WHAT IS THE BOOK VALUE PER SHARE (BVPS)?

The ratio of equity available to common stockholders against the number of outstanding shares is called the Book Value per share (BVPS). It shows the net asset value (i.e. total tangible assets less total liabilities) of the company on a per share basis. Book value per share also known as the book value of equity is the value of assets of the company per share remaining once all the outstanding liabilities are paid off if the company is to be liquidated. It is an accrual accounting based metric and is used for bookkeeping purpose and recoded on the balance sheet of the company. The Book value per share can be calculated using data from the latest financial report (like 10-K or 10-Q). Since the preferred stockholders have a higher claim on assets than equity shareholders in case of liquidation, preferred stock is usually excluded from the calculation of the Book Value per share.

The book value per share is often compared with the current market value per share to provide information on how a company’s stock is valued. The company’s stock is deemed to be undervalued if the book value per share of the company exceeds the market value per share.

FORMULA FOR BOOK VALUE PER SHARE CALCULATION

The book value per share is calculated using the given formula:

Book Value Per Share (BVPS)= Shareholder’s Equity- Preferred Stock

Average Shares Outstanding

Points to be noted:

- We deduct Preferred Stock since it has a higher claim on assets than equity shareholders in case of liquidation.

- The “average number of shares outstanding” is used because if there was a stock issuance or major stock buyouts, the closing period number of outstanding shares amount may give distorted results. The closing figure of outstanding shares may be influenced by some short term events and may provide incorrect results misleading investors into thinking that the price of the stock is undervalued or overvalued while the actual case might be completely opposite.

Example:

XYZ Ltd. has shareholder’s equity of $50 million out of which the preferred stock is $10 million. The average outstanding number of shares during the period is 4 million shares. Hence, the Book value per share is calculated as below:

Book Value Per Share= ($ 50,000,000- $10,000,000)/4,000,000

= ($40,000,000/4,000,000

= $10

HOW TO INCREASE THE BOOK VALUE PER SHARE?

A company can increase its Book value per share by the following:

- Repurchasing the Common Stock of the company- A company’s BVPS can be increased through buy back of common stocks from shareholders which reduces the number of shares outstanding. Let us understand this using the above example. Assume that the company buy backs 500,000 common stocks from its shareholders. This shall reduce the current shares outstanding to 3.5 million (4,000,000 – 5,00,000). Hence the revised Book value per share will be as follows:

BVPS= $40,000,000/3,500,000

= $11.43

The book value per share increases from $10 to $11.43 as a result of buy back of 500,000 common stocks.

- Increase assets of the company- A company can increase the Book value per share by increasing its assets by investing in new plant, property or equipment, or by increasing the company’s operational efficiency. For example, if XYZ Ltd. generates $5 million net earnings during the year and uses $700,000 to purchase additional equipment for the company. This shall increase the company’s common equity, and hence, raise the Book value per share.

- Decrease the liabilities of the company- The liabilities of the company can be decreased through reduction of debt or by selling of the assets of the company. For example, if the company used $300,000 of the net earnings generated to pay off the debts outstanding and reduce its liabilities, the equity available to common shareholder’s increases.

MARKET VALUE PER SHARE VS. BOOK VALUE PER SHARE

Both the Market value per share and Book value per share are tools used to evaluate a company’s stock value. The difference between the two are as following:

- Market value per share: The market share price means the current share price of the company and is forward looking since it is influenced by the sentiments of the investors regarding the future performance of growth and profits. The market value per share of the company is expected to increase with the increase in the company’s expected growth and profitability. The market value per share is the most recent prices paid by the investors for each share.

- Book value per share: Book value per share is an accounting-based metric calculated using the historical costs and is not a forward-looking metric since it does not reflect the company’s actual market value of shares. It reflects the equity value recorded on the balance sheet and shows what the shareholders of the company will own when the company liquidates and all the debts are paid off.

WHAT DOES BOOK VALUE PER SHARE TELL YOU?

The book value per share is a useful metric to identify whether a company’s stock is undervalued or overvalued. If the market value per share is trading below its book value per share, it means that the investors in the market is valuing the company at less than its liquidation value.

However, this cannot be the sole factor to decide if the stock is a good buy. Before making an investment decision there are other factors that need to be taken into consideration.

DRAWBACKS OF BOOK VALUE PER SHARE

Some of the limitations of the book value per share metric are as following:

- Does not take into account intangible assets: The book value per share only considers the book value of assets and fails to incorporate other intangible factors that may increase or decrease the company’s market value of a shares even upon liquidation of the company. Often the banks or technology software companies have very few tangible assets relative to the intangible assets like the intellectual property, copyrights, trademarks or the human capital. Since these intangibles is not factored in to the book value calculation, the resulted book value per share may be undervalued.

- Focus on historical costs rather than the current market values: The book value per share is calculated using historical costs of assets while the market value per share reflects the current share price of the company and hence is a forward-looking metric. It takes into account the future earning potential and growth prospects of the company and is more relevant. Since book value per share is based on the historical cost it can sometimes be misleading. Book value per share is a very conservative approach to value stock of a company and ignore important factors like growth of the company.

REAL LIFE EXAMPLE OF BOOK VALUE PER SHARE AND MARKET VALUE PER SHARE CALCULATION

The Market price per share of Alphabet Inc. as on 5th February 2024 is $142.37 and Book value per share for the quarter ended in December 2023 was $22.74. The price per share data can be sourced from any public finance site like cnbc.com. For the book value per share, we can find that information in the quarterly reports of the company published on its website.

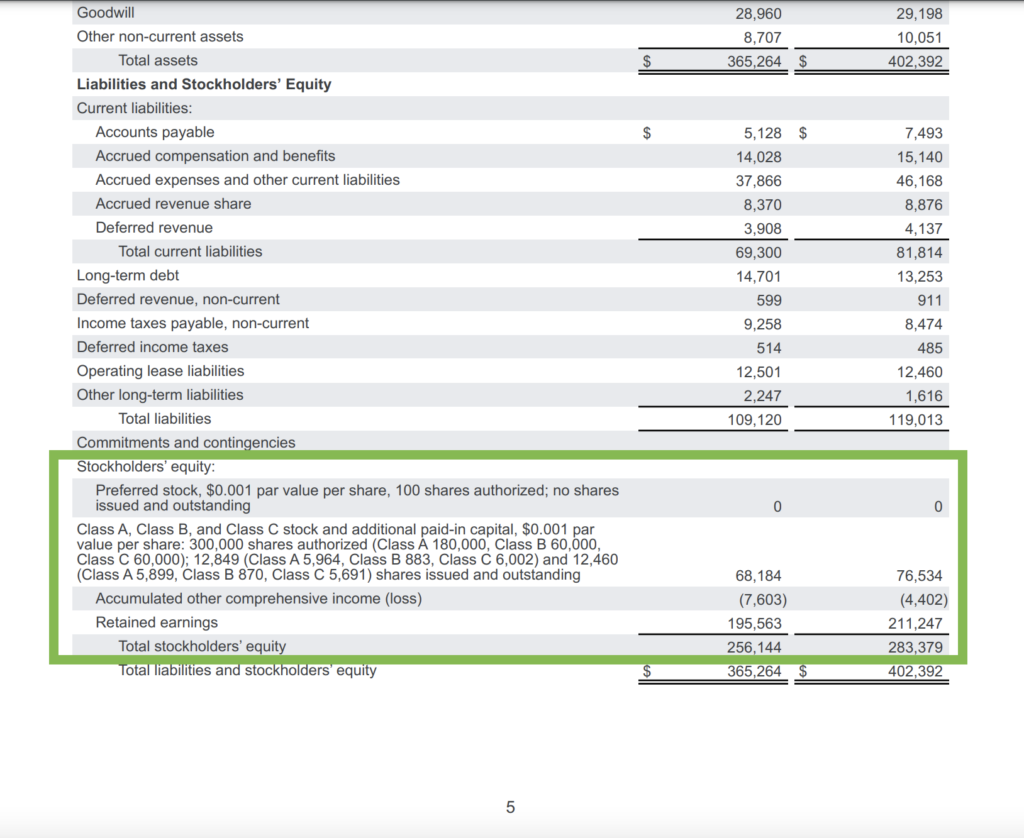

If you read through the Q4 earnings release report of the company and check out its Balance Sheet, you will noticed the total shareholders equity section therein. This is where you will find the numerator for the calculation of book value per share.

Source: https://abc.xyz/assets/95/eb/9cef90184e09bac553796896c633/2023q4-alphabet-earnings-release.pdf

As we can see from the above snapshot, the total book value for Alphabet is around USD 283,379 mn in FY 2023. Also you can see that there are 3 categories of shares i.e Class A, Class B and Class C shares outstanding in Alphabet. If we add them together, we get 12,460 mn shares outstanding as on December 31, 2023.

Now. if you divide the total book value by the total shares outstanding, we can do the calculation of book value per share as

= USD 283,279 mn / 12,460 mn shares

= USD 22.74 mn / share

It is indeed a simple calculation that tell us how much worth per share of a company is based on profits and capital invested into the company. While this can be treated as an absolute minimum share value of the company that can be realized on liquidating the assets and liabilities of the company. In reality though, the market price per share is a real estimate of the company’s worth. One can look at the ratio of price per share to book value per share to really understand how much value creation has been made possible.