UNDERSTANDING GOODWILL IN SIMPLER TERMS

Have you wondered what is goodwill in accounting? Let’s explain here in detail.

We often read about various acquisitions, mergers, or corporate sales in the newspaper or on the net where a company sells for money more than its net identifiable assets. Net identifiable assets are nothing but the sum of the company’s assets less the sum of its liabilities on the balance sheet. The premium paid by the acquiring company is termed as “Goodwill”. When you acquire a new business, you are not just purchasing their fixed assets, contracts and licenses but in fact purchasing those intangible and difficult to quantify crucial assets such as the customer base, brand name, location, its reputation which impact the acquiring company directly in the long run etc.,

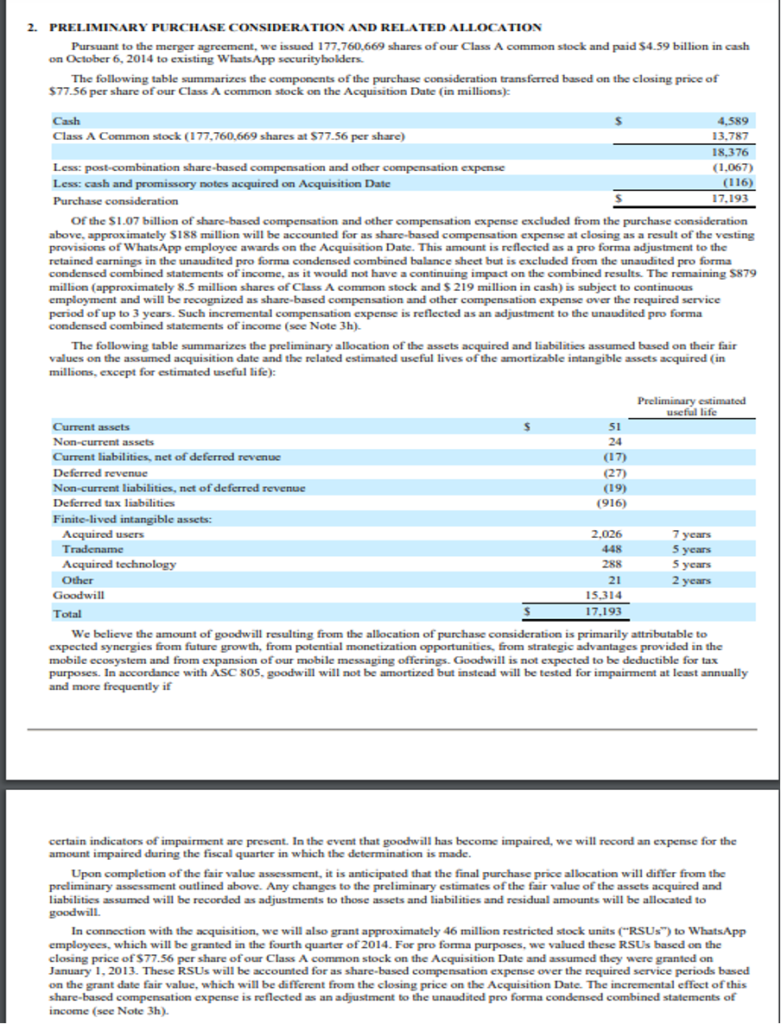

We can quote several examples of such Acquisitions. One of the famous examples being the acquisition of WhatsApp by Facebook. In the filing to Securities and Exchange Commission (SEC), Facebook declared WhatsApp’s goodwill is worth $15.3bn, and it acquired for nearly $20bn. Facebook mentioned in its filing that the amount of goodwill it paid for is primarily attributable to expected synergies from future growth and expansion of their mobile messaging offerings.

(Source: https://d1lge852tjjqow.cloudfront.net/CIK-0001326801/1f57fd25-66b8-42e6-89e9-c28725d215da.pdf)

Another example is the acquisition of Time Warner by Discovery that was approved in 2022. Discovery not only purchased the moviemaking company but also its intellectual properties that sum up to a great deal of Goodwill from its customer base. Intangible assets like licenses and trademarks can be bought or sold for money but what cannot be purchased is the loyal customer base. This loyalty that Time warner has earned is the premium that Discovery has paid for.

Understanding the accounting treatment of business goodwill can help investors, entrepreneurs, and other stakeholders understand how to assess the fair market value of companies in any given sector since they invest their hard-earned money and time in the company.

WHAT IS GOODWILL IN ACCOUNTING?

The amount that the acquiring company pays for the target company that is over and above the target’s net assets (Total Assets-Total Liabilities) at fair value accounts for the value of the target’s goodwill. The premium paid by the acquiring company is for the brand value, loyal customer base and strong market hold earned by the target over the years of business. The company gains negative goodwill if the acquiring company pays less than the target’s book value. This indicates that the company has been acquired in sale as a part of distressed sales.

Some examples of the elements that produce goodwill in business acquisition include the value of your company’s brand name and reputation, good employee relations, strong relations with customers, excellent location, proprietary technology etc.

IMPORTANCE OF GOODWILL IN FINANCIAL STATEMENTS

Goodwill holds an important role in a company’s financial statements since it reflects the intangible assets that have indirect monetary value attached to it and are important in establishing a company’s sustainability in the long run and a strong competitive edge. Since it is intangible and does not have a resalable value its presence in the financial statements has to be properly evaluated by the stakeholders before taking any important decision regarding making any investment or extending any loan or credit to the company.

FACTORS CONTRIBUTING TO THE CREATION OF GOODWILL

- Reputation and brand recognition

- Customer loyalty

- Employee skills and expertise

- Proprietary technology

THE NATURE OF GOODWILL

Goodwill is recorded under the head Long term assets as an Intangible asset as a separate line item. Goodwill is considered an intangible asset because it is not a physical asset that can be touched or seen like a plant, building, or equipment. It is categorized under non-current assets as it has indefinite life. Goodwill recognized is not depreciated or amortized but is tested for impairment every year as per US GAAP and IFRS. It is different from other Intangible assets as it is merely the premium paid over fair value of the assets during any acquisition or merger and cannot be bought or sold independently unlike other intangible assets like licenses, trademark or patents that can be easily bought or sold independently.

HOW TO CALCULATE GOODWILL

Although Goodwill calculation in real life acquisitions or mergers is a complicated process and slightly differ under IFRS and US GAAP, there is a relatively simple formula in general to understand the Goodwill calculation:

Goodwill = Purchase price(P) – [Fair Market Value of Assets(A) – Fair Market Value of Liabilities(L)]

The assets here include:

- Tangible assets such as cash & cash equivalents, accounts receivable, marketable securities, plant, property and equipment, inventory, and furniture.

- Intangible assets (other than Goodwill which can be quantified) such proprietary software, trademark and patents, intellectual proprietary software and product design.

The liability here includes:

- Income tax payable

- Accrued expenses

- Accounts payable

- Interest payable

- Loans

STEPS TO CALCULATE GOODWILL:

- Calculate book value of the assets. Include all the assets mentioned above.

- Determine the fair value of these assets. Fair value can be determined by several methods like determining its market value or assessment of the asset’s discounted cash flows.

- Calculate the difference between the book value of the assets and fair value of the assets.

- Calculate the difference between the actual purchase price and the net book value of the assets i.e., assets minus liabilities to find the excess purchase price.

- Finally take the excess purchase price and deduct the fair value adjustments calculated in step 3 and we will get the Goodwill amount.

ACCOUNTING EXAMPLE

Company XYZ reports the following amounts:

(Amount in $)

| Particulars | Book Value | Fair Value |

| Cash | 50000 | 50000 |

| Accounts Receivable | 750000 | 66000 |

| Inventory | 45000 | 42000 |

| PPE (net) | 210100 | 235400 |

| Intangible Assets | 30000 | 30000 |

| Total Assets | 1085100 | 423400 |

| Total Liabilities | 140000 | 140000 |

| Net Assets | 945100 | 283400 |

The fair value of assets differs from Book value of assets due to the following reasons:

- Accounts receivable’s fair value is lower due to uncollectable accounts from the debtors.

- Inventory fair value is lower due to reduced demand for the final product.

- PPE fair value is higher as per the fair valuation report.

If another company, ABC, purchases XYZ for $350000, then the amount of goodwill to be recognized would be purchase price minus fair market value of net assets i.e., $350000(P)-$283400(A-L) = $66600. This can also be calculated as $350000-945100-(423400-1085100) =$66600.

JOURNAL ENTRY For the Acquiring Company ABC would be as follows:

| Account Title | Debit | Credit |

| Assets | 423400 | |

| Goodwill | 283400 | |

| Liabilities | 140000 | |

| Cash | 350000 |

PRESENTATION OF GOODWILL IN FINANCIAL STATEMENTS AND REPORTING REQUIREMENTS

Goodwill is categorized as an intangible asset under the Non-Current Assets in a company’s balance and is listed as a separate line item within this section. The balance reflects a company’s financial position at a given point in time. The goodwill in the Balance Sheet provides insight into the company’s intangible value purchased reflecting the premium paid for synergies, brand recognition, customer loyalty, easy access to larger marketplace and other similar non-physical attributes and help investors analysts, and other stakeholders evaluate whether the company’s payment of such premium is justified or not and whether the premium paid by the company will bring higher future revenues.

In the Notes to accounts the company sheds light on the rationale behind its recognition, calculation, and any associated changes. The notes may include specifics about acquisitions, mergers, or other transactions that led to the creation of goodwill.

Real life example of such presentation:

Data Source: Notes to Accounts of Facebook Inc. (https://d1lge852tjjqow.cloudfront.net/CIK-0001326801/1f57fd25-66b8-42e6-89e9-c28725d215da.pdf)

DISCLOSURE REQUIREMENTS IN THE ANNUAL REPORT

- Nature, segment, and size of acquired business: Companies disclose information about the acquired business, including its industry, strategic location, size, and the opportunities attached to such acquisition in the business of the acquirer and how it will impact its business in the long run. This disclosure helps stakeholders understand the companies’ intention behind the acquisition and the role of goodwill in enhancing the overall business profitability and market opportunities.

- Amortization or impairment details & Assumptions used in impairment testing: Goodwill is an intangible asset as per US GAAP and IFRS standards with an indefinite life span and thus does not need to be amortized. However, it needs to be evaluated for impairment yearly. The Financial Accounting Standards Board (FASB) in year 2014 issued updates on accounting for goodwill. FASB Accounting Standards via Update No. 2014-02, Intangibles—Goodwill and Other (Topic 350) Accounting for Goodwill, permits a private company to amortize goodwill on a straight-line basis over a period of 10 years. Companies following the impairment-based model need to provide details about the regular testing for impairment, the results from these tests, and any adjustments made due to impairment losses. This information offers transparency into the assessment and recognition of goodwill in the financial statements and its impact on the company’s stakeholders. Where the company is following amortization of goodwill (private companies), disclosure includes information about the amortization policy and the specific period over which goodwill is to be amortized.

A significant degree of judgment and estimation is involved in the impairment testing as it relies on factors like future cash flows and market conditions. Disclosure requirements mandate that companies provide information about the key assumptions used in impairment testing, such as discount rates, growth rates, and future economic conditions.

GOODWILL IMPAIRMENTS

Goodwill impairment is an accounting charge that is incurred when the fair value of goodwill drops below the original purchase price of the goodwill from the time of the acquisition of the company or the value recorded in the previous financial year in the Balance sheet. A test for goodwill impairment as per the generally accepted accounting principles (GAAP) must be undertaken by the acquiring company on an annual basis. Goodwill impairment is required when there is deterioration in the capabilities of acquired business to generate future cash flows and profits and the fair value of the goodwill falls below its book value.

Events that may lead to goodwill impairment include:

- Adverse economic conditions

- Increased competition in the market

- Entry of a new competitor in the market

- Loss of key personnel

- Regulatory action.

The basic procedure governing goodwill impairment tests is set out by the Financial Accounting Standards Board (FASB), Topic 350, Intangibles—Goodwill and Other and by International Accounting Standards Board (IASB) in IAS 36 Impairment of Assets.

The impairment expense is calculated as follows:

Impairment amount =difference between the current market value and the purchase price of the intangible asset.

As a result of the impairment charge, the Goodwill amount is reduced in the balance sheet. Similarly, expense is also recognized as a loss on the income statement, giving dual impact in the financial statements. This expense directly reduces net income for the year and hence EPS is also negatively impacted.

The key thing to note is that the goodwill impairment loss cannot exceed Net Book Value or carrying value of goodwill (i.e., goodwill cannot be negative).

These are some of the largest write-offs because of M&A transactions:

| Acquiring Company | Target Company | Year of Acquisition | Year of Write off | Amount of Write off |

| America Online | Time Warner | 2001 | 2002 | $99 billion |

| Vodafone Airtouch | Mannesmann AG | 2000 | 2002 | $44.4 billion |

| AT&T | Time Warner | 2018 | 2018 | $39 billion |

| Hewlett-Packard | Autonomy | 2011 | 2012 | $8.8 billion |

(Source data: https://imaa-institute.org/goodwill-in-mergers-acquisitions/ )

DIFFERENCE OF IMPAIRMENT CALCULATION UNDER IFRS AND US GAAP

| IFRS (IAS 36) | US GAAP (Topic 350) |

| Impairment is tested at the cash generating unit (CGU) | Impairment is tested at the reporting unit level for US GAAP |

| Goodwill Impairment Test: FMV of CGU -NBV of the CGU If result is positive= No Impairment If result is negative= Impairment Loss | Goodwill Impairment Test: FMV of Reporting Unit-NBV of the Reporting Unit If result is positive= No Impairment If result is negative= Impairment Loss |

| An impairment loss for a CGU is allocated first to any goodwill and then pro rata to other assets in the CGU that are in the scope of IAS 36. However, no asset is written down to below its known recoverable amount. | Unlike IFRS Accounting Standards, any impairment loss that results from the goodwill impairment test is limited to the amount of goodwill allocated to that reporting unit. |

IMPORTANCE OF GOODWILL

Goodwill disclosure is important because it has relevance to various stakeholders. Let’s understand its importance to different stakeholders in brief:

- For investors and shareholders: Investors and shareholders use financial statements to evaluate whether to invest in a company or not. Since goodwill is part of assets it influences various ratios of assets and equity calculated to evaluate a company’s financial position and performance. Goodwill is looked upon as the success or failure barometer of the company’s acquisitions and mergers by the shareholders. Any increase in goodwill might indicate that the company has strategically invested the shareholders’ money. On the other hand, any decline in goodwill might signify challenges in realizing the expected benefits from the investment made thereby prompting investors to re-evaluate their investment decisions.

- For creditors and lenders: An increase in goodwill enhances the creditworthiness of the company indicating towards its stronger brand value or customer base and makes it easier to acquire loans. However, any decline or impairment in the same can indicate a company’s inability to repay its debt.

- For analysts and financial professionals: Goodwill is used by financial analysts and financial professionals in their valuation models to better capture the company’s overall worth, beyond just tangible assets. They use goodwill as an important metric to analyze companies’ long term growth prospects in terms of better brand value, loyal customer base or better market access. However, any decrease in the goodwill may be seen by analysts as a red flag indicating towards decline in future cash flows due to declining customer case, outdated product, reduced market access etc.,

LIMITATIONS OF GOODWILL

- Dependence on assumptions and Subjectivity in valuation Goodwill valuation relies on assumptions like future cash flows and discount rate, growth rate etc. Any small change can lead to huge differences in the valuation of the company. When one company is bought by another, a fair value exercise must take place to allocate the consideration paid to net tangible and intangible assets and any remaining unallocated value is classified as “Goodwill”.

As per FASB and US GAAP goodwill identified upon the acquisition of a company will subsequently have to be tested for impairments. As per this policy goodwill does not necessarily decrease in value and have long term in nature unless impaired, which is again based on assumption and judgement of the management or the auditors. This policy allows high levels of goodwill on company balance sheets. Where neither managers nor auditors feel that an impairment should be made, no impairment is charged against the carrying amount of the goodwill asset. This persistent trend of non-impairment can inflate the assets in a company’s balance sheet, leaving investors, employees, and other stakeholders of the economy vulnerable.

- Potential for manipulation: There have been many examples of companies in the past that tend to overpay for acquisitions intentionally to inflate the recognized goodwill. This leads to a temporary boost in reported assets and equity, which might create a favorable impression among stakeholders making them invest solely based on inflated assets. Such practices can distort the true value of a company’s assets, make investors make wrong investment decisions and create a false company image in the industry.

- Makes comparison with other companies in the same industry difficult: As goodwill valuation is dependent on factors like assumption of future cash flows, estimating the fair value of net assets of the company, the valuation of goodwill may differ from company to company making their comparison difficult.

- Affects the EPS and share price of the company: The impairment results in a decrease in the goodwill account on the balance sheet. The expense is recognized as a loss on the income statement which in turn reduces the net income for the year and negatively impacts on the earnings per share (EPS) and the company’s stock price.

- Investors deduct goodwill from their determinations of residual equity in case of insolvency of any acquired company which was successful in the past. Since goodwill has no resale value, in case of insolvency the goodwill value is not considered.

- Misleading Financial statements: In the S&P 500 companies balance sheet total goodwill assets nearly topped $3.6 trillion and a net increase of more than $880 billion since 2017. This inflated goodwill figure is not only restricted to the large cap companies. Infant looking at all public companies in the U.S., the figure is estimated at roughly $5.6 trillion. Due to this increasing trend of goodwill both U.S. and international accounting standard setters are considering modifications to its treatment. Some investors worry that if this trend continues then it will diminish the information they currently get from financial statements. (https://www.valuationresearch.com/pure-perspectives/trillions-goodwill-balance-sheet-s-p-500-needs-attention/)

HERE ARE SOME OF THE LARGEST M&A TRANSACTIONS WITH THE HIGHEST AMOUNT OF GOODWILL RECORDED:

| Acquiring Company | Target Company | Year of Acquisition | Purchase Price | Value of Goodwill Recorded |

| Vodafone Airtouch | Mannesmann AG | 2000 | $202.8 billion | $129.2 billion |

| America Online | Time Warner | 2001 | $164 billion | $102.5 billion |

| Pfizer | Warner-Lambert | 2000 | $111.8 billion | $75.3 billion |

| Vodafone | Verizon Communications | 2014 | $130 billion | $35.5 billion |

| America Online (AOL) | Netscape Communications | 1998 | $4.2 billion | $3.5 billion |

| AT&T | BellSouth | 2011 | $86 billion | $24.1 billion |

| Microsoft | 2Skype | 2011 | $8.5 billion | $8.4 billion |

| Oracle | PeopleSoft | 2005 | $10.3 billion | $7.7 billion |

| 2014 | $19 billion | $15.3 billion |

(Source data: https://imaa-institute.org/goodwill-in-mergers-acquisitions/ )

55 thoughts on “Goodwill in accounting – blessing or a curse?”

[…] that the assets are as follows: Equipment: $1 million Real estate: $1 million Patents: $2 million Goodwill: $1 million With this information, you can add up the total value of the company to see what the […]

[…] physical resources (land, buildings, equipment) and intangible resources (intellectual property, goodwill) that provide value for the […]

[…] Property, plants and equipment, other operating assets and goodwill to the Net Working calculated in Step […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Read More Information here to that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] There you will find 61650 more Information to that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Here you can find 11676 additional Information to that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Find More on to that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Find More Information here on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Here you can find 52856 additional Info to that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Read More here on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] There you will find 28306 additional Info on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] There you can find 44021 more Information to that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/goodwill-in-accounting/ […]

… [Trackback]

[…] Find More Info here to that Topic: skillfine.com/goodwill-in-accounting/ […]

Incredible Bali villas for sale

jEXejOMMFdXiWxfyD

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

It?¦s actually a cool and helpful piece of info. I?¦m glad that you just shared this helpful info with us. Please keep us informed like this. Thank you for sharing.

I dugg some of you post as I cerebrated they were very helpful handy

617638 104398Woh I enjoy your articles , saved to favorites ! . 458061

382485 674404As being a Newbie, Were permanently exploring online for articles which can be of support to me. Many thanks 387688

477497 734852You must participate in a contest for among the best blogs on the web. I will suggest this internet site! 140585

I loved as much as you will receive carried out right here.

The sketch is attractive, your authored material stylish.

nonetheless, you command get bought an impatience over that you

wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly

a lot often inside case you shield this increase.

If some one needs expert view on the topic of blogging afterward i suggest him/her to pay a visit this

website, Keep up the pleasant job.

Someone essentially assist to make seriously articles I’d state.

This is the first time I frequented your web page and

thus far? I surprised with the analysis you made to create

this particular put up incredible. Great task!

Attractive component of content. I simply

stumbled upon your blog and in accession capital to assert that

I get actually enjoyed account your weblog posts. Anyway I

will be subscribing for your augment and even I fulfillment you get entry to

constantly quickly.

คอนเทนต์นี้ มีประโยชน์มาก

ครับ

ผม ไปเจอรายละเอียดของ เนื้อหาในแนวเดียวกัน

ซึ่งอยู่ที่ tbgame888

เผื่อใครสนใจ

เพราะอธิบายไว้ละเอียด

ขอบคุณที่แชร์ คอนเทนต์ดีๆ นี้

จะรอติดตามเนื้อหาใหม่ๆ ต่อไป

After looking into a few of the blog articles on your web site, I truly

appreciate your technique of blogging. I saved as a favorite

it to my bookmark site list and will be checking back soon. Take a look at my

website as well and let me know what you think.

I used to be recommended this blog via my cousin. I’m not sure whether this submit is

written by means of him as nobody else know such distinctive

about my trouble. You are amazing! Thanks!

Truly when someone doesn’t be aware of then its up to other people that they will assist,

so here it happens.

Appreciation to my father who shared with me on the topic

of this blog, this website is genuinely amazing.

Thanks for sharing your thoughts. I truly appreciate your efforts and I am waiting for your further post thanks

once again.

I was wondering if you ever considered changing the layout of

your site? Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content

so people could connect with it better. Youve got an awful lot

of text for only having 1 or two pictures.

Maybe you could space it out better?

Hello, I want to subscribe for this website to get newest updates, therefore where can i do it please help out.

I loved as much as you will receive carried out right here.

The sketch is tasteful, your authored material stylish. nonetheless, you command get bought an impatience over that you wish be delivering the following.

unwell unquestionably come further formerly again as exactly the same

nearly very often inside case you shield this increase.

Excellent post. I was checking continuously this

blog and I am impressed! Very helpful info specially the last part

🙂 I care for such information a lot. I was seeking this certain information for a long time.

Thank you and best of luck.

Hi there, yes this article is actually pleasant and I have learned lot of things from it about blogging.

thanks.

What’s Happening i am new to this, I stumbled upon this I have discovered It

positively helpful and it has helped me out

loads. I am hoping to give a contribution & aid different users like its aided

me. Good job.

Howdy! This post couldn’t be written any better!

Reading through this post reminds me of my good old room mate!

He always kept chatting about this. I will forward this

write-up to him. Fairly certain he will have a good read.

Many thanks for sharing!

Hurrah, that’s what I was exploring for, what a information! present here at this website, thanks admin of this web site.

Link exchange is nothing else but it is just placing the other person’s

webpage link on your page at suitable place and other person will also do similar in favor of

you.

You ought to take part in a contest for one of the

most useful websites online. I’m going to recommend this website!

I like the valuable information you provide in your articles.

I’ll bookmark your weblog and check again here frequently.

I’m quite sure I’ll learn many new stuff right

here! Best of luck for the next!

당신의 블로그 기사에서 좋은 정보을 찾을

수 있었습니다.

My brother recommended I would possibly like this blog.

He used to be totally right. This post actually made my day.

You cann’t consider just how so much time I had spent for this information!

Thank you!

This is genuinely a fantastic site! Your articles are so well-written and engaging.

I’ve bookmarked it and will definitely be back for more.

Any tips on how to make my own blog as captivating as yours?

Thanks!

와, 이 블로그는 정말 인상적입니다!

익산출장마사지에 대한 포스트가

너무 명확하고 흥미로워요. 친구들에게 공유할게요.

더 많은 시각적 요소를 추가하면 어떨까요?

고맙습니다!

Woah! I’m really digging the template/theme of this site.

It’s simple, yet effective. A lot of times it’s difficult to get that “perfect balance” between usability and appearance.

I must say you have done a fantastic job with this.

Also, the blog loads very fast for me on Internet explorer.

Exceptional Blog!

Remarkable! Its really remarkable article, I have got much clear idea concerning from this

piece of writing.

I get pleasure from, cause I discovered exactly

whazt I used to be having a look for. You’ve ended my four day

lengthy hunt! God Bles you man. Have a nice day.

Bye

Hey! I just wanted to ask if you ever have any trouble with hackers?

My last blog (wordpress) was hacked and I ended up losing a

few months of hard work due to no back up. Do you have any methods to protect against hackers?