INTRODUCTION

A company’s finance team one of the job is to evaluate whether their company can meet the unexpected short term liability without the need to rely on outside sources of fund and how liquid is their company at any given point of time. They achieve this goal by calculating two most important metrics: working capital and cash flow of the company. These two metrics evaluate two different aspects of a company’s financial health. While cash flow shows how much cash or cash equivalent a company generates or consumes at any given period of time, the working capital shows the difference between the current assets and current liabilities of the company. A company which maintains a positive working capital balance has a better liquidity position and ability to pay off its short term liabilities without much reliance on outside sources of fund.

WHAT IS NET WORKING CAPITAL?

Net Working Capital is the difference between a company’s current assets such as cash, accounts receivable, inventories, customers’ unpaid bills and current liabilities such as accounts payable and debts, accrued tax payable etc., on its Balance Sheet. It a commonly used to evaluate a company’s liquidity position, fund its business operations and the ability to pay its short term obligations. In short it is a measure of the company’s short term health and company’s operational efficiency.

Though put in simple terms net working capital is difference between the current assets and current liabilities, the most common way to calculate the net working capital is by excluding non-operating current assets i.e., cash and cash equivalents from current assets and non-operating current liabilities debt (current portion only) from current liabilities, since these are not directly a part of a company’s core operations.

NET WORKING CAPITAL FORMULA

The net working capital can be calculated using different methods depending on what an analyst wants to evaluate and want it wants to include or exclude depending on the nature of the operations of the company.

- The most common, easy and popular formula is:

Net Working Capital= Current Assets – Current Liabilities

This formula includes all the current assets and current liabilities and is the simplest formula.

- The most practical formula, since it does not consider the non-operating current assets and non-operating current liabilities.

Net Working Capital = Current Assets (less cash) – Current Liabilities (less debt)

- This is the most stringent formula and includes very limited items in the calculation of nwt working capital.

Net Working Capital = Accounts Receivable + Inventory – Accounts Payable

COMPONENTS OF WORKING CAPITAL

A company’s Balance Sheet is the source to calculate the net working capital, though what to include in the calculation and hat to exclude depends on what the analyst or finance professionals are trying to analyze. For example, an IT company may not have inventory in its balance sheet and so it shall not have the inventory included in its working capital calculation.

Current assets are those assets with the economic benefits that the company expects to receive within the next 12 months. When calculating the working capital, the company takes a hypothetical situation in which it liquidates all its current assets to pay off its current liabilities.

The current assets to be considered for the net working capital are as follows:

- Cash and cash equivalents: This includes the cash in hand which is the most liquid asset and cash equivalents includes certain types of investments such as marketable securities, commercial paper, certificate of deposits, treasury bills etc., and foreign currency. However, it is a non-operating current asset and is excluded in the second type of net working capital formula.

- Inventory: This includes all the unsold stock of goods and includes the raw materials used in manufacturing of final products, partially assembled inventory for work in progress goods and finished goods in stock not yet sold off.

- Accounts receivable: It is the final products sold at credit and should be included net of doubtful payments.

- Notes receivable: It includes claims for which some formal instruments of credit are issued as the evidence of debt such as promissory note. The debtor usually has to pay interest on these instruments and usually extends for a period of 30 days.

- Prepaid Expenses: These are the expenses paid in advance. Though these are included in the working capital working, they cannot usually be liquidated in the event when the company requires cash urgently.

- Other Current Assets: These are the other current assets not included above. Example may include short term deferred tax asset that reduces a future liability.

Current Liabilities are the debts owed or to be owed by the company within the next twelve months. The overall goal of calculating net working capital is to understand whether a company will be able to pay off all its short term liabilities due within 12 months with the current assets that can be converted to cash within 12 months.

The current liabilities to be considered for the net working capital are as follows:

- Accounts Payable: It is the money owed or unpaid invoices by the business to the suppliers of raw material or goods, utilities, unpaid rent or property taxes or any other operating expenses owed to any outside third party. Often these invoices have a credit term of 30 days, an so all these invoices are covered in the calculation.

- Wages Payable: It is the wages that the company’s employees have earned but not yet paid. The account payable balance is eliminated early in the following reporting period when the wages are paid to the employees.

- Long term debt (current portion): This is the short term payments related to long term debt. For example, if a company takes a 10-year loan, then the payments due in installments in the next twelve months are of short term nature, while the rest of the installments of 9 years are of long term nature. Those 12 months’ installments due in the next twelve months are considered in the net working capital calculation. However, this component shall not be included in the second type of net working capital calculation discussed above since it is non-operating liability.

- Accrued tax payable: This includes the taxes assessed against a company’s earned revenue or property value that has not been paid yet but is due within the next 12 months.

- Unearned revenue: It is the money received by a company for a service not yet provided or product not yet delivered. It is the prepayment for goods or services that a company is obliged to supply to the purchaser at a later date.

- Dividend payable: It is the portion of profit after taxes that the company has formally authorized to distribute amongst its shareholders but yet not paid.

GENERAL INTERPRETATION OF NET WORKING CAPITAL

The net working capital of a company may be positive or negative. Let’s understand what does the positive and negative figure means:

- Positive Net Working Capital: A positive net working capital means that a company’s current assets are greater than its current liabilities. This means that a company has enough resources to pay off its short term debts and also has residual cash left given all its current liabilities are liquidated to pay off its debts. However, a very high positive net working capital may also be a sign of company’s inefficiency to realize its accounts receivable within time, or it has too much ideal cash and is not investing the money properly into new opportunities or ventures, upgrades or expansion of the business.

- Negative Net Working Capital: A negative net working capital means that a company does not have sufficient current assets to pay off its current liabilities. The company has more short term debt than the short term resources and hence indicates poor health status of the company, low liquidity and potential of the company going into bankruptcy. However, a negative working capital may not always be a bad indicator. It can be good or bad and its depends on the stage at which the company is in its lifecycle, its nature of business, or its relative with the creditors or debtors. A company may have good relations with its creditors or due to its good credit rating it may have procured loan at favorable terms, which means that the company have prolonged time to pay back the creditors or loan providers. These favorable terms are not included in the balance sheet from where net working capital is calculated but it is crucial to analyze a company’s financial stability and health. Also net working capital changes often and some companies have seasonal nature of business where one half of the year may require relying on external financing while the other season may be of huge profits.

LIMITATIONS OF WORKING CAPITAL

Although net working capital is one of the most useful metrics to determine a company’s financial health and liquidity, is has its own drawbacks listed below:

- Working capital is always changing: Since working capital calculation includes all current operating accounts, it is likely that the figures involved in the calculation is subject to change many times even in a single day. Therefore, by the time a finance professional gathers all the necessary components of working capital, it may happen that those figures are already outdated and irrelevant for decision making purpose.

- Working capital does not consider some specific type of underlying accounts: A company may have a positive working capital but it may have around 90% to 100% of its current assets as accounts receivable. Even after having a positive working capital its financial health depends on whether the customers will pay the money on time. Similarly, a company may have negative working capital, and from outside it may seem that the company’s financial health is not sound. But it may happen that the company has huge amounts tied up in accounts payable due to its good relations with the creditors and favorable credit terms.

- Current assets may quickly become devalued due to factors outside the control of the company: The current assets involved in the calculation of net working capital may become devalued with the passage of time. Accounts receivable may lose value if its high worth customers file for a bankruptcy. Similarly, if a company is carrying large inventories in its stock and if it becomes obsolete its working capital shall be impacted negatively. Inventories and physical cash are also exposed to the risk of theft and damage.

- Dependent on strong internal controls and correct accounting practices: All the accounts considered in the net working capital calculations are subject to change on a daily basis and since all are operating accounts, any small mistake in the accounting by the accountants can lead to huge differences in net working capital amount. For example, if an accountant misses to record some of the large value sales invoices, the accounts receivable shall stand deflated and the net working capital will not depict the true liquidity position of the company.

- Anomalies as of the Measurement Date: Since the net working capital is calculated at a specific date or specific point of time, it may include such anomaly that does not represent a general trend of net working capital. For example, it may include a one-time large accounts payable but not due yet, and due to this the net working capital may seem to be small until this one-time creditor is paid off.

- Not All Assets are Liquid: All the current assets included in the calculation may not be liquid. For example, some accounts receivable may be not as liquid as others as they may enjoy favorable credit terms from the company due to its good relations with the company or it may have considerable negotiating powers over the business. Similarly, inventories may not always be that liquid and cannot easily be converted to cash without a steep discount.

- Should not be the sole factor to decide on company’s financial health: Although net working capital is one of the most important financial metric, it should be seen along with other metric based on company’ capital structure, profit margins and historical trends to take any major decision.

HOW TO IMPROVE THE NET WORKING CAPITAL?

As discussed above neither a very high or very or negative net working is preferable, since an ideal net working capital is difficult to deicide. However, each company has its own ideal net working capital depending on its nature of its operations and competitive advantages it enjoys in the market. We shall discuss some of the ways in which companies can improve their net working capital:

- Require the customers to pay within shorter time period: Large accounts receivable figure may lead to positive net working capital but also possess the threat of bad debts and customers going for bankruptcy. Hence, companies should adopt policies that require the customers to pay the dues within shorter period of time. However, this may be challenging when the customers are large and influential. Active collection of outstanding accounts receivable can also be adopted by the company.

- Engage in just in time inventory purchases: This option can reduce the inventory investment and thereby reducing the risk of inventory obsolesce, but may increase the delivery costs.

- Negotiating with the suppliers for return of unused inventory in exchange for a restocking fee or extending the credit period: Since inventory is subject to obsolesce, the managers can try to negotiate such terms with the suppliers so that they can return the unused inventory in exchange for restocking fee. The managers can also extend the time period for paying back the suppliers in exchange for volume purchases where the raw materials are not subject to obsolesce.

- Selling Illiquid assets for cash thereby increasing the current assets: A company’s working capital may be blocked in the form of some illiquid and irrelevant capital assets, the managers should take a call to sell off those assets if not required to increase the company’s net working capital required to finance the current operations and growth.

- Reducing unnecessary expenses: The managers should analyze the profit and loss statement and all the expense heads. Where the company has negative net working capital the managers should take an effort to curb the unnecessary expenses that ultimately reduces the current liabilities.

- Taking on long term debt: Where a company has negative net working capital, long term loans increases the available cash and therefore increases the current assets but does not increase the current liabilities.

- Refinancing short term debt as long term debt: Where a company has net working capital but has future growth prospects, it may refinance its short term debt into long term debt, so that it has sufficient current assets to settle its other current liabilities.

- Automate accounts receivable and accounts payable monitoring: A strong accounting software or ERP should be in place in every company to analyze the net working capital of the company on a real time basis and automate the accounts payable and receivable so that the company maintains a healthy net working capital balance at all times.

COMMON DRIVERS USED FOR NET WORKING CAPITAL ACCOUNTS

Corporates have to not only prepare the financials based on past data but also have to prepare the future set of financial statements to predict its future course of actions and for budgeting purpose. However, for each item in the forecasted income statement and balance sheet some drivers are used that justify the predicted future amount. Some of the assumptions used in the financial model to forecast net working capital are listed below:

- Accounts receivable: Accounts receivable days

- Inventory: Inventory days

- Accounts payable: Accounts payable days

- Other current assets and other current liabilities: Growth percentage, percentage of sales, fixed amount of increase or decrease.

Calculation of the accounts receivable days, accounts payable days and inventory days are all dependent on the sales and cost of goods sold figure. If either of sales or cost of goods sold component is missing we cannot calculate the “days” metric and hence the accounts payable, receivable and inventory figures for the future. Whenever such a situation arises, accounts receivable, payable and inventory figures can be calculated by referring to the past trends and thereby estimating a future value.

IMPACT OF NET WORKING CALCULATION ON COMPANY’S CASH FLOW STATEMENT

The net working capital is calculated to understand the impact of the company’s operations on its free cash flow. Due to this net working capital has a significant impact on the company’s cash flow statement and is shown as the change in the net working capital under the cash flow from operating activities.

Since we calculate the increase or decrease in free cash flow of the firm across any two periods, “Change in Net Working Capital” needs to be calculated as below:

Change in Net Working Capital = Prior Period Net working capital – Current Period Net working capital

The logic behind subtracting the current period net working capital from the previous year net working capital is to analyze how much impact is created on the free cash flow in the given period due to the company’s operating activities. An increase in the operating assets (example: accounts receivable, inventory) from one period to another represents cash being “used”, while an increase in current liability (example: accounts payable, accrued tax liability) from one period to another represent built up of cash or “source” of cash and vice versa.

With this we can summarize the change in net working capital as follows:

- Positive change in net working capital: More free cash flow generation

- Positive change in net working capital: Less free cash flow generation

WHAT IS WORKING CAPITAL MANAGEMENT?

Working capital management is a financial strategy used by companies to optimize the use of its working capital which enables the company to fund its operational costs and pay off its short term debt without having to rely on outside sources of fund. Analysts calculate several financial ratios for working capital management of any company. Some of these ratios are discussed below:

- Working capital ratio: It is also known as the current ratio. It is calculated by dividing a company’s current assets by its current liabilities and is a measure of a company’s ability to meet its short term obligations. A working capital ratio less than one means that a company has insufficient current assets to pay off its current liabilities. A Working capital ratio between 1.2 and 2.0 means that the company is making good use of its assets and it has a good liquidity and growth position. However, ratios greater than 2.0 indicate that the company is not making efficient use of its current assets, it may have too much ideal cash which can otherwise be invested in investments giving high returns in future and is not investing properly in growing the operations of the company.

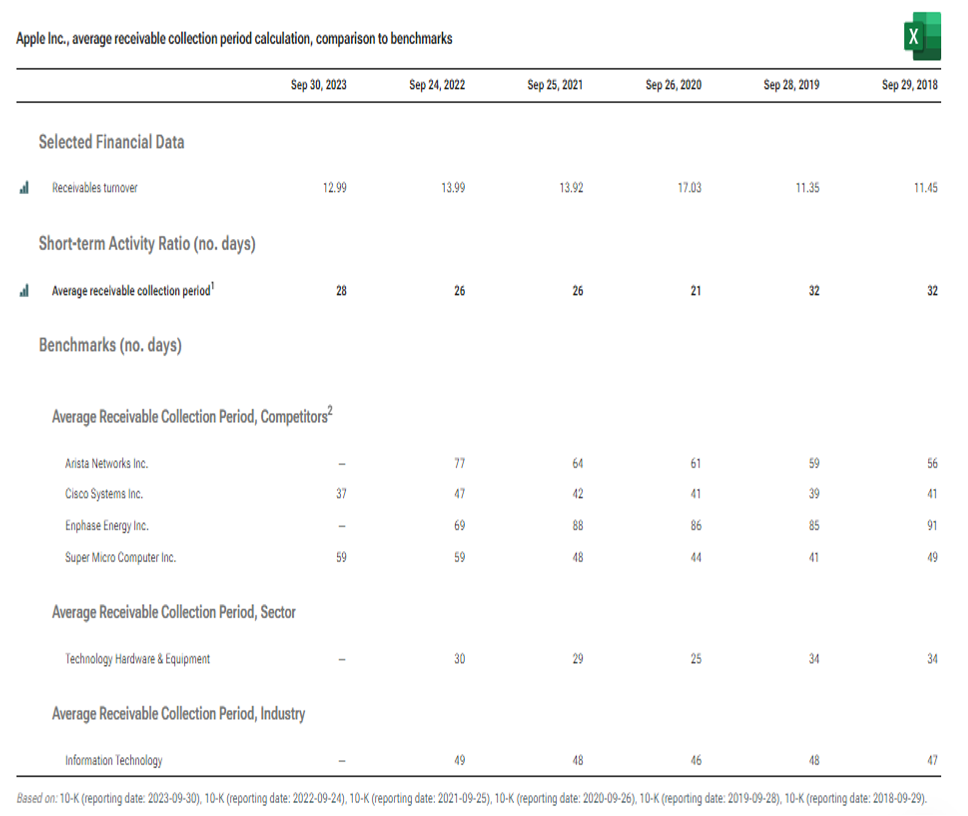

- Average collection period: It refers to the amount of time a business takes to receive payments from its debtors. This is used by the companies to make sure that enough cash to meet its short term financial obligations. This metric reflects a company’s effectiveness of accounts receivable management practices and is important for companies having he accounts receivable balances. It is calculated by diving the company’s average accounts receivable balance by its net credit sales during the period and then multiplying the result with the number of days in that period. Alternatively, it can be calculated by number of days in the period by the Receivables turnover ratio.

- Inventory Turnover ratio: This ratio represents the rate that inventory is sold or used and replaced. It measures how efficiently a company uses it inventory by dividing the cost of goods sold by the average inventory value during the period. This ratio helps the company to track if they have enough inventory on hand so as to avoid tying up too much cash in inventory. A high ratio indicates the company is selling its inventory at a good rate and managing its inventory efficiently.

Some ratios are used by analyst, lenders or investors to measure company’s liquidity and used to compare a company’s performance with prior periods or with the performance of its competitors.

- Quick ratio: Quick ratio is calculated by dividing the companies most liquid assets i.e., cash and cash equivalents and accounts receivable by the current liabilities. It is a more stringent ratio than current ratio as it excludes inventory that may not be as liquid as other current assets.

- Current ratio: This ratio is calculated by dividing total current assets with total current liabilities. However, the quick ratio is a better ratio since it excludes those items which are less liquid in nature and gives a better and true picture of a company’s liquidity.

REAL LIFE EXAMPLE ON NET WORKING CAPITAL CALCULATION

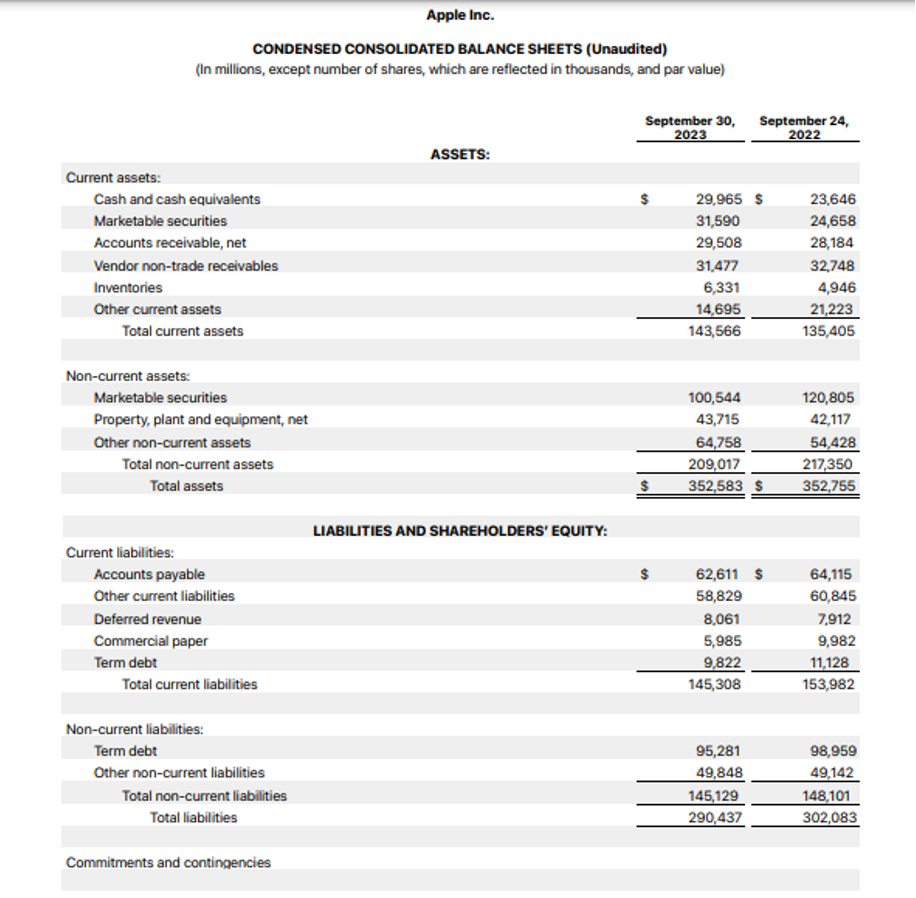

Let us calculate the Net working capital of Apple Inc. for the Financial year ended Sept 30, 2023 from the Balance Sheet of the company.

Source:https://www.apple.com/newsroom/pdfs/fy2023-q4/FY23_Q4_Consolidated_Financial_Statements.pdf

The total current assets of the company is $143,566 million.

The total current liabilities of the company is $145,308 million.

Hence the Net working capital by formula 1 as discussed above shall be:

Net Working Capital = $143,566 – $145,308 = -$1,742 million

The Net Working Capital of Apple Inc. for the year ended 30th Sept,2023 is negative. However, one may conclude that Apple Inc. has a poor financial health and its liquidity position is not sound and may exposed to the risk of bankruptcy. But we all know that Apple Inc. shares always trade at an all-time high and is one of the top most US companies. So what can the Negative Net Working Capital mean here?

A company may have negative Net working capital due to many reasons. For example, a company may have excess amount in accounts payable due to good business relations with the lenders and favorable credit terms from creditors. This crucial aspect is not included in the Balance sheet directly but has a great influence on the Net Working capital analysis indirectly. This means the company has more time to pay back the loans and invoices due to suppliers. The company may have negative net working capital also if it has recently invested in large projects which leads to outflow of cash. The net working capital may look bad on the outside but on deeper analysis we find that the company has high growth prospects. Also, in case of companies with seasonal nature, one half of the year where it has high revenue may show positive net working capital, and on the other hand the lean season where revenue is low it may show a negative net working capital.

If we calculate the net working capital excluding the non-operating items we get the following:

Net Working Capital = (Total Current assets- Cash) + (Total Current Liabilities- Short term debt)

= ($143,566 – $29,965) – ($145,308 – $9,822)

= -$21,885 million

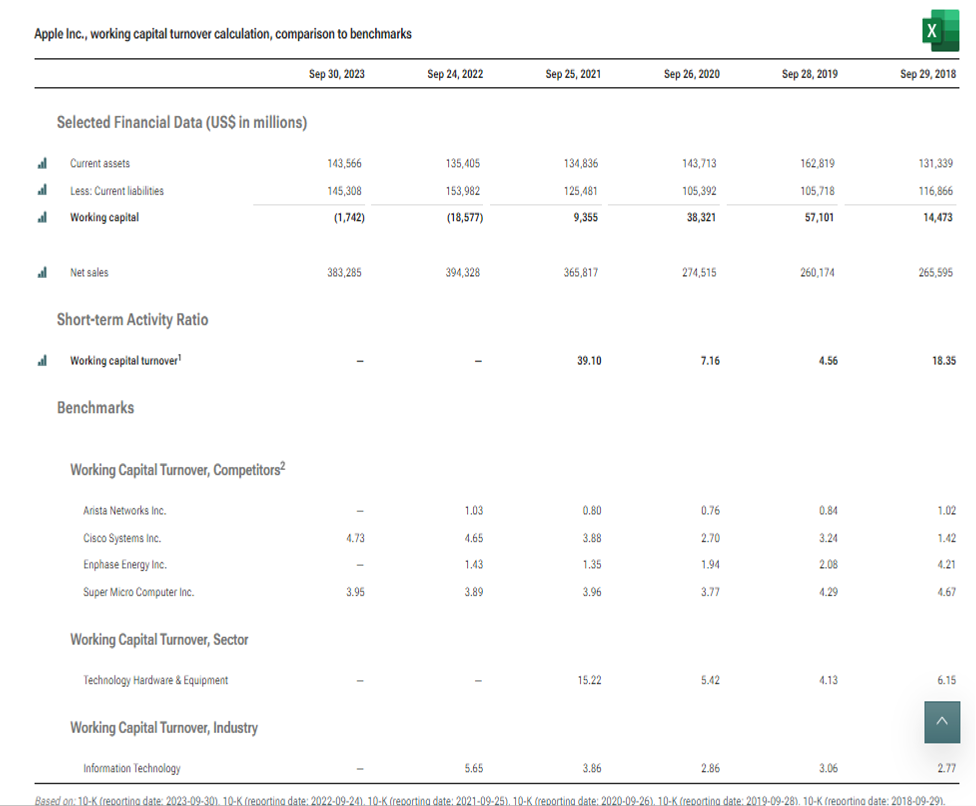

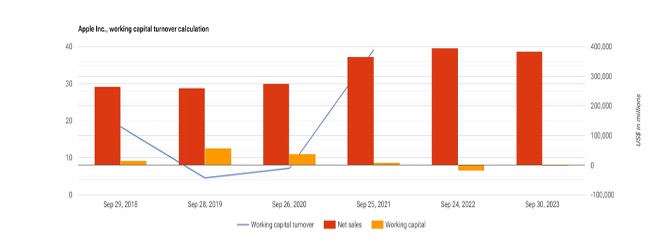

Let us see the year wise analysis of net working capital of Apple Inc. and comparison of the working capital turnover ratio with competitors.

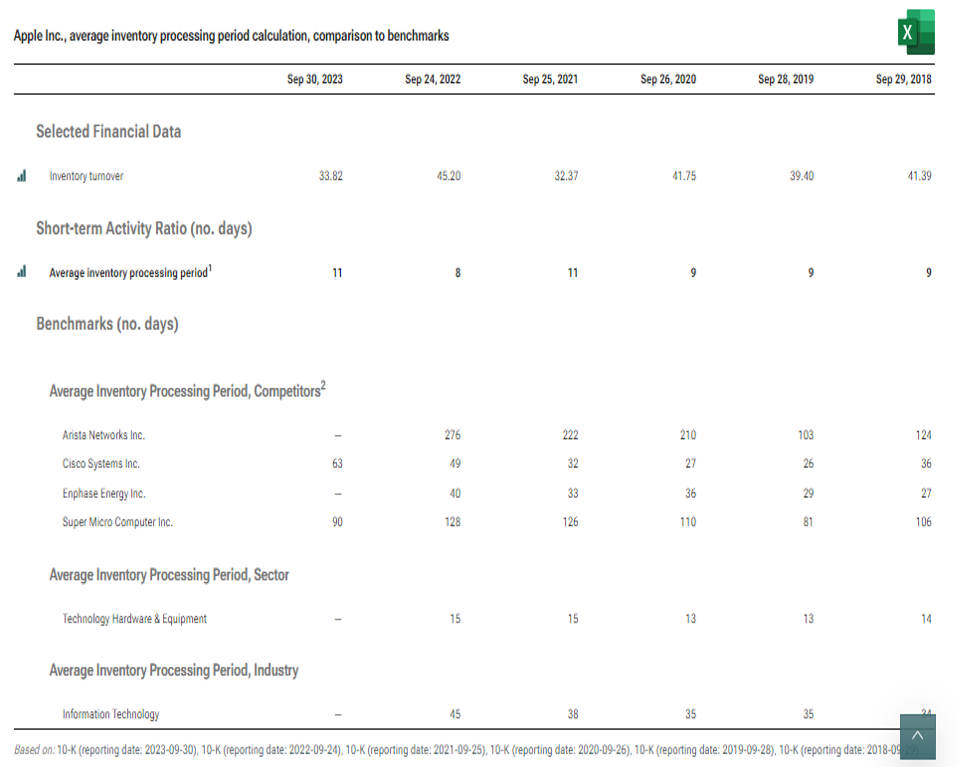

Average Inventory turnover ratio of Apple Inc. and comparison with its competitors.

Average receivable collection period of Apple Inc. and comparison with its competitors.

Read more on this on our LinkedIn page as well:

22 thoughts on “Net Working Capital – positive or negative?”

[…] net working capital, a business is able to meet payroll, make payroll obligations, purchase inventory, pay bills, and […]

[…] calculate the net Working Capital which is equal to Operating Current Assets (non-financial like Accounts Receivables, Inventory, […]

[…] transaction, repay it and then withdraw it again whenever required. It helps to fund a company’s working capital needs. It’s one of many flexible funding solutions on the alternative finance market […]

Как распознать истину?

абсолютная истина это [url=http://www.koah.ru/kanke/62.htm]http://www.koah.ru/kanke/62.htm[/url].

Ответственные и опытные грузчики для переездов любой сложности

профессиональные грузчики [url=https://gruzchikityazhest.ru]https://gruzchikityazhest.ru[/url].

Планируете переезд? Наши надежные грузчики помогут

заказать услуги грузчиков [url=https://www.gruzchikimashina.ru/]https://www.gruzchikimashina.ru/[/url].

Приключения ждут: выберите свой идеальный тур прямо сейчас

горящие туры [url=https://www.togototravel.ru/tours/specials/goryashchie-tury/]https://www.togototravel.ru/tours/specials/goryashchie-tury/[/url].

Вызов сантехника на дом срочно и оперативно: круглосуточные услуги

сантехник срочно [url=https://vyzovsantekhnikaspb-1.ru]https://vyzovsantekhnikaspb-1.ru[/url].

Интересные места и достопримечательности: путеводитель для путешественников

куда сходить в баку [url=https://www.turizmblog.ru/blog/strany/dostoprimechatelnosti-baku/]https://www.turizmblog.ru/blog/strany/dostoprimechatelnosti-baku/[/url].

Как выбрать летние шины: советы от профессионалов

дешевые летние шины в спб [url=http://www.letnie-shiny78.ru]http://www.letnie-shiny78.ru[/url].

Какой стабилизатор напряжения лучше: сравнение моделей и брендов

стабилизатор напряжения 220в для дома купить [url=http://www.stabilizatory-napryazheniya-1.ru/stabilizatoryi-napryajeniya-dlia-doma]http://www.stabilizatory-napryazheniya-1.ru/stabilizatoryi-napryajeniya-dlia-doma[/url].

Входные двери в квартиру: современные тенденции и популярные материалы

дверь входная в квартиру купить [url=https://www.vhodnye-dveri-v-kvartiru77.ru]https://www.vhodnye-dveri-v-kvartiru77.ru[/url].

Amirdrassil Boost: Elevate Your Raid Experience Beyond Limits

wow amirdrassil boost [url=https://www.amirdrassil-boost.com]https://www.amirdrassil-boost.com[/url].

A New Level of Power: Buy WoW Boost and Dominate the Game

wow boosting services [url=https://wow–boost.com/]https://wow–boost.com/[/url].

I liked it as much as you did. Even though the picture and writing are good, you’re looking forward to what comes next. If you defend this walk, it will be pretty much the same every time.

Magnificent beat I would like to apprentice while you amend your site how can i subscribe for a blog web site The account helped me a acceptable deal I had been a little bit acquainted of this your broadcast offered bright clear idea

За гранью зависимости: форум наркозависимых как источник поддержки

форум родственников наркозависимых [url=https://www.narcoforum.ru/]https://www.narcoforum.ru/[/url].

Экономия пространства: недорогие телевизоры в ДНР для квартиры

телевизоры донецк днр [url=http://www.kupit-televizor-v-dnr.ru]http://www.kupit-televizor-v-dnr.ru[/url].

Чистота без усилий: клининг после пожара с комфортом для вас

клининг после пожара цена [url=https://uborca-posle-pozhara.ru]https://uborca-posle-pozhara.ru[/url].

I do believe all the ideas youve presented for your post They are really convincing and will certainly work Nonetheless the posts are too short for novices May just you please lengthen them a little from subsequent time Thanks for the post

Профессиональная просушка квартиры: секреты быстрого результата

сушка квартиры после затопления цена в москве [url=http://www.prosushka-kvartiry.ru/]http://www.prosushka-kvartiry.ru/[/url].

Уборка грязной квартиры: наша забота о вашем комфорте

уборка запущенной квартиры москва [url=https://www.uborka-gryaznoj-kvartiry.ru/]https://www.uborka-gryaznoj-kvartiry.ru/[/url].

Comments are closed.