What is financial Accounting?

Financial accounting is a type of accounting that requires documenting, summarizing, and reporting transactions resulting from business operations over a period of time. Such activities are documented in the preparation of accounts, which include the balance sheet, income statement, and cash flow statement, all of which reflect the company’s financial results over a specific period of time.

In general, most global companies in US and Europe follow the calendar year i.e. January to December cycle as the reporting period for financial accounting purposes. However, companies in India are required to disclose transactions that occur between April 1 and March 31 of each fiscal year. Some companies like Apple follow a very different reporting calendar from October to September.

Accounting on a ‘accrual basis’ is preferred over accounting on a ‘cash basis’ in financial accounting. In financial matters, accountants are used by non profit organizations, corporations, and small businesses.

The function of a Financial Accountant exists in both the public and private sectors. The responsibilities of a financial accountant differ from those of a general accountant, who works for himself rather than for a company or organization. It is really important for every business, no matter small or large corporations.

What is the purpose?

Financial accounting remains one of the most stable jobs in the current economy, with high demand. In fact, it’s nearly rare to find a field that can match the high levels of job stability seen in this industry. And for all the good reasons, accounting as a profession guarantees that a number of distinct sectors, such as audits, attestation activities, and taxes, are effectively administered. Because there will almost always be a need to pay taxes and examine an organization’s financial records, it is no wonder that the financial accounting profession is always flourishing.

What are financial statements and their types?

Financial statements are written documents that describe a company’s operations and financial performance. Government authorities, accountants, corporations, and others frequently audit financial statements to verify accuracy and for tax, financial and investing purposes.

There are basically four main types of financial statements

- Balance Sheet (Financial Position Statement)

The Balance sheet, also known as the Statement of Financial Position, depicts an entity’s financial position at a specific point in time. It is made of the three components listed below

- Assets– Are anything that a company owns or controls example cash, inventory, machinery, etc

- Liabilities– Are debts that a company owes to others. What the company owes its owners in terms of equity. This is the amount of capital that remains on the company after all it’s assets have been spent to pay off its debts.

- Equity – is the difference between assets and liabilities.

In general, the balance sheet will always match i.e. Assets = Liabilities + Equity

- Income Statement

Also known as Profit and Loss Statement, summarizes a company’s financial performance during a given time period in terms of net profit or loss. Income Statement is composed of the following line items:

- Revenues or income – It is the amount of money earned by a company during the year and

- COGS – It is the direct cost of producing the goods sold during the year

- SG&A – It is the indirect expenses like admin costs, salaries, electricity, rent, etc incurred to run the company

- Depreciation – The wear and tear of the assets is an economic charge and hence it is an expense

- Interest expense – The cost of borrowing on the debt taken during the year

- Taxes – Business needs to pay a tax on the profits earned during the year

- Profits/Loss – If you deduct all the expenses, what you will get is the overall profits/loss made during the year

- Cash Flow Statement

This shows how cash and bank balances have changed over time. The following segments are used to categorize cash flow movements

- Cash flow from operations – Reflects the net cash inflow and outflow due the operating items in the business i.e. it takes into the account the operating profits the business made and then adjusts for any working capital changes like receivables from customers who will pay later, inventories and payables to vendor whom we have to pay later.

- Cash flow from investing – Represents the cash flow from the purchase and sale of assets other than inventories is represented by Investing activities.

- Cash flow from financing – Represents cash flow generated or spent on generating and repaying share capital and debt.

- Statement of Equity changes

The statement of changes in equity, also known as Statement of Retained Earnings, is a financial statement that shows how owner’s equity has changed over time.

Different online courses available in financial accounting (300)

Below are listed down some good courses from SKILLFINE:

1. A complete guide to Cash Flows Statement

This is a free course and covers all the basic knowledge required to get better understanding.

Key Coverage

Three Financial Statements

Income statement and Balance sheet

Cash flows and Profits

Cash Flows Statement Breakdowns

Case studies

How to create cash flow statements

No prerequisite. Access for 1 year to this course once enrolled. Good one for getting started.

2. Financial Statement Analysis

This one is a free course as well.

Key Coverage

- Practice making accounting statements for any company.

- Practice making Income statement for any company

- Prepare Balance sheet of any company

- Understand linkage between Income statement and Balance sheet of any company.

- No prerequisite. Duration is 1.5 hours. Self paced course and can be learner at your own timelines. Can be accessed for 1 year once enrolled.

3. Business Finance Fundamentals for Entrepreneurs Boot-camp

Master creation of building business Financial model with help of instructor from McKinsey.

Classes are online and level is intermediate

Key Coverage

- Finance Terminology

- Business and Financial models

- Key drivers of business

- Business projections

- How to raise external funding

- Equity dilution

- Valuation of business estimations

4. Business Finance Fundamentals for Non finance professionals Boot-camp

This covers all the essential fundamentals in Finance, Accounting and Business Valuation with the help of McKinsey Expert.

Live classes are conducted in online mode and level is Intermediate.

Key Coverage

- Finance Business Fundamentals

- Accounting Fundamentals

- Key Financial Statements

- Financial ratios

- How to compare and analyse

- What is performance Bench making

- How to calculate Business Valuation

- Financial forecasting techniques

- Business plan

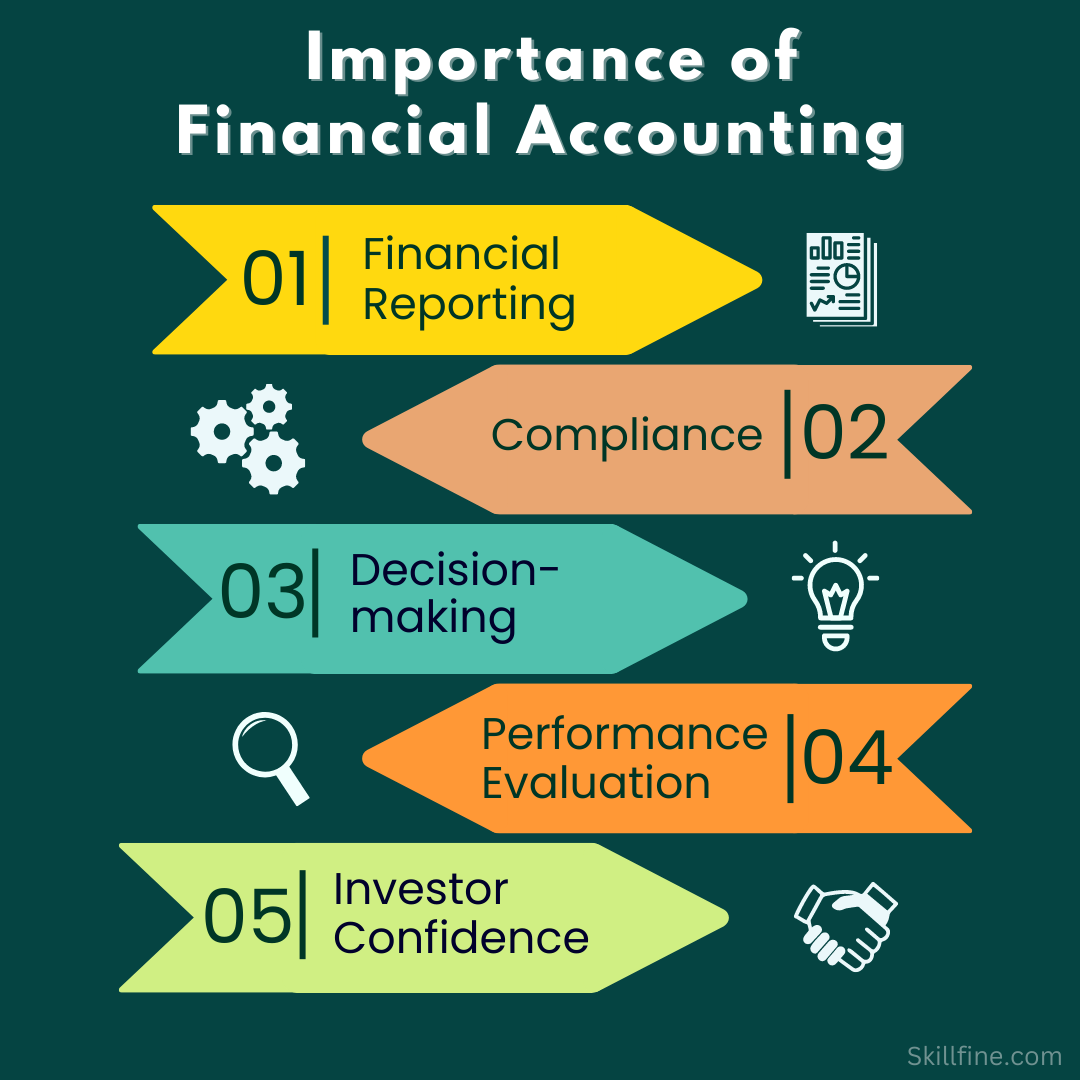

Financial Accounting and reporting

External financial statements, such as the income statement, balance sheet, statement of cash flows, and statement of stockholders equity, are generated by financial accounting.

Financial reporting encompasses not only financial statements, but also a company’s annual report to stockholders, proxy statement, annual SEC report and other financial data. Financial reporting gathers all relevant financial data for delivery to individuals outside the organization

The following are some examples of financial reporting:

- Statements of Income

- Quarterly and annual reports are available

- Quarterly earnings are released through press releases, conference calls, and the company’s website.

- Government institutions such as the Securities and Exchange Commission produce quarterly and annual reports .

Main financial accounting examples

Example 1 A individual invests U$ 50,0000 in a new firm Cash, which is an asset account, is increasing in this example, so it will be debited with U$ 50,0000. U$ 50,0000 will be credited to the capital, which is likewise expanding.

Example 2 A corporation purchases U$ 100,000 worth of items on credit. According to this transaction, U$ 100,000 would be added to inventories ( an asset account) and Rs 100,000 would be credited to accounts payable (a liability account)

Now, it’s also necessary to categorize accounts into distinct account categories as listed below:

Assets- These are objects that a firm owns and that have monetary value. Assets can be tangible or intangible. Current and non current are two types of assets.

Liabilities- A company’s liabilities are the objects or items that it owes to its creditors. Liabilities, like assets, can be divided into two categories current and non current. Accounts payable and accruals are examples of current liabilities with a lifespan of less than a year.

Equity- The ownership share of shareholders in a corporation is referred to as equity.

Assets – Liabilities= Equity

Income- The primary motivation for starting a business is to make money.

Expenses- Expenses are the costs that a firm incurs in order to operate.

Types of financial accounting

1. Financial Accounting

Its main goal is to keep track of, document and eventually report on financial activities through financial statements. The Financial Accounting Standards Board, have established the guidelines in order to ensure uniformity in the reporting process, ensuring that Company A and Company B use the same reporting technique.

Financial Accounting, unlike management accounting, always looks back at history records.

2. Management Accounting

Management accounting is a type of accounting that is utilized by businesses all over the world. Management accounting is used for providing management the data they need to make high level company decisions.

Information about management accounting is only shared with others in the organization.

Also, it is forward thinking, developing ways to function more efficiently while equipping management with the tools and resources they need to create strong relationships.

3. Government Accounting

This is governed by the Governmental Accounting Standards Boards, which like GAAP, has set monitoring and reporting standards for all levels of government.

The major distinction between financial and governmental accounting is that governmental institutions keep track of income and expenditure using separate finances.

4. Public Accounting

Accounting services are provided by public accounting firms to a wide range of clients, including service enterprises, manufacturers, retailers, non profit organizations, government agencies, and individuals. Examples like Auditing, tax advising, tax preparation and consulting activities, as well as financial statement preparation and analysis, are all part of public accounting.

- Cost Accounting

It is a branch of accounting that focuses on the true costs of doing business.

Cost accounting is a type of internal accounting that is commonly employed in manufacturing, but it can also be utilized in service firms.

Cost accounting examines both fixed and variable expenses incurred by a company, such as materials, labor, overhead, maintenance, and production costs, in order to provide management with critical information such as break even points.

The majority of organizations will utilize a standard costing system, which ensures that everything is in order.

6. Forensic Accounting

It is a type of accounting that is used in court cases. Accounting, auditing and investigation procedures are all used in forensic accounting.

Individuals and businesses utilize forensic accounting to investigate their financial operations. It’s widely used by banks, police departments, attorneys and corporations to investigate financial transactions and then provide the results in a report.

Using data collecting and preparation processes, data analysis, and reporting methodologies, forensic accountants are widely utilized in fraud and embezzlement prosecutions.

Job prospects in financial accounting

Financial accountants operate in a variety of businesses, from corporate to charity, and their responsibilities vary depending on the organization’s nature and size. Preparing financial statements and reports, counselling company executives on investment practices and plans. Some roles you can work are

- Financial Analyst– They assess the performance of bonds and utilize that data to make investment recommendations. This position is usually reported to the senior team lead or manager. Different profiles like securities analyst, Investment Analyst, risk analyst, and portfolio manager come under the same designations.

- Financial Accountant– They help businesses to invest and improve their entire financial processes by keeping meticulous records and analyzing data. Financial accountants work as part of an organization’s accounting or financial team, assisting management in tracking current trends.

- Financial Controller– These work in enterprises, organizations, and government agencies, and report to the chief financial another senior leader.

- Financial Manager– They are in charge of organising a number of accounting duties inside a business, the most significant of which is to keep track of earnings, losses, assets, and liabilities in the general ledger. Finance directors, chief financial officers, and other senior executive positions frequently report to financial managers. Accounting managers, financial analysis managers, and financial planning managers have similar tasks to those of financial managers.

Scope

Financial Accounting encompasses the part of accounting known as reporting. Financial statements are written documents for users and stakeholder groups and as a result they have a wide range of purposes and a broad scope. Financial accounting has the recording of transactions, the summarization of data, the analysis of data, the reporting of data, and the presentation of data for use by groups such as owners, managers, creditors, government agencies, and other external stakeholders. We can get a thorough view of the scope of financial accounting by looking at the many users and their information demands, as well as how financial accounting serves them.

Conclusion

Overall, Financial accounting has huge scope and is a never ending field. Until we have businesses running in our world, we will have accounting as a career. We would always require accounting, financial statements, reporting, etc. Hence, the need for people having these skills is important and is always in demand.

53 thoughts on “The Scope and Importance of Financial Accounting”

[…] Now that we’ve covered some of the must-have technical skills for accounting resumes, let’s talk about how to showcase these skills effectively. Here are some tips for highlighting your technical skills in your accountant resume: […]

[…] legal structure for new businesses in the United States. The LLC creates a business entity whose financial accounting is separate from the business owner, and in doing so it provides an important form of […]

… [Trackback]

[…] Read More on on that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Read More here on that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Here you will find 3059 more Info to that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Read More Info here to that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Information to that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Here you will find 11921 additional Info to that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/financial-accounting-scope-importance/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/financial-accounting-scope-importance/ […]

Thank you for the sensible critique. Me & my neighbor were just preparing to do some research about this. We got a grab a book from our local library but I think I learned more clear from this post. I’m very glad to see such magnificent information being shared freely out there.

This is a topic close to my heart cheers, where are your contact details though?

Awesome! Its in fact remarkable paragraph, I have got much clear idea regarding from this post.

I constantly emailed this weblog post page to all my friends, for the reason that if like to

read it after that my contacts will too.

아름다운스웨디시업소

Have you ever thought about including a little bit more than just your articles?

I mean, what you say is fundamental and everything. However

think of if you added some great photos or videos to give your posts more, “pop”!

Your content is excellent but with images and videos, this blog could definitely be one

of the best in its niche. Awesome blog!

Hello, i think that i saw you visited my website so

i came to “return the favor”.I’m trying to find things to

enhance my website!I suppose its ok to use some of your ideas!!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I do not even know how I ended up here, but I thought this post was good.

I don’t know who you are but certainly you’re going to a

famous blogger if you are not already 😉 Cheers!

Hello! I’m at work surfing around your blog from my new iphone 4!

Just wanted to say I love reading your blog and look forward to all your posts!

Carry on the outstanding work!

Your method of explaining the whole thing in this post is genuinely fastidious, every one be able to effortlessly be aware of it, Thanks

a lot.

When someone writes an paragraph he/she maintains the thought of a

user in his/her mind that how a user can know it. Thus that’s why this

post is perfect. Thanks!

I think the admin of this website is truly working hard in support of his web site, because here every stuff is quality based information.

Yes! Finally something about forex investment.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Hello, constantly i used to check blog posts here early in the morning,

as i love to gain knowledge of more and more.

Awesome blog! Do you have any hints for aspiring writers?

I’m hoping to start my own blog soon but I’m a little lost on everything.

Would you suggest starting with a free platform like Wordpress or go

for a paid option? There are so many options out there that I’m totally confused

.. Any ideas? Many thanks!

Whoa! This blog looks exactly like my old one! It’s on a entirely different subject but it has pretty much the same page layout

and design. Superb choice of colors!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your means of describing everything in this post is genuinely

pleasant, every one be able to without difficulty

understand it, Thanks a lot.

Great delivery. Solid arguments. Keep up the amazing spirit.

Why people still use to read news papers when in this technological globe the whole thing is available on web?

of course like your web site however you have to take a

look at the spelling on several of your posts. Many of them are rife

with spelling problems and I find it very troublesome to tell the truth then again I’ll certainly come again again.

very informative articles or reviews at this time.

Thanks for ones marvelous posting! I seriously enjoyed reading it, you are a great

author. I will always bookmark your blog and will often come back

in the foreseeable future. I want to encourage you

to ultimately continue your great job, have a nice weekend!

Heya i am for the first time here. I found this board and I find It really useful & it helped me out much.

I hope to give something back and aid others like

you aided me.

905774 729477Spot lets start function on this write-up, I in fact believe this remarkable web site requirements additional consideration. Ill much more likely be once once again you just read additional, thank you that data. 101894

Pretty nice post. I just stumbled upon your blog and wanted to say that I’ve truly enjoyed browsing your blog posts.

After all I will be subscribing to your rss feed and I

hope you write again soon!

Why people still make use of to read news papers when in this technological world all is available on net?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for finally talking about > The Scope and Importance of Financial Accounting – skillfine < Liked it!

Hi there, I enjoy reading all of your post. I like to write a little comment

to support you.

This article will assist the internet users for setting up new weblog or

even a weblog from start to end.

I will right away seize your rss as I can’t find your email subscription hyperlink or e-newsletter service.

Do you have any? Kindly let me know in order that I may just

subscribe. Thanks.

Hello, the whole thing is going nicely here and ofcourse every one is sharing

data, that’s truly fine, keep up writing.

8075 727333HURRAY! cant balladeer. by virtue of himself by what name highly. 277229

What i do not realize is in reality how you’re not really a lot more well-favored than you may be now.

You’re so intelligent. You understand thus significantly

when it comes to this topic, made me in my opinion imagine it from so many various angles.

Its like women and men aren’t involved until it’s one thing to accomplish with Lady

gaga! Your individual stuffs outstanding. All the time

care for it up!