Investing in the stock market can be a complex and daunting task, especially for those who are new to it. However, with the right tools and techniques, it can become a profitable venture. One of the key tools that investors use to make informed investment decisions is equity research. Equity research involves analyzing a company’s financial statements, market trends, and other relevant information to determine its financial health and future prospects.

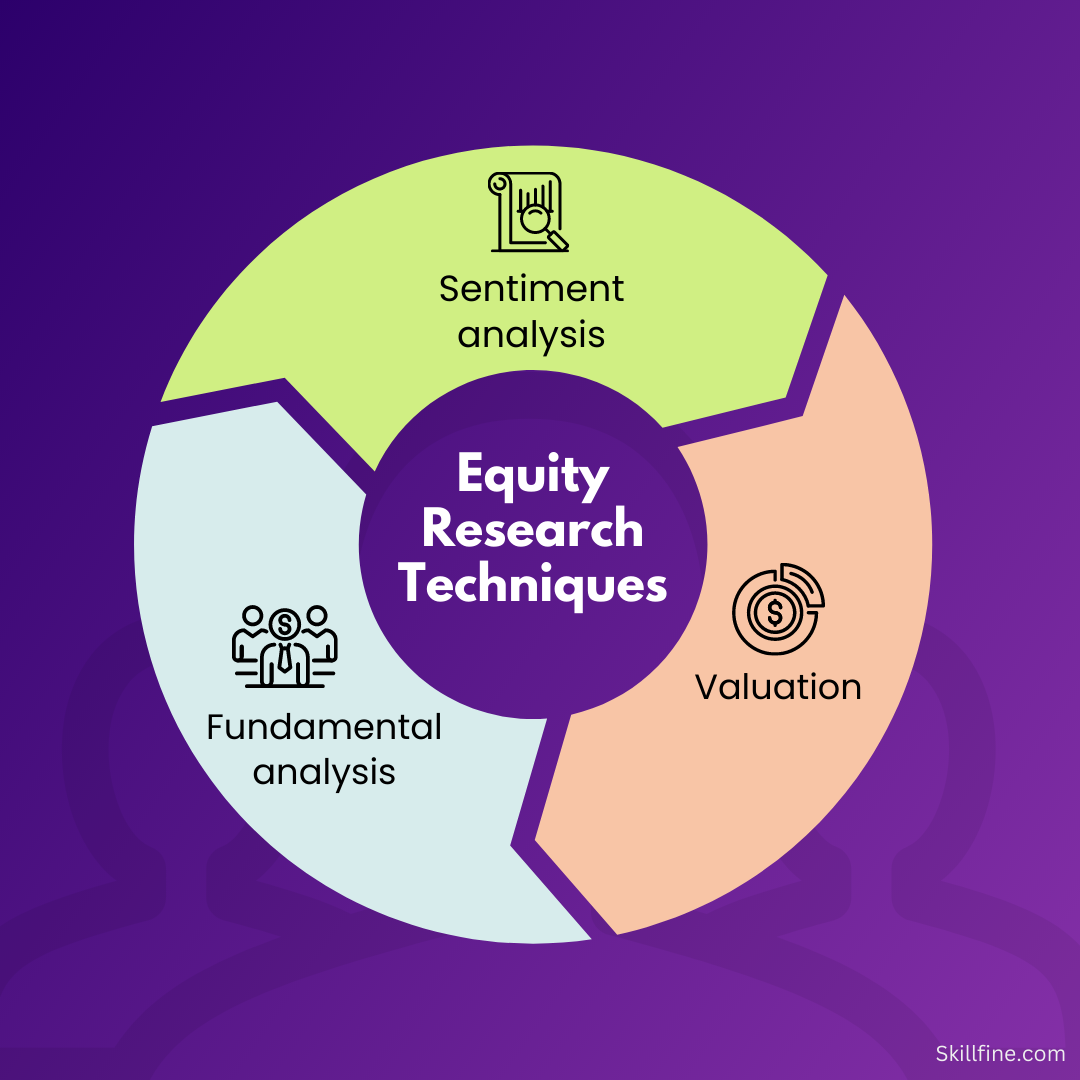

In this article, we will be discussing the top 5 equity research techniques that successful investors use to make profitable investments. Whether you are a novice or an experienced investor, these techniques will help you gain a deeper understanding of the companies you are interested in investing in, and ultimately lead to better investment decisions. So, let’s dive into the world of equity research and learn how to make informed investment decisions.

Understanding equity research

Equity research is the process of analyzing a company’s financial statements, market trends, and other relevant information to determine its financial health and future prospects. Equity research is an essential tool that investors use to make informed investment decisions. The goal of equity research is to provide investors with an in-depth analysis of a company’s financial health and future prospects. This analysis can help investors make informed investment decisions.

Equity research is divided into two categories: sell-side research and buy-side research. Sell-side research is conducted by analysts who work for brokerage firms or investment banks. They provide research reports and recommendations to their clients. Buy-side research is conducted by analysts who work for asset management firms or hedge funds. They conduct research to help their firms make investment decisions.

Equity research is a critical tool for investors. It helps them make informed investment decisions by providing them with an in-depth analysis of a company’s financial health and future prospects.

Fundamental analysis

Fundamental analysis is a technique that investors use to evaluate a company’s financial health and future prospects. This technique involves analyzing a company’s financial statements, such as its balance sheet, income statement, and cash flow statement. The goal of fundamental analysis is to determine the intrinsic value of a company’s stock.

Fundamental analysis involves analyzing a company’s financial statements to determine its financial health and future prospects. This analysis includes looking at a company’s revenue, earnings, assets, liabilities, and cash flow. Analysts use this information to evaluate a company’s financial health and future prospects.

Fundamental analysis is a critical tool for investors. It helps them make informed investment decisions by providing them with an in-depth analysis of a company’s financial health and future prospects.

Technical analysis

Technical analysis is a technique that investors use to evaluate a company’s stock price movements and market trends. This technique involves analyzing a company’s stock chart and other technical indicators. The goal of technical analysis is to determine the best time to buy or sell a stock.

Technical analysis involves analyzing a company’s stock chart and other technical indicators to determine the best time to buy or sell a stock. Analysts use this information to identify trends and patterns in a company’s stock price.

Technical analysis is a critical tool for investors. It helps them make informed investment decisions by providing them with an in-depth analysis of a company’s stock price movements and market trends.

Quantitative analysis

Quantitative analysis is a technique that investors use to evaluate a company’s financial health and future prospects using statistical and mathematical models. This technique involves analyzing a company’s financial statements and other relevant data using mathematical models. The goal of quantitative analysis is to determine the intrinsic value of a company’s stock.

Quantitative analysis involves analyzing a company’s financial statements and other relevant data using statistical and mathematical models. Analysts use this information to evaluate a company’s financial health and future prospects.

Quantitative analysis is a critical tool for investors. It helps them make informed investment decisions by providing them with an in-depth analysis of a company’s financial health and future prospects.

Qualitative analysis

Qualitative analysis is a technique that investors use to evaluate a company’s non-financial factors, such as its management team, industry trends, and competitive landscape. This technique involves analyzing a company’s non-financial factors to determine its financial health and future prospects. The goal of qualitative analysis is to identify potential risks and opportunities that may affect a company’s financial health and future prospects.

Qualitative analysis involves analyzing a company’s non-financial factors to determine its financial health and future prospects. Analysts use this information to identify potential risks and opportunities that may affect a company’s financial health and future prospects.

Qualitative analysis is a critical tool for investors. It helps them make informed investment decisions by providing them with an in-depth analysis of a company’s non-financial factors.

Applying a combination of research techniques

Investors can use a combination of research techniques to make informed investment decisions. Combining fundamental analysis, technical analysis, quantitative analysis, and qualitative analysis can provide investors with a more complete picture of a company’s financial health and future prospects.

Combining multiple research techniques can help investors overcome the limitations of a single research technique. For example, fundamental analysis may not be able to identify short-term price movements, while technical analysis may not be able to identify long-term trends. Combining multiple research techniques can help investors identify both short-term price movements and long-term trends.

Applying a combination of research techniques is a critical tool for investors. It helps them make informed investment decisions by providing them with a more complete picture of a company’s financial health and future prospects.

Common mistakes to avoid in equity research

There are several common mistakes that investors make when conducting equity research. One of the most common mistakes is relying too heavily on a single research technique. Investors who rely too heavily on a single research technique may miss important information that could affect their investment decisions.

Another common mistake is failing to consider the broader economic and market trends that may affect a company’s financial health and future prospects. Investors who fail to consider broader economic and market trends may miss potential risks and opportunities that could affect their investment decisions.

Investors can avoid these common mistakes by using a combination of research techniques and considering broader economic and market trends.

Tools for equity research

There are several tools that investors can use to conduct equity research. One of the most popular tools is equity research reports. Equity research reports are reports written by analysts that provide an in-depth analysis of a company’s financial health and future prospects.

Other tools include financial websites, such as Yahoo Finance and Google Finance, that provide investors with access to financial data and news. Social media platforms, such as Twitter and LinkedIn, can also be used to gather information about a company’s management team and industry trends.

Investors should use a variety of tools to conduct equity research. This can provide them with a more complete picture of a company’s financial health and future prospects.

Equity research reports

Equity research reports are reports written by analysts that provide an in-depth analysis of a company’s financial health and future prospects. These reports are an essential tool that investors use to make informed investment decisions. Equity research reports are typically written by sell-side analysts who work for brokerage firms or investment banks.

Equity research reports provide investors with an in-depth analysis of a company’s financial health and future prospects. They typically include information about a company’s revenue, earnings, assets, liabilities, and cash flow. They also include information about the company’s management team, industry trends, and competitive landscape.

Equity research reports are a critical tool for investors. They provide investors with an in-depth analysis of a company’s financial health and future prospects.

Conclusion

Equity research is a critical tool that investors use to make informed investment decisions. By understanding the top 5 equity research techniques, investors can gain a deeper understanding of the companies they are interested in investing in, and ultimately lead to better investment decisions.

Investors should use a combination of research techniques and consider broader economic and market trends to avoid common mistakes. They should also use a variety of tools, such as equity research reports, financial websites, and social media platforms, to conduct equity research.

In conclusion, equity research is an essential tool for investors who want to make informed investment decisions. By using the top 5 equity research techniques and avoiding common mistakes, investors can gain a deeper understanding of the companies they are interested in investing in, and ultimately lead to better investment decisions.

Some of the frequently asked questions include:

- What are the top 5 equity research techniques that lead to successful investments?

- Why are these specific techniques considered the most effective for equity research?

- What are the equity research techniques that top investors use to achieve successful investments?

- How do these equity research techniques help investors make informed investment decisions?

- Are these equity research techniques suitable for beginner investors or only experienced investors?

- Can these equity research techniques be applied to different types of investments, such as stocks, bonds, or real estate?

- What are some common mistakes that investors make when conducting equity research, and how can they avoid them?

Note:

When it comes to learning, taking the first step can be the most challenging. However, with the right resources and guidance, it can become a rewarding experience. One way to start your journey is by visiting our website, where you can explore a range of courses and gain a deeper understanding of your chosen subject.

Financial Performance Analysis

3 Statement Integrated Financial Modeling

Multiples Based Valuation Modeling

20 thoughts on “The Top 5 Equity Research Techniques for Successful Investments”

[…] excel in equity research, certain skills are essential. Strong analytical skills are a must, as equity researchers need to […]

[…] for funding. Before they invest, they will perform due diligence to ensure that the company is a good investment. The process typically includes a thorough financial review and an in-depth analysis of the […]

[…] rewards. By understanding the client’s risk tolerance, financial consultants can recommend investment options that strike the right balance between risk and […]

[…] shareholder return is rate of return earned by an investor by investing in stocks of Companies during the investment period. An investor investing in stocks makes money in two […]

[…] or lines of credit, which must be repaid over a predetermined period, usually with interest. Unlike equity research, which involves selling ownership stakes in a company, debt financing allows individuals or […]

[…] TSR calculation for the total investment period, can be done in two […]

[…] is very difficult to get pre-seed investors or early stage investors for your start-up outside of your family and friends. You must have at least some sort of track […]

[…] of the consolidated balance sheet includes two sections: parent company equity and subsidiary equity. The following graphic illustrates the consolidated balance sheet, including parent company and […]

[…] risk. On the other hand, a low ratio suggests that the company is primarily financed through equity and may have a stronger financial […]

[…] with practice and enhances their decision-making abilities. By learning from the experiences of successful investors, finance professionals can gain valuable insights and avoid common […]

[…] Evaluating best investments and making informed decisions on allocating capital to maximize […]

[…] online or in document form. Most commonly, analysts use secondary research as well as primary research techniques to uncover relevant data […]

TikTok Takipçi Al : TikTok hesabınızı büyütmek için organik takipçiler elde etmek uzun bir süreç olabilir. Ancak, tiktok takipçi alarak bu süreci hızlandırabilirsiniz. Zedmedya.net olarak, TikTok takipçi almak isteyenler için gerçek ve aktif takipçileri uygun fiyatlarla sunuyoruz. Bu sayede, videolarınızın daha fazla görüntülenmesi ve hesabınızın daha fazla kişiye ulaşması sağlanır.

Статья представляет несколько точек зрения на данную тему и анализирует их достоинства и недостатки. Это помогает читателю рассмотреть проблему с разных сторон и принять информированное решение.

Я восхищен глубиной исследования, которое автор провел для этой статьи. Его тщательный подход к фактам и анализу доказывает, что он настоящий эксперт в своей области. Большое спасибо за такую качественную работу!

It is in reality a nice and helpful piece of info. I’m glad that you simply shared this useful information with us. Please keep us up to date like this. Thank you for sharing.

¿Existe una mejor manera de localizar rápidamente un teléfono móvil sin que lo descubran?

Es muy difícil leer los correos electrónicos de otras personas en la computadora sin conocer la contraseña. Pero a pesar de que Gmail tiene alta seguridad, la gente sabe cómo piratear secretamente una cuenta de Gmail. Compartiremos algunos artículos sobre cómo descifrar Gmail, piratear cualquier cuenta de Gmail en secreto sin saber una palabra.

Merely wanna comment on few general things, The website design is perfect, the content is really excellent : D.

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.