When you’re working with potential investors, they’ll often ask about your company’s acquisition structure. It may seem like an odd question, but it helps potential investors see if your company is well-positioned to take advantage of new opportunities. Working with a venture capital firm as an investor means that they expect you to reinvest profits as part of your agreement.

Therefore, they want to know what kind of acquisition structure you have in place in case the opportunity presents itself. An acquisition structure is the way a business owns other companies or businesses own yours. There are many different ways this can be setup and which one is best for your business will depend on its present circumstances, future plans and investor agreements. Here is what you need to know about the basics of acquisition structure:

Why have an acquisition structure?

Businesses that are looking for investment often have a few key reasons for having a particular acquisition structure. First, investors want to understand why you have a specific acquisition structure and not another. They want to know the reasons behind your decision making so they can better understand your investment decision-making process. Second, investors are interested in seeing a clear path to exit. An acquisition structure can provide a path to exit that isn’t in the business plan.

If you’ve worked through the process of choosing the right acquisition structure, then you’ll also be prepared if the opportunity presents itself. Third, an acquisition structure can help a business cut down on operational costs. If you’re planning on acquiring a company in your field, you may want to consider placing them under a separate company name. This can help you retain the employees of the acquired company and can also help them retain clients.

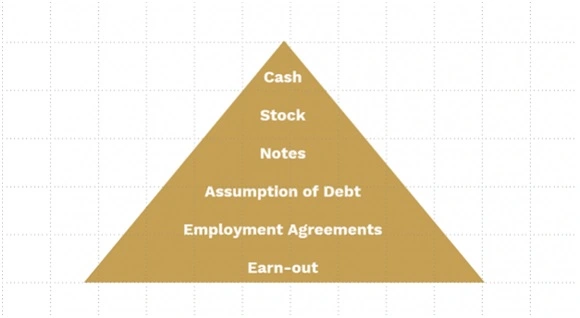

Photo Credit: https://www.corumgroup.com/sites/default/files/styles/320px_16x9/public/social-images/Structure.PNG?itok=3AlMR1fD

Different types of acquisition structures

The type of acquisition structure that best suits your business will depend on a variety of factors. One of the first decisions you’ll need to make is whether the acquired company will remain independent or become part of your company. – Co-ownership Acquisition Structure With a co-ownership acquisition structure, the acquired company remains as a separate entity and does not become part of your business.

An example of this would be a business partnership where one company owns part of the assets of another company. – Internal Asset Acquisition Structure With an internal asset acquisition structure, the acquired company becomes a division of your business. It’s its own entity, but it is part of your company. This is often the acquisition structure that large companies use. – Acquisition Agreement An acquisition agreement is a binding contract that outlines the terms and conditions of an acquisition. This is used when both entities are privately held. – Mergers and Acquisitions A merger is when two companies combine their assets and operations. An acquisition is when one company buys out another.

These terms are often used interchangeably, but there is a slight difference. Mergers can take place between public or private companies and an acquisition can take place between private companies. – Co-operation Partnership and Equity Exchange Agreement If you’re looking to partner with another company, you may want an equity exchange agreement. This is basically a partnership without the commitment of a full merger. – Cooperative Development Agreement (CDA) A CDA is an agreement between two or more parties who are developing a new product or service.

This is often used in research and development projects. – Single-seller acquisition A single-seller acquisition is when one business purchases another. This is often done when one company buys out another for strategic reasons. For example, a technology company may buy out a company that manufactures their parts to save on overhead costs. – Sequenced acquisition A sequenced acquisition is when one company acquires another company that it already has an investment in.

This is often done for strategic reasons. – Hooked-product acquisition In a hooked-product acquisition, one company acquires another company that produces a product or service related to its business. This is often done when the company has an acquisition offer but can’t purchase the target company due to regulatory issues.

Conclusion

An acquisition structure is a business’s way of owning other companies or businesses owning them. There are many different types of acquisition structures and they depend on several factors. If you’re looking to make an acquisition, it is important to have an acquisition structure in place. Having a well thought-out acquisition structure can help you take advantage of new opportunities.

6 thoughts on “Acquisition Structure 101: The Basics You Need to Know”

I may need your help. I’ve been doing research on gate io recently, and I’ve tried a lot of different things. Later, I read your article, and I think your way of writing has given me some innovative ideas, thank you very much.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you very much for sharing, I learned a lot from your article. Very cool. Thanks.

I highly recommend ernestopro.com for anyone looking to understand acquisition structures in depth. Their expertise and comprehensive resources provide practical guidance that can significantly enhance your strategic approach. I’ve used their platform and found the information clear and actionable. It’s a valuable tool for both beginners and seasoned professionals aiming to master acquisition techniques with confidence.