What is a Share Buyback?

Share Buyback, also called Share Repurchase, is a financial decision companies make to repurchase their outstanding shares from the market. A company may use the share buyback strategy to pull down the total number of shares outstanding in the open market or to repay its shareholders. The reason for share buyback differs from company to company. The shares purchased in this process are either cancelled or held in the company’s treasury.

What are Outstanding Shares?

Outstanding shares are the portion of a company’s shares held by its shareholders. It represents the number of shares available in the open market plus those held by institutional investors, individual investors and insiders & directors.

What are the reasons for a Share Buyback?

Companies perform share buybacks with the main aim of generating high returns for the shareholders. As we know, a company’s highest goal is to maximise the value of shareholders. Companies initiate share repurchase plans to hike share prices using market dynamics. It is one of the many reasons for a share buyback plan. Let’s look at the other reasons:

- To increase share price: When the company presume its stock price is undervalued. Therefore, to increase the stock price, companies use a buyback strategy. Share repurchase impacts the market dynamic, as demand for the share increases, the supply is pressed down by the share repurchase program. As a result, the stock prices shoot up.

- Tax Efficiency: Companies consider share buybacks as a better alternative to dividends distribution. This is because share repurchase is a more tax-efficient method of paying cash to shareholders. In some countries, the tax payable on dividends is much higher than that on capital gains. Therefore, many companies prefer share buybacks over cash dividends distribution.

- To offset dilution: Companies use buyback programs to offset the ownership dilution by reducing the number of shares in the market. When a company proceed to repurchase its shares from the market, the number of shares available for trading falls short. It leads to a stable or increase in the ownership percentage of the existing shareholders and offsets ownership dilution.

- Capital Allocation: Businesses may think that buying back or repurchasing their stock is a more appropriate use of cash than other investment options like dividends, expansion initiatives, or acquisitions because they feel that their shares are undervalued. By executing a share repurchase plan a company not only increases the demand and value of the company but also restricts the management power to the existing shareholders. With share buyback, companies can also avoid irrelevant investments when they have surplus cash reserves.

Share Buyback Methods

We know that once a company repurchases its shares, they are either cancelled or parked in the treasury of the company. But we must also know the methods used by a company to execute its share repurchase program. Here are four methods through which companies buy back their shares:

- Buying from the open market: It’s thefundamental strategy companies use to execute their share buyback programs. In an open-market strategy, companies purchase their shares directly from the market. The company’s brokers perform this transaction on behalf of the company. This operation takes longer than other share buyback methods because they need to target sizable holders and repurchase stocks in blocks.

- Direct Negotiation: Under direct negotiation, the company directly contacts the shareholders with sizable shareholding. The company offers a repurchase price generally higher than the market rates. Using the direct negotiation strategy, companies can directly bargain with sizable investors.

- Dutch Auction Tender Offer: The Dutch Auction Tender Offer originated in the 17th century because of the Dutch Tulip Market. In the Dutch Auction Tender, the company offers a price range to the shareholders to place bids instead of a fixed price. Investors can bid any price within the range for the share repurchase. The minimum value of the range is usually higher than the market value of the shares.

- Tendering: Tendering is another method in which companies issue a tender claiming their intentions of buying shares from the existing shareholders at a fixed price. The price mentioned in the tender is usually higher than the current market price.

Real Life Example of Share BuyBack – Apple:

Since 2012, Apple Inc. has spent more than $573 billion on share repurchases and in the 10-Q report of the last three months of 2023, Apple repurchased $20,668 million worth of common stock.

Let’s look at the share buyback programs of Apple Inc. for 2023:

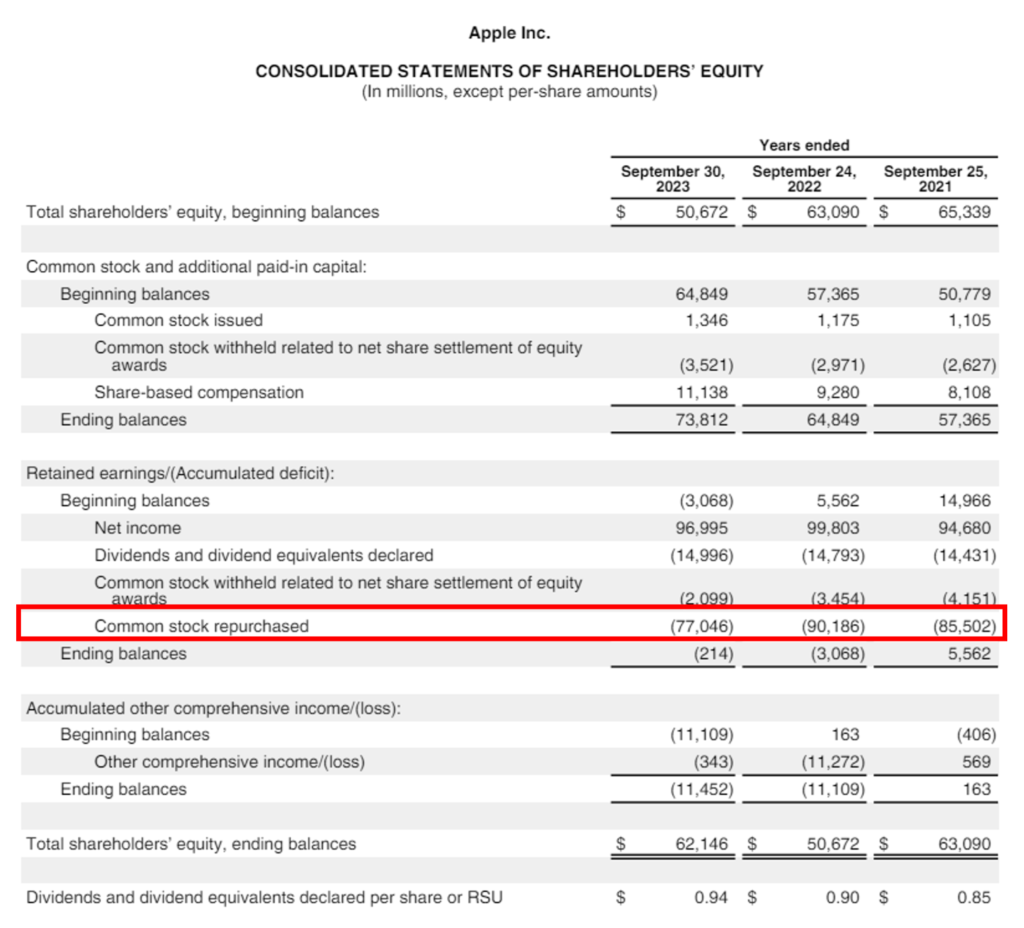

Apple Inc. in its Consolidated Statements of Shareholders’ Equity has recorded a common stock repurchase valuing $77,046 million.

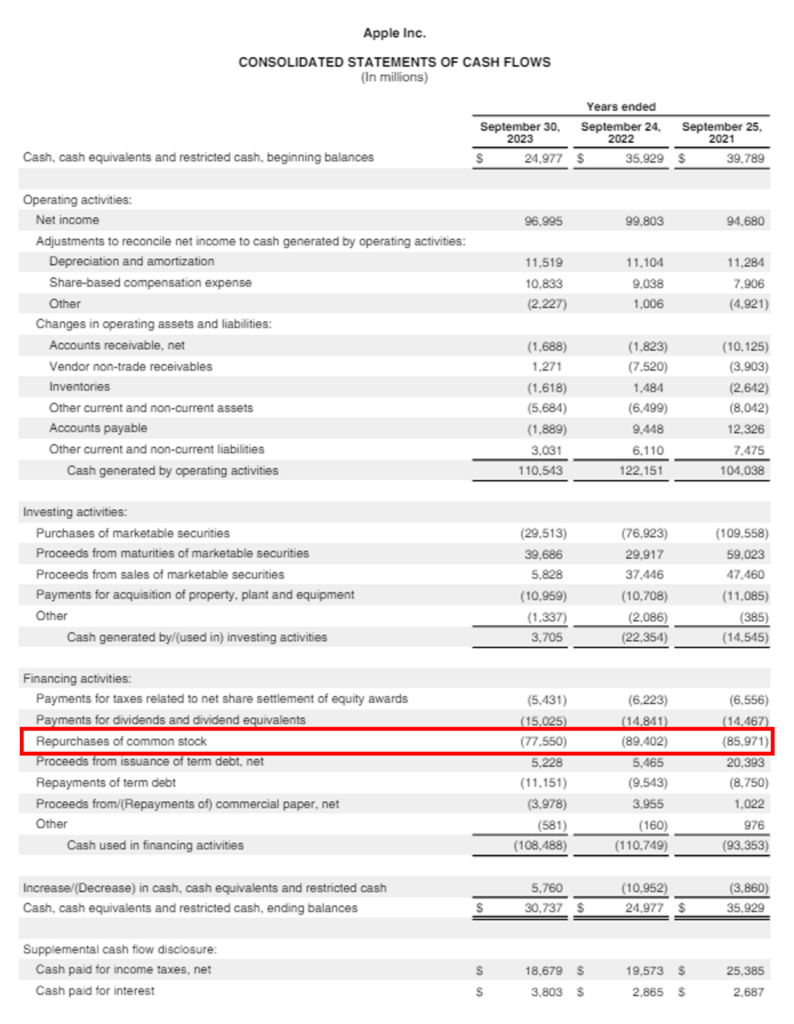

Similarly, we know that the value of share buyback is also recorded under the financing head of the cash flow statement. Under cash flow from the financing head Apple Inc. has recorded its share repurchase value as $77,550 million or $77.55 billion. The quarterly bifurcation of this $77.55 billion is as follows:

On 31 December 2022, Apple’s quarterly repurchase value was recorded as $19.48 billion. At the end of the next quarter, i.e. 31st March 2023 the share repurchase value recorded was $19.59 billion. By the end of 30th June 2023, a total of $17.48 billion share repurchase transaction was done by Apple. And on 30th September 2023, the quarterly common stock buyback value recorded was $21.00 billion.

Therefore, $19.48 billion + $19.59 billion + $17.48 billion + $21.00 billion = $77.55 billion.

Note: The table is published in the 10-K report of Apple Inc. on page – 45.

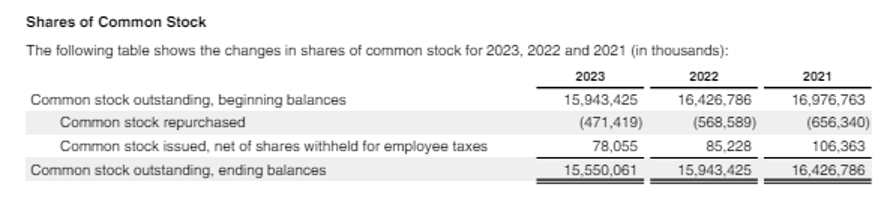

The Share of Common Stock Table published under Note 10 Shareholders’ Equity gives us an idea of the number of common stocks outstanding i.e. 15,550.061 mn. Additionally, it also shows the total number of shares repurchased in 2023 as 471.419 mn.

If we work out the average purchase price of share buyback in FY 2023, it will come around to be equal to USD 77.55bn divided by 471,419 mn shares which will be equal to USD 164.50 per share. Current share price for Apple as of April 24, 2024 is USD 169.02 per share which is close to the average buyback price.

Share Buyback Methods:

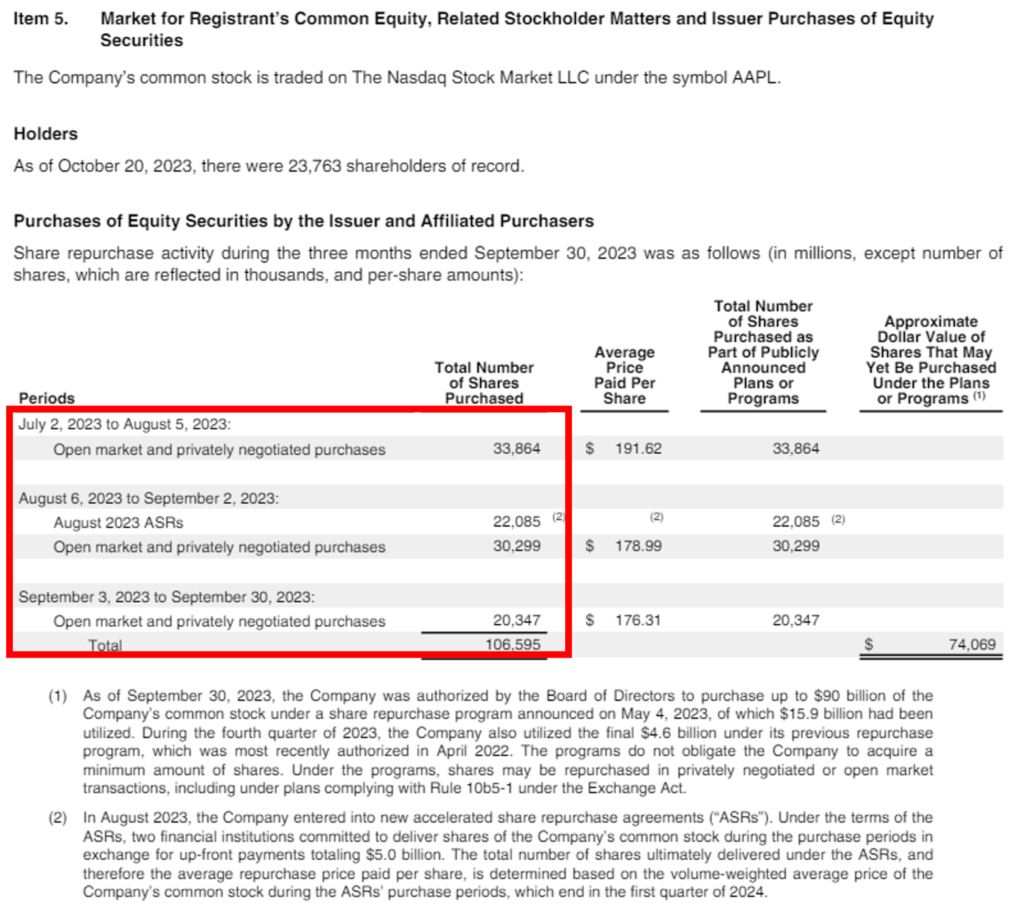

Note: The Purchases of Equity Securities table is on page – 18 of the 10-K report of Apple Inc.

Source: https://s2.q4cdn.com/470004039/files/doc_earnings/2023/q4/filing/_10-K-Q4-2023-As-Filed.pdf

The Purchases of Equity Securities table shows us the total number of shares repurchased by Apple in one quarter, i.e. from July 2023 to September 2023. It also highlights the methods used to execute the share buyback program. Apple repurchased shares from the open market and settled private negotiations. Apple repurchased a total of 106,595 shares in three months.

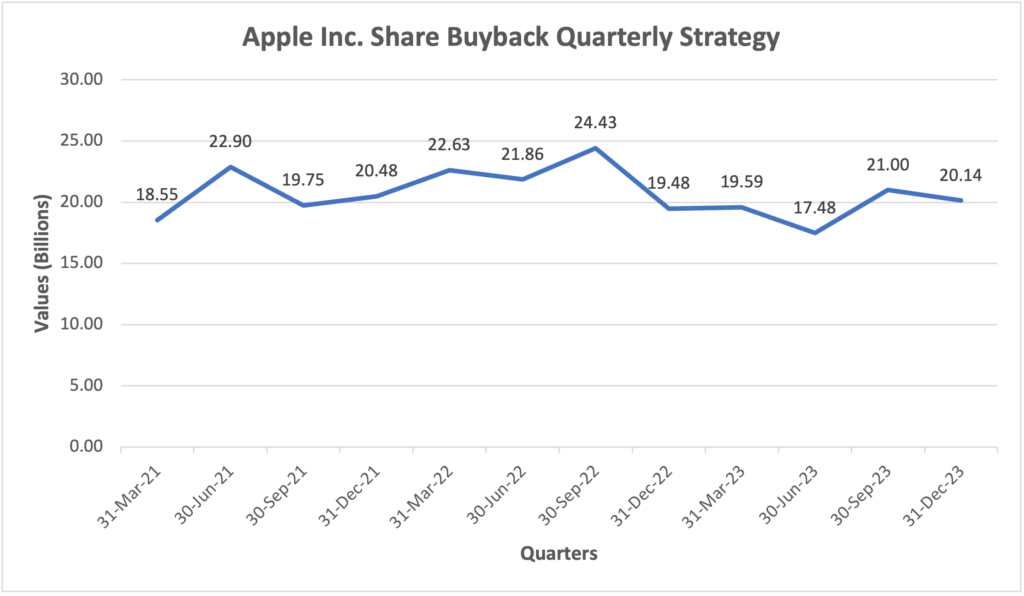

Now let’s look at the Apple’s Share Buyback Quarterly Strategy for 2023, 2022 and 2021:

Source: https://ycharts.com/companies/AAPL/stock_buyback

In the above chart, we can see Apple’s quarterly Share Buyback strategy. The methods opted by Apple to perform these common stock repurchase programs are open-market repurchases and private negotiations. In these 12 quarters of 2021, 2022 and 2023 Apple has repurchased common stocks worth $248.29 billion.

How Buyback of Shares Affect EPS

Earnings per share (EPS) is a financial metric that measures a company’s profitability. When a company’s net income is divided by the total number of outstanding shares, we get earnings per share.

Share Buyback directly impacts the value of shares outstanding in the market. It decreases the total number of shares available, effectively increasing the proportion of net income in the EPS calculation. Therefore, a company’s EPS tends to swell due to the share repurchase program.

Impact of Buyback of Shares on Price-to-Earnings Ratio

The price-to-earnings ratio is a valuation metric which assesses the relative value of company stock by measuring the ratio between the current market price of a share and earnings per share. The P/E ratio is computed when the market price of a share is divided by Earnings per Share.

When a company initiates a share repurchase program, the total number of outstanding shares in the open market decreases. It, in turn, increases the EPS ratio of the company. A higher earnings ratio pulls down the P/E ratio, because the denominator of EPS increases, and the share price is relatively stable. Thus, the P/E ratio falls.

Summing Up

Share buybacks represent a strategic financial decision for companies aimed at maximising shareholder value. By repurchasing their shares from the open market, companies can potentially increase share prices, offset the dilution of management control, and raise the company’s valuation. Various methods like open market purchases, direct negotiation, Dutch auction tender offers, and tendering are employed to execute share buyback programs effectively. Moreover, share buybacks positively impact earnings per share (EPS) by reducing the total number of outstanding shares, thus contributing to the company’s profitability. Additionally, the reduction in outstanding shares due to buybacks lowers the price-to-earnings (P/E) ratio, signalling potentially attractive valuations for investors. Thus, increasing the share price, overall value and demand of the company.