INTRODUCTION

Operating leases are a common financial arrangement in which the lessee (user) rents an asset from the lessor (owner) for a specified period without the intention of ownership. This arrangement is prevalent in various industries, offering flexibility and cost-effectiveness for businesses needing to use equipment, vehicles, or property without committing to long-term ownership. This article provides a detailed overview of operating leases, their benefits, accounting treatment, and how they differ from other leases.

WHAT IS AN OPERATING LEASE?

An operating lease is a contractual agreement allowing the lessee to use an asset the lessor owns for a predetermined period. Unlike a finance lease, where the lessee assumes the risks and rewards of ownership, an operating lease keeps ownership and the related risks with the lessor. At the end of the lease term, the asset is typically returned to the lessor.

Keywords of the Operating Leases are detailed below:

Lease Term and Usage

- Predetermined Period: An operating lease defines a set period during which the lessee is entitled to use the asset. This period is typically shorter than the useful life of the asset, allowing for flexibility in asset management and utilization.

- Usage Rights: During the lease term, the lessee can use the asset as per the agreement’s terms. This allows businesses to access necessary equipment or property without the commitment and financial burden of purchasing it.

Ownership and Risk

- Ownership Retention: Unlike finance leases, where the lessee may eventually gain ownership of the asset, operating leases ensure that ownership remains with the lessor throughout the lease term. This means the lessor is responsible for the asset’s residual value and any associated risks.

- Risk Management: The risks related to the asset, including depreciation, obsolescence, and maintenance, generally remain with the lessor. This is beneficial for lessees who prefer not to handle the complexities of asset management.

End-of-Term Considerations

- Asset Return: Once the lease term is over, the asset is usually returned to the lessor. This arrangement is particularly advantageous for businesses that need the asset for a temporary period or anticipate upgrading to newer technology soon.

- Renewal and Extension Options: Some operating leases may include options to renew or extend the lease. This provides lessees with additional flexibility to continue using the asset if needed, without committing to long-term ownership.

KEY FEATURES OF OPERATING LEASES

Operating leases have several defining characteristics that distinguish them from other types of leases, such as finance leases. These features provide significant advantages to lessees, particularly in terms of flexibility, cost management, and operational efficiency. Below is an in-depth look at the key features of operating leases:

1.Short-term Commitment

- Flexibility in Duration: Operating leases typically have shorter lease terms than finance leases. This shorter duration allows businesses to adjust their asset usage based on current needs and market conditions. For instance, a company could lease computers for three years, allowing them to upgrade to newer models as technology progresses.

- Adaptability: The short-term nature of operating leases enables businesses to adapt quickly to changes in their operational requirements without being tied down by long-term commitments. This is particularly beneficial in fast-paced industries where technology and equipment can become obsolete quickly.

- Budget Management: With shorter commitments, businesses can better manage their budgets by avoiding large capital expenditures and spreading costs over a manageable period.

2. No Ownership Transfer

- Temporary Usage: In an operating lease, the lessee uses the asset without the intention or option to purchase it at the end of the lease term. This makes it ideal for assets that are needed temporarily or are subject to rapid technological changes.

- Return of Asset: Upon the lease’s conclusion, the asset is returned to the lessor, thereby relieving the lessee of the responsibility for managing asset disposal or contending with its depreciation over time.

- Focus on Core Activities: Without the concern of asset ownership, businesses can focus their resources and efforts on their core activities rather than on asset management and maintenance.

3. Maintenance and Insurance

- Lessor Responsibility: In many operating lease agreements, the lessor retains responsibility for the asset’s maintenance and insurance. This arrangement transfers the burden of upkeep and risk management from the lessee to the lessor.

- Cost Savings: By not having to handle maintenance and insurance, lessees can save on these costs and reduce administrative tasks. This is particularly advantageous for small to medium-sized enterprises (SMEs) that may not have the resources to manage these responsibilities efficiently.

- Operational Efficiency: Lessees benefit from having well-maintained and insured assets, ensuring uninterrupted use and reducing downtime. This contributes to overall operational efficiency and productivity.

4. Off-balance Sheet Financing

- Historical Accounting Treatment: Historically, operating leases were not recorded on the lessee’s balance sheet, allowing companies to keep liabilities off their financial statements.

- Current Accounting Treatment: Recent changes in accounting standards, such as the Financial Accounting Standards Board (FASB) ASC 842 and International Financial Reporting Standards (IFRS) 16, now require lessees to recognize operating leases on their balance sheets. This includes recording a right-of-use asset and a corresponding lease liability for leases longer than 12 months.

- Transparency and Disclosure: The updated standards enhance transparency and provide stakeholders with a more accurate representation of a company’s financial obligations. This increased disclosure helps investors, lenders, and other stakeholders better understand the financial impact of leasing arrangements on the company’s overall financial position.

PRACTICAL EXAMPLES OF OPERATING LEASES

- Office Equipment: A company may lease office equipment like printers, computers, and photocopiers under an operating lease. This allows them to use up-to-date technology without investing heavily in purchasing and maintaining the equipment.

- Real Estate: Businesses often lease office spaces or retail locations under operating leases. This arrangement provides flexibility to move or expand without being tied down by property ownership.

- Vehicles: Many companies lease vehicles for their employees or for operational needs through operating leases, ensuring they can update their fleet regularly and avoid the long-term costs of ownership.

OPERATING LEASE VS. CAPITAL LEASE

Here’s a detailed comparison between operating leases and capital leases (also known as finance leases) under US GAAP, presented in a tabular format:

| Feature | Operating Lease | Capital Lease (Finance Lease) |

| Definition | A lease in which the lessor retains ownership and associated risks of the asset. The lessee uses the asset for a specified period. | A lease that effectively transfers most of the risks and rewards of ownership to the lessee. The lessee has the option to purchase the asset or automatically gain ownership at the lease end. |

| Ownership | Ownership remains with the lessor. | Ownership transfers to the lessee either during or at the end of the lease term. |

| Lease Term | Typically shorter, often less than the useful life of the asset. | Generally covers most or all of the useful life of the asset. |

| Balance Sheet Treatment (ASC 842) | Both right-of-use asset and lease liability are recognized on the balance sheet for leases longer than 12 months. | Right-of-use assets and lease liability are recognized on the balance sheet. |

| Lease Expense | Lease payments are expensed on a straight-line basis over the lease term. | Lease payments are split into interest expense and amortization of the right-of-use asset. |

| Criteria for Classification | If none of the finance lease criteria are met (see below)*. | Meets one or more of the following: 1. Transfer of ownership by end of lease term 2. Bargain purchase option 3. The lease term is 75% or more of the asset’s economic life 4. The present value of lease payments is 90% or more of the asset’s fair value 5. The asset is of a specialized nature with no alternative use to the lessor after the lease ends. |

| Risk and Reward | Retained by the lessor. | Transferred to the lessee. |

| Depreciation | It is not recognized by the lessee. The lessor depreciates the asset. | It is recognized by the lessee, as the asset is treated similarly to owned assets. |

| Maintenance and Insurance | Typically the responsibility of the lessor. | Typically the responsibility of the lessee. |

| End-of-term Options | The asset is returned to the lessor. | Lessee may purchase the asset or continue leasing at a nominal rate. |

| Impact on Financial Ratios | Traditionally, less impact on debt ratios (though ASC 842 now requires balance sheet recognition). | Increases both assets and liabilities, affecting debt ratios. |

*Criteria for Classification of Finance Lease (Under ASC 842)

- Transfer of Ownership: The lease agreement specifies that ownership of the asset transfers to the lessee upon the lease term’s completion.

- Bargain Purchase Option: The lessee in the lease agreement has an option to buy the asset at a price considerably below its anticipated fair market value when the option can be exercised.

- Lease Term: The lease term is for the major part of the remaining economic life of the asset (generally 75% or more).

- Present Value: The present value of the lease payments amounts to at least substantially all of the fair value of the leased asset (generally 90% or more).

- Specialized Nature: The asset is specialized in a way that the lessor anticipates no other viable use for it at the lease term’s conclusion.

These criteria help in determining a finance lease. If none of these criteria is met, then the lease is classified as an operating lease. This classification between finance and operating lease is important as it influences the financial reporting and treatment of the leased asset.

OPERATING LEASE IMPACT ON THE COMPANY FINANCIALS

Operating lease information can be found in several sections of a company’s financial statements. Here are the primary places to look:

1. Balance Sheet

Under ASC 842, both the right-of-use (ROU) asset and the lease liability for operating leases are recognized on the balance sheet. These items are usually listed under non-current assets and non-current liabilities, respectively.

- Right-of-Use Asset: This will be listed under non-current assets, sometimes grouped with other long-term assets.

- Lease Liability: This will be split into current and non-current portions, with the current portion listed under current liabilities and the non-current portion under non-current liabilities.

2. Income Statement

The lease expense for operating leases is recorded on a straight-line basis over the lease term. This expense can usually be found in the following sections, depending on the nature of the lease:

- Operating Expenses: Lease expenses related to operating activities (e.g., office rent).

- Cost of Goods Sold (COGS): If the lease expense is directly related to the production process.

3. Cash Flow Statement

Lease payments are included in the operating activities section of the cash flow statement:

- Cash Paid for Operating Leases: This will appear under cash flows from operating activities.

4. Notes to the Financial Statements

The notes to the financial statements provide detailed disclosures about leasing arrangements, including both operating and finance leases. Key disclosures typically include:

- Lease Terms: Information about the duration and terms of significant lease agreements.

- Lease Payments: Future lease payment obligations, are often broken down by year.

- Lease Expense: Total lease expense for the period, which may include a breakdown of different types of leases.

- ROU Asset and Lease Liability: Details on the right-of-use asset and lease liability, including the methodology for calculating these amounts.

- Discount Rate: The discount rate used to calculate the present value of lease payments.

REAL-LIFE EXAMPLE OF OPERATING LEASES

To understand the disclosure of lease information better let us look at the example of DELTA AIR LINES, INC. The notes section of Form 10-K for Delta Airlines Inc. shows the following information.

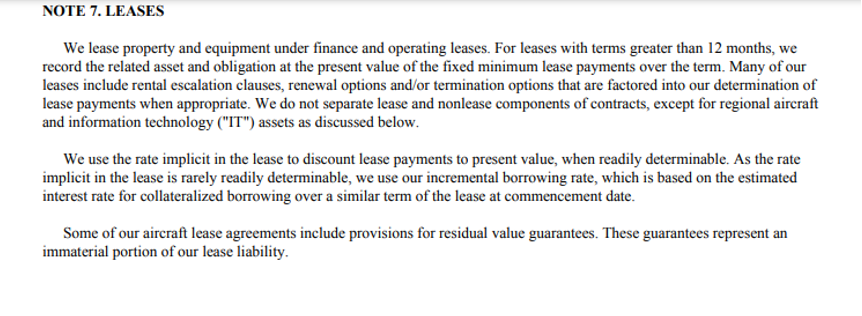

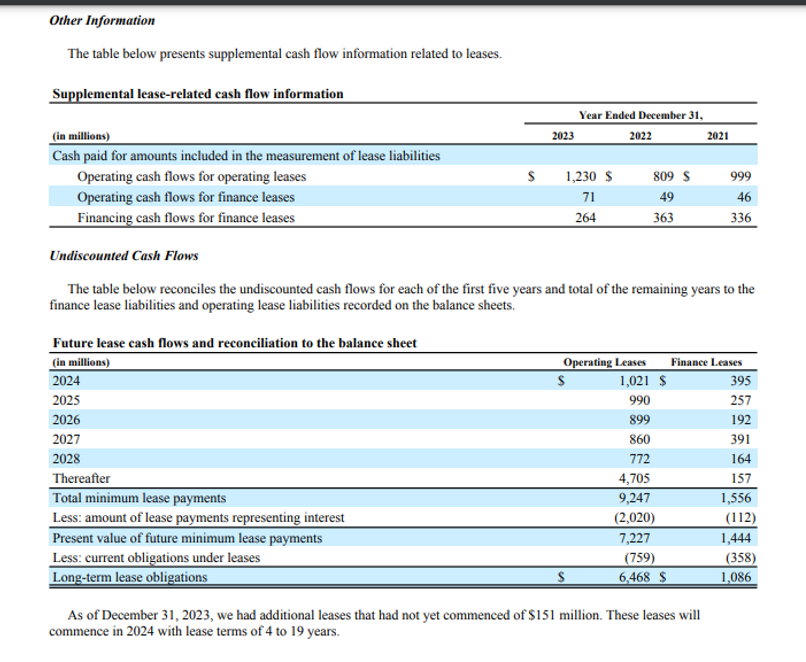

Source: Note 7 of Form 10-K

https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

Delta Airlines discloses that it leases property and equipment both under operating and finance leases. It also discloses all the important information relating to the leased property and equipment. These disclosures enhance the operating transparency of the company and make it easier for analysts, investors, and financial institutions to compare the costs and benefits involved with companies’ leasing decisions.

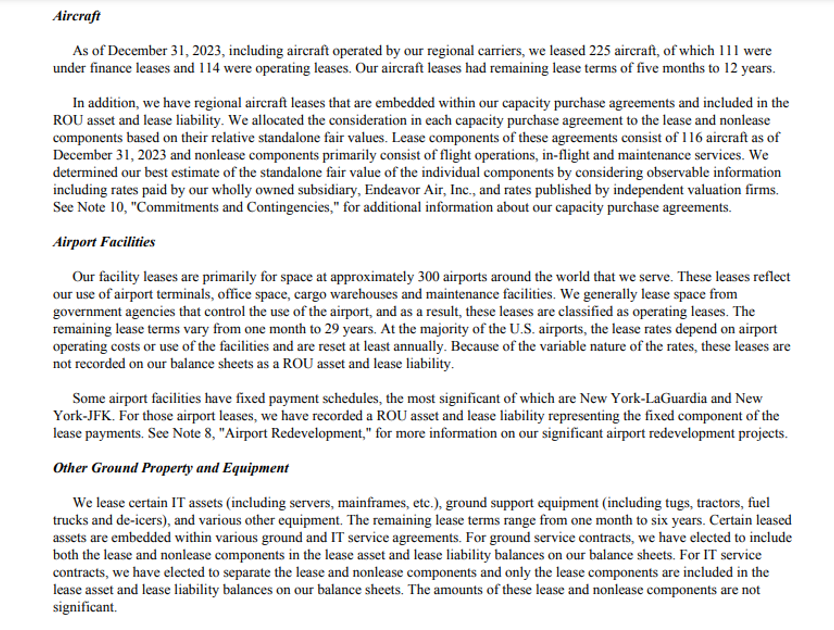

Source: Note 7 of Form 10-K

https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

In this section, the company has listed different categories of property and equipment leased by it. It also mentions which kind of lease it has opted for each category of asset and the basis of lease valuation.

***

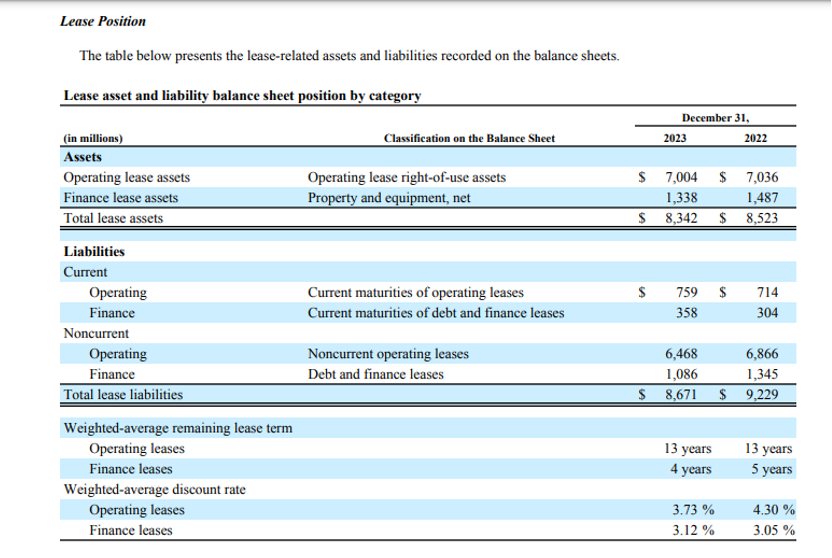

Source: Note 7 of Form 10-K

https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

The company has given a detailed description of the lease position in the company’s balance sheet category-wise. Any stakeholder can get a complete detail of the company’s leasing strategy and its impact on the financial statement.

***

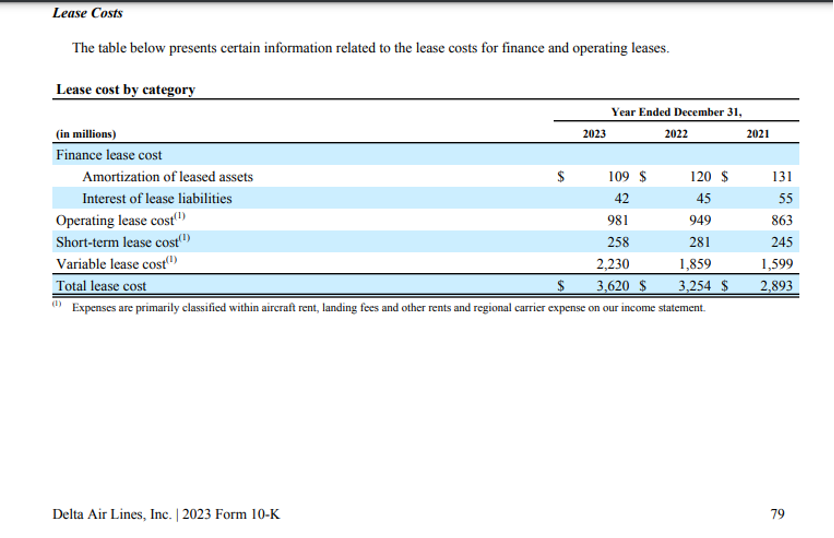

Source: Note 7 of Form 10-K

https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdfx

The company discloses the cost involved around the leased property and equipment. These operating lease costs are clubbed within broad cost heads in the Income statement like the aircraft rent and landing fees. Hence the operating cost is not traceable directly in the Income Statement of this company.

***

Source: Note 7 of Form 10-K

https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

In the above information, the company discloses the cash flow-related details of the leases and its estimated future cash flows. The company has major long-term lease obligations in the form of operating leases as compared to finance leases.

***

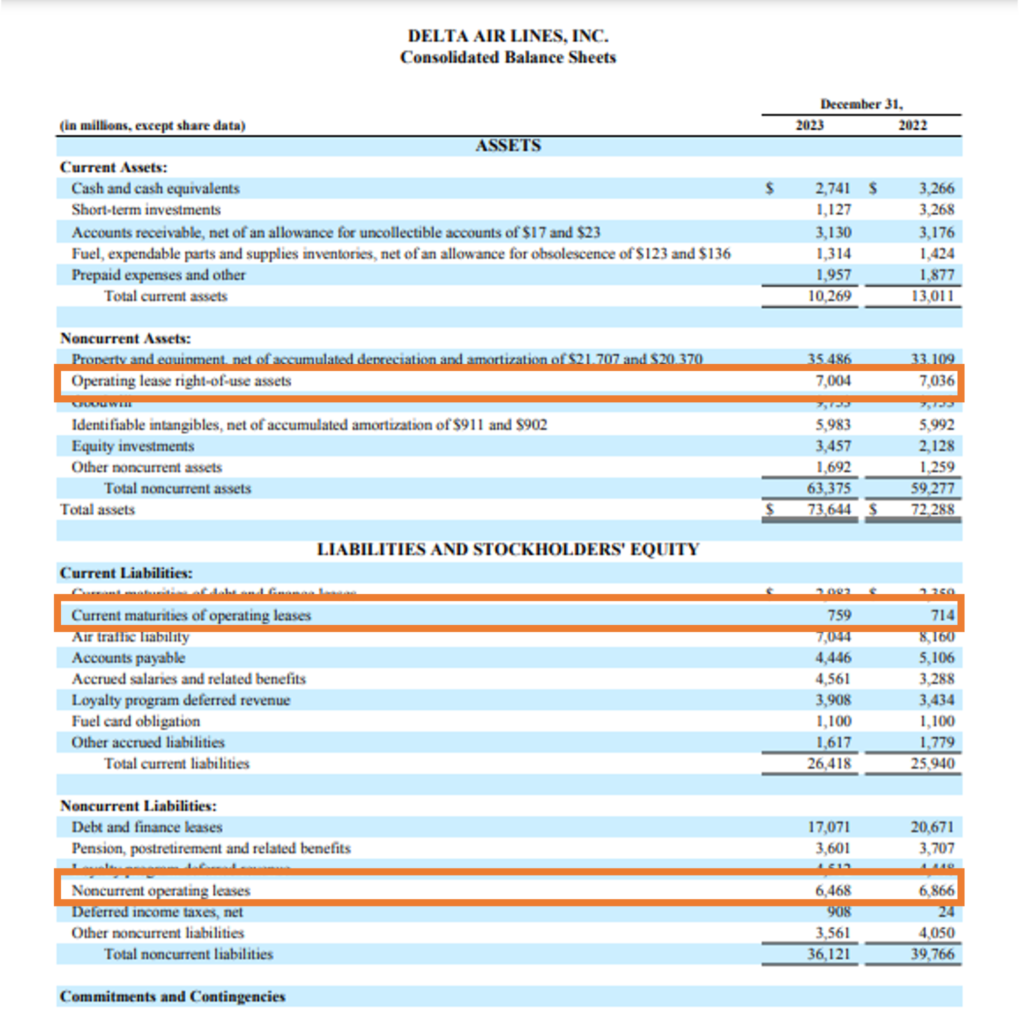

Operating Lease on the Balance Sheet of the company.

Source: https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

From the above Balance Sheet of the company, we find that the company has grouped Operating lease assets under Non-current assets and Operating lease liabilities under Current and Non-current liabilities. The Operating lease asset total is $7004 million while the total operating lease liabilities are $7227 million. We must note here that the total amounts for operating lease assets and operating lease liabilities on a company’s balance sheet may differ slightly due to several reasons related to the accounting treatment of these items under the relevant accounting standards, such as IFRS 16 or ASC 842. Understanding these factors helps in accurately interpreting a company’s balance sheet and financial health.

***

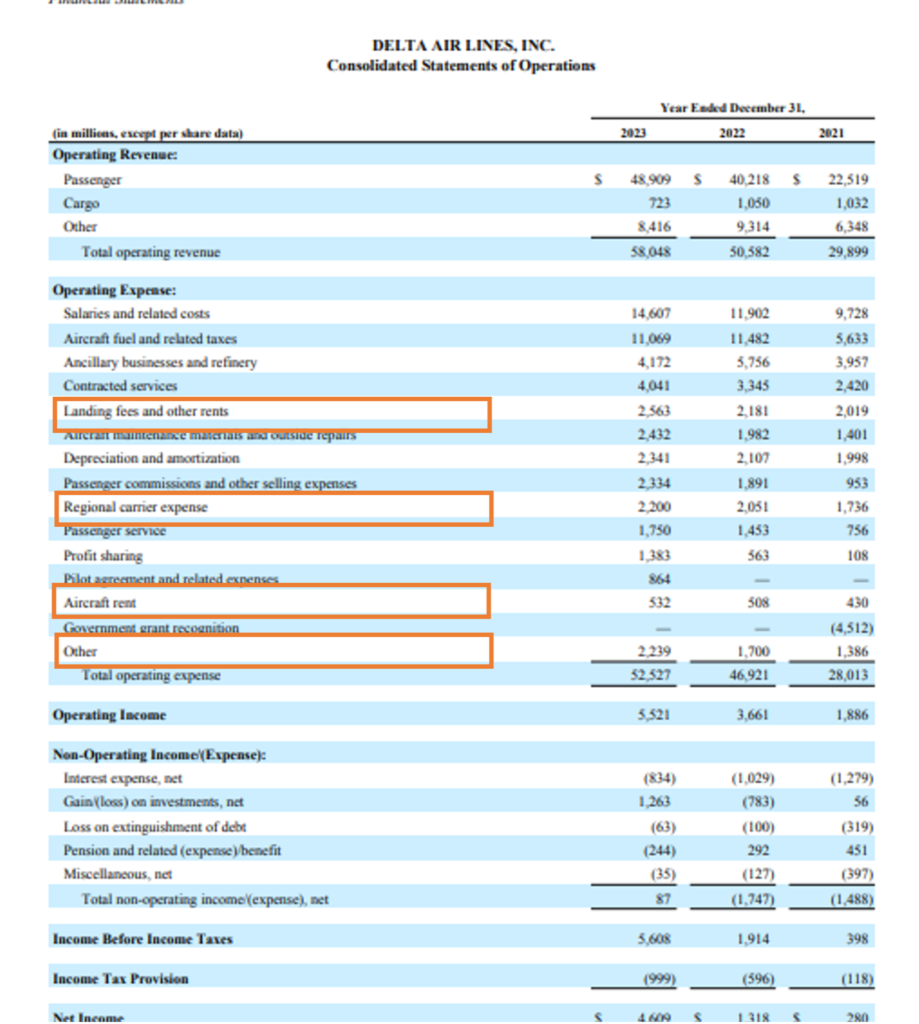

Source: https://s2.q4cdn.com/181345880/files/doc_financials/2023/q4/02/dal-12-31-2023-10k-2-12-24-filed.pdf

From the above Income Statement, we cannot find the Operating lease expenses directly as these costs are embedded in other costs like aircraft rent, landing fees, and other rents and regional carrier expenses. The details of the operating lease expenses can be found in Note 7 (Leases) of the Financial Statements.

DISADVANTAGES OF OPERATING LEASES

Some of the disadvantages of operating leases are as under:

- Higher Long-Term Cost

Over the long term, the total cost of leasing can be higher than purchasing the asset outright, as lease payments include the lessor’s profit margin.

- No Ownership Benefits

At the end of the lease term, the lessee does not own the asset, meaning they do not benefit from any residual value or potential appreciation.

- Limited Customization

Operating leases may come with restrictions on how the leased asset can be used, maintained, or modified, limiting the lessee’s flexibility.

- Continuous Expense

Leasing requires continuous payments throughout the lease term, which can strain cash flow, especially if the asset is needed for a prolonged period.

- Potential for Higher Interest Rates

Operating leases may have an implicit interest rate that is higher than current market rates, leading to higher financing costs over time.

- Financial Statement Impact (ASC 842)

With the implementation of ASC 842, operating leases must be recognized on the balance sheet, increasing reported liabilities and potentially affecting financial ratios and borrowing capacity

CONCLUSION

A strategic advantage is provided by the Operating leases for businesses that want to use assets without the burden of ownership. They provide flexibility, cost management, and potential tax benefits, making them an attractive option for many companies. Understanding the accounting implications and differentiating operating leases from financing eases are crucial for making informed financial decisions. With the evolving accounting standards, transparency in lease reporting has increased, allowing businesses to better manage their leasing arrangements and financial statements.