WHAT IS SHAREHOLDERS EQUITY?

Shareholders equity also known as the net worth of the company is equal to the total value of remaining assets that would be returned to the shareholders if the company is liquidated and all its outstanding debt obligation are settled off. Thus, the difference between company’s total assets and its total liabilities is called the shareholders equity.

Investors and analysts look at the shareholders’ equity of any company to evaluate a company’s overall financial health and helps them to make better investment decisions by using shareholders’ equity figure to calculate various financial ratios.

Shareholder equity represents the total dollar value of capital directly linked to the owners or investors in a company. In a hypothetical liquidation scenario, the book value of equity or the residual value represents the remaining dollar proceeds that could be distributed among the shareholders of the company once all its outstanding debts and liabilities are taken paid and taken care of.

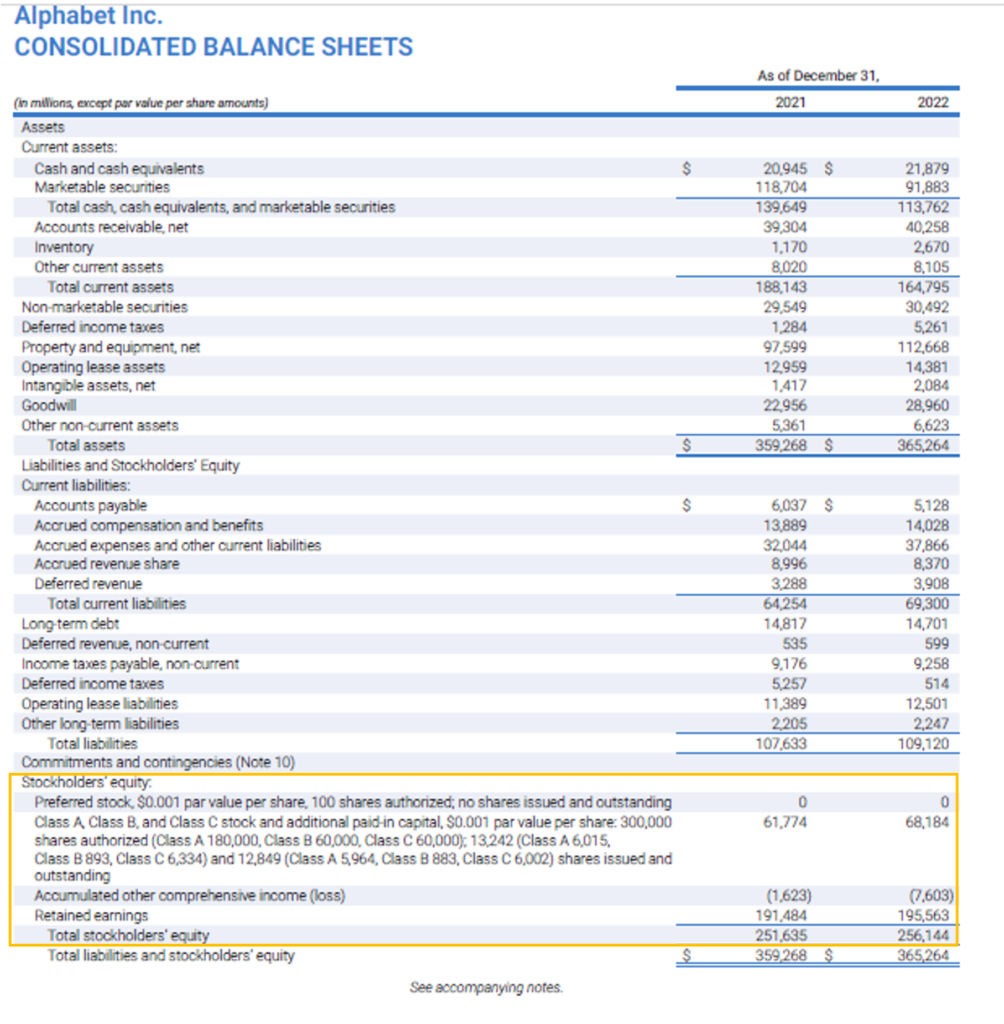

REAL LIFE EXAMPLE OF SHAREHOLDERS EQUITY REPRESENTATION IN THE BALANCE SHEET

Let us see how Alphabet Inc. shows its Shareholders Equity in the Balance Sheet.

Source: https://abc.xyz/investor/

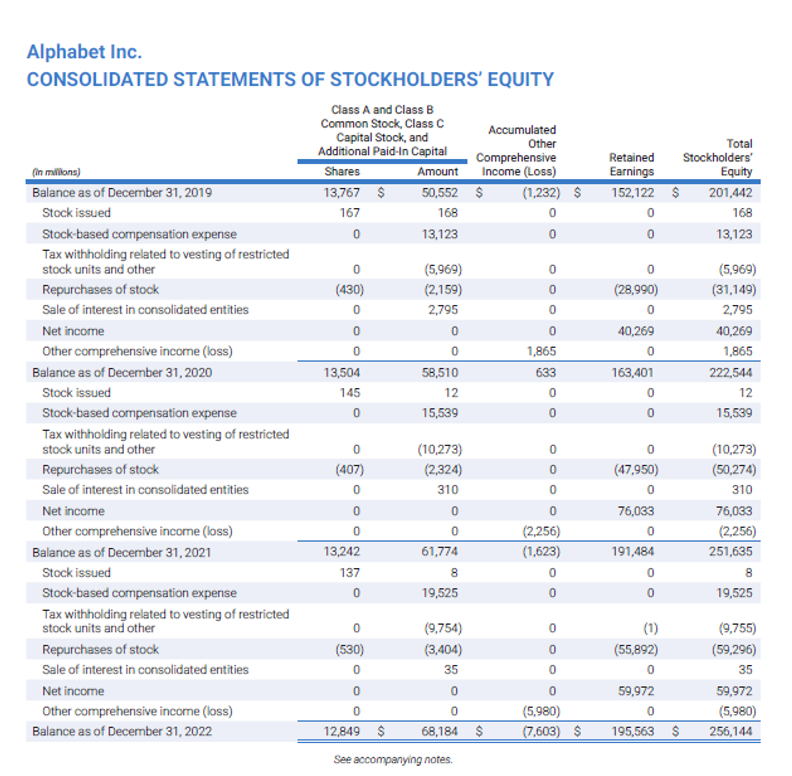

Source: https://abc.xyz/investor/

We can see from the Balance sheet that the shareholders’ equity for Alphabet Inc. USD 256,144 mn in FY 2022 up from USD 251,635 mn in FY 2021. The consolidated statements of shareholders’ equity show detailed Shareholders’ equity breakup year wise. From the above snapshots, we can see how the different components that go into calculating the shareholders equity has changed for the company Alphabet.

HOW TO CALCULATE SHAREHOLDERS EQUITY?

Shareholders’ equity is the shareholders’ residual claims on the company’s assets once all the outstanding debts and liabilities have settled off. As per the fundamental accounting equation, total assets of a company are always equal to the total liabilities and shareholders’ equity.

Formula 1

Shareholders Equity= Total Assets- Total Liabilities

Or, Total Assets= Shareholders Equity+ Total Liabilities

While on side of the equation is Total assets that are resources that owned by a company that can be sold off for cash proceeds or used to generate present and future cash flows, the other side of the equation has Total Liabilities and Equity which represents the sources of funding used by the company to purchase the assets.

If the shareholders’ equity is positive, it means that the company has enough assets to cover its outstanding debt and liabilities. If the shareholders’ equity is negative, it means that the company’s outstanding debt exceeds the assets required to pay them off if the company was to be liquidated. If a company’s shareholders’ equity continues to be negative and continues to move downwards, it is a signal of the company to face insolvency in the near future (exception being dividend recapitalization).

Other approach to calculate shareholders’ equity is as follows:

Formula 2

Shareholders Equity = Paid-In Capital + Retained Earnings + Accumulated Other Comprehensive Income (AOCI) – Treasury Stock

COMPONENTS OF SHAREHOLDERS EQUITY

The main components of the shareholders’ equity are defined below.

- Common Stock and Additional Paid-In Capital (APIC)- “Common Stock” on the balance sheet also known as paid in capital consists of all contributions made by the equity shareholders of the company and represents the most basic ownership level in the company’s equity. In order to raise capital from outside investors corporations issue common shares in exchange for partial ownership stake in the company.

The companies record the value of issued shares of equity at the par value i.e. the face value of the total outstanding shares (i.e. that have not been repurchased). Usually the price at which equity shares are issued exceeds the par value by a substantial margin and this excess value paid by the purchaser of the equity shares over and above the par value is found in the Additional paid in capital line item in the Balance Sheet.

- Preferred Stock- Preferred stock have features of both common shares and debt instruments and is a hybrid form of equity. In terms priority of right and claim over the profits and assets of the company preferred equity stands above common equity but below all other debt instruments.

- Treasury Stock (Stock buyback)- The “Treasury Stock” refers to previously issued shares later repurchased by the company in the open market or directly from shareholders also known as share buyback.

As a result of the share buyback the number of shares available for trade in the open market reduces and hence the ownership of the company’s equity returns to the issuer.

Treasury stock is deducted from shareholders’ equity since the shares repurchased can no longer trade in the open markets. The treasury stock is considered as a contra equity account in the balance sheet.

- Retained Earnings- “Retained Earnings” is the accumulated net profits of the company. Every company has two options- either to pay dividends to the shareholders or retain the profits earned during any financial year to use it for business purpose. The retained earnings line item is titled as “Accumulated Deficit” if its balance turns to negative.

The retained earnings for companies making consistent profits can contribute the highest percentage of shareholders’ equity. Mature companies are more likely to declare higher dividends and retain lesser net profits as they are confident of their future net profit generation. In contrast, startup and early-stage companies are more likely to keep higher percentage of retained earnings for re-investment and growth purpose rather than frequently declaring dividends.

- Other Comprehensive Income (OCI)- The Other comprehensive income reflects the revenues, expenses, gains, and losses that are excluded from net income on the income statement according to the GAAP and IFRS standards. The OCI consists of miscellaneous items, such as foreign currency hedge gains and losses, unrealized gains and losses for securities, cash flow hedge gains and losses etc.

IMPACT OF STOCK BUYBACK ON SHAREHOLDERS EQUITY

The stock buyback reduces the outstanding number of shares and hence reduces the common equity balance in the Balance sheet. As a result, the value of the remaining shareholders in the company increases. The company’s stock may be undervalued when the market is not performing well. In such scenarios the management of the company often decide to buy back the shares to boost the share price and which in turn benefits the remaining shareholders of the company.

Buying back shares improve various ratios which uses the number of outstanding shares in its formula. Examples of such ratios are price/earnings ratio and earnings per share, since the number of outstanding shares reduces. The ratios like return on assets and return on equity also improves as these ratios use the equity value of shares outstanding as its denominator.

CAN SHAREHOLDERS EQUITY BECOME NEGATIVE?

Yes, technically it is possible that the shareholders equity is negative when the total assets of a company is less than the total liabilities. For some companies, that are perpetually loss making it is common to see that the total shareholder equity has become negative over time.

Sometimes, companies also buyback shares regularly in order to provide exit to investors and the buyback premium is adjusted against the retained earnings of the company. As such, consistent share buyback can also make the shareholders equity turn negative for a company.

RATIOS CALCULATED USING SHAREHOLDERS EQUITY

Some of the common ratios that uses shareholders’ equity as an input are as follows:

- SHAREHOLDERS EQUITY RATIO

The shareholders’ equity ratio also known as the equity ratio shows the proportion of the total equity of the company to its total assets on its balance sheet and reflects the level of a company’s reliance on the borrowed funds. Its shows the proportion of a company’s asset that is financed via equity. A higher ratio is preferred, since investors are more interested in conservative companies than a leveraged company. A conservative company pays less interest and financing costs thereby leaving more cash to finance company’s growth activities and higher dividend distribution. The solvency position of the conservative company is stronger and is able to pay of the debts timely without default.

Formula:

Shareholders’ Equity Ratio= Shareholders’ Equity/ Total Assets

- RETURN ON EQUITY

It is the amount of net income returned as a percentage of shareholders’ equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested. It measures how effectively a company uses equity to generate a profit. It is obtained by dividing the net income of the business by the shareholders’ equity. Net income is derived by subtracting the total revenue from all the business expenses and taxes during a specific period.

The return on equity of a company should be analyzed for several years to show the trend in earnings growth of a company and can also be used to compare with return on equity of similar companies in the same industry.

Formula:

Return on Equity= Net Income/ Average Total Equity

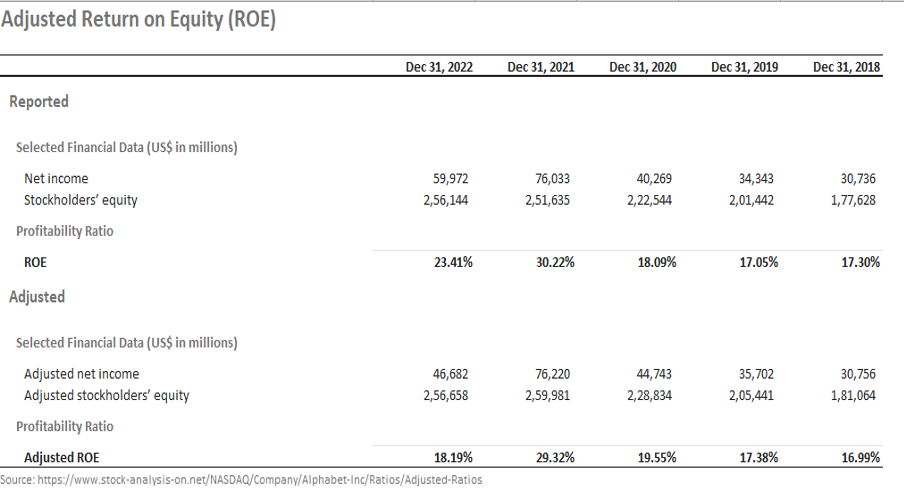

Below is the Return on Equity ratio of Alphabet Inc. for 5 financial years.

Source: https://www.stock-analysis-on.net/NASDAQ/Company/Alphabet-Inc/Ratios/Adjusted-Ratios#Adjusted-ROE

From the above analysis, it is clear that in FY 2021, there was a super normal increase in the net profits of the company Alphabet which let to massive increase in the ROE ratio for the company. But the long term average ROE has been close to 17-19% range over the last 5 years which is indeed a very healthy number. the shareholders equity has definitely increased consistently over the years which is a good sign from a business growth perspective.

2 thoughts on “Shareholders Equity – how much is your net worth?”

[…] by the number of outstanding shares. Equity value only considers the value attributable to the shareholders equity and does not include the company’s debt or other […]

[…] Statements of Shareholders Equity […]

Comments are closed.