INTRODUCTION

Market risk can either make or break a company’s financial success. On one hand, it presents opportunities for businesses to capitalize on favorable market movements and boost their profits. On the other, it poses a significant threat, as sudden changes in stock prices, interest rates, exchange rates, or commodity prices can lead to unexpected losses. Companies like Tesla and Deutsche Bank are constantly navigating this delicate balance, closely monitoring market conditions to protect their investments and seize growth opportunities. Mastering market risk analysis isn’t just about avoiding pitfalls—it’s also about leveraging the right moments to drive profitability and stay ahead of the competition.

WHAT IS MARKET RISK?

Market risk, also known as systematic risk, is the risk that affects the entire market and cannot be eliminated through diversification. Unlike unsystematic risk, which is company-specific, market risk impacts all securities in the market due to factors such as economic downturns, geopolitical events, increased competition or changes in government policies.

In this article we will be seeing how market risk impacts companies in different industries like: Retail, Technology, Automobile, Bank and Oil and Gas.

KEY TYPES OF MARKET RISKS

Key Types of Market Risks

1. Macroeconomic Risk: This risk refers to the potential for investment losses or reduced profit margin due to broad economic factors that affect the entire market or economy. These risks are typically driven by changes in key macroeconomic indicators such as GDP growth, inflation, interest rates, unemployment rates, or exchange rates. When these factors shift unexpectedly, they can disrupt financial markets and influence business conditions across various sectors. Macroeconomic risk is a subset of market risk because it influences the overall performance of the financial markets. For example, a falling GDP growth rate affects companies across industries by reducing consumer demand. Walmart faces lower sales in discretionary items, Apple experiences reduced demand for premium devices, and General Motors sees a drop in vehicle purchases as consumers cut back on spending during economic downturns.

2. Industry Risk: Industry risk refers to the potential for losses or challenges that a company faces due to specific factors affecting the industry it operates in. These risks can stem from regulatory changes, technological disruptions, labor shortages, or shifts in consumer preferences that impact an entire industry. For instance, the automotive industry may face risks related to evolving emission standards, or the retail sector may experience challenges due to the rise of e-commerce. The rise of electric vehicles (EVs) has significantly disrupted traditional car makers like Ford and Volkswagen, which are struggling to adapt as consumers shift away from diesel and gasoline vehicles. In contrast, Tesla has been on the positive side of this transformation, leading the EV market with growing demand and innovation. Similarly, the surge in online shopping through platforms like Amazon has hurt brick-and-mortar retailers and malls, resulting in store closures and reduced foot traffic as consumers increasingly favor the convenience of e-commerce.

3. Equity Risk: This risk refers to the potential for financial loss resulting from fluctuations in stock prices. When stock markets experience significant downturns, like the 2008 financial crisis or the COVID-19 pandemic, companies can see sharp declines in their valuations. For instance, during these market crashes, even stable companies saw their stock prices plummet, highlighting how equity risk can drastically impact a firm’s market capitalization, investor confidence, and ability to raise capital.

4. Interest Rate Risk: This type of risk arises from changes in interest rates, which can directly affect companies with substantial debt or heavy investments in interest-sensitive instruments like bonds. For example, Verizon Communications, with its large debt load, faces interest rate risk as rising rates increase borrowing costs, impacting profitability. Additionally, higher interest rates can reduce the market value of bonds, affecting companies holding these investments.

5. Currency Risk: Also known as exchange rate risk, this affects companies operating internationally, as fluctuations in currency values can impact profits. For instance, Apple faces currency risk when the U.S. dollar strengthens against other currencies, diminishing the value of its overseas revenues when converted back to dollars. This can lead to significant losses in profitability, especially for companies with substantial foreign sales.

6. Commodity Risk: Companies that rely on raw materials, such as airlines that depend on fuel or food producers reliant on agricultural products, are exposed to commodity risk. U.S. airline companies, for example, frequently hedge against fuel price volatility to manage costs effectively. Without these hedging strategies, sharp increases in fuel prices could severely impact their operating margins and overall profitability, demonstrating the significant impact of commodity risk on business operations.

HOW MARKET RISK IMPACTS SOME REAL-LIFE COMPANIES FROM DIFFERENT INDUSTRIES?

Market risk significantly influences the operational and financial performance of companies across various industries, shaping their strategic decisions and resilience. Let’s take 5 companies from 5 different sectors and read from their annual reports what market risks impact these companies and how do they measure them or mitigate those risk.

Technology Sector: Apple Inc

In Apple’s 2023 Annual Report, the market risk section highlights the company’s exposure to economic risks, focusing on interest rate and foreign exchange rate fluctuations.

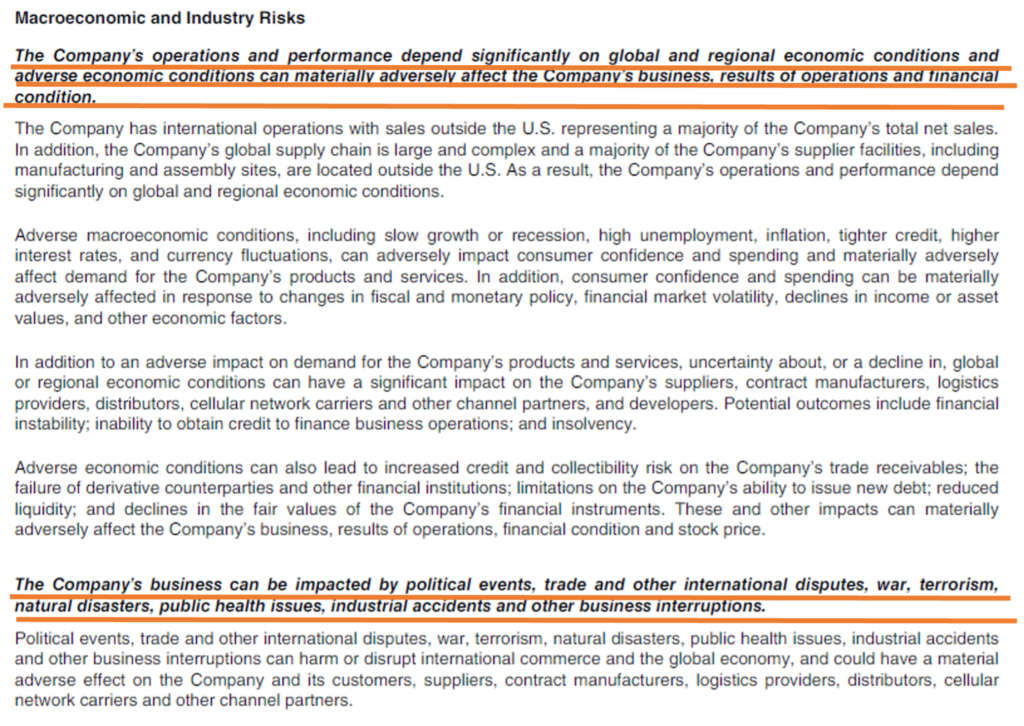

1. Macroeconomic and Industry Risk: Apple’s macroeconomic and industry risks include its dependence on global economic conditions, such as inflation, interest rates, and currency fluctuations, which can negatively impact consumer spending and demand for its products. The company’s international operations also face risks from political events, trade disputes, and supply chain disruptions, especially as a significant portion of its manufacturing is outsourced to countries like China and India.

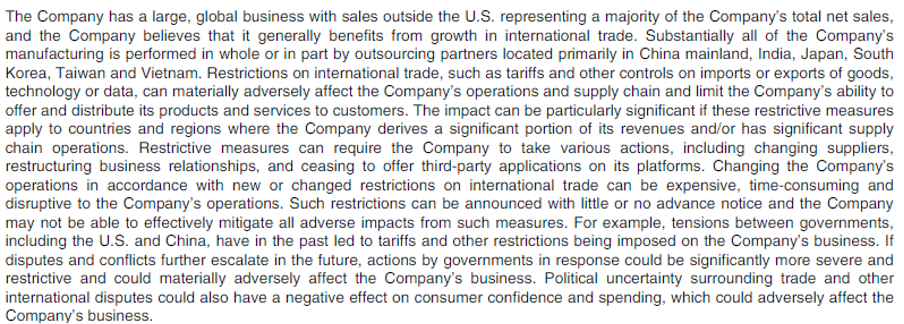

2. Interest Rate Risk: Apple faces risks from changes in U.S. interest rates, which can lower investment values and increase debt expenses. To mitigate this, Apple employs hedging strategies, with a hypothetical 100 basis point rate increase potentially reducing its investment portfolio’s fair value by $3.09 billion in 2023.

3. Foreign Exchange Rate Risk: As a global company, Apple is affected by currency fluctuations, particularly a stronger U.S. dollar, which can harm net sales and gross margins. The company uses hedging instruments, like forwards and options, for protection, but some risks remain unhedged due to cost or accounting issues.

Source: Annual Report Apple Inc. https://s2.q4cdn.com/470004039/files/doc_earnings/2023/q4/filing/_10-K-Q4-2023-As-Filed.pdf

**

Oil and Gas Sector: ExxonMobil

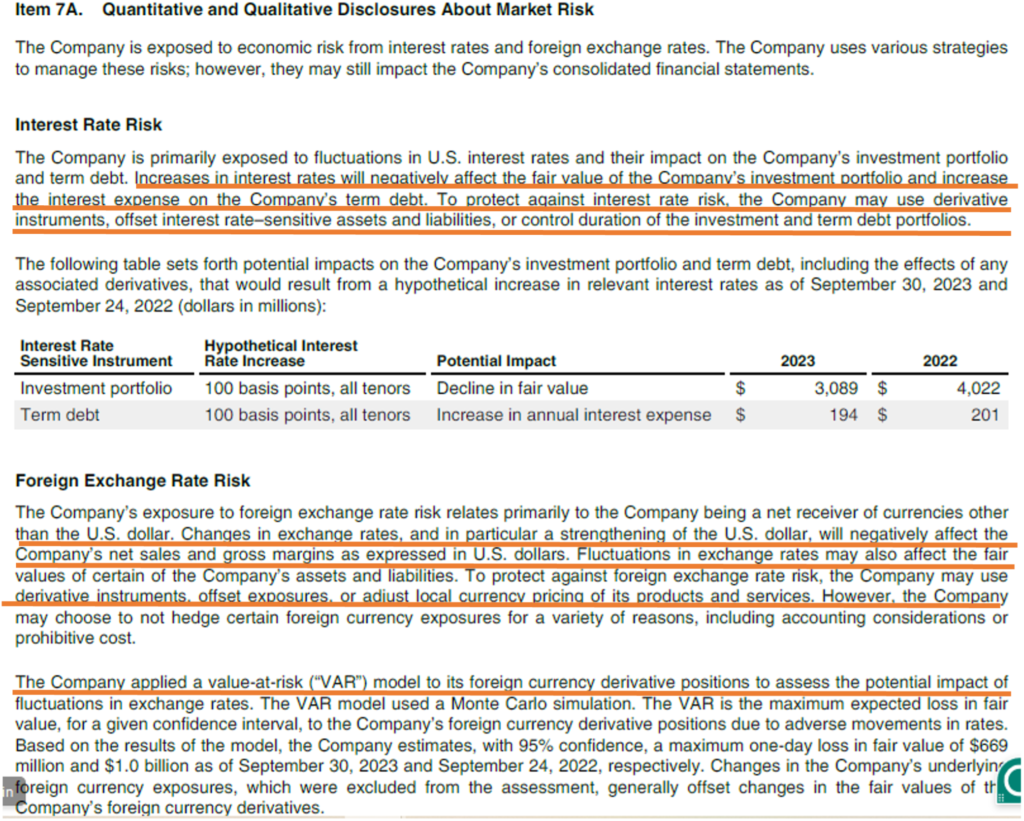

The “Market Risk” section of ExxonMobil’s annual report outlines risks from fluctuations in commodity prices, interest rates, and currency exchange rates. The company manages these risks through contracts and derivatives, though hedge accounting is not applied. A $1 change in crude oil prices impacts annual earnings by about $525 million. While short-term price fluctuations occur, ExxonMobil focuses on long-term global supply and demand fundamentals and emphasizes strong financial positioning to withstand market volatility.

Source: Annual Report ExxonMobil https://investor.exxonmobil.com/sec-filings/annual-reports/content/0001193125-24-092555/0001193125-24-092555.pdf

**

Retail Sector: Walmart

Here’s a breakdown of Walmart’s market risks from the 2023 Annual Report:

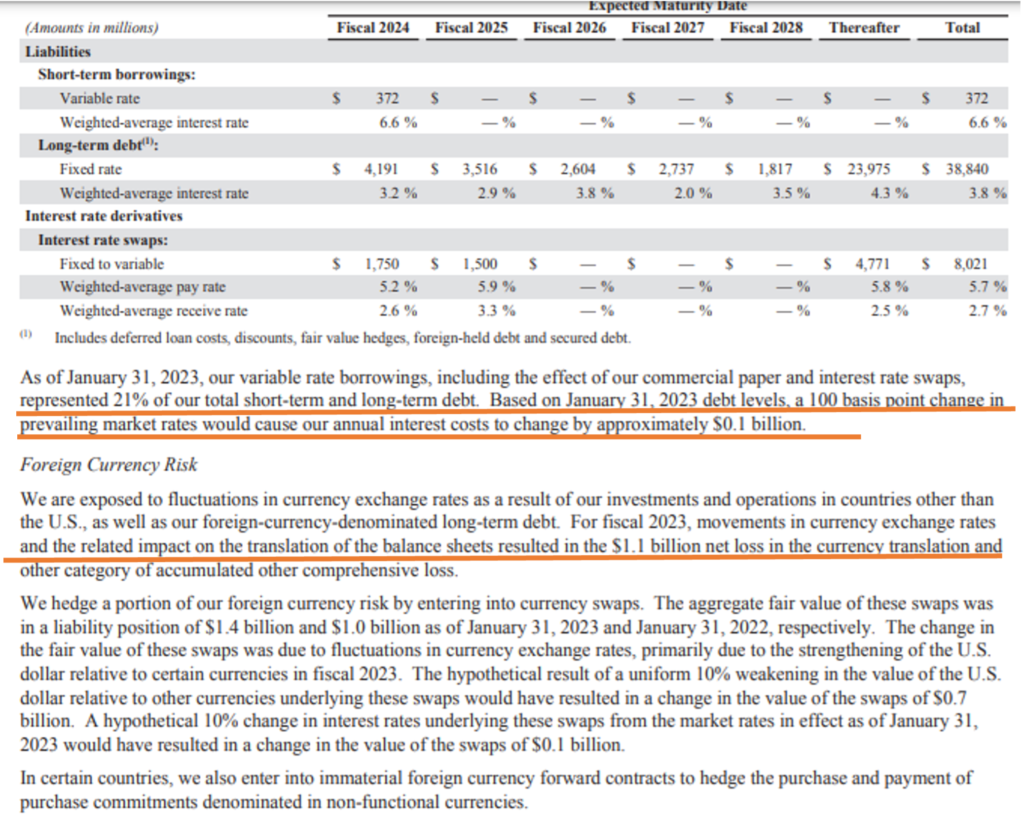

1. Interest Rate Risk: Walmart is exposed to interest rate fluctuations due to its mix of fixed and variable-rate debt. The company uses interest rate swaps to manage this risk, but in 2023, the net fair value of these swaps decreased by $0.6 billion due to changes in market interest rates.

2. Foreign Currency Risk: Walmart’s global operations expose it to currency exchange rate volatility. Currency movements resulted in a $1.1 billion loss from currency translation in 2023. The company mitigates this risk with currency swaps.

3. Fair Value Risk: Changes in the fair value of certain investments are also a market risk for Walmart, which it manages through the use of hedging instruments to reduce exposure to market fluctuations.

4. Macroeconomic Risk: Walmart faces significant macroeconomic and industry risks from natural disasters, climate change, geopolitical events, and health pandemics. Such events can lead to physical damage to properties, supply chain disruptions, changes in consumer purchasing patterns, and increased operational costs. Additionally, long-term climate-related risks may affect energy prices, regulatory compliance, and consumer confidence, potentially harming Walmart’s financial performance, especially given its substantial operations in the U.S.

Source: Annual Report Walmart https://corporate.walmart.com/content/dam/corporate/documents/esgreport/reporting-data/tcfd/walmart-inc-2023-annual-report.pdf

**

Bank: Deutsche Bank

Deutsche Bank’s market risk management focuses on managing the potential changes in market value across various trading and investment positions. Market risk can arise from fluctuations in interest rates, credit spreads, foreign exchange rates, equity prices, commodity prices, and market volatility. The risk management framework is integrated within the Group’s Market and Valuations Risk Management function and is critical in ensuring that risk exposure aligns with the bank’s overall strategy and risk appetite.

The bank identifies three core types of market risks:

- Trading Market Risk: Arising from market-making and client facilitation, mainly in debt, equity, foreign exchange, securities, and commodities.

- Traded Default Risk: Risks from defaults or downgrades of trading instruments.

- Non-Trading Market Risk: Primarily concerns interest rate risk, credit spread risk, and investment risk within the banking book, as well as risks related to pension schemes and client deposits.

Deutsche Bank employs various risk metrics such as value-at-risk (VaR) and economic capital to measure market risk exposure. These metrics guide the risk appetite and limit framework, which the Management Board, supported by Market Risk Management, establishes for managing the bank’s overall risk exposure.

Source: Annual Report https://investor-relations.db.com/files/documents/annual-reports/2024/Annual-Report-2023.pdf

Deutsche Bank faces significant industry and macroeconomic risks, including geopolitical tensions, rising interest rates, and economic uncertainties, which can impact client behavior and overall market stability. These factors may influence revenue generation and the bank’s ability to maintain a robust capital position amidst a challenging economic landscape.

Source: Annual Report https://investor-relations.db.com/files/documents/annual-reports/2024/Annual-Report-2023.pdf

**

Automobile: Tesla

1. Macroeconomic & Industry Risk : Tesla faces significant macroeconomic and industry risks, including fluctuations in global economic conditions, interest rates, and inflation, which can impact consumer demand for electric vehicles. The company is also exposed to supply chain disruptions, increased raw material costs, and competition within the electric vehicle and renewable energy sectors. Additionally, changes in government policies and environmental regulations pose regulatory risks that can affect Tesla’s operations and financial performance. These factors combined contribute to volatility in the company’s profitability and growth trajectory.

2. Foreign Currency Risk – The Market Risk section of Tesla’s annual report discusses the impact of foreign currency fluctuations due to the company’s global business operations. Tesla faces risks related to revenue, cost of revenue, and operating expenses in currencies like the Chinese yuan and euro. The company does not typically hedge foreign currency risk, which means exchange rate fluctuations affect their financial performance. A hypothetical 10% change in exchange rates could have led to a $1.01 billion impact on net income for 2023, compared to $473 million in 2022.

Source: Annual Report Tesla https://ir.tesla.com/_flysystem/s3/sec/000162828024002390/tsla-20231231-gen.pdf

HOW MARKET RISK ANALYSIS WORKS?

Market risk analysis is a crucial aspect of financial management, allowing companies to safeguard their financial health against market uncertainties. The process generally involves three key steps: identifying, measuring, and mitigating risks. Here’s a detailed breakdown of each:

1. RISK IDENTIFICATION: Risk identification is the first step in market risk analysis, where a company identifies the specific types of market risks it faces. This step requires a thorough understanding of the business environment, industry trends, and potential market exposures. For instance, a company like Deutsche Bank identifies risks associated with fluctuating interest rates, currency exchange rates, equity prices, and commodity prices. By pinpointing these risks, companies can understand which market factors could adversely affect their financial performance.

2. RISK MEASUREMENT: Once risks are identified, the next step is to quantify them using various analytical tools. Common methods include:

a) Value at Risk (VaR): Value at Risk (VaR) is a widely used technique to measure market risk, providing an estimate of the maximum expected loss an investment or portfolio might experience within a set timeframe under typical market conditions, based on a given confidence level. VaR provides a clear, single number that reflects the potential loss, making it straightforward to communicate risk levels. However, VaR does not account for extreme market movements, known as tail risks, and relies on the assumption of normal market conditions, which can underestimate risks during periods of market volatility.

b) Stressed Value at Risk (Stressed VaR): Stressed Value at Risk (Stressed VaR) is a financial metric that gauges the potential losses an investment might incur during periods of severe market stress or extreme conditions. Unlike traditional Value at Risk (VaR), which calculates potential losses based on normal market fluctuations, Stressed VaR focuses on volatile, crisis-like scenarios. It uses historical data from periods of significant market turmoil, such as the 2008 financial crisis, to determine how much a portfolio could lose if similar conditions were to recur. For banks and financial institutions, like Deutsche Bank, Stressed VaR is crucial for assessing risk exposure during periods of high market stress and ensuring they hold enough capital to weather severe downturns.

c) Scenario Analysis: Scenario Analysis involve simulating extreme market conditions, such as market crashes, interest rate spikes, or geopolitical crises, to evaluate how a portfolio would respond. These methods help identify vulnerabilities and guide risk management strategies, ensuring that companies are better prepared for severe market disruptions. However, their effectiveness depends heavily on the quality and realism of the scenarios, and they may not capture every possible risk.

d) Sensitivity Analysis: Sensitivity Analysis measures how changes in specific market variables—like interest rates, stock prices, or exchange rates—impact a portfolio’s value. This method highlights the primary drivers of risk, enabling targeted risk mitigation. While it provides valuable insights into how a portfolio reacts to changes in individual risk factors, it often overlooks the combined effects of multiple factors, which could lead to a less comprehensive understanding of the total risk.

e) Monte Carlo Simulation: Monte Carlo Simulation is a powerful statistical method that models potential future performance by running thousands of scenarios with random changes in market variables. It provides a detailed probability distribution of potential outcomes, capturing a wide range of market conditions, including extreme events. Although Monte Carlo simulations offer a thorough risk assessment, they are computationally intensive and rely heavily on the accuracy of input assumptions, which can be complex and challenging to validate.

f) Expected Shortfall (ES) or Conditional Value at Risk (CVaR): Expected Shortfall (ES), also known as Conditional Value at Risk (CVaR), goes beyond VaR by measuring the average loss in the worst-case scenarios beyond the VaR threshold. This method provides a more comprehensive measure of tail risk, capturing potential losses during extreme market conditions. However, ES is more complex to calculate and interpret than VaR, making it less accessible for some risk managers.

g) Historical Simulation: Historical Simulation evaluates market risk by analyzing past market data to determine how historical price changes would affect a current portfolio. This approach assumes that past market behaviors are indicative of future risks, making it easy to understand and apply. However, historical simulations can fall short if the market environment changes significantly, as past patterns may not always predict future risks accurately.

By using these methods, companies, investors, and financial institutions can gain a deeper understanding of their market risk exposure and make informed decisions to mitigate potential financial losses. Each method offers unique strengths and limitations, and often a combination of these approaches provides the most comprehensive risk evaluation.

3. RISK MITIGATION: After identifying and measuring risks, companies implement strategies to mitigate these exposures. Common risk mitigation techniques include:

a) Diversification: Diversification involves spreading investments across various asset classes, sectors, or geographic regions to minimize the impact of market volatility. For example, Apple diversifies its business operations by investing in different product lines, including smartphones, wearables, and services, and expanding its market presence globally. By not relying solely on one product or region, Apple minimizes the effect of market-specific challenges, like regulatory shifts in a particular country or changes in consumer demand for certain products, helping to maintain stability in its overall financial performance.

b) Hedging with Financial Instruments: Hedging involves using financial derivatives like options, futures, and swaps to offset potential losses from adverse market movements. For instance, General Electric (GE) actively hedges its exposure to currency and commodity price fluctuations through forward contracts and options. For example, if GE has significant revenue in euros but incurs costs in U.S. dollars, it might use currency swaps to lock in exchange rates, protecting its cash flow from adverse currency movements. Similarly, GE hedges its commodity exposure, such as fluctuating oil prices, to maintain more predictable input costs and protect its profit margins.

c) Maintaining a Balanced Asset Portfolio: Maintaining a balanced asset portfolio involves adjusting the mix of investments—such as equities, fixed income, and cash reserves—to manage market risk more effectively. BlackRock, one of the world’s largest asset managers, employs this strategy by offering balanced mutual funds that combine stocks, bonds, and alternative investments. For instance, during periods of stock market volatility, BlackRock might increase its allocation to bonds or cash, which are generally safer and less correlated with equities, thus mitigating the impact of any single market downturn on the overall portfolio performance. This dynamic adjustment helps maintain stable returns and reduce the risk of significant losses.

d) Asset Liability Management: Asset Liability Management (ALM) is crucial for mitigating market risk, as demonstrated by banks like JPMorgan Chase. To manage interest rate risk, JPMorgan aligns the maturities of its assets (like loans) with its liabilities (such as deposits). For instance, if interest rates rise, the bank’s fixed-rate loans may become less valuable, but its liabilities could decrease in cost. By employing strategies like interest rate swaps, JPMorgan can effectively hedge against these risks, ensuring that its income remains stable despite market fluctuations. This proactive approach not only protects the bank’s financial performance but also enhances its resilience in volatile market conditions.

Through these steps, market risk analysis helps companies proactively manage uncertainties, maintain financial stability, and make informed strategic decisions.

CONCLUSION

Market risk analysis is a vital component of financial management, helping companies anticipate and prepare for potential adverse market movements. By understanding and mitigating these risks, businesses can protect their assets, stabilize cash flows, and ensure long-term sustainability. Whether it’s a tech company like Tesla, retail giant like Walmart, Technology major like Apple, or a global bank like Deutsche Bank, market risk analysis is essential in today’s unpredictable financial environment. This dynamic approach to risk management not only safeguards a company’s bottom line but also empowers it to seize opportunities even in the most volatile market conditions.