The federal securities law requires the domestic public companies to submit various reports to Securities and Exchange Commission (SEC) like Form 10-Q (quarterly reports), Form 10-K (annual report) and Form 8-K (current reports) that must comply with a variety of disclosure requirements and report on varies specified events reflecting on company’s financial performance and standing from time to time.

SEC Form 10-Q is a comprehensive financial report required to be quarterly reported by all the public companies to the Securities and Exchange Commission (SEC). It is required to be reported as per the federal securities law so as to disclose the financial performance of the companies on an ongoing basis. This form includes unaudited financial statements of the company providing an updated view of the company’s financial position during different quarters of the year. The company during its fiscal year is required to report this Form for each of the first three fiscal quarters. For the final quarter of the company’s fiscal year it is required to file Form 10-K which is an annual form. Form 10-Q is similar to form 10-K the main difference being that Form 10-Q is unaudited financial data and is less detailed than Form 10-K.

Deadlines to file SEC Form 10-Q

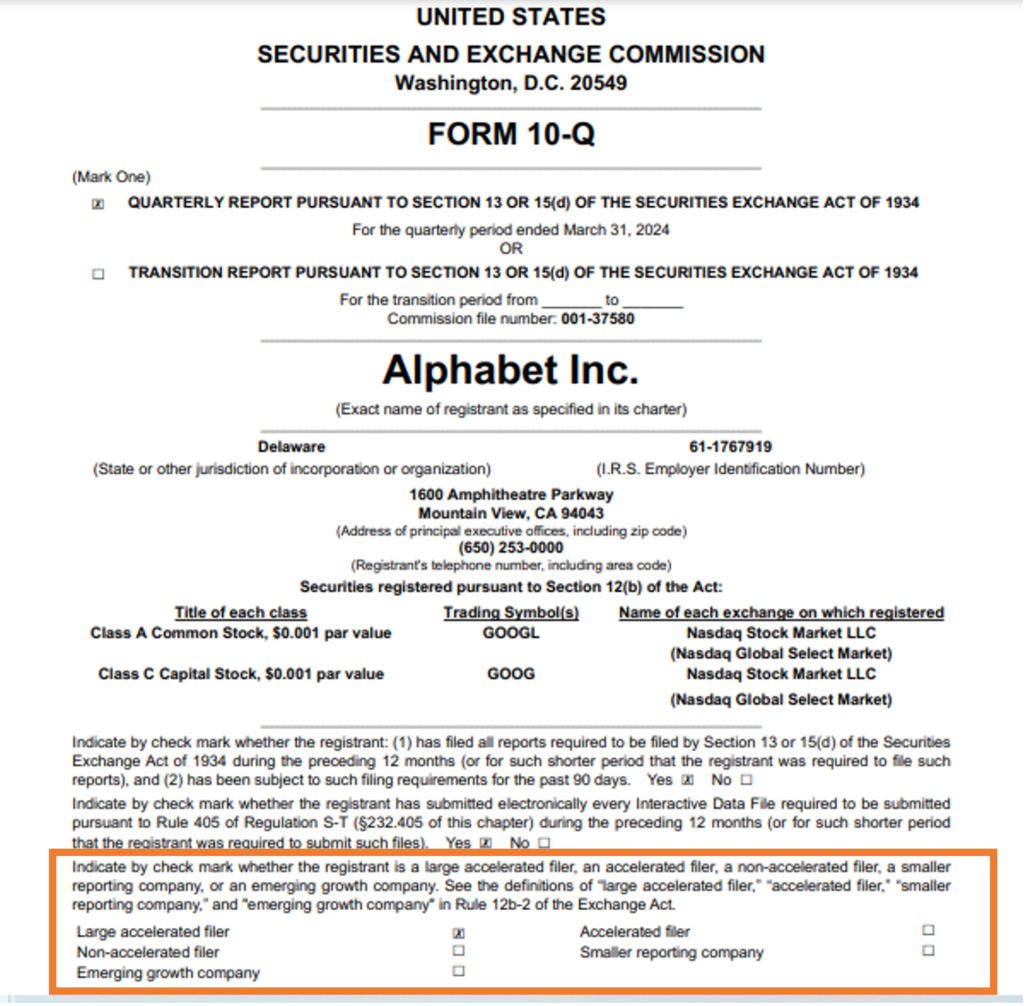

The deadline for filing Form 10-Q varies across different companies and is determined by its public float. Public float is nothing but the number of shares outstanding in the hands of the public and which is freely trading in the market and not held by the owners, officers or the government. A company filing a 10-Q is classified in one of three categories as following:

- Large accelerated filers- These are the largest companies which must have at least $700 million in public float. These types of filers have 40 days after the quarter end to file Form 10-Q.

- Accelerated filers- These companies are one with at least $75 million but less than $700 million in public float. These companies also have 40 days to file form 10-Q.

- Non-accelerated filers- These companies have less than $75 million of public float. These companies have 45 days to file Form 10-Q from the close of the quarter.

| Type of Filer | Public Float | 10-Q Deadline | 10-K Deadline |

| Large Accelerated Filer | $700 MM or more | 40 days | 60 days |

| Accelerated Filer | $75 – $700MM | 40 days | 75 days |

| Non-Accelerated Filer | Less than $75MM | 45 days | 90 days |

Compliance to be done on failure to file Form 10-Q within the deadline

If the company fails to file Form 10-Q or Form 10-K within the respective deadline then it must file SEC NT i.e., the Non Timely form no later than one day after the due date. One-time grace period of 5 days is allowed by SEC NT for filing Form 10-Q and 15 days for Form 10-K. The management is required to explain the reason for the deadline being missed by the company in Form NT.

The securities and Exchange Commission allows late filings within a specified time period if the company has a reasonable explanation for delay. Some of the common reasons for company’s delay in filing Form 10-Q are: ongoing corporate litigations, any form of company restructuring going on like mergers and acquisitions or demerger, due to bankruptcy etc.

If Form 10-Q or Form 10-K is filed within the extended time period, it is considered to be filed timely. The consequences of failure to file Form 10-Q within extended period as well includes imposition of variety of costly penalties, delisting by registered stock exchanges, deregistration by securities and exchange commission, potential debt covenant violations, various legal implications and inability to raise capital through issuance of securities from public.

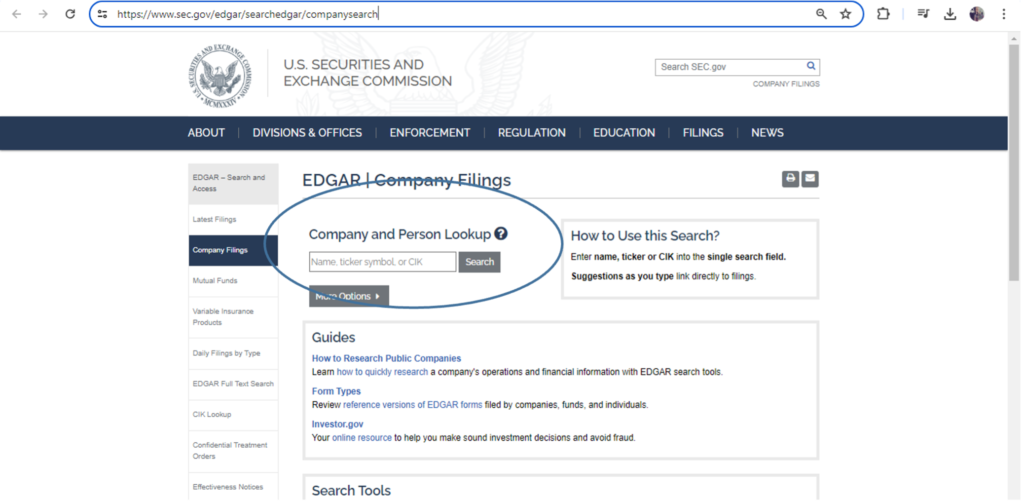

Where to find Form 10-Q filed by a company?

Form 10-Q and Form 10-K filed by any company is publicly available for those who want to take important decisions or make any sort of analysis based on companies financials. A company’s quarterly report can be viewed on the Securities and Exchange Commissions (SEC) EDGAR database. The form can be searched by using the company name, SEC Central Index Key (CIK) or the ticker symbol tab on the EDGAR website.

Source: https://www.sec.gov/edgar/searchedgar/companysearch

Many companies also post Form 10-Q and Form 10-K on their company’s website under the Investors Relation section.

Two Components of SEC Form 10-Q

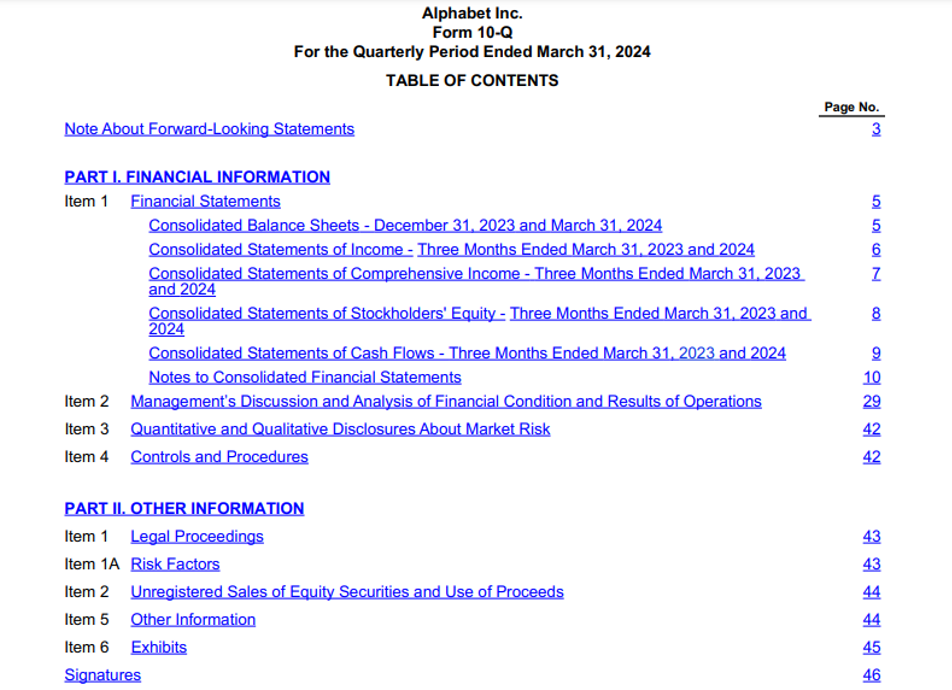

Broadly Form 10-Q is divided into two components as following:

- PART I. FINANCIAL INFORMATION: This part covers the financial aspects of the company covering the respective quarter for which it is filed. It includes the following sub headings:

- Financial Statements: This includes the company Balance sheets, Income statements, Statement of Comprehensive income, statement of shareholder’s equity, cash flow statement and notes to financial statements.

- Management’s Discussion and Analysis of Financial Condition and Results of Operations

- Quantitative and Qualitative Disclosures About Market Risk

- Controls and Procedures

- PART II: OTHER INFORMATION: This part includes other information not covered above like

- Legal proceedings

- Risk factors

- Unregistered Sales of Equity Securities and Use of Proceeds

- Any other Information

- Exhibits

Sample of Contents of Form 10-Q of Alphabet Inc.

Source: https://abc.xyz/assets/9c/12/c198d05b4f7aba1e9487ba1c8b79/goog-10-q-q1-2024.pdf

Who signs Form 10-Q?

A duly authorized officer of the registrant on the registrant’s behalf and the principal financial or chief accounting officer of the registrant must sign manually at least one complete copy of the report filed with the Commission and one such copy filed with each exchange. The instructions for Form 10-Q include more details.

Importance of Form 10-Q

The Securities and Exchange Act of 1934 introduced the requirement of filing Form 10-Q with the aim to promote transparency to the investors of the public company’s operations. This form contains unaudited financial statements of the company till date which help varies stakeholders in varies aspects. Some of the benefits of Form 10-Q are as following:

- Provide snapshot of the company’s financial health: The Form 10-Q is a dependable tracking tool providing investors with quarterly financial data that helps them to compare the financial performance of the company across different quarters

- Helps in inter-company performance: Form 10-Q helps in comparing performance of companies across the same industry in any given quarter. Analysts and Investors can compare the changes in various financial ratios of companies and compare the working capital and accounts payable and receivable accounts of the competitor companies.

- Improves transparency of the companies: Since public companies raise capital from the public, it becomes important for both the existing and potential investors to know the key performance metrics of the company and to determine whether it will remain profitable or not in the long run.

- Helps in future estimations: It helps the analysts to make future estimates of the company’s financial performance and helps in financial modelling.

- Regular Updates: Since Form 10-Q has to be filed quarterly a company’s financial performance is examined more frequently than the annual Form 10-K. This enables investors to keep a track of unusual patterns and spot any significant changes in the company’s financial standing.

Difference between Form 10-Q and Form 10-K

Some of the differences between Form 10-Q and Form 10-K are as following:

- Timing of filing: While Form 10-Q is a quarterly report, Form 10-K is an annual report.

- Disclosure of information: Form 10-Q is less information than Form 10-K.

- Reliability: Form 10-Q is unaudited and less reliable than Form 10-K which is audited.

Overall, 10-Q is an important financial document that keeps investors and analysts up to date about a company’s performance during the quarter. In fact, if there would have been no information about the financial performance for the full year before the 10-k / annual report came out, there would be a lot of speculation about a business. 10-q is an important bridge to the full year reports and hence must be periodically analyzed to understand the business better.