The three financial statements – Income statement, balance sheet and cash flow statement are dependent and linked to each other.

Many of our students know about the income statement and balance sheet but struggle to create a cash flow statement. A cash flow statement is a critical part of the financial modeling exercise.

In our previous article, Cash Flow Statement : Explanation and Example we discussed what a cash flow statement is and the different types of cash flows. Cash flows from Operating activities, Cash flows from investing activities and Cash flows from financing activities.

In this article, we will discuss how to prepare a cash flow statement with the help of a simple example.

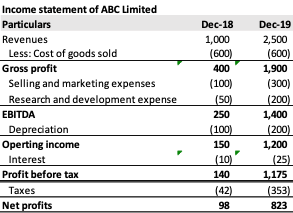

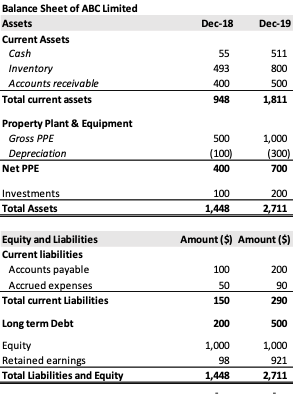

We have the income statement and balance sheets of ABC Limited for year ended Dec 2019 and Dec 2018.

From these financial statements, we are asked to prepare the cash flow statement of the Company.

1) Cash Flow from Operating Activities

This is the most important portion of the cash flow statement. It shows how much cash flows the company has generated from its business operations.

Cash flow from operations is linked both to the income statement and Balance sheet of the Company.

To calculate the cash flow from operations, start with the net income. Then add non-cash expenses (Depreciation) and financing expenses (interest expenses). For Simplicity we have ignored taxes on financing expenses in our example.

In accounting, the books of accounts are prepared on accrual basis. Revenues recognized during the period may not result in actual cash inflows for the company during the period (if goods are sold on credit). Similarly, goods purchased, or expenses incurred may not result in a cash outflow during the same period (if payment is not made during the same accounting period).

Therefore, it is important to link our cash flow statement to the working capital changes in the balance sheet, which is our second step to calculate the cash flows from operations.

Increase in Current assets (inventory, Accounts receivable) is a cash outflow and vice-versa. Similarly, increase in Current Liabilities Accounts is a cash inflow and vice-versa.

Summing up all these components give us the cash flow from operations, which in our example is 781 for ABC Limited.

**

2) Cash Flow from Investing Activities

Cash flow from investing activities shows how much the company has invested in future growth. It is generally negative as it is a cash outflow from the business. This is more linked to the balance sheet of the company.

In our example, cash flow from investing activities would include investment made in Property Plant and equipment and Other investments made during the period.

**

3) Cash Flow from Financing Activities

This section summarizes transactions that involve raising or repayment of capital. Raising capital could be done by issuance of new shares or borrowing through debt financing. Repayment includes, repayment of debt or share repurchases. This also includes interest payments to debt financiers and payment of dividends to shareholders.

In our example, no new equity financing has been done during the period. There is additional funding through debt financing. Also, there is interest payment on debt, which we had added back while calculating cash flow from operations.

The sum of all the three cash flows give us the net changes in cash during the period. When we add the net cash changes to the opening cash balance, we get the closing cash balance for ABC Limited.

Here is how the full cash flow statement looks.

The Closing cash balance matches with the reported number in ABC’s balance sheet.

This is how we can easily prepare a cash flow statement, with the information available. In case you have any questions or suggestions, please post in the comments section.

Have a nice day.

33 thoughts on “Preparing a Cash Flow Statement: A Step-by-Step Guide”

… [Trackback]

[…] Find More on to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Read More Info here to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] There you can find 28215 additional Information on that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] There you can find 75942 additional Info to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Read More here to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Here you can find 60814 additional Info to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Find More Info here to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Information to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] There you can find 13831 additional Info on that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Find More Information here on that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] There you will find 37411 more Information on that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/preparing-a-cash-flow-statement/ […]

Thanks for the marvelous posting! I seriously enjoyed reading it,you are a great author.I will be sure to bookmark yourblog and may come back later in life. I want to encourage you toultimately continue your great job, have a nice holiday weekend!

Wonderful blog! I found it while browsing on Yahoo News.

Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to

get there! Thanks

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

169007 34686This is such a fantastic resource that youre offering and you provide out at no cost. I appreciate seeing websites that realize the worth of offering a perfect valuable resource entirely free. I genuinely loved reading your submit. 619979

336166 503168Thanks for this fantastic post! It has long been really valuable. I wish that youll carry on posting your wisdom with us. 357181

191981 329417The book is excellent, but this review is not exactly spot-on. Being a Superhero is far more about selecting foods that heal your body, not just eating meat/dairy-free. Processed foods like those mentioned in this review arent what Alicia is trying to promote. If you arent open to sea vegetables (and yes, Im talking sea weed), just stop at vegan. 352700

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

388512 725262Wonderful post, I conceive website owners really should learn a great deal from this web weblog its rattling user genial . 224842

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.