Buying your dream home is a significant milestone in your life, but it can also come with a hefty price tag. This is where home loans come into play, providing you with financial assistance to make your dream a reality. However, repaying a home loan can be daunting, especially if you’re on a tight budget. That’s where the Equated Monthly Installment (EMI) functions comes into play.

EMI is a mechanism that helps you pay off your home loan in a systematic and structured manner, without putting too much strain on your finances. In this step-by-step guide, we’ll explore how EMI functions can help you save money on your home loan, and how you can leverage this tool to manage your finances efficiently. So, whether you’re a first-time homebuyer or looking to refinance your existing home loan, read on to discover how EMI can help you save money and make your home ownership journey a lot smoother.

What are EMI functions?

EMI stands for Equated Monthly Installments. It is a mechanism used by banks and financial institutions to facilitate the repayment of loans, including home loans. EMI is a fixed amount that you have to pay each month towards the repayment of your loan, which includes both the principal amount and the interest accrued on it. EMI functions are designed to help you repay your loan in a structured manner, over a predetermined period. This makes it easier for you to manage your finances and plan your expenses accordingly.

How do EMI functions work?

EMI functions work by breaking down your loan repayment into smaller, manageable installments that you have to pay each month. The EMI amount is calculated based on the principal amount, the interest rate, and the tenure of the loan. The longer the tenure of the loan, the lower the EMI amount, and vice versa. The EMI amount remains fixed throughout the tenure of the loan, which means that you’ll have to pay the same amount each month until the loan is fully repaid.

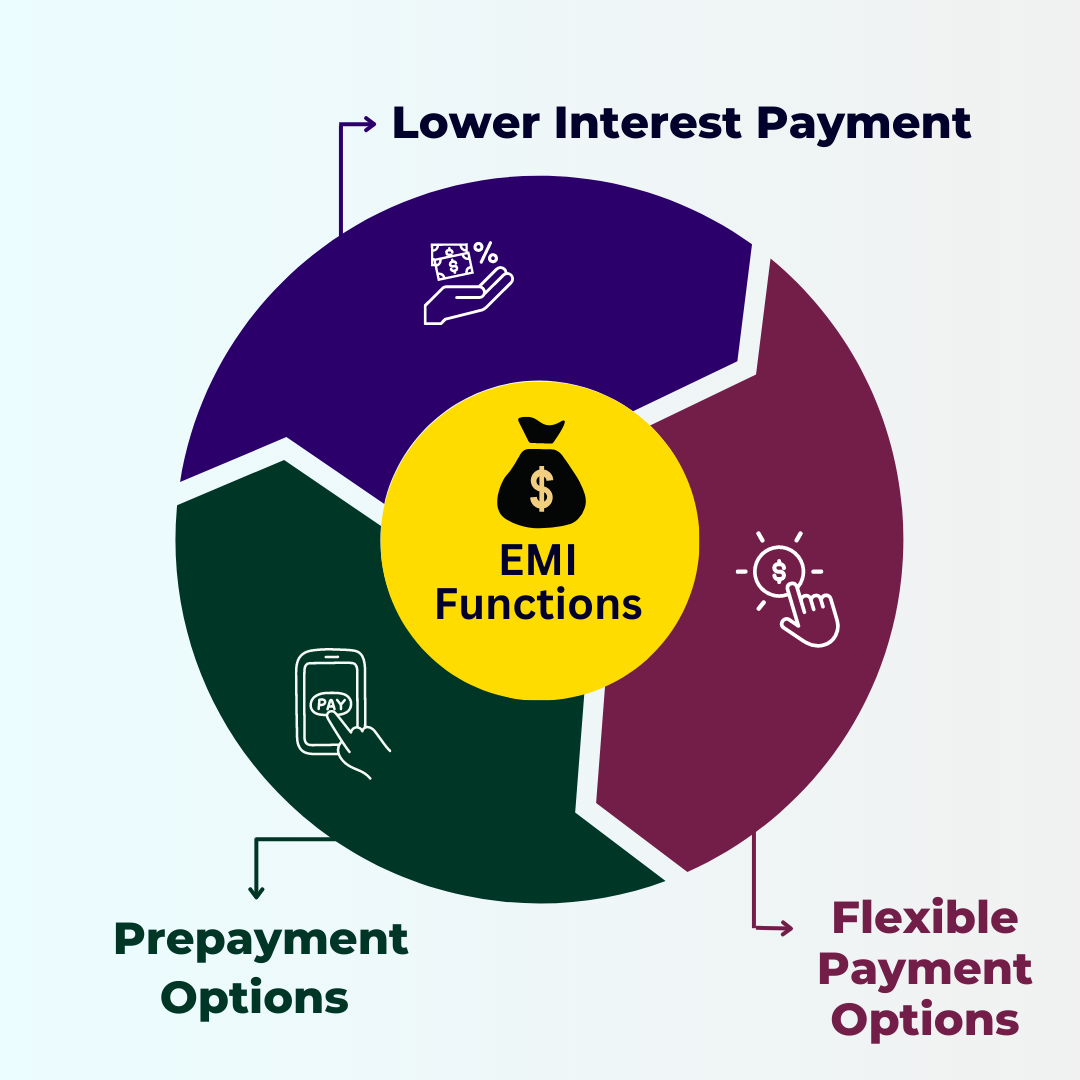

Benefits of EMI functions for home loans

There are several benefits of using EMI functions for home loans. Firstly, EMI functions make it easier for you to manage your finances, as you’ll know exactly how much you have to pay each month towards your loan repayment. This helps you plan your expenses and budget your finances more efficiently.

Secondly, EMI functions help you save money on your home loan by breaking down your repayment into smaller installments. This reduces the burden of repaying a large sum of money in one go, which can be challenging for many borrowers. Finally, EMI functions help you build a good credit score, as timely repayment of your EMI can improve your creditworthiness and increase your chances of getting loans in the future.

Understanding the EMI calculation process

The EMI calculation process is a mathematical formula used by banks and financial institutions to determine the EMI amount for your home loan. The formula takes into account the principal amount, the interest rate, and the tenure of the loan. The formula is as follows:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

Where P is the principal amount, R is the interest rate per month (calculated as the annual rate divided by 12), and N is the tenure of the loan in months.

Factors that affect your EMI

Several factors can affect your EMI, including the principal amount, the interest rate, and the tenure of the loan. The higher the principal amount, the higher the EMI amount, and vice versa. Similarly, the higher the interest rate, the higher the EMI amount, and vice versa.

Finally, the longer the tenure of the loan, the lower the EMI amount, and vice versa. It’s essential to understand these factors before applying for a home loan and to choose a loan that suits your budget and repayment capacity.

How to calculate your EMI

Calculating your EMI is easy, thanks to online EMI calculators available on the websites of banks and financial institutions. All you have to do is enter the principal amount, the interest rate, and the tenure of the loan, and the calculator will give you the EMI amount.

Alternatively, you can use the formula mentioned above to calculate your EMI manually. It’s essential to calculate your EMI before applying for a home loan, as it will help you plan your finances and choose a loan that suits your budget.

Tips to save money on your home loan using EMI functions

There are several tips you can follow to save money on your home loan using EMI functions. Firstly, you can opt for a longer tenure of the loan, which will reduce your EMI amount but increase the interest paid over the long term. Secondly, you can make prepayments towards your loan, which will reduce the principal amount and, in turn, reduce the interest paid.

Finally, you can opt for a floating interest rate, which can fluctuate based on market conditions and can help you save money on your interest payments over the long term.

Understanding the impact of interest rates on your EMI

Interest rates play a significant role in determining your EMI amount. The higher the interest rate, the higher the EMI amount, and vice versa. It’s essential to understand the impact of interest rates on your EMI and to choose a loan with a favorable interest rate. Additionally, you can opt for a fixed interest rate, which remains constant throughout the tenure of the loan and provides stability to your EMI amount.

Conclusion and final thoughts

In conclusion, EMI functions can help you save money on your home loan by breaking down your repayment into smaller, manageable installments. By understanding the EMI calculation process, the factors that affect your EMI, and the tips to save money on your home loan, you can manage your finances efficiently and make your home ownership journey a lot smoother.

So, before applying for a home loan, make sure to calculate your EMI, choose a loan that suits your budget, and plan your finances accordingly. With the right approach, home ownership can be a lot more affordable and achievable than you think.

In today’s fast-paced world, learning has become more important than ever. To kickstart your learning journey, one can easily head over to the website and browse through the plethora of courses on offer. With detailed information about each course, you can make an informed decision and choose the one that aligns with your goals and aspirations.

9 thoughts on “How EMI Functions Can Help You Save Money on Your Home Loan”

MyCellSpy es una poderosa aplicación para el monitoreo remoto en tiempo real de teléfonos Android.

Esto puede ser molesto cuando sus relaciones se interrumpen y no se puede rastrear su teléfono. Ahora puede realizar esta actividad fácilmente con la ayuda de una aplicación espía. Estas aplicaciones de monitoreo son muy efectivas y confiables y pueden determinar si su esposa lo está engañando.

Rastreador de teléfono celular – Aplicación de rastreo oculta que registra la ubicación, SMS, audio de llamadas, WhatsApp, Facebook, fotos, cámaras, actividad de Internet. Lo mejor para el control parental y la supervisión de empleados. Rastrear Teléfono Celular Gratis – Programa de Monitoreo en Línea.

Мы собрали список действующих МФО, предоставляющих микрозаймы без отказа, в том числе при наличии плохой кредитной истории. Все предложения актуальны и проверены. Доступно по ссылке: [url=https://t.me/s/mfo_2024_online]мфо займ на карту круглосуточно без проверок[/url] .

Друзья! Ищущие оптимальный сайт для игры? Представляем вам [url=https://1xslots-baq.xyz/]1xslots скачать на андроид бесплатно[/url] — платформа, где любой найдет что-то по душе.

Преимущества:

? Широкий выбор развлечений.

? Эксклюзивные бонусы для новичков а также опытных пользователей.

? Надежность и удобство на высшем уровне.

Просто зайдите по адресу и начните игру моментально!

Почему терять драгоценные минуты? Начните вашу игру сегодня же а также получите удовольствие увлекательными моментами!

Компания “Развитие” это опытный дистрибьютор агротехники с гарантией качества. На сайте razvitieagro.ru представлен широкий выбор товаров для животноводства, птицеводства, систем хранения урожая и тепличных комплексов. Мы поставляем технику для свиноферм, животноводческих комплексов, доильных блоков, систем вентиляции, автоматического управления и кормления. Вся оснащение имеет документы и удовлетворяет потребности агропроизводства. Работаем без посредников — с выгодными условиями и сервисом.

Если вы подбираете конкретные решения — вы по адресу. У нас можно найти всё, вплоть до таких редких позиций, как [url=https://razvitieagro.ru/]оборудование для молочного животноводства[/url] которое гарантирует циркуляцию воздуха в теплицах. Также в наличии системы обогрева, системы освещения, распылители, инкубаторы, оборудование для чистки животных, водоснабжение для животных, раздатчики корма, шнеки, малогабаритные цеха по производству комбикорма и весь спектр техники. Весь ассортимент — на складе, доставка по всей России.

Наша компания находится по адресу: г. Ижевск, ул. Маркина 197. Если ваша задача — [url=https://razvitieagro.ru/]для доения коров[/url] или приобрести комплексное оборудование для предприятия, мы поможем найти лучший вариант. Укомплектуем, рассчитаем и доставим — всё быстро, надежно и с консультацией специалиста.

Когда банковский отказ — не вариант, на помощь приходит [url=https://mikro-zaim-online.ru/zaim-bez-otkaza-na-kartu/]mikro-zaim-online.ru[/url]. Достаточно паспорта и карты на ваше имя, с 18 лет. Более 60 МФО, высокая вероятность одобрения, даже с плохой кредитной историей. Хотите без процентов или фиксировано 0.8% в день? Всё доступно здесь.

Выдача займов без проверки и отказа возможна — но только если всё делается по закону. Закон №151-ФЗ гарантирует, что вы получите займ от лицензированной МФО с официальным договором. Деньги переводятся моментально, условия честные и открытые. Это не серые схемы, а реальная финансовая помощь.

Anacortes limo service offers luxurious transportation for various occasions. With a fleet of high-end vehicles, Anacortes limo services cater to weddings, corporate events, and airport transfers. For larger groups, the [url=https://bdlxlimo.com/blog/2022/06/04/limousine-rental-in-anacortes/] Anacortes party bus [/url] is an excellent choice, providing ample space and amenities for a memorable experience. Whether you need a sleek sedan for a business meeting or a spacious party bus for a night out, Anacortes limo services ensure comfort and style. Professional chauffeurs guarantee a smooth and safe ride, making every journey a VIP experience. Book your Anacortes limo service today for a seamless and elegant travel solution.[url=https://bdlxlimo.com/blog/2022/06/04/limousine-rental-in-anacortes/] Anacortes limo service [/url] offers luxurious transportation for various occasions. With a fleet of high-end vehicles, Anacortes limo services cater to weddings, corporate events, and airport transfers. For larger groups, the Anacortes party bus is an excellent choice, providing ample space and amenities for a memorable experience. Whether you need a sleek sedan for a business meeting or a spacious party bus for a night out, Anacortes limo services ensure comfort and style. Professional chauffeurs guarantee a smooth and safe ride, making every journey a VIP experience. Book your Anacortes limo service today for a seamless and elegant travel solution.Anacortes limo service offers luxurious transportation for various occasions. With a fleet of high-end vehicles, [url=https://bdlxlimo.com/blog/2022/06/04/limousine-rental-in-anacortes/] Anacortes limo services [/url] cater to weddings, corporate events, and airport transfers. For larger groups, the Anacortes party bus is an excellent choice, providing ample space and amenities for a memorable experience. Whether you need a sleek sedan for a business meeting or a spacious party bus for a night out, Anacortes limo services ensure comfort and style. Professional chauffeurs guarantee a smooth and safe ride, making every journey a VIP experience. Book your Anacortes limo service today for a seamless and elegant travel solution.

Great news for all us