What is the Loan to Deposit Ratio?

Loan to deposit is a financial measure that investors and banks use to assess a bank’s economic health and liquidity. We calculate loan to deposit ratio (LDR) by dividing the total loans by the total deposit for the same time frame. LDR is the liquidity ratios used for banks to understand what percentage of the deposits available with the bank are given out in loans along with its risk profile. The loan to deposit ratio also helps assess various management strategies of the bank.

Formula:

| Loan to Deposit Ratio | = (Total Loan/ Total Deposit) * 100 |

- Total Loans: Total Loans represent the aggregate amount of money that the bank has lent to its customers. They are recorded as assets on the balance sheet. It includes all forms of loans such as personal loans, mortgages, commercial loans, and other types of credit provided by the bank. The total loans figure reflects the bank’s lending activity and its role in providing credit to individuals, businesses, and other entities.

- Total Deposits: It encompasses all the funds that the customers have deposited in the bank. It includes checking accounts, savings accounts, current accounts, and certificates of deposit (CDs). Total deposits serve as a critical indicator of the bank’s funding base, showcasing the customer’s level of trust and confidence in the bank’s ability to protect their money.

The loan to deposit ratio is calculated in percentage. Where LDR ranging from 80% to 90% is considered healthy for a bank.

When a bank crosses the threshold of 90% or 100%, it indicates that the bank is giving out more loans than required. A high loan to deposit ratio indicates that the bank is issuing more interest-bearing loans that might reflect on the income statement as interest income.

When the loan to deposit ratio is high, this also indicates that the company is compromising on its liquidity by extending more loans as it shortens the cash supply in the bank, causing a liquidity crisis. The loan to deposit ratio reflects a simple concept to the investors that not all loans are redeemed, but the bank has to repay the deposits. This concept builds the foundation for the assessment of credit and liquidity risk.

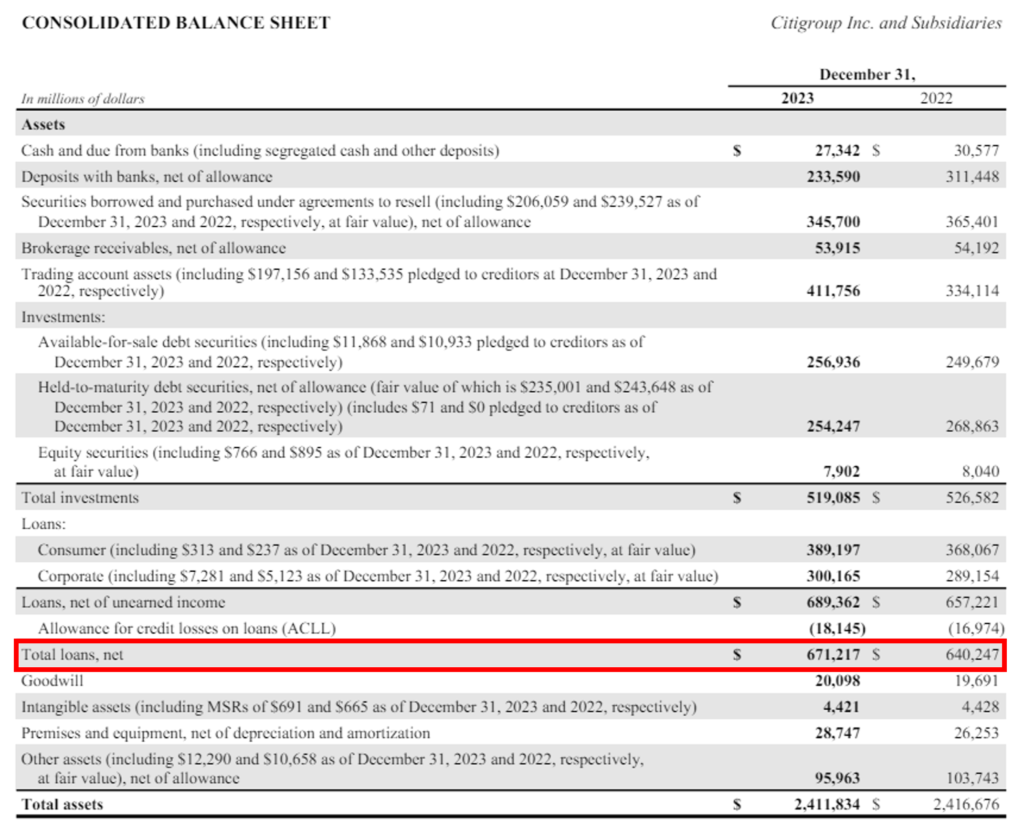

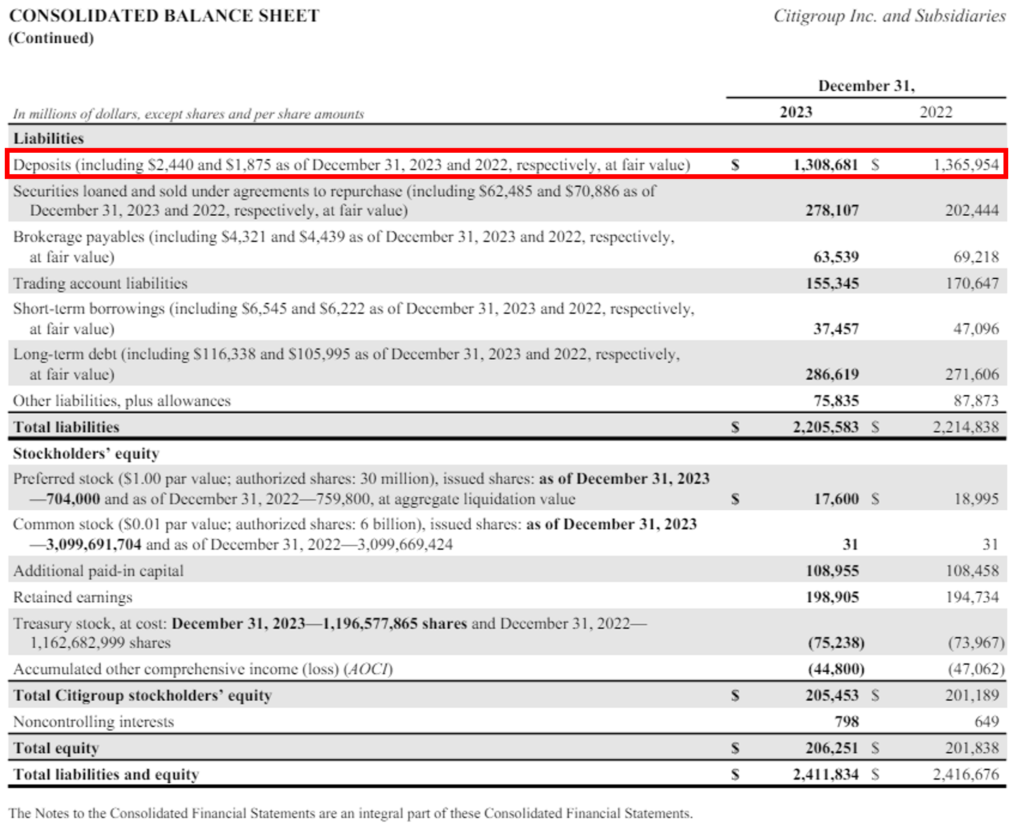

Real Life Example of Loan To Deposit Ratio – Citibank

Let’s try to understand the calculation of the Loan to Deposit Ratio of Citibank for 2023:

Source: https://www.citigroup.com/rcs/citigpa/storage/public/Citi-2023-Annual-Report.pdf

Calculation of Loan to Deposit Ratio of Citibank for 2023:

| Total Loans | = 671,217 |

| Total Deposits | = 1,308,681 |

| Loan to Deposit Ratio | = (Total Loan/ Total Deposit) * 100 |

| = (671,217/ 1,308,681) * 100 | |

| Loan to Deposit Ratio | = 51.2% |

The Loan to Deposit Ratio (LDR) of Citi Bank for 2023 was recorded as 51.2%, which is categorised as a low loan to deposit ratio. It shows that Citi Bank is holding more cash in the form of deposits and limiting the extent of interest-bearing loans. This strategy can be opted by Citi Bank because of the economic volatility in the markets.

Now let’s compare the Loan to Deposit Ratio of Citi Bank for 2023 to the LDR of Citi Bank for 2022.

Calculation of Loan to Deposit Ratio of Citi Bank for 2022:

| Total Loans | = 640,247 |

| Total Deposits | = 1,365,954 |

| Loan to Deposit Ratio | = (Total Loan/ Total Deposit) * 100 |

| = (640,247/ 1,365,954) * 100 | |

| Loan to Deposit Ratio | = 46.8% |

Looking at the values, we get a loan to deposit ratio of 46.8% of Citi Bank for 2022, by comparing the LDR of 2023 and 2022 i.e. 51.2% and 46.8% respectively, we can see that the loan to deposit ratio increased by 4.4 per cent point in 2023. A 4.4 per cent point increase is due to the rise seen in the loans given out by the bank. In 2023, the total loan amount recorded in the balance sheet increased by $30,970 million.

Factors Affecting Loans to Deposit Ratio

The loan to deposit ratio reflects the relationship between the bank’s loan and its customer deposit. The LDR shows a bank’s risk exposure and financial strategies which can be influenced by numerous factors such as:

- Economic Conditions: Fluctuations in the economic conditions impact the borrowing and depositing behaviour of the people. During the recession, consumers avoid taking loans and save more money than bank deposits due to risk aversion. Conversely, when the economy is expanding, the demand for loans expands, potentially increasing the loan-to-deposit ratio.

- Interest Rates: Interest Rate is the amount charged by the lender for loaning its funds to the borrower.Changes in the interest rates lead to changes in the lending and deposit levels of the bank. When the interest rates are low, borrowers tend to take high amounts of loans, resulting in a higher loan-to-deposit ratio. When the interest rates are high, the loan-taking capacity of the borrowers shrinks, leading to a lower loan-to-deposit ratio.

- Industry Competition: Competition can also impact a bank’s Loan-Deposit Ratio (LDR). A bank facing strong competition from other banks may strategise to increase its lending to customers to remain competitive, leading to a higher LDR.

Difference between Loans to Deposit and Loans to Value

The Loan to Deposit Ratio focuses on the relationship between a bank’s loan portfolio and its deposit base, reflecting the bank’s liquidity position and funding strategy. A higher LDR suggests potential reliance on external funding sources due to a larger loan book relative to deposits, while a lower LDR indicates sufficient deposits to fund loans.

The Loan to Value ratio focuses on the relationship between the loan amount and the value of the underlying collateral, indicating the level of risk exposure for lenders in case of borrower default. A higher LTV indicates higher risk to the lender due to a smaller borrower equity stake, while a lower LTV indicates lower risk with a larger borrower equity stake.

Changes in the LDR reflect shifts in loan demand, deposit inflows, or changes in a bank’s lending and deposit strategies, impacting the bank’s liquidity management. Changes in the LTV ratio affect loan approval decisions, interest rates, and loan terms, influencing the lender’s risk management and loan eligibility criteria.

Conclusion:

The Loan to Deposit Ratio (LDR) is a vital indicator of a bank’s financial health and liquidity, revealing the balance between its loan book and deposit base. A healthy LDR, typically ranging from 80% to 90%, signifies prudent liquidity management and effective funding strategies. Factors like economic conditions, interest rates, and industry competition can significantly influence the loan to deposit ratio. Understanding the difference between LDR and Loan to Value (LTV) is crucial, as each measures distinct aspects of financial risk and stability. By monitoring these ratios, investors and analysts can make informed decisions regarding the bank’s risk profile and operational efficiency, ensuring a robust assessment of its financial soundness.