url=https://best.manhattan-massage.com]massage ny[/url]

UO

поролон мебельный

[b][url=https://horecamiami.com]Professional Pizzeria Contractor Company Services for Quality Builds and Reliable Solutions

[/url][/b]

Juice Bar Layout Firm

Companion with our juice bar design company for creative and useful design remedies. We produce enticing environments that attract and maintain customers.

[b][url=https://hotelrenovation.us/]General Contractor for Restaurant Projects

[/url][/b]

[url=hotelrenovation.us]Hotel renovation projects ny

[/url]Hotel Renovation Business Near Me Manhattan

Searching for hotel restoration business near you in Manhattan? Look no further. Our neighborhood team provides superior renovation solutions that boost visitor experiences and home worth. We provide customized solutions to meet your particular requirements. Call us today for a totally free consultation.

Change your resort right into a modern-day place with our comprehensive improvement services. We provide tailored services to revitalize your property, bring in brand-new visitors, and rise productivity. Our skilled team makes sure minimal interruption throughout improvements, so your resort can remain to run seamlessly.

[url=https://professionals.beauty/salons/city/kalach/] Салоны красоты Калач [/url]

Советы по предотвращению дублирования номеров, какие действия принять?

Как избежать проблем с одинаковыми номерами, дайте совет.

Эффективные способы обнаружения повторяющихся номеров в тексте, расскажите.

Принципы удаления дубликатов номеров из базы данных, дайте совет.