INTRODUCTION

Provisions in accounting are a testament to prudence and foresight, crucial for safeguarding a company’s financial integrity. By embracing the matching concept, provisions ensure that future expenses are aligned with the revenues they impact, reflecting a thoughtful approach to financial management. This proactive strategy not only mitigates the risk of unforeseen liabilities but also enhances the accuracy and reliability of financial statements. Provisions, therefore, are more than just accounting entries—they are strategic safeguards that enable businesses to navigate uncertainties with confidence and maintain a balanced and transparent financial outlook. As we delve deeper into the concept of provisions, we’ll explore their types, importance, accounting standards requiring recognition of provisions, how provisions are different from reserves, accrued expenses and contingent liabilities, and factors important for recognizing and recording provisions in the books of accounts.

WHAT IS PROVISION ACCOUNTING?

In accounting, a provision is an allocation of funds from a company’s profits to cover anticipated future liabilities or expenses whose exact timing or amount is uncertain. Provisions are recognized on the balance sheet under liabilities and are also recorded as an expense in the income statement. The primary purpose of creating a provision is to ensure that the financial statements reflect a more accurate and realistic view of the company’s financial position.

CRITERIA FOR RECOGNIZING PROVISIONS UNDER IFRS AND US GAAP

Both the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles in the United States (US GAAP) provide specific criteria for recognizing provisions. While there are similarities, there are also some differences in the way each framework handles provisions.

IFRS Criteria for Recognizing Provisions

Under IFRS, the guidelines for recognizing provisions are specified in IAS 37 – Provisions, Contingent Liabilities, and Contingent Assets. IAS 37 states that a provision should be recognized when:

1. Present Obligation: There is a present obligation (legal or constructive) as a result of a past event.

A legal obligation is an obligation that derives from contractual agreements, whether written or implied, obligations imposed by law or regulation, or that are enforceable in a court of law.

A constructive obligation arises from an entity’s actions. Through consistent past practices, published policies, or clear current statements, the entity indicates it will accept certain responsibilities. As a result, other parties have a valid expectation that the entity will fulfill those responsibilities.

An example of legal obligation is when a company is required by law to decommission an oil platform and restore the seabed to its original state after the end of its useful life. An example of a constructive obligation is when a company has a policy of providing refunds to dissatisfied customers even though it is not legally required to do so. Customers have come to expect this refund policy, creating a constructive obligation.

2. Probable Outflow of Resources: It is probable (more likely than not) that an outflow of resources embodying economic benefits will be required to settle the obligation. The term “probable” under IFRS generally means a greater than 50% likelihood.

3. Reliable Estimate: A reliable estimate can be made of the amount of the obligation. If a reliable estimate cannot be made, then the obligation is disclosed as a contingent liability rather than being recognized as a provision.

US GAAP Criteria for Recognizing Provisions

In US GAAP, the criteria for recognizing provisions are primarily governed by ASC 450 – Contingencies (formerly FASB Statement No. 5). According to ASC 450, a provision (referred to as an “accrual” in US GAAP) is recognized when the following conditions are met:

1. Present Obligation: An entity has a current obligation stemming from a past event. This includes legal obligations and constructive obligations where the entity’s past practices or stated policies create a reasonable expectation among other parties that it will accept certain responsibilities.

2. Probable Outflow of Resources: An outflow of resources embodying economic benefits will probably be required to settle the obligation. In US GAAP, “probable” is defined as likely to occur, which implies a higher threshold than under IFRS.

3. Reasonably Estimable Amount: The amount of the obligation can be reasonably estimated. If the amount cannot be reasonably estimated, the entity discloses the contingency rather than recognizing a provision.

COMMON EXAMPLES OF PROVISION IN THE BOOKS OF ACCOUNTS

Some of the common examples of the provisions created in the books of accounts are as follows:

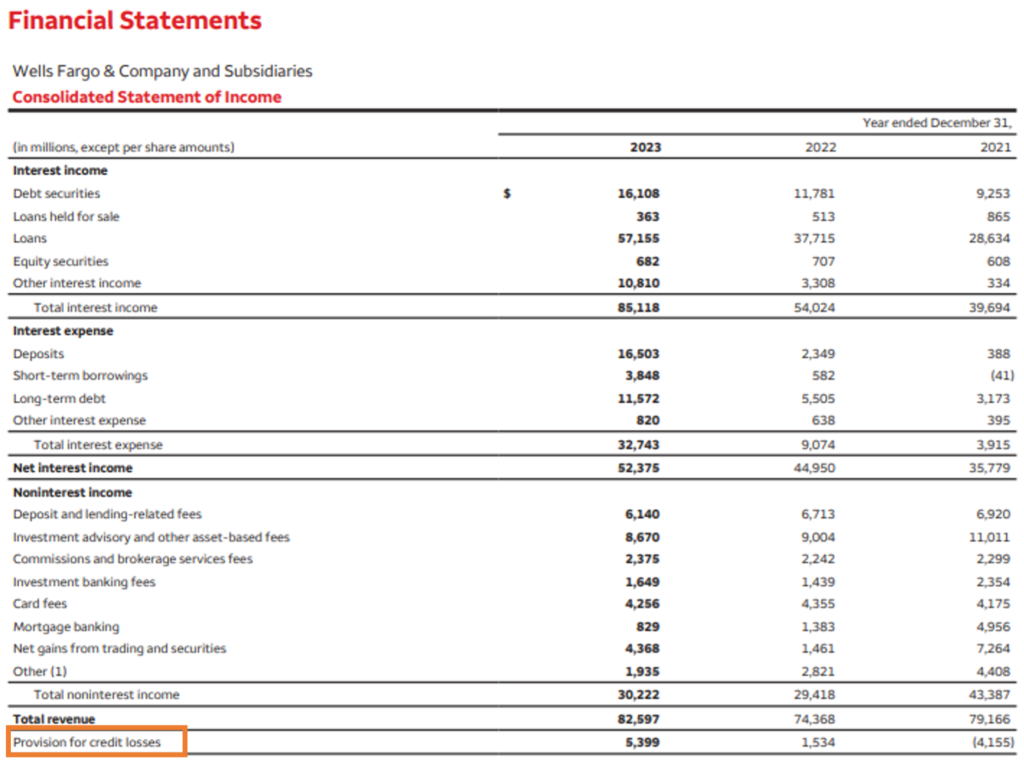

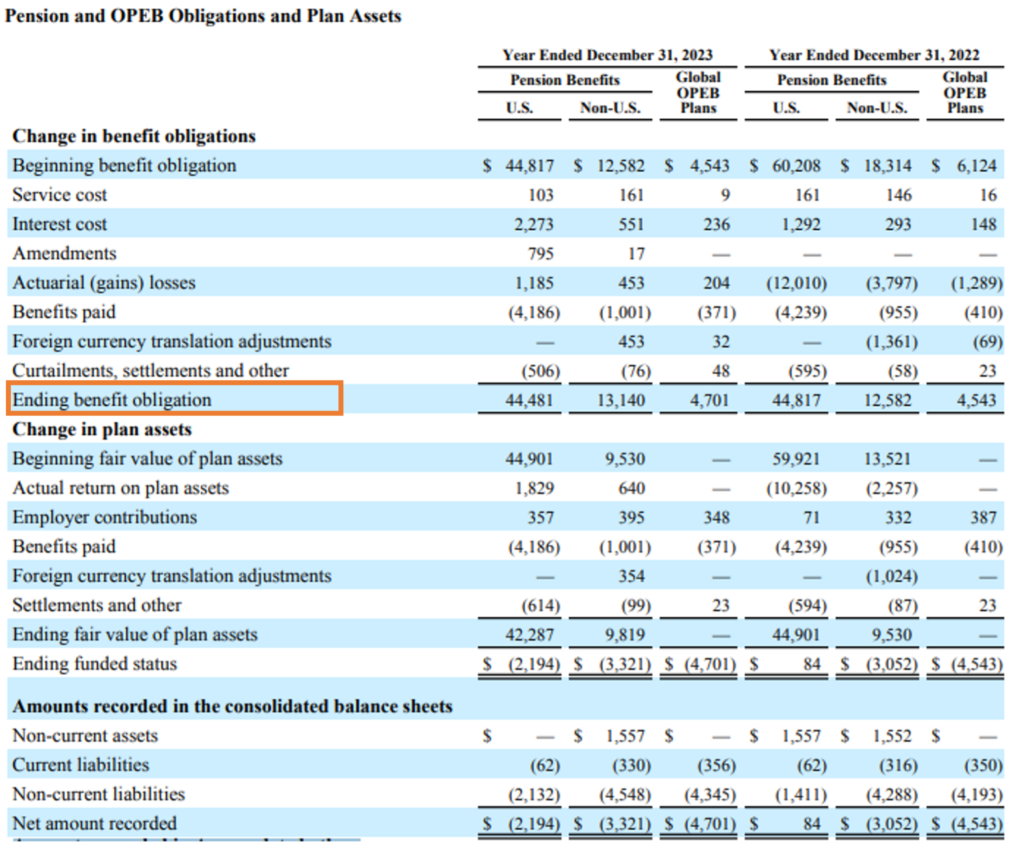

1. Loan Losses or Provision for credit losses: A provision for loan losses is established to account for potential future losses from loans that may not be fully repaid. This provision estimates the amount of loans expected to become uncollectible, reflecting the credit risk faced by the company. Recorded as an expense on the income statement and a liability on the balance sheet under “Allowance for Loan Losses,” it ensures that the financial statements present a realistic view of the company’s credit risk and financial position. These provisions are mostly recognized and recorded by the banking companies.

For example, Wells Fargo Bank recognizes the allowance for loan losses in the Balance sheet and provision for credit losses in the Income Statement as below:

Source: Annual Report https://www08.wellsfargomedia.com/assets/pdf/about/investor-relations/annual-reports/2023-annual-report.pdf

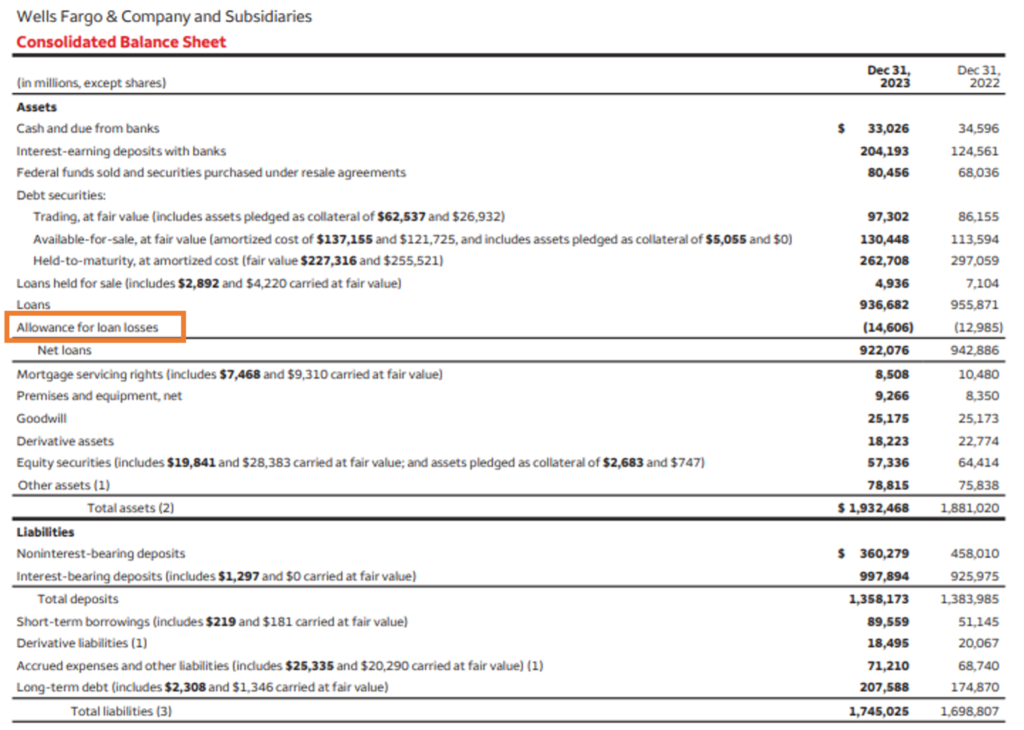

2. Warranties: Provisions for warranties cover the estimated costs of future warranty claims related to products sold. This provision accounts for expected expenses associated with repairs or replacements under warranty agreements. It is recorded as a liability on the balance sheet under “Warranty Provision” and as an expense on the income statement under “Warranty Expense.” This ensures that the cost of honoring warranty commitments is recognized in the same period as the related sales.

Below is the Provision for warranty for Tesla Inc.

Source: Annual Report https://ir.tesla.com/_flysystem/s3/sec/000162828024002390/tsla-20231231-gen.pdf

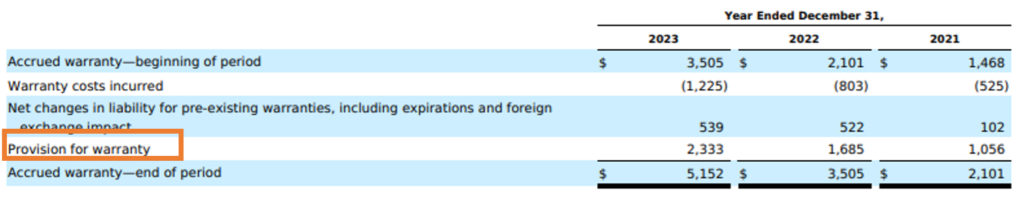

3. Pensions: Provisions for pensions are made to cover future obligations arising from employee retirement benefits. These provisions are based on factors such as employees’ years of service and salary levels, ensuring that the company will have sufficient funds to meet its pension liabilities. This provision appears as a liability on the balance sheet under “Pension Liability” and impacts the income statement through pension expense, reflecting the company’s commitment to its employees’ retirement benefits.

Below is the Pension liability of General Motors.

Source: Annual Report https://investor.gm.com/static-files/1fff6f59-551f-4fe0-bca9-74bfc9a56aeb

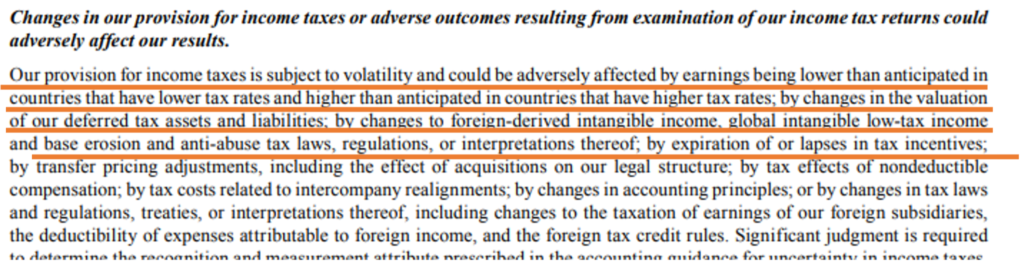

4. Tax Payments: A provision for tax payments is set aside to account for taxes that are due but not yet paid or assessed. This ensures that anticipated tax liabilities are accurately reflected in the financial statements. Recorded as a liability on the balance sheet under “Provision for Tax” and as a tax expense on the income statement, this provision aligns the company’s financial records with its tax obligations and provides a clearer picture of its financial health.

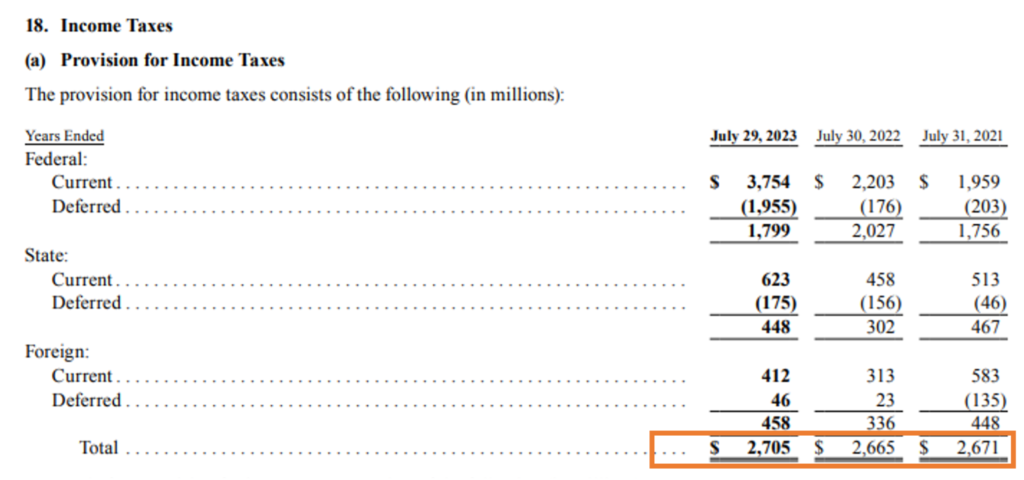

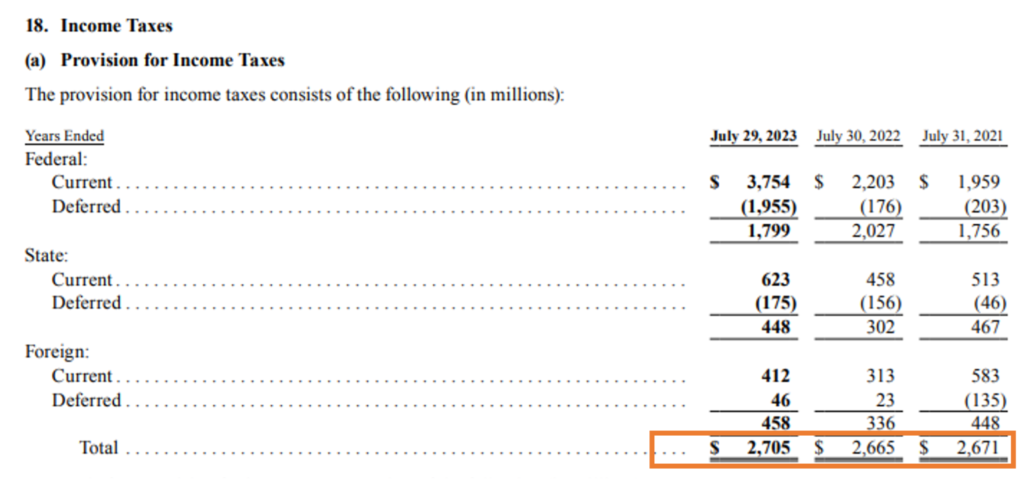

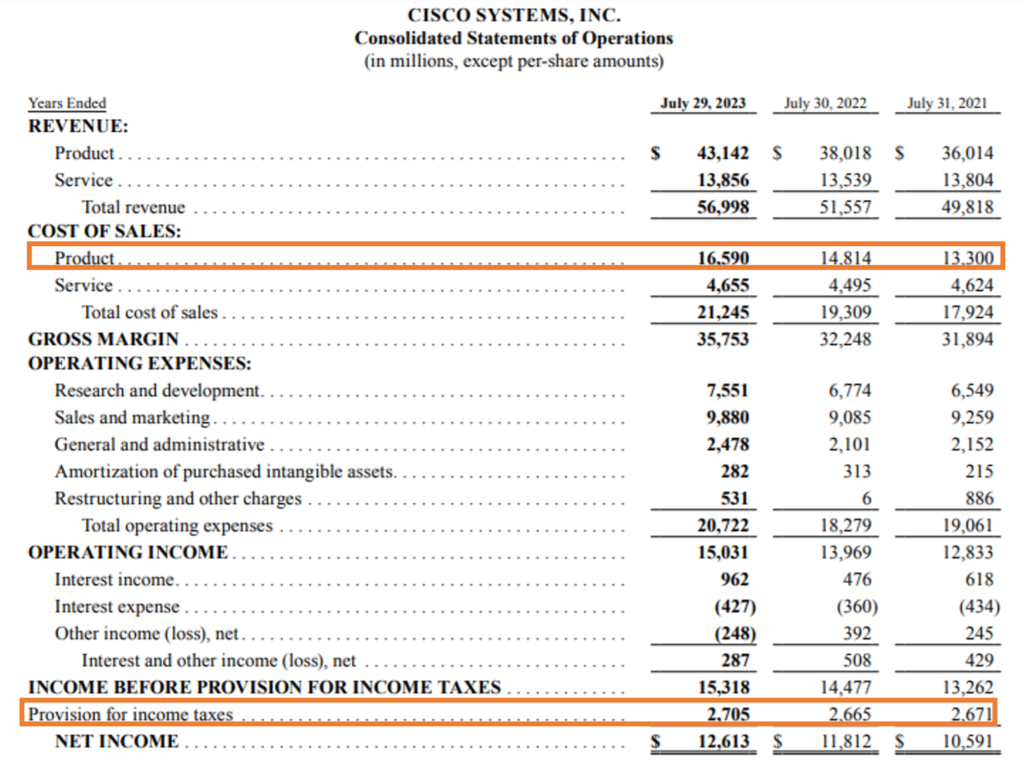

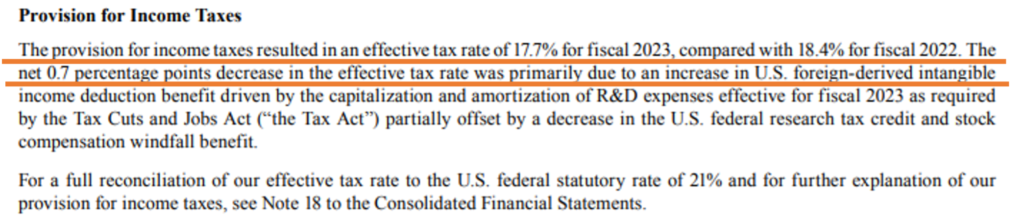

For example, Cisco recognizes Provision for Income Taxes of $ 2,705 million in its Income Statement. The details for the same is disclosed below in the annual reports of the company. The Provision for Income taxes can be seen on the face of the Income Statement and under balance sheet it can be seen in the liabilities section under the category Income Taxes Payable.

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

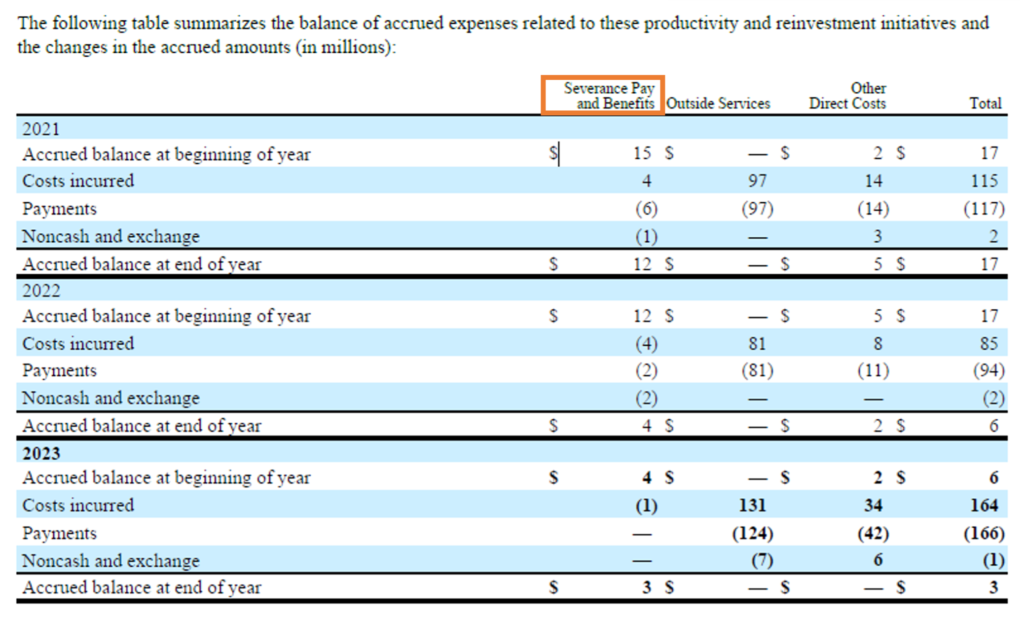

5. Severance Payments: Provisions for severance payments are made to cover costs associated with employee terminations, including severance pay and related expenses. This provision accounts for future obligations resulting from layoffs or terminations. It is listed as a liability on the balance sheet under “Severance Pay” and as an expense on the income statement. This approach ensures that the financial effect of severance obligations is accounted for in the period when the terminations take place.

Coca-Cola records severance pay and benefits expenses and creates severance provisions. The expense is clubbed with the other operating charges in the Income Statement. The severance working for Coca-Cola is shown below.

Source: Annual Report https://investors.coca-colacompany.com/filings-reports/all-sec-filings/content/0000021344-24-000009/0000021344-24-000009.pdf

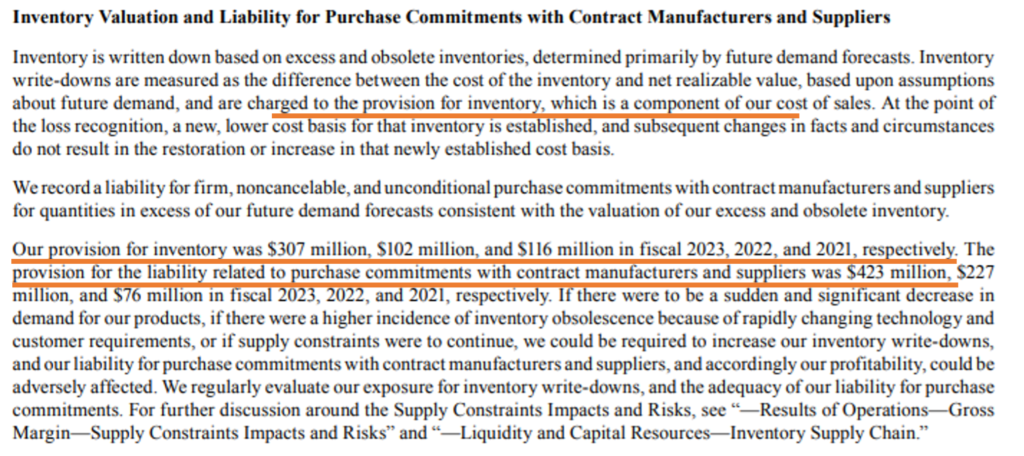

6. Obsolete Inventory: A provision for obsolete inventory addresses the expected loss in value of inventory that is unsellable or significantly devalued. This provision ensures that inventory is reported at its net realizable value, reflecting potential losses. It is shown as a decrease in the inventory value on the balance sheet and as an expense on the income statement under “Inventory Write-Down.” This adjustment ensures that the financial statements accurately reflect the true value of the inventory.

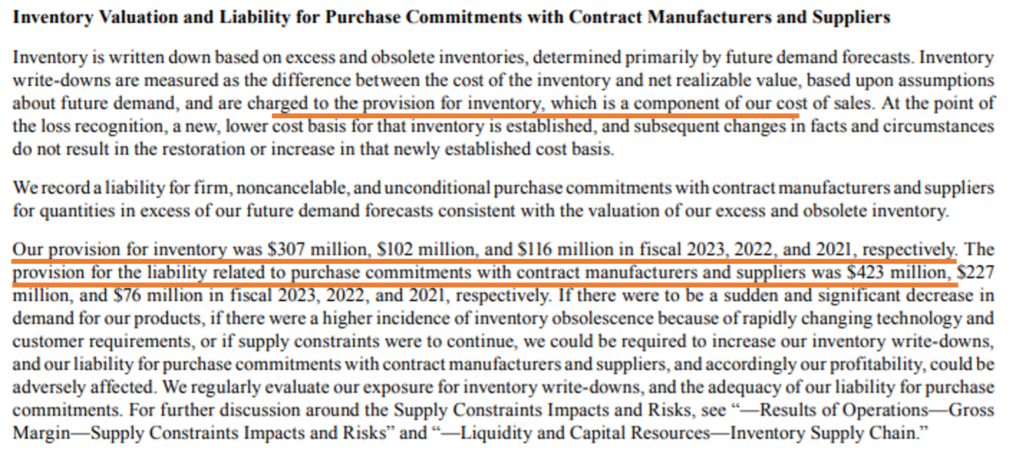

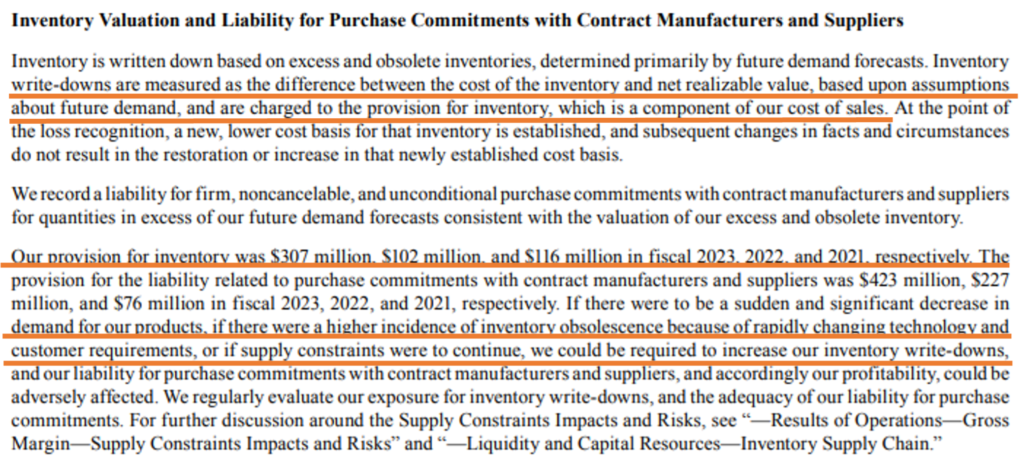

For example, Cisco accounts provision for inventory which is a component of the cost of sales. The amount of provision is $307 million in 2023. Since it is part of the cost of sales, these provisions cannot be seen on the face of the Income statement or balance sheet. The creation of a provision for inventory reduces the cost of sales in the Income Statement and Inventory Balance on the Balance Sheet hence neutralizing the accounting impact in the financial statements.

The company also accounts provision for the liability related to purchase commitments with contract manufacturers and suppliers of $423 million in 2023.

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

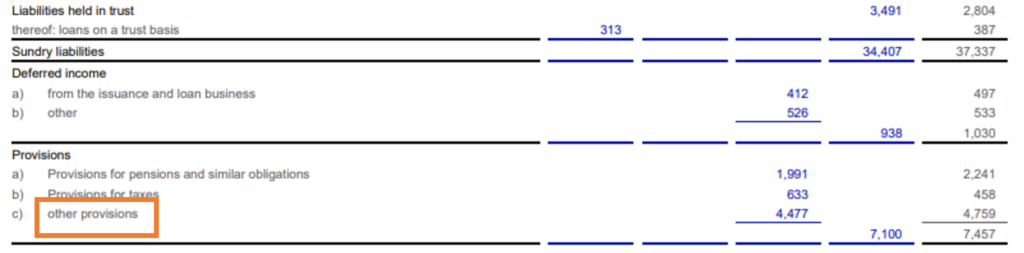

7. Restructuring: A provision for restructuring costs addresses expenses related to significant changes in the company’s operations, such as facility closures or workforce reductions. This provision estimates the future costs associated with restructuring plans. Recorded as a liability on the balance sheet under “Restructuring Provision” and as an expense on the income statement under “Restructuring Costs,” it reflects the financial impact of restructuring activities.

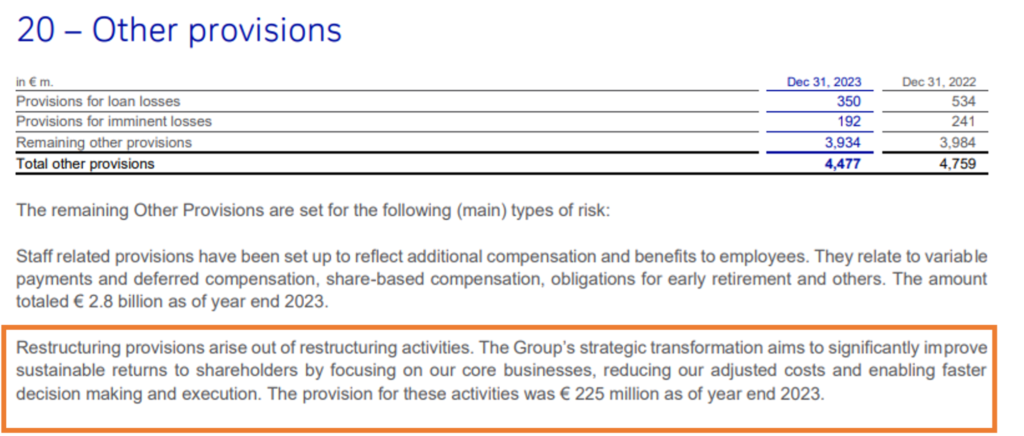

Deutsche Bank recognizes restructuring provisions on the liabilities side of the Balance Sheet under the Provisions heading as below.

The break-up of the other provisions is shown below.

Source: Annual Report https://investor-relations.db.com/files/documents/annual-reports/2024/Annual-Financial-Statements-of-Deutsche-Bank-AG-2023.pdf

REAL-LIFE EXAMPLE OF PROVISION ACCOUNTING BY CISCO

Let us take the example of Cisco and show various provisions made by it during the fiscal year 2023.

As a major technology company, Cisco deals with various risks related to product warranties and legal issues. Cisco accounts for various provisions like provision for warranty costs, legal claims, income tax, and restructuring costs. Some of these provisions that could be identified from the annual reports of the company for fiscal year 2023 are as follows:

1. Provision for Income Taxes: Cisco recognizes Provision for Income Taxes of $ 2,705 million in its Income Statement. The details for the same is disclosed below in the annual reports of the company. The Provision for Income taxes can be seen on the face of the Income Statement and under the balance sheet it can be seen in the liabilities section under the category of Income Taxes Payable.

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

2. Provision for Inventory and liability related to purchase commitments: Cisco accounts provision for inventory which is a component of the cost of sales. The amount of provision is $307 million in 2023. Since it is part of the cost of sales, these provisions cannot be seen on the face of the Income statement or balance sheet. The creation of a provision for inventory reduces the cost of sales in the Income Statement and Inventory Balance on the Balance Sheet hence neutralizing the accounting impact in the financial statements.

The company also accounts provision for the liability related to purchase commitments with contract manufacturers and suppliers of $423 million in 2023.

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

IMPACT OF PROVISIONS ON THE FINANCIAL STATEMENTS OF THE COMPANY

Provisions are accounting estimates set aside to cover future liabilities or losses. Their impact on financial statements is substantial, influencing both the balance sheet and the income statement. Here’s how:

Balance Sheet:

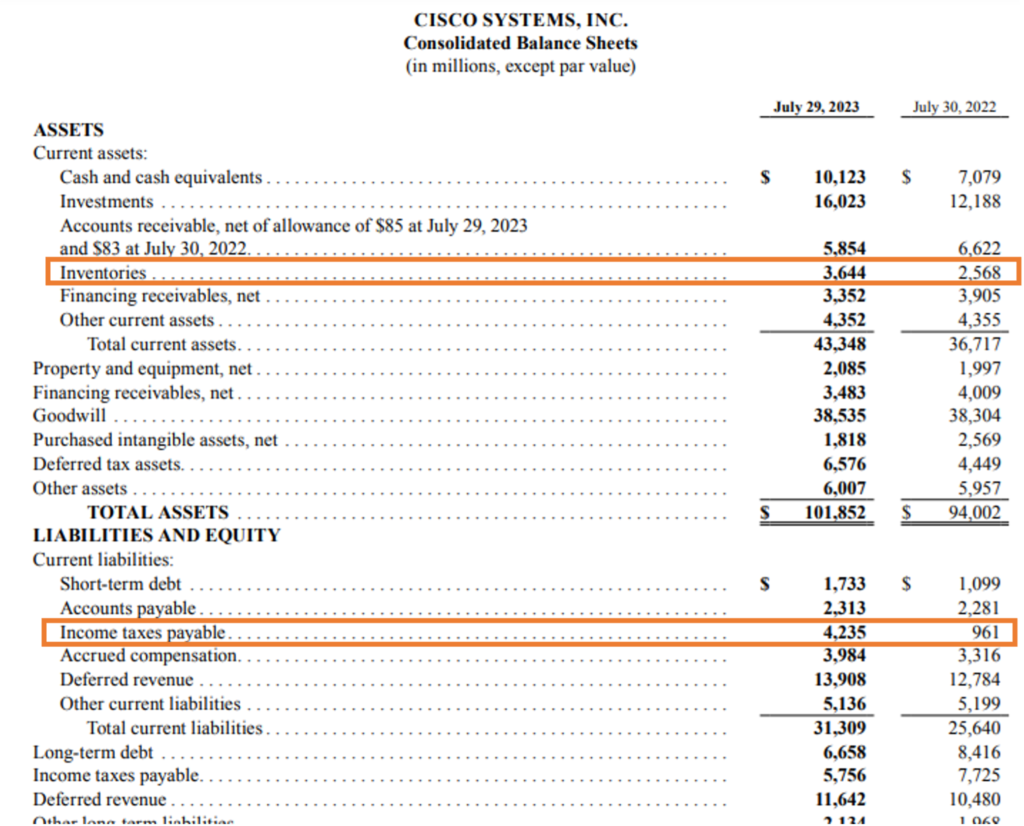

1. Liabilities: Provisions appear as liabilities on the balance sheet. They represent future obligations or potential losses, which can affect the company’s financial position and liquidity.

Cisco shows Provision for Income Taxes in the current liabilities section under the heading named Income Taxes Payable. The breakup of Income Taxes Payable including Provision for Income Taxes can be seen from the notes to accounts of the financial statements.

Also the provision for inventory is shown in the balance sheet as a deduction or write down of inventory.

Below is the Consolidated Balance Sheet of Cisco for the fiscal year 2023.

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

2. Equity: Since provisions are charged against profits, they indirectly affect the retained earnings and overall equity of the company.

Income Statement:

1. Expenses: Provisions are recognized as expenses in the income statement. They reduce the net profit or increase the net loss of the company for the period in which they are recognized.

In the Cisco Income statement, we can see Provision for Income Taxes directly on the face of the Income Statement, whereas the provision for inventory is shown as a part of cost of sales.

Below is the Income Statement of Cisco for the fiscal year 2023.

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

2. Profitability: By recognizing a provision, the company might show reduced profitability, which can impact financial ratios and performance metrics used by investors and analysts.

Disclosure and Transparency:

1. Notes to Financial Statements: Companies need to provide detailed disclosures about provisions, including the nature of the provision, the amount recognized, and any uncertainties related to the provision. This helps in understanding the financial position and risk profile of the company.

Cisco for both provision for income taxes and provision for inventory discloses the following information.

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

Source: Annual Report https://www.cisco.com/c/dam/en_us/about/annual-report/cisco-annual-report-2023.pdf

2. Impact on Financial Ratios: Provisions can affect key financial ratios such as the current ratio, quick ratio, and debt-to-equity ratio, as they impact both the assets and liabilities of the company.

Accurately accounting for provisions ensures that financial statements provide a true and fair representation of the company’s financial health and performance.

ACCOUNTING FOR PROVISIONS: STEPS AND CONSIDERATIONS

- Identifying the Obligation: The first step in accounting for provisions is identifying the obligation. This involves determining whether a liability exists and if it can be reliably estimated.

- Estimating the Amount: Once an obligation is identified, the next step is to estimate the amount required to settle the liability. This estimation should be based on the best available information and consider factors such as historical data and expert opinions.

- Recording the Provision: The provision is then recorded in the financial statements. It is typically recognized as an expense in the income statement and a liability in the balance sheet.

- Reviewing and Adjusting Provisions: Provisions should be reviewed regularly to ensure they remain accurate. If new information becomes available or circumstances change, the provision should be adjusted accordingly.

DIFFERENCE BETWEEN PROVISIONS AND ACCRUED EXPENSES

| Aspect | Provisions | Accrued Expenses |

| Definition | Created for anticipated future liabilities or losses with uncertain timing or amount | Costs incurred but not yet paid or invoiced |

| Purpose | To account for future obligations arising from past events | To recognize expenses in the period they are incurred |

| Obligation | Exists due to a past event | Recognized when expenses are incurred |

| Timing | Future liabilities or losses with uncertain timing | Expenses incurred in the current period but paid in the future |

| Example | Warranty costs: A company sets up a provision for expected warranty claims on products sold | Utility bills: Utilities used in December but billed and paid in January |

| Recording | Recorded as a liability on the Balance Sheet and an expense on the income statement | Recorded as a liability on the balance sheet and as an expense on the income statement |

| Matching | Reflects the estimated cost of fulfilling future obligations | Ensures expenses are matched with the period in which the services were used |

DIFFERENCE BETWEEN PROVISIONS AND RESERVES

| Aspect | Provisions | Reserves |

| Definition | Created for anticipated future liabilities or losses with uncertain timing or amount | Portions of profits set aside to strengthen the financial position or for specific future needs |

| Purpose | To account for future obligations arising from past events | To cover unexpected future expenses, investments, or other specific purposes |

| Obligation | Exists due to a past event | Not tied to a specific obligation but meant for general or specific future use |

| Timing | Future liabilities or losses with uncertain timing | Generally long-term, set aside from profits over time |

| Example | Warranty costs: A company sets up a provision for expected warranty claims on products sold | General reserve: Funds set aside from profits for future expansion or contingencies |

| Recording | Recorded as a liability and an expense on the income statement | Recorded as an appropriation of profit in the equity section of the balance sheet |

| Usage | Used to settle specific future obligations | Used to strengthen the company’s financial stability or for planned future expenditures |

DIFFERENCE BETWEEN PROVISIONS AND CONTINGENT LIABILITY

| Aspect | Provisions | Contingent Liabilities |

| Definition | Created for anticipated future liabilities or losses with uncertain timing or amount | Potential liabilities that may occur depending on the outcome of a future event |

| Recognition | Recognized in the financial statements as a liability and an expense | Not recognized in the financial statements but disclosed in the notes |

| Certainty | Obligation exists due to a past event, though the timing or amount is uncertain | Obligation is possible but not certain, dependent on a future event |

| Example | Warranty costs: A company sets up a provision for expected warranty claims on products sold | Pending lawsuit: A company might disclose a contingent liability for a lawsuit’s potential loss |

| Recording | Recorded in the balance sheet as a liability and in the income statement as an expense | Disclosed in the notes to the financial statements, not recorded in the financial statements |

| Measurement | Amount is estimated based on the best available information | Amount is uncertain and depends on the outcome of a future event |

IMPORTANCE OF PROVISION ACCOUNTING

- Accurate Financial Reporting: Provision accounting ensures that financial statements reflect all known liabilities, providing a more accurate picture of the company’s financial health. This transparency is essential for stakeholders such as investors, creditors, and regulators.

- Regulatory Compliance: Many accounting standards, such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), require the recognition of provisions. Compliance with these standards is essential for maintaining the integrity of financial reporting.

- Risk Management: By setting aside funds for future liabilities, companies can better manage financial risks. This proactive approach helps in mitigating the impact of unforeseen expenses on the company’s financial stability.

- Budgeting and Planning: Provision accounting aids in effective budgeting and financial planning. By anticipating future costs, businesses can allocate resources more efficiently and avoid unexpected financial strain.

CHALLENGES AND BEST PRACTICES

- Estimating Amounts Accurately: One of the main challenges in provision accounting is estimating the amount of future liabilities accurately. Inaccurate estimates can lead to either under-provisioning or over-provisioning, both of which can distort financial statements.

- Judgment and Subjectivity: Provision accounting often involves a degree of judgment and subjectivity, particularly in estimating future liabilities. It is essential to base these judgments on reliable data and sound reasoning to maintain the integrity of financial reporting.

- Regular Review and Adjustment: Provisions should be reviewed and adjusted regularly to ensure they reflect current information and circumstances. This ongoing review process is critical for maintaining accurate financial statements.

CONCLUSION

Accounting for provisions is crucial for maintaining the accuracy and reliability of financial statements. By setting aside funds for future liabilities, companies can better manage financial risks and maintain regulatory compliance. While there are challenges in estimating and recording provisions, adhering to best practices and regularly reviewing provisions can help businesses achieve accurate financial reporting and sound financial management. Understanding provision accounting is essential for anyone involved in financial management, from accountants and auditors to business owners and investors.