WHAT IS CASH CONVERSION CYCLE?

The cash conversion cycle (CCC) also known as the net operating cycle or the cash cycle measures the length of time taken by a company to convert its inventory into cash after a sale to a customer. This financial metric helps companies to keep track of their cash flows and profitability by expediting inventory turnover and debtor’s turnover and negotiating favorable credit terms with its vendors.

One of the biggest challenges faced by businesses today is the economic slowdown in cash flow which hinders the company’s growth and can even lead to its failure. Hence Cash conversion cycle is one of the key metric for company to improve its financial health and cash flow. The CCC is a reflection of a company’s operational and managerial efficiency. Companies can improve its working capital management by improving its CCC over time.

CCC varies from one company to another depending on its nature of its business and industry. For example, industries like e-commerce (Amazon, flip kart) and fast-moving consumer goods (Nestle, Colgate) often have a shorter cash conversion cycle. While on the other hand construction and manufacturing have a longer CCC due to its inventory being tied up for a longer period in the production cycle.

CCC is a metric used by businesses of all sizes to keep a track on how efficiently and fast they are able to sell their inventory, collect cash from debtors, and pay their vendors.

REAL LIFE EXAMPLE OF CASH CONVERSION CYCLE OF COMPANIES

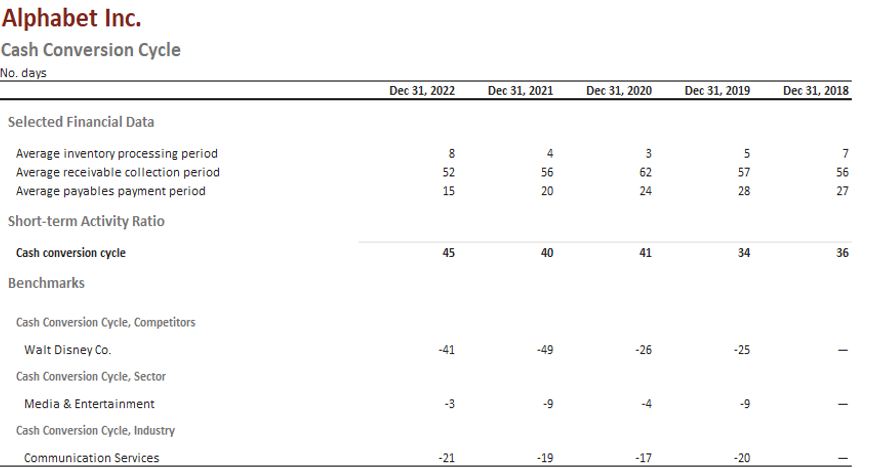

Let us see the Cash Conversion Cycle of Alphabet Inc. from the year 2018 to 2022.

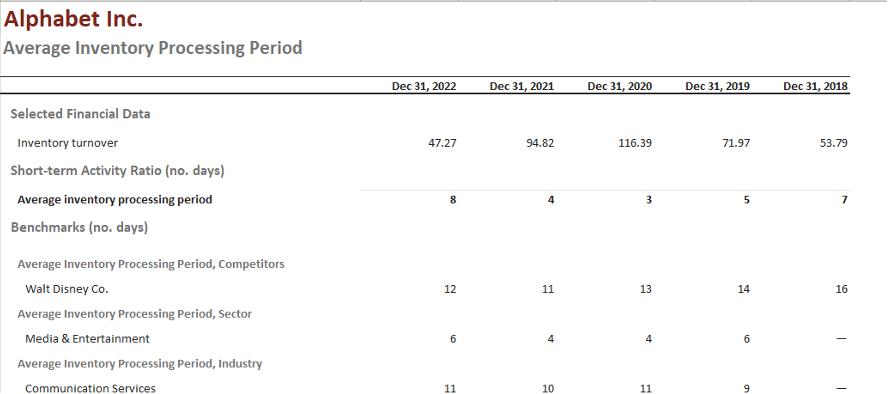

Days Inventory Outstanding (DIO)

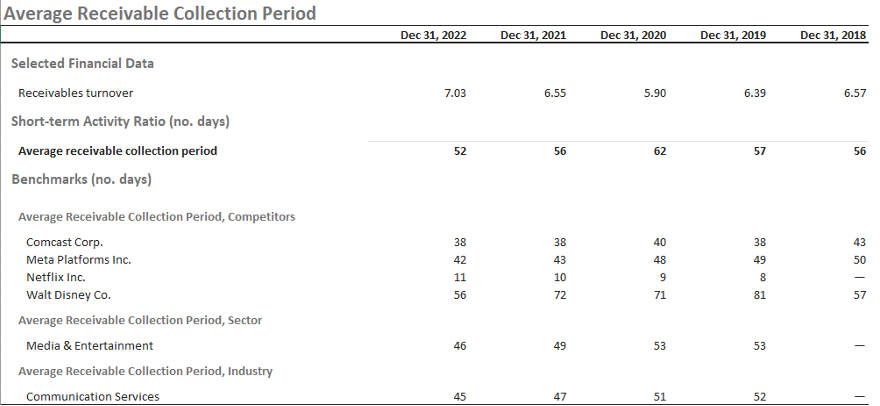

Days Sales Outstanding (DSO)

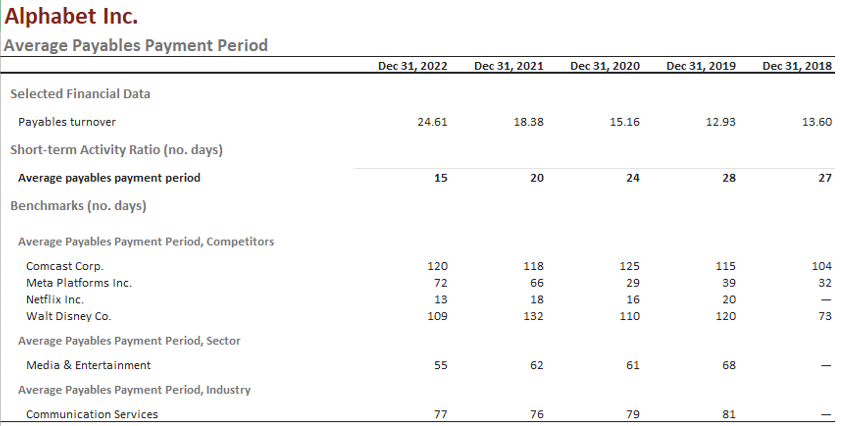

Days Payable Outstanding (DPO)

Cash Conversion Cycle

HOW TO CALCULATE THE CASH CONVERSION CYCLE?

The cash conversion cycle covers three stages – the time required for the company to sell its stored inventory, efficient collection of cash from its customers (outstanding accounts receivables), and for how long the payment date can be pushed out for suppliers for goods/services (accounts payable). Three important working capital metrics are used to calculate the cash conversion cycle metric and each of these metrics give us a valuable insight into what is happening within the company and how cash flows can be improved.

The company can improve its working capital, cash flow and liquidity by consistently monitoring the cash conversion cycle (CCC) metric.

These three metrics with its formula are as follows:

- Days Inventory Outstanding (DIO)- It refers to the average number of days it takes for a company to sell off its inventory balance. It shows how efficiently a company is managing its inventory and turning its assets into cash. Companies aim to minimize their Days inventory outstanding, as that implies inventory is quickly being converted to sales.

Formula: Days Inventory Outstanding (DIO)= Average or ending inventory/ Cost of Goods Sold*365

- Days Sales Outstanding (DSO)- Days Sales Outstanding is the average number of days it takes for a company to collect payment from its customers after sale. This metric shows company’s effectiveness in its credit and collection processes. Lower Days Sales Outstanding suggests that a company takes lesser time to convert its credit sales into cash. Tracking this metric is essential to maintain a healthy financial position.

Formula: Days Sales Outstanding = Average or Ending Accounts Receivable/ Revenue *365

- Days Payable Outstanding (DPO)- Days Payable Outstanding is the average number of days it takes a company to pay its invoices from trade creditors or suppliers for products or services received. This metric helps to access whether the company is managing its payables in a way to maintain a healthy cash flow and net working capital balance to meet its financial obligations and operational needs. A high Days Payable Outstanding of a company relative to its industry competitors indicates that the company has bargaining power over its suppliers.

Formula: Days Payable Outstanding = Average or Ending Accounts Payable/ Cost of Goods Sold *365

CASH CONVERSION CYCLE FORMULA

The cash conversion cycle is calculated by summing up the days inventory outstanding and days sales outstanding and subtracting from it the days payable outstanding.

Cash Conversion Cycle (CCC)= Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO)

Cash conversion cycle is also known as the Net Operating Cycle since the formula can be broken into two parts as following:

The first portion of the formula including DIO and DSO is called as the Operating Cycle which measures the average time taken in number of days for inventory to get converted to finished goods and being sold off and number of days for outstanding accounts receivable to get converted to cash.

The second part of the formula is days payable outstanding and needs to be deducted from the operating cycle. The higher the DPO the better for company as it gets extended time to hold on to the working capital required to meet the operational needs of the company. A lower CCC is preferred since it shows that the company is able to quickly convert its assets into cash and has lesser reliance on external funds to finance its operations.

INPUTS REQUIRED FOR CALCULATING CASH CONVERSION CYCLE

A company’s cash conversion cycle calculation moves through three separate stages and require several inputs from the financial statements of the company as following: –

- Inputs required from the Income Statement- Revenue and cost of goods sold (COGS)

- Inputs required from Balance Sheet- Inventory at the beginning and end of the time period, Accounts receivable (AR) at the beginning and end of the time period and Accounts payable (AP) at the beginning and end of the time period

- The number of days in the period which can be either a year (365 days or a quarter( 90 days) or a month (30 days).

IMPORTANCE OF CASH CONVERSION CYCLE

Some of the reasons why the cash conversion cycle is important to any business are as following:

- It helps to access the financial health and liquidity of a company- The cash conversion cycle is used to determine a company’s financial health and liquidity by the company stakeholders. A lower cash conversion cycle sends a message to the stakeholders that the company is able to quickly and efficiently able to convert its unsold inventory and outstanding receivables into cash which improves its ability to meet its operational and financial obligations and pay back its creditors and outstanding business loans timely without having to rely much on external source of financing.

- It helps in improving credit terms with its vendors- The cash conversion cycle metric is often looked by Vendors when deciding the credit terms with the company. A lower cash conversion cycle indicates that the liquidity position of the company is healthy and is more likely to pay off its invoices on time. Hence, a lower cash conversion cycle helps a company to secure favorable credit terms from its vendors. This can improve a company’s chances of getting better credit terms from vendors.

- Helps company easy access to capital and loans- Financial lenders often look at cash conversion cycle metric to extend business loan to a corporate since this metric shows whether a company has a healthy liquidity position and will be able to pay off its debts timely. A company with lower cash conversion cycle indicates that the company is able to pay off its debts timely as it has strong liquidity position and hence improves the chances of getting easy approval for business loans.

- Benchmarking Cash Conversion Cycle among different companies- Cash Conversion Cycle can be used to see how the company matches up with its competitors to analyze the company’s financial health compared to other companies in the same industry. A company with lower CCC compared to its competitors indicates that the company is more efficient in0 capital management which further results in faster conversion of assets to cash and higher profitability. It also enables a company to identify which areas need improvement to make its CCC better than its competitors.

WHAT IS A GOOD CASH CONVERSION CYCLE?

In general, it would be a positive signal if the Cash Conversion Cycle of a company is moving downward relative to previous periods indicating that assets are quickly converted to cash to meet its operational needs and a negative signal if the Cash Conversion Cycle is moving upward relative to the previous periods since it points towards potential management inefficiencies to convert the assets to cash timely and poor working capital management. However, there is no limit set to determine what is exactly a good or a bad CCC. We can say that the CCC of any company is good or bad only when compared with companies in the same industry or when CCC for the same company is calculated for different time periods and tracking the movement of CCC over time.

High Cash Conversion Cycle- A higher cash conversion cycle shows the inefficiencies of the management to manage its inventory levels, timely collection of payments from the customers and inability to secure favorable credit terms from the vendors.

Lower Cash Conversion Cycle- A low cash conversion cycle shows how the company enjoys bargaining power over its suppliers, have efficient payment collection process in place and has good control over inventory management in place.

HOW TO IMPROVE THE CASH CONVERSION CYCLE?

Companies by keeping track of its CCC over time and comparing it with other companies in the same industry can make certain improvements in its business processes so that its liquidity position and cash flow improves. Some of the common areas for improvement include:

- Inventory management: CCC can improve by reducing the inventory holding period. Further, optimization of the production and supply chain processes can effectively improve demand forecasting and reduce lead times.

- Accounts receivable management– A company can improve its CCC further by implementing effective credit and cash collection policies, incentives for early payments and automatic bill and collection processes in place.

- Accounts payable management– This can improve by negotiating better payment terms with the vendors, optimization of the procurement processes and implementing automated payment process within the company.

- Working capital financings– Cash flow can improve further reducing the CCC by opting for financing options like invoice discounting and factoring.

- Automation of the business processes- Automation of processes allows customer prioritization of the company based on their credit risk and payment behavior. This enables the company to focus on the most critical accounts leading to faster revenue collection. Automated credit management systems enable a company to identify the real time credit risk and disputes related to debtors that helps in reduction of the bad debts and improve the overall cash flow to the company. Automated inventory management further helps the company to reduce the unnecessary old stock building up and helps in real time identification of short or excess inventory.

A detailed analysis of working capital management has to be done to identify specific areas that need improvement to further reduce the CCC of the company.

WHAT CAUSES A NEGATIVE CASH CONVERSION CYCLE?

A negative cash conversion cycle means that the company has frequent inventory turnover and credit sales turning to cash more quickly before paying off the suppliers. Negative CCC’s though uncommon, it means “source” of cash for the company.

Online retailers like Amazon and eBay Inc. can have negative CCC’s. Online retailers often receive money in their accounts for sales of goods by the third party sellers who use the online platform. However, these online companies follow a monthly or time based payment cycle and do not pay the third party sellers immediately after the sale. This ends up the company with negative CCC since it allows these companies to hold onto the cash for a longer period of time. Moreover, mostly the goods sold through online platform are directly supplied by the third-party seller to the customer not requiring the online platform company to hold much inventory in house. In fact, a negative CCC helped Amazon survive the dot-com bubble of 2000, since negative CCC became a source of cash for the company to help carry out its operational activities without a pause.

Conclusion : Businesses need to maintain a healthy cash flows to be able to sustain the operations of the company. A faster cash conversion cycle is a huge enabler to improve the working capital requirement of a business and therefore means lower investment in inventory or receivables. While some businesses can operate on a negative cash conversion cycle which is a good thing from a cash flow perspective, for most other business a cash conversion cycle of 30-45 days would be a reasonable cycle to have.