INTRODUCTION

Stock based compensation (SBC), or equity compensation, is a method companies use to reward and incentivize their executives’ employees and directors by offering them shares of the company’s stock. This approach aligns the interests of employees with those of shareholders, encouraging a focus on profitability and long-term growth. This article delves into the various types of stock-based compensation, how they work, their benefits and challenges of stock-based compensation, their impact on both employees and companies, implications on financial statements and financial modeling, and their accounting impact.

TYPES OF STOCK-BASED COMPENSATION

1. Stock Options

Stock options give employees the right to purchase company stock at a predetermined price, known as the exercise or strike price after a certain period or once specific performance criteria are met. Two main types of stock options are:

- Incentive Stock Options (ISOs): Offered to employees only and provide favorable tax treatment.

- Non-Qualified Stock Options (NSOs): Can be granted to employees, directors, contractors, and others, with less favorable tax treatment compared to ISOs.

2. Restricted Stock Units (RSUs)

RSUs are company shares given to employees as a form of compensation. Unlike stock options, RSUs don’t require employees to buy the stock. Instead, they are granted directly but usually vest over time or upon meeting specific performance goals.

3. Stock Appreciation Rights (SARs)

SARs grant employees the right to receive the increase in value of a specified number of shares over a defined period. Employees benefit from the stock’s appreciation without needing to buy the stock.

4. Employee Stock Purchase Plans (ESPPs)

ESPPs allow employees to purchase company stock at a discount, usually through payroll deductions over a specific offering period. These plans often include favorable tax treatment for employees.

HOW DOES STOCK BASED COMPENSATION WORK?

Stock compensation is a method companies use to reward employees by granting them equity ownership through company shares. Here’s an overview of how stock compensation works:

1. Granting the Stock Compensation

The process begins with the company granting stock-based compensation to employees. This could be in the form of stock options, restricted stock units (RSUs), stock appreciation rights (SARs), or through an employee stock purchase plan (ESPP). The details of the grant, including the number of shares, the price (if applicable), and the vesting schedule, are outlined in the grant agreement.

2. Vesting Period

Most stock compensation comes with a vesting period, a specified duration during which employees earn the right to the shares. Vesting can be based on time, performance, or a combination of both. For example, an employee might receive 1,000 RSUs that vest over four years, with 25% vesting each year.

3. Exercising Options

For stock options, employees need to exercise their options to purchase the stock at the predetermined exercise price. This can usually be done after the options have vested. If the company’s stock price has increased since the options were granted, employees can buy the shares at the lower exercise price and potentially sell them at the current higher market price, realizing a gain.

4. Tax Considerations

When employees exercise stock options or when RSUs vest, there are tax implications. Typically, the difference between the exercise price and the market price at the time of exercise (for options) or the market price at the time of vesting (for RSUs) is regarded as taxable income. The specifics of taxation can vary based on the type of stock compensation and local tax laws.

5. Selling the Shares

Once the shares have vested and any required exercises have been completed, employees fully own the shares and can decide to hold or sell them. Holding onto the shares may offer the potential for further appreciation while selling them can provide immediate financial gain.

Example Scenario

Consider an employee, Jane, who receives a grant of 1,000 RSUs with a four-year vesting schedule, vesting at 25% per year. At the end of each year, Jane earns 250 shares. If the company’s stock price increases over time, the value of Jane’s vested shares also increases.

In another example, suppose John receives stock options to purchase 1,000 shares at an exercise price of $10 per share. If the stock price rises to $30 per share by the time John exercises his options, he can buy the shares for $10 each and sell them at $30, realizing a $20 gain per share.

ADVANTAGES OF STOCK-BASED COMPENSATION

Stock-based compensation offers several advantages for companies and employees, making it a valuable tool in modern compensation packages. Here are the key benefits:

For Employees:

- Alignment with Company Performance: Stock-based compensation ties employees’ financial rewards directly to the company’s performance and stock price. This alignment encourages employees to work towards the company’s long-term success and shareholder value.

- Potential for Financial Gain: As the company grows and its stock price increases, employees can realize significant financial rewards. This potential for capital appreciation can be substantial, especially in high-growth companies or during periods of stock price appreciation.

- Long-Term Incentives: Stock awards often come with vesting schedules that encourage employee retention and long-term commitment to the organization. This helps reduce turnover and ensures continuity in key roles.

- Tax Advantages: Depending on the type of stock-based compensation and local tax laws, employees may benefit from favorable tax treatment. For example, incentive stock options (ISOs) can offer preferential tax treatment if certain holding requirements are met.

For Companies:

- Attraction and Retention of Talent: Stock-based compensation is a powerful tool for attracting top talent, particularly in competitive industries where skilled professionals have high demand. It also helps retain employees by aligning their interests with those of shareholders.

- Conservation of Cash: Offering equity instead of cash can help companies conserve liquidity, especially in early-stage or high-growth phases where cash flow may be limited. This allows companies to reward employees without immediate cash outflows.

- Performance Motivation: Equity ownership motivates employees to perform at their best to increase the company’s stock price. This performance-driven culture can lead to enhanced productivity, innovation, and overall business performance.

- Employee Ownership Culture: Stock-based compensation fosters an ownership culture where employees feel a sense of pride and responsibility for the company’s success. This can improve morale, engagement, and teamwork across the organization.

- Tax Deductions: Companies may be eligible for tax deductions corresponding to the fair value of stock-based compensation granted to employees. This can help offset the cost of issuing equity awards.

CHALLENGES AND CONSIDERATIONS OF STOCK-BASED COMPENSATION

Stock-based compensation is a valuable tool for aligning employee and shareholder interests, but it comes with several challenges and considerations. These can impact both the employees who receive the compensation and the companies that issue it. Here are some key pointers to consider:

1. Valuation Complexity

Assessing the accurate value of stock-based compensation, particularly for private companies, can pose significant challenges. Accurate valuation is crucial for setting the exercise price, assessing tax implications, and complying with financial reporting standards. Companies often need to engage external valuation experts, adding to the complexity and cost.

2. Tax Implications

The tax treatment of stock-based compensation varies significantly based on the type of award and jurisdiction. Generally:

For Employees: Taxes are generally payable upon the exercise of stock options or the vesting of RSUs. The timing and calculation of taxes can be intricate, affected by variables such as the type of stock option (ISO vs. NSO) and the duration of holding for capital gains considerations.

For Companies: Companies may receive a tax deduction corresponding to the amount reported as income by the employee. However, the details can vary greatly and necessitate careful planning to maximize tax benefits.

3. Dilution of Shareholder Equity

Including new shares in stock-based compensation can reduce the ownership percentage of current shareholders. This dilution can impact earnings per share (EPS) and potentially affect the company’s stock price. Companies must thoughtfully handle the issuance of new shares to maintain a balance between employee incentives and shareholder interests.

4. Regulatory and Compliance Issues

Companies must navigate various regulatory requirements when offering stock-based compensation. This includes compliance with securities laws, financial reporting standards (such as FASB ASC 718 in the U.S.), and tax regulations. Failure to comply can result in legal penalties, financial restatements, and reputational damage.

5. Administrative Complexity

Administering stock-based compensation plans can be administratively burdensome. Companies need robust systems and processes to track vesting schedules, manage exercises and sales, and ensure accurate reporting. This administrative load can be particularly challenging for small and growing companies.

6. Employee Understanding and Perception

Employees may not fully understand the value and mechanics of their stock-based compensation, leading to undervaluation or mismanagement of their equity awards. Companies need to invest in education and communication to ensure employees appreciate and effectively manage their stock compensation.

7. Market Volatility

The value of stock-based compensation is directly tied to the company’s stock price, which can be volatile. Significant fluctuations in stock price can impact the perceived and actual value of compensation, affecting employee morale and retention. Companies need strategies to mitigate the impact of market volatility on their compensation plans.

FINANCIAL IMPACT OF STOCK-BASED COMPENSATION AND KEY POINTS TO CONSIDERED BY ANALYSTS

Stock-based compensation can have significant financial implications for companies, influencing various aspects of financial reporting and analysis. Analysts must consider several key points when evaluating the impact of stock-based compensation on a company’s financial performance and shareholder value:

Financial Impact:

- Expense Recognition: Stock-based compensation expense affects the company’s income statement. The fair value of stock options, RSUs, or other equity awards granted to employees is recognized as an expense over the vesting period. This expense reduces reported earnings, impacting profitability metrics such as earnings per share (EPS).

- Dilution: Issuing new shares as part of stock-based compensation can dilute existing shareholders’ ownership percentage. Dilution affects EPS calculation and can influence investor sentiment and stock price performance.

- Cash Flow Considerations: While stock-based compensation does not initially require cash outflows (except for tax withholding purposes), it can impact cash flow indirectly. For example, if employees exercise options and sell shares, the company may receive cash from the exercise price but might need to repurchase shares on the open market to cover employee exercises, impacting liquidity.

- Tax Implications: Companies may receive tax deductions for stock-based compensation expenses reported on their income statements. Analysts should consider the tax effects on earnings and cash flow, as well as any potential impacts on effective tax rates.

Key Points for Analysts:

- Footnote Disclosures: Analysts should carefully review the footnotes in financial statements to understand the methodology used to value stock-based compensation, vesting schedules, and the impact on financial statements. Key details like the Black-Scholes option pricing model or the fair value determination for RSUs are essential.

- Impact on Valuation: Analysts should adjust their valuation models to account for the expense and dilution effects of stock-based compensation. This may involve incorporating diluted shares into EPS calculations or adjusting the enterprise value based on the potential dilutive impact on ownership.

- Comparative Analysis: When comparing companies within the same industry or sector, analysts should normalize for differences in stock-based compensation practices. Variations in compensation plans can affect financial ratios and performance metrics, requiring adjustments for accurate peer comparisons.

- Long-Term Effects: Stock-based compensation aligns employee interests with shareholders’ interests over the long term. Analysts should evaluate how these incentives impact employee retention, productivity, and overall corporate governance practices.

- Regulatory Compliance: Companies must adhere to accounting standards such as FASB ASC 718 (or IFRS 2) for reporting stock-based compensation. Analysts should verify compliance and assess the impact of any changes in accounting policies or disclosures.

Implications of Stock-Based Compensation on Financial Modelling

Stock-based compensation has several implications on financial modeling, affecting valuation, forecasting, and financial analysis. Most accountants and analysts add back Stock-Based Compensation to the Net Income of the company to arrive at the free cash flow by applying the logic that Stock-based compensation is a Non-Cash Expense. However, while stock-based compensation is often considered a non-cash expense, it is more akin to in-kind compensation. Therefore, while calculating adjusted earnings or free cash to firm or equity for valuation purposes one must answer whether Stock-Based Compensation should be added back. Here are some key considerations for analysts when incorporating stock-based compensation into financial models based on arguments by eminent valuation experts like Aswath Damodaran.

1. Dilution of Ownership:

Stock-based compensation results in the issuance of new shares or options, which dilutes the ownership percentage of existing shareholders. This dilution reduces the value of each share and the claim existing shareholders have on future earnings.

2. Economic Cost:

Although no cash changes hands at the time of granting stock options or RSUs, the economic cost is equivalent to compensating employees with cash. The company is effectively giving away a portion of its equity, which has value.

3. Barter System Analogy:

If a company issued stock options to the market and used the cash proceeds to pay employees, it would be recognized as a cash expense. The use of stock options instead of cash is a barter system that still represents a cost to the company.

For instance, suppose you own a business valued at $200 million that generates $10 million in annual income. If you hire a manager and compensate them with $2 million worth of equity (1% of the business), although this compensation may appear as a non-cash expense initially, your ownership stake in the business decreases to 99%, thereby reducing your share of the income.

Similarly, when companies utilize Stock-Based Compensation (SBC), they effectively diminish the ownership percentage of existing shareholders. Despite appearing as a non-cash expense, SBC dilutes the shareholder value. If the company had instead issued these shares to the market and used the resulting cash proceeds to compensate employees, it would have been recognized as a cash expense.

4. Impact on Earnings Per Share (EPS):

Stock-based compensation affects the calculation of diluted EPS, which reflects the potential dilution from stock options and other convertible securities. Simply adding back stock-based compensation without considering its impact on dilution would overstate the company’s profitability.

5. Alignment with Shareholder Interests:

Treating stock-based compensation as a regular expense aligns with the interests of shareholders. It provides a more accurate picture of the company’s profitability and ensures that the true cost of compensating employees is recognized in financial statements.

6. Comparison with Depreciation:

Unlike depreciation, which spreads the cost of an asset over its useful life, stock-based compensation is an immediate cost to shareholders as it affects their ownership stake. Adding back stock-based compensation like depreciation fails to account for the dilution impact.

7. Impact on Valuation Multiples:

Using multiples and comparables to evaluate companies might seem like a way to avoid the complexities of stock-based compensation in intrinsic valuation, but this is misleading. All multiples are affected by stock-based compensation.

For example, if you compare PE ratio across technology firms that heavily use stock-based compensation, the ratios can be distorted. Suppose you have two companies that have the same size, economics, and growth. It can be argued that their valuation multiple will be more or less similar. Following is the data for each company below:

| Company A | Company B | |

| GAAP Net Income (U$ mn) | $100 | $100 |

| Market Cap (U$ mn) | 1000 | 1000 |

| PE Multiple (MCap / GAAP NI) | 10x | 10x |

Now let’s assume Company A pays its employees in cash while Company B pays its employees in stocks.

| Company A | Company B | |

| GAAP Net Income (U$ mn) | $100 | $100 |

| +Stock Based Compensation (U$ mn) | $0 | $50 |

| Adjusted Net Income (U$ mn) | $100 | $150 |

| Common Shares (mn) | 100 | 100 |

| +Potential Shares through stock-based compensation (U$ mn) | 0 | 5 |

| Diluted shares (mn) | 100 | 105 |

| GAAP EPS ($) | 100/100=1 | 100/100=1 |

| Diluted EPS ($) | 100/100=1 | 100/105=0.95 |

| Adjusted EPS ($) | 100/100=1 | 150/105=1.43 |

| Price per share | 1000/100=10 | 1000/105=9.52 |

| PE Multiple (GAAP EPS) | 10/1=10 | 9.52/1=9.52 |

| PE Multiple (Diluted EPS) | 10/1=10 | 9.52/0.95=10 |

| PE Multiple (Adjusted EPS) | 10/1=10 | 9.52/1.43=6.66 |

As can be seen from the table above, adjusted net income, adjusted EPS, and PE multiple calculated based on that does not give correct results. Based on the PE multiple calculated based on adjusted EPS, Company B might appear cheaper than Company A, but this is due to how stock-based compensation is handled. If the PE multiple is calculated correctly based on diluted EPS as highlighted in the above table, it will be 10x for both companies.

Hence, Stock-based compensation represents a real economic cost that impacts shareholders by diluting their ownership. Therefore, it should not be added back to net income like other non-cash items such as depreciation. Properly accounting for stock-based compensation ensures accurate financial reporting and reflects the true cost of compensating employees, aligning with shareholder interests.

TAX IMPLICATIONS

The tax treatment of stock-based compensation varies depending on the type of award and jurisdiction. Typically, employees are taxed when they exercise stock options or when RSUs vest. The company may also receive a tax deduction corresponding to the amount reported as income by the employee. However, the specifics can be complex and vary widely, necessitating careful planning and consultation with tax professionals.

REAL-LIFE EXAMPLE OF STOCK-BASED COMPENSATION IMPACT ON FINANCIAL STATEMENTS

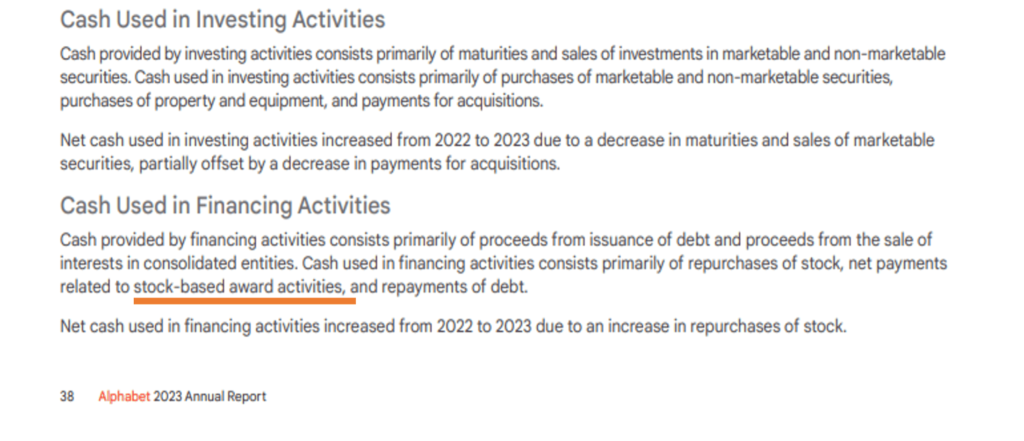

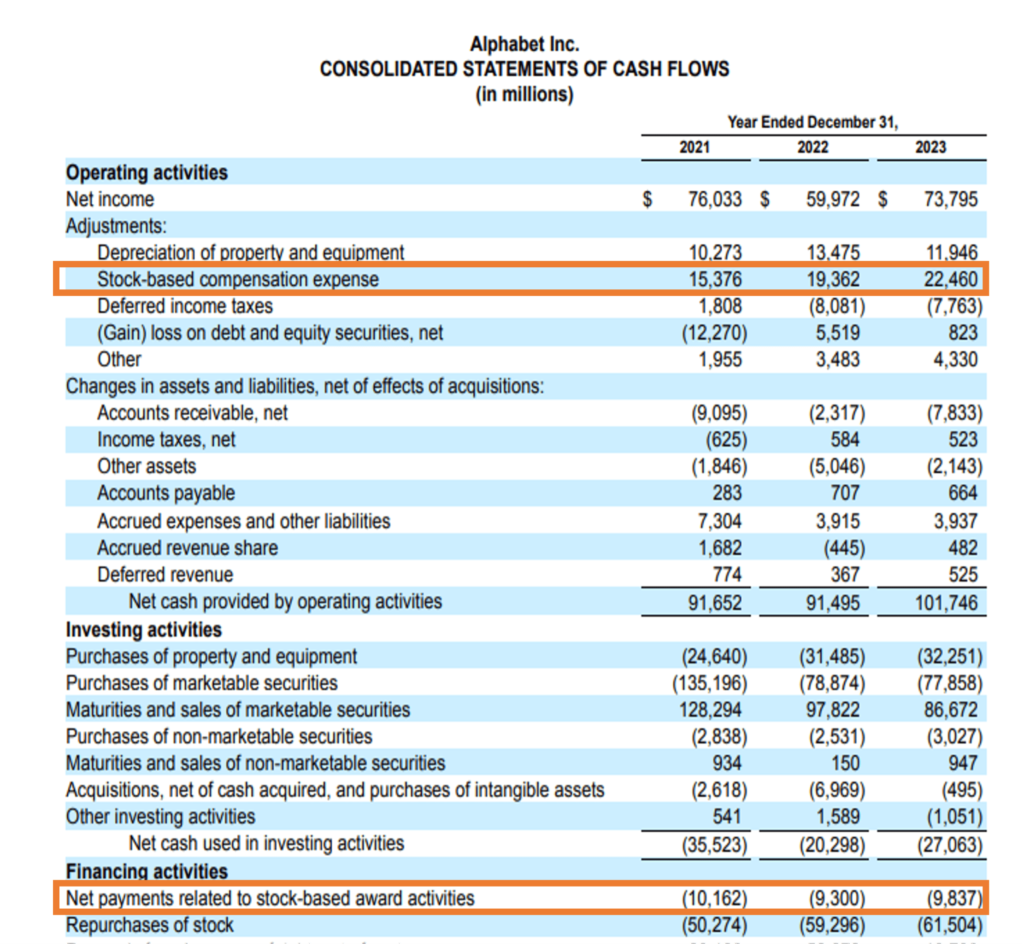

Let us look at the Annual Report of Alphabet Inc. for the Financial Year 2023 for the impact of Stock-Based Compensation. As noted below in the Annual Report, we can see that Stock-Based Compensation impacts the Cash Flow from Financing Activities.

Source: Annual Report https://abc.xyz/assets/52/88/5de1d06943cebc569ee3aa3a6ded/goog023-alphabet-2023-annual-report-web-1.pdf

***

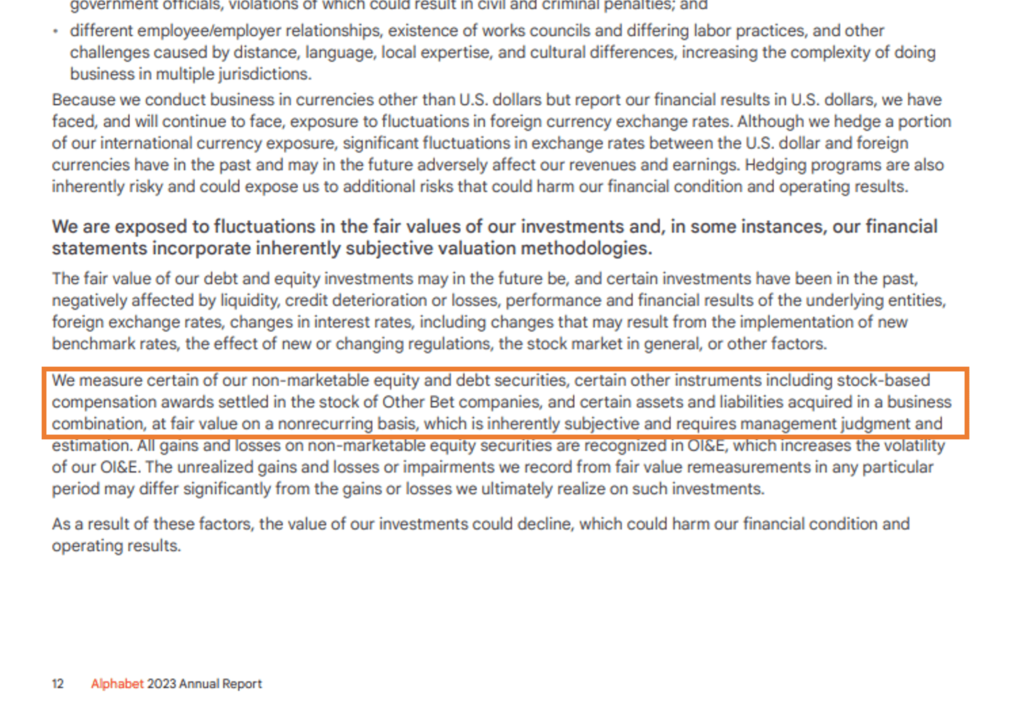

The paragraph below forms part of the Risk Factors of the company. The company mentions here that the company is exposed to the risk of fluctuations in the fair value of their investments including the stock-based compensation.

Source: Annual Reports https://abc.xyz/assets/52/88/5de1d06943cebc569ee3aa3a6ded/goog023-alphabet-2023-annual-report-web-1.pdf

***

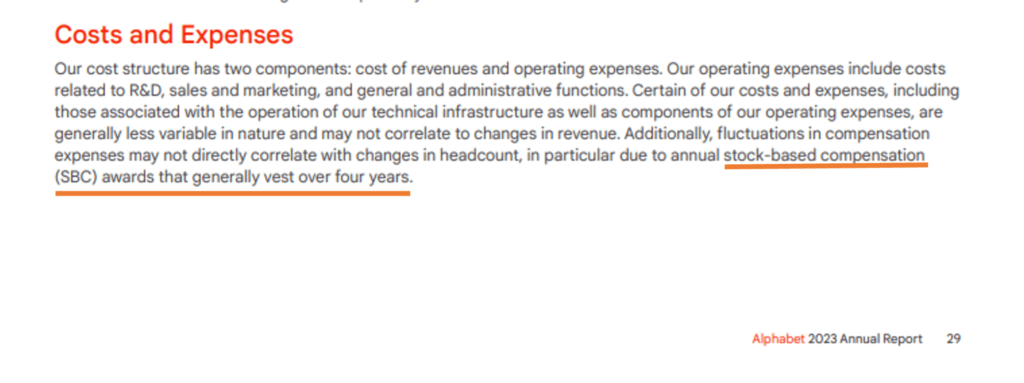

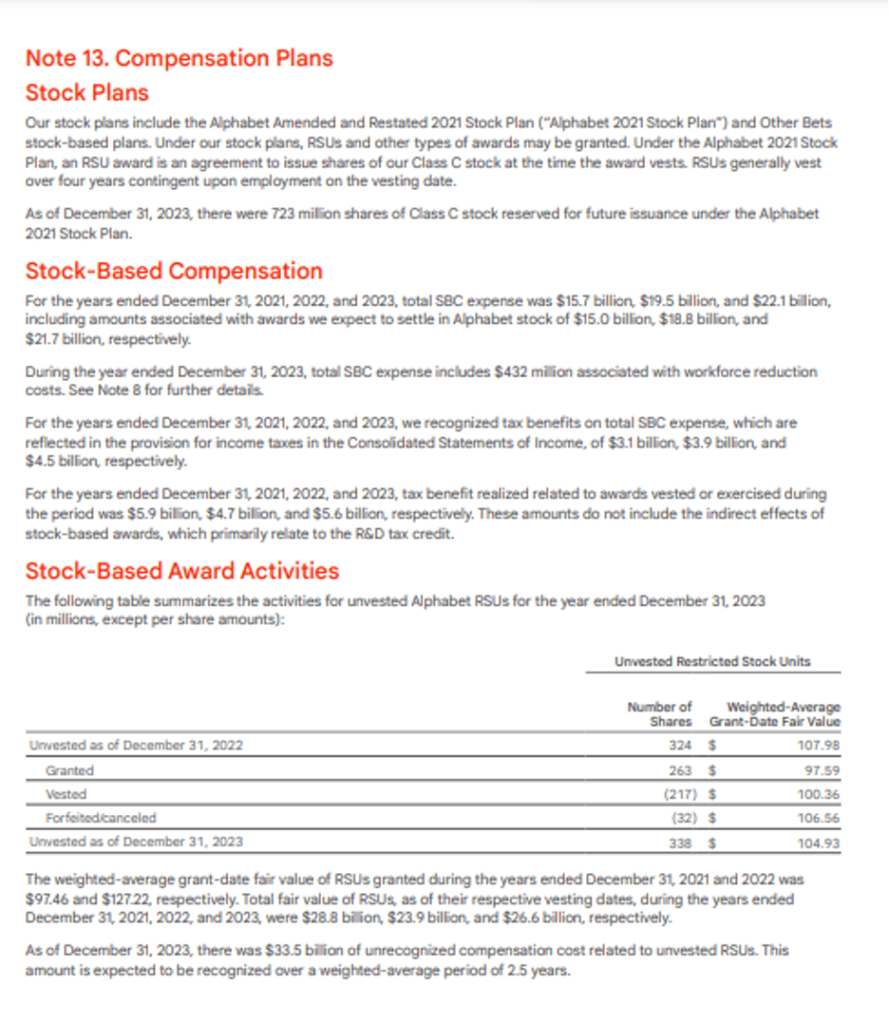

It is also worth noting that the stock-based compensation has a vesting period of four years.

Source: Annual Report https://abc.xyz/assets/52/88/5de1d06943cebc569ee3aa3a6ded/goog023-alphabet-2023-annual-report-web-1.pdf

***

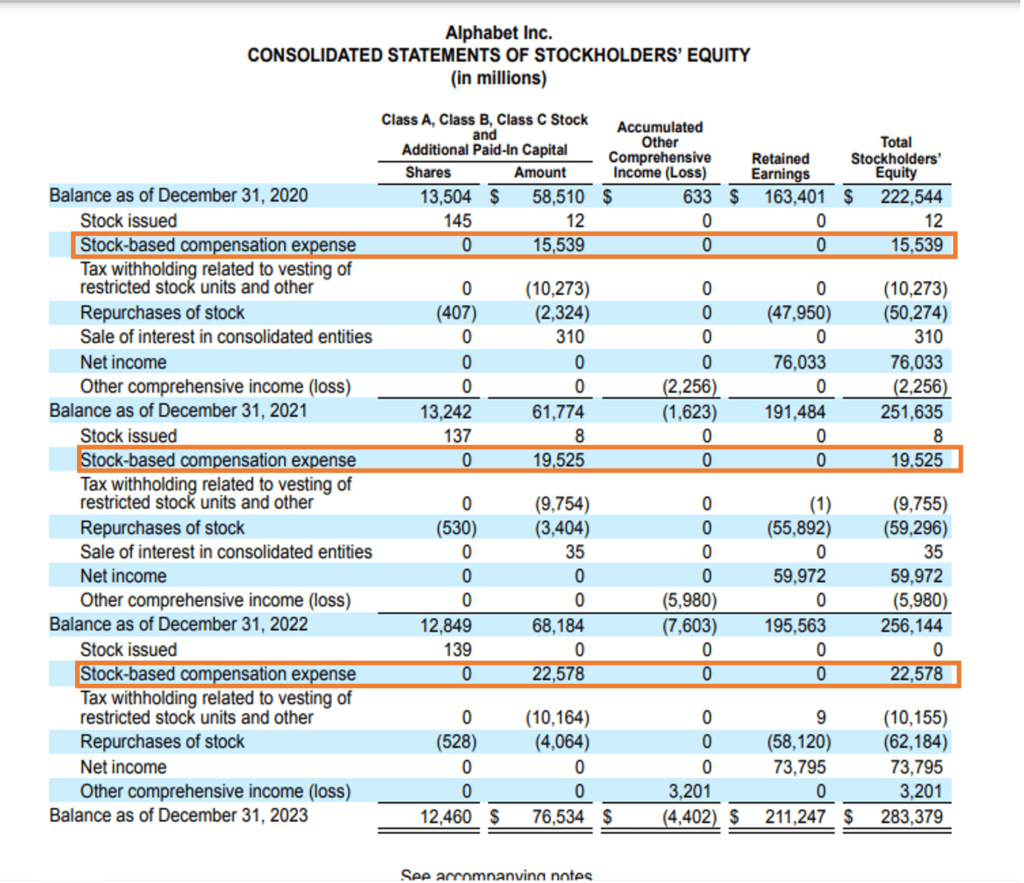

This is the Consolidated Statement of Shareholders Equity of Alphabet Inc. We can see the value of Stock-based compensation offered by the company as against the total outstanding balance of the company’s shares from December 2020 to December 2023.

Source: Annual Report https://abc.xyz/assets/52/88/5de1d06943cebc569ee3aa3a6ded/goog023-alphabet-2023-annual-report-web-1.pdf

***

Below is the Consolidated Statement of Cash Flow of the company. Here we can see that since stock-based compensation is a non-cash item it is adjusted to the net income and hence added back. Also, the net payments related to stock-based compensation are shown in the cash flow from financing activities section of the cash flow statement.

Source: Annual Report https://abc.xyz/assets/52/88/5de1d06943cebc569ee3aa3a6ded/goog023-alphabet-2023-annual-report-web-1.pdf

***

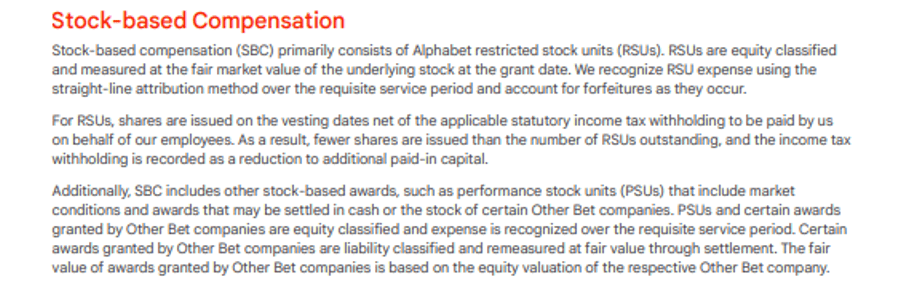

The Notes to the Consolidated Financial Statements of the company also contain a section on Stock-based compensation. Here the company describes the type of stock-based compensation issued by it and how it measures the same. This is an area to be looked into when doing any sort of analysis by a stakeholder of the company.

Source: Annual Report https://abc.xyz/assets/52/88/5de1d06943cebc569ee3aa3a6ded/goog023-alphabet-2023-annual-report-web-1.pdf

***

JOURNAL ENTRY FOR STOCK-BASED COMPENSATION

Stock-based compensation involves accounting entries to recognize the expense associated with the issuance of stock options, restricted stock units (RSUs), or other equity instruments to employees. Here’s how the journal entries typically work:

Grant Date

At the grant date, there is no immediate journal entry because the compensation cost is recognized over the vesting period. However, the company will calculate the total compensation expense to be recognized over the vesting period based on the fair value of the equity awards.

During the Vesting Period

During each reporting period over the vesting period, the company recognizes a portion of the total compensation expense.

Example:

Assume a company grants 1,000 RSUs to an employee, and the fair value of each RSU at the grant date is $10. The RSUs vest over four years. The total compensation expense to be recognized over the vesting period is $10,000 ($10 x 1,000 RSUs).

Each year, the company will recognize one-fourth of the total compensation expense, which is $2,500 ($10,000 / 4).

Journal Entry:

Date: [End of each year]

Dr. Stock-Based Compensation Expense $2,500

Cr. Additional Paid-In Capital $2,500

Vesting Date

On the vesting date, if the company issues the shares to the employee, the journal entry would be as follows:

Journal Entry:

Date: [Vesting date]

Dr. Additional Paid-In Capital $2,500

Cr. Common Stock (Par Value) [Nominal Value]

Cr. Additional Paid-In Capital [Remainder]

The exact amounts for Common Stock and Additional Paid-In Capital depend on the par value of the company’s shares.

Exercise of Stock Options

When employees exercise stock options, the company receives cash (the exercise price) and issues shares.

Example:

Assume an employee exercises 1,000 stock options with an exercise price of $5 per share. The par value of the shares is $1.

Journal Entry:

Date: [Exercise date]

Dr. Cash $5,000 (1,000 options x $5 exercise price)

Cr. Common Stock $1,000 (1,000 shares x $1 par value)

Cr. Additional Paid-In Capital $4,000[Remaining Balance]

The exact amounts for Additional Paid-In Capital would depend on the difference between the exercise price and the par value of the shares.

CONCLUSION

Stock-based compensation is a valuable tool for aligning employee interests with those of shareholders, attracting and retaining talent, and conserving cash. While complexities and challenges are associated with its implementation, the potential benefits make it an attractive option for many companies. By understanding the different types of stock-based compensation and their implications, employees and employers can make informed decisions supporting their financial and strategic goals.