WHAT IS TREASURY STOCK?

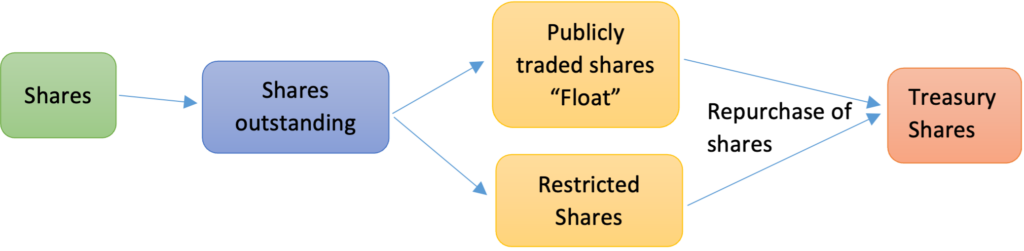

Treasury stock is also known as treasury shares or reacquired stock. It refers to the stock that has been bought back by the issuing company from stockholders which were previously outstanding as a result of which the total number of outstanding shares decreases in the open market. The portion of shares that a company keeps in its own treasury is known as the Treasury shares.

One of the most effective way to raise capital by any company is to offer stock to the public. However, there are times when company may decide to reduce the number of shares circulating in the open market. Every company can legally issue an authorized amount of stock. Out of this amount, some stocks are restricted stocks owned by investors including the company’s insiders and officers and some stock that is available to only public to buy and sell is known as float. The treasury shares may have either come from a part of restricted shares or part of the float or those stock that may have never been issued to the public at all.

DIFFERENCE BETWEEN AUTHORIZED, ISSUED AND OUTSTANDING SHARES

Authorized share capital is the maximum amount of capital that a company can issue to stakeholders as agreed in its articles of association. Authorized share capital is the amount of stock the company can lawfully sell to investors.

A company in its public stock offering often put fewer than the fully authorized number of shares on the auction block as it may want to have some shares in its reserve so that it can raise additional capital when required and these shares sold is termed as issued shares.

Outstanding shares is the portion of the stock currently held by all of its investors. This outstanding shares is used to calculate some key financial metrics like: earnings per share, dividend per share, return on assets and return on equity.

Often the number of outstanding and issued shares are same but if a company buyback its shares, then the shares tagged as treasury shares are issued and are no longer outstanding. The shares on the other hand are no longer considered issued If the company decides to retire the treasury stock.

.

RETIRED VS. NON-RETIRED TREASURY STOCK

Treasury stock can either be Retired Treasury Stock or Non-Retired Treasury Stock. Retired treasury stock is permanently cancelled and cannot be re-instated or reissued on a later date and are no longer listed on a company’s financial statements as treasury stock. On the other hand, non-retired treasury stock is held by the company for the time being. These stocks can be re-issued at a later date if deemed appropriate by the company or when company needs to raise additional funds. These stocks once issued are traded in the open market as Dividends to equity shareholders, Stock based compensation for employees, Shares Issued Per Options Agreements

METHODS OF ACCOUNTING FOR TREASURY STOCK

Two methods of accounting are generally used for treasury stock:

- Cost Method

- Par Value Method

The cost method of accounting is more commonly used due to its simplicity. This method is based on the assumption that the acquisition of treasury stock leads to a temporary reduction in stockholders’ equity that will be reversed when the shares are reissued in the market. When the shares are acquired the treasury stock is debited by the cost of purchase and cash account is credited by the same amount.

On the other hand, under the par value method, the acquisition of shares is recorded by debiting the treasury stock account by the total par value of the shares, the cash account is credited by the amount paid to purchase the treasury stock and the difference between the par value and cash paid for treasury stock shall be credited or debited to Additional paid in capital account. If the treasury stock is acquired for a price more than its par value, the difference is debited to the additional paid in capital account. If the treasury stock is acquired for a price less than its par value, the difference is credited to the additional paid in capital account.

ACCOUNTING FOR TREASURY STOCK

The treasury stock is a contra account to the shareholders’ equity and is listed on the Balance Sheet under the Shareholders’ equity as a negative number. It is commonly called as “Treasury stock” or “equity reduction”. Adding treasury stock though may benefit the investors through rise in share price, in short term it actually weakens the balance sheet of the company.

The basic accounting equation is

Assets-Liability= Shareholder’s Equity

When a company buyback its shares, it has to pay in cash reducing the assets on the Balance Sheet and as a result of buyback the outstanding shares also reduces hence reducing the shareholder’s equity on the Balance Sheet. The share repurchase is reflected as a cash outflow in the cash flow statement of the company.

Let us understand the entire process through a simple example:

EXAMPLE 1: Company ABC Ltd. sold 20 million shares for $40 each. The company receives cash which is debited and its outstanding shares increases and hence common stock is credited. The accounting entry for the same will be as follows:

Accounting entry for Issuance of Common Stock:

| Debit | Credit | |

| Cash | $ 800 million | |

| Common Stock | $800 million |

The company decides to buybacks 14 million of the above shares at the current market price of $35 a share. To buy back the shares the company has to spend $490 million, which is credited to Cash account. The same amount is debited to “Treasury Stock” which is listed under the “Shareholders’ Equity” section of the Balance sheet as a reduction.

Accounting entry for Acquisition of Treasury Stock:

| Debit | Credit | |

| Cash | $ 490 million | |

| Treasury Stock | $490 million |

The company has the option to either hold on to its treasury stock for further issuance to the public or other strategic purpose or decide to retire it. If company ABC Ltd. share price is trading at suppose $45 each and it decides to sell it at a profit.

The transaction will result in increase of Cash by $630 million (14 million shares multiplied by $45 per share) and hence cash is debited by that amount. Since all the treasury shares are issued back to the public and liquidated the entire balance of $490 million is credited back. The remaining $140 million balance represents a gain over the acquisition price and is credited to an account called the “Paid in Capital- Treasury Stock” account.

Accounting entry for Reissuance of Treasury Stock at a profit:

| Debit | Credit | |

| Cash | $630 million | |

| Treasury Stock | $490 million | |

| Paid in Capital- Treasury stock | $140 million |

If instead of the above scenario the company is in need of additional capital immediately and has to issue the shares at the current trading price of $30, the company faces a loss. Since the Treasury stock is depleted the Treasury Stock is credited by $490 million. Since the company gets cash, the Cash account is debited by $420 million. The balance amount of $70 million is debited to “Retained Earnings” account reflecting a loss of shareholders’ equity.

Accounting entry for Reissuance of Treasury Stock at a loss:

| Debit | Credit | |

| Cash | $420 million | |

| Retained Earnings | $70 million | |

| Treasury Stock | $490 million |

However, if the management of the company decides to retire the treasury shares, then both the common stock and additional paid in capital would be debited and the treasury stock account would be credited.

EXAMPLE 2: Let us understand one example of retired treasury stock.

The board of directors of Company ABC Ltd. authorizes the repurchase of 200,000 shares of its stock, which has a $1 par value. The company originally sold the shares for $11 each or $2,200,000 in total. ABC Ltd. pays $3,000,000 to repurchase the shares. The accountant records the transaction with the following journal entry:

| Debit | Credit | |

| Common stock, $1 par value | 200,000 | |

| Additional paid in capital | 2,200,000 | |

| Retained earnings | 600,000 | |

| Cash | 3,000,000 |

HOW DO COMPANIES PERFORM A BUYBACK OF STOCKS?

There are three methods by which a company may carry out the repurchase of its shares:

- Direct repurchase of shares in the open market: When a company announces to repurchase its share in the open market, it is perceived to be a positive outcome by the market as the share price increases. Just like other investors in the market, the company then simply proceeds to purchase the shares.

- Tender Offer: The company may offer to repurchase a specified number of shares from the shareholders at a specified price which it is willing to pay. This price is often at a premium to the current market price. The company also discloses the duration for which the offer is open and the interested shareholders are welcome to sell their shares to the company during this duration at the specified price.

- Dutch Auction: The company announces the number of shares to be repurchased and the range at which it can repurchase to the shareholders under the Dutch Auction. Shareholders can offer their shares for sale within or below the range specified by the company. The company then purchase the desired number of shares from the shareholders who have quoted the lowest end of the range.

WHY DO COMPANIES REPURCHASE SHARES?

The reasons why companies repurchase issued and outstanding shares from the investors are as follows:

- For further reselling: Treasury stock not retired act as set aside reserved stock to raise funds or pay for future investments. These treasury stocks can be used by companies to pay for acquisition of a competing business, used to pay for an investment and can also be reissued to existing shareholders to reduce dilution from incentive compensation plans for employees.

- For enhancing the control of investors and prevent hostile takeovers: Since the buyback of shares reduce the number of outstanding shares the value of the remaining shareholders in the company increases. The buyback of shares can also prevent hostile takeover of the company as the equity ownership of the company becomes more concentrated.

- Improve the valuation of the company share price: The company’s stock may be undervalued when the market is not performing well. In such scenarios the management of the company often decide to buy back the shares to boost the share price and which in turn benefits the remaining shareholders of the company.

- Retiring of shares benefiting the remaining shareholders: When the treasury shares are retired they can no longer be issued to the public and permanently reduces the shareholders equity. The share count reduces permanently which means that the remaining shareholders interest in the company increases and also their share in the company’s dividends and profits.

- Improves the financial ratios: Buying back shares improve various ratios which uses the number of outstanding shares in its formula. Examples of such ratios are price/earnings ratio and earnings per share, since the number of outstanding shares reduces. The ratios like return on assets and return on equity also improves as these financial ratios use the equity value of shares outstanding as its denominator.

- Tax Advantage: In jurisdictions that treat capital gains more favorably, rather than paying dividends, stock buybacks are used as a tax efficient method to put cash into shareholders’ hands.

EXAMPLE OF SHARE BUYBACK

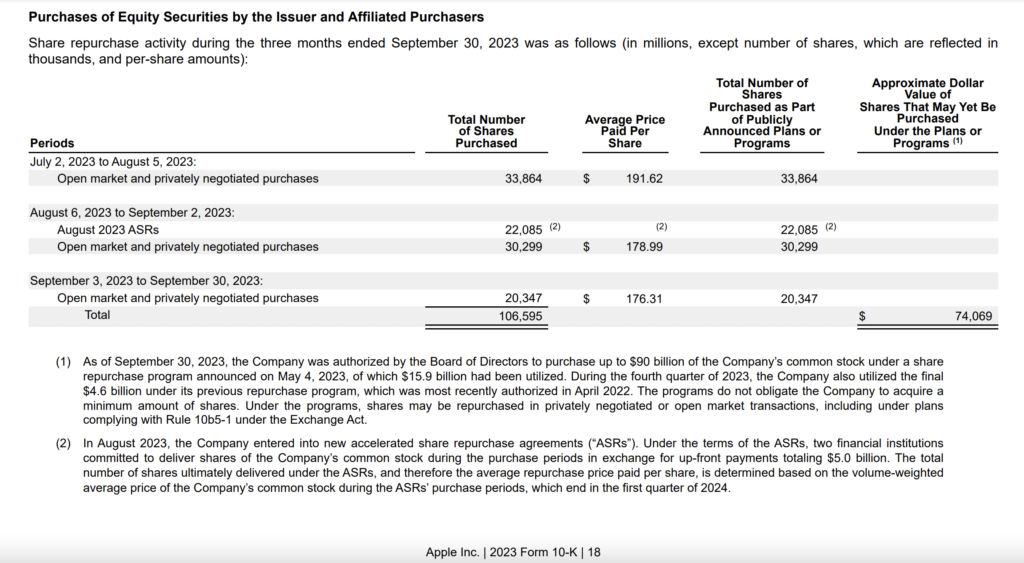

Apple Inc is one company that has been consistently buying back shares from the open market. In the quarter ending September 2023, the company had bought back 106,595 shares at an average price ranging from $176.31 to $191.62 per share. As such, the total value of share buy back amounted to USD 74.069 bn for Apple in the quarter ending September 2023.

Source : https://investor.apple.com/sec-filings/

LIMITATIONS OF TREASURY STOCK

Some of the limitations of the Treasury stock are as following:

- The treasury shares have no voting rights

- The treasury shares are not entitled to receive dividends

- The treasury shares are not included in the calculation of the outstanding shares and hence not included in the Earnings per share calculation

- The treasury shares do not exercise preemptive rights as a shareholder

- In case the company liquidates the treasury shares are not entitled to receive net assets

- In some countries, the total treasury shares cannot exceed the maximum proportion of total capitalization specified by law of that country. In the United states the buybacks are regulated by the Securities and Exchange Commission. The Companies Act 1955 in UK disallowed companies from holding their own shares, which was later repealed by the Companies Act 1985.

Conclusion – Buyback of shares is a great signal to the market about the strength of a company’s stock price and such can be a good way to utilize excess cash on the balance sheet of a company. Sometimes, treasury stock arising from such share repurchases is used to increase the ownership of the founding team so as to give them a better control on the company’s operations.

Read more about this on our LinkedIn page:

One thought on “Treasury Stock – is a share buy back worth it?”

[…] Treasury stock […]

Comments are closed.