Introduction

In the day-to-day operations of a business, transactions occur frequently, ranging from cash exchanges to credit agreements. While cash transactions ensure immediate liquidity, credit transactions can tie up funds, potentially affecting a company’s cash flow. Recognizing the impact of these credit transactions on liquidity is essential for effective financial management. Consequently, businesses must monitor and mitigate the delay in receiving debtor payments.

In the modern business landscape, customers are often given the choice between paying in cash or using credit. This flexibility can lead to delays in payment, affecting the company’s cash flow and overall liquidity. Therefore, to measure the time, it takes for debtors to settle their obligations, firms use a metric called Days sales outstanding (DSO).

What is days sales outstanding (DSO)?

Days sales outstanding (DSO) is a metric businesses use to determine the average time a company takes to recover the credit sales payment.

Firms calculate Days sales outstanding by dividing the average accounts receivable by the total credit sales of a given period. DSO calculation happens in days.

| Days Sale Outstanding | = (Average Accounts Receivable/ Total Credit Sales) * Number of Days |

- Accounts receivables are the amount recorded as due by a company for the goods and services sold on credit.

Average accounts receivables is the mean value of opening and closing accounts receivables of a given period.

| Average Accounts Receivables | = (Opening Accounts receivables + Closing Accounts receivables) / 2 |

Real Life Example

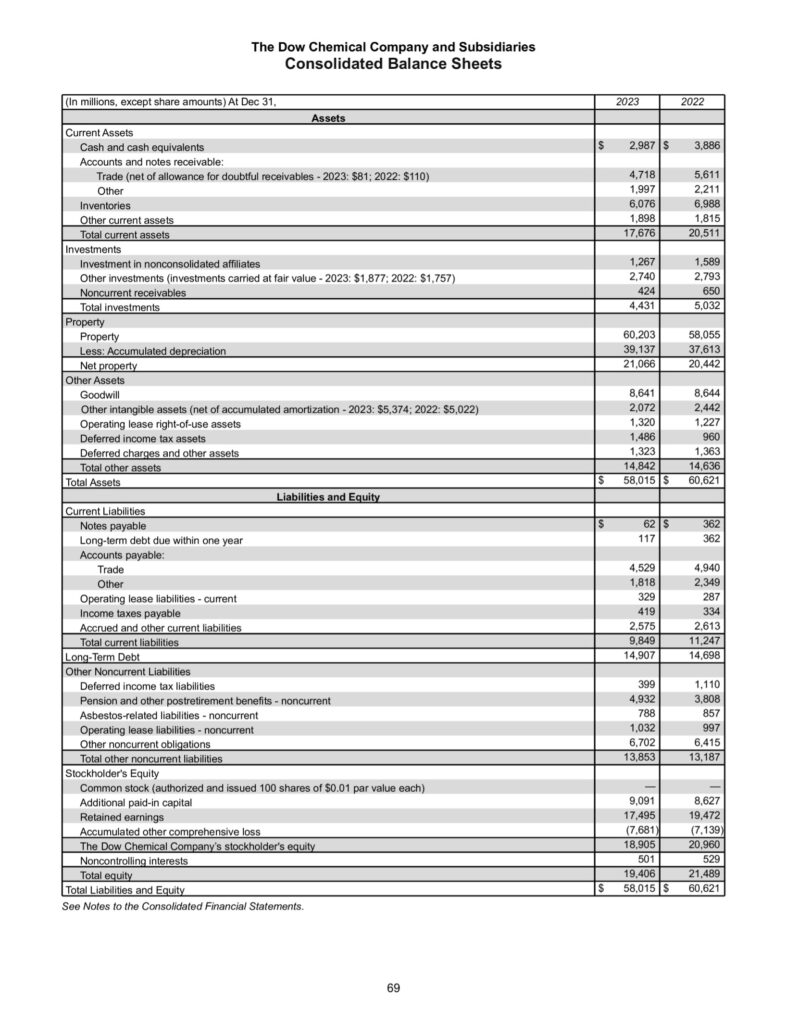

Let’s understand the Days Sales Outstanding of Dow Inc. for the year ending 2023:

Source: https://s23.q4cdn.com/981382065/files/doc_financials/2023/ar/dow_2023-annual-report_final.pdf , Page: 67 & 69.

| Sales | = 44,622 |

Note: For DSO calculation Dow Inc. has taken net sales of 2023.

Calculation of Average Accounts Receivables

| Opening Accounts Receivables | = 5,611 |

| Closing Accounts Receivables | = 4,718 |

| Average Accounts Receivables | = (Opening Accounts receivables + Closing Accounts receivables) / 2 |

| = (5,611 + 4,718) / 2 | |

| Average Accounts Receivables | = 5,164.5 |

Note: For Average Accounts Receivables, the value of Trade for the years 2022 and 2023 under Accounts and Notes receivables is considered.

Calculation of Days Sales Outstanding (DSO)

| Day Sale Outstanding | = (Average Accounts Receivable/ Total Credit Sales) * Number of Days |

| = (5,164.5/ 44,622) * 365 | |

| Day Sale Outstanding | = 42 Days. |

From the above calculation, we can conclude that the Days Sales Outstanding of Dows Inc. is 42 days. It means on average the debtors of Dow Inc. take 42 days to clear their pending invoices.

Analysis and Interpretation of Days Sales Outstanding (DSO)

Days Sales Outstanding helps businesses and investors with numerous interpretations.

- It helps investors perform different company analyses within a sector. Investors compare DSO to find which company is tying its money in unpaid invoices, which may lead to mismanagement of net working capital.

- DSO calculation helps businesses identify customers with extended credit terms, which provides them with the ability to forecast possible bad debts.

- Businesses use DSO to counter problems related to customer satisfaction by identifying the root cause of delayed payment.

- DSO calculation also opens the door of factoring for the businesses, to meet working capital requirements.

- Businesses use DSO to understand the monthly seasonality in sales. It also helps in forecasting demand for goods and services.

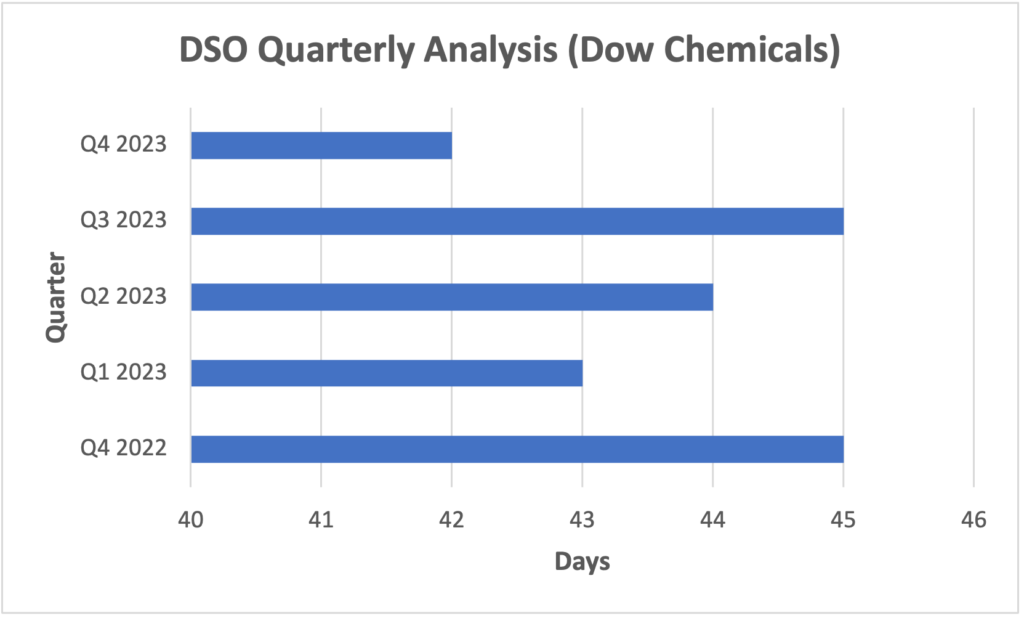

Five-Point Quarterly DSO Analysis

To understand the seasonality of days sales outstanding of Dow Inc., let’s perform a five-point analysis by calculating the DSO of Quarter 4 of 2022, Quarter 1 of 2023, Quarter 2 of 2023, Quarter 3 of 2023 and Quarter 4 of 2023.

Note: The data for the analysis is taken from the quarterly reports of Dow Inc.

For Quarterly calculation, the value for the number of days is taken as 90.

Source for Quarterly Reports: https://investors.dow.com/en/reporting/#earnings

- (all figures in millions)

| Sales | = 11,859 |

Calculation of Average Accounts Receivables

| Opening Accounts Receivables | = 6,407 |

| Closing Accounts Receivables | = 5,611 |

| Average Accounts Receivables | = (Opening Accounts receivables + Closing Accounts receivables) / 2 |

| = (6407 +5,611) / 2 | |

| Average Accounts Receivables | = 6,009 |

Calculation of Day Sale Outstanding

| Day Sale Outstanding | = (Average Accounts Receivable/ Total Credit Sales) * Number of Days |

| = (6,009/ 11,859) * 90 | |

| Day Sale Outstanding | = 45 Days. |

- (all figures in millions)

| Sales | = 11,851 |

Calculation of Average Accounts Receivables

| Opening Accounts Receivables | = 5,611 |

| Closing Accounts Receivables | = 5,740 |

| Average Accounts Receivables | = (Opening Accounts receivables + Closing Accounts receivables) / 2 |

| = (5,611+ 5,740) / 2 | |

| Average Accounts Receivables | = 5,675.5 |

Calculation of Day Sale Outstanding

| Day Sale Outstanding | = (Average Accounts Receivable/ Total Credit Sales) * Number of Days |

| = (5,675.5/ 11,851) * 90 | |

| Day Sale Outstanding | = 43 Days. |

- (all figures in millions)

| Sales | = 11,420 |

Calculation of Average Accounts Receivables

| Opening Accounts Receivables | = 5,740 |

| Closing Accounts Receivables | = 5,539 |

| Average Accounts Receivables | = (Opening Accounts receivables + Closing Accounts receivables) / 2 |

| = (5,740 + 5,539) / 2 | |

| Average Accounts Receivables | = 5,639.5 |

Calculation of Day Sale Outstanding

| Day Sale Outstanding | = (Average Accounts Receivable/ Total Credit Sales) * Number of Days |

| = (5,639.5/ 11,420) * 90 | |

| Day Sale Outstanding | = 44 Days. |

- (all figures in millions)

| Sales | = 10,730 |

Calculation of Average Accounts Receivables

| Opening Accounts Receivables | = 5,539 |

| Closing Accounts Receivables | = 5,343 |

| Average Accounts Receivables | = (Opening Accounts receivables + Closing Accounts receivables) / 2 |

| = (5,539 + 5,343) / 2 | |

| Average Accounts Receivables | = 5,441 |

Calculation of Day Sale Outstanding

| Day Sale Outstanding | = (Average Accounts Receivable/ Total Credit Sales) * Number of Days |

| = (5,441/ 10,730) * 90 | |

| Day Sale Outstanding | = 45 Days. |

- (all figures in millions)

| Sales | = 10,621 |

Calculation of Average Accounts Receivables

| Opening Accounts Receivables | = 5,343 |

| Closing Accounts Receivables | = 4,718 |

| Average Accounts Receivables | = (Opening Accounts receivables + Closing Accounts receivables) / 2 |

| = (5,343 + 4,718) / 2 | |

| Average Accounts Receivables | = 5,030.5 |

Calculation of Day Sale Outstanding

| Day Sale Outstanding | = (Average Accounts Receivable/ Total Credit Sales) * Number of Days |

| = (5,030.5 / 10,621) * 90 | |

| Day Sale Outstanding | = 42 Days. |

On comparing the DSO of 5 quarters of Dow Inc., we concluded that there are minimal fluctuations in the days taken by the customers to clear the credit term.

Relationship of Days Sales Outstanding (DSO) with Cash Flow

DSO tells how quickly a company converts its accounts receivables into cash. With the help of Days Sales Outstanding, we can analyse the sales rolling.

Cash Flow monitors the sources and inflow and outflow of cash. By conducting DSO and cash flow analysis, businesses can regulate their working capital management and meet their short-term capital requirements.

With High DSO, accounts receivables block the cash. Resulting in low cash flow in the business. It also indicates that the company is making large credit sales. Watching the other side, with low DSO, the business experiences high cash flow, maintaining liquidity.

DSO and Cash Conversion Cycle

The Cash Conversion Cycle (CCC) or Operating cash flow cycle is a loop which measures the time it takes for a business to turn its cash into inventory, then sell this inventory and earn revenue. The cash cycle consists of three parts:

- Days Inventory Outstanding

- Days Sales Outstanding

- Days Payable Outstanding

Days sales outstanding form the second element of the cash conversion cycle, responsible for measuring the time taken for cash generation in the business.

Conclusion

In summary, Days sales outstanding (DSO) is a vital metric used by businesses to gauge the efficiency of their credit sales collection process. It is calculated by dividing the average accounts receivable by total credit sales and expressing the result in days. A high DSO indicates extended credit terms, potentially impacting cash flow and liquidity negatively, while a low DSO signifies efficient credit management and healthier cash flow.

DSO analysis helps in identifying potential bad debts, addressing customer satisfaction issues, and optimising working capital management. Moreover, it plays a crucial role in cash flow monitoring and understanding the cash conversion cycle, aiding businesses in maintaining liquidity and meeting short-term capital requirements. Overall, DSO serves as a valuable tool for businesses and investors alike in assessing financial health, identifying areas for improvement, and making informed decisions regarding credit policies and cash management strategies.