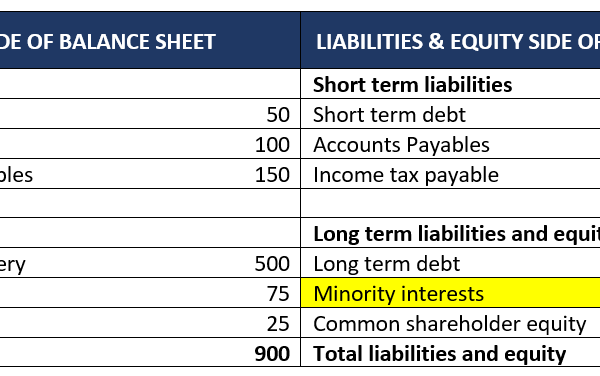

If you have ever looked at the Balance sheet of large companies, you would often find this line item Minority Interest on the liabilities section.

They look something like below:

Ever wondered what are these?

Well these are equity-equivalent liabilities of a company.

But they are NOT really the shareholders/owners of the entire company.

Caution, they are not same as minority investors who typically hold a small % of share of the company.

Let us understand Minority Interests through an example.

Take a hypothetical company ABC Ltd.

This company has a joint venture/partnership with another firm say PQR Ltd.

The joint venture firm is called ABCPQR Ltd.

The ownership structure of ABCPQR Ltd is 80:20.

That is 80% of the joint venture is owned by ABC Ltd.

And 20% is owned by PQR Ltd.

Now, the total equity investment made by the two partners is $100 mn.

So ABC has contributed $80mn in line with 80% of its share.

And PQR has contributed $20mn in line with 20% of its share.

This 20% contribution or $20 mn is the minority interest in the company.

This is what is reflected in the balance sheet of the company above.

So Minority interest refer to the share of capital provided by a JV partner in JV or a Partnership with the company.

You may wonder, why does it appear at all in ABC Ltd Balance sheet?

This is because of Accounting rules and regulations.

If a Firm has more than 50% stake in a JV/Partnership, it will need to be “consolidated” on the balance sheet of that Firm.

In this case, all the assets and liabilities of the JV ABCPQR Ltd will be recorded in ABC Ltd Balance sheet.

So, ABC Ltd. records the entire assets of the JV ABCPQR Ltd of $100 mn in its books.

However, ABC’s own contribution is only $80 mn which is already reflected in its shareholder capital.

The remaining $20 mn is the contribution by PQR Ltd. in the JV.

Hence, this $20 mn gets recorded as a minority interest in the liabilities section.

How does the balance of Minority Interest change over time?

Well, any profit that the JV/Partnership makes gets attributed between the 2 partners in 80:20 ratio.

So, if the JV makes a profit of USD 10 mn, then the share of profit of Minority Interest partner is just USD 2mn.

The Minority interest balance will increase by this share of profit i.e USD 2 mn of the minority partner every year.

Also, if there is more investment in the JV firm, the contribution of the minority partner will also get added.

Finally, if the minority partner gets dividend or is paid back the capital contribution it has made, it will reduce the balance of minority partner.

So in essence, Minority Interests behave like smaller Partners in a Joint Venture with the larger Partner.

Remember, minority interests in not the same as minority investors!

Fun fact: Minority Interests are also sometimes called Non-Controlling Interests!

So then, who are Minority Investors?

Minority Investors are simply the smaller owners of an entire company i.e. ABC Ltd in this case.

If there are some individuals who hold a very small % of total shares of ABC Ltd, they would be classified as Minority Investors.

Minority investors still have ownership on the entire company although a very small portion of it.

In most cases, retail individual investors are classified as minority investors.

Does this help clear the confusion? Let us know what you think!

*The Learning Hour is a weekly knowledge sharing initiative of SKILLFIN LEARNING. To subscribe to this initiative, kindly mail us at [email protected]. We will add you to the distribution list.

89 thoughts on “Minority Interests vs. Minority Investors: Understanding the Differences”

… [Trackback]

[…] Find More on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Find More here to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Find More on on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Find More on to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] There you can find 20635 additional Info to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Read More Information here to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Here you can find 14661 additional Info to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] There you will find 11274 more Info to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] There you can find 11353 additional Information to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Find More on on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

… [Trackback]

[…] There you can find 85660 additional Information to that Topic: skillfine.com/minority-interests-vs-minority-investors-differences/ […]

It haѕ a hugе spread of options thazt greatly improve

tһе compliance experience.

A round of applause for your blog.

Awesome article post.Thanks Again. Keep writing.

Muchos Gracias for your blog.Really thank you!

This is one awesome post.Really thank you! Will read on…

Great, thanks for sharing this blog.Thanks Again. Will read on…

Im obliged for the article post.Really looking forward to read more. Great.

Really enjoyed this blog article.Thanks Again. Really Great.

Thanks for sharing, this is a fantastic article post.Really thank you! Fantastic.

Looking forward to reading more. Great article post.Much thanks again. Will read on…

Thanks for sharing, this is a fantastic article post.Really thank you!

Say, you got a nice blog article.Much thanks again. Want more.

Very good blog post.

I truly appreciate this article.Really looking forward to read more. Great.

Fantastic blog article. Awesome.

Awesome post.Thanks Again.

Thank you ever so for you blog post.Really thank you! Cool.

Appreciate you sharing, great article post.Much thanks again. Really Cool.

Enjoyed every bit of your article. Want more.

Great, thanks for sharing this post.Really thank you! Great.

Thanks a lot for the article post.Really looking forward to read more. Much obliged.

Great, thanks for sharing this article post.Much thanks again. Really Cool.

Really enjoyed this article.Thanks Again.

Fantastic post.Really thank you! Want more.

I really like and appreciate your blog. Will read on…

This is one awesome blog article.Really thank you!

I appreciate you sharing this article.Really looking forward to read more. Great.

I really like and appreciate your article.Really looking forward to read more. Keep writing.

I really enjoy the post.Thanks Again.

I appreciate you sharing this blog post.Really looking forward to read more. Cool.

A round of applause for your post.Really looking forward to read more. Keep writing.

Thanks a lot for the blog.Thanks Again. Awesome.

Thank you ever so for you blog post.Thanks Again. Fantastic.

Im thankful for the blog post.Thanks Again.

I think this is a real great article post.Much thanks again. Great.

wow, awesome blog. Want more.

Great, thanks for sharing this blog article.Really looking forward to read more. Really Cool.

Really enjoyed this blog.Thanks Again. Great.

Fantastic blog post.Thanks Again. Will read on…

Thank you for your blog.Thanks Again. Much obliged.

I am so grateful for your post.Thanks Again. Really Cool.

Thanks for sharing, this is a fantastic blog article. Great.

Im thankful for the article post. Great.

Fantastic post.Thanks Again. Awesome.

I really liked your blog.Thanks Again. Much obliged.

Explore the ethical dimensions of environmental decision-making and the trade-offs between economic interests and environmental preservation.

Thanks a lot for the blog post. Awesome.

wow, awesome article.Much thanks again. Much obliged.

Thanks for sharing, this is a fantastic article post.Really thank you! Really Cool.

I really like and appreciate your post. Really Great.

Say, you got a nice article post.Really looking forward to read more. Cool.

Major thanks for the article.Much thanks again. Really Great.

Thanks a lot for the article post. Great.

Major thankies for the post.Really looking forward to read more. Want more.

Appreciate you sharing, great post.Thanks Again. Keep writing.

Hello my friend! I wish to say that this post is amazing, nice written and include approximately all significant infos. I?d like to see more posts like this.

Great work! This is the kind of information that are supposed to be shared across the net. Disgrace on the search engines for now not positioning this submit higher! Come on over and visit my website . Thanks =)

Another issue is really that video gaming became one of the all-time most important forms of entertainment for people of any age. Kids enjoy video games, and also adults do, too. The particular XBox 360 has become the favorite gaming systems for those who love to have a huge variety of video games available to them, as well as who like to learn live with people all over the world. Thanks for sharing your notions.

Thanks for your posting on the traveling industry. I’d personally also like contribute that if you’re a senior thinking about traveling, it can be absolutely vital that you buy travel insurance for senior citizens. When traveling, older persons are at biggest risk of having a health care emergency. Receiving the right insurance plan package in your age group can safeguard your health and provide peace of mind.

Thanks for the useful information on credit repair on all of this blog. Some tips i would offer as advice to people will be to give up the mentality they will buy right now and fork out later. Like a society many of us tend to do this for many issues. This includes holidays, furniture, and items we wish. However, you’ll want to separate one’s wants from the needs. As long as you’re working to improve your credit rating score you have to make some trade-offs. For example you’ll be able to shop online to save money or you can click on second hand outlets instead of expensive department stores with regard to clothing.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

This article is a breath of fresh air! The author’s distinctive perspective and perceptive analysis have made this a truly engrossing read. I’m grateful for the effort she has put into producing such an informative and mind-stimulating piece. Thank you, author, for sharing your wisdom and igniting meaningful discussions through your brilliant writing!

Heya i?m for the first time here. I came across this board and I in finding It really helpful & it helped me out a lot. I’m hoping to provide something back and help others like you helped me.

Thanks for your posting. One other thing is always that individual states in the United states of america have their own laws that will affect householders, which makes it extremely tough for the our lawmakers to come up with a different set of rules concerning foreclosures on householders. The problem is that every state offers own laws and regulations which may have impact in an unwanted manner in terms of foreclosure insurance policies.

With the whole thing that seems to be developing throughout this particular area, your viewpoints happen to be relatively stimulating. However, I beg your pardon, but I do not give credence to your entire theory, all be it exciting none the less. It looks to me that your remarks are not entirely rationalized and in fact you are yourself not even wholly convinced of your assertion. In any case I did appreciate reading it.

You could certainly see your enthusiasm in the work you write. The world hopes for even more passionate writers such as you who aren’t afraid to mention how they believe. Always go after your heart.

One more thing is that when searching for a good on the internet electronics retail outlet, look for online stores that are regularly updated, always keeping up-to-date with the newest products, the very best deals, and also helpful information on products and services. This will ensure you are dealing with a shop that really stays over the competition and give you what you need to make intelligent, well-informed electronics buying. Thanks for the vital tips I’ve learned from the blog.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!