Mergers and acquisitions have become a popular strategy for companies looking to expand their operations, increase market share, and gain a competitive edge. These transactions can be complex, involving legal, financial, and operational considerations. One of the most critical components of this process is conducting financial due diligence.

Financial due diligence involves a comprehensive assessment of a company’s financial health, including its assets, liabilities, cash flow, and any potential financial risks. It’s a critical step that helps identify potential deal breakers and ensures that the transaction is structured correctly.

However, conducting financial due diligence can be a daunting task, particularly for those who are new to the process. That’s why we’ve put together the ultimate checklist for conducting financial due diligence in mergers and acquisitions.

Importance of Conducting Financial Due Diligence

The importance of conducting financial due diligence cannot be overstated. It helps the buyer understand the target company’s financial health and identify any potential financial risks that may impact the transaction’s success. Financial due diligence provides valuable insights into the target company’s assets, liabilities, cash flow, and profitability. It also helps the buyer understand the target company’s financial performance and how it compares to its peers in the industry.

Moreover, financial due diligence helps the buyer identify any potential red flags that may impact the transaction’s success. These red flags may include undisclosed liabilities, pending litigation, regulatory compliance issues, or other financial risks that may impact the target company’s financial stability. By identifying these risks early on, the buyer can develop a more informed negotiation strategy and structure the transaction to mitigate these risks.

In short, conducting financial due diligence is a critical step in the mergers and acquisitions process that helps the buyer make informed decisions, structure the transaction correctly, and mitigate potential financial risks.

Preparing for Financial Due Diligence

Before conducting financial due diligence, the buyer should prepare a detailed plan that outlines the scope of the due diligence process, the key financial documents to review, and the timeline for completing the due diligence. The plan should also identify the team responsible for conducting the due diligence, including the buyer’s internal team and any external advisors.

The buyer should also prepare a list of questions and issues to address during the due diligence process. These questions should focus on the target company’s financial health, including its assets, liabilities, cash flow, and profitability. The buyer should also identify any potential red flags that may impact the transaction’s success and develop a plan to address these risks.

Finally, the buyer should ensure that all necessary confidentiality agreements are in place before conducting financial due diligence to protect sensitive financial information from disclosure.

Key Financial Documents to Review

During financial due diligence, the buyer should review a range of key financial documents to assess the target company’s financial health. These documents may include:

Financial Statements

The buyer should review the target company’s financial statements, including its balance sheet, income statement, and cash flow statement. These statements provide valuable insights into the target company’s financial performance, including its revenue, expenses, net income, cash flow, and financial position.

Tax Returns

The buyer should review the target company’s tax returns for the past three years to assess its tax liabilities, compliance with tax laws, and any potential tax risks.

Accounts Receivable and Payable

The buyer should review the target company’s accounts receivable and payable to assess its cash flow and any potential risks associated with unpaid bills or uncollected payments.

Debt Agreements

The buyer should review the target company’s debt agreements, including loans, lines of credit, and other debt instruments, to assess its debt levels, interest rates, and repayment terms.

Inventory

The buyer should review the target company’s inventory to assess its value, age, and potential obsolescence.

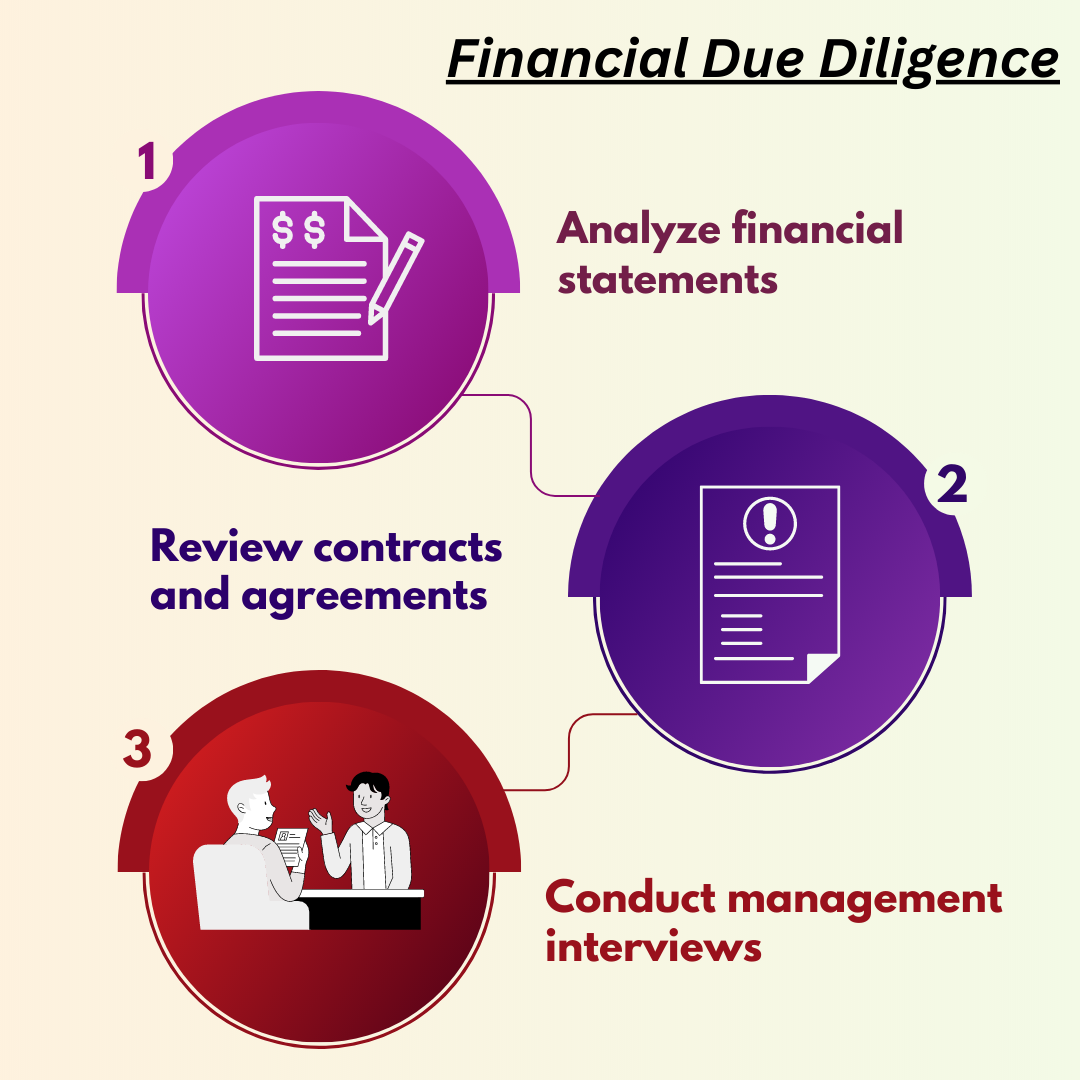

Analyzing Financial Statements

Analyzing financial statements is a critical component of financial due diligence. The buyer should review the target company’s financial statements to assess its financial health and identify any potential red flags that may impact the transaction’s success.

The buyer should review the target company’s balance sheet to assess its financial position, including its assets, liabilities, and equity. The buyer should also assess the target company’s liquidity and solvency ratios to assess its ability to meet its financial obligations.

The buyer should review the target company’s income statement to assess its revenue, expenses, and net income. The buyer should also assess the target company’s gross margin, operating margin, and net margin to assess its profitability and efficiency.

Finally, the buyer should review the target company’s cash flow statement to assess its cash inflows and outflows. The buyer should also assess the target company’s cash conversion cycle to assess its cash management efficiency.

Identifying Potential Red Flags

During financial due diligence, the buyer should identify any potential red flags that may impact the transaction’s success. These red flags may include undisclosed liabilities, pending litigation, regulatory compliance issues, or other financial risks that may impact the target company’s financial stability.

The buyer should also assess the target company’s management team and their ability to manage the company’s finances effectively. The buyer should review the target company’s internal controls and accounting policies to assess their effectiveness and identify any potential weaknesses.

The buyer should also assess the target company’s customer and supplier relationships to identify any potential risks associated with these relationships. The buyer should review the target company’s contracts and agreements to assess their terms and conditions and identify any potential risks associated with these agreements.

Valuation Considerations

Valuation considerations are an essential component of financial due diligence. The buyer should assess the target company’s value and determine the appropriate purchase price for the transaction.

The buyer should consider a range of valuation methods, including discounted cash flow analysis, comparable company analysis, and precedent transaction analysis. The buyer should also assess the target company’s growth prospects, competitive position, and industry trends to determine its long-term value.

Finally, the buyer should develop a negotiation strategy that takes into account the target company’s value and the risks associated with the transaction.

Post-Due Diligence Actions

After completing financial due diligence, the buyer should develop a plan to address any potential red flags that may impact the transaction’s success. The buyer should also develop a post-due diligence plan that outlines the next steps in the transaction process, including negotiating the purchase price, structuring the transaction, and closing the deal.

The buyer should also develop a post-transaction plan that outlines the steps to integrate the target company into the buyer’s operations effectively. This plan should include identifying key personnel, integrating systems and processes, and developing a communication plan to ensure a smooth transition.

Common Mistakes to Avoid During Financial Due Diligence

There are several common mistakes that buyers should avoid during financial due diligence. These mistakes include:

- Failing to identify potential red flags that may impact the transaction’s success

- Failing to review all necessary financial documents

- Failing to assess the target company’s management team and their ability to manage the company’s finances effectively

- Failing to assess the target company’s customer and supplier relationships

- Failing to consider all valuation methods

By avoiding these common mistakes, buyers can conduct more effective financial due diligence and make informed decisions about the transaction.

Benefits of Conducting Financial Due Diligence

The benefits of conducting financial due diligence are clear. By conducting comprehensive financial due diligence, buyers can:

- Make informed decisions about the transaction based on accurate financial information

- Identify potential deal breakers early on and structure the transaction to mitigate these risks

- Develop a more informed negotiation strategy that takes into account the target company’s financial health and value

- Identify potential opportunities for cost savings, revenue growth, and operational efficiencies

In short, conducting financial due diligence is essential to the success of any merger or acquisition transaction.

Conclusion

In conclusion, conducting financial due diligence is a critical step in the mergers and acquisitions process that helps the buyer make informed decisions, structure the transaction correctly, and mitigate potential financial risks. By following the ultimate checklist for conducting financial due diligence, buyers can ensure that they cover all the essential aspects of financial due diligence and make informed decisions that lead to successful transactions.

Financial due diligence requires a comprehensive assessment of a company’s financial health, including its assets, liabilities, cash flow, and any potential financial risks. It’s a critical step that helps identify potential deal breakers and ensures that the transaction is structured correctly.

60 thoughts on “The Ultimate Checklist for Conducting Financial Due Diligence in Mergers and Acquisitions”

[…] The M&A model assesses the impact on profits per share of the new enterprise of the newly formed enterprise, resulting from a merger or acquisition. This is then compared with the current EPS of the company. The M&A model helps a corporation to determine whether the company can benefit from a proposed merger or acquisition. […]

Wow, great article.Thanks Again. Much obliged.

Thanks for the article.Really thank you! Fantastic.

I truly appreciate this article.Much thanks again. Cool.

Thanks-a-mundo for the article post.

Thanks for sharing, this is a fantastic article post. Keep writing.

I cannot thank you enough for the blog article.Really thank you! Fantastic.

Great blog article.Thanks Again. Cool.

Thank you ever so for you blog.Really looking forward to read more. Cool.

Really enjoyed this article post.Really thank you! Great.

I appreciate you sharing this article post.Really thank you! Awesome.

Im thankful for the blog article.Much thanks again. Keep writing.

Thanks-a-mundo for the article post.Much thanks again. Awesome.

I am so grateful for your blog.Thanks Again. Really Cool.

Very informative blog.Really looking forward to read more.

Very informative blog post.Really thank you! Awesome.

Great, thanks for sharing this article.Much thanks again. Much obliged.

Very neat blog post.Thanks Again. Awesome.

Say, you got a nice blog article.Thanks Again. Awesome.

Major thanks for the blog post.Really thank you!

This is one awesome blog article.Really thank you! Really Cool.

Thanks a lot for the post.Thanks Again. Really Great.

I truly appreciate this article.

Thanks again for the blog article.Really thank you! Awesome.

Let me be the queen of ur deepest naughty fantasies!

Really enjoyed this article post.Really thank you! Want more.

Thanks so much for the blog.Really thank you! Fantastic.

Enjoyed every bit of your blog.Thanks Again. Great.

Major thanks for the article post.Really thank you!

Thank you for your blog.Really thank you! Really Great.

Thanks again for the article. Great.

Major thanks for the blog article.Really looking forward to read more. Awesome.

Really appreciate you sharing this post. Keep writing.

Very neat article. Will read on…

Awesome blog article.Thanks Again. Cool.

Thanks so much for the blog article.Really looking forward to read more. Really Great.

Awesome post.Much thanks again. Really Cool.

Thanks for sharing, this is a fantastic blog post.Really thank you! Cool.

Thanks for the article post.Really looking forward to read more. Will read on…

Awesome article post.Much thanks again. Want more.

This is one awesome post.Really thank you! Really Cool.

Enjoyed every bit of your post. Will read on…

Im thankful for the blog post.Thanks Again. Fantastic.

Really enjoyed this blog article.Really thank you! Really Cool.

I cannot thank you enough for the blog post.Really thank you! Great.

I really enjoy the post.Really looking forward to read more. Really Great.

I loved your blog.Really thank you! Want more.

Muchos Gracias for your post.Really looking forward to read more. Great.

Looking forward to reading more. Great article post. Really Great.

Thank you for your blog post.Really looking forward to read more. Much obliged.

I loved your blog. Keep writing.

Very good blog article.Much thanks again. Really Great.

I think this is a real great article post.Thanks Again. Much obliged.

MyCellSpy é um aplicativo poderoso para monitoramento remoto em tempo real de telefones Android.

Isso pode ser irritante quando seus relacionamentos são interrompidos e o telefone dela não pode ser rastreado. Agora você pode realizar essa atividade facilmente com a ajuda de um aplicativo espião. Esses aplicativos de monitoramento são muito eficazes e confiáveis e podem determinar se sua esposa está te traindo.

Rastreador de celular – Aplicativo de rastreamento oculto que registra localização, SMS, áudio de chamadas, WhatsApp, Facebook, foto, câmera, atividade de internet. Melhor para controle dos pais e monitoramento de funcionários. Rastrear Telefone Celular Grátis – Programa de Monitoramento Online.

A big thank you for your article post.Much thanks again. Fantastic.

I like what you guys are up also. Such smart work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it will improve the value of my web site :).

Nice post. I learn one thing more difficult on completely different blogs everyday. It would at all times be stimulating to learn content material from different writers and follow a bit of one thing from their store. I’d want to make use of some with the content on my blog whether or not you don’t mind. Natually I’ll offer you a link on your net blog. Thanks for sharing.

Stake Online Casino GameAthlon Online Casino is among the best cryptocurrency casinos since it integrated crypto into its transactions early on.

The online casino market is growing rapidly and players have a vast choice, but not all casinos are created equal.

In this article, we will take a look at top-rated casinos you can find in the Greek region and the advantages for players who live in the Greek region.

The best-rated casinos this year are shown in the table below. The following are the best casino websites as rated by our expert team.

When choosing a casino, it is important to check the validity of its license, gaming software licenses, and security protocols to guarantee safe transactions for players on their websites.

If any of these factors are absent, or if we have difficulty finding them, we avoid that platform.

Software providers are crucial in selecting an gaming platform. As a rule, if the previous factor is missing, you won’t find trustworthy software developers like NetEnt represented on the site.

The best online casinos offer known payment methods like bank cards, but should also provide electronic payment methods like Skrill and many others.