Introduction

In the dynamic landscape of financial management, Days Payable Outstanding (DPO) emerges as a crucial indicator of a company’s financial stability and operational efficiency. DPO measures the average number of days a company takes to settle its accounts payable, offering valuable insights into its liquidity management and supplier relationships. By analysing DPO, businesses can measure their ability to optimise cash flow, balance net working capital requirements, and strengthen supplier partnerships. This metric plays a pivotal role in strategic decision-making, guiding organisations towards prudent cash management practices and sustainable growth. In this article, we delve into the details of days payable outstanding, the significance of DPO and highlight strategies for optimising this key financial metric.

Days Payable Outstanding (DPO)

Days Payable Outstanding (DPO) measures the average number of days a company takes to pay back its accounts payables. DPO usually measures on a quarterly or annual basis.

A higher Days Payable Outstanding represents that a firm takes more days to pay its bills. Higher days payable outstanding increases the amount of cash with the firm. This leads to growth, investing in securities, paying off short or long-term debt and improving the liquidity of a business.

While a lower day’s payable outstanding shows that the company is quickly clearing its credit purchases. A company’s days payable outstanding varies from industry to industry.

Formula:

| Days Payable Outstanding | = (Average Accounts Payable/ Cost of Goods Sold) * Number of days |

- Accounts Payables refers to the amount of money a company owes to its suppliers. Accounts payables are recorded as the current liabilities of a business on the balance sheet. Average accounts payable is calculated by adding the opening balance and closing balance of accounts payable and then dividing it by two.

| Average Accounts Payable | = (Opening Accounts Payable + Closing Accounts Payable) / 2 |

- Cost of Goods Sold is the direct cost incurred by the firm for producing the goods.

- Number of Days taken for days conversion of DPO. The number of days changes depending on the period. For yearly calculation of DPO, 365 days shall be considered, 90 days for quarterly calculation, etc.

Real Life Example:

Let’s understand the calculation of Days Payable Outstanding of Walmart for the year ended 2022:

Source: https://s201.q4cdn.com/262069030/files/doc_financials/2022/ar/WMT-FY2022-Annual-Report.pdf

Calculation of Average Accounts Payables

| Opening Accounts Payable | = 49,141 |

| Closing Accounts Payable | = 55,261 |

| Average Accounts Payable | = (Opening Accounts Payable + Closing Accounts Payable) / 2 |

| = (49,141 + 55,261) / 2 | |

| Average Accounts Payable | = 52,201 |

| Cost of Goods Sold | = 429,000 |

Calculation of Days Payable Outstanding

| Days Payable Outstanding | = (Average Accounts Payable/ Cost of Goods Sold) * Number of days |

| = (52,201/ 429,000) * 365 | |

| Days Payable Outstanding | = 44 Days |

Based on the above calculations we can conclude that the days payable outstanding of Walmart in the year 2022 was 44 days.

Optimal Level of Days Payable Outstanding

We have seen that the lower the Days Sales Outstanding (DSO), the better. However, this is not the case with Days Payable Outstanding (DPO). A company needs to determine the optimum days required to pay back its trade creditors.

If a company has a low day payable outstanding, it means the company is quickly clearing its bills. This is good for maintaining healthy relations with the suppliers and enjoying trade discounts but, due to this, the company might lose different investment opportunities and liquidity.

On the other side, a company having a very high day payable outstanding, may hamper relations with the suppliers, slow down the delivery and lead to the development of unfavourable payment terms.

Therefore, a very high day payable outstanding ratio or very low day payable outstanding is not optimal for a business.

Comparative Analysis of Days Payable Outstanding:

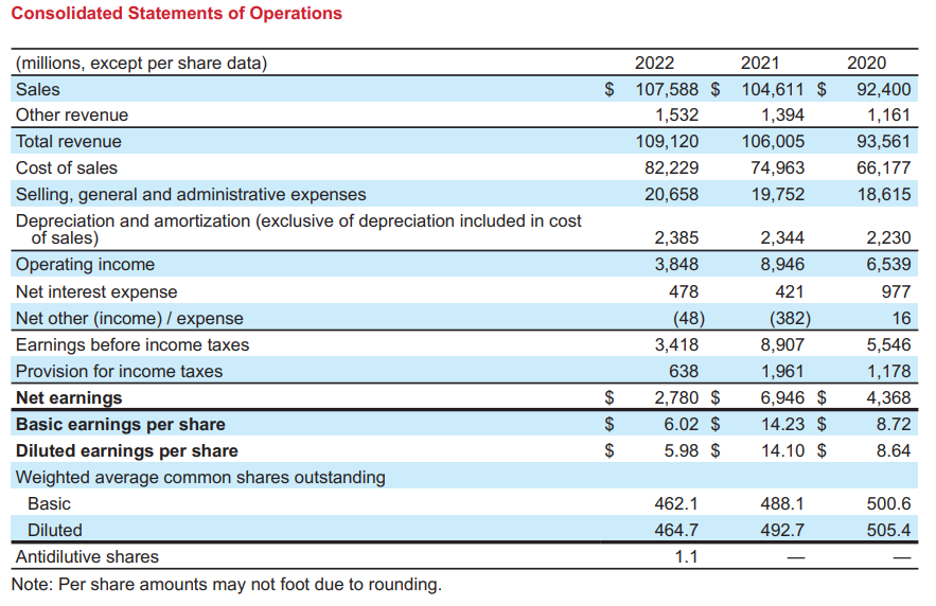

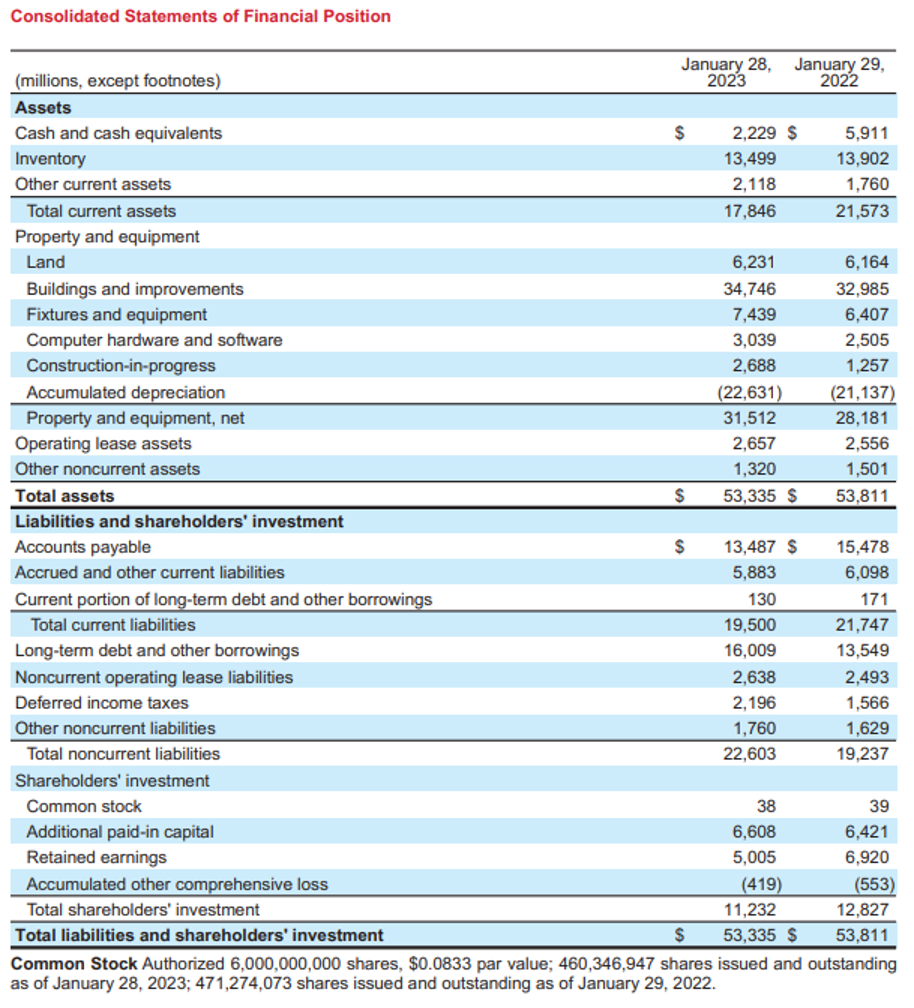

Now let’s calculate and compare the days payable outstanding of Walmart and Target for the year ended 2022:

Calculation of Days Payable Outstanding of Target

Calculation of Average Accounts Payables of Target

| Opening Accounts Payable | = 15,478 |

| Closing Accounts Payable | = 13,487 |

| Average Accounts Payable | = (Opening Accounts Payable + Closing Accounts Payable) / 2 |

| = (15,478 + 13,487) / 2 | |

| Average Accounts Payable | = 14,482.5 |

| Cost of Goods Sold | = 82,229 |

Calculation of Days Payable Outstanding of Target

| Days Payable Outstanding | = (Average Accounts Payable/ Cost of Goods Sold) * Number of days |

| = (14,482.5/ 82,229) * 365 | |

| Days Payable Outstanding | = 64 Days. |

On calculating the days payable outstanding of Walmart and Target we saw that Walmart took 44 days to clear its payables, while Target took 64 days to pay off its creditors. So, we can conclude that Walmart has a lower days payable outstanding than Target as Walmart paid its creditors 20 days earlier.

Trends in Days Payable Outstanding

Fluctuations may occur in a company’s days payable outstanding over a long period. This can be a result of:

- The economic conditions of a country, can hamper the overall liquidity of the industry and firms. Therefore, this results in high days payable outstanding due to a cash crunch.

- Financial Distress is also a major reason that a company might have a fluctuating day payable outstanding over a long duration.

- Loyalty to particular suppliers might help a company negotiate on credit terms with them. Thus, a company might get a longer credit period.

- If a company is involved in manipulating its accounts, it to show an optimal DPO. This is an unethical practice which might temporarily inflate the days payable outstanding.

How to optimise the Days Payable Outstanding of a company

A company needs to maintain an optimal Days Payable Outstanding by taking the following steps:

- To opt for a better accounts payable process. This includes establishing clear policies regarding credit purchases with its suppliers and developing an online supplier portal to smooth down the payment process.

- Keeping accurate records is essential to optimise a company’s days payable outstanding. Record keeping is not only limited to the proper maintenance of invoices but also includes appropriate reconciliation of accounts payables, updating records and reviewing suppliers’ contracts.

- A business can optimise its days payable outstanding by working on the payment terms with the supplier. This process includes the standardisation of payment terms, and negotiating with suppliers over discounts, etc.

- A company must avoid penalties for making late payments, this does give the business a higher days payable outstanding but might cost them on penalties and even destroy relationships with the suppliers.

- A company should also ascertain the advantage between getting an early payment discount or holding the cash and paying the suppliers near the due date.

Relationship between Days Payable Outstanding and Accounts Payable Turnover

Accounts Payable Turnover is a metric that quantifies the number of times a company pays off its trade creditors in a given period. Or we can say the number of times a company turns its accounts payable.

Accounts payable turnover and Days payable outstanding have an inverse relationship.

If the days payable outstanding go up, the company takes more time to pay off its bills, resulting in lower accounts payable turnover.

If the company pays off its creditors quickly, the more the company will be able to turn its suppliers in a period.

Days Payable Outstanding and Cash Conversion Cycle

The cash Cycle shows how many days it takes for a business to convert its cash in inventory to money again.

Formula of Cash Conversion Cycle:

| Cash Conversion Cycle | = Days Inventory Outstanding + Days Sales Outstanding – Days Payable Outstanding |

Days Payable Outstanding forms the final part of the cash cycle. A high days payable outstanding leads to a shorter cash conversion cycle. To exercise the opportunity of having more cash in hand, businesses tend to delay the payment of their suppliers.

Conclusion

In conclusion, Days Payable Outstanding (DPO) is a critical metric for assessing a company’s financial health and operational efficiency. A higher DPO indicates more time taken to pay bills, increasing cash reserves for growth and debt repayment. Conversely, a lower DPO suggests prompt bill payments, fostering supplier relations but limiting liquidity. Achieving an optimal DPO requires balancing these factors and implementing efficient accounts payable processes.

By understanding the relationship between DPO, Accounts Payable Turnover, and Cash Conversion Cycle, businesses can make informed decisions to optimise cash flow and working capital.

Overall, DPO provides valuable insights into cash flow dynamics and supplier relations, enabling businesses to enhance financial performance and position themselves for long-term success in today’s competitive landscape.

27 thoughts on “Days Payable Outstanding (DPO) – how long do you have before you pay them”

[…] Payable Outstanding (DPO)- Days Payable Outstanding is the average number of days it takes a company to pay its invoices from trade creditors or […]

[…] Cash Conversion Cycle: Days inventory outstanding + Days sales outstanding – Days payables outstanding […]

… [Trackback]

[…] Information to that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Read More here on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Here you will find 30605 more Information on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Find More Information here to that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Here you can find 56398 additional Information on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/days-payable-outstanding/ […]

… [Trackback]

[…] There you can find 18418 more Info on that Topic: skillfine.com/days-payable-outstanding/ […]

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

It seems like you’re repeating a set of comments that you might have come across on various websites or social media platforms. These comments typically include praise for the content, requests for improvement, and expressions of gratitude. Is there anything specific you’d like to discuss or inquire about regarding these comments? Feel free to let me know how I can assist you further!

I am so grateful for your article.Much thanks again. Cool.

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my difficulty You are wonderful Thanks

awesome

851406 427923camping have been the top activity that we can have during the summer, i enjoy to roast marshmallows on a campfire` 972251

711767 590253Im having a small dilemma. Im unable to subscribe to your rss feed for some reason. Im making use of google reader by the way. 777498

I read this article fully concerning the comparison of most up-to-date and

preceding technologies, it’s amazing article.

บทความนี้ ให้ข้อมูลดี

ครับ

ผม เพิ่งเจอข้อมูลเกี่ยวกับ เนื้อหาในแนวเดียวกัน

ซึ่งอยู่ที่ สล็อตเว็บตรง

ลองแวะไปดู

เพราะให้ข้อมูลเชิงลึก

ขอบคุณที่แชร์ คอนเทนต์ดีๆ นี้

และอยากเห็นบทความดีๆ แบบนี้อีก