Introduction

A business is involved in numerous activities, like production and business operations. In the previous articles, we have understood COGS as the funds used to sustain the production of goods and performing services. But the question remains: what happens to the expenses related to the business operations? Therefore, in this article, we will understand the cost related to business operations known as selling, general & administrative expenses (SG&A), its classification, how it differs from COGS and operating expenses (OPEX), SG&A Sales Ratio and the relation between SG&A and profitability.

What is SG&A?

SG&A is an abbreviation of Selling General and Administrative expenses, the cost of performing all the tasks related to business operations apart from production of goods and performing a service.

The fundamental understanding of SG&A expenses is that they pertain to non-production activities.

Companies record SG&A expenses in the income statement. It is subtracted from gross profit to get the operating profit or EBITA.

Examples of SG&A include sales expenses, rent, utilities, consulting fees, advertising expenses, etc. Yet, SG&A categorizes these costs as selling expenses and general and administrative expenses.

Classification of SG&A

SG&A is a combination of the following:

- Selling Expenses: The selling aspect of SG&A encompasses both the direct and indirect expenses associated with revenue generation. The business incurs direct costs only on product sales. It includes delivery costs, sales commissions, etc.

From manufacturing to post-sales services, the company incurs indirect selling expenses. It includes advertising, marketing costs, travel and accommodation costs, etc.

- General & Administrative Expenses: These are a company’s day-to-day overheads. Here, general expenses are the overheads necessary to run a company, such as rent, insurance, supplies, etc.

Administrative expenses are the costs related to personnel. A company can employ personnel internally or hire external parties for their services. It includes HR payroll, legal counsel, consulting fees, etc.

Real-Life Example of SG&A

Let’s see the breakup of SG&A expenses of Google and Facebook for the year ending 2023:

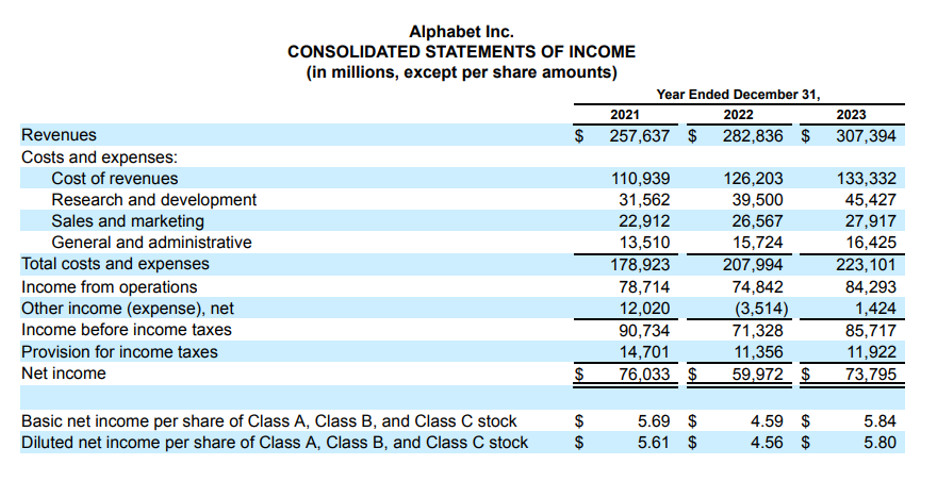

Consolidated Income Statement of Alphabet Inc. (Google):

Source: https://abc.xyz/investor/sec-filings/annual-filings/2024/

Based on the information in the Income Statement, we can see that Alphabet has separately recorded sales & marketing expenses and general & administrative expenses of $27,917 million and $16,425 million respectively, for 2023.

By adding sales & marketing expenses and general & administrative expenses, we get the consolidated value of SG&A expenses.

Calculation of Consolidated Selling General & Administrative Expenses:

| SG&A Expenses | = Sales & Marketing Expenses + General & Administrative Expenses |

| = 27,917 + 16,425 | |

| SG&A Expenses | = 44,342 |

The consolidated SG&A Expenses of Alphabet Inc. for 2023 is $ 44,342 million.

Alphabet Inc. also stated in the management discussion segment of its annual report that its sales & marketing expenses were related to functions like advertising and promotion, compensation to employees working in sales and marketing, sales support and customer services.

For general and administrative costs, Alphabet Inc. recorded compensation to employees in finance, HR, IT, Legal and administrative departments, costs for obtaining third-party services, and expenses related to legal matters.

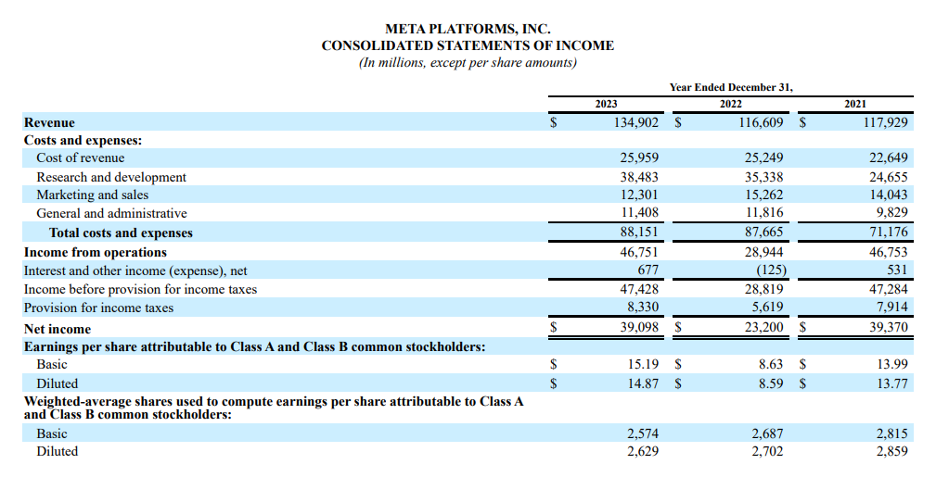

Now, let’s analyse the SG&A expenses of Facebook/ Meta for the year 2023:

Source: https://investor.fb.com/financials/

Meta has also separately recorded the Marketing & sales costs and general & administrative costs.

Calculation of Consolidated Selling General & Administrative Expenses:

| SG&A Expenses | = Sales & Marketing Expenses + General & Administrative Expenses |

| = 12,301 + 11,408 | |

| SG&A Expenses | = 23,709 |

The SG&A of Meta Platforms Inc. for 2023 was $23,709 million.

In the management discussion of the Meta annual report, it incurred marketing and sales expenses on marketing and promotional activities, payrolls of employees engaged in sales, sales support, customer support, business development and marketing. Meta also hired numerous professionals for their services.

General & administrative expenses primarily consisted of legal costs and fees, payrolls of employees in finance, HR and other departments and professional services.

How do SG&A expenses differ from COGS?

COGS are the expenses related to manufacturing products or performing a service. SG&A are the expenses attributed to the business’s day-to-day operations. They are the residual expenses after COGS. COGS include costs related to raw materials, factory costs, direct labour, etc. While SG&A advertising costs, marketing, travel and accommodation overheads, etc.

When going through the Income Statement of Alphabet, we saw COGS of $110,939 million for 2023. And Meta recorded COGS as $25,959 million.

Are SG&A and Operating Expenses the same?

It depends on the company. Small companies use SG&A and operating expenses synonymously when recording them in their income statements. Large companies bifurcate them by segregating R&D costs from SG&A expenses.

So, the difference between SG&A and operating expenses is that SG&A is a part of operating expenses. But OPEX includes R&D, depreciation and SG&A expenses.

When we read the Income Statements of Alphabet and Meta, we noted that both companies recorded R&D, marketing & sales and general & administrative expenses separately.

Calculation of OPEX of Alphabet Inc. for 2023:

| Operating Expenses | = Research & Development + Sales & Marketing Expenses + General & Administrative Expenses |

| = 31,562 + 22,912 + 13,510 | |

| Operating Expenses | = 67,984 |

Therefore, the OPEX of Alphabet was $ 67,984 million, and SG&A expenses were $ 44,342 million for 2023.

Calculation of OPEX of Meta Platforms Inc. for 2023:

| Operating Expenses | = Research & Development + Sales & Marketing Expenses + General & Administrative Expenses |

| = 38,483 + 12,301 + 11,408 | |

| Operating Expenses | = 62,192 |

The OPEX of Meta was $ 62,192 million, and SG&A expenses are $ 23,709 million for 2023.

What is the SG&A Sales Ratio?

To understand a company’s financial health and profitability, managers and investors use the SG&A Sales Ratio. To calculate the SG&A Sales Ratio, the total SG&A is divided by the revenue and later multiplied by 100 to get the percentage value. With SG&A Sales Ratio we can tell how much percentage of revenue is contributed to incur the SG&A expenses.

| SG&A Sales Ratio | = (Total SG&A expenses/ Total sales) * 100 |

Managers use the SG&A Sales Ratio to monitor and control the costs. SG&A Sales Ratio varies widely depending upon the industry, but managers consider a low SG&A Sales Ratio good for a company’s health.

Let’s calculate the SG&A Sales Ratio of Alphabet Inc. and Meta Platforms Inc. for 2023:

Calculation of SG&A Sales Ratio for Alphabet:

| SG&A Sales Ratio | = (Total SG&A expenses/ Total sales) * 100 |

| = (44,342/ 307,394) * 100 | |

| SG&A Sales Ratio | = 14.4% |

The SG&A Sales Ratio of Alphabet Inc. for 2023 is 14.4%

Calculation of SG&A Sales Ratio for Meta:

| SG&A Sales Ratio | = (Total SG&A expenses/ Total sales) * 100 |

| = (23,709/ 134,902) * 100 | |

| SG&A Sales Ratio | = 17.6% |

The SG&A Sales Ratio of Meta Platforms Inc. for 2023 is 17.6%

How does SG&A impact the profitability and financial health of a company?

SG&A expenses cannot be overlooked when managers discuss profitability and a company’s financial health. A fundamental concept in accounting and finance is that managers should first minimise costs to maximize a company’s profitability. Therefore, SG&A analysis helps managers choose cost-reduction strategies. Additionally, a company should balance its revenue and SG&A growth. This balance between revenue and SG&A is the key to sustainable growth, and it can be achieved by optimizing costs.

Conclusion

Comprehending Selling, General, and Administrative (SG&A) expenses is vital for assessing a company’s operational efficiency and financial well-being. Unlike Cost of Goods Sold (COGS), which covers production-related costs, SG&A encompasses all expenses except those directly related to production.

While smaller firms may use SG&A interchangeably with operating expenses, big corporations often differentiate between them, segregating Research and Development (R&D) costs. The SG&A Sales Ratio, a key metric, offers insights into cost management and financial performance by comparing SG&A expenses to total sales we can understand how much revenue is contributed to incur SG&A expenses. Effective management of SG&A expenses enables businesses to minimise costs, optimise operational efficiency, boost profitability, and enhance their competitive edge.