INTRODUCTION

In the intricate world of financial analysis, one metric stands out as a cornerstone for evaluating corporate performance: weighted average shares outstanding. Imagine a thriving tech giant like Apple issuing additional shares to fund a ground-breaking innovation, or a dynamic start-up like Zoom repurchasing shares to boost investor confidence. These actions can significantly alter the share landscape over time, impacting key metrics like earnings per share (EPS). The weighted average shares outstanding adjusts for such fluctuations within a reporting period, offering a more precise snapshot of a company’s financial health. Mastering the calculation and interpretation of this metric is indispensable for investors, analysts, and stakeholders aiming to make informed decisions in an ever-evolving market.

WHAT IS THE WEIGHTED AVERAGE OF OUTSTANDING SHARES?

Weighted average shares outstanding represent the number of shares a company has issued and outstanding, adjusted for any changes over a specific reporting period. Unlike the simple average, which might overlook the timing of share issues or repurchases, the weighted average method accounts for the exact duration each share was outstanding. This adjustment is crucial because it reflects the actual number of shares that were eligible to receive dividends and participate in the company’s profits throughout the period.

STEPS TO CALCULATE WEIGHTED AVERAGE SHARES OUTSTANDING

- Identify the Starting Number of Shares Outstanding: At the beginning of the reporting period, determine the number of shares the company has outstanding.

- Identify Changes in Shares: Determine all changes in the number of shares during the reporting period. These changes could result from new shares issued, shares repurchased, stock splits, or conversions of convertible securities.

- Assign Weights: Each share change is weighted based on the fraction of the reporting period it was outstanding. For example, if a company issued 1,000 shares on April 1 in a fiscal year starting January 1, these shares would be outstanding for 9 months of the year, or 75% of the period.

- Sum Weighted Shares: Multiply the number of shares by the fraction of the period they were outstanding, then sum these amounts to get the weighted average.

Here’s a simplified formula:

Weighted Average Shares Outstanding =∑(Shares Issued× Months Outstanding/12)

Or,

Weighted Average Shares Outstanding =∑(Shares Issued× Days Outstanding/365)

EXAMPLE

Let’s understand the above with the help of a hypothetical example.

Consider a company with the following share transactions within a fiscal year:

- Beginning of the year: 10,000 shares

- April 1: Issued 2,000 shares

- October 1: Repurchased 1,000 shares

Weighted average shares outstanding at the end of the year (31st December) can be calculated as follows:

| Particulars | Number of shares | Months Outstanding | Weighted Average |

| Opening balance of shares as of 1st Jan | 10,000 | 12 | =10,000*12/12=10,000 |

| Shares issued on 1st April | 2,000 | 9 | =2,000*9/12=1,500 |

| Shares repurchased on 1st Oct | -1,000 | 3 | =-1,000*3/12=-250 |

| Total weighted average shares outstanding as of 31st Dec | 11,250 |

Thus the Weighted Average Shares Outstanding as of 31st December is 11,250.

WHAT ARE SHARES OUTSTANDING AND HOW IT IS DIFFERENT FROM WEIGHTED AVERAGE SHARES OUTSTANDING?

Shares outstanding represent the total count of shares owned by all shareholders, including those restricted and held by company insiders. Companies often authorize more shares than are currently issued, reserving the right to release additional shares through secondary offerings, convertible securities, or employee stock options. These actions cause the actual number of shares outstanding to fluctuate over a reporting period, reflecting the dynamic nature of corporate finance.

In contrast, weighted average shares outstanding adjusts for the changes mentioned above in the number of shares over a reporting period, providing a more accurate figure for calculating earnings per share (EPS).

To illustrate the difference between shares outstanding and weighted average shares outstanding, consider the above example where the company starts the year with 10,000 shares. On April 1, it issues 2,000 additional shares, and on October 1, it repurchases 1,000 shares. By year-end, the shares outstanding are 11,000. However, the weighted average shares outstanding accounts for the timing of these changes, resulting in 11,250 shares.

Suppose the company’s net income for the year is $100,000 and we need an Earnings per share (EPS) calculation.

Earnings per share (EPS)= Net Income/ Weighted Average Shares Outstanding

Using the year-end shares outstanding (11,000), the EPS would be $9.09 ($100,000 / 11,000). Using the weighted average shares outstanding (11,250), the EPS would be $8.89 ($100,000 / 11,250), providing a more accurate measure of earnings attributable to each share over the entire period.

DIFFERENCES IN USING WEIGHTED AVERAGE SHARES OUTSTANDING FOR BASIC EPS AND DILUTED EPS CALCULATIONS

The difference between Basic EPS and Dilutive EPS calculation using weighted average shares outstanding is as follows.

| Metric | Basic EPS | Diluted EPS |

| Definition | Measures profitability per share using actual outstanding shares | Measures profitability per share including potential shares from convertible securities, stock options, and warrants |

| Calculation | Net income divided by the weighted average number of actual shares outstanding | Net income divided by the total of actual and potential shares (including dilutive securities) |

| Example | Net income: $200,000; Shares outstanding: 11,250 | Net income: $200,000; Total shares including dilutive: 12,250 |

| EPS Value | =$200,000/11,250=$17.78 | =$200,000/122,250=$16.33 |

| Complexity | Straightforward, considers only current shares | More complex, includes potential dilution from future shares |

| Insight Provided | Basic view of profitability | Comprehensive and cautious view considering potential dilution |

This table highlights the differences between Basic EPS and Diluted EPS, illustrating how each metric provides distinct insights into a company’s profitability.

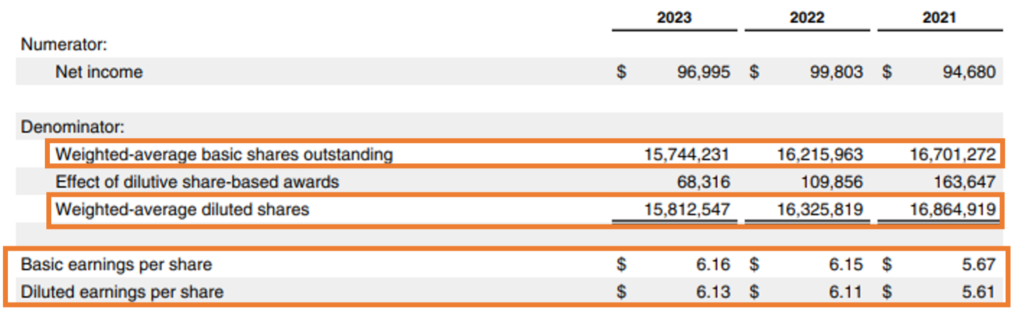

Below are the weighted average shares outstanding and basic and diluted EPS calculations for Apple Inc. for fiscal year 2023.

Source: Annual Report https://s2.q4cdn.com/470004039/files/doc_earnings/2023/q4/filing/_10-K-Q4-2023-As-Filed.pdf

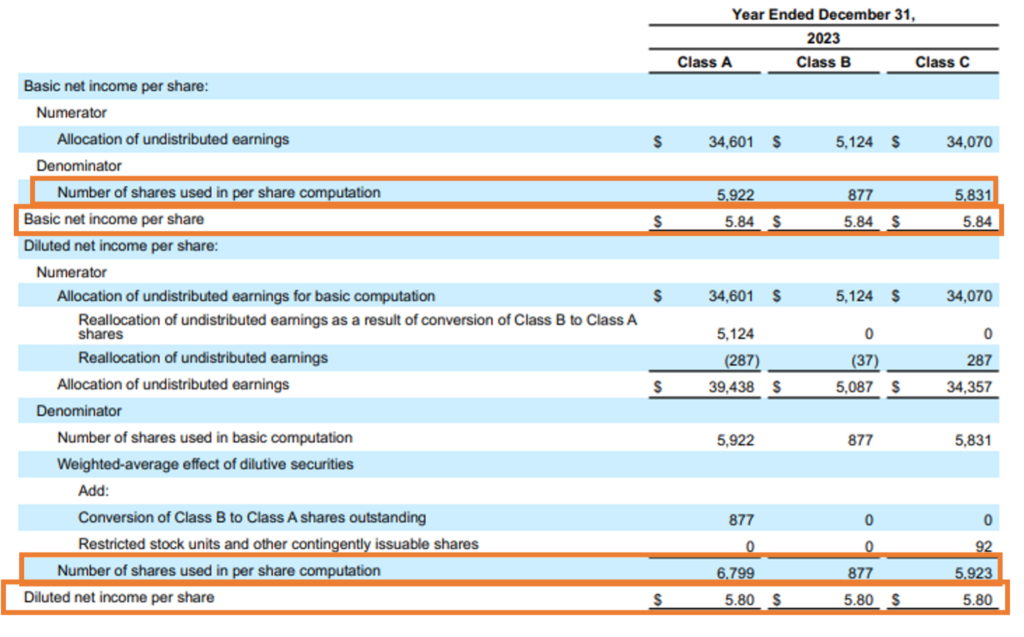

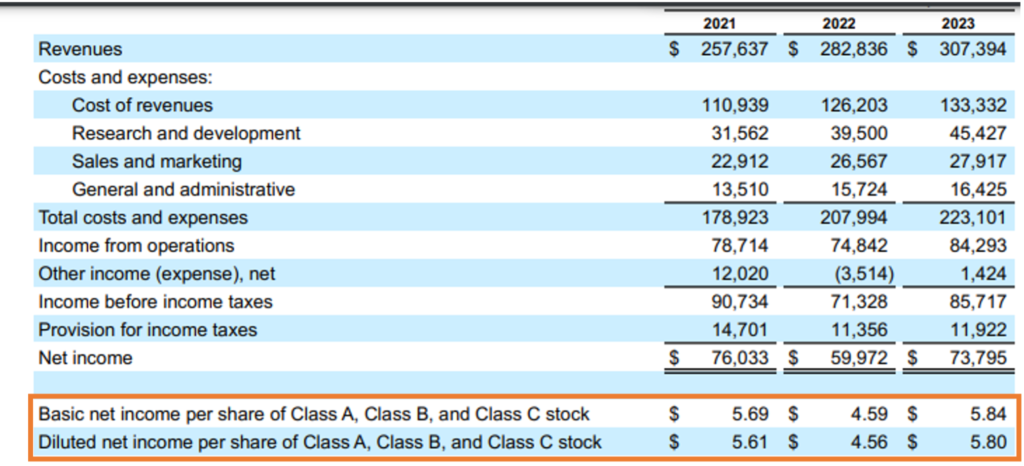

Below are the Weighted average share outstanding and basic and diluted EPS calculations for Alphabet Inc. for fiscal year 2023.

Source: Annual Report https://abc.xyz/assets/43/44/675b83d7455885c4615d848d52a4/goog-10-k-2023.pdf

IMPORTANCE OF CALCULATING THE WEIGHTED AVERAGE NUMBER OF SHARES

Calculating the weighted average number of shares is crucial for both company accountants and investors for several compelling reasons:

- Accurate EPS Calculation: The weighted average number of shares is essential for determining earnings per share (EPS), a key indicator of a company’s profitability. EPS is calculated by dividing net income by the weighted average shares, offering a precise reflection of earnings distributed across all shares outstanding during the period.

- Reflects Share Changes: This method accounts for changes in the number of shares due to stock issuances, repurchases, splits, or conversions. By considering the timing and duration of these changes, the weighted average number of shares provides a more accurate representation of a company’s share structure throughout the reporting period.

- Informed Investment Decisions: Investors rely on EPS to gauge a company’s financial health and compare it with other firms. An accurate EPS, based on the weighted average number of shares, helps investors make more informed decisions about buying, holding, or selling stock.

- Consistency in Financial Reporting: For company accountants, using the weighted average number of shares ensures consistency and comparability in financial reporting. This method aligns with accounting standards and provides a reliable basis for financial analysis and valuation.

- Transparency and Credibility: Accurate calculation of EPS through the weighted average method enhances transparency and credibility in financial statements. This builds investor confidence and can positively influence the company’s market valuation and reputation.

- Calculating Cost Basis for Individual Investors: Understanding how to calculate a weighted average is also useful for individual investors when determining their cost basis in a security. By averaging the purchase prices of shares bought at different times, investors can accurately calculate their overall cost basis, which is essential for tax reporting and assessing investment performance.

Overall, the weighted average number of shares is a vital metric that ensures the accuracy and integrity of financial analysis, benefiting both company accountants and investors, and providing individual investors with valuable insights into their investment costs.

INSTANCES IN WHICH OUTSTANDING SHARES CHANGE AND THEIR IMPACT

- Issuance of New Shares: A company issues new shares through a public offering or private placement. It Increases the number of outstanding shares, potentially diluting the value of existing shares but raising capital for growth or debt repayment.

- Stock Splits: A company declares a stock split, such as a 2-for-1 split. It doubles the number of outstanding shares while halving the share price, keeping the market capitalization the same but making shares more affordable and potentially more attractive to investors.

- Reverse Stock Splits: A company executes a reverse stock split, such as a 1-for-10 split. It reduces the number of outstanding shares and increases the share price, often to avoid delisting or to attract institutional investors by boosting the share price.

- Share Repurchases (Buybacks): A company repurchases its own shares or does a share buyback either from the open market or via a tender offer. This reduces the number of outstanding shares, which can boost both EPS and share price, as the reduced share count often signals management’s confidence in the company’s future.

- Conversion of Convertible Securities: Holders of convertible bonds or preferred shares convert their securities into common shares. It increases the number of outstanding shares, potentially diluting existing shareholders’ equity but providing an infusion of equity capital.

- Exercise of Stock Options or Warrants: Employees or investors exercise their stock options or warrants. It increases the number of outstanding shares, leading to potential dilution but often tied to incentives that align employee interests with those of shareholders.

- Issuance of Shares for Acquisitions: A company issues new shares as part of the purchase consideration in an acquisition. It increases the number of outstanding shares, which can dilute existing shareholders but might add value through the acquired assets and synergies.

Each of these instances impacts the number of outstanding shares and, consequently, the weighted average share outstanding and key financial metrics like EPS, market capitalization, and shareholder equity, influencing investor perceptions and the company’s financial strategy.

CONCLUSION

Weighted average shares outstanding is a nuanced metric that provides a deeper understanding of a company’s financial performance. By accounting for changes in the number of shares throughout a reporting period, it offers a more precise measure for calculating EPS and other per-share metrics. For investors and analysts, grasping this concept is essential for making informed decisions based on a company’s financial health and performance.