Return on Invested Capital (ROIC) measures profits on all capital (short term debt, long-term debt, and equity). It reflects how efficiently the company uses it total capital to generate Profits for the Debt providers and Shareholders. The return on capital employed (ROCE) ratio shows how much profit each dollar of employed capital generates. Obviously, a higher ratio would be more favorable because it means that more dollars of profits are generated by each dollar of capital employed and shows that the company is using the funds invested by various fund providers efficiently. It is one of the most used and relied upon Profitability Ratios used by analysts and investors to analyze whether a company is doing good in terms of growing the business and generating more returns from the given funds at hand. It helps to analyze whether a company’s stock is undervalued by the stock market or where trading at a premium it deserves so.

FORMULA

ROIC (%) = Net Operating Profit After Taxes (NOPAT)

Invested Capital

The Formula is expressed in percentage. ROIC can be calculated using Balance sheet and Income statement.

HOW TO CALCULATE ROIC:

Steps to calculate NOPAT-

- NOPAT can be calculated using two numbers from the company’s Income statement- Earnings Before Interest and Taxes (EBIT) and the Marginal tax rate of the company. We can take the Operating Income of the company and add any other the company generates. We may alternatively also take EBITDA and remove depreciation and amortization expenses from it.

- Next we have to take the tax rate applicable to the company. Tax rates may vary from company to company based on the country in which it is located and the regulatory tax laws. The Federal marginal tax rate for most of the US companies is currently ranging from 10% to 37%.

- Once we calculate both the figures in step 1 & step 2 we can easily get NOPAT. NOPAT= EBIT*(1-effective tax rate).

Steps to Calculate Invested Capital-

One can calculate Invested Capital either by considering the company’s net operating assets or by considering its net debt and equity financing on the balance sheet. However, the first option of calculating Invested Capital by considering its net operating assets is a better option since it will give us a better view of how efficiently the company is using the capital invested by its shareholders and debt providers.

- Firstly, calculate the net Working Capital which is equal to Operating Current Assets (non-financial like Accounts Receivables, Inventory, Prepaid expenses, etc) minus operating Current Liabilities (non-interest bearing such as Accrued Expenses or Accounts Payable. Don’t add cash since is is mostly financial in nature.

- Add Property, plants and equipment, other operating assets and goodwill to the Net Working calculated in Step 1.

- You may choose to exclude goodwill if you want to calculate ROIC excluding goodwill.

ROIC Calculation

Once we have both NOPAT and Invested Capital calculated as above we just have to divide NOPAT by the Invested Capital.

EXAMPLE:

A company generates $100,000 EBIT

Marginal Tax rate is 21%

Operating Current Assets (excluding cash) of the company is $ 300,000

Operating Current Liabilities (non- interest bearing) is $ 200,000

Fixed Assets (Plant, property and equipment, goodwill and other operating assets) is $ 600,000

Goodwill = $50,000

Solution:

ROIC (including goodwill) = EBIT*(1- Tax)/ Invested Capital (with goodwill)

= 100,000*(1-21%)/ (300,000-200,000+600,000+50000)

= 10.53%

ROIC (excluding goodwill) = EBIT*(1- Tax)/ Invested Capital (w/o goodwill)

= 100,000*(1-21%)/ (300,000-200,000+600,000)

= 11.29%

RETURN ON INVESTED CAPITAL AND WEIGHTED AVERAGE COST OF CAPITAL

In order to see whether a company is creating or destroying value it should compare its Return on Invested capital with the weighted average cost of capital (WACC).

What Is Weighted Average Cost of Capital?

Every company requires Capital to undertake projects. Capital will be provided by different set of investors- Equity investors or debt investors. Each investor will seek an adequate compensation (return) to invest in the Company’s projects. The weighted average return that company offers to investors is WACC. It is a function of existing capital structure, project risk, company financial position and other factors.

Example: The market value of ABC Ltd equity and debt is $50,000 crores and $15,000 crores respectively. The cost of equity for ABC Ltd is 15% and cost of debt is 10%. It operates in a 30% tax bracket. What is the WACC for ABC Ltd?

Solution: Capital Structure Weights

Equity (50000/65000) =77%

Debt (15000/65000) = 23%

Cost of Capital

Cost of Equity: 15%

Cost of Debt: 7% (10% *30%)

WACC= {(0.77×0.15) + (0.23×0.07)}

= 13.16%

From the above example we can clearly see that WACC is the cost of the project while ROIC is the return a company generates per unit of capital invested.

A firm is expected to create value by investing in profitable projects is the calculated ROIC is greater than the WACC. On the other hand, value is expected to be destroyed, if the ROIC is lower than the WACC, since the cost of funding the projects is greater than the return earned by the company on those projects.

Hence, If ROIC>WACC, then Invest in the company or project

If ROIC<WACC, then ignore to invest in the company or project

Difference between ROIC and WACC is called as Economic return or Excess return.

WHAT IS CONSIDERED AS A GOOD OR IDEAL ROIC RATIO?

The return on invested capital is one such method to analyze whether a company has certain advantage to help protect the company from their competitors and grow the returns from the given funds a term also known as economic moat.

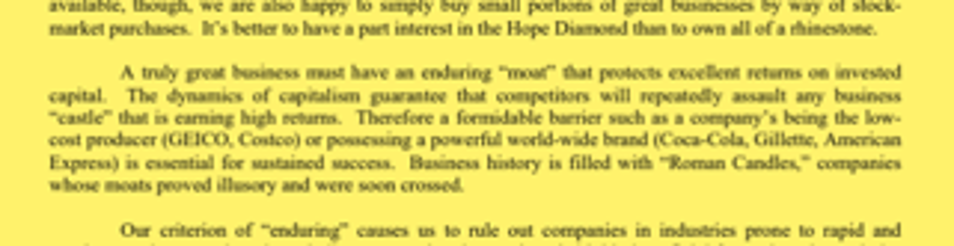

Source data: Warren Buffett on Economic Moats (Source: 2007 Berkshire Hathaway Shareholder Letter)

This ratio is the most important profitability ratio used by the investors both retail and institutional investors to identify the potential investment in the stock market.

When investors look to invest in potential investments, ROIC tends to be set minimum between 10% and 15%, but this again will depend upon company to company, the industry in which it is operating and the type of growth strategy employed by the company. However, in any case ROIC should be greater than WACC.

A 50% ROIC means that if a company has total $1 billion funds with it, it is able to reinvest this amount to increase the investment to $1.5 billion. In contrast, a 25% ROIC means that if a company has a total of $1 billion funds with it, it is able to reinvest only $1.25 and hence to raise additional funds from the market hence further diluting the existing shareholders share in the net profits of the company.

WAYS TO IMPROVE ROIC IN THE LONG RUN BY THE COMPANIES

Some of the ways for the companies to improve its ROIC in the long run are:

- Lowering its WACC from Debt Issuance and optimizing its capital structure

- Identify the high value creating projects, where ROIC>WACC, and focus their funds in those projects to continue increasing its ROIC and value for the investors

- Identify the projects that are destroying the value, i.e., where ROIC <WACC and divert the funds from that project or put an end to that project

- Implementing methods to improve operating efficiency of the company i.e., Improving the profit margins of the company by focusing the funds into high value generating projects or reducing the unnecessary spending.

- Improving the Working capital cycle. Lower the working capital cycle of the company the lesser funds will be tied up in accounts receivable or inventory and more credit period will be available to the company to pay off its short term debts. Since Working capital will be less the Invested capital in turn will be lower thus improving the ROIC metric of the company.

EXPANDED FORMULA OF ROIC

ROIC= (Revenue/Average Invested Capital) * (NOPAT/Revenue)

ROIC is all about how much Revenue is generated by each dollar of invested capital donated as “Invested Capital” and much profit is retained after reducing the cost of goods sold and other operating expenses from the revenue to arrive at EBIT which is then tax adjusted to give “NOPAT”.

Hence a high profit margin (here termed as Operating margin) means higher return on invested capital since the company can convert more of Revenue into profits (NOPAT) for the fund providers.

DIFFERENCE BETWEEN ROIC AND ROE

| Return on Invested Capital (ROIC) | Return on Equity (ROE) |

| Measures return on all capital( short term debt, long term debt and equity) | Measures return on all equity (minority equity, preferred equity, common equity |

| Measures return earned for all fund providers | Measures return for only equity shareholders |

| This ratio measures how efficiently a firm utilizes its debt providers and equity shareholders money invested | This ratio measures how efficiently a firm utilizes its shareholders money invested |

| ROIC= NOPAT/Average Invested Capital | ROE= Net Income/ Average Total Equity |

LIMITATIONS OF ROIC

- More important for some sectors compared to others: For companies that invest heavily on capital assets like manufacturing companies, companies operating oil rigs etc., ROIC is the best measure to capture how much return is generated by each capital investment made. However, it is not of much use for companies like software companies or the finance companies like banks and insurance companies because they use capital in their products itself.

- Do not give a true picture for companies operating in multiple segments: Some companies operate in multiple segments like ITC ltd or Unilever. Some segments may be extremely capital-intensive while the others may not require much of capital. Since these segments operate in entirely different industries from one another, ROIC which is calculated using entire companies operating profit and Invested capital, the investors will not be able to clearly identify which segment of the business has led to maximum value generation or value loss.

- Presence of some factors in ROIC giving misleading results: A company has varied assets in its balance sheet and impairment of those assets have an impact of reducing the Invested capital. Since invested capital falls, the ROIC margin becomes higher. However, the investors here often miss out to check which factor in the ROIC formula led to increase or decrease in the margin. For example, if the Goodwill takes the major share of the company’s asset total, any new acquisition will lead to lower ROIC as the denominator for ROIC formula will increase. On the other hand, if the Goodwill is written off due to any reason like declining brand reputation of the acquired business, ROIC will in turn improve as the denominator reduces.

Excess cash in hand with the company which is not really invested into the project causes the ROIC to fall, since it increases the denominator of ROIC unless adjusted for.

- Non-recurring events affecting ROIC: Some of the non-recurring gain or loss to the company can affect its ROIC metric since it has direct impact on the numerator side of the ROIC formula. Investors should adjust those non-recurring income or losses to arrive at the correct ROIC figure.

- Difficulty in inter-company comparison of the ROIC metric: Accounting practices vary across industries and tax rates too. Hence before comparing any two company’s ROIC one should make sure to account for the necessary adjustments in the NOPAT and Invested capital figures.

HOW ROIC IS THE MOST IMPORTANT MEASURE OF PROFIT & MAIN DRIVER OF FREE CASH FLOW

Assume Company X has ROIC of 20% and Company Y has ROIC of 10%. Both the companies aim to grow at 5% per annum.

Company has to only reinvest only (5%/20%) i.e., 25% of its profits to grow earnings, whereas Company Y has to reinvest (5%/10%) i.e., 50% of its profit to grow earnings at the same given 5% of growth. Since Company X requires lower reinvestment rate, it requires lesser capital investment to achieve the same result that Company Y achieves using higher capital investment. Lesser Capital Investment also results in higher free cash flow for Company X because of lesser payout of interest to the debt providers. Hence, higher ROIC leads to higher generation of Free Cash Flow per dollar of earnings and which in turn drives growth of Company’s Intrinsic value. This also means lesser dilution of funds available for existing debt and equity providers. The higher Free cash flow available ensures that the companies rely on the internally available funds and have to rely less on the outside sources of funds. Using this free cash flow companies can also pay off its existing debt and hence leads to further increased free cash flow and higher growth for the company. However, growth only increases the value of business if its ROIC is greater than the WACC.

ROIC Calculation – REAL LIFE EXAMPLE

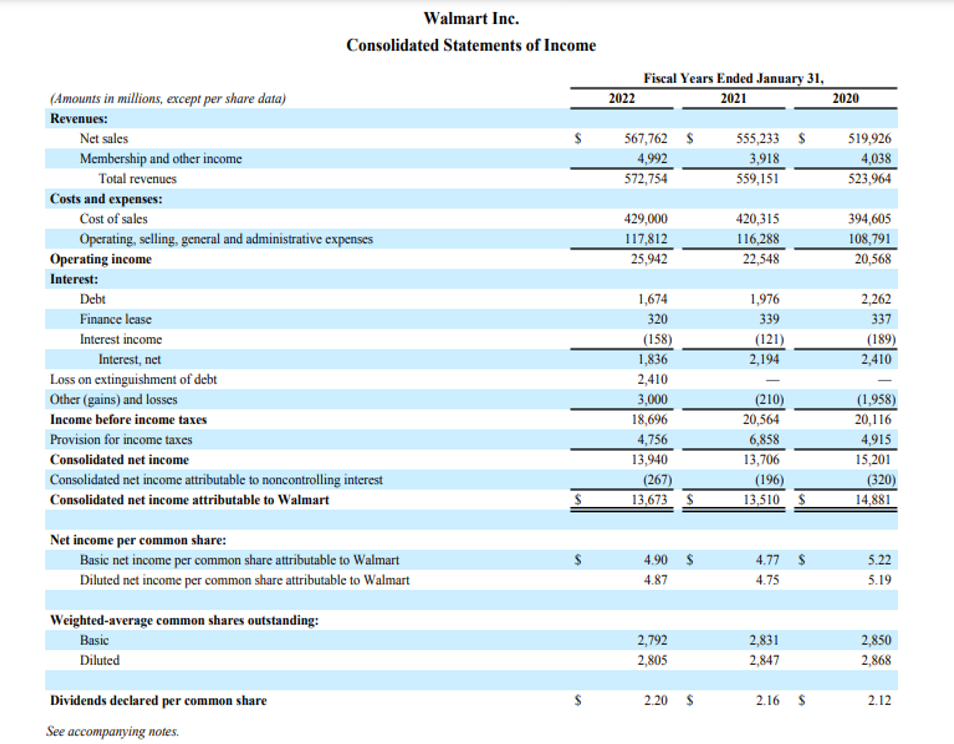

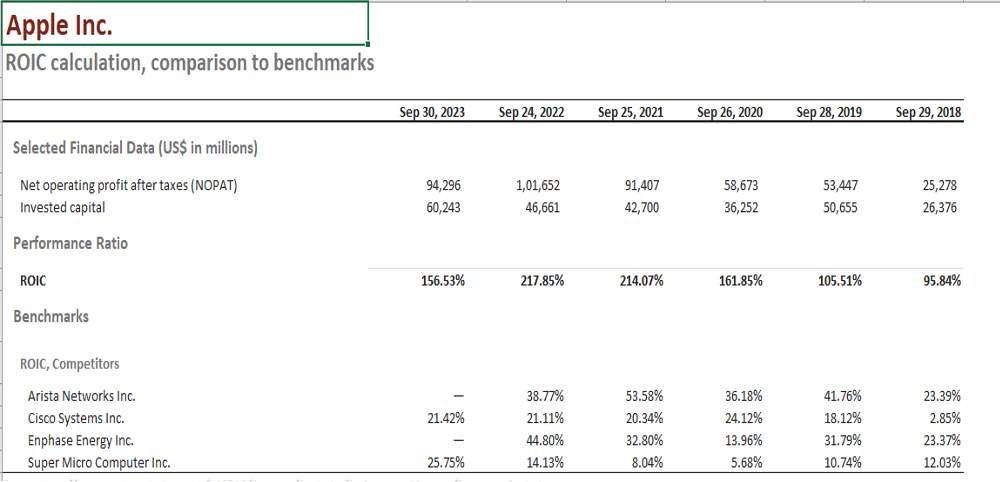

Let’s consider The Consolidated Income Statement and Consolidated Balance Sheet of Walmart Inc. for the Financial year ended 2022.

Source: https://stock.walmart.com/financials/annual-reports/default.aspx

Let’s Calculate the ROIC of the Company for the FY 2022

- Companies Operating profit for 2022 as given in the Income statement is $25,942 million. Its effective tax rate is Provision for Income taxes divided by Income before Income Taxes, i.e., $ 4,756 million divided by $ 18,696 million= 25.44 %. The NOPAT hence comes to 25,942(1-25.44%)= $ 19,342.

- The Invested capital for 2022 and 2021 is as follows:

(Amount in millions)

| Particulars | 2022 | 2021 |

| Total Assets | $244,860 | $252,496 |

| Less: Cash and cash equivalents | $14,760 | $17,741 |

| Total assets less excess cash (A) | $230,100 | $234,755 |

| Less: Accounts payable | $55,261 | $49,141 |

| Less: Accrued Liability | $26,060 | $37,966 |

| Less: Accrued Income taxes | $851 | $242 |

| Total Non- Interest Bearing Liability (B) | $82,172 | $87,349 |

| Invested Capital (A-B) including Goodwill | $147,928 | $147,406 |

Average Invested Capital= $(147,928+147,406)/2= $147,667

- ROIC (including goodwill)= $19,342/$147,667 = 13.1%

- ROIC (excluding goodwill) = 16.3%

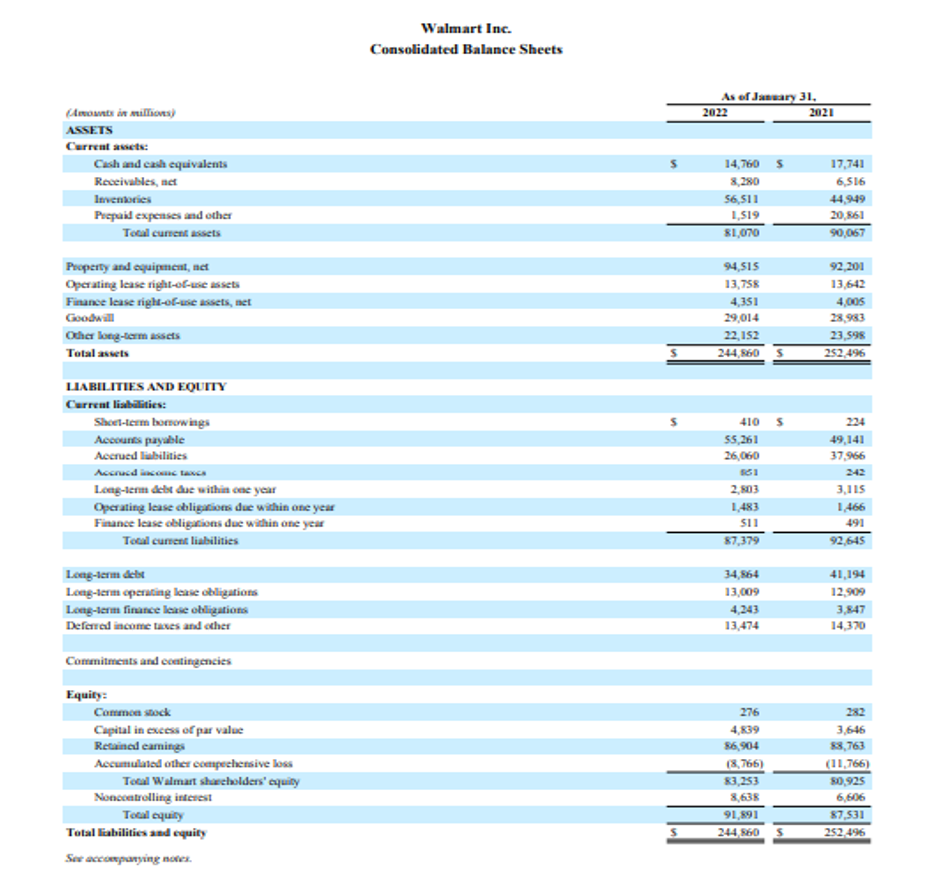

YEAR ON YEAR ANALYSIS OF APPLE INC’S ROIC & COMPARISION WITH ROIC OF ITS COMPETITORS

ROIC is also used as a metric to compare the ROIC of the Company with its competitors by the analyst and investors. Here we have taken the ROIC of some of the companies who operate in the similar industry like Apple Inc.

Source: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Performance-Measure/Return-on-Capital

44 thoughts on “ROIC – do we finally have a good measure of value creation?”

[…] ROIC – Return on invested capital […]

[…] interest and taxes, while the “G” represents the revenue growth rate in the business. ROIC is return on invested capital. By taking into account different components of a company’s […]

[…] examples to gain a better understanding of ROE and distinguish it from other metrics such as ROIC and ROA. Let’s dive […]

… [Trackback]

[…] Here you will find 25464 more Information to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Find More Info here to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Read More here on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Find More on to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Find More on to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Find More on to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Read More here on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] There you will find 82415 additional Information on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Find More here to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Here you will find 29018 additional Info to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Information to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] There you can find 42254 additional Information to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/roic-return-on-invested-capital/ […]

… [Trackback]

[…] Read More on on that Topic: skillfine.com/roic-return-on-invested-capital/ […]

Pretty! This has been a really wonderful post. Many thanks for providing these details.

I was recommended this website by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my difficulty. You are wonderful! Thanks!

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

Excellent web site. A lot of helpful information here. I¦m sending it to a few pals ans additionally sharing in delicious. And of course, thanks for your sweat!

Greetings from Colorado! I’m bored at work so I decided to check out your website on my iphone during lunch break. I really like the info you present here and can’t wait to take a look when I get home. I’m surprised at how fast your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyways, excellent blog!

magnificent issues altogether, you simply gained a

new reader. What may you suggest in regards to your put up that you just made

some days in the past? Any sure?

647657 43978I was reading some of your content on this website and I conceive this internet web site is really informative ! Maintain on putting up. 415303

286008 260145Extremely informative and outstanding bodily structure of content material material , now thats user friendly (:. 735767

450793 325503Sweet web web site , super style and style , rattling clean and utilize genial . 191155

469828 478002Youre so cool! I dont suppose Ive read anything like this before. So good to find somebody with some original thoughts on this topic. realy thank you for starting this up. this internet site is something that is needed on the internet, someone with a little originality. helpful job for bringing something new towards the internet! 812928

你们的项目 百分百 教授。多发布!

我经常计划, 那么放松地度假。继续分享感动。 [url=https://iqvel.com/zh-Hans/a/%E9%98%BF%E6%A0%B9%E5%BB%B7/%E4%B9%8C%E7%8E%9B%E7%93%A6%E5%8D%A1%E6%97%B1%E8%B0%B7]干旱峡谷[/url] 我很少遇到, 这么高质量的内容。非常酷。

不可思议的 关于旅行的门户! 越来越棒!

28804 970544Thanks for the post, was an interesting read. Curious as to how you came about that solution 310294

What if a company with a low effective tax rate was found to be engaging in offshore tax havens, shedding light on potential tax evasion practices? [On our website, we offer present-day and the best Crypto Analysis with AI to go to your house] [url=https://crypto.kodx.uk/]crypto.kodx.uk[/url]

[url=http://agiusandagius.com/via-the-internet-traditional-casino-first-deposit-bonuses-get-the-best-quality-prices-2/#comment-36004]#gpt_question_subject [The surpass Crypto Analysis with AI. crypto.kodx.uk][/url] 122d027

[url=https://github.com/apps/dr-fone-crack-wondershare]Dr-Fone Crack[/url]

Have you ever considered the implications of manipulating tax strategies to achieve an artificially lower effective tax rate? What ethical dilemmas might arise when balancing shareholder profits with societal responsibility? [Upload, send files across the internet with ease. Highly customizable, trackable. tender contemporary and the a- Easy file transfers through despite your house] [url=https://transfer.kodx.uk/]transfer.kodx.uk[/url]

[url=https://mealswdmustard.com/decoding-victory-a-tactical-guide-to-football-betting-excellence/#comment-36556]#gpt_question_subject [The most suitable Easy file transfers.][/url] 8d84e61

Is the ‘Magic Triangle’ of Effective Tax Rate, WACC, and ROIC a Mirage in Today’s Hyper-Connected Business World? Can Short-Term Debt and Long-Term Debt be the Key to Unlocking New Investment Opportunities? Explore at

你 真正 给予建议。多发布!