WHAT IS SEGMENT REPORTING?

The main objective of any company is to increase its shareholders’ wealth and to achieve this objective many companies often engage in several business lines or expand their operations in different geographical regions to increase their profits and cash flow. As a result of such operational diversity in product or service line and geographical diversity, public companies are required by the Securities and Exchange Commission (SEC) and The Financial Accounting Standards Board (FASB) to provide in the footnotes to the financial statements information about its reportable operating segments. The main purpose of Segment reporting is to better understand the company’s performance at a granular level, better assessment of its prospects for future cash flows and make more informed judgments about the company’s overall performance.

In short, a component of a business that can generate its own revenues and incur its own costs, has a distinguishable product or service offering, or has a separate geographical location and its financial data can be reported independently in the financial statements can be termed as a segment. A unit of a business that even after being removed from the larger business remains self-sufficient may be termed as a business segment.

Segment reporting while focusing on separate business segments improves the reporting transparency much needed by the investors and analysts and gives a deeper insight into what is driving the net profit or loss for the overall company. While studying different segments one might find that one segment has outstanding performance in terms of revenue generated while compensating for other segments that may have high fixed or variable costs that may require more focus in terms of cost-cutting.

OBJECTIVES OF SEGMENT REPORTING

The main objectives for the introduction of segment reporting in financial reporting are mentioned below:

- Helps in-depth understanding of the company’s performance in terms of product/service line or geographical operations

- Enabling better decision-making by investors and potential investors about the key unit drivers of any company and decide whether to invest in the company or not

- Improves the transparency of the Financial data and understandability of the financial statements at a granular level

- Help investors, creditors, and analysts to make better decisions given the performance of different segments in terms of revenue, cost, and creditability

- Enabling in-depth analysis of the organizations’ risk and returns

- Analyze the most revenue-making and the most loss-making units to improve the focus of management on areas requiring improvement

The accounting standards for segment reporting are set by the Financial Accounting Standards Board specifically in Accounting Standards Codification (ASC) Topic 280. This ASC requires all the business segments of a corporation to be aligned with the corporation’s reporting structure. However, all segments need not be reported as there are few rules to qualify to become a reportable segment in the financial statements. The qualifying factors to become a reportable segment are as follows:

- Segment Revenue is greater than or equal to 10 percent of the company’s revenue as a whole; or

- Profit of the segment is greater than or equal to 10 percent of the company’s profit; or

- Segment assets are greater than or equal to 10 percent of the total assets of the company.

If any of the above three criteria is met for a segment, then it has to be reported separately in the financials. As per the requirement of the law, all the revenue, expenses, assets, and liabilities of that particular segment are shown separately.

HOW IS REVENUE AND COST ALLOCATED TO SEGMENTS?

In Segment reporting revenue, variable costs, and fixed costs of the company are allocated to the respective segments. Revenue/Sales and variable costs of the company are driven by units sold and hence revenue and variable costs can be easily allocated to individual segments. For example, the famous Starbucks reports three main segments based on revenue generation: 1) North America, which is inclusive of the U.S. and Canada; 2) International, which is inclusive of China, Japan, Asia Pacific, Europe, Middle East and Africa, Latin America and the Caribbean; and 3) Channel Development.

However, it is difficult to allocate fixed costs since some fixed costs are common to the company while some fixed costs may be incurred by a particular segment. Therefore, we can categorize the fixed costs into two categories- Traceable and Common fixed cost.

Costs that can be directly traced and allocated to a segment are called Traceable fixed costs. For example, the product and distribution cost and the store operating cost can be allocated to the three segments mentioned above in the case of Starbucks. Traceable fixed costs are those costs that can be avoided if a particular segment is eliminated from the overall business.

On the other hand, costs that are commonly incurred by or for all or some of the segments are called Common fixed costs. For example, the internal auditor works for the entire company and hence fees paid to the auditor would be considered common fixed costs and hence difficult to trace to a particular segment. Common costs are not used to calculate the segment margin in segment income reporting since the common costs are difficult to be traced to a particular segment and these costs cannot be avoided on elimination of any particular segment. However, net operating income is arrived at by subtracting common fixed costs from the segment margin.

IMPORTANCE OF BUSINESS SEGMENT REPORTING

Segment reporting reflects the performance of different segments of the business and has different importance for each stakeholder of the company as follows:

- For Shareholders: It helps the existing and prospective shareholders to gain a deep insight into the company’s performance which enables them to make investment-related decisions and also analyze the future prospects of the company in terms of its existing product/ service line. A segment of the company may be performing very well, while on the other hand, another segment may be draining the company’s resources. A shareholder through segment reporting and the management analysis and discussion section in the annual report can gather an idea of whether the company is correctly focusing its resources on the expansion of the well-performing sector or it is uselessly draining the public money in its loss-making segment. It helps the shareholders to decide whether to retain their shares or sell them off.

- For Management: It helps the management of the company in making better decisions as to whether it should expand or diversify a particular product line based on the result of the segment performance and segment margin. It helps the management to take a call on expanding a profitable segment or selling off a loss-making segment.

- For Creditors: It helps the creditors decide on whether to extend credit to the company or not based on a detailed and in-depth analysis of different segments.

- For Analyst: A company may be performing well in one segment and poor in another. A consolidated financial statement makes it difficult to compare two or more similar companies operating in different segments. Segment reporting however allows analysts to compare different segments of two or more similar competitor companies. For example, we can compare the segment margin of consumer products for HUL and ITC.

DISADVANTAGES OF SEGMENT REPORTING

Some of the disadvantages of segment reporting are as follows:

For the Company-

- Time-consuming process: Segment reporting is a time-consuming process as it has many disclosure requirements. Companies also need to determine from time to time whether a particular segment meets the definition of the reportable segment.

- Difficulty in allocating common fixed cost: In segment reporting it becomes difficult to divide and allocate the common fixed cost of the company. Hence, these costs are not included in calculating the segment margin.

For the External Stakeholders-

- Misinterpretation of segment data: The segment data can be misinterpreted by some of the investors and creditors if they do not view segment reporting along with the overall financial statement of the company.

- Difference in method of segment reporting: Different companies use different bases for segment reporting. Some companies divide segments based on product or service line while some may divide based on geographical location.

REAL-LIFE EXAMPLE OF SEGMENT REPORTING

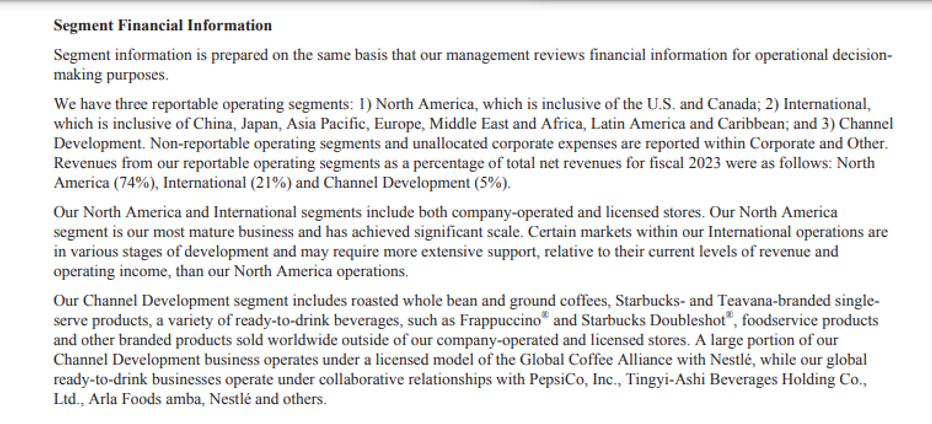

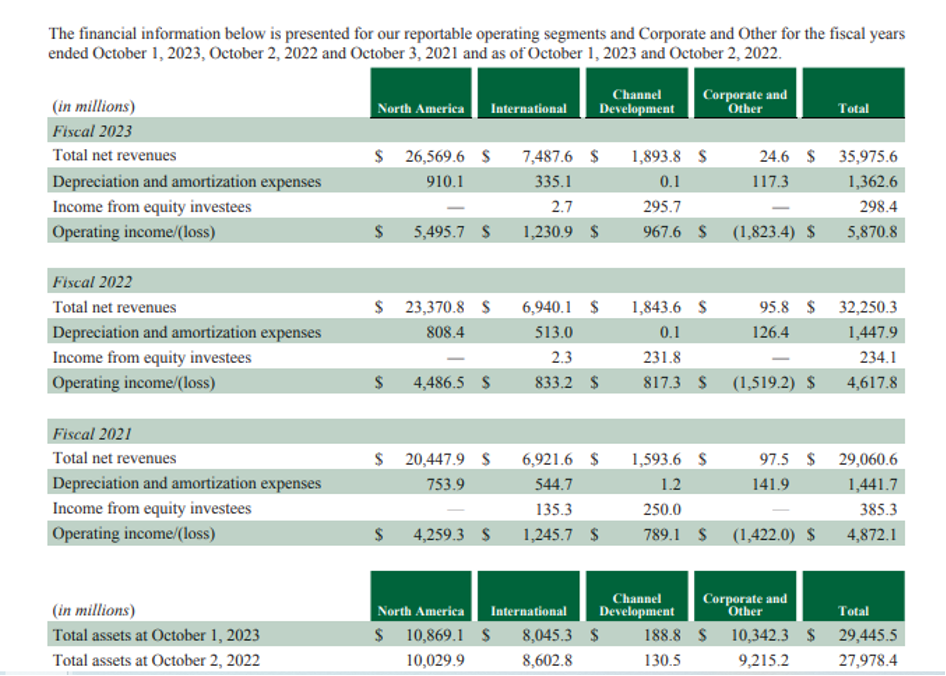

Let us take the example of Starbucks Corporation, the famous coffee house chain for understanding the segment reporting. Starbucks has three reportable operating segments: 1) North America, which is inclusive of the U.S. and Canada; 2) International which is inclusive of China, Japan, Asia Pacific, Europe, Middle East and Africa, Latin America, and the Caribbean; and 3) Channel Development.

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

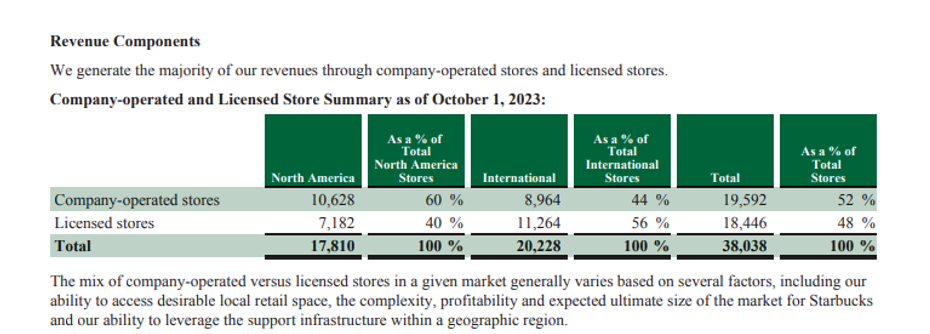

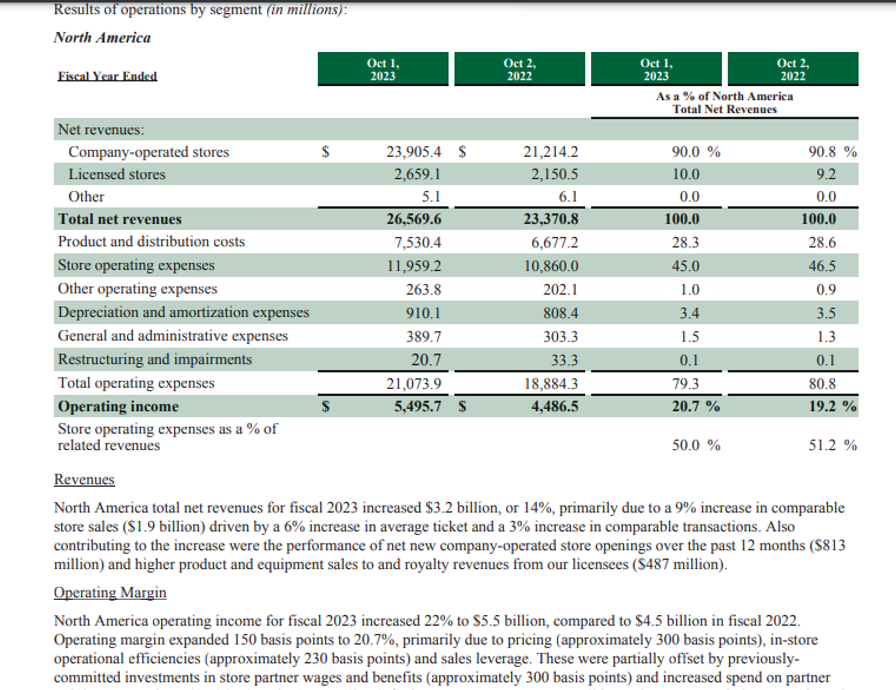

The North American and International segments include both Company-operated and licensed stores. We can see below how Starbucks reports Revenue segment-wise for Company-operated and licensed stores. North America drives the major revenue for the company.

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

From the above information, we get that Starbucks operates in North America mainly through company-operated stores. As the company has mentioned in its annual report this mix between company-operated stores and licensed stores is based on several factors like profitability, complexity in operations, and size of the market.

Interestingly, while the licensed stores are 48% of the total stores for Starbucks, they contribute only 13% to the overall FY 23 revenues. They earn lower gross margins but higher operating margins on licensed stores vs company-operated stores. Licensed stores are responsible for operating costs and investments for their respective stores.

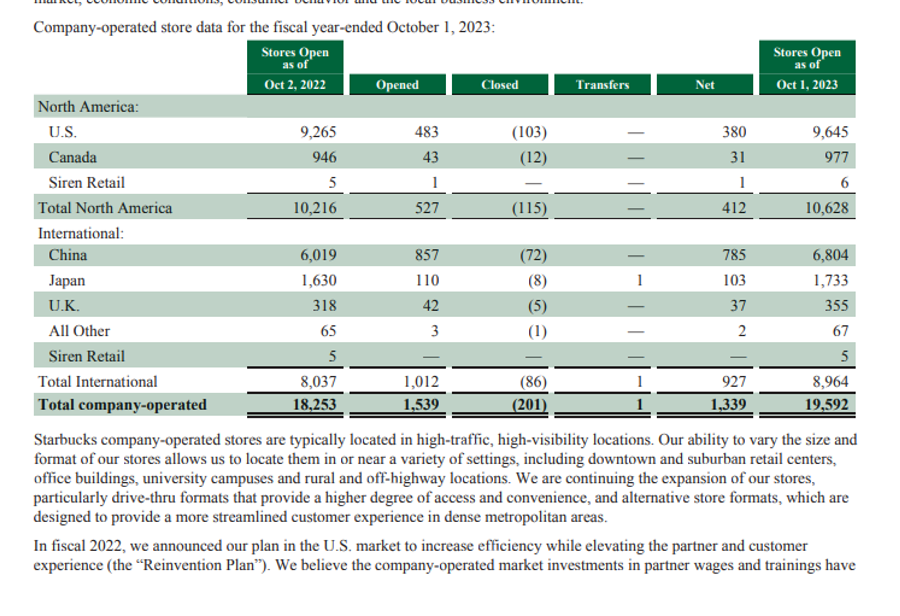

The company-operated store data for different geographical locations is presented below:

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

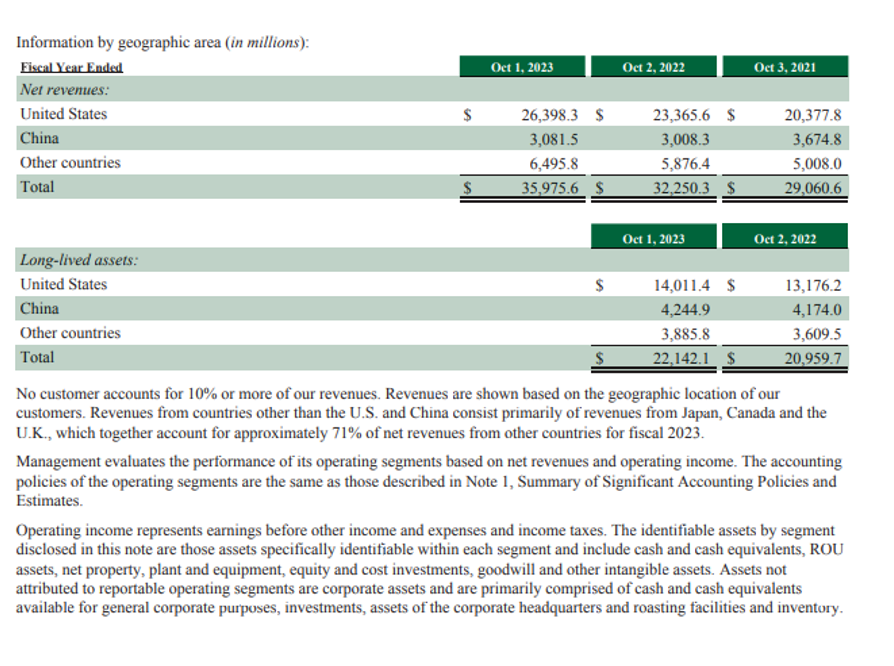

From above we can see that Starbucks operates in high-traffic areas like North America and China significantly. Investors through this information can drive useful insights into future prospects for the company. Any political or economic disturbance in these areas can largely disrupt Starbucks’ profitability in these regions. This small piece of data can serve many analysis purposes for investors, analysts, and management.

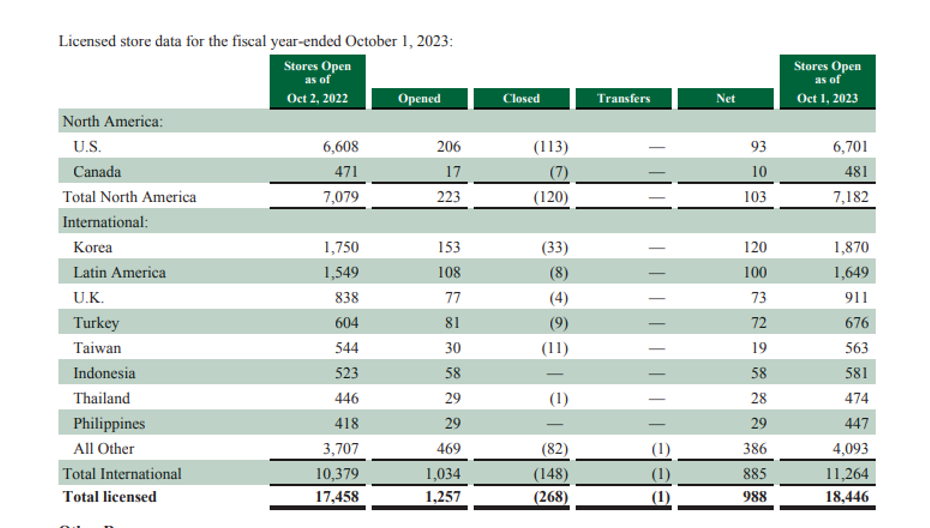

The company-licensed store data for different geographical locations is presented below:

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

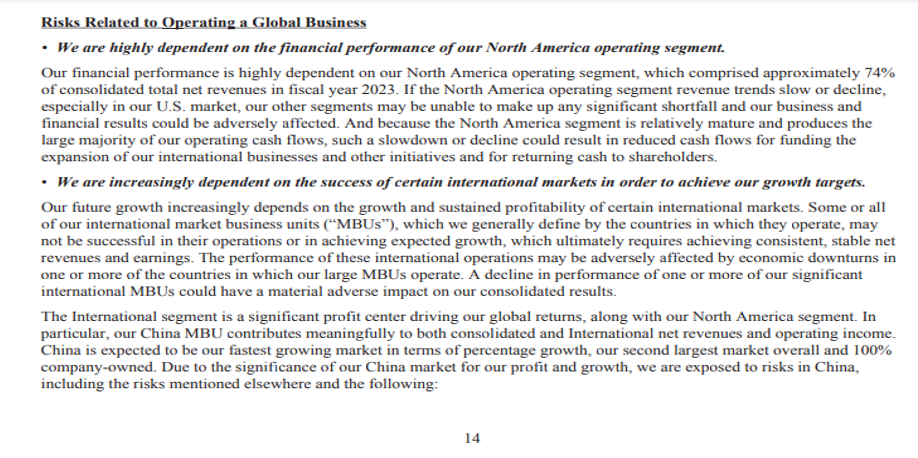

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

From the above section of the annual report, we find that the company is highly dependent on North America for its financial performance. Hence, investors need to read segment reporting along with other notes to better understand the future performance of the company. For example, currently, Starbucks is making huge profits in the North American region. Any economic disturbance in North America can impact the purchasing power of the public thereby impacting its overall revenue at large.

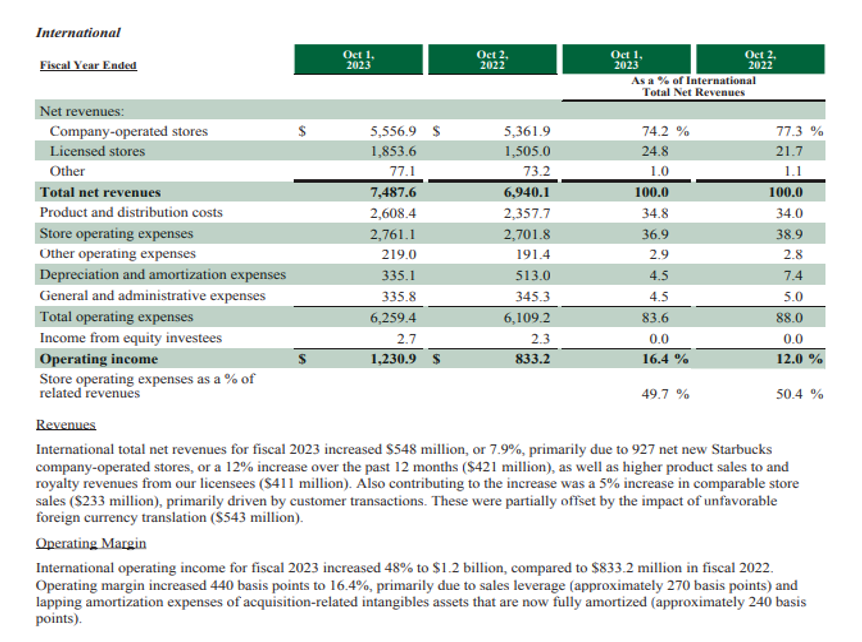

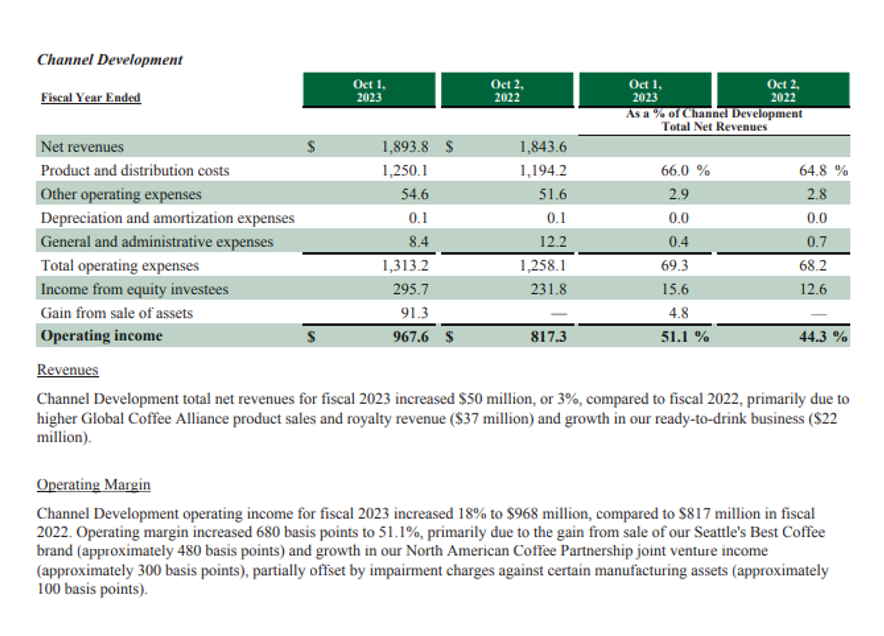

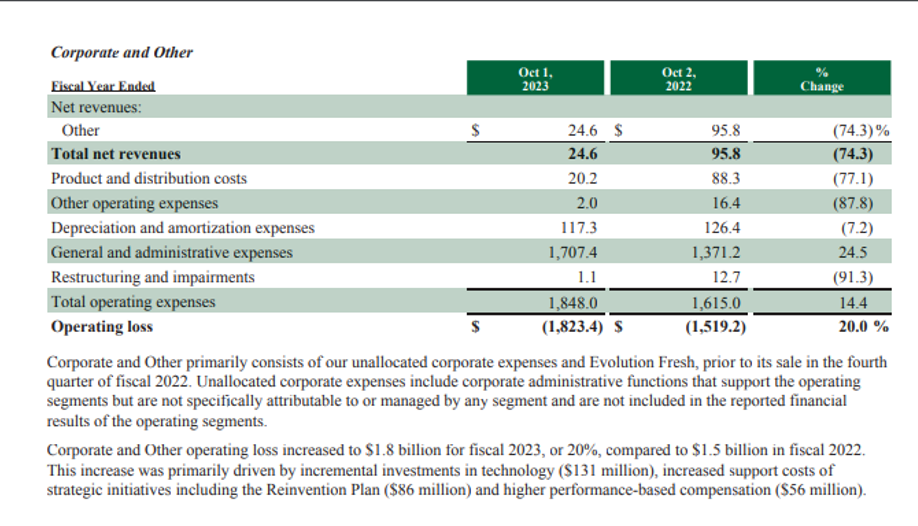

Let us see the result of operations by segment for Starbucks Corporation.

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

An investor or analyst can easily understand the segment performance from the above segment disclosures in the Annual report. The reason for the increase/decrease in segment revenue over two consecutive fiscal years is shown for a better understanding of the financial position and performance of the segments.

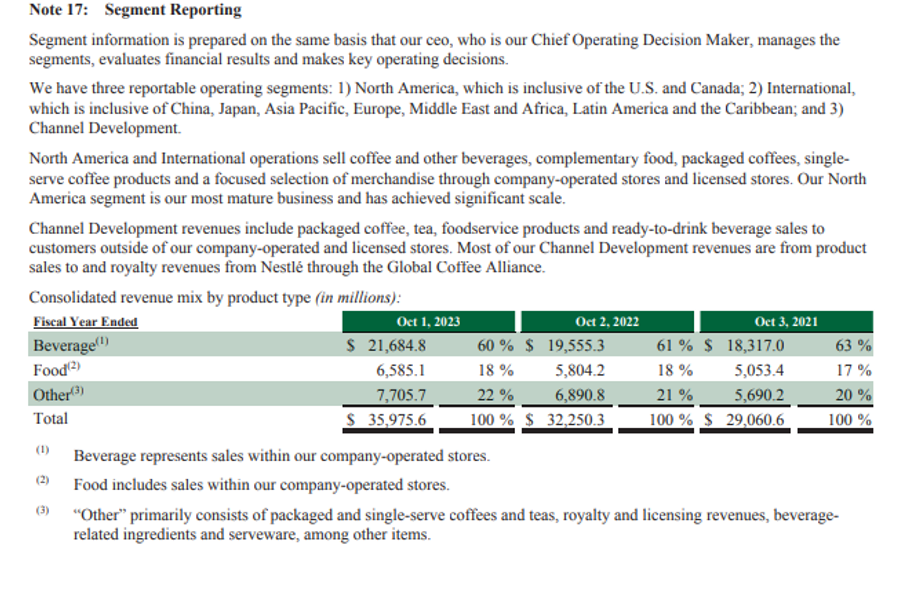

Further in the Notes to Accounts section the company in its Note no. 17 Segment reporting has shown Consolidated Revenue mix by product type, Net revenue by geographical area, and long-lived assets allocation by geographical area as below:

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

Source: https://investor.starbucks.com/files/doc_financials/2024/ar/fy23-annual-report.pdf

SEGMENT REPORTING AS PER US GAAP AND IFRS

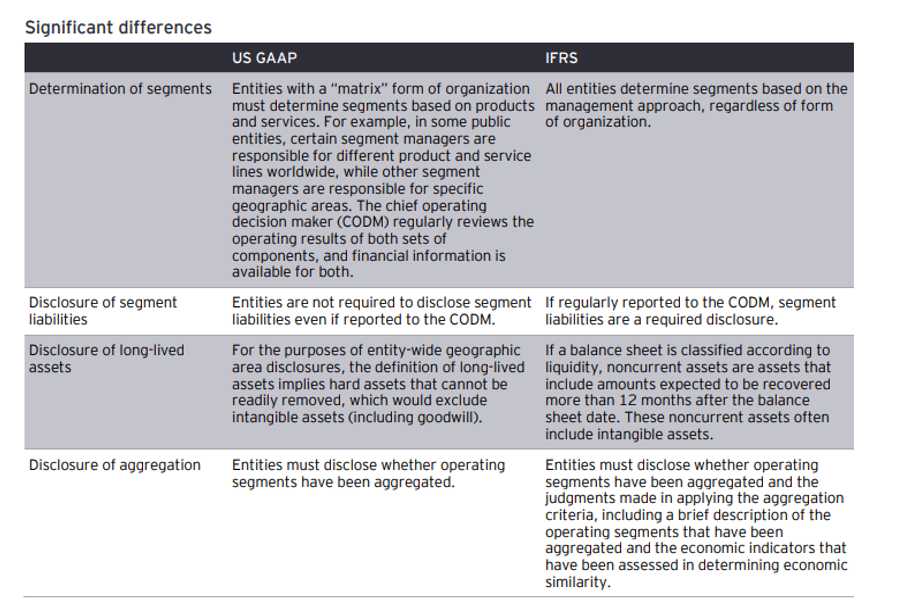

While US GAAP applies to only US-based companies, the International Financial Reporting Standards (IFRS) used by companies all around the world are mostly identical which makes it relatively easy to compare the segment performance of different multinational companies. The comparison between the segment reporting under US GAAP and IFRS is shown below.

BASIS OF SEGMENT IDENTIFICATION

Segments are identified in segment reporting based on several criteria to provide useful information about different components of a business. The primary basis for identifying segments includes:

- Business Activities: Segments are often identified based on distinct business activities or lines of business. Each segment may represent a different product line or service offering that generates revenues and incurs expenses.

- Geographical Areas: Companies may identify segments based on geographical areas or regions where they operate. This helps to understand the financial performance and risks associated with different locations.

- Management Structure: Segments are identified based on the company’s internal management and reporting structure. This means segments are aligned with the way the company’s management organizes and evaluates different parts of the business.

- Revenue Generation: Segments are identified based on major sources of revenue. Different segments may represent significant streams of revenue that are distinct from each other.

- Customer Type: Segments can be identified based on the types of customers served. For example, a company may have separate segments for retail customers and commercial customers.

- Regulatory Environment: Segments may also be identified based on different regulatory environments if the company operates in industries subject to distinct regulatory requirements.

CONCLUSION

Segment reporting is the breakdown of a company’s revenue, expenses, and assets into smaller distinguishable units. Segments are identified based on various criteria mentioned above in the article. Segment reporting helps the external stakeholders of the company to better understand the Aggregated Income statement. Segment Reporting helps investors, creditors, and analysts to gain deep insights into the core operations of the company and helps them to compare the segment performance of several competitor companies. It also enables the management of the company to determine the segment operations that bring the most profit to the company and identify those segment operations that are draining the company’s money and require portfolio restructuring or closer. Thus, Segment reporting helps both the external and internal stakeholders in better decision-making.

18 thoughts on “Segment Reporting – how to make big decisions at a granular level?”

[…] Income statement can be prepared for the entire Organization as a whole including all the business segment reporting together, or can be prepared standalone for each business segment or both. Total revenue of the […]

[…] capital and cash budgets. A lot of the budgeting efforts can be focussed on a very granular segment reporting that helps to make decision making at a more fundament business unit […]

I loved as much as youll receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike

Your blog is a true hidden gem on the internet. Your thoughtful analysis and in-depth commentary set you apart from the crowd. Keep up the excellent work!

Thanks I have recently been looking for info about this subject for a while and yours is the greatest I have discovered so far However what in regards to the bottom line Are you certain in regards to the supply

I do believe all the ideas youve presented for your post They are really convincing and will certainly work Nonetheless the posts are too short for novices May just you please lengthen them a little from subsequent time Thanks for the post

Your blog is a treasure trove of valuable insights and thought-provoking commentary. Your dedication to your craft is evident in every word you write. Keep up the fantastic work!

896977 33561for however yet another fantastic informative post, Im a loyal reader to this weblog and I cant stress enough how considerably valuable information Ive learned from reading your content. I really appreciate all the hard work you put into this wonderful blog. 645094

391560 160073Really man or woman speeches need to seat giving observe into couples. Brand new sound system just before unnecessary men and women really should always be mindful of generally senior general rule from public speaking, which is to be the mini. very best man speaches 936472

164101 866615I like this web site its a master peace ! Glad I discovered this on google . 600491

763187 328136Hello. Fantastic job. I did not expect this. This is a exceptional articles. Thanks! 581100

I found this article quite helpful. Looking forward to more content like this.

50745 621121Extremely properly written story. It will probably be valuable to anyone who usess it, including yours truly . Keep up the good work – canr wait to read much more posts. 142556

Great post! Really enjoyed reading this. Keep up the excellent work!

A truly fantastic read. Your writing style is both engaging and informative.

Great post! Really enjoyed reading this. Keep up the excellent work!

276182 939686Outstanding post, I think men and women need to learn a lot from this internet website its rattling user genial . 936761

Great post! Really enjoyed reading this. Keep up the excellent work!