In our earlier blog, Total Shareholder Return – Definition & Explanation we discussed about the meaning of Total Shareholder Returns and factors driving returns. In this blog, we will discuss how to calculate TSR if the investment period is more than one year.

Example 1 – TSR calculation when there is no dividend payout.

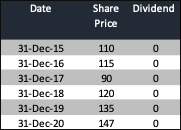

John has purchased 1 share of ABC Limited for $110 on 31st December 2015. ABC Limited has not paid any dividend till date. John wants to calculate the total returns earned annually by him in ABC Limited from 31st December 2015 to 31st December 2020.

Here is a table showing the share price of ABC Limited for last 5 years from 31st December 2015 to 31st December 2020.

TSR is total returns earned by an investor during the investment period. Investing in stock generate returns in 2 ways.

- Capital appreciation from share price increase

- Dividend yield

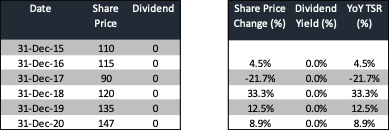

Annual Capital appreciation is calculated as change in share price divided by share price at the beginning of the period.

For example, Capital appreciation in 2016 = (115-110)/110 = 4.5%

Dividend yield is calculated as dividend earned during the period divided by the share price at the start of the year.

In our example, there is no dividend, therefore the dividend yield is NIL.

Total shareholder return in this case, is just the share price appreciation.

The annual share price appreciation and dividend yield for all the years is shown in the below table. Total TSR in this example, is equal to the share price change.

Here TSR calculation for the total investment period, can be done in two ways.

One is by calculating annualized share price appreciation, which is equal to the total TSR in this example.

In the second method, we can compute the annualized return by using the Geomean function in excel.

To calculate Geomean, type =Geomean(1+(YoY return range))-1

Then press, Control + Shift + Enter (Since it is an array function). You get the same answer. TSR = 6%.

Learn more about our course on Valuation Analyst Skills Training (VAST) course to become an expert in business valuation.

**

Example 2 – TSR calculation when there is dividend payout.

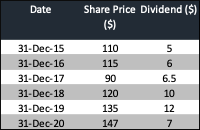

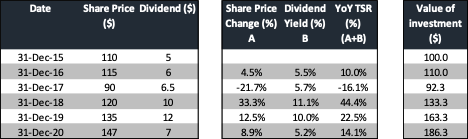

Let us look at another example. Here we have the share price and dividend payment by XYZ Limited for year ending 2015 to 2020. This Company has paid dividends annually.

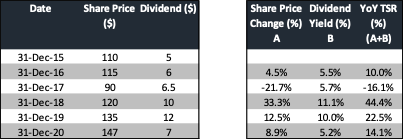

Total shareholder returns here is share price appreciation plus dividend yield.

Capital appreciation in 2016 = (115-110)/110 = 4.5%

Subscribe Now to avail an offer for a comprehensive course on statistical analysis

Dividend yield for 2016 = (Dividend paid/Starting period share price) = 6/110 = 5.5%

Total TSR for 2016 = 4.5% + 5.5% = 10%

The table below shows TSR calculation annually for each year.

Suppose you had invested $100 on 31st Dec 2015, your investment would have become $110 on 31st Dec 2016 (ie, 100(1+10%))

In 2017, the investment would become $92.3 (ie, 110*(1+(-16.1%))

We can calculate the value of investment annually (see table below).

Investment of $100 on 31st Dec 2015, would become $186.3 on 31 st Dec 2020.

We can also use the Geomean function in excel, to calculate annualized TSR.

To calculate Geomean, type =Geomean(1+(YoY returns))-1

= Geomean(1+(10%,-16.1%,44.4%,22.5%,14.1%))-1

Then press, Control + Shift + Enter (Since it is an array function).

You get the same answer. TSR = 13.3%.

26 thoughts on “How to Calculate Total Shareholder Returns (TSR)”

… [Trackback]

[…] Find More to that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] There you will find 22255 additional Info to that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Find More here to that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Information to that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Read More Info here to that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Find More Info here to that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/total-shareholder-returns-tsr/ […]

nXvLr8Je8h9KmZSJphjUpxf7VS0uC8jZ7nBbhxB5oB1Law93ZIOLiIxHwbQcTo9CoZ6imi774Uj4G61zqcVr6OaTTHkawFJQ6XwAzRMl8XqEw3i15

I am not very great with English but I find this rattling easygoing to translate.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

961030 687057Hello to all I cannot understand the approach to add your web site in my rss reader. Assist me, please 655812

954563 379510I enjoyed reading your pleasant website. I see you offer priceless info. stumbled into this web site by chance but Im certain glad I clicked on that link. You certainly answered all the questions Ive been dying to answer for some time now. Will definitely come back for far more of this. 347579

795114 184956Hello, Neat post. Theres an concern together together with your internet site in web explorer, may check this? IE nonetheless will be the marketplace leader and a huge component to folks will omit your wonderful writing because of this difficulty. 44442

251256 26073It is hard to find knowledgeable folks on this topic however you sound like you know what you are talking about! Thanks 468603

373917 781820Only a smiling visitant here to share the enjoy (:, btw wonderful design and style . 558071