Risk management models are a core component of running any kind of business. You can’t run your business if you don’t know how much money you can afford to lose and what risk factors could affect that figure. If you’re just starting out, it might be tempting to avoid thinking about risk management because it can feel like an intimidating topic.

However, as your business grows and you expand your operations, it becomes even more important to track your risk exposure so that you know what factors need to be monitored to keep your company operating safely and efficiently. In this article, we’ll introduce you to the different kinds of risk management models that are available in the market and outline why they are useful for identifying and mitigating risks in your business.

What is Risk Management?

Risk management is the process of identifying, measuring, and controlling the risk factors that could negatively impact your company. It is the act of considering risk and deciding how to best mitigate them. Risk management is the process of looking at the risk factors that can affect your company, and then deciding how to mitigate those risks.

Risk factors include things like competition, the strength of your product/service, your ability to execute on your strategy, and many more. When you’re starting out, you don’t have the resources to monitor every single risk factor that could impact your business. You need to prioritize the most significant risks, and then start building a strategy around mitigating them. If you’re just getting started, you don’t have enough information to evaluate risk factors and make strategic decisions about how to mitigate those risks. You need to first identify the significant risks and then set up programs to mitigate them.

Asset Register or Inventory

Before you start managing risk, you need to know the current state of your assets and how much the company owns. This is called a “asset register/inventory.” You can do this by conducting an inventory of your company’s current assets, and then organizing them on a spreadsheet or database so that you can see their current values. You can also use an online inventory tool like Business Management Software.

This inventory is important because it identifies what your company owns right now. Once you have this information, you can start managing risk by looking at the risks associated with each asset. For example, in your start-up phase, it is fine to make decisions that increase your overall asset value because you have a small business that doesn’t have a lot of assets to begin with. But as your company expands and you begin managing larger risks, you need to know what your assets are worth so that you can make more informed decisions.

How do you take your business to the next level?

When you’re starting out, the most important thing that you can do to manage risk is to understand the risks that your business faces. Once you have identified these risks, you can put together a risk management program to mitigate them.

To take your business to the next level, you need to understand these three key areas of risk. – External Risks: External risks are the risks that your company faces from outside factors, like the strength of your competition, the performance of your customers, and many more. External risks are different from internal risks because they are not something that your company does. You can’t control external factors, so you need to focus on managing them.

– Asset Risks: Asset risks are the risks associated with each asset in your company. For example, an asset might be your intellectual property, the technology you are using to run your business, or the equipment that you use to produce your product/service. – Operational Risks: Operational risks are the risks that occur during daily business operations. For example, an operational risk might be poor inventory management or a breakdown in your supply chain that causes your product to be delayed in arriving at the customer.

Why is it important to know the different kinds of risk management models?

As you grow your business, you will encounter new types of risks that you haven’t encountered before. You can’t deal with new risks if you don’t know what they are! By identifying different kinds of risk management models, you can prepare for any new risks that you may encounter in the future. Different risk management models are suitable for different types of businesses.

For example, asset management is more useful for companies that sell physical assets like a manufacturing facility or retail store. However, a digital business may not be as affected by asset management risks like having too much inventory or having too much money tied up in assets like equipment.

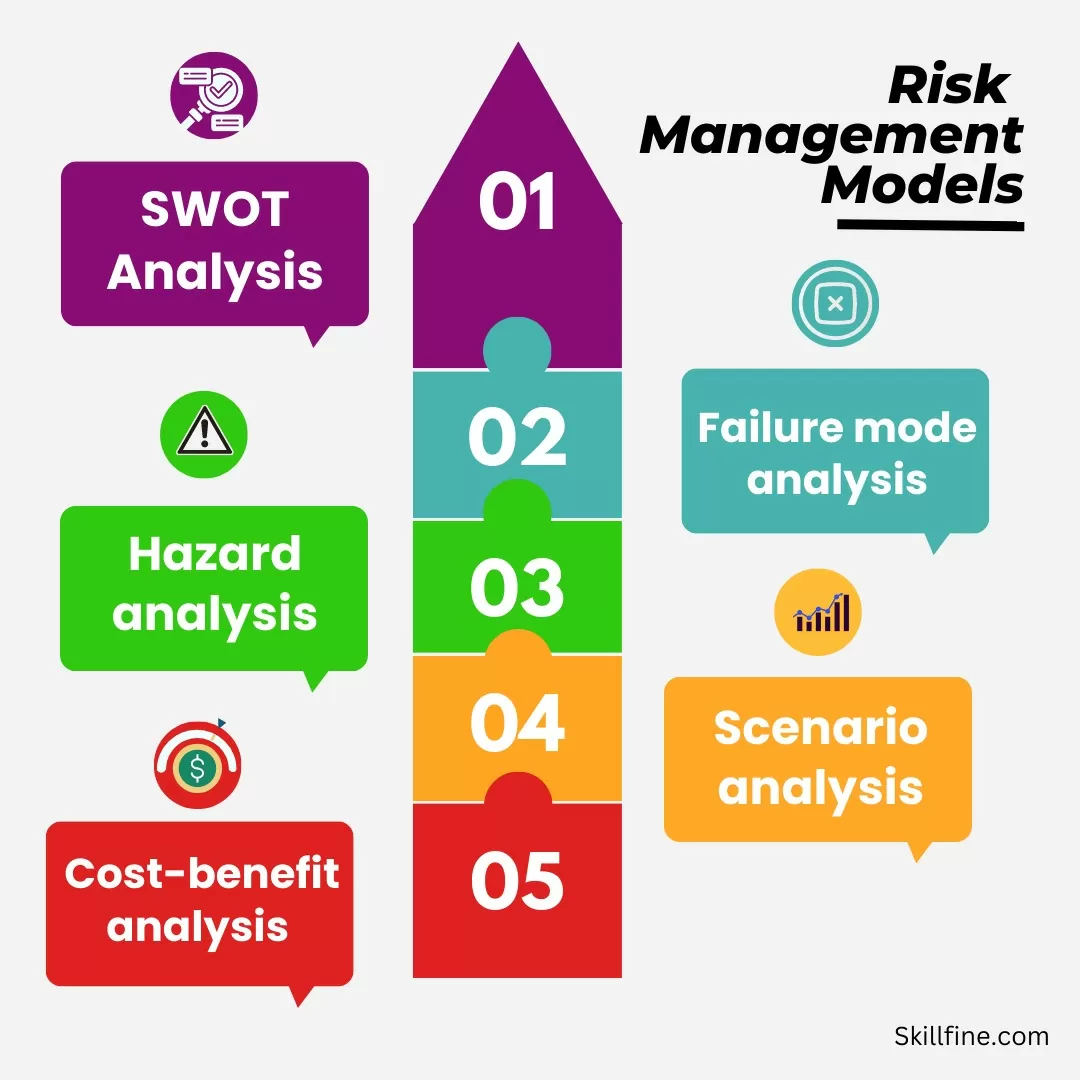

Types of Risk Management Models

There are different types of risk management models that can help you identify and mitigate risk. One of the most popular risk management models is the Five-Factor Model, and it is one that you should consider when you’re starting out. The Five-Factor Model was developed by Harvard Business School professor Dr. Henry Mintzberg.

This model identifies five key factors that determine the overall risk of your company. If any three of these factors are high, then it is likely that your overall risk is high, too. If any one of these factors is low, then it has a small impact on the overall risk of your company. If all three factors are high, though, then it has a significant impact on your overall risk.

Capital Requirement or Buffer Account

If you already have an established business, the next step is to start managing risk associated with existing assets. The most common way to do this is to create a “buffer account.” A buffer account is a reserve fund that you set aside from your operating revenue to cover any unexpected but likely expenses that could arise.

For example, if you have a product that is selling for $100, and you expect to operate at a loss of $100 for the month, that’s an expense that isn’t unusual for your business. However, it is an expense that could significantly affect your overall risk if it happens too often. That’s why you need to have a buffer account set aside to cover these types of expenses. The buffer account can be thought of as a cash reserve that you keep separate from your operating revenue.

Probabilistic Risk Management

The Five-Factor Model is a deterministic model that assumes that risks are evenly distributed across the factors. Therefore, if any one factor is low, then the overall risk is not significantly affected. However, businesses often don’t operate in a vacuum – they also have human beings working for them, and human beings are not always as rational as we would like to think. Therefore, in the real world, some factors will be higher than others. In those cases, you need a probabilistic model that takes into account the likelihood of each factor occurring.

Financial Risk Analysis

At the end of the day, financial risk analysis is about trying to identify the factors that have the highest probability of causing your company to go bankrupt or miss payroll. Therefore, the goal of this analysis is to identify the factors that have the highest chance of negatively affecting your company. You can do or learn about this by looking at the courses on financial analysis that give a brief of your company to see if any factors are significantly low. If any factors are significantly low, you need to investigate why that is happening so that you can find a way to fix it.

Conclusion

So now you know what risk management is, what different models are available, and how to identify the most significant risks facing your business. These are important topics to understand before you start managing risk in your company because it can be difficult to do if you don’t know what you’re getting yourself into.

13 thoughts on “7 Risk Management Models To Consider Before You Start Your Business”

[…] risks that can have adverse financial consequences. Insurance acts as a critical tool in this risk management process. It provides a safety net that helps individuals and businesses recover from unexpected […]

[…] of risks, such as credit risk, market risk, and liquidity risk. Compliance programs contribute to risk management by ensuring that financial institutions comply with regulations related to risk measurement, […]

I am so grateful for your article post.Much thanks again. Cool.

Existe – T – Il un moyen de récupérer l’historique des appels supprimés? Ceux qui disposent d’une sauvegarde dans le cloud peuvent utiliser ces fichiers de sauvegarde pour restaurer les enregistrements d’appels de téléphone mobile.

Lorsque nous soupçonnons que notre femme ou notre mari a trahi le mariage, mais qu’il n’y a aucune preuve directe, ou que nous voulons nous inquiéter de la sécurité de nos enfants, surveiller leurs téléphones portables est également une bonne solution, vous permettant généralement d’obtenir des informations plus importantes..

Enjoyed reading this, very good stuff, thankyou. “Management is nothing more than motivating other people.” by Lee Iacocca.

103957 898565hey excellent website i will definaely come back and see once more. 436574

272757 64089Some truly wonderful articles on this internet site , appreciate it for contribution. 953673

85491 435237How much of an appealing guide, maintain on creating much better half 866120

474326 259788You could surely see your skills within the function you write. The world hopes for a lot more passionate writers like you who arent afraid to say how they believe. At all times follow your heart 665137

958618 906930Enjoyed reading via this, very great stuff, thankyou . 701866

286071 705162There is noticeably a bundle to realize about this. I assume you produced specific nice points in functions also. 393671

186281 887185Ive applied the valuable points from this page and I can surely tell that it gives plenty of assistance with my present jobs. I would be really pleased to maintain getting back in this web page. Thank you. 775261