WHAT IS AN ANNUAL REPORT?

Every public corporation is required by law to publish annually a report named Annual Report. The report describes to its current and potential shareholders the company’s operations and financial conditions so that informed decision can be made. The Annual Report is usually divided into two sections. The first section is more narrative in nature and includes a description of the company’s performance in the previous financial year and its future plans and goals. It includes Letter to the shareholders from the CEO of the company and various representations in the form of graphs, charts, photos & informative diagrams. The second section includes more detailed financial information in the form of Financial Statements. The Financial Statements are usually prepared by professionals because it is used as a marketing tool by the company narrating its Financial data as well as its future plans, vision, mission and objectives to the stakeholders at large. The companies publish the annual reports at their websites and are required to send the report to the shareholders before holding an Annual Shareholders meeting wherein the board of directors are elected.

Public Companies in addition to the Annual Reports are also required to yearly publish a report as per the US Securities and Exchange Commission (SEC) named as 10-K report. This report provides financial information and financial status of the business to the current and potential investors so that they can make an informed decision whether to buy or sell the shares of the company. The 10-K report unlike the Annual reports are organized as per SEC guidelines. It includes information about the overview of the company’s main operations, activities of the company during the financial year, company’s risk and opportunities, executive compensation, current operations, business agreements, market and industry analysis. The 10-K reports since based on SEC guidelines are much informative and detailed than the annual reports. A company’s 10-K report can be easily viewed on the SEC website. It must be filed through SEC’s EDGAR database within 60 to 90 days after the end of the fiscal year of the company.

The financial information provided by the Annual Report can be used to measure the following:

- The company’s financial performance in the previous financial year

- The company’s past, present growth and also future growth prospects

- Retention of profits by the company to grow its activities and earnings in future

- Various financial ratios of profitability and liquidity

- A company’s liquidity position to determine its ability to pay off the debts when they become due

The financial statements which are included in the Annual Report are compiled in compliance with IFRS or the GAAP.

INFORMATION CONTAINED IN ANNUAL REPORT

The Annual Report consists of the following information:

- Letters to Shareholders: It is a document created by company executives to inform the present and prospective company shareholders about the events occurred during the financial year and its operations to give an insight into its financial position and what to expect in the coming years. This part contains important information like- financial results, achievements, obstacles, market conditions, upcoming projects and improvements to be carried out by the company. Letter to shareholders is written by company executives like company executive officer (CEO), Chief Financial Officer (CFO), Company’s executive director, or Chief Operations Officer (COO).

- Management’s discussion and analysis (MD&A): In this section the company’s performance with quantitative and qualitative measures are presented by the company’s management and executives. This section includes discussion of Risks and compliance, future plans of the company like future investments to be made in any new project or any further expansion plans.

- Audited Financial Statements: These are the financial documents that are audited by a certified public accountant. An audited financial statements by a CPA ensures that the financial statement adheres to the general accounting principles and auditing standards. This section includes the Balance Sheet, Income statement, Cash Flow Statements and Statement of changes in the equity.

- A summary of financial data: This section includes any notes or discussions that are relevant to the financial statements.

- Auditor’s Report: An auditor’s report is a report provided by the auditor containing their opinion on whether a company’s financial statements are free from material misstatement and complied with generally accepted accounting principles (GAAP). There are 4 varieties of the Annual Report: Unqualified opinion (Clean Report), Qualified opinion, Disclaimer Opinion and Adverse Opinion.

- Accounting Policies: These are the specific procedures and policies implemented by a company’s management team that are used to prepare its financial statements.

WHO USES THE ANNUAL REPORTS?

Annual reports are a very comprehensive report containing a detained financial performance of the company in the last financial year and qualitative information like its future goals, initiatives to expand or improve its productivity in future and varies activities performed as a part of corporate social responsibility. Due to the wide information available in the Annual report it is useful to varies stakeholders like- Shareholders and potential investors, customers, employees, competitors etc.

Though the primary use of the Annual Reports is to convey the financial information to the stakeholders and its performance in the immediately preceding financial year, it is also used as a tool by companies to advertise their future plans and goals with the prospective investors or financial institutions for the betterment of their image.

Let’s discuss how the Annual reports are used by some of the common stakeholders:

- Shareholders and Potential Investors: Shareholders use the Annual reports to understand the financial performance of the company in which they have invested their money. It is also used by the potential investors to understand the future prospects of the company. It helps the potential investors to make an informed decision about their investments and returns they are likely to get in future.

- Customers: Customers are concerned with working with the companies that can provide them with uninterrupted supply of high quality products or services and where the company upholds its core values and objectives. Annual report is one such medium which enables the customers to decide whether to engage with a company in the long run.

- Employees: Employees are most directly associated with the company and affected with its performance directly or indirectly. If a company is performing well, it is likely that it will pay good to its employees and if its distressed it will delay the payments or bonus shall be curbed. Some companies through stock option benefits also allow employees to be shareholders of the company. Due to these reasons employees are also one of the key users of the annual reports to decide whether to remain employed in the company for the long run or switch over to other alternatives.

- Competitors: The competitors use the Annual Report to compare their performance with the competitors and also analyse their strengths and weakness compared to their competitors.

- Analysts – Market financial analysts also use the annual reports of a company to analyze the business performance and make recommendations to their clients on whether to buy the stock or not. For example, one of our analysts used the annual reports of Coursera vs Udemy stock to analyze in detail which of the two stocks an investor should look to buy between them.

STEPS TO PREPARE AN ANNUAL REPORT

1. Compilation of the key Business Information: This section of the annual report summarises the key business information. Some of the information include the company’s mission and vision, its key products and services, the composition of board of directors and other key business officers, its key competitors, its investors profile and its opportunities and major risks. This section of annual report is also commonly called as the General Business Information. The key goal when drafting this section should be to provide the shareholders and potential investors all the necessary information in an easy and quick format needed to understand the business and industry of the company.

2. Generation of Key Financial Statements: The main objective of the Annual report is to convey the financial performance and results of the company to its varies stakeholders. Hence, Financial statements due to this reason is the most important part of the Annual report. The Financial Statements included in the Annual Report are:

- Income Statement or Statement of Operations

- Statement of Cash Flow

- Statement of Comprehensive Income

- Balance Sheet

- Statements of Shareholders Equity

While other sections of the report can be generated before generating financial statements, it is preferable to first generate the financial statements since it is the most crucial part of the Annual report based on which most decisions and analysis are made. The company’s letter to the shareholders, management discussion and analysis are all based upon the figures reported in the financial statements. Once we make the other sections of the Annual Report first, based on the financial statement figures the other sections need to be amended which doubles the efforts.

3. Selection of Financial and Operational Highlights: Once the financial statements are generated, the company must select the financial and operational highlights. Some of these include- Opening up of new facilities, major contracts or partnership signed off, details about new mergers and acquisitions, Revenue growth rate, Whether the company was in profit or loss during the year, major launch of new product or service line etc.

4. Draft the Management Discussion and Analysis: The Management Discussion and Analysis section is more subjective than the financial statement section and it presents the internal analysis of the financial performance and standards of the financial statements by the Management team. The MD&A section must meet the standards set by the regulating body “The Financial Accounting Standards Board”. The standards ensure that MD&A though being subjective is based on facts and is balanced and has both positive and negative information about the company’s performance. The key issues addressed by the MD&A section typically includes issues faced by the company like compliance issue with laws & regulations, new & emerging risk faced by the company, the internal controls recently put in place.

5. Writing Shareholders Letter: This should be the final step to prepare the Annual Report and includes an overview into the operating activities and finances of the business for the previous year. Though this should be prepared at the end, this section acts as an introduction to the Annual Report and is the first section to be viewed by any stakeholder. Although every section of the Annual Report is informative in its own way, the letter to the shareholder must be set right to reach out a positivenote to the viewers of the Annual Report.

CHARACTERISTICS OF A GOOD ANNUAL REPORT

Annual report is used by a wide section of stakeholders in the society and therefore these simple characteristics should be kept in mind to make an Annual Report easy to use and extract useful information about the company.

1. It should be kept simple: Including quality and useful information should be the goal rather than including anything and everything in the report. Adding too much information especially the irrelevant ones will only make the Annual Report unusable for the shareholders or potential investors. The number of pages in the Annual Report of a company should not be too much than required. Below, we have done some analysis of the number of pages that the annual report had for the following companies:

| Name of company | # of pages in 10-k |

| Apple Inc. (Year ending Nov 3, 2023) | 80 |

| The Coca Cola Company (Year ending Dec 31, 2022) | 183 |

| Walmart Inc. (Year ending Jan 31, 2023) | 215 |

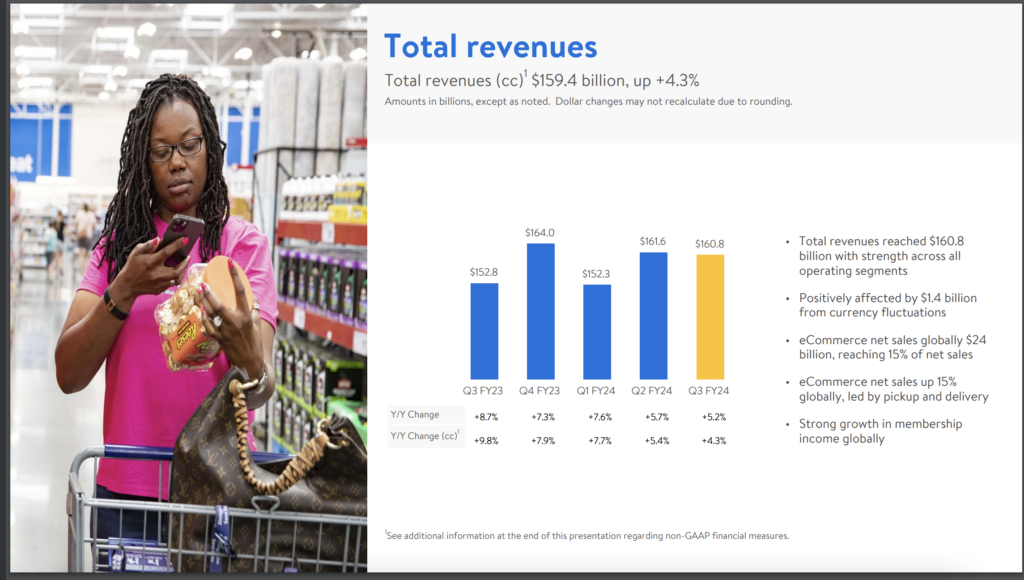

2. Adding up visual elements and infographics in the Annual Report: While the 10-k filings of companies are generally in a set tone, Annual Report should not be boring to read and monotonous. It should have some visual graphs and pictures reporting the financial figures.

However, the investor presentations of the companies are generally more visually appealing. The visual graphs and figures in bold held the users of the financial information to grasp large amount of information in shorter span of time and take informed decisions. It also acts as a marketing tool for the company.

Example of Walmart’s Investor Presentations that shows the revenues of the company over previous quarters is a pretty visual one.

Source : Walmart Quarterly Presentation Q3 FY 24

3. Include information that evokes emotions: It is a proven fact that humans talk decisions based on emotions. These emotions are often evoked by numerous factors one being the combination of facts with stories.

4. The Annual Report should be narrated in a positive way: The Annual reports should be drafted on a positive note. This means that it is better to say what should be done or what efforts can be take rather than what should not be done.

5. Punctuation: In order to avoid the sentences to be misinterpreted or misunderstood punctuations should be used carefully.

6. Accuracy: The facts mentioned in the Annual Report should be accurate and not based on the personal bias or the feelings of the person drafting it. Only when the information is accurate, it will be useful for the readers to make informed decisions.

7. Sequence of sections in logical order: A proper planning is required before drafting an Annual Report. The sections should be arranged one after the other in a logical sequence instead of haphazardly arranging them.

8. Attractive presentation: Big companies often attract the readers because of its appealing presentation. The quality of paper used and the print type and quality greatly determines a company’s standard and reputation.

9. Proper Form: The Annual report must be prepared in the proper form as stipulated by the statutory requirements.

In short, Annual Report provides a ton of information about the performance of the company (vs last year) directly from the lens of the management. A careful reading of the Annual Report can give you so much strategic insights about the business and the competitive landscape it is in. Warren Buffet, one of the world’s most successful investor likes to read up more than 500 pages of Annual Report to form his investment perspective on the company.

33 thoughts on “Annual Report – A credible storehouse of all financial information”

[…] for external users and communicating that information through various reporting mechanisms such as annual reports or quarterly […]

[…] Annual report of the companies on their respective company […]

[…] reports to Securities and Exchange Commission (SEC) like Form 10-Q (quarterly reports), Form 10-K (annual report) and Form 8-K (current reports) that must comply with a variety of disclosure requirements and […]

[…] A shareholder through segment reporting and the management analysis and discussion section in the annual report can gather an idea of whether the company is correctly focusing its resources on the expansion of […]

… [Trackback]

[…] Information on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] There you will find 40859 additional Info on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Here you can find 95031 more Information on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Here you can find 21475 additional Information to that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Here you can find 11644 more Info on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Information to that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Read More on on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/annual-report/ […]

… [Trackback]

[…] Information to that Topic: skillfine.com/annual-report/ […]

Быстромонтажные здания: прибыль для бизнеса в каждой детали!

В современном обществе, где моменты – финансы, сооружения с быстрым монтажем стали настоящим выходом для бизнеса. Эти современные объекты объединяют в себе солидную надежность, эффективное расходование средств и быстрое строительство, что обуславливает их превосходным выбором для бизнес-проектов разных масштабов.

[url=https://bystrovozvodimye-zdanija-moskva.ru/]Каркас быстровозводимого здания[/url]

1. Ускоренная установка: Часы – ключевой момент в бизнесе, и скоростроительные конструкции дают возможность значительно сократить время строительства. Это особенно ценно в условиях, когда требуется быстрый старт бизнеса и начать прибыльное ведение бизнеса.

2. Финансовая эффективность: За счет оптимизации производства и установки элементов на месте, затраты на экспресс-конструкции часто снижается, по сопоставлению с традиционными строительными задачами. Это позволяет сократить затраты и обеспечить более высокую рентабельность вложений.

Подробнее на [url=https://bystrovozvodimye-zdanija-moskva.ru/]https://scholding.ru[/url]

В заключение, сооружения быстрого монтажа – это идеальное решение для предпринимательских задач. Они обладают ускоренную установку, эффективное использование ресурсов и твердость, что делает их отличным выбором для деловых лиц, ориентированных на оперативный бизнес-старт и выручать прибыль. Не упустите возможность сэкономить время и средства, прекрасно себя показавшие быстровозводимые сооружения для вашего следующего делового мероприятия!

My brother recommended I might like this web site. He was totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

Hi my loved one! I wish to say that this post is amazing, nice written and include approximately all vital infos. I’d like to peer more posts like this.

Absolutely composed content, thank you for selective information. “The last time I saw him he was walking down Lover’s Lane holding his own hand.” by Fred Allen.

My brother recommended I might like this web site. He used to be totally right. This publish truly made my day. You can not consider simply how much time I had spent for this info! Thank you!