What is Credit Ratings?

Credit Ratings is the assessment of an individual, business or state’s ability to repay its debt. Credit ratings provides third-party insights about the borrower’s creditworthiness and financial health.

Credit ratings is vital for lenders, investors, intermediaries, businesses and financial institutions. They analyse, evaluate and compare the credit ratings of an individual or institution before making any investment or lending decision. The credit ratings helps lenders understand the debt quality and the economic position of the borrowers.

Objectives of Credit Ratings

Credit rating was introduced in the early 20th century to avoid default risk, the probability of financial loss where the debtor fails to repay the debt. In today’s dynamic world of investment, numerous market players use credit ratings to ensure the safety of their principal investments. The following are the objectives of having a credit rating:

- The fundamental aim of a credit rating is to speculate and avoid the default risk.

- Credit rating underscores the financial health of a company.

- It also assesses the debt repayment profile of the individual, company or state.

- Credit rating, with other strategic tools, helps individuals, banks, and institutional investors chalk out their investment decisions.

- Credit rating helps investors develop forward-looking opinions about a company’s creditworthiness.

Users of Credit Ratings

Under credit rating objectives, we have seen why credit rating is crucial for a business. Under this section, we will understand different users of credit rating:

Investors:

Before investing in debt securities, investors often use credit rating to gain clarity on the institution’s creditworthiness and credit risk. Institutional investors like banks, insurance companies, mutual funds, etc, use credit ratings to analyse prime debt securities. It also indicates the credit quality of a debt issue and helps investors set investment thresholds and risk tolerance levels.

Intermediaries:

Intermediaries are the parties which connect the borrowers to the lenders to promote the flow of capital. In this case, investment banks are the intermediaries. They use credit ratings to benchmark the credit risk associated with the debt instruments. They also use credit ratings to determine the cost of debt issues and their initial pricing.

Issuers:

Issuers of debt securities like corporations, financial institutions, governments, etc use credit ratings to present views of their financial health and creditworthiness. Companies also use credit ratings to highlight the credit quality of the debt issue.

Issuers follow the thumb rule that the higher the credit rating, the lower the cost of debt and visa versa. It holds because of the risk-return relation associated with the debt and creditworthiness of an organisation.

Time Horizons in Credit Ratings

When discussing credit ratings, understanding the concept of time horizons is crucial. Time horizons in credit ratings refer to the timeframe over which credit risk is assessed and evaluated. Credit rating agencies may use varying time horizons based on their methodologies and the specific characteristics of the securities being rated. Here’s a breakdown of the typical time horizons used in credit ratings:

Short-Term Credit Ratings:

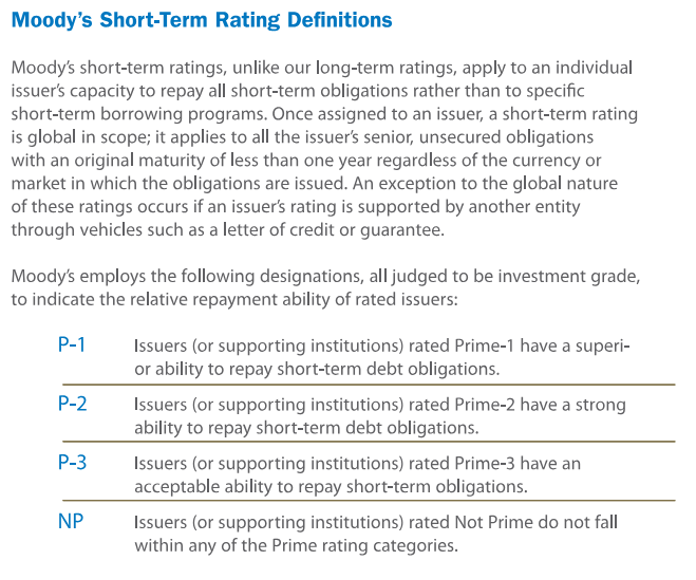

Short-term credit ratings assess the creditworthiness of debt securities with maturities typically ranging from a few days to one year. Short-term credit ratings are used for commercial paper, short-term bonds, and other money market instruments.

These ratings are relevant for investors seeking to evaluate the likelihood of timely repayment within a short timeframe. Time horizons for short-term credit ratings typically focus on near-term cash flow projections, liquidity positions, and short-term financial obligations.

Long-Term Credit Ratings:

Long-term credit ratings evaluate the credit risk associated with debt securities with maturities exceeding one year. These ratings provide insight into the issuer’s ability to meet its financial obligations over an extended period.

Long-term credit ratings are essential for investors making long-term investment decisions, such as purchasing corporate bonds or government treasury bills & securities. Time horizons for long-term credit ratings often involve assessing factors like the issuer’s financial stability, business outlook, industry trends, and economic conditions over the medium to long term.

What do Investment Quality and Speculative Quality mean in Credit Ratings?

When studying credit ratings investors and businesses need to understand the quality or grade of a debt security based on the risk associated with them.

Investment Quality:

Investment quality, also known as investment grade, refers to debt securities considered relatively low risk in terms of default. These securities are typically assigned credit ratings within the higher tiers of the credit rating scale, indicating a strong capacity for timely repayment of principal and interest.

Investment-grade ratings are often assigned to bonds issued by financially stable corporations or governments with strong creditworthiness. Investors seeking stable income streams and capital preservation focus more on investment-grade securities due to their lower risk profile.

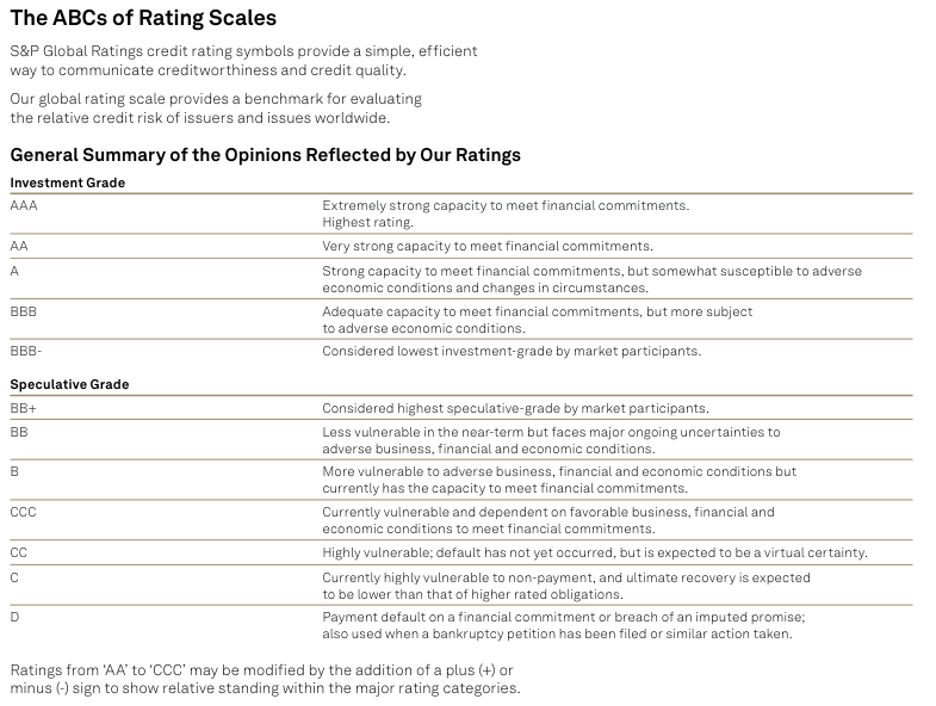

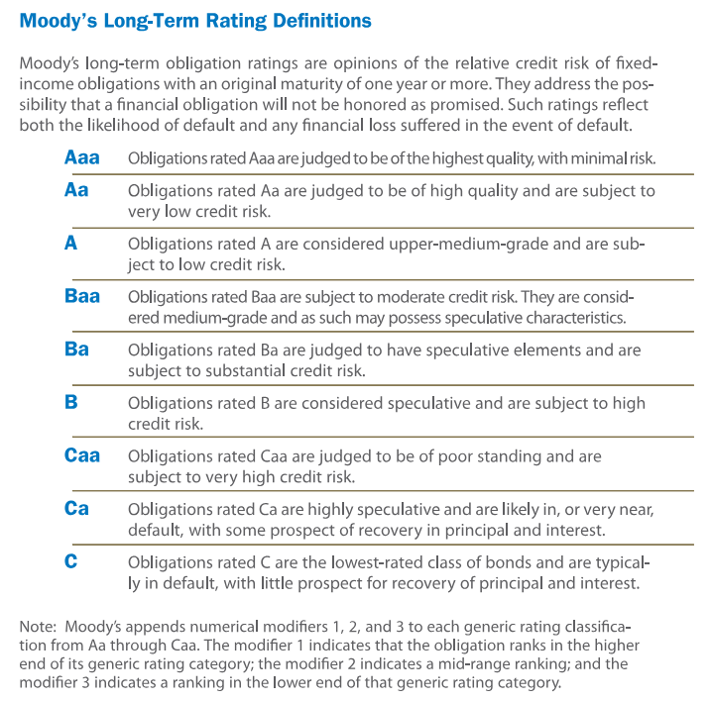

Credit rating agencies typically assign investment-grade ratings to securities with ratings falling within the highest categories of their credit rating scales, such as AAA to BBB- by S&P Global and Fitch, or Aaa to Baa3 by Moody’s.

Speculative Quality:

Speculative quality, also termed high-yield or non-investment grade, refers to debt securities with a higher default risk than investment-grade securities. These securities are typically assigned credit ratings within the lower tiers of the credit rating scale, indicating a higher probability of default or greater credit risk.

Speculative-grade ratings are often assigned to bonds issued by companies or entities with weaker credit profiles, higher leverage, or uncertain financial prospects. Investors attracted to speculative-grade securities may be willing to accept higher yields in exchange for taking on increased credit risk.

Credit rating agencies assign speculative-grade ratings to securities falling within the lower categories of their credit rating scales, such as BB+ to D by S&P Global and Fitch, or Ba1 to C by Moody’s.

Credit Rating Agencies

Credit rating agencies are the organisations which rate companies, credit default swaps, government or corporate bonds, mortgage-backed securities, collateral debt obligations, etc and produce ratings based on their credit risk.

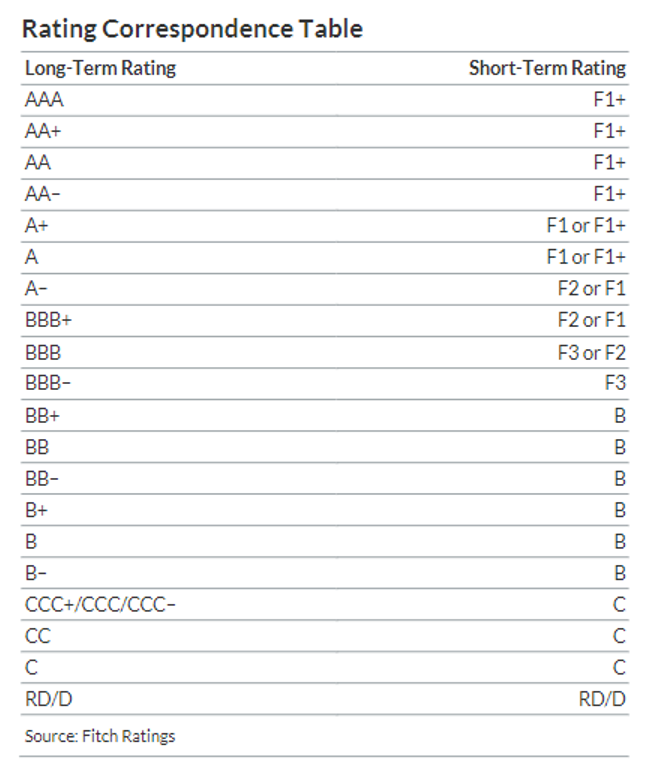

The organisations assess ratings on credit risk because they show the borrower’s probability of making a default on servicing the debt obligation. Credit rating agencies use letter grades as credit ratings for debt securities. They also assign separate ratings for short-term and long-term commitments.

Three prime credit rating agencies issue the credit ratings for the companies, bonds and debt instruments.

S&P Global Ratings:

Standard & Poor’s (S&P) Global Ratings, was founded in 1860 by Henry Varnum Poor. S&P’s mission is to offer high-quality credit ratings, research, and analytics to facilitate informed decisions in the financial markets. Their vision is to be a primary provider of essential intelligence for global financial markets. S&P utilises a transparent methodology that involves the evaluation of financial strength, industry dynamics, and macroeconomic factors. S&P Global’s credit ratings span investment-grade (AAA to BBB) and speculative-grade (BB to D) securities.

Source: https://www.spglobal.com/ratings/_division-assets/pdfs/guide-to-credit-rating-essentials.pdf

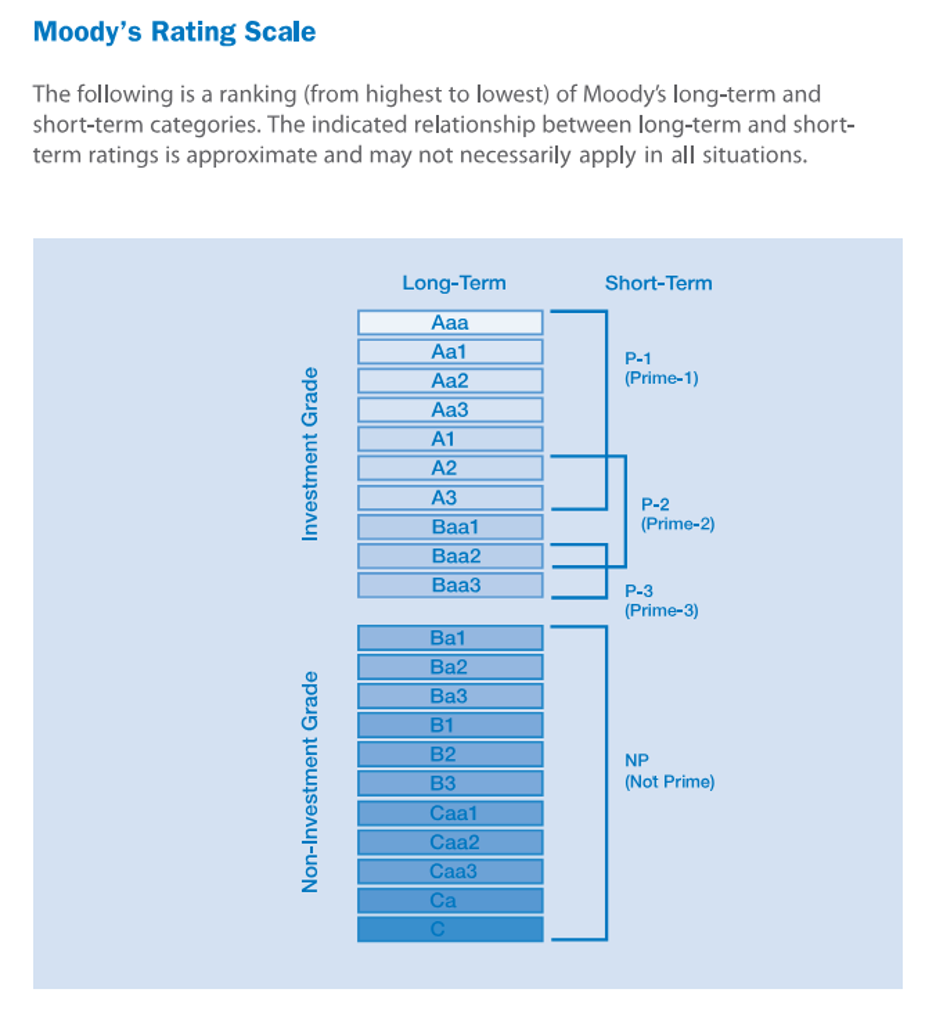

Moody’s Company:

Moody’s Company was established in 1909 by John Moody and aims to provide credit ratings, research, and analysis to support informed credit decisions globally. Their vision is to lead in offering credit ratings and risk analysis worldwide. Moody’s employs a rigorous methodology to assess creditworthiness, analysing financial statements, industry trends, and economic conditions. Their credit ratings cover investment-grade (Aaa to Baa) and speculative-grade (Ba1 to C) securities, indicating varying levels of credit risk. Moody’s uses numbers from 1 to 3 as modifiers to do a sub-categorisation within a grade scale.

Source: https://www.moodys.com/sites/products/productattachments/ap075378_1_1408_ki.pdf

Fitch:

Fitch Ratings, established in 1913 by John Knowles Fitch, is committed to providing independent and objective credit ratings and research. They envision being a leading global provider of credit ratings and research. Fitch uses a methodology to analyse the financial performance, industry trends, and regulatory environment. Their credit ratings cover investment-grade (AAA to BBB) and speculative-grade (BB to D) securities. Fitch ratings may include “+” or “–” modifiers to indicate relative status within the rating categories.

Source: https://www.fitchratings.com/research/fund-asset-managers/rating-definitions-24-04-2023

Credit Rating Analysis of Boeing Company:

Boeing Company, a leading aerospace manufacturer and defence contractor, is a prominent position holder in the global aviation industry. Boeing has established itself as a key player in commercial aeroplanes, defence systems, and space exploration.

Boeing Company has raised debt capital by issuing fixed-rate senior unsecured notes of $10 billion. The debt securities carry interest rates from 6.259% to 7.008% with time maturity varying from 2027 to 2064.

Source: https://in.investing.com/news/boeing-secures-10-billion-through-senior-notes-offering-93CH-4161679

Let’s see the credit ratings issued by Fitch Ratings, S&P Globals and Moody’s regarding this debt issue:

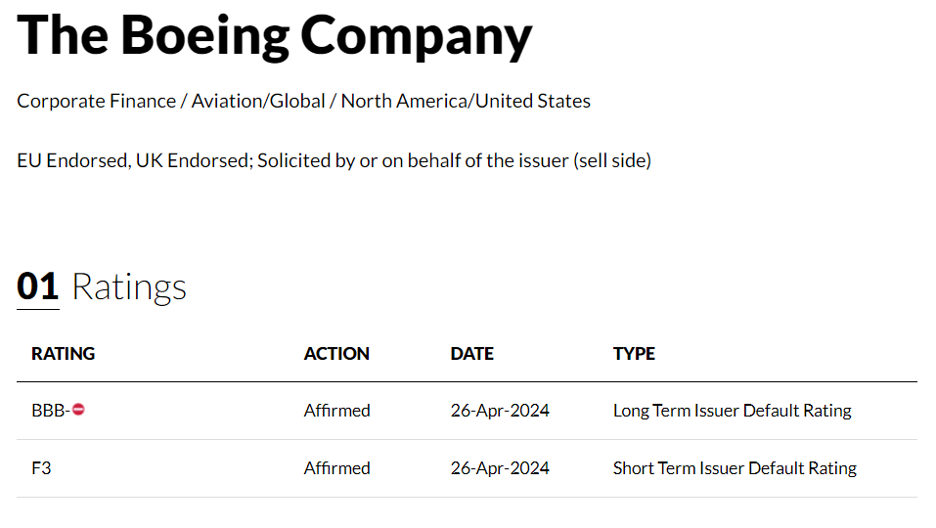

Fitch’s Rating:

Source: https://www.fitchratings.com/entity/the-boeing-company-80090948

Looking at the historical credit ratings of Boeing, Fitch Ratings from March 24, 2020, have downgraded Boeing’s credit rating from an A to BBB to Boeing’s debt issues. And the triple B trend has continued to date. On April 26, 2024, Fitch gave a BBB (–) rating to long-term debt issues and an F3 rating to short-term debt securities of Boeing Company.

A BBB (-) rating indicates a low probability of default risk, as the payment capacity of financial commitments is considered adequate. However, adverse business or economic conditions may impair this capacity. An F3 rating indicates “Fair Short-Term Credit Quality”. The intrinsic capacity for timely payment of financial commitments is adequate.

Source of the Article: https://www.fitchratings.com/research/corporate-finance/fitch-assigns-boeing-new-notes-bbb-29-04-2024

S&P Global Ratings:

On 29th April 2024, S&P Globals assigned a BBB (-) credit rating with a negative outlook to Boeing’s Senior Unsecured Notes. A BBB(-) credit rating is the lowest investment grade in the S&P Globals rating chart. An S&P Globals triple B rating indicates that the company has adequate finances to service the debt security, but the company is highly subjected to adverse economic conditions.

Source: https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3162257

Moody’s Company:

Moody’s has assigned a Baa3 with a negative outlook rating to Boeing’s fixed-rate senior unsecured notes on 29th April 2024. A Baa3 rating under Moody’s credit rating scale has two parts Baa which means that the debt issue is subject to a moderate level of credit risk and may show speculative characteristics. The number is a modifier that indicates a sub-categorisation in the Baa category. The modifier 3 shows that the issue belongs to the lower end of the Baa category.

Source: https://www.moodys.com/credit-ratings/Boeing-Company-The-credit-rating-108050

Summing Up

Credit ratings are an important part of the global financial landscape, providing invaluable insights into the creditworthiness of individuals, businesses, and governments. Through meticulous analysis and transparent methodologies, credit rating agencies such as S&P Global Ratings, Moody’s Investors Service, and Fitch Ratings offer vital intelligence for informed decision-making in the investment arena. Understanding the distinctions between investment quality and speculative quality, plus the implications of time horizons in credit ratings, empowers investors to navigate the complexities of the financial markets with confidence. By leveraging credit ratings effectively, stakeholders can mitigate risks, optimise returns, and contribute to sustainable economic prosperity.