INTRODUCTION

In the realm of corporate finance, non-controlling interest (NCI) plays a crucial role in understanding the ownership and financial dynamics between parent companies and their subsidiaries. Also known as minority interest, NCI represents the portion of a subsidiary’s equity that is not owned by the parent company. This concept is vital for accurate financial reporting and analysis, as it ensures transparency and fairness in reflecting the interests of all stakeholders. The article delves into the meaning of Non-Controlling Interest, the Accounting aspect, implications on the financial statements, and treatment of Non-Controlling Interests in Financial Analysis, Cost of Capital, and Valuation.

WHAT IS NON-CONTROLLING INTEREST?

A non-controlling interest, also referred to as a minority interest, occurs when a shareholder holds less than 50% of a company’s outstanding shares and lacks the authority to influence company decisions. This type of interest is measured based on the net asset value of the entity and does not include any potential voting rights.

For example, if a parent company owns 80% of a subsidiary, the remaining 20% represents the non-controlling interest. This portion signifies the minority shareholders’ claim on the subsidiary’s net assets and income.

TYPES OF NON-CONTROLLING INTEREST

There are two categories of Non-Controlling Interest: Direct Non-Controlling Interest and Indirect Non-Controlling Interest. These are just concepts used to describe different ways in which a parent company’s minority interest in a subsidiary can be structured. Here’s a breakdown of each:

1. Direct Non-Controlling Interest: This refers to the situation where outside investors directly own a portion of a subsidiary’s equity. These investors have a direct stake in the subsidiary and are not involved in the ownership structure of the parent company.

For example:

- Parent Company A owns 80% of Subsidiary B.

- Outside investors directly own the remaining 20% of Subsidiary B. In this scenario, the 20% owned by the outside investors is the direct non-controlling interest.

2. Indirect Non-Controlling Interest: It occurs when the non-controlling interest is held through one or more intermediate entities. This means that the ownership is not directly in the subsidiary but rather through a chain of ownership.

For example:

- Parent Company A owns 70% of Subsidiary B.

- Subsidiary B owns 60% of Subsidiary C.

- In this case, Parent Company A has an indirect interest in Subsidiary C through Subsidiary B. The non-controlling interest in Subsidiary C can be calculated by considering the ownership chain:

- Parent Company A’s indirect interest in Subsidiary C = 70% (ownership in Subsidiary B) * 60% (ownership of Subsidiary B in Subsidiary C) = 42%.

- Therefore, the remaining 58% of Subsidiary C is owned by the non-controlling interest, which includes both the direct non-controlling interest in Subsidiary C and the indirect non-controlling interest through Subsidiary B.

ACCOUNTING TREATMENT UNDER US GAAP AND IFRS

It is common for large firms to have ownership stakes in other companies, with ownership ranging from a very small percentage to full ownership. Under US GAAP and IFRS, consolidated financial statements are required for all subsidiaries that the parent company “controls.” Although the percentage of ownership needed to exert “control” can vary depending on factors such as voting rights, for simplicity, control is generally assumed when a company owns 50% or more of a subsidiary. In such instances, the consolidated income statement includes 100% of the subsidiary’s income and expenses, with intercompany transactions excluded. Similarly, 100% of the subsidiary’s assets and liabilities are included in the consolidated balance sheet. The ownership interest in subsidiaries held by entities other than the parent company, historically referred to as minority interest, is identified, labeled, and presented on the equity section of the balance sheet. The portion of consolidated net income attributable to the non-controlling interest (NCI) must be presented on the income statement, along with the income attributable to the parent company.

IMPACT ON INCOME STATEMENT AND BALANCE SHEET

Income Statement: Non-controlling interest (NCI) affects the income statement by necessitating the separation of net income attributable to the parent company and NCI. This segregation ensures clarity on the earnings belonging to different shareholder groups.

Balance Sheet: On the balance sheet, NCI appears within the equity section, distinct from the parent company’s equity. This delineation helps in understanding the ownership structure and the distribution of net assets.

HOW TO MEASURE NON-CONTROLLING INTEREST?

Both US GAAP and IFRS have specific requirements for how NCI should be reported in consolidated financial statements. NCI can be calculated as under:

- Fair Value Measurement (US GAAP and IFRS): As per both US GAAP and IFRS, NCI can be measured at its fair value, which includes a proportionate share of the subsidiary’s goodwill. This method results in recognizing a higher amount of NCI because it includes goodwill.

- Proportionate Share of Net Assets (IFRS Option): IFRS also permits the measurement of non-controlling interest (NCI) using the proportionate share of the identifiable net assets of the subsidiary. This method does not include goodwill attributable to NCI.

Example Scenario

- Parent Company P acquires 80% of Subsidiary S.

- The fair value of Subsidiary S’s identifiable net assets at the acquisition date is $1,000,000.

- The total consideration transferred by Parent Company P for an 80% stake is $1,000,000 implying the total value of a 100% stake is $1,250,000

- The fair value of the 20% NCI is assessed to be $250,000.

Fair Value Method (IFRS & US GAAP)

1. Calculate Goodwill:

- Goodwill is calculated as the excess of the total fair value of the subsidiary (including NCI) over the fair value of identifiable net assets.

- Total Fair Value of Subsidiary = Consideration Transferred + Fair Value of NCI

- Total Fair Value of Subsidiary = $1,000,000 + $250,000 = $1,250,000

- Goodwill = Total Fair Value of Subsidiary – Identifiable Net Assets

- Goodwill = $1,250,000 – $1,000,000 = $250,000

2. Calculate NCI:

- NCI is measured at its fair value, (which is 20% of the fair value of subsidiary $1,250,000) given as $250,000.

3. Total Goodwill Attributable:

- Total Goodwill includes both the parent’s share and the NCI’s share since the fair value method is used.

4. Consolidated Statements:

- Total Identifiable Net Assets: $1,000,000

- Goodwill: $250,000

- Total Assets (Identifiable Net Assets + Goodwill): $1,250,000

- Total cash consideration paid: $1,000,000

- Net change in Assets: $1,250,000-$1,000,000- $250,000

- NCI in Equity: $250,000

Proportionate Share Method (IFRS)

1. Calculate Goodwill:

- Goodwill is calculated as the excess of the total consideration transferred over the parent’s share of the identifiable net assets.

- Goodwill = Total Consideration Transferred – Parent’s Share of Identifiable Net Assets

- Parent’s Share of Identifiable Net Assets = 80% of $1,000,000 = $800,000

- Goodwill = $1,000,000 – $800,000 = $200,000

2. Calculate NCI:

- NCI = NCI Percentage * Identifiable Net Assets

- NCI = 20% * $1,000,000 = $200,000

3. Total Goodwill Attributable:

- Total Goodwill is attributed only to the parent’s share since the proportionate share method is used.

- Therefore, NCI does not include any part of the goodwill.

4. Consolidated Statement:

- Total Identifiable Net Assets: $1,000,000

- Goodwill: $200,000

- Total Assets (Identifiable Net Assets + Goodwill): $1,200,000

- Total cash consideration paid: $1,000,000

- Net change in Assets: $1,200,000-$1,000,000- $200,000

- NCI in Equity: $200,000

DISCLOSURE REQUIREMENTS FOR NCI

Both US GAAP and IFRS require detailed disclosures about NCI:

- Reconciliation: A reconciliation of the beginning and ending balances of NCI.

- Share of Profit or Loss: Information on the share of profit or loss attributable to NCI.

- Dividends: Details of dividends paid to NCI.

- Significant Transactions: Information on significant transactions between the parent and the NCI.

IMPLICATIONS FOR FINANCIAL ANALYSIS, VALUATION AND COST OF CAPITAL

Non-controlling interest is a concept that has confused many analysts and investors. When not properly addressed, it can result in errors in financial analysis and valuation. A thorough understanding of non-controlling interest is also essential when structuring loans and bond covenants. Here, we examine the implications of non-controlling interest on:

1. Financial analysis

For precise financial analysis, it’s essential to carefully factor in non-controlling interests (NCIs) when computing ratios such as the market-to-book value of equity, total liabilities to equity, and return on equity. It is to be noted that the total book value of equity includes non-controlling interest, while the market value (market capitalization) does not.

- Market/Book Value of Equity: The market-to-book equity ratio may lead to misleading results if not calculated accurately. The market value of equity excludes the value associated with NCI because the parent company’s shareholders only pay for the portions of the subsidiaries that the parent owns, not for interests held by other parties. However, if the total equity from the balance sheet is used for the book value, it includes NCI. For a meaningful comparison, excluding NCI from the book value of equity ensures that the ratio reflects solely the market-to-book value of the controlling equity.

- Total Liabilities to Equity: When calculating total liabilities to equity ratios use total equity (including NCI) since the liabilities represent the total liabilities of the group, including 100% of any liabilities related to non-controlled interests.

- Return on Equity: Care must be taken to ensure consistency when calculating return on equity. Use either total net income and total equity, which both include non-controlling interest or use net income attributable to the parent and the parent’s equity (after deducting NCI).

2. Valuation: Enterprise value represents the total value of a firm, encompassing all capital components, including equity, net debt, and preferred stock. When determining the implied equity value from enterprise value, it is crucial to handle non-controlling interest (NCI) correctly. If enterprise value is estimated using discounted cash flow (DCF) or multiples of EBIT/EBITDA, it generally includes the value of NCI. This is because EBIT and EBITDA typically reflect the operating earnings of all consolidated subsidiaries. Since the enterprise value derived from these methods includes the total value of the enterprise (including NCI), you must deduct the value of NCI (at market value) when calculating the implied equity value.

Equity Value = Enterprise Value + Cash – Debt – Preferred Stock – Non-Controlling Interest +/- Other adjustments

3. Weighted Average Cost of Capital: Non-controlling interest (NCI) represents the equity interest in a subsidiary not attributable to the parent company. Including NCI in the weighted average cost of capital (WACC) calculation is important for several reasons:

- Total Capital: WACC aims to reflect the overall cost of capital for the entire enterprise, including all sources of funding. Non-controlling interest (NCI) is included in the total equity and therefore constitutes a part of the company’s overall capital structure.

- Accurate Weightings: By including NCI (at market value), the proportion of debt, equity, and other financing sources used to fund the company’s operations is accurately represented.

- Enterprise Value Calculation: Enterprise value (EV) includes the market value of equity, debt, preferred stock, and NCI. For consistency, WACC, which is used to discount the enterprise value’s cash flows, should also account for all these components.

- Free Cash Flows: When calculating WACC to discount free cash flows, those flows often include earnings attributable to both controlling and non-controlling interests. Including NCI ensures that the cost of capital aligns with the cash flows being valued.

- Risk Profiles: Different components of capital, including NCI, come with their own risk profiles. The WACC reflects the average risk and return expectations for all investors, including those with non-controlling interests.

- Comprehensive Cost: By incorporating NCI, the WACC calculation considers the cost associated with all equity holders, providing a more comprehensive measure of the company’s cost of capital.

- Precise Measurement: Excluding NCI would lead to an underestimation of the equity portion in the capital structure, thus distorting the cost of equity and overall WACC.

- Balanced Cost Structure: Including NCI (at market value) ensures that the cost of capital is balanced and accurately reflects the company’s financing structure. If there is a significant non-controlling interest, excluding NCI from the WACC calculation will result in underestimating the equity weight and consequently underestimating the WACC.

WACC = %Debt * Cost of Debt after tax + %Common Equity * Cost of Common Equity+ %NCI* Cost of NCI

REDEEMABLE NON-CONTROLLING INTEREST (RNCI) VS. REGULAR NON-CONTROLLING INTEREST (NCI)

- Redeemable non-controlling interest (RNCI): It refers to a type of ownership stake in a subsidiary where the parent company holds a contractual obligation to repurchase the interest from non-controlling shareholders at a future date or upon specific conditions.

- Regular non-controlling interest (NCI): This, on the other hand, represents a standard ownership interest in a subsidiary where the parent company does not hold full ownership but does not have a contractual obligation to repurchase the interest from non-controlling shareholders.

REAL-LIFE EXAMPLE OF A COMPANY RECOGNISING NON-CONTROLLING INTEREST IN THE FINANCIAL STATEMENTS

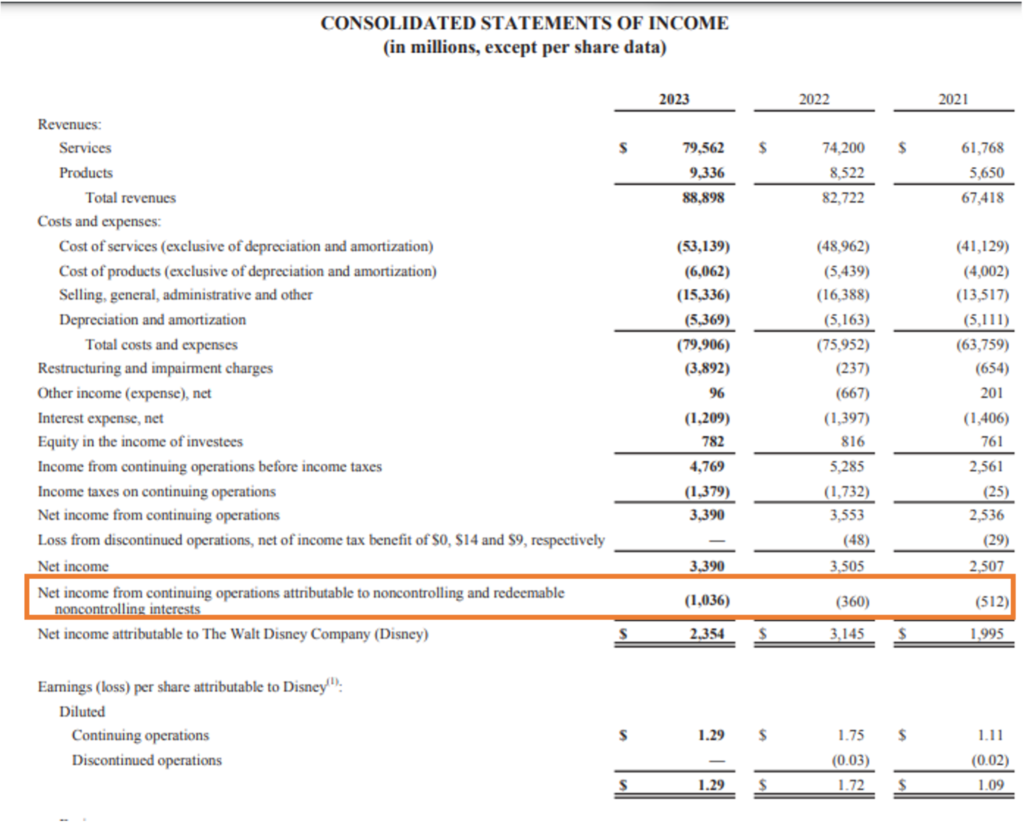

Let us take the Example of the Walt Disney Company and study the impact of Non-Controlling interest in its financial statements.

Disney often acquires companies or forms joint ventures where it does not hold 100% ownership. For instance, Disney acquired a majority stake in Hulu but did not initially own 100% of the streaming service, resulting in non-controlling interests held by other stakeholders.

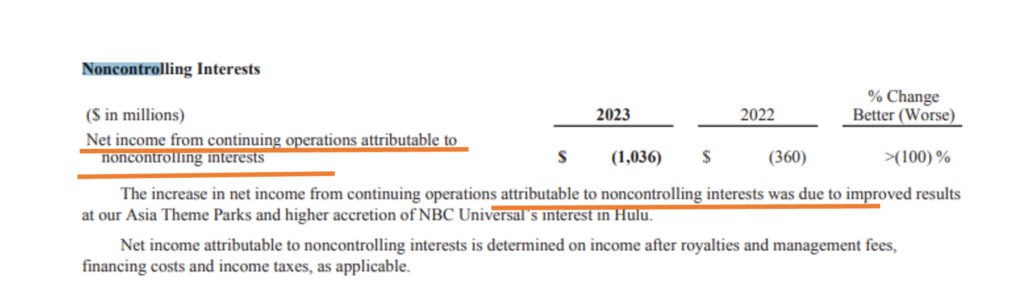

In the two images below we can see the Net Income from continuing operations attributable to non-controlling interest. The company discloses in its notes the reasons for the increase or decrease of the Net Income attributable to non-controlling interest.

Source: Annual Report https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

Source: Annual Report https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

**

The below image shows that Non-Controlling Interest is also included in the Consolidated Statements of Comprehensive Income.

Source: Annual Report https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

**

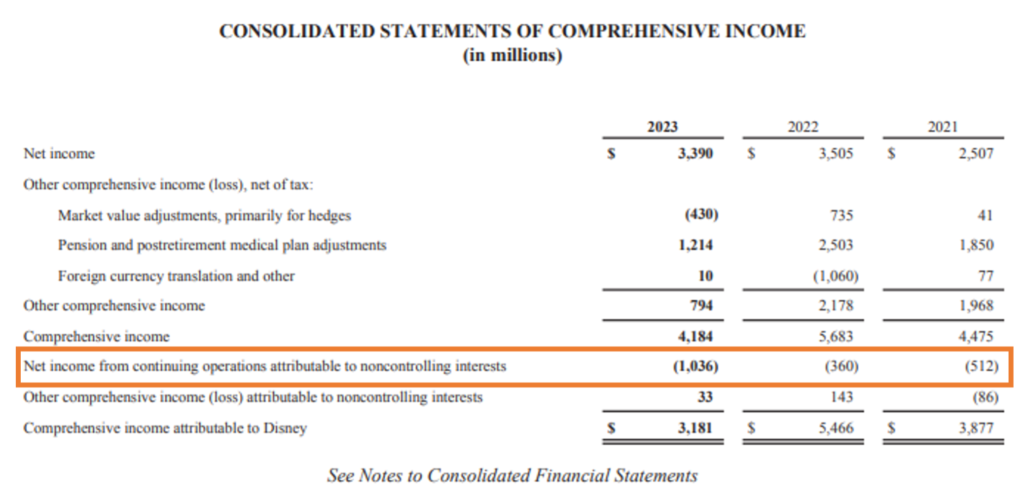

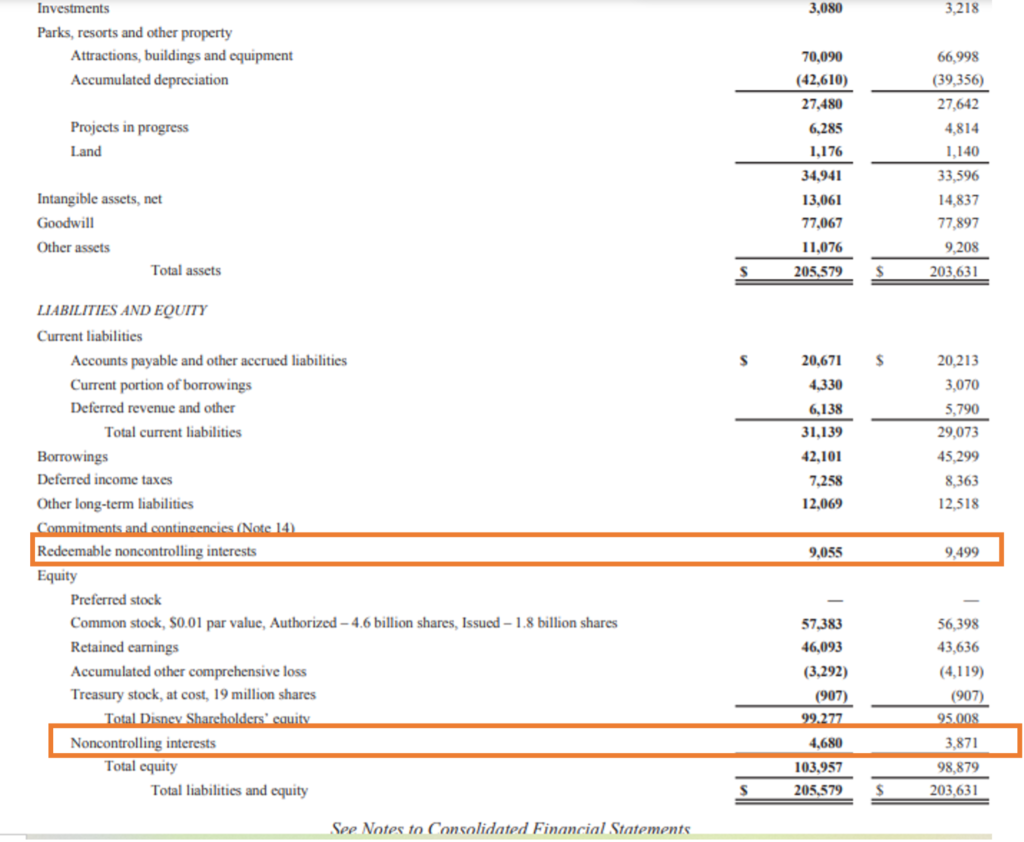

From the below Consolidated Balance Sheet of the company, we can see that Non-Controlling Interest is shown under the Equity section of the Balance sheet while Redeemable Non-Controlling Interest is shown under the liabilities section of the Balance sheet. Redeemable non-controlling interest (RNCI) is typically shown in the liability section of the balance sheet rather than the equity section due to its contractual nature that obligates the parent company to repurchase the interest from non-controlling shareholders at a future date or under specific conditions.

Source: Annual Report https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

**

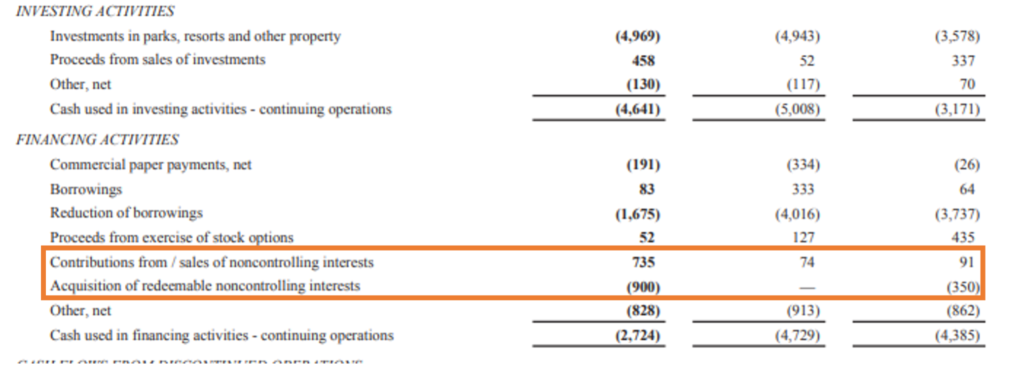

Below are the Consolidated Statements of Cash Flows of the Walt Disney Company. Under the financing activities, we can see the contributions from / sales of non-controlling interests and the acquisition of redeemable non-controlling interests.

Source: Annual Report https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

**

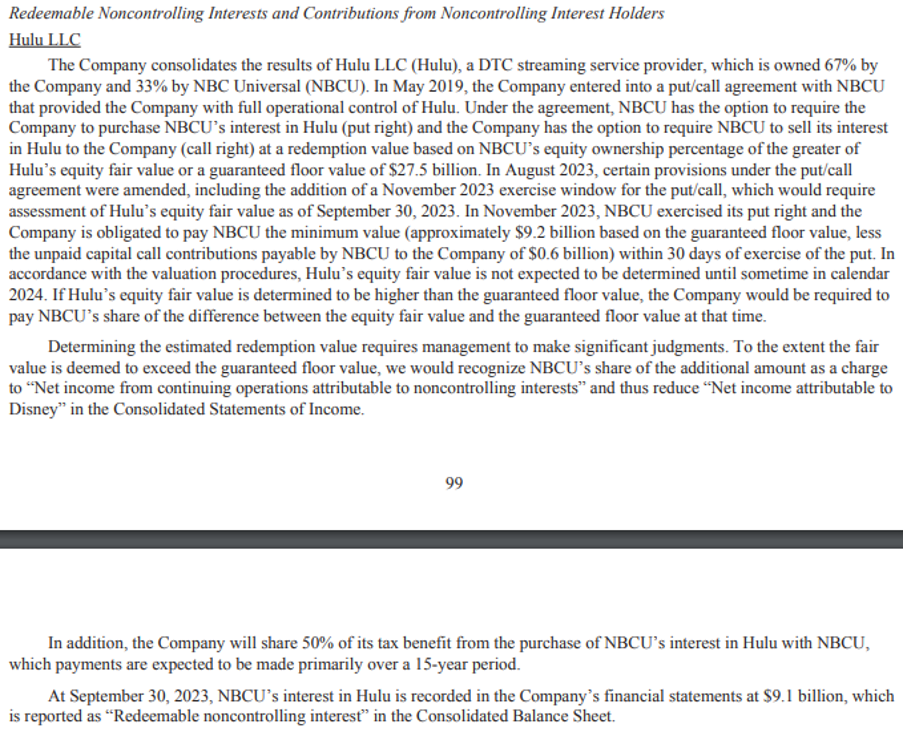

In the Summary of Significant Accounting Policies section of the Annual Report the company mentions its Subsidiaries, non-controlling interest, and, redeemable non-controlling Interest holders. If you look at redeemable NCI, the Company consolidates the financial results of Hulu LLC (Hulu), a direct-to-consumer streaming service provider. The ownership structure of Hulu is such that the Company owns 67%, while NBC Universal (NBCU) owns the remaining 33%. In May 2019, the Company and NBCU entered into a put/call agreement that grants the Company full operational control over Hulu.

Under this agreement, NBCU holds the option to require the Company to purchase NBCU’s stake in Hulu (put right). Conversely, the Company has the option to require NBCU to sell its stake in Hulu to the Company (call right). The redemption value for NBCU’s equity stake is determined based on either Hulu’s equity fair value or a guaranteed floor value of $27.5 billion, whichever is greater.

Source: Annual Report https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

**

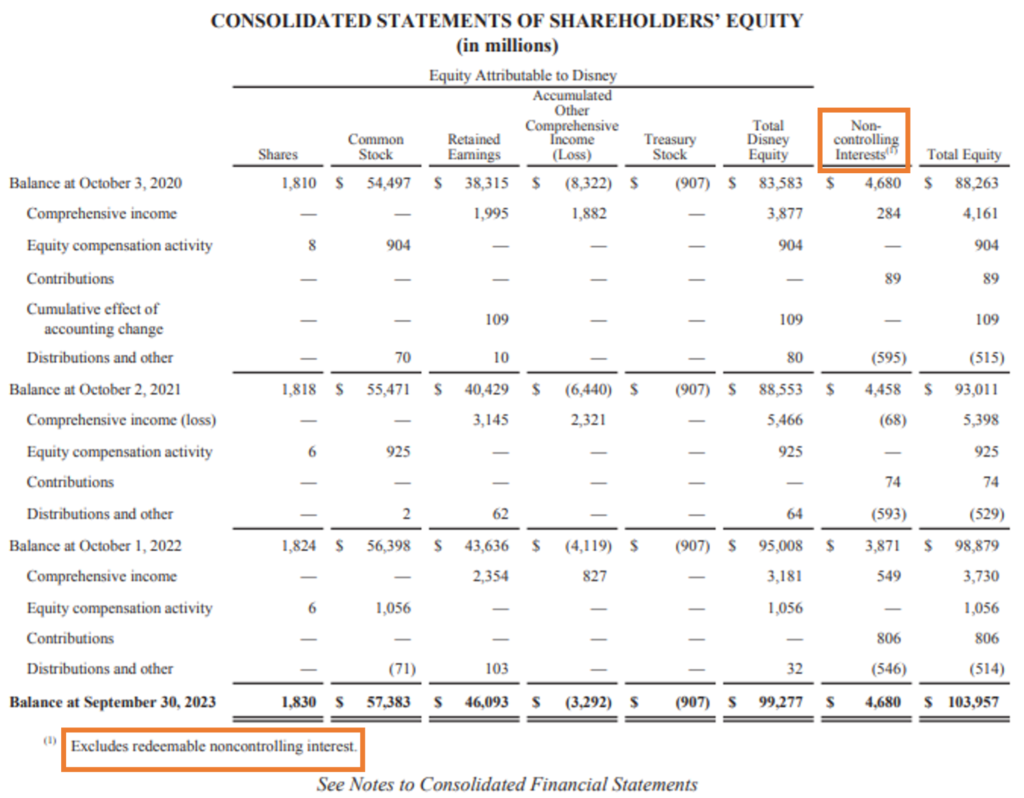

The Consolidated Statements of Shareholders Equity Includes the non-controlling interest but excludes redeemable non-controlling interest. Redeemable non-controlling interest is excluded from shareholders’ equity since it is classified under liabilities in the balance sheet.

Source: Annual Report https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

**

ADVANTAGES AND DISADVANTAGES OF NCI

Advantages:

- Enhanced Capital: NCI allows subsidiaries to raise capital without relinquishing full control.

- Risk Sharing: Risks are shared between the parent company and minority shareholders.

- Market Perception: Reflecting NCI can enhance market perception by showcasing diversified ownership.

Disadvantages:

- Complex Reporting: Consolidating financial statements involving non-controlling interests (NCI) can be intricate and require significant time and effort.

- Diluted Control: The parent company has to consider the interests of minority shareholders, which might dilute decision-making power.

- Profit Sharing: A portion of profits has to be distributed to minority shareholders, reducing the overall profitability of the parent company.

CONCLUSION

Non-controlling interest is a fundamental concept in corporate finance, essential for accurate and transparent financial reporting. It has profound implications for financial analysis, valuation, and cost of capital. It requires careful consideration in financial reporting, performance metrics, valuation models, and cost of capital calculations. By understanding and accurately accounting for NCI, companies and analysts can ensure more precise financial assessments and strategic decisions. This comprehensive approach enhances the transparency and reliability of financial information, benefiting all stakeholders involved.