WHAT IS EBITA?

The full form of EBITA is Earnings before Interest, Tax and Amortization. EBITA is a metric used by Analysts and Investors to measure the operating profitability and efficiency of any company and used as a tool for comparison with companies in the similar industry. EBITA excludes the non-operating expenses of the company i.e., the financing costs in the form of interest payment, effect of taxes and amortization of any intangible assets but includes the cost of capital assets (depreciation). EBITA is a non-GAAP measure of the operating profitability of a company where the non-cash items (except amortization expenses) and non-operating expenses are added back to the Net profit figure.

EBITA is an operating profitability metric that lies between other two very commonly used profitability metrics EBIT and EBITDA.

EBIT also commonly called “operating income” is profit of the company remaining after deducting the cost of goods sold and operating expenses from Revenue. EBITDA on the other hand is the company’s normalized operating cash flows which is arrived by removing the non-cash expenses such as depreciation and amortization. Both the measures exclude non-cash items i.e., interest and taxes. The only difference between the two is that EBIT includes non-cash expenses (depreciation and amortization) and EBITDA excludes non-cash expenses.

EBITA lies in between these two measures by adding back only the amortization expenses to the EBIT. This metric excludes only a part of the non-cash expenses (i.e., the amortization expense) while the other part i.e., the depreciation is included. Amortization under the accrual accounting system is a methodology through while carrying value of Intangible assets are reduced incrementally over the useful life of the asset.

In day to day analysis, EBITA is lesser used than EBIT and EBITDA, however in many instances analyst use EBITA to study the impact of depreciation through the variance between EBITA and EBITDA.

EBITA can be a positive or negative value. A positive EBITA shows that the company is generating more revenue from its operations than the expenses it incurs on carrying out its operations. It shows that after setting off the operational expenses the company has surplus amount available to pay off its interest and tax liability and if any further surplus is left shall be available for distribution to shareholders as dividends or retention in the company for future growth of operations. A negative EBITA on the other hand indicates that a company may be facing troubles in managing its cash flow from operations and thereby making profits.

EBITA Vs. EBITDA

The depreciation add back to EBIT can significantly increase the EBITDA of companies especially of those which are in capital intensive industries requiring heavy expenditures on heavy equipment and machines like manufacturing industries and mining companies. Hence EBITDA can be a misleading metric for investors since it artificially inflates the profitability of such companies. It is however useful for comparison of two companies in the same industry and both the companies being compared are capital intensive. This ratio cannot be used to compare a capital and a non-capital intensive industry at the same time since it will give distorted comparison of profitability.

In contrast, EBITA metric considers depreciation as a real cost to run a business and not added back to the operating profit of the company (EBIT).

EBITDA does not consider non-cash expenses and hence depreciation is added back in this metric. The major flaw in this metric is that it neglects the impact of full cash flow from capital expenditure, whereas the EBITA is somewhat better off as it only adds back amortization expense and does not ignore the cash flow from capital expenditure. In short, EBITA is similar to EBITDA less capex.

EBITA FORMULA

EBITDA can be calculated by two methods- Direct and Indirect method discussed below:

- Direct Method: The direct method is a top down approach to calculate EBITA since under this method EBITA is arrived by subtracting cost of goods sold and operating expenses less amortization expenses from the company’s total revenue.

FORMULA:

EBITA = Total Revenue – COGS – (Operating Expenses – Amortization)

Where,

- Revenue: It is the total sales generated by providing service or selling the goods. It is how much money a company brings in during a period of time.

- Cost of Goods Sold (COGS): It is any direct costs associated with the sale of goods or rendering of services. Some of the expenses associated with cost of goods sold include: Factory labour, Freight, Parts used during manufacturing/ production, Raw materials, Storage, Wholesale price of goods etc.

- Operating Expenses (OPEX): It is the cost associated with the day to day operations of the company. Common operating expenses include: Advertising, Equipment, Depreciation, Insurance, Inventory, Maintenance, Marketing, Office supplies, Payroll, Property taxes, Rent, Repairs, R&D.

All the inputs required for calculating the EBITA is easily available in the Income Statement of the Financial Statements published by the company. Amortization expenses and depreciation expenses are usually clubbed and shown together at the face of the Income Statement. To get a breakup of Amortization expense one has to refer the Statement of Cash flow, and if the break is not given there also then one can refer through the section of 10-K or 10-Q filing where the details of Intangible assets and amortization expenses are stated separately.

However, some companies may not provide the breakup of the operating expenses or cost of goods sold and for such companies EBITA can be calculated using the Indirect method.

- Indirect Method: In this method the interest, taxes and amortization expenses are added back to the profit after tax i.e., the net income thereby giving us the EBITA value.

FORMULA:

EBITA = Net income + Interest + Taxes + Amortization

where,

- Net Income: It is profit after tax and the bottom most line item of the Income Statement.

- Interest: It is the cost incurred by an entity for borrowed funds. It is a non-operating expenses component in the income statement. It shows the interest payable on loans, bonds, convertible debt and other forms of credit taken by the company.

- Taxes: It is an expenses incurred by the company in earning income and is accrued in the same period in which the company earns the income to which they relate to.

- Amortization: It is the accounting method for distributing the cost of Intangible assets over the useful life of the asset.

The components in the above formula can be easily found on the face of the Income statement, and amortization expense details from the cash flow statement as discussed above and is a much straightforward method than the direct method.

EBITA VS. GAAP EARNINGS

The difference GAAP earnings and EBITA is listed below:

| Particulars | GAAP | NON-GAAP (Example: EBITA) |

| Standards | It is required to be mandatorily followed by the public companies and is the financial reporting standard used in the United States. | Can be used by the private and public companies singularly or in addition to GAAP and is not an industry standard. |

| Governance | Regulated and governed by FASB and SEC | It is less regulated but still guided by SEC rules and regulations. |

| Purpose | To provide a fair and true picture of a company’s financial performance. | To convey a more detailed financial picture about a company’s business operations by making certain adjustments. |

| Accounting | It is the standards mandated for public companies, while some private companies may also follow them. | It is an alternative accounting method and is not mandatory to be followed. |

| Adjusted Earnings | The financial statements include the non-recurring expenses | The financial statements exclude non-recurring expenses |

| Consistency | It provides uniform preparation and presentation of financial information | It lacks consistency in the inclusion or exclusion of certain expenses and |

| Financial Comparison | Since its provides consistency in reporting it provides reliability in comparison of financial statements of different company, over different time periods and comparison of industry as well. | It lacks consistency and hence no reliable comparison of financial results can be made of companies over time, with different companies and industry. |

| What does it show | It shows that a company is steadily increasing its revenue and earnings. | Since it includes adjustments to be made, it can show the nuances of the company that is spending more money or restructuring its budget to grow its operations and also reflect the non-recurring items giving the actual financial position of the company. |

EBITA Vs. NOPAT

EBITA is Operating profit(EBIT) plus amortization expenses of the company. It excludes the tax impact and amortization from its calculation. However, NOPAT is operating profit(EBIT) less tax impact. The formula for both the measures is given below:

EBITA= EBIT+ Amortization

NOPAT= EBIT (1-tax)

USES OF EBITA

The EBITA is used by Accounts, analysts and investors in day to day analysis and decision making process. Some of the uses of EBITA are as following:

- Comparison with peer companies: EBITA metric can be used to compare a company’s profitability with industry benchmarks and give an insight how the company is performing as compared to its competitors in the industry. This gives the company a base to compare and do a swot analysis and identify areas that require improvements and hence helps it make more informed decisions.

- Gives a clear picture of the company’s profitability: It helps in getting a clear picture of a company’s operating profitability as it excludes the non-operating items like- interest and tax and also non-cash element amortization. It provides an excellent tool to evaluate the company’s performance from its core operations and is used to assess a company’s ability to generate cash flow and its financial health.

- Help investors to take more informed decisions: EBITA since provides an insight into company’s profitability from its core operations, it acts as an excellent tool for investors to evaluate their investment alternatives into the company who look whether the company has the ability to generate cash from operations and also evaluate risk associated with the investment.

- Helps in assessing the operational efficiency of the company: Since it focuses on evaluating the profitability from core operations it provides a tool to assess the operational efficiency of any company and the areas where improvement can be done to improve its operations and thereby the revenue from operations.

LIMITATIONS OF EBITA

Some of the limitations of EBITA are as following:

- Exclusion of non-operating and certain non-cash expenses: EBITA in its calculation excludes non-operating expenses like interest and tax and non-cash expense like amortization. These expenses may however be significant expenses for some businesses and can have a significant impact on the overall company’s profitability and health. Hence, this measure does not provide a comprehensive view of a company’s financial profitability.

- Dependence on accounting standards: EBITA metric is dependent on accounting standards and caries from company to company as it may be differently calculated for different companies. This makes the comparison of EBITA figures difficult across companies and industry.

- Does not take taxes into account: For some company’s taxes may be a significant figure and since EBITA excludes taxes in its calculation it can make it challenging to compare the overall financial performance of companies.

- Potential for misinterpretation: EBITA cannot be used as the sole metric to evaluate a company’s performance since it excludes non-operating items from the net profit of the company. If for example, a company has high EBITA but low net income, it means that the company has high debt and incurring significant amount on interest expenses or is paying higher taxes compared to its peer companies. Hence, EBITA should be used along with other financial ratios to provide a holistic view of a company’s financial performance.

EXAMPLE 1: Let us demonstrate how Depreciation add-back to EBIT has impact on the profitability of a Hypothetical company named ABC Ltd.

Below is the Income Statement of ABC Ltd.

| Particulars | Amount in $ million |

| Revenue | 300 |

| Less: COGS | (280) |

| Gross Profit | 120 |

| SG&A (Excluding D&A) | (50) |

| EBITDA | 70 |

| Less: Depreciation | (50) |

| Less: Amortization | (10) |

| EBIT | 10 |

From the above we can calculate the following ratios:

EBIT margin = EBIT/Revenue*100

= 10/300*100

= 3.33%

EBITDA margin = EBITDA/Revenue*100

= 70/300*100

= 23.33%

EBITA margin = EBITA/Revenue*100

= (10+10)/300*100

= 6.67%

We can see that with exclusion of depreciation, the profitability margin shoots up to 23.33% whereas with the inclusion of depreciation the profitability margin drops to direct 6.67% in EBITA margin. The difference between the EBIT margin and EBITA margin is only around 3%. However, the difference between EBITA margin and EBITDA margin is around 16.67%. This example shows that depreciation expense is a major expense here and have a significant impact on the profitability.

EXAMPLE 2: Let us see an example where the Sales of the company increase however the net profit drops and how depreciation plays a major role here.

Income Statement items of ABC Ltd for the year 2022 and 2023 are as following:

(Amount in million $)

| Particulars | 2022 | 2023 |

| Sales | 20,00,000 | 27,00,000 |

| Net Profit (Profit after tax) | 10,00,000 | 950,000 |

| Amortization expenses | 7,000 | 7,000 |

| Taxes | 60,000 | 110,000 |

| Interest | – | 120,000 |

EBITA (2022) = (Net Profit+ Interest+ Taxes+ Amortization)

= $(10,00,000+0+60,000+7,000)

= 10,67,000

EBITA (2023) = (Net Profit+ Interest+ Taxes+ Amortization)

= $(950,000+120,000+110,000+7,000)

= $11,87,000

From the above example we can see that the net profit of the company dropped by $50,000 from 2022 to 2023, whereas the EBITA increased by $120,000. This shows that due to the loan taken by the company in 2023, it has to bear interest expenses and due to which the net profit falls. However, the loan is taken to increase the net sales which actually increased by $700,000 from 2022 to 2023. Hence, when an investor is looking to invest in the growth company, it should look into the EBITA metric rather than net profit to take better investment decision.

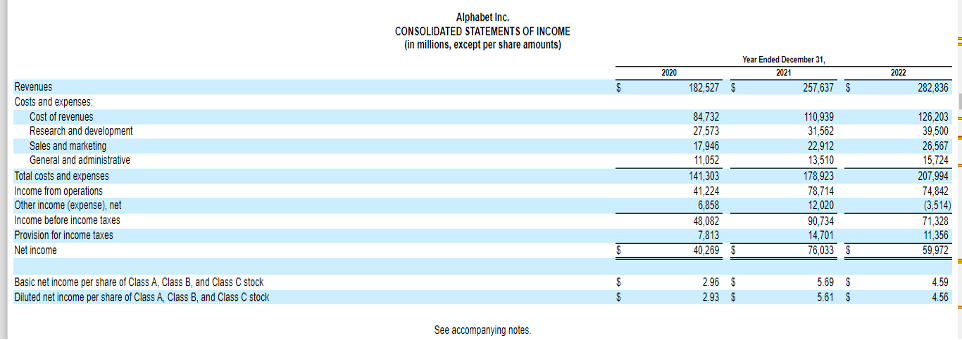

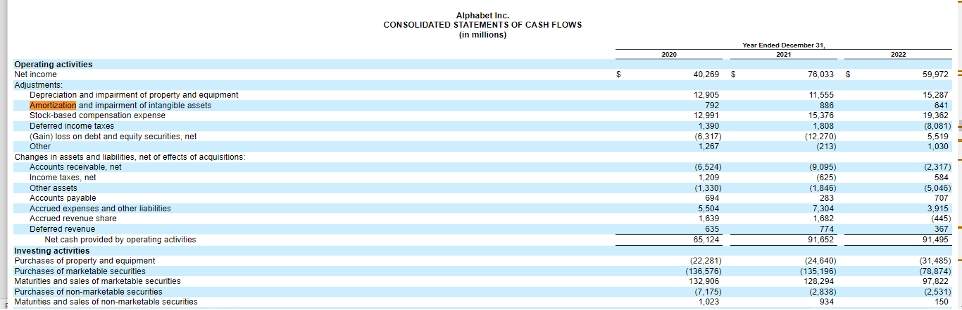

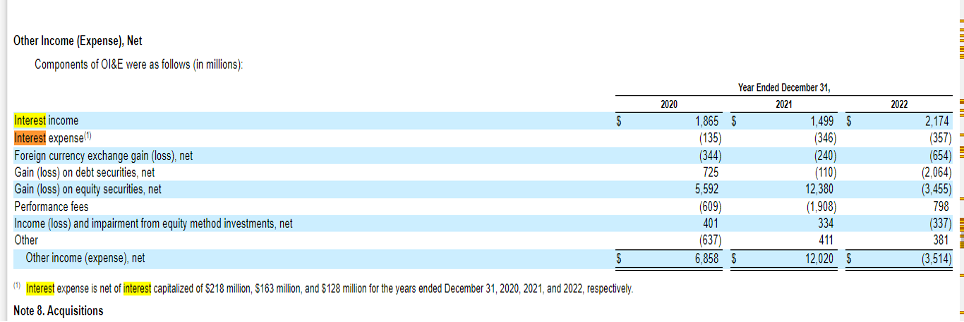

EXAMPLE 3: Let us calculate EBITA for Alphabet Inc. for FY 2022,2021 and 2020

Source: https://www.sec.gov/Archives/edgar/data/1652044/000165204423000016/goog-20221231.htm

Source: https://www.sec.gov/Archives/edgar/data/1652044/000165204423000016/goog-20221231.htm

Source: https://www.sec.gov/Archives/edgar/data/1652044/000165204423000016/goog-20221231.htm

Since from the above Income statement we get only the net profit and Taxes amount, we gather information on amortization and interest expense from the notes to accounts.

From the above financial statements, we get the following data to calculate EBITA:

| Particulars | 2022 | 2021 | 2020 |

| Net Income | 59,972 | 76,033 | 40,269 |

| Add: Interest | 357 | 346 | 135 |

| Add: Taxes | 11,356 | 14,701 | 7,813 |

| Add: Amortization | 641 | 886 | 792 |

| EBITA | 72,326 | 91,966 | 49,009 |

From the above table we can see that EBITA of Alphabet Inc. has increased in year 2021 as compared to year 2020. And then again it has decreased in 2022 as compared to 2021. We can see from the above table that in year 2021 the taxes amount has doubled and also the Interest amount. The reason for increase in interest amount has to be further investigated by studying the Annual reports of the company before reaching any conclusion about the performance of the company.

Read more about this on our LinkedIn page as well:

2 thoughts on “EBITA – better than EBITDA?”

[…] get the Earnings before Interest and Taxes (EBIT), by subtracting the Depreciation and Amortization from the […]

[…] Here we reduce the tax effect from the EBIT […]

Comments are closed.