INTRODUCTION

Inventory accounting is more than just a number on a balance sheet—it’s a cornerstone that shapes a company’s financial narrative, affects tax obligations, and guides strategic choices. At the heart of this accounting lie two powerful methods: Last-In, First-Out (LIFO) and First-In, First-Out (FIFO). This article dives into LIFO vs FIFO methods, unraveling their implications under various accounting standards and their impact on financial performance and tax strategies. Whether you’re an investor or a business leader, understanding these inventory techniques is key to mastering the financial puzzle and making astute, informed decisions.

WHAT IS INVENTORY AND WHAT IS THE FORMULA TO CALCULATE THE INVENTORY VALUE IN THE BALANCE SHEET?

Inventory represents the goods and materials a business holds for production or sale, divided into three stages: raw materials, work-in-progress (WIP), and finished goods. Inventory accounting determines the value at each production stage by monitoring the costs tied to purchasing raw materials, direct labor and overhead costs during work-in-progress (WIP), and the final production costs for finished goods. These inventories form part of the company’s total assets and hence need to be carefully evaluated as they impact the company’s valuation, especially the companies holding large inventories.

To calculate the ending inventory value, use the formula:

Ending Inventory = Beginning Inventory + Purchases – Cost of Goods Sold (COGS), where COGS represents the cost of inventory items sold during the period.

Note 1: There is a third method named the Weighted Average Inventory Method. The average inventory method typically produces results that fall between those of LIFO and FIFO. For instance, if LIFO yields the lowest net income and FIFO the highest, the average inventory method will generally result in a net income that lies somewhere in the middle.

Note 2: As per US GAAP Inventory is valued at the lower of its historical cost (determined by either weighted average, LIFO, or FIFO method) or market value. Market value is defined as replacement cost, but it cannot exceed the net realizable value (the selling price minus any costs to complete and sell the goods) and should not fall below the net realizable value minus a typical profit margin. If the market value falls below cost, a write-down is required, and this loss is recognized in the income statement.

LIFO VS FIFO INVENTORY ACCOUNTING METHODS

LIFO INVENTORY ACCOUNTING: LIFO, or Last-In, First-Out, is an inventory accounting method where the most recently acquired or produced items are sold first. This approach means that the cost of goods sold (COGS) reflects the latest inventory costs, while older inventory costs remain on the balance sheet. Under US GAAP, LIFO is allowed and used by companies to align the higher current costs with revenues. It is commonly used by commodity companies like oil, petroleum & metal companies. IFRS does not allow the use of the LIFO method for Inventory accounting.

FIFO INVENTORY ACCOUNTING: FIFO, or First-In, First-Out, is an inventory accounting method where the oldest inventory items are sold first. This means that the cost of goods sold (COGS) is based on the earliest purchased or produced inventory, while the remaining inventory on the balance sheet reflects the cost of more recent purchases. Under both US GAAP and IFRS, FIFO is permitted and commonly used, providing a straightforward approach to valuing inventory and financial reporting.

UNDERSTANDING THE IMPACT OF LIFO VS FIFO METHOD ON THE FINANCIAL STATEMENTS AND TAXATION

Inventory impacts the income statement by determining the Cost of Goods Sold (COGS), which affects gross profit and net income, while on the balance sheet, it influences the valuation of assets and equity. The chosen inventory method also impacts taxes paid, as different methods affect taxable income. Understanding these effects is vital for investors and management, as they influence financial performance, profitability, and tax liabilities, guiding strategic decisions and financial analysis.

Let’s explore the impact of LIFO (Last-In, First-Out) and FIFO (First-In, First-Out) inventory methods on the Cost of Goods Sold (COGS), net income, taxation, and the balance sheet with a detailed example.

Assume XYZ Corp starts the year with the following inventory:

Opening Inventory: 50 units at $180 each

Throughout the year, XYZ Corp makes additional purchases:

- Batch 1: 100 units at $200 each

- Batch 2: 100 units at $250 each

XYZ Corp sells 150 units during the inflation period of the year.

The COGS and Ending Inventory values under both LIFO and FIFO methods are calculated as below.

| FIFO | |||

| Units | Price per unit | Total Amount | |

| Opening Inventory Balance | 50 | 180 | 9000 |

| Add: Purchases during the year | |||

| Batch 1 | 100 | 200 | 20000 |

| Batch 2 | 100 | 250 | 25000 |

| Less: COGS | |||

| from Opening balance | 50 | 180 | -9000 |

| from Batch 1 | 100 | 200 | -20000 |

| Ending Inventory Balance | 100 | 25000 | |

| LIFO | |||

| Units | Price per unit($) | Total Amount($) | |

| Opening Inventory Balance | 50 | 180 | 9000 |

| Add: Purchases during the year | |||

| Batch 1 | 100 | 200 | 20000 |

| Batch 2 | 100 | 250 | 25000 |

| Less: COGS | |||

| from Batch 2 | 100 | 250 | -25000 |

| from Batch 1 | 50 | 200 | -10000 |

| Ending Inventory Balance | 100 | 19000 | |

Let us study the impact of both the LIFO and FIFO methods on the cost of goods sold, net income, taxation, and balance sheet of XYZ Corp.

Impact on Cost of Goods Sold (COGS)

- FIFO: FIFO operates on the assumption that the oldest inventory items are sold first. Therefore, the COGS for the 150 units sold calculated above is $29,000.

- LIFO: LIFO is based on the premise that the most recently purchased inventory items are sold first. As a result, the COGS for the 150 units sold, as calculated above, amounts to $35,000.

Impact on Net Income

- FIFO: FIFO results in lower COGS because it uses the older, less expensive inventory first, leading to a higher gross profit and net income.

- LIFO: LIFO results in a higher COGS because it uses the newer, more expensive inventory first, leading to a lower gross profit and net income.

Impact on Taxation

- FIFO: Higher net income under FIFO results in higher taxable income, leading to higher tax expenses.

- LIFO: Lower net income under LIFO results in lower taxable income and, consequently, lower tax expenses.

Impact on Ending Inventory on the Balance Sheet

- FIFO: FIFO values the remaining inventory at the cost of the most recent purchases. Hence the closing inventory calculated above is $25,000. The ending Inventory value on the Balance Sheet is generally higher under the FIFO method.

- LIFO: LIFO values the remaining inventory at the cost of the oldest purchases. Hence the closing inventory calculated above is $19,000. The ending Inventory value on the Balance Sheet is generally lower under the LIFO method.

WHICH METHOD OUT OF LIFO vs FIFO SHOULD A COMPANY SELECT?

When selecting between LIFO and FIFO inventory valuation methods, companies must carefully weigh several critical factors. These include the impact on taxation, the accuracy of financial reporting, and the specific characteristics of their industry. Understanding the implications of each method is crucial, as it influences tax liabilities, financial transparency, and alignment with the inventory management practices of the company.

Some of the key factors to be considered when selecting between LIFO and FIFO Inventory accounting methods are as follows:

1. Taxation Perspective

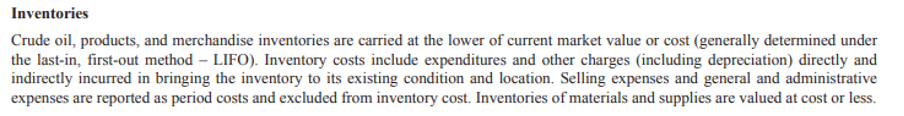

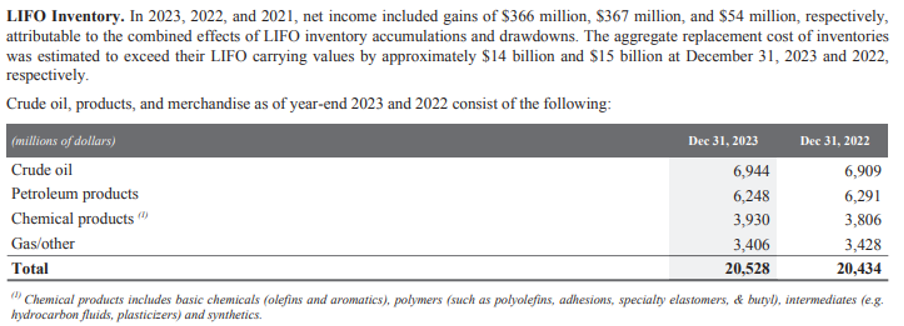

LIFO: LIFO can lower taxable income during inflationary times by aligning higher current costs with revenues, thereby reducing tax liabilities. For example, ExxonMobil uses LIFO to benefit from tax savings in the petroleum industry where prices can fluctuate significantly. LIFO is allowed under US GAAP but not under IFRS, limiting its use for companies operating internationally or required to comply with IFRS.

Source: Annual Report of ExxonMobil https://investor.exxonmobil.com/sec-filings/annual-reports/content/0001193125-24-092555/0001193125-24-092555.pdf

Source: Annual Report of ExxonMobil https://investor.exxonmobil.com/sec-filings/annual-reports/content/0001193125-24-092555/0001193125-24-092555.pdf

FIFO: FIFO often results in higher taxable income during inflationary periods since it uses older, lower-cost inventory first. This leads to higher taxes but provides a clearer view of actual profitability. Johnson & Johnson uses FIFO, reflecting its high inventory turnover and the need for a transparent financial view. FIFO is straightforward and widely accepted under both US GAAP and IFRS, simplifying global financial reporting.

Source: Annual Report of Johnson & Johnson https://s203.q4cdn.com/636242992/files/doc_downloads/Annual_meeting/2024/Johnson-Johnson-2023-Annual-Report.pdf

Note: Many companies like Pepsi Co., and Coca-Cola use different inventory accounting methods for different categories of inventory. They may use two or more methods out of the weighted average cost method, LIFO method, and FIFO method.

Source: Annual Report of Pepsi Co. https://www.pepsico.com/docs/default-source/annual-reports/2023-pepsico-annual-report.pdf

Source: Annual Report Coca-Cola https://investors.coca-colacompany.com/filings-reports/all-sec-filings/content/0000021344-24-000009/0000021344-24-000009.pdf

2. Realistic Financial View

LIFO: LIFO may show outdated inventory costs on the balance sheet, making financials less reflective of current market conditions. Companies in the metals or oil & petroleum industry may use LIFO to match revenues with the most recent costs, but this can complicate financial analysis. The difference between LIFO and FIFO inventory values, known as the LIFO reserve, can obscure true inventory value and financial health.

FIFO: FIFO provides a realistic view of inventory value on the balance sheet, as ending inventory reflects recent purchase costs. This gives a more accurate picture of financial position and market conditions. Retail giants benefit from FIFO, as it aligns with the natural flow of goods in their stores.

3. Nature of Industry

LIFO: Industries with stable or decreasing prices, or where inventory items are not perishable and can be stockpiled for long periods, may prefer LIFO. For instance, Chevron uses LIFO due to the nature of the oil industry, where inventory costs are significant and can vary widely. LIFO is also suitable for industries where inventory turnover is slow, and products can be held for extended periods without losing value.

Source: Annual Report of Chevron https://www.chevron.com/-/media/chevron/annual-report/2023/documents/2023-Annual-Report.pdf

FIFO: Industries with high inventory turnover or where products have a short shelf life, such as retail, food, and technology sectors, often use FIFO. Apple uses FIFO, reflecting the rapid turnover of their tech products. FIFO aligns well with industries where the oldest inventory is sold first, ensuring that financials reflect the actual flow of goods and current market conditions.

Source: Annual Report of Apple Inc. https://s2.q4cdn.com/470004039/files/doc_earnings/2023/q4/filing/_10-K-Q4-2023-As-Filed.pdf

IMPACT OF INFLATION ON LIFO AND FIFO METHOD SUMMARIZED IN A TABLE

| Economic Condition | Inventory Valuation Method | Change in Inventory Costs | Impact on COGS | Impact on Net Income | Impact on Taxation |

| Inflation | FIFO | Inventory Costs rises | Lower COGS | Net Income is high | Taxes are high |

| LIFO | Inventory Costs rises | Higher COGS | Net Income is low | Taxes are low | |

| Deflation | FIFO | Inventory Costs falls | Higher COGS | Net Income is low | Taxes are low |

| LIFO | Inventory Costs falls | Lower COGS | Net Income is high | Taxes are high |

PROS AND CONS OF LIFO AND FIFO METHODS

Here’s a summary of the pros and cons of LIFO and FIFO inventory accounting methods.

| Inventory Accounting Method | Pros | Cons |

| FIFO (First-In, First-Out) | – Reflects actual physical flow of goods – Higher ending inventory value in inflationary periods – Higher profits during inflation (due to lower COGS) | – Higher taxes in inflationary periods – May not match current costs with current revenues |

| LIFO (Last-In, First-Out) | – Matches recent costs with current revenues – Lower tax during inflation due to lower taxable income – Lower profits during inflation (due to higher COGS) | – Lower ending inventory value in inflationary periods – Can result in outdated inventory values – Cannot be used internationally since not permitted under IFRS |

This table highlights the key advantages and disadvantages of each method, helping to understand their impact on financial reporting and decision-making.

CONCLUSION

In conclusion, comparing LIFO and FIFO inventory accounting methods reveals distinct impacts on financial statements and taxation. We have explored how each method influences the Cost of Goods Sold (COGS), net income, and ending inventory value on the balance sheet. LIFO, with its emphasis on recent costs, can reduce taxable income during inflation but may obscure true inventory value. FIFO, on the other hand, offers a clearer view of current inventory costs and financial health but often results in higher tax liabilities. Understanding these differences helps companies and investors make informed decisions that align with their financial strategies and industry practices.