What are T-accounts?

T-accounts, called ledger accounts, are a conventional way of recording financial statements in double-entry bookkeeping. T-account looks like a big T dividing the space into two columns. The top of the horizontal line of T records the heading of the T-account. The vertical line separates the left column, which records debit entries and the right-hand column, which records credit entries.

T-accounts build the visual representation of various accounts. As it helps ease the fundamental understanding of the financials of a company.

Accountants use T-accounts for recording and understanding numerous accounts related to assets, expenses, revenue and liabilities.

Some frequently used T-accounts in double-entry bookkeeping are:

- Trial Balance

- Profit and Loss Account

- Balance Sheet

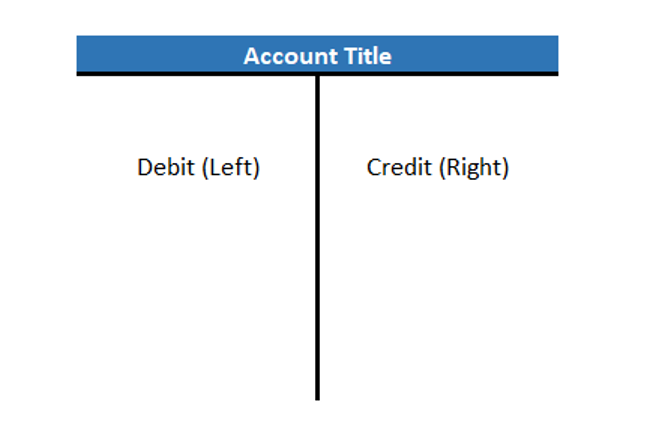

Format of T-Accounts

The T-account is the fundamental account used to record financial transactions. The format for T-account is as follows:

The space above the vertical line states the name of the respective account. That’s the vertical line of T. The horizontal line of T divides the space below into two columns. The left-hand side column always represents the debit side, and the right-hand side column will always record the credit side entries. The debit and credit will always remain the same for all T-accounts.

Concept of Debit and Credit

Debit and credit are the foundational concepts of bookkeeping. Both are multiple-meaning terms in accounting. Debit can mean an increase in assets, a decrease in revenues, an inflow of cash or goods in the business, etc. But when talking about T-Accounts, debit means the left side of the ledger account.

Similar is the case with the term credit. Credit has numerous meanings in accountancy. It can indicate an increase in liabilities, a decrease in expenses, etc. But here, credit shows the right side of the T-Account.

As we know, debit and credit are opposites. Likewise, in T-Account, debit represents the left side in opposition to credit representing the right.

Recordings in T-Accounts

Accountancy revolves around four types of financial transactions: expenses, incomes, assets and liabilities. When dealing with these four elements, it’s necessary to understand the rules surrounding them and how they react when recorded in the T-Account.

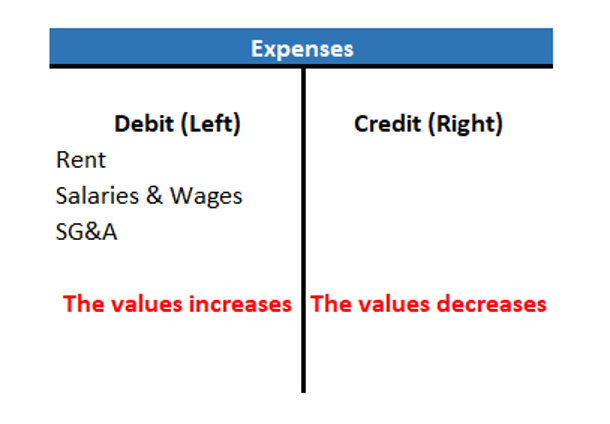

Expenses:

Expense equals the cost incurred by the business for generating revenue or performing daily operations. Examples of expenses comprise salaries and wages, rent, SG&A, etc. Expenses are recorded on the debit side of the T-Account. By recording expenses on the debit side, we increase its value, and a credit entry will decrease its value.

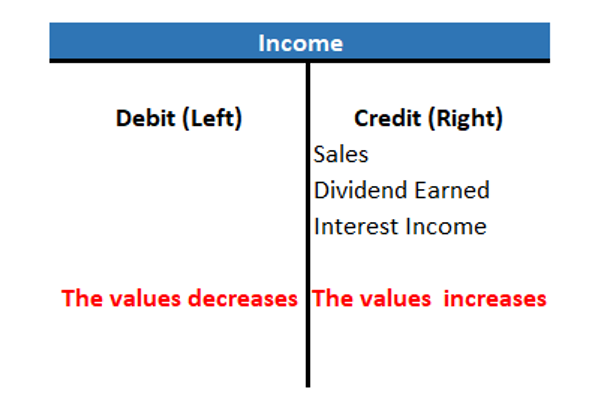

Incomes:

Incomes are the revenue earned by the business in a given period. Examples of income include sales of goods & services, interest income, dividends received, etc. Incomes are shown on the credit side of the T-Account. To increase its value, we add it to the credit side, and to rectify or decrease the amount of income, we make an entry on the debit side.

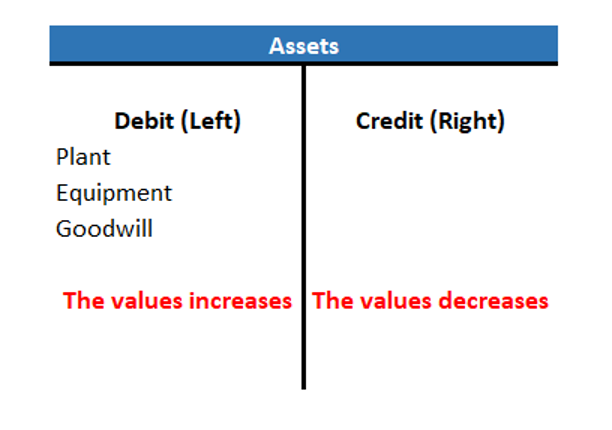

Assets:

Assets are the resources owned by the business. It constitutes tangible assets like property, plants & equipment (PP&E), cash, etc and intangible assets like goodwill, patents, etc.Accountants record assets in the debit of the T-Accounts. Debit entries increase the asset’s value, and credit entries diminish the asset’s value.

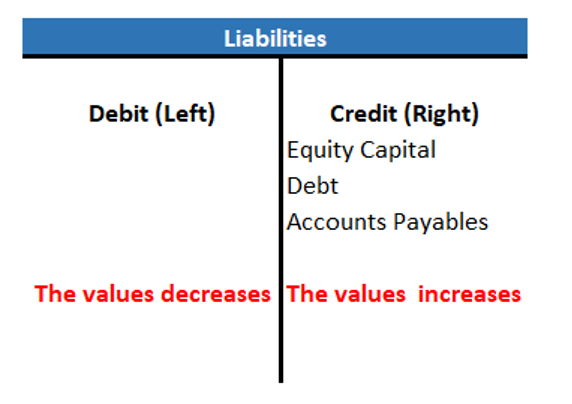

Liabilities:

Liabilities are the obligations or debts owed by the company to external parties. Liabilities are categorised as current liabilities and non-current liabilities. Accountants record liabilities in the credit of the T-Accounts. Credit entries increase the liabilities value, and debit entries diminish the liabilities value.

Frequently Used T-Accounts in Double-Entry Bookkeeping:

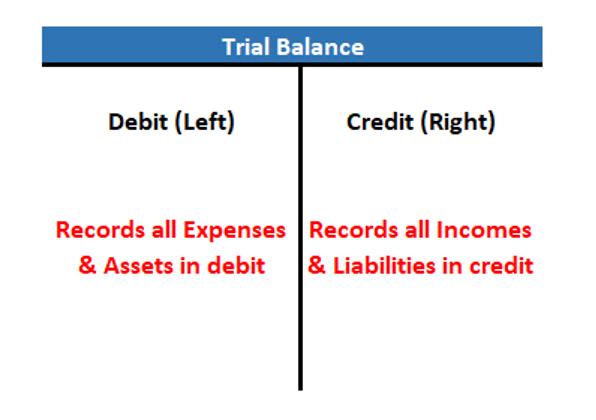

Trial Balance:

Trial Balance is a T-Account, which consists of the balances of all the ledger accounts prepared by the company. It helps in verifying the accuracy of the recorded financial transactions.

Trial Balance records assets and expenses in the debit and credit the incomes and liabilities.

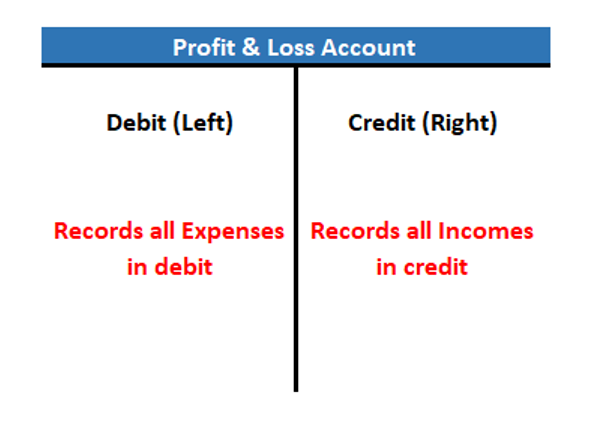

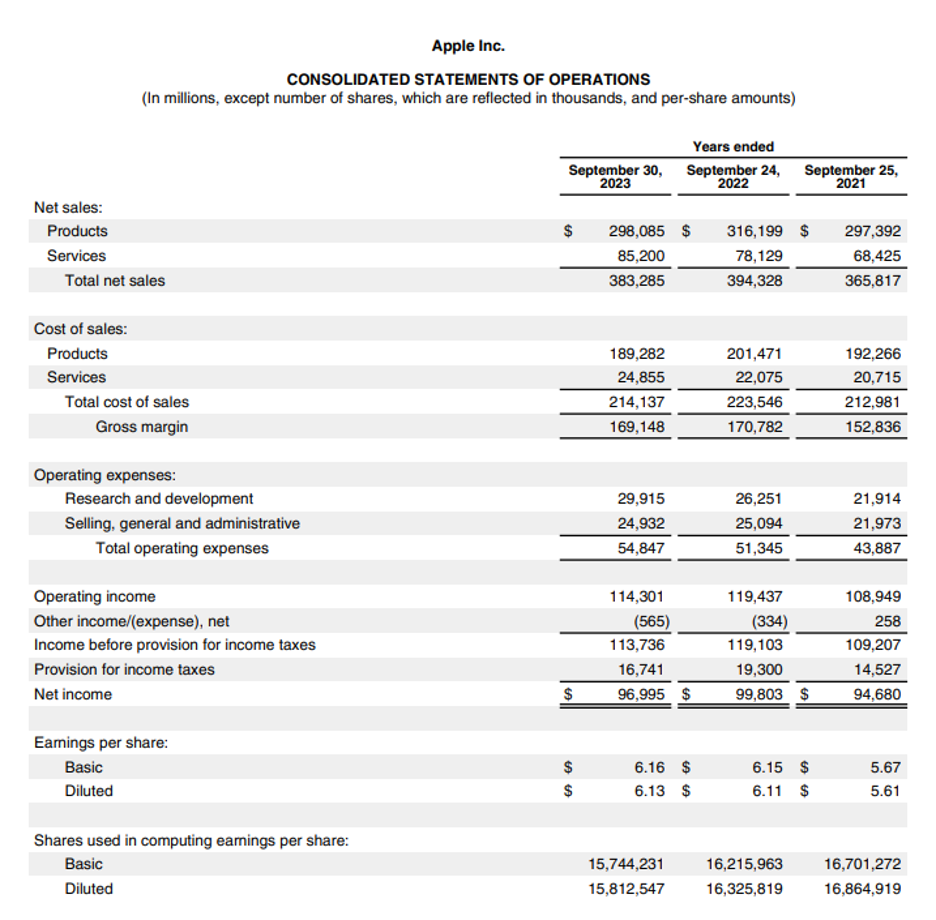

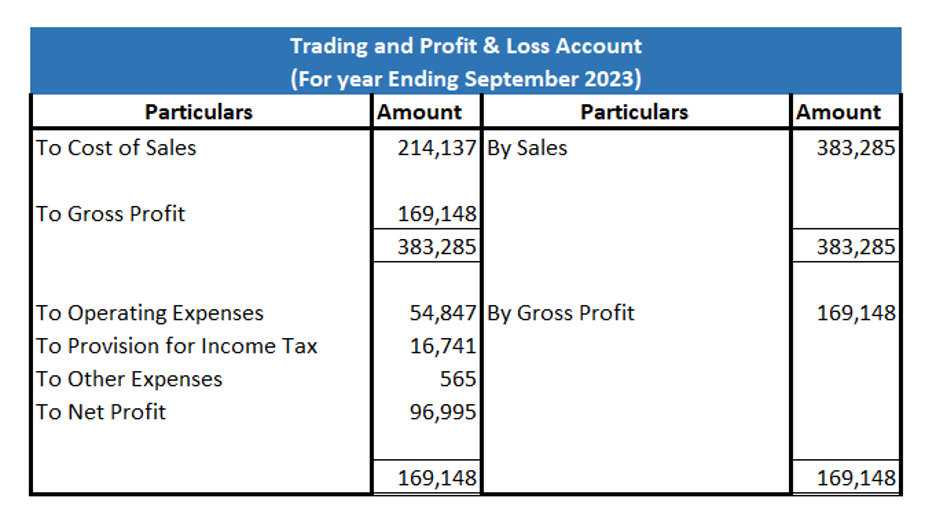

Profit and Loss Account:

Profit & Loss account gives the summary of the company’s income, expenses, gains and losses by recording it in T-Account or vertical format.

In the P&L account, the debit records the expenses, and the credit side records all incomes.

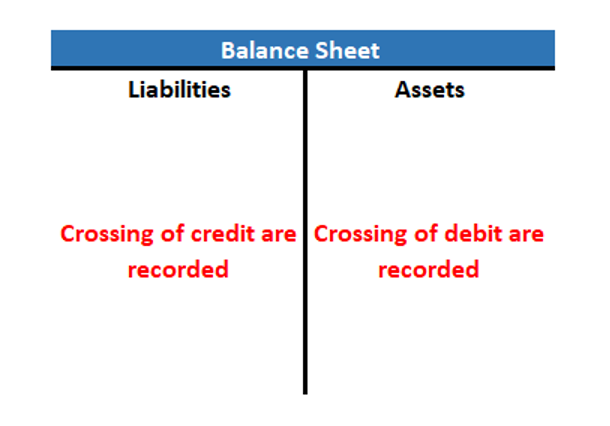

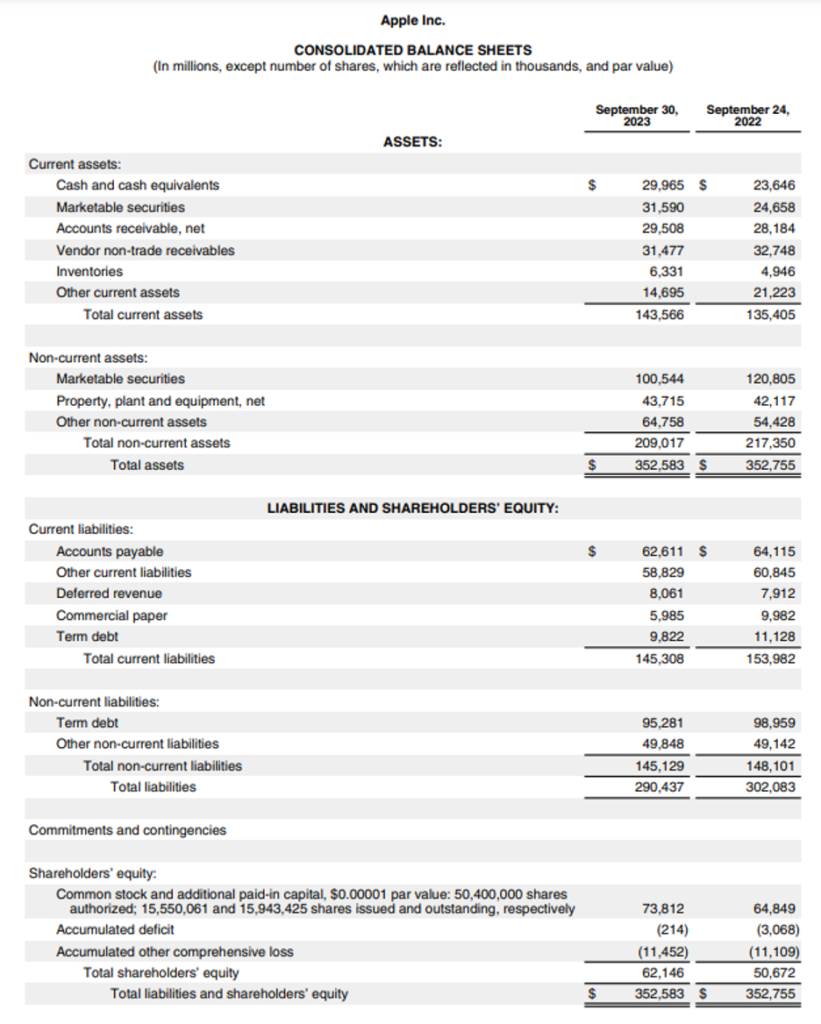

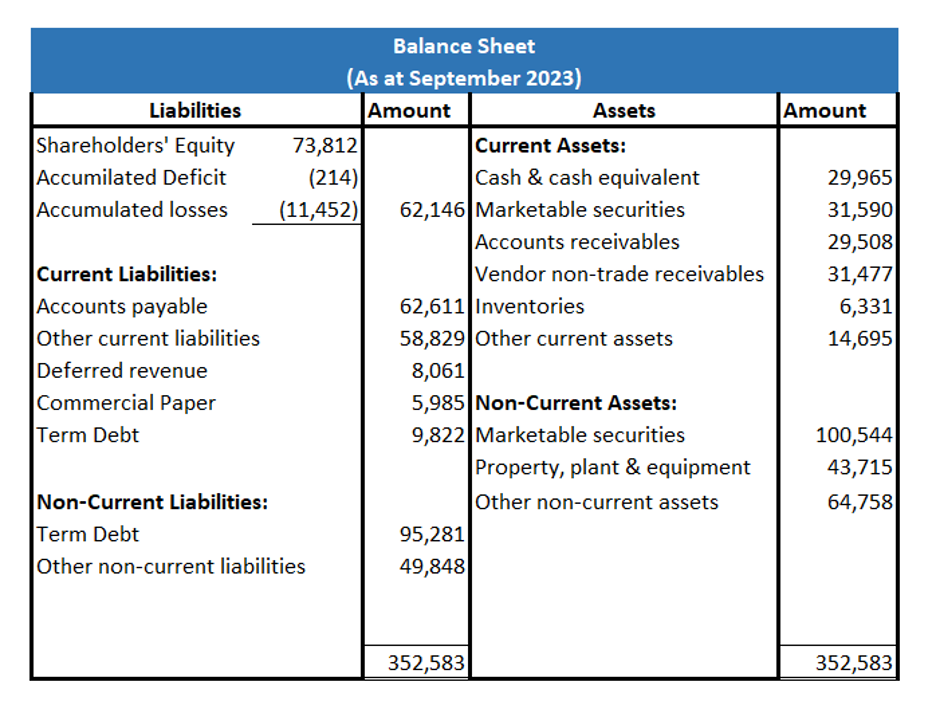

Balance Sheet:

If a company wants to determine its financial position at a particular point, it prepares a balance sheet. The balance sheet holds the data related to all the assets and liabilities of the company.

We know that assets are in the debit, and liabilities are in the credit. We have also learned that debit is on the left and credit is on the right of the T-account.

However, a T-structured balance sheet does not follow the debit-credit rules. Rather, it brings in the crossing of trial balance in the respective columns. This means the assets in the debit are brought to the right side of the balance sheet and liabilities in the credit are crossed over to the left side of the balance sheet.

Hence, a T-structured balance sheet looks like this:

T-Format Profit & Loss Account and Balance Sheet of Apple Inc.

Companies as per the guidelines, prepare their balance sheet in vertical format. So, let’s prepare a T-structured Profit & Loss account and Balance Sheet for Apple Inc. for 2023 by using the vertical financial statements.

Source: https://s2.q4cdn.com/470004039/files/doc_earnings/2023/q4/filing/_10-K-Q4-2023-As-Filed.pdf

The T-structured Trading and Profit & Loss Account and Balance Sheet of Apple Inc. for 2023 are as follows:

Advantages of using T-accounts

The advantages of making T-Accounts are:

- T-accounts give a clear and proper visual representation of all transactions.

- As T-accounts are simple and easy to understand, they are widely used for educational purposes.

- T-accounts help accountants and finance professionals quickly assess the impact of one transaction on others. Thus, enhancing decision-making, and strategic planning.

- T-accounts are fundamental to accountancy, allowing effective communication of financial information.

Conclusion

The T-account, a foundational tool in double-entry bookkeeping, visually represents financial transactions, dividing entries into debit and credit sides. It aids in recording and understanding various accounts, including assets, expenses, revenue, and liabilities. T-accounts help accountants and financial professionals gain clarity in transaction recording, aiding decision-making and communication of financial information effectively.