INTRODUCTION

In the ever-evolving landscape of corporate finance, pension accounting stands out as a crucial yet complex area that significantly impacts a company’s financial health and its employees’ future security. At its essence, pension accounting entails the precise calculation and reporting of the costs linked to providing retirement benefits to employees. As companies navigate the intricacies of pension obligations, they must balance financial stewardship with ethical responsibility, ensuring that promises made to employees are honored while maintaining transparency and regulatory compliance.

Understanding pension accounting is essential for grasping how companies manage their long-term financial commitments. Whether through defined benefit plans that offer guaranteed retirement incomes or defined contribution plans that shift investment risks to employees, the way a company accounts for its pension liabilities reveals much about its financial strategy and stability. This introduction to pension accounting delves into the mechanics behind these calculations, the impact on financial statements, and the critical role played by various stakeholders.

TYPES OF PENSION PLANS

There are mainly two categories of pension plans: defined benefit plans and defined contribution plans.

Defined Benefit Plans (DB Plans)

1. Overview:

Defined Benefit (DB) Plans promise a specified monthly benefit to employees upon retirement. The benefit amount is typically determined based on factors such as the employee’s salary history and length of service.

2. Key Features:

- Benefit Formula: The retirement benefit is determined by a formula that typically considers factors such as the employee’s average salary over their career and the number of years they have worked for the employer. For example, a common formula might be 1.5% of the average salary for the last five years multiplied by the number of years of service.

- Investment Risk: The employer assumes the investment risk. The company must ensure that the pension fund has enough assets to meet its future obligations, regardless of how the investments perform.

- Funding Requirements: Employers are required to make regular contributions to the pension fund to ensure it is adequately funded. These contributions are based on actuarial valuations that estimate future pension obligations.

- Accounting Complexity: Pension accounting under DB plans involves complex calculations. Companies must estimate the present value of future pension benefits (Projected Benefit Obligation or PBO), calculate interest costs, and expected returns on plan assets, and amortize any gains or losses.

- Balance Sheet Impact: The PBO and the fair value of the pension plan’s assets are reported on the company’s balance sheet. The difference between these two figures (funded status) can result in either a pension liability (if obligations exceed assets) or a pension asset (if assets exceed obligations).

- Employee Security: Employees are guaranteed a specific benefit amount upon retirement, providing them with a predictable and stable source of income.

3. Accounting Components:

- Service Cost: The present value of benefits earned by employees during the current year.

- Interest Cost: The increase in the PBO due to the passage of time, calculated using the discount rate.

- Expected Return on Plan Assets: The anticipated return on the pension plan’s assets, which reduces pension expense.

- Amortization of Prior Service Costs: Costs associated with changes in the pension plan that affect past service.

- Actuarial Gains and Losses: Differences between actual and expected outcomes in actuarial assumptions, which may be amortized over time.

Defined Contribution Plans (DC Plans)

1. Overview:

Defined Contribution (DC) Plans do not promise a specific benefit amount at retirement. Instead, the employer and/or employee contribute a set amount to the employee’s individual account in the plan. The final benefit depends on the total contributions and the investment performance of the account.

2. Key Features:

- Contribution Formula: Contributions are typically defined as a percentage of the employee’s salary or a fixed dollar amount. For example, an employer might contribute 5% of an employee’s salary to their retirement account, or match employee contributions up to a certain limit.

- Investment Risk: The employee assumes the investment risk. The final retirement benefit is determined by the amount of money accumulated in the account and the returns earned on investments made with those contributions.

- Funding Requirements: There is no obligation for the employer to make additional contributions beyond the defined amount. The employer’s contribution is fixed or based on a formula, and there is no requirement to ensure a specific level of funding for future benefits.

- Accounting Simplicity: Pension accounting for DC plans is straightforward. The expense recorded in the financial statements is simply the total amount of contributions made during the period.

- Balance Sheet Impact: There are no long-term pension liabilities or assets reported on the balance sheet for DC plans. Only the current period’s contributions are recorded.

- Employee Benefit Security: The amount of retirement income depends on the contributions made and the investment performance. Since there is no guaranteed benefit amount, employees assume the risk associated with investment performance.

3. Accounting Components:

Contributions: The amount contributed by the employer and/or employee during the accounting period is recorded as an expense.

Summary of Differences

| Feature | Defined Benefit Plans (DB) | Defined Contribution Plans (DC) |

| Benefit Determination | Based on a formula (e.g., salary history, years of service) | Based on contributions and investment returns |

| Investment Risk | Employer bears the risk | The employee bears the risk |

| Funding | The employer must ensure sufficient funds | Employer’s obligation is limited to contributions |

| Expense Recognition | Includes service cost, interest cost, expected return on assets, amortizations | Based on contributions made during the period |

| Liability | PBO recorded as a liability | No long-term liability recorded |

| Assets | Plan Assets as an asset | No long-term assets recorded |

| Balance Sheet Impact | The net of PBO and plan asset decides whether it is a net liability or net asset | No significant impact beyond contributions |

| Income Statement Impact | Pension expenses include several components | Expense is the total contributions made |

| Volatility | Can be volatile due to actuarial assumptions and market conditions | Less volatile, tied to current contributions |

| Employee Benefit Security | Guaranteed benefit amount | Dependent on investment performance |

| Administrative Complexity | More complex due to actuarial valuations | Simpler, focused on contributions and investments |

Key Concepts in Pension Accounting

- Present Value of Future Benefits: This concept involves estimating the present value of the future pension benefits that will be paid to employees. Actuarial assumptions, such as discount rates, mortality rates, and employee turnover rates, play a crucial role in this estimation.

- Pension Expense: The annual cost recognized in the financial statements for providing pension benefits. It includes several components:

- Service Cost: The present value of benefits earned by employees during the current year.

- Interest Cost: The increase in the pension obligation due to the passage of time.

- Expected Return on Plan Assets: The estimated return on the funds invested in the pension plan.

- Amortization of Prior Service Costs and Gains/Losses: Adjustments for modifications to the pension plan and variations from actuarial assumptions.

- Funded Status: This is the difference between the fair value of plan assets and the projected benefit obligation (PBO). A positive funded status indicates a surplus, while a negative status indicates a deficit.

ACCOUNTING STANDARDS

Several accounting standards govern pension accounting, with the most notable being:

- FASB (Financial Accounting Standards Board) ASC 715: This standard provides guidelines for the recognition, measurement, and disclosure of pension costs and obligations in financial statements for U.S. companies.

- IAS 19 (International Accounting Standard 19): Issued by the International Accounting Standards Board (IASB), IAS 19 outlines the accounting treatment for employee benefits, including pensions, for companies outside the U.S.

MEASUREMENT AND RECOGNITION

The measurement of pension obligations involves complex actuarial calculations. Actuaries use various assumptions to estimate the amount of benefits that will be paid to employees and the timing of these payments. These assumptions include:

- Discount Rate: The rate used to discount future benefit payments to their present value.

- Salary Growth Rate: The expected rate of increase in employee salaries.

- Mortality Rates: The estimated life expectancy of employees.

- Employee Turnover Rates: The anticipated rate at which employees are expected to leave the company.

Recognition of pension expenses in the financial statements involves recording the various components of pension cost, as mentioned earlier. Companies must also disclose detailed information about their pension plans, including the funded status, plan assets, and actuarial assumptions used.

PARTIES INVOLVED IN PENSION ACCOUNTING

- Employer (Plan Sponsor): The employer is responsible for establishing and maintaining the pension plan. The employer makes contributions to the pension fund, manages the plan’s assets, and ensures that the plan meets its obligations to employees. In the case of a defined benefit plan, the employer bears the investment risk and is responsible for funding any shortfalls. For defined contribution plans, the employer’s responsibility is limited to making the specified contributions.

- Employees (Plan Participants): Employees are the beneficiaries of the pension plan. They earn pension benefits based on the plan’s terms, such as years of service and salary history. In a defined contribution plan, employees may also contribute to their accounts and bear the investment risk. For defined benefit plans, employees are guaranteed a specific benefit upon retirement.

- Actuaries: Actuaries are professionals who specialize in assessing financial risks using mathematics, statistics, and financial theory. They play a crucial role in pension accounting by performing the actuarial valuations needed to estimate the present value of future pension benefits. Actuaries make critical assumptions about discount rates, salary growth, employee turnover, mortality rates, and other factors to determine the pension plan’s obligations and costs.

These parties interact to ensure the accurate accounting, funding, and management of pension plans, safeguarding the financial interests of employees while maintaining the financial health and regulatory compliance of the employer.

RELATIONSHIPS THAT EXIST IN PENSION ACCOUNTING

In pension accounting, three primary relationships exist that are crucial for understanding the dynamics and responsibilities among the different parties involved. These relationships involve:

- Employer (Plan Sponsor) and Employees (Plan Participants)

- Employer (Plan Sponsor) and Trustees

- Trustees and Employees (Plan Participants)

Let’s explore these relationships in more detail:

Employer (Plan Sponsor) and Employees (Plan Participants)

- Benefit Provision: The employer promises specific retirement benefits to the employees, which are typically defined in the terms of the pension plan. These benefits could be a defined amount (in the case of a Defined Benefit Plan) or based on contributions made (in the case of a Defined Contribution Plan).

- Contribution and Funding: In Defined Benefit Plans, the employer is responsible for funding the pension plan to ensure that it has enough assets to meet future obligations. In Defined Contribution Plans, the employer may make contributions to the employees’ individual accounts, often matching a portion of the employee’s contributions.

- Communication and Transparency: Employers must communicate the terms, conditions, and status of the pension plan to the employees. This includes providing information about the benefits, funding status, and any changes to the plan.

Employer (Plan Sponsor) and Trustees

- Establishment and Oversight: The employer establishes the pension plan and appoints trustees to manage the plan’s assets. Trustees are responsible for the oversight and administration of the pension fund, ensuring it is managed in the best interest of the beneficiaries.

- Funding and Contributions: The employer makes contributions to the pension fund, which the trustees manage. In Defined Benefit Plans, the employer must make sufficient contributions to meet the actuarial requirements. In Defined Contribution Plans, the contributions are typically defined and fixed.

- Compliance and Reporting: Trustees ensure that the pension plan complies with legal and regulatory requirements. They report to the employer on the performance of the pension fund, its financial status, and any significant issues that may arise.

Trustees and Employees (Plan Participants)

- Fiduciary Responsibility: Trustees have a fiduciary duty to act in the best interests of the plan participants. They must prudently manage the plan’s assets and ensure that the pension benefits are secure and sufficiently funded.

- Investment and Management: Trustees are responsible for the investment and management of the pension fund’s assets. They select investment strategies and managers, monitor performance, and make adjustments as necessary to meet the plan’s long-term objectives.

- Communication and Transparency: Trustees are responsible for providing plan participants with information about the pension plan, including investment performance, funding status, and any changes to the plan. They must ensure that participants are kept informed about the security of their benefits and any factors that might affect their retirement income.

IMPACT OF PENSION ACCOUNTING ON THE FINANCIAL STATEMENT OF THE COMPANY

Pension accounting significantly impacts a company’s financial statements, affecting key financial metrics and providing insights into the company’s long-term financial obligations as follows:

- Balance Sheet: For the defined benefit plan, pension liabilities, which represent the present value of future pension obligations (Projected Benefit Obligation or PBO), and pension assets, which are the fair value of the assets set aside to fund these obligations, are recorded. The net difference between these figures, known as the funded status, is recorded as either a net pension liability or asset, indicating whether the pension plan is underfunded or overfunded. This affects the company’s overall financial position and can influence the assessment of its solvency and risk profile.

- Income Statement: For defined benefit plan, pension expense is recognized, which includes components such as service cost, interest cost, expected return on plan assets, and amortizations of prior service costs and actuarial gains or losses. For defined contribution plan income statement includes contribution expense. This expense reduces the company’s net income, directly impacting profitability ratios like return on assets (ROA) and return on equity (ROE). Furthermore, actuarial gains and losses, which arise from changes in actuarial assumptions or differences between expected and actual returns on plan assets, are initially recorded in other comprehensive income (OCI) and can be amortized to the income statement over time, adding another layer of complexity to financial reporting.

- Cash Flow Statements: In the cash flow statement, employer contributions to the pension plan are listed as cash outflows, which impact the company’s liquidity and cash management. These contributions are part of the operating activities and influence the cash available for other corporate needs.

IMPACT ON FINANCIAL RATIOS AND METRICS

The Pension Accounting impacts the different ratios as below:

- Profitability Ratios: Pension expenses reduce net income, affecting profitability ratios such as return on assets (ROA) and return on equity (ROE).

- Leverage Ratios: For defined benefit planif the PBO is more than the plan asset it is a net liability recognised as a pension liability. This increases total liabilities, impacting leverage ratio such as the debt-to-equity ratio.

- Liquidity Ratios: Contributions to the pension plan affect cash flows, influencing liquidity ratios such as the current ratio and quick ratio.

DISCLOSURE REQUIREMENTS FOR PENSION ACCOUNTING

- Key disclosure requirements: Companies are required to include detailed disclosures in the notes to the financial statements. These include descriptions of the pension plan, key actuarial assumptions, the components of pension expense, and the funded status of the plan.

- Sensitivity Analysis: Disclosure of the sensitivity of pension obligations to changes in key assumptions, such as discount rates and salary growth rates, is often required.

IMPACT OF PENSION ACCOUNTING (PRIMARILY DEFINED BENEFIT PLAN) ON STAKEHOLDERS

- Investors and Analysts: Pension accounting affects the perceived financial health and risk profile of a company. Investors and analysts scrutinize pension obligations and funded status to assess long-term viability and potential financial risks.

- Credit Rating Agencies: Pension liabilities are considered when evaluating a company’s creditworthiness. Significant underfunded pension obligations can negatively impact credit ratings, leading to higher borrowing costs.

- Employees: The financial health of the pension plan is crucial for employees relying on future pension benefits. Underfunded plans can raise concerns about the security of their retirement benefits.

CALCULATION OF PENSION EXPENSE

The calculation involves several components, each reflecting different aspects of the pension plan’s financial and actuarial dynamics. Here’s a detailed breakdown of how pension expense is calculated:

Components of Pension Expense

Service Cost:

- Definition: The present value of benefits earned by employees during the current period.

- Calculation: Determined by actuarial valuation based on the benefit formula, employee salaries, and years of service.

Interest Cost:

- Definition: The increase in the projected benefit obligation (PBO) due to the passage of time.

- Calculation: Calculated by applying the discount rate to the beginning PBO. Interest Cost = PBO at the Beginning of Period × Discount Rate

Expected Return on Plan Assets:

- The anticipated return on the pension plan’s assets over the period.

- Calculation: The expected return rate is applied to the fair value of plan assets at the beginning of the period. Expected Return on Plan Assets = Fair Value of Plan Assets at Beginning of Period× Expected Return Rate

Amortization of Prior Service Cost:

- The cost of retroactive benefits granted due to plan amendments affecting prior service.

- Calculation: The total prior service cost is usually amortized over the average remaining service period of the impacted employees.

Amortization of Actuarial Gains and Losses:

- Differences between actual and expected actuarial outcomes, such as changes in assumptions or unexpected changes in plan assets or obligations.

- Calculation: Gains and losses exceeding a certain corridor (usually 10% of the greater of the PBO or plan assets) are amortized over the average remaining service period of active employees.

THE FORMULA FOR PENSION EXPENSE

Combining these components, the pension expense can be calculated using the following formula:

Pension Expense = Service Cost + Interest Cost − Expected Return on Plan Assets + Amortization of Prior Service Cost + Amortization of Actuarial Gains/Losses

Example Scenario

Company XYZ has a defined benefit pension plan for its employees. Here are the relevant details:

- Projected Benefit Obligation (PBO) at the beginning of the year: $1,000,000

- Service Cost for the year: $50,000

- Discount Rate: 5%

- Fair Value of Plan Assets at the beginning of the year: $800,000

- Expected Return on Plan Assets: 6%

- Prior Service Cost: $100,000, amortized over 10 years

- Actuarial Gain/Loss: $0 (for simplicity)

Step-by-Step Calculation

1. Service Cost

The service cost is the present value of benefits earned by employees during the current year.

Service Cost = $50,000

2. Interest Cost

The interest cost is the increase in the PBO due to the passage of time, calculated by applying the discount rate to the beginning PBO.

Interest Cost= PBO at the Beginning of Year× Discount Rate

Interest Cost=$1,000,000×0.05=$50,000

3. Expected Return on Plan Assets

The expected return on plan assets is calculated by applying the expected return rate to the fair value of plan assets at the beginning of the year.

Expected Return on Plan Assets=Fair Value of Plan Assets at Beginning of Year× Expected Return Rate

Expected Return on Plan Assets=$800,000×0.06=$48,000

4. Amortization of Prior Service Cost

The prior service cost is amortized over the average remaining service period of employees. In this case, it’s amortized over 10 years.

Amortization of Prior Service Cost = Total Prior Service Cost / Amortization Period

Amortization of Prior Service Cost = $100,000/ 10 = $10,000

5. Amortization of Actuarial Gain/Loss

For simplicity, we assume no actuarial gains or losses in this example.

Amortization of Actuarial Gain/Loss=$0

TOTAL PENSION EXPENSE

Now, we add up all the components to calculate the total pension expense:

Pension Expense = Service Cost + Interest Cost − Expected Return on Plan Assets + Amortization of Prior Service Cost + Amortization of Actuarial Gain/Loss Pension Expense

Pension Expense = $50,000+$50,000−$48,000+$10,000+$0 = $62,000

CHALLENGES IN PENSION ACCOUNTING

- Actuarial Assumptions: Small changes in actuarial assumptions can significantly impact the estimated pension obligations and expenses. Choosing the appropriate assumptions requires careful consideration and expert judgment.

- Volatility: Market fluctuations can impact the value of plan assets, causing volatility in the funded status and pension expenses. To manage this risk, companies must employ effective investment strategies and ensure proper asset-liability alignment.

- Regulatory Compliance: Pension accounting standards are subject to frequent updates and changes. Companies must stay informed about these changes to ensure compliance and avoid potential penalties.

- Transparency and Disclosure: Providing clear and comprehensive disclosures about pension plans is crucial for stakeholders. Companies must balance the need for transparency with the complexity of the information.

REAL-LIFE COMPANY EXAMPLE OF PENSION ACCOUNTING

Let us take the example of General Motors. We will look at various disclosures made by the company in its annual report on pensions including both the Defined Benefit Plan and Defined Contribution Plan.

In Note 15 of the Consolidated Financial Statements, the company gives disclosure of various calculations related to the pension.

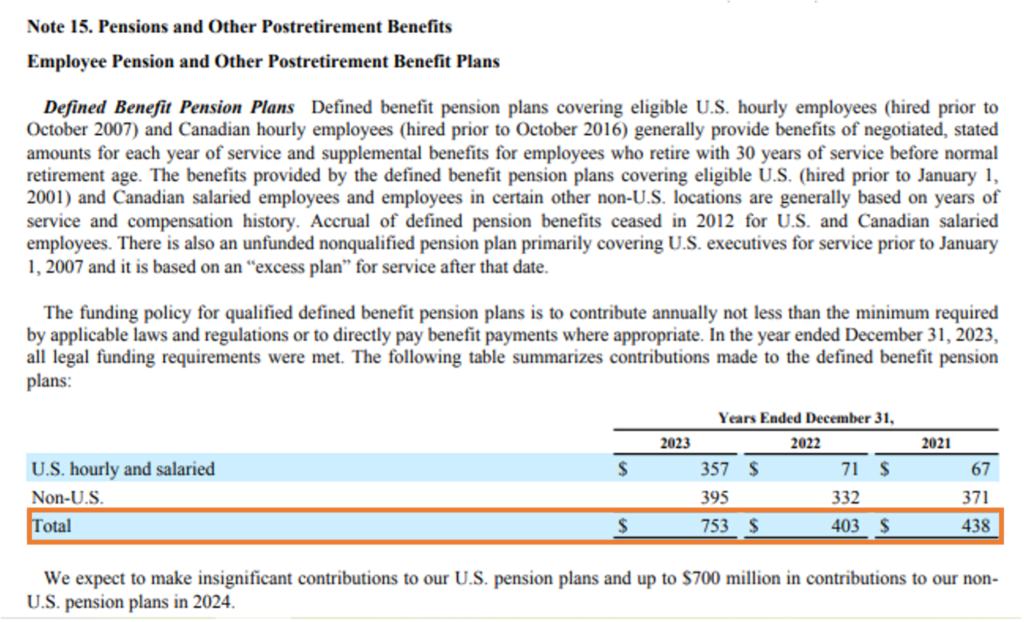

Below is the Disclosure related to the defined benefit pension plan. The company contributes $753 million to the defined benefit pension plan in the year 2023.

Source: Annual Report https://investor.gm.com/static-files/1fff6f59-551f-4fe0-bca9-74bfc9a56aeb

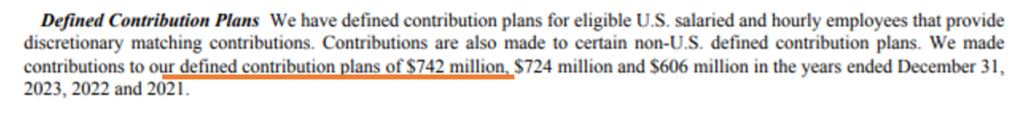

The company also contributes to the defined contribution pension plan a sum of $742 million in the year 2023.

Source: Annual Report https://investor.gm.com/static-files/1fff6f59-551f-4fe0-bca9-74bfc9a56aeb

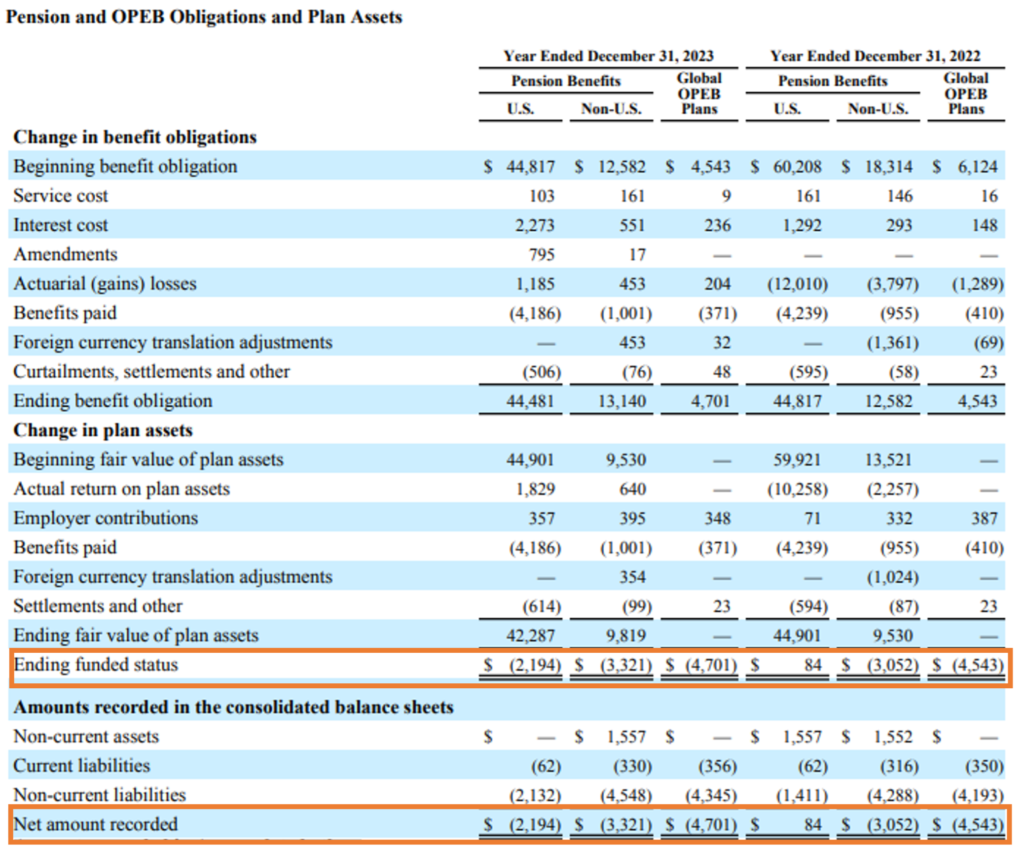

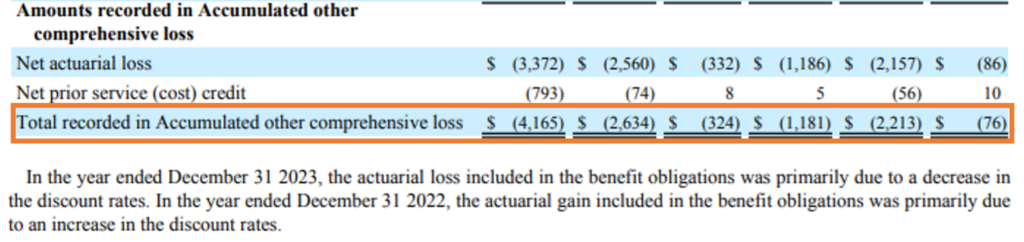

Below is the schedule for changes in benefit obligations, changes in plan assets, ending funding status, amounts recorded in the consolidated balance sheets, and Amounts recorded in Accumulated other comprehensive loss.

Source: Annual Report https://investor.gm.com/static-files/1fff6f59-551f-4fe0-bca9-74bfc9a56aeb

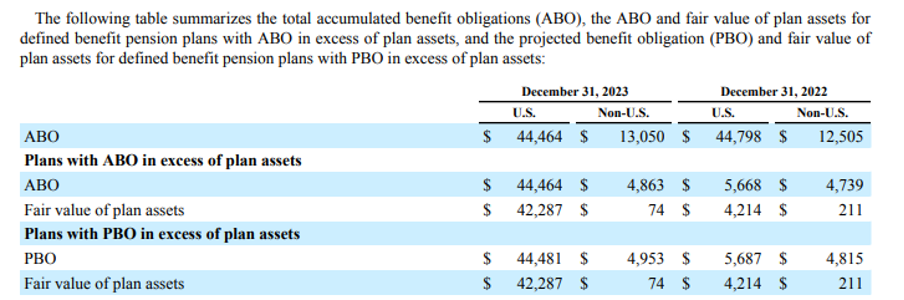

Below is the table summarizing the total accumulated benefit obligations.

Source: Annual Report https://investor.gm.com/static-files/1fff6f59-551f-4fe0-bca9-74bfc9a56aeb

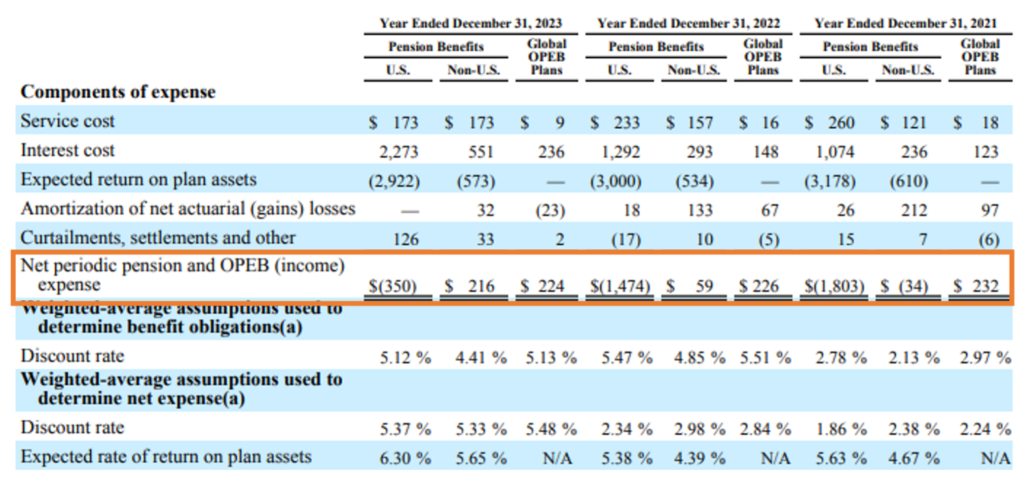

Below are the components of net periodic pension along with the assumptions used to determine benefit obligations.

Source: Annual Report https://investor.gm.com/static-files/1fff6f59-551f-4fe0-bca9-74bfc9a56aeb

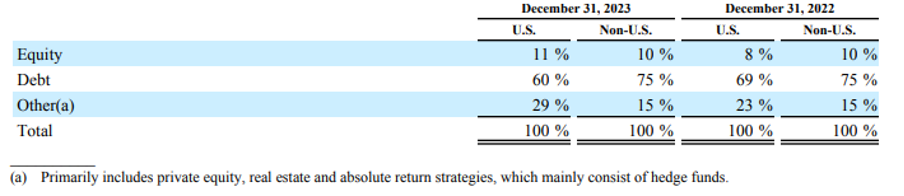

Below is the table summarizing the target allocations by asset category for U.S. and non-U.S. defined benefit pension plans.

Source: Annual Report https://investor.gm.com/static-files/1fff6f59-551f-4fe0-bca9-74bfc9a56aeb

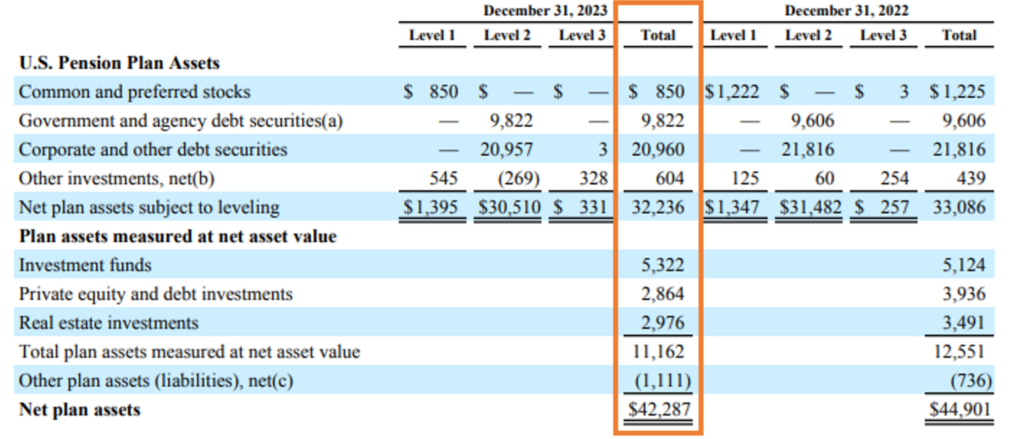

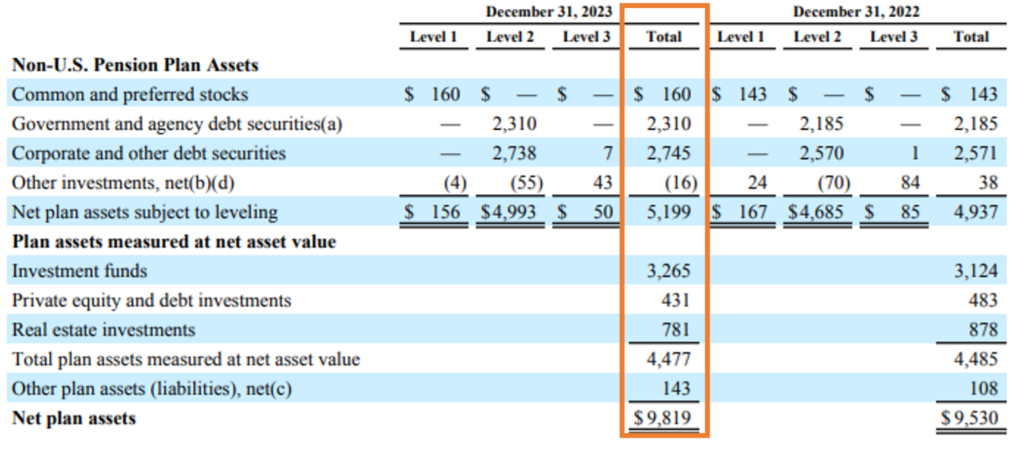

Below are the tables summarizing the fair value of U.S. and non-U.S. defined benefit pension plan assets by asset class.

Source: Annual Report https://investor.gm.com/static-files/1fff6f59-551f-4fe0-bca9-74bfc9a56aeb

CONCLUSION

Pension accounting is a vital aspect of financial reporting that requires a deep understanding of actuarial principles, regulatory standards, and financial management. By accurately accounting for pension obligations and expenses, companies can ensure the financial well-being of their employees while maintaining transparency and compliance with regulatory requirements. Effective pension accounting not only safeguards the interests of employees but also enhances the credibility and reliability of a company’s financial statements.