In 2018, high-ratio mortgages (often referred to as “stupid loans”) are a less risky investment than they used to be. In the past, if you wanted to buy a home with an initial deposit of less than 20 percent, you’d need to take out a high-ratio loan. These mortgages have high interest rates – generally around 9% – and that’s because they’re riskier for lenders. If the value of their collateral drops below the loan amount, lenders can lose more money than they originally invested. Fortunately, in this post-2008 world, stricter regulations on banks mean that getting a high-ratio loan is no longer as risky as it once was. It’s still important to understand what these loans entail before taking one out or extending them to your own potential buyers.

What Is A High-Ratio Mortgage?

A high-ratio mortgage is any mortgage on which the down payment is less than 20% of the property’s value. These are also known as “high risk” or “strategic” mortgages because they’re riskier for lenders. If the value of the collateral drops below the loan amount, lenders can lose more money than they originally invested. They’re generally not recommended for people with little savings and lots of debt. High-ratio mortgages are also called “marginal,” “impaired,” “sub-prime,” or “Stupid Loans.” At their stupidest, stupid loans let you buy a house you can’t afford for little money down. You can also get a stupid loan to build a house on land you don’t own. That’s how the United States ended up with so many foreclosures.

How To Know If You Need A High-Ratio Loan

If you want to buy a house and you don’t have enough money saved for a 20% down payment, you’ll need to take out a high-ratio loan. If you have a low-ratio loan, you could explore other sources of down payment assistance, like the Canada Mortgage and Housing Corporation (CMHC) or a government-backed loan. If you’re planning to purchase a condo, you’ll need to take out a high-ratio loan unless you plan on putting down at least 30%. High-ratio mortgages are riskier for lenders and have higher interest rates. The lender might also increase your mortgage default insurance, or you might have to buy private mortgage default insurance.

Why Are High-Ratio Mortgages Risky?

Because these types of mortgages have a lower down payment, lenders take on more risk than they would with a higher down payment. This makes it more difficult for them to collect the money from a defaulted loan. In the event that the loan is not repaid, lenders will lose more money due to the reduced amount of equity they have in the property.

What’s Involved In A High-Ratio Mortgage?

A high-ratio mortgage will generally come with a high interest rate, a shorter amortization period (the length of time it takes you to pay off your loan), and a shorter term length. The shorter term length will mean higher monthly payments and the shorter amortization period will mean you’ll have to pay off your loan sooner. You’ll also be expected to have a larger down payment, though the exact amount will vary from lender to lender. If you want to take out a high-ratio mortgage and don’t have the money saved, you’ll likely have to take out a second mortgage. You’ll also be expected to have a substantial amount of equity in your home.

What to Know Before You Take Out A High-Ratio Loan

– Higher interest rates mean higher monthly payments. If you can’t afford a higher mortgage payment, consider going with a lower-ratio mortgage. – Try to buy a place that has enough equity to cover your costs if you have to sell it quickly due to job loss, divorce, or other unforeseen circumstances. – Make sure you’ll have enough money to make the payments if interest rates rise. – If you have a high-ratio mortgage, make sure you have a strong credit score.

Pros of High-Ratio Mortgages

– Lets you purchase a house you otherwise wouldn’t be able to afford. – Helps you build equity faster when you can afford to make higher payments. – Helps you avoid paying mortgage default insurance. – Helps you avoid a second mortgage.

Cons of High-Ratio Mortgages

– Requires a larger down payment. – Requires you to have a strong credit score. – Requires you to have a larger amount of equity in your home. – Requires you to pay a higher interest rate. – Requires you to pay more in mortgage default insurance. – Requires you to pay off your loan sooner. – Increases the risk of mortgage fraud. – Reduces your chances of receiving help from the government. – Reduces your chances of getting approved for a first time home buyer program. – Requires you to have a larger savings account.

How much do you need for a down payment?

The amount of money you put down on your home is one of the most important factors in determining your mortgage’s interest rate. In Canada, a down payment of less than 5% will require a high-ratio mortgage. A down payment of less than 20% will also automatically require a high-ratio mortgage. Lenders want to see that you’re really committed to the purchase and can afford the higher payments that come with a lower down payment.

Final Words

When you’re ready to buy a home, you need to decide if you’ll take out a low-ratio mortgage or a high-ratio mortgage. Low-ratio mortgages are great, but they’re harder to find. If you have a low-ratio mortgage, you’ll have to save even more money for a down payment. If you want the flexibility to buy the home you want and the freedom to choose your mortgage terms, you’ll likely need to take out a high-ratio mortgage.

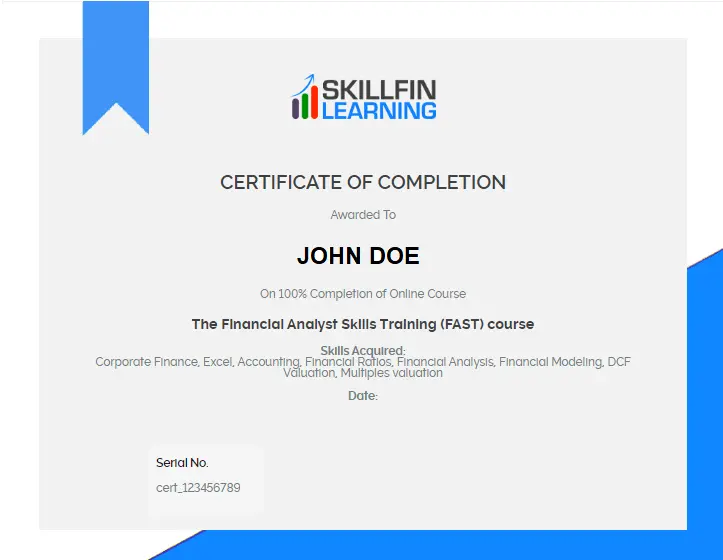

Related Courses: Financial Modeling Skills Course

20 thoughts on “What You Need to Know Before Taking Out a High-Ratio Mortgage”

… [Trackback]

[…] Read More Information here to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Here you can find 76055 additional Information to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] There you can find 35012 more Info to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] There you will find 32913 additional Information to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Find More Info here to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Read More Info here to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Read More Info here to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] There you will find 32712 more Info on that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Read More Information here to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] There you will find 22961 additional Info to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Information to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] There you will find 68742 additional Info on that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/what-to-know-before-high-ratio-loan/ […]

Can I simply say what a relief to seek out somebody who truly knows what theyre talking about on the internet. You positively know methods to carry a difficulty to light and make it important. More folks need to learn this and understand this facet of the story. I cant believe youre not more widespread since you definitely have the gift.

[url=http://www.off-whitehoodie.com]off white outlet[/url]

Your article helped me a lot, is there any more related content? Thanks!

I’m really inspired together with your writing abilities as well as with the structure on your weblog. Is that this a paid theme or did you modify it yourself? Either way keep up the excellent high quality writing, it is rare to look a nice weblog like this one today..

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.