INTRODUCTION

Mergers and Acquisition (M&A) refer to the process where two companies combine (merger) or one company purchases another (acquisition). These intricate transactions can significantly affect a company’s financial statements. Proper accounting for M&A activities is crucial for providing an accurate representation of the financial health and performance of the involved entities. This article explores the key aspects of M&A accounting, including the acquisition method, purchase price allocation, subsequent accounting considerations, advantages of M&A accounting, impact on financial statements, key considerations for the analyst, and some real-life examples of M&A transactions.

WHAT IS MERGERS AND ACQUISITION?

Merger

A merger occurs when two companies of approximately equal size and power combine to form a new entity. In this process, both companies cease to exist independently and instead create a new company. The goal of a merger is often to combine resources, improve efficiency, and increase market share. Even though a new entity emerges from the merger, for accounting purposes identifying the acquirer is necessary under the guidance provided in ASC 810 Consolidation or IFRS 10 Consolidated Financial Statements, which determines the entity with the controlling financial interest. As per the guidance, the acquirer is:

- The entity that issues equity interests (stock) is typically the acquirer

- The entity whose board of directors or governing body can control decisions is often the acquirer.

- The larger entity in terms of assets, revenue, or other key metrics is typically the acquirer

- If the terms of the exchange indicate that one entity is transferring significant resources or assuming significant liabilities, that entity may be the acquirer

For example, Company A and Company B merge. Company A issues shares to the shareholders of Company B. Company A’s board of directors will control the combined entity, and Company A is larger in terms of assets and revenue. Thus, Company A is identified as the acquirer.

Acquisition

An acquisition occurs when one company (the acquirer) purchases another company (the target) and takes control of its operations. The acquired company might operate as a subsidiary or undergo complete integration into the acquiring company. In contrast to a merger, where a new entity forms, in an acquisition, the acquirer maintains its identity while the target company may either cease to exist or operate as a subsidiary. As per the US GAAP, the acquirer recognizes the identifiable assets acquired, liabilities assumed, and any non-controlling interest of the target company at their fair values on the acquisition date. Identifying the acquirer is simpler under the Acquisition, unlike the merger where a new entity is formed.

For example, Company X acquires Company Y for $1 million in cash. The fair value of Company Y’s net identifiable assets is $800,000. The acquisition will create $200,000 in goodwill in the books of Company X who is the acquirer.

THE ACQUISITION METHOD of M&A ACCOUNTING

The acquisition method, also known as purchase accounting, is the standard approach for recording Mergers as well as Acquisition transactions under both the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). This method involves several key steps:

- Identification of the Acquirer:

The first step is to identify the acquiring entity in the transaction. The acquirer is typically the entity that obtains control over the other entity or net assets. In the case of acquisition identifying the acquirer is quite simple as compared to the merger. In case of a merger, the acquirer needs to be identified as per the guidance laid down in the accounting standards.

- Determination of the Acquisition Date:

The acquisition date is the date on which the acquirer effectively gains control of the acquiree. This date is crucial as it determines when the assets, liabilities, and operations of the acquiree are included in the acquirer’s financial statements.

- Measurement of the Purchase Consideration:

The purchase consideration includes all forms of payment made to acquire the target company, such as cash, equity instruments, or contingent considerations. The total purchase price is measured at fair value on the acquisition date.

PURCHASE PRICE ALLOCATION (PPA)

Once the acquisition date and purchase consideration are determined, the next step is the purchase price allocation. This process involves allocating the purchase price to the acquired assets and assumed liabilities based on their fair values. Key steps in the PPA process include:

- Identification and Valuation of Tangible Assets: Tangible assets such as property, plant, and equipment are identified and valued at their fair market value.

- Identification and Valuation of Intangible Assets: Intangible assets, including trademarks, patents, customer relationships, and proprietary technologies, are identified and valued. This step often requires specialized valuation techniques and expertise.

- Recognition of Goodwill: Goodwill is recognized when the purchase price exceeds the fair value of the identifiable net assets. It signifies the future economic benefits from assets that are not individually identifiable and separately recognized. Goodwill is not amortized but undergoes annual impairment testing.

- Recognition of Liabilities: All assumed liabilities, including contingent liabilities and long-term debt, are recognized at their fair value on the acquisition date.

SUBSEQUENT ACCOUNTING CONSIDERATIONS

After the initial recording of the M&A transaction, several ongoing accounting considerations must be addressed:

- Goodwill Impairment Testing: Goodwill is tested for impairment at least annually or more frequently if events or changes in circumstances indicate a potential impairment. Impairment happens when the carrying amount of goodwill surpasses its fair value, leading to a write-down.

- Amortization of Intangible Assets: Intangible assets with finite useful lives are amortized over their estimated useful life, with the amortization expense recorded in the income statement.

- Contingent Consideration Adjustments: If the purchase consideration includes contingent payments based on future performance, adjustments to the contingent consideration are made as conditions are met. These adjustments can affect the fair value of the contingent liability and impact net income.

- Integration and Restructuring Costs: Costs associated with integrating the acquired business and restructuring activities are expensed as incurred. These costs can include severance payments, relocation expenses, and costs related to consolidating operations.

DISCLOSURE REQUIREMENTS

Transparent disclosure of M&A activities is essential for stakeholders to understand the financial impact of the transactions. Key disclosure requirements include:

- Description of the Acquisition: A detailed description of the acquired business, the acquisition date, and the primary reasons for the acquisition.

- Purchase Price Allocation: A breakdown of the purchase consideration and the allocation of the purchase price to the acquired assets and assumed liabilities.

- Goodwill and Intangible Assets: Information on the amount of goodwill recognized, the factors contributing to goodwill, and the useful lives and amortization methods for intangible assets.

- Impact on Financial Statements: Disclosure of the pro forma impact of the acquisition on the acquirer’s financial statements, including revenue and net income.

IMPACT ON FINANCIAL STATEMENTS

The impact of M&A on financial statements is profound, affecting various components of the balance sheet, income statement, and cash flow statement.

1. Balance Sheet:

- Increased Assets and Liabilities: The acquisition adds the fair value of the acquired assets and assumed liabilities to the acquirer’s balance sheet, expanding the company’s asset base and obligations.

- Goodwill and Intangible Assets: Goodwill and identified intangible assets are recorded as long-term assets. Goodwill reflects the premium paid over the fair value of net identifiable assets and remains on the balance sheet unless impaired.

2. Income Statement:

- Amortization and Impairment: Intangible assets with finite useful lives are amortized over their estimated lives, impacting net income. Goodwill is tested annually for impairment; if impaired, it results in an expense that reduces net income.

- Integration and Restructuring Costs: Costs related to integrating the acquired business and restructuring activities are expensed as incurred, affecting profitability.

3. Cash Flow Statement:

- Operating Cash Flows: Non-cash expenses such as amortization and goodwill impairment are added back to net income in the operating cash flow section.

- Investing Cash Flows: The cash paid for the acquisition is reported as an outflow in the investing section, reflecting the investment made to acquire the business.

ADVANTAGES OF M&A ACCOUNTING

M&A accounting offers several advantages for companies engaged in mergers and acquisitions. These advantages include:

- Consolidation of Financial Statements: M&A accounting facilitates the consolidation of the financial statements of the acquired company with those of the acquiring company. This offers a thorough overview of the combined entity’s financial position, performance, and cash flows, assisting in decision-making and strategic planning.

- Enhanced Reporting Transparency: By following standardized accounting principles (such as the acquisition method), M&A accounting ensures transparency in financial reporting. Stakeholders, including investors, regulators, and analysts, gain clear insights into the financial impact of the transaction on the acquirer’s operations.

- Efficient Resource Allocation: Proper M&A accounting helps in the efficient allocation of resources, including assets and liabilities, among the combined entity. This optimization can lead to cost savings, improved operational efficiency, and enhanced profitability over the long term.

- Valuation and Fair Value Assessment: M&A accounting involves rigorous valuation assessments to determine the fair value of acquired assets, liabilities, and goodwill. This process ensures that the purchase price accurately reflects the economic value of the acquired business, mitigating risks of overpayment and facilitating informed investment decisions.

- Synergy Recognition: Synergies, such as cost savings, revenue enhancement opportunities, and strategic benefits, are often a key driver of M&A transactions. M&A accounting allows companies to recognize and quantify these synergies, demonstrating the potential value creation to stakeholders.

- Strategic Alignment and Integration: Through M&A accounting, companies align their strategic objectives with financial reporting requirements. This alignment facilitates smooth integration of operations, systems, and cultures post-acquisition, leading to faster realization of synergies and value creation.

- Compliance and Governance: Following M&A accounting standards ensures compliance with regulatory requirements and governance practices. Companies maintain credibility and trust among stakeholders by adhering to transparent and ethical financial reporting practices.

- Long-term Financial Performance Evaluation: M&A accounting provides a framework for evaluating the long-term financial performance of the combined entity. By tracking and analyzing financial metrics over time, companies can assess the success of M&A transactions and make informed decisions for future strategic initiatives.

ACCOUNTING STANDARD GOVERNING M&A

The primary accounting standard governing M&A (Mergers and Acquisitions) accounting depends on the jurisdiction and reporting framework followed by the company. The key standards commonly used are:

- IFRS 3 – Business Combinations: Issued by the International Accounting Standards Board (IASB), IFRS 3 outlines the principles and requirements for accounting in business combinations. It specifies how the acquirer should recognize and measure the fair value of assets acquired, liabilities assumed, and any non-controlling interest in the acquiree. IFRS 3 also guides the treatment of goodwill, contingent considerations, and restructuring costs related to the acquisition.

- ASC 805 – Business Combinations: Under the Financial Accounting Standards Board (FASB) in the United States, ASC 805 (formerly SFAS 141R) outlines the accounting standards for business combinations. It requires the acquirer to recognize the fair value of assets acquired and liabilities assumed at the acquisition date. ASC 805 also addresses the measurement and reporting of goodwill, intangible assets, and contingent considerations arising from the transaction.

- ASPE 1582 – Business Combinations: In Canada, the Accounting Standards for Private Enterprises (ASPE) includes Section 1582, which guides accounting for business combinations. ASPE 1582 is based on principles similar to IFRS and ASC standards, focusing on fair value measurement of assets acquired, liabilities assumed, and goodwill recognition.

- Other Local GAAP (Generally Accepted Accounting Principles): Depending on the country or region, there may be other local accounting standards governing M&A accounting. For example, in the UK, the Financial Reporting Standard for Smaller Entities (FRSSE) or the Financial Reporting Standard (FRS) 102 governs mergers and acquisitions.

These standards provide a framework for companies to ensure consistent and transparent accounting treatment of M&A transactions. They help stakeholders, including investors, analysts, and regulators, understand the financial impact of business combinations and assess the resulting financial statements accurately. Companies are required to apply these standards when preparing their financial statements following an acquisition, ensuring compliance with reporting requirements and enhancing financial reporting transparency.

RELEVANCE OF M&A ACCOUNTING FOR ANALYSTS

M&A (Mergers and Acquisitions) accounting is highly relevant for financial analysts as it provides critical insights into the financial health, strategic direction, and potential risks of companies involved in such transactions. Analysts focus on several key aspects of M&A accounting to assess the impact and implications of these transactions:

- Financial Impact Assessment: Analysts use M&A accounting to evaluate how the transaction affects the financial statements of the acquiring company. This includes assessing changes in assets, liabilities, goodwill, and other intangible assets resulting from the acquisition.

- Valuation and Purchase Price Allocation: Understanding how the purchase price is allocated to acquired assets and liabilities is crucial for analysts. They evaluate the valuation methods used, such as fair value assessments, to determine the reasonableness of the purchase price and the risk of overpayment.

- Goodwill and Intangible Assets: Analysts scrutinize the amount and composition of goodwill and intangible assets recognized in the acquisition. They evaluate the strategic rationale behind the acquisition and assess whether the anticipated synergies justify the recognized goodwill.

- Earnings Impact and Synergies: M&A accounting impacts earnings through amortization of acquired intangible assets and potential impairment of goodwill. Analysts assess the impact on future earnings and cash flows, considering synergies expected to be realized post-acquisition.

- Impairment Testing and Risks: Analysts monitor impairment testing of goodwill and other intangible assets post-acquisition. They evaluate the risk of impairment and its potential impact on financial performance and shareholder value.

- Integration and Operational Challenges: Analysts assess the integration process and potential operational challenges post-acquisition. They analyze integration costs, restructuring expenses, and the timeline for achieving synergies to gauge the overall success and timing of the acquisition.

WHAT ANALYSTS SHOULD LOOK OUT FOR?

- Quality of Financial Disclosures: Analysts rely on transparent and detailed financial disclosures related to the acquisition. They scrutinize footnotes and management discussions to understand assumptions made in purchase price allocation and valuation.

- Consistency with Accounting Standards: Analysts ensure that M&A accounting practices comply with relevant accounting standards (e.g., IFRS 3, ASC 805). Any discrepancies or failure to comply may raise concerns regarding the integrity of financial reporting.

- Impact on Financial Ratios: Analysts evaluate changes in financial ratios, such as return on assets (ROA), return on equity (ROE), and debt-to-equity ratio, post-acquisition. Significant deviations from industry norms or prior periods may indicate integration challenges or financial risks.

- Management Guidance and Long-Term Strategy: Analysts assess management’s guidance and strategic rationale for the acquisition. They look for alignment between the acquisition objectives and the company’s long-term growth strategy to determine potential value creation for shareholders.

- Market Reaction and Investor Sentiment: Analysts monitor market reaction to the acquisition announcement and subsequent financial disclosures. They analyze investor sentiment and stock price movements to gauge market perception of the acquisition’s potential benefits or risks.

RECENT MERGERS AND ACQUISITIONS AND THEIR FINANCIAL IMPACT

Here are some notable mergers and acquisitions from the past few years and their impacts on the financial statements of the involved companies:

1. Microsoft and Nuance Communications (2022):

Deal Value: $18.8 billion

Impact: The acquisition aimed to enhance Microsoft’s presence in the healthcare sector by integrating Nuance’s advanced AI solutions into its cloud offerings. Nuance, known for its speech recognition and AI technology, particularly in healthcare, would bolster Microsoft’s efforts to provide better decision-making tools and meaningful connections through AI-powered applications. Financially, the deal was structured as an all-cash transaction.

2. Amazon and One Medical (2023):

Deal Value: $3.9 billion

Impact: Amazon’s acquisition of One Medical expanded its footprint in the healthcare sector, adding 188 medical clinics and over 800,000 members. This acquisition aimed to integrate One Medical’s primary care services with Amazon’s logistical capabilities, potentially reducing healthcare delivery costs and improving patient care. Financially, the acquisition increased Amazon’s medical infrastructure assets and operational costs related to healthcare services.

3. Broadcom and VMWare (2022):

Deal Value: $61 billion

Impact: Broadcom’s acquisition of VMWare was a major move to strengthen its software and cloud computing capabilities. The agreement, comprising cash and stock, also involved taking on $8 billion of VMWare’s debt. This acquisition increased Broadcom’s liabilities and impacted its cash flow. Additionally, the cultural differences and restructuring post-acquisition led to significant changes in workforce dynamics, affecting operational efficiencies and integration costs.

4. BHP Billiton and OZ Minerals (2023):

Deal Value: $9.6 billion

Impact: This acquisition aimed to capitalize on the rising demand for copper and gold, which are crucial for the clean energy sector. Financially, the deal increased BHP’s asset base in Brazil and added significant mineral reserves to its portfolio. This move was also expected to enhance BHP’s revenue from these critical resources, although it required substantial regulatory approvals and integration costs.

5. Pfizer and Seagen (2023):

Deal Value: $43 billion

Impact: Pfizer’s acquisition of Seagen, a biotechnology firm specializing in cancer treatments, was a strategic move to bolster its oncology portfolio. The acquisition, paid in cash, significantly increased Pfizer’s research and development capabilities and added valuable intellectual property related to cancer treatments. Financially, it increased Pfizer’s intangible assets and R&D expenses while expecting long-term revenue growth from new cancer therapies.

REAL-LIFE M&A ACCOUNTING IMPACT ON FINANCIAL STATEMENTS

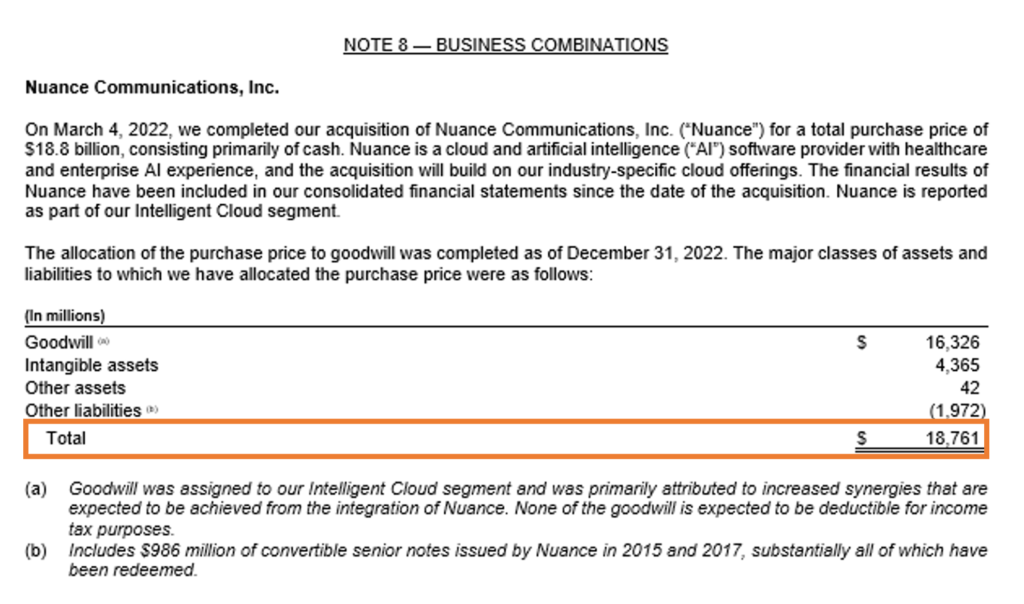

Let us take the example of Microsoft Inc. and have a look at Note 8 on Business Combination where the company discloses the acquisition made by it.

Here we can see how Microsoft has mentioned all the acquisitions made by it in the recent past. It mentions the purchase price for acquisition and how the purchase price is allocated to different assets and liabilities.

Source: Annual Report https://www.microsoft.com/investor/reports/ar23/download-center/

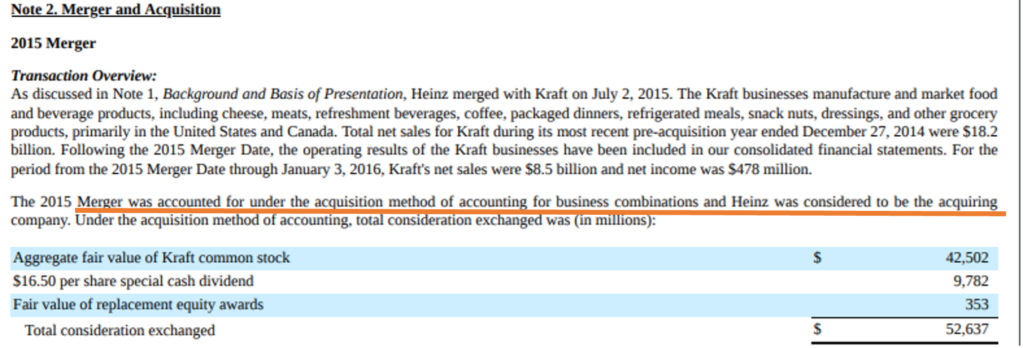

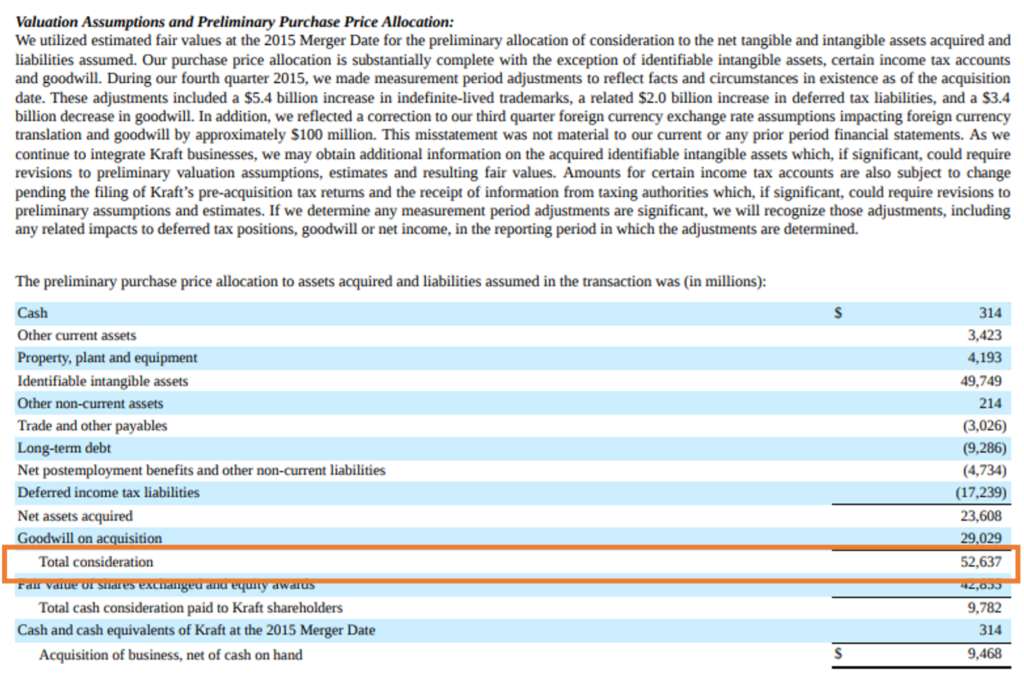

Let us also look at an example of a merger of two real-life companies. The merger between Kraft Foods Group and H.J. Heinz Company, which took place in 2015, is a notable example in the food industry. Kraft Heinz Company: Kraft Foods Group, known for its wide range of food and beverage products, merged with H.J. Heinz Company, famous for its ketchup and other food products, to form the Kraft Heinz Company. This merger created one of the largest food and beverage companies in the world, with a portfolio that includes iconic brands like Kraft, Heinz, Oscar Mayer, and others.

The merger aimed to achieve cost synergies and leverage the combined strength of both companies’ distribution networks and brand portfolios to compete more effectively in the global food market. However, like many mergers, it faced challenges in integrating operations and achieving expected synergies. We can find the details of the merger in the Annual Reports of the company as below. Here for the accounting purpose, Heinz is treated as the acquiring company and Kraft Foods as the acquired or the target company.

Source: Annual Report https://ir.kraftheinzcompany.com/static-files/3f28b8a3-cc22-4e19-a6c7-5b649d0b5ea9

Source: Annual Report https://ir.kraftheinzcompany.com/static-files/3f28b8a3-cc22-4e19-a6c7-5b649d0b5ea9

CONCLUSION

M&A accounting is a complex and critical aspect of financial reporting tha Trequires careful consideration and adherence to accounting standards. By following the acquisition method, performing thorough purchase price allocation, and addressing subsequent accounting considerations, companies can ensure accurate and transparent reporting of M&A activities. Proper accounting and disclosure practices provide stakeholders with valuable insights into the financial implications of mergers and acquisitions, facilitating informed decision-making and enhancing financial transparency.