Blog Summary

- Accounting Tools

- Compliance Tools

- Fraud Detection Tools

- Regulatory Reporting Tools

- Robotic Process Automation (RPA) Tools

- Virtual Assistants Tools

- Blockchain Tools

- Cybersecurity Tools for Protecting Financial Data

- Financial analysis tools

- Budgeting and expense tracking tools

- Investment management tools

- Tax preparation and planning tools

- Financial reporting and forecasting tools

- Risk management and compliance tools

- Customer service tools

- Market research tools

- Treasury tools

- Personal finance tools for career growth

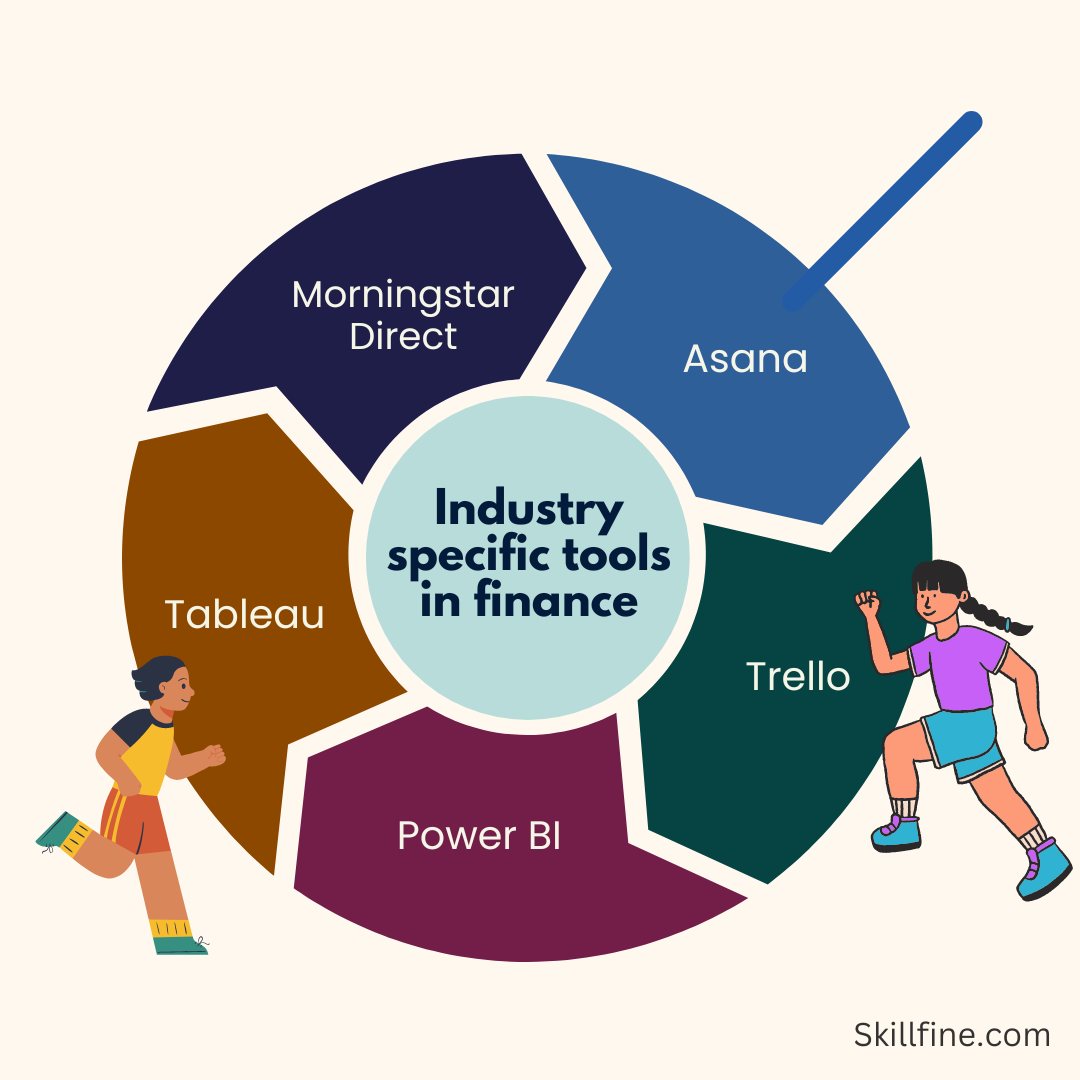

- Industry-specific tools for finance professionals

Introduction

In today’s fast-paced and competitive finance industry, staying ahead of the curve is essential for success. One of the key factors that can give you an edge is utilizing the right tools. Whether you are an accountant, compliance officer, or a financial analyst, having access to the right financial tools can streamline your workflow, improve accuracy, and enhance productivity. In this article, we will explore the essential finance tools that can help you excel in your finance career.

Accounting Tools

- QuickBooks

QuickBooks is a widely-used accounting software that simplifies bookkeeping tasks for small businesses and individuals. It offers features such as invoice generation, expense tracking, and financial reporting. With its user-friendly interface and powerful functionalities, QuickBooks is a go-to tool for many finance professionals.

- Xero

Xero is another popular cloud-based accounting software that provides comprehensive accounting solutions. It allows you to manage invoices, track expenses, and reconcile bank transactions seamlessly. With its real-time reporting and collaborative features, Xero is a top choice for finance professionals who value efficiency and accuracy.

- Sage Intacct

Sage Intacct is an advanced financial management system designed for growing businesses. It offers robust features for budgeting, cash management, and financial consolidation. With its automation capabilities and customizable dashboards, Sage Intacct empowers finance professionals to make informed decisions and drive business growth.

- Microsoft Dynamics 365

Microsoft Dynamics 365 is a comprehensive business management solution that includes financial accounting modules. It enables seamless integration with other Microsoft tools, such as Excel and Power BI, for enhanced data analysis and reporting. With its scalability and flexibility, Microsoft Dynamics 365 is ideal for finance professionals working in large organizations.

Compliance Tools

- Filing Tree

This incredible tool is designed to streamline and simplify the entire process, making it easier than ever before to ensure that your financial operations are in full compliance with all relevant regulations and laws. With FilingTree, you can say goodbye to the headaches and frustrations that often come with finance compliance, and instead, embrace a seamless and efficient solution that will save you both time and money. One of the standout features of FilingTree is its user-friendly interface. Even if you’re not a financial expert, this tool is incredibly intuitive and easy to use.

- Compliance Bridge

ComplianceBridge’s finance compliance tool is a game-changer for businesses in the financial industry. This innovative tool is designed to streamline and automate compliance processes, ensuring that companies meet all regulatory requirements without any hassle. What sets ComplianceBridge apart from other compliance tools is its user-friendly interface and advanced features that make compliance management a breeze. With the finance compliance tool, organizations can easily track and monitor compliance activities, generate reports, and maintain a comprehensive audit trail. This not only saves time and resources, but also gives businesses peace of mind knowing that they are fully compliant with all financial regulations.

Fraud Detection Tools

- SEON

SEON’s finance fraud detection tool is absolutely remarkable! With its advanced technology and cutting-edge features, it has revolutionized the way financial institutions combat fraud. This tool is a game-changer in the industry, providing unparalleled accuracy and efficiency in detecting fraudulent activities. SEON’s platform is designed to analyze vast amounts of data in real-time, ensuring that no suspicious transaction slips through the cracks. It uses sophisticated algorithms and machine learning techniques to identify patterns and anomalies, making it incredibly effective in flagging potential fraud cases.

- Signifyd

Signifyd has truly transformed the way businesses detect and prevent fraudulent activity in their financial transactions. With Signifyd’s finance fraud detection tool, businesses can now have complete peace of mind when it comes to their financial transactions. This tool uses advanced machine learning algorithms to analyze and detect any suspicious activity in real-time. It not only identifies fraudulent transactions, but also provides a detailed analysis of the risk associated with each transaction. With this tool, businesses can easily identify and prevent fraud without causing any inconvenience to their customers.

- SIFT

Sift is an incredible finance fraud detection tool that has revolutionized the way businesses protect themselves from fraudulent activities. This powerful tool utilizes advanced machine learning algorithms to analyze and detect suspicious transactions in real-time, providing businesses with an unparalleled level of security. With Sift, businesses can now confidently identify and prevent fraudulent activities before they even occur, saving them from potential financial losses and damage to their reputation. It can process millions of transactions within seconds, enabling businesses to stay one step ahead of fraudsters. .

Regulatory Reporting Tools

- Workiva

This incredible tool has revolutionized the way financial institutions handle their regulatory reporting. With its advanced features and user-friendly interface, Workiva has made the process of reporting to regulatory authorities a breeze. One of the standout features of the Workiva finance Regulatory Reporting Tool is its ability to automate the reporting process.

Gone are the days of manually inputting data and cross-referencing multiple spreadsheets. With Workiva, you can simply input your data once, and the tool will automatically populate it across all relevant reports. This not only saves time and reduces the risk of errors but also ensures consistency and accuracy in your regulatory reporting..

- Data Rails

DataRails is an incredibly powerful and efficient finance regulatory reporting tool that is revolutionizing the way financial institutions manage their reporting processes. This innovative software is designed to streamline and automate the complex task of regulatory reporting, making it faster, more accurate, and less time-consuming. With DataRails, finance professionals can say goodbye to the days of manually inputting data into spreadsheets and struggling to meet tight reporting deadlines. This cutting-edge tool simplifies the entire process, allowing for seamless integration with existing systems and providing real-time data updates.

Robotic Process Automation (RPA) Tools

- UiPath

UiPath is a leading robotic process automation (RPA) platform that enables finance professionals to automate repetitive tasks and processes. With its drag-and-drop interface and visual workflow builder, UiPath makes it easy to create bots that can handle various finance-related activities, such as data entry, reconciliation, and report generation.

- Automation Anywhere

Automation Anywhere is an RPA tool that empowers finance professionals to automate complex business processes. It offers features such as cognitive automation, analytics, and cloud deployment. With Automation Anywhere, finance professionals can streamline their workflows, reduce errors, and free up time for more strategic tasks.

- Blue Prism

Blue Prism is a robust RPA platform that provides a digital workforce for finance professionals. Its intelligent automation capabilities enable the automation of end-to-end processes, from data extraction to decision-making. With Blue Prism, finance professionals can improve efficiency, accuracy, and compliance in their day-to-day operations.

- WorkFusion

WorkFusion is an AI-powered automation platform that combines RPA with machine learning capabilities. It enables finance professionals to automate complex tasks, such as data extraction, document processing, and regulatory compliance. With WorkFusion, finance professionals can unlock new levels of productivity and focus on higher-value activities.

Virtual Assistants Tools

- Amazon Alexa

Amazon Alexa is a virtual assistant developed by Amazon that can perform various finance-related tasks through voice commands. It can provide real-time stock quotes, assist in budget management, and answer finance-related questions. With its wide range of skills and integrations, Amazon Alexa is a valuable tool for finance professionals seeking quick and convenient access to information.

- Google Assistant

Google Assistant is a virtual assistant developed by Google that offers similar functionalities to Amazon Alexa. It can help finance professionals with tasks such as setting reminders, managing calendars, and accessing financial news. With its advanced natural language processing capabilities, Google Assistant provides a seamless and intuitive user experience.

- Apple Siri

Apple Siri is a virtual assistant exclusive to Apple devices that can assist finance professionals with various tasks. It can provide financial information, set up reminders for bill payments, and even make financial transactions through supported apps. With its integration with Apple’s ecosystem, Siri offers a seamless and personalized experience for finance professionals.

- Microsoft Cortana

Microsoft Cortana is a virtual assistant developed by Microsoft that can perform a wide range of tasks, including finance-related activities. It can provide stock market updates, track expenses, and assist in financial planning. With its deep integration with Microsoft’s suite of productivity finance tools, Cortana is a valuable asset for finance professionals looking to streamline their daily activities.

Blockchain Tools

- Hyperledger Fabric

Hyperledger Fabric is an open-source blockchain platform that enables the development of secure and scalable enterprise applications. It provides features such as permissioned networks, smart contracts, and privacy controls. Finance professionals can leverage Hyperledger Fabric to improve transparency, traceability, and security in financial transactions.

- Corda

Corda is a blockchain platform designed specifically for the financial industry. It offers features such as secure sharing of data, smart contract functionality, and regulatory compliance. Finance professionals can use Corda to streamline complex financial workflows, reduce costs, and enhance trust among participants.

- R3 Corda

R3 Corda is another blockchain platform developed by R3 that focuses on the needs of financial institutions. It provides features such as privacy, scalability, and interoperability. Finance professionals can leverage R3 Corda to create secure and efficient financial networks, enabling faster and more transparent transactions.

- Quorum

Quorum is an enterprise-grade blockchain platform developed by J.P. Morgan. It combines the benefits of blockchain technology with the privacy and security requirements of financial institutions. Finance professionals can utilize Quorum to build decentralized applications, streamline settlement processes, and enhance data privacy.

Cybersecurity Tools for Protecting Financial Data

Protecting financial data is of utmost importance in the finance industry. Finance professionals rely on cybersecurity finance tools to safeguard sensitive information from unauthorized access and potential threats. These finance tools include firewalls, encryption software, intrusion detection systems, and multi-factor authentication. By implementing robust cybersecurity measures, finance professionals can ensure the integrity and confidentiality of financial data.

Financial analysis tools

Financial analysis is a fundamental aspect of finance careers. It involves interpreting financial data to assess the performance and financial health of companies or investment opportunities. To excel in financial analysis, you need reliable tools that can help you analyze data efficiently and derive meaningful insights. Some popular financial analysis tools include:

- Excel

Excel is the go-to tool for financial analysis. Its powerful features, such as formulas, pivot tables, and data visualization, make it indispensable for finance professionals.

- Bloomberg Terminal

Bloomberg Terminal is a comprehensive platform that provides real-time financial data, news, and analytics. It is widely used by professionals in the finance industry for in-depth financial analysis.

- Tableau

Tableau is a data visualization tool that helps finance professionals create interactive dashboards and reports. It enables them to present complex financial data in a visually appealing and easy-to-understand format.

Budgeting and expense tracking tools

Effective budgeting and expense tracking are crucial for financial success, both at the personal and organizational level. With the right finance tools, finance professionals can easily create budgets, track expenses, and identify areas for cost optimization. Some popular budgeting and expense tracking tools include:

- Mint

Mint is a personal finance tool that allows you to set budgets, track expenses, and manage your finances in one place. It automatically categorizes transactions and provides insights into your spending habits.

- QuickBooks

QuickBooks is a comprehensive accounting software that simplifies budgeting, expense tracking, and financial reporting. It offers features like invoicing, payroll management, and inventory tracking, making it ideal for small businesses.

- YNAB

You Need a Budget (YNAB) is a budgeting tool that helps you gain control of your finances. It encourages you to allocate every dollar to specific categories, ensuring that you stay on track with your financial goals.

Investment management tools

For investment professionals, having the right finance tools is essential to make informed investment decisions and manage portfolios effectively. Here are some popular investment management tools:

- Portfolio123

Portfolio123 is a powerful portfolio management platform that allows you to create and backtest investment strategies. It provides a wide range of quantitative models and finance tools to help you make data-driven investment decisions.

- Morningstar Portfolio Manager

Morningstar Portfolio Manager is a comprehensive investment analysis tool that provides portfolio tracking, performance analysis, and risk assessment. It also offers access to a vast database of investment research and insights.

- Wealthfront

Wealthfront is a robo-advisor that uses sophisticated algorithms to manage your investments. It offers automated portfolio rebalancing, tax-loss harvesting, and personalized investment advice.

Tax preparation and planning tools

Tax preparation and planning can be a complex and time-consuming task for finance professionals. Fortunately, there are tools available that can automate the process and ensure compliance with tax regulations. Some popular tax preparation and planning finance tools include:

- TurboTax Business

TurboTax Business is a software solution that simplifies tax preparation for businesses. It provides step-by-step guidance, automatically fills in forms, and ensures accurate calculations.

- Thomson Reuters ONESOURCE

ONESOURCE is a comprehensive tax software that helps businesses manage their tax compliance and reporting. It offers features like global tax research, tax planning, and transfer pricing analysis.

- Avalara

Avalara is a cloud-based tax compliance software that automates the calculation and filing of sales tax. It integrates with popular accounting and e-commerce platforms, making it easy to stay compliant.

Financial reporting and forecasting tools

Accurate financial reporting and forecasting are critical for finance professionals to assess the financial performance of organizations and make informed decisions. Here are some popular financial reporting and forecasting finance tools:

- OneStream

OneStream is a unified financial planning, reporting, and analysis platform. It provides real-time financial insights, automates consolidation and reporting, and enables collaborative budgeting and forecasting.

- BlackLine

BlackLine is a cloud-based finance and accounting automation platform. It streamlines the financial close process, improves accuracy, and enhances control over financial data.

- Host Analytics

Host Analytics is an enterprise performance management platform that helps finance professionals streamline financial planning, budgeting, and reporting. It provides a centralized platform for collaboration and data-driven decision-making.

Risk management and compliance tools

Risk management and compliance are essential aspects of finance careers, particularly in industries like banking and insurance. To effectively manage risks and ensure regulatory compliance, finance professionals can rely on various finance tools. Some popular risk management and compliance tools include:

- Value at Risk (VaR)

VaR is a statistical tool used to estimate the maximum potential loss of an investment portfolio over a specified time horizon. It helps finance professionals measure and manage the risk associated with their investments.

- Monte Carlo simulation

Monte Carlo simulation is a technique that uses random sampling to model the probability of different outcomes in a financial model. It is commonly used to assess the risk and uncertainty of investment portfolios.

- Stress testing

Stress testing is a risk management technique that involves simulating extreme scenarios to assess the resilience of financial systems or portfolios. It helps finance professionals identify vulnerabilities and develop contingency plans.

- Scenario analysis

Scenario analysis is a technique that involves evaluating the potential impact of different scenarios on financial performance. It helps finance professionals assess the sensitivity of their investments to changes in market conditions.

Customer service tools

In the finance industry, providing excellent customer service is essential to build trust and maintain strong relationships with clients. Customer service finance tools can help finance professionals streamline their interactions with clients and ensure timely and effective communication. Some popular customer service tools include:

- Zendesk

Zendesk is a customer service software that helps finance professionals manage customer support tickets, inquiries, and complaints. It provides a centralized platform for tracking and resolving customer issues.

- Salesforce

Salesforce is a comprehensive customer relationship management (CRM) platform that enables finance professionals to manage customer interactions, track sales opportunities, and analyze customer data.

- Freshdesk

Freshdesk is a cloud-based helpdesk software that enables finance professionals to provide multichannel support to their customers. It offers features like ticket management, knowledge base, and collaboration tools.

- Intercom

Intercom is a messaging platform that allows finance professionals to engage with their customers through live chat, targeted messages, and personalized emails. It helps improve customer satisfaction and drive conversions.

Market research tools

To make informed investment decisions and stay ahead of the competition, finance professionals need access to reliable market research and insights. Market research finance tools provide real-time data, analysis, and trends that can help professionals identify potential investment opportunities. Here are some popular market research tools:

- Trading Economics

Trading Economics is a platform that provides economic indicators, historical data, and forecasts for countries around the world. It allows finance professionals to track macroeconomic trends and make data-driven investment decisions.

- SentimenTrader

SentimenTrader is a market research platform that analyzes investor sentiment and market indicators. It provides insights into market psychology and helps finance professionals assess market conditions.

- Finviz

Finviz is a financial visualization platform that provides real-time stock market data, charts, and analysis. It allows finance professionals to screen for stocks based on various criteria and identify potential investment opportunities.

Treasury tools

For finance professionals involved in treasury management, specialized tools are available to help them manage cash flow, foreign exchange, debt issuance, and derivatives trading. These tools help finance professionals optimize liquidity, mitigate currency risks, and ensure compliance with financial regulations. Some popular treasury finance tools include:

- Cash management software

Cash management software helps finance professionals monitor and manage their organization’s cash flow. It provides features like cash forecasting, liquidity management, and bank account reconciliation.

- Foreign exchange platforms

Foreign exchange platforms enable finance professionals to execute foreign currency transactions, hedge currency risks, and manage international payments. They provide real-time exchange rates, analysis, and reporting capabilities.

- Debt issuance platforms

Debt issuance platforms streamline the process of issuing debt securities, such as bonds or commercial paper. They provide end-to-end support for debt issuance, including document preparation, investor management, and compliance tracking.

- Derivatives trading platforms

Derivatives trading platforms facilitate the trading of financial derivatives, such as options, futures, and swaps. They provide access to various markets, trading tools, and risk management features.

Personal finance tools for career growth

To excel in your finance career, it is essential to manage your personal finances effectively. Personal finance tools can help you track your expenses, save money, and plan for the future. Here are some personal finance tools that can support your career growth:

- Personal Capital

Personal Capital is a comprehensive personal finance tool that allows you to track your investments, create budgets, and plan for retirement. It provides a holistic view of your financial situation and helps you make informed decisions.

- Mint

Mint, mentioned earlier as a budgeting and expense tracking tool, is also a great personal finance tool. It enables you to set financial goals, track your net worth, and receive personalized financial advice.

- You Need a Budget (YNAB)

YNAB, mentioned earlier as a budgeting tool, can also be used for personal finance management. It helps you prioritize your financial goals, save money, and build a strong financial foundation.

Real estate investment tools

Real estate investment finance tools, such as CoStar and LoopNet, provide access to property listings, market research, and investment analysis. They help real estate finance professionals identify potential investment opportunities and assess property values.

Conclusion

In today’s finance industry, leveraging the right tools can make a significant difference in your career. From accounting software to real estate investment finance tools, fraud detection tools to RPA platforms, virtual assistants to blockchain technology, and cyber security tools, the possibilities are endless. By incorporating these essential tools into your workflow, you can streamline processes, enhance productivity, and stay ahead of the competition. Embrace the power of technology and excel in your finance career.

6 thoughts on “20 Finance Industry-specific tools for 2023”

[…] to assist finance professionals in their work. In this section, we will explore the top 10 AI tools that are expected to dominate the finance industry in […]

[…] great data source for financial modeling is existing financial tools and databases. These databases can be internal databases or databases associated with other […]

[…] Artificial Intelligence Tools: Artificial intelligence tools can be used to investigate potential fraudulent activities within an organization. These tools can […]

I genuinely treasure your piece of work, Great post.

It is in point of fact a nice and useful piece of info. I am happy that you shared this helpful info with us. Please keep us up to date like this. Thanks for sharing.

Thanks for sharing excellent informations. Your web site is very cool. I am impressed by the details that you have on this blog. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for more articles. You, my pal, ROCK! I found simply the info I already searched everywhere and simply couldn’t come across. What a perfect web-site.