INTRODUCTION

Other Comprehensive Income (OCI) is a critical element in financial reporting, encompassing specific gains and losses that do not contribute to net income. It provides a more comprehensive view of a company’s financial health, capturing economic events that impact equity but do not pass through the income statement. Understanding OCI is crucial for investors, analysts, and stakeholders who seek a complete picture of a company’s performance and risk exposure. In this article, we are going to delve into what is OCI, the Components of OCI, accounting treatment of OCI, the importance of OCI, and how OCI disclosure helps in financial planning and analysis.

COMPONENTS OF OTHER COMPREHENSIVE INCOME AS PER ACCOUNTING STANDARDS

Several accounting standards require the reporting of Other Comprehensive Income (OCI), each with specific guidelines on what items should be included in OCI and how they should be presented in financial statements. Here are some key accounting standards that mandate OCI reporting:

1. International Financial Reporting Standards (IFRS)

Under IFRS, OCI is required to be presented separately from profit or loss (net income) in the financial statements. The standard that governs OCI under IFRS is:

IAS 1 Presentation of Financial Statements: IAS 1 specifies that an entity should present a statement of comprehensive income that includes both profit or loss (net income) and OCI items. It mentions the components that should be included in Other comprehensive income, such as:

- Unrealized gains and losses on available-for-sale financial assets.

- Revaluation surplus on property, plant, and equipment.

- Foreign currency translation adjustments.

- Actuarial gains and losses on defined benefit plans.

- Gains and losses on cash flow hedges.

These items are accumulated in OCI and may be subsequently reclassified to net income when certain conditions are met (e.g., realization of gains or losses on available-for-sale securities).

2. Generally Accepted Accounting Principles (GAAP)

In the United States, GAAP includes specific requirements for OCI reporting under the following standards:

ASC 220 Comprehensive Income: ASC 220 (formerly SFAS 130) requires entities to report comprehensive income, which includes both net income and OCI, in a single continuous financial statement or two separate but consecutive financial statements. It guides on the items that should be included in OCI, such as:

- Unrealized gains and losses on available-for-sale securities.

- Foreign currency translation adjustments.

- Certain gains and losses on derivative instruments designated as cash flow hedges.

- Pension and other post-retirement benefit plan adjustments.

Similar to IFRS, these items are accumulated in OCI and may be reclassified to net income in subsequent periods.

3. Other Jurisdictions

Other jurisdictions around the world have adopted similar requirements for OCI reporting, often aligning with either IFRS or their local accounting standards that mandate the reporting of comprehensive income. These standards ensure consistency and transparency in financial reporting across different countries and facilitate comparability of financial statements for investors and stakeholders globally.

Let us discuss the components mentioned above in detail along with examples.

- Unrealized Gains and Losses on Available-for-Sale Securities: These are changes in the fair value of certain investments that are not immediately recognized in net income. Instead, they are reported in OCI until the securities are sold or experience a significant decline in value.

- Foreign Currency Translation Adjustments: Companies with international operations must convert foreign subsidiaries’ financial statements (Balance Sheet & Income Statement) into the reporting currency. The resulting translation gains or losses are included in OCI to reflect the impact of currency exchange rate fluctuations.

- Pension and Post-Retirement Benefit Plan Adjustments: Actuarial gains and losses, prior service costs, and other changes in the value of defined benefit pension plans and other post-retirement benefits are reported in OCI. This helps to smooth out the volatility that would otherwise impact net income.

- Gains and Losses on Cash Flow Hedges: When companies use derivatives to hedge against risks such as interest rate changes or commodity price fluctuations, the effective portion of the hedge’s gains or losses is reported in OCI. This ensures that the income statement reflects only the actual performance of the company’s core operations. The effective portion of the gain or loss on the hedging instrument is recognized in OCI until the hedged transaction impacts net income.

- Revaluation Surplus on Property, Plant, and Equipment: Under certain accounting standards, companies can revalue their property, plant, and equipment to fair value. Any increase in the carrying amount resulting from revaluation is recorded in OCI as a revaluation surplus. This surplus is transferred to retained earnings over time as the asset is used.

- Changes in the Fair Value of Certain Financial Instruments: Changes in the fair value of certain financial instruments, such as equity investments that are not held for trading and are designated at fair value through OCI, are recorded in OCI. This includes both unrealized gains and losses.

ACCOUNTING TREATMENT OF OTHER COMPREHENSIVE INCOME

The accounting treatment of Other Comprehensive Income (OCI) involves recognizing and reporting certain gains and losses that affect a company’s equity but are excluded from net income. Here’s a detailed overview of how OCI is treated in accounting:

RECOGNITION AND MEASUREMENT

Identification of OCI Items:

Determine which items qualify for inclusion in OCI based on relevant accounting standards (e.g., IFRS or GAAP). Typical items include foreign currency translation adjustments, unrealized gains and losses on available-for-sale securities, pension plan adjustments, and gains and losses on cash flow hedges.

Measurement:

Measure the items at their fair value or the amount specified by the relevant accounting standard. For example, available-for-sale securities are measured at fair value, and changes in this fair value are recognized in OCI.

RECORDING OCI IN FINANCIAL STATEMENTS

- Journal Entries:

Record OCI items through appropriate journal entries. For instance:

- Unrealized Gains on Available-for-Sale Securities:

Dr. Available-for-Sale Securities (Asset)

Cr. Unrealized Gain on Available-for-Sale Securities (OCI)

- Foreign Currency Translation Adjustments:

Dr. Foreign Currency Translation Adjustment (OCI)

Cr. Foreign Currency Translation Gain (or Loss)

- Accumulated Other Comprehensive Income (AOCI):

- OCI items are accumulated in a separate equity account called Accumulated Other Comprehensive Income (AOCI). This account is part of shareholders’ equity and reflects the cumulative balance of OCI items over time.

REPORTING OTHER COMPREHENSIVE INCOME (OCI)

1. Statement of Comprehensive Income:

OCI is reported as part of the Statement of Comprehensive Income, which includes both net income and OCI. This statement can be presented in one of two ways:

Single Statement Approach: This method combines net income and OCI into a single continuous statement. It starts with net income and then adds OCI items to arrive at the total comprehensive income.

Two-Statement Approach: This approach presents net income on the income statement and then provides a separate statement of comprehensive income, starting with net income and listing OCI items to calculate total comprehensive income.

2. Disclosure:

Provide detailed disclosures about OCI items in the notes to the financial statements. These disclosures should include the nature of the OCI items, their amounts, and any reclassification adjustments (i.e., transfers of OCI items to net income when they are realized).

RECLASSIFICATION ADJUSTMENTS

- Transfer to Net Income:

When certain OCI items are realized (e.g., when available-for-sale security is sold), the cumulative OCI related to that item is reclassified from AOCI to net income. This process is called a reclassification adjustment.

Example Journal Entry for Reclassification:

Dr. Unrealized Gain on Available-for-Sale Securities (AOCI)

Cr. Realized Gain on Sale of Securities (Net Income)

Examples

- Available-for-Sale Securities:

Recognize unrealized gains and losses in OCI until the securities are sold. Upon sale, reclassify the cumulative gain or loss from OCI to net income.

- Foreign Currency Translation Adjustments:

Recognize translation gains and losses in OCI. If the foreign subsidiary is sold or liquidated, reclassify the cumulative translation adjustment to net income.

- Pension Plan Adjustments:

Recognize actuarial gains and losses and prior service costs in OCI. These amounts are amortized to net income over time based on the relevant accounting standards.

EXAMPLE OF OCI RECOGNITION AND TRANSFER TO NET INCOME

Scenario:

ABC Corporation holds a portfolio of available-for-sale (AFS) securities. At the beginning of the fiscal year, the fair value of these securities was $100,000. By the year-end, the fair value increased to $120,000. The company decides to sell these securities at the end of the following fiscal year when the fair value reaches $130,000.

Year 1: Recognition of OCI

At the end of Year 1, ABC Corporation recognizes an unrealized gain on its AFS securities due to the increase in fair value from $100,000 to $120,000.

Journal Entry at the End of Year 1:

Dr. Available-for-Sale Securities $20,000

Cr. Unrealized Gain on AFS Securities (OCI) $20,000

This entry increases the fair value of the securities on the balance sheet and recognizes the gain in OCI.

Financial Statements Impact (Year 1):

- Balance Sheet:

- Available-for-Sale Securities: $120,000

- Accumulated Other Comprehensive Income (AOCI): $20,000

- Statement of Comprehensive Income:

- Other Comprehensive Income: $20,000

Year 2: Transfer to Net Income

At the end of Year 2, ABC Corporation sells the AFS securities for $130,000. The previously unrealized gain recognized in OCI is now realized and needs to be transferred to net income.

Journal Entry at the End of Year 2 (Upon Sale):

Dr. Cash $130,000

Dr. Unrealized Gain on AFS Securities (OCI) $20,000

Cr. Available-for-Sale Securities $120,000

Cr. Realized Gain on Sale of AFS Securities (Net Income) $10,000

Cr. Reclassification Adjustment (OCI to Net Income) $20,000

This entry removes the securities from the balance sheet, recognizes the realized gain in net income, and reclassifies the previously recognized OCI to net income.

Financial Statements Impact (Year 2):

Balance Sheet:

- Available-for-Sale Securities: $0 (from earlier balance of $120,000)

- Cash: Increased by $130,000

- Accumulated Other Comprehensive Income (AOCI): Reduced by $20,000

Income Statement:

- Realized Gain on Sale of AFS Securities: $10,000

Statement of Comprehensive Income:

- Net Income: Increased by $10,000

- Reclassification Adjustment (OCI to Net Income): $20,000 (This reduces AOCI)

Summary

In Year 1, the unrealized gain is recognized in OCI, providing insight into the potential gains without affecting net income. In Year 2, upon the sale of the securities, the gain is realized and transferred from OCI to net income, ensuring that the financial statements reflect the actual economic event of the sale. This example illustrates how OCI serves to capture and subsequently realize gains and losses, enhancing the accuracy and completeness of financial reporting.

IMPORTANCE OF OTHER COMPREHENSIVE INCOME (OCI)

OCI disclosure is important for the following reasons:

- Enhanced Transparency: OCI enhances financial transparency by capturing economic events that affect a company’s value but are not immediately realized. This allows stakeholders to better understand the underlying risks and potential future impacts on the company’s financial position.

- Reduced Earnings Volatility: By excluding certain gains and losses from net income, OCI helps to reduce earnings volatility. This provides a clearer view of a company’s operational performance, free from the noise of short-term market fluctuations.

- Improved Comparability: Reporting OCI separately from net income improves the comparability of financial statements across different companies and industries. This is particularly important for investors making decisions based on financial performance and stability.

HOW OCI IMPACTS FINANCIAL PLANNING AND ANALYSIS (FP&A)?

Other Comprehensive Income (OCI) plays a significant role in financial planning and analysis (FP&A) by providing a more comprehensive view of a company’s financial health and performance. Here’s how OCI impacts FP&A:

1. Enhanced Financial Transparency

OCI includes gains and losses that are not realized or included in net income, such as unrealized gains on available-for-sale securities, foreign currency translation adjustments, and pension plan adjustments. This additional layer of information offers a clearer and more transparent picture of a company’s financial situation, which is essential for informed decision-making.

2. Risk Management

Understanding OCI helps in identifying and assessing various financial risks that a company faces. For example, large fluctuations in foreign currency translation adjustments can indicate significant exposure to foreign exchange risk. Likewise, fluctuations in the value of pension plan assets and liabilities can indicate potential long-term financial obligations.

3. Performance Evaluation

OCI provides insights into the components of a company’s comprehensive income that are not captured in net income. Analysts can evaluate the quality and sustainability of earnings by examining both net income and OCI. For instance, significant unrealized gains or losses on securities might indicate potential future income or expenses, affecting the overall performance evaluation.

4. Investment Decisions

For investors, OCI is an important indicator of potential future earnings and risks. By analyzing OCI, investors can make more informed decisions about the long-term prospects of a company. For example, substantial unrealized gains in available-for-sale securities might suggest future profit potential, while large pension plan losses could indicate future cash outflows.

5. Strategic Planning

OCI can influence strategic decisions, such as mergers and acquisitions, capital investments, and financial structuring. For example, understanding the impact of foreign currency translation adjustments can guide decisions on international expansion or hedging strategies. Similarly, recognizing the implications of pension plan adjustments can affect decisions related to employee compensation and benefits.

6. Regulatory Compliance and Reporting

OCI is an essential component of financial reporting under various accounting standards (e.g., IFRS and GAAP). Accurate reporting and analysis of OCI ensure compliance with regulatory requirements, which is critical for maintaining investor confidence and avoiding legal issues.

7. Budgeting and Forecasting

Including OCI in budgeting and forecasting processes allows for a more holistic view of a company’s financial future. For example, projecting future gains and losses on available-for-sale securities or anticipating the impact of foreign currency movements can improve the accuracy of financial forecasts and budgets.

8. Capital Structure and Equity Management

OCI affects a company’s equity, which in turn impacts key financial ratios such as the debt-to-equity ratio and return on equity (ROE). Understanding the components of OCI helps in managing the company’s capital structure more effectively, ensuring optimal balance between debt and equity.

REAL-LIFE EXAMPLE OF OTHER COMPREHENSIVE INCOME IN THE FINANCIAL STATEMENTS

Let us look at the financial statements of Walmart Inc. for the financial year 2023 to understand the disclosure requirements of OCI.

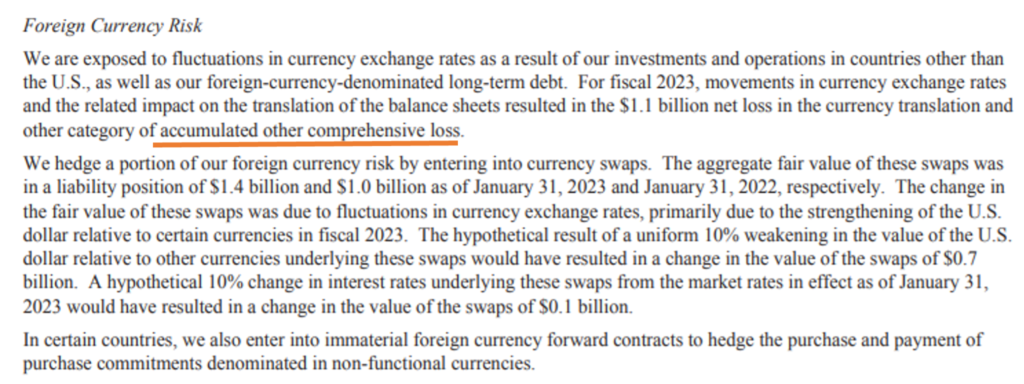

In the below information the company in its Foreign currency risk disclosure has mentioned that the company faces foreign currency risk due to its exposure to fluctuations in currency exchange rates as a result of its operations in countries other than the U.S. This exposure has resulted in $1.1 billion net loss which is classified in the OCI. This piece of information is very crucial for investors and creditors to correctly determine the financial health of the company and its risk exposure.

Source: Annual Report https://s201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

***

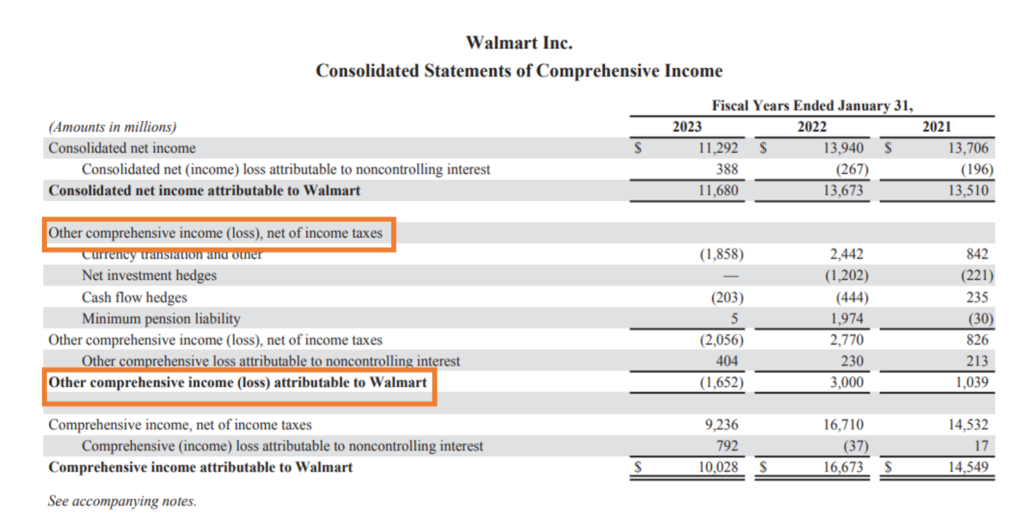

Below is the Consolidated Statement of Comprehensive Income of Walmart Inc. We can see the OCI for the FY ended 2021,2022 and 2023. The Starting point of the statement is the Net Income from the Consolidated Statement of Income. To the Net Income are added other gains and losses which are other comprehensive income. The OCI for Walmart Inc. is generated through Currency translation and other, from Net investment hedges, cash flow hedges, and minimum pension liability. We see that the OCI is negative for FY 2023 while the OCI is positive in FY 2021 and 2022. The investors and analysts should delve deep into the reasons why the OCI has become negative in 2023 hurting the comprehensive income attributable to Walmart.

Source: Annual Report https://s201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

***

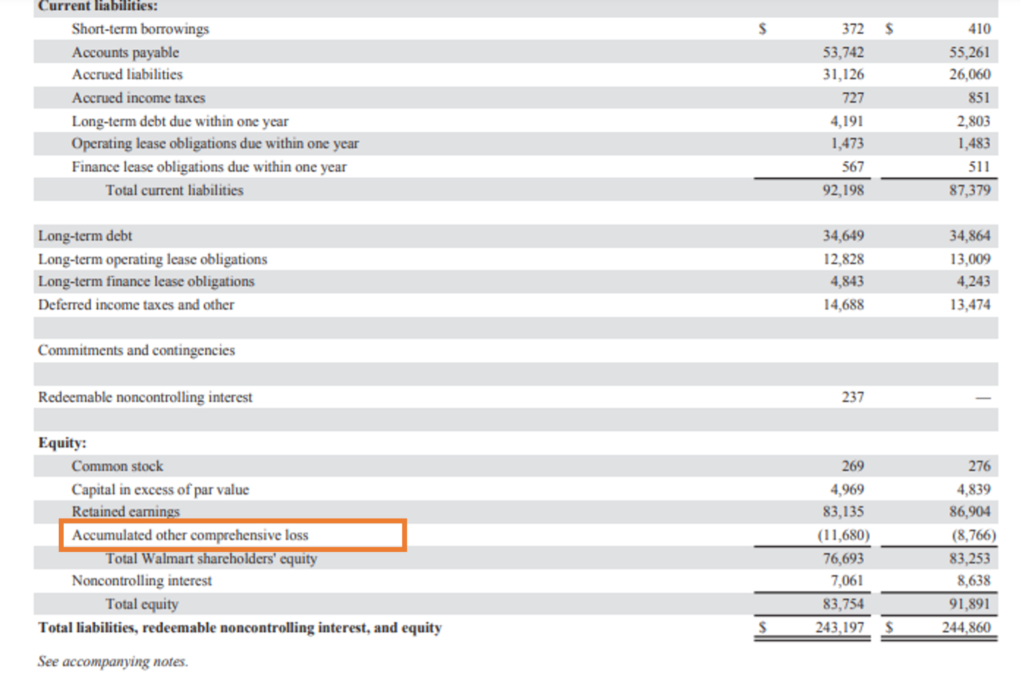

From the below Balance Sheet, we can see that Accumulated other comprehensive income forms part of the equity and hence impacts the debt-to-equity ratio of the company. Hence it becomes important for the shareholders to study the OCI in detail since fluctuations in OCI (especially due to currency translation) can impact equity to a large extent.

Source: Annual Report https://s201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

***

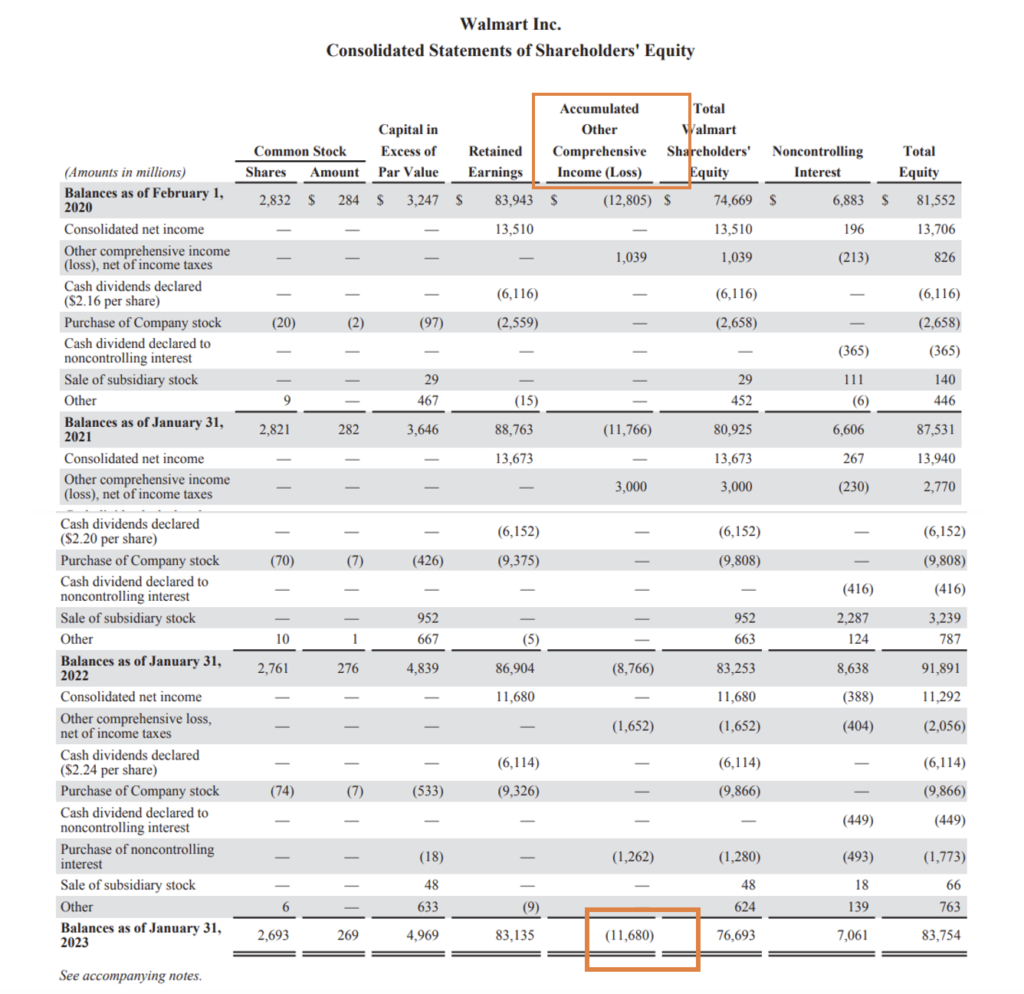

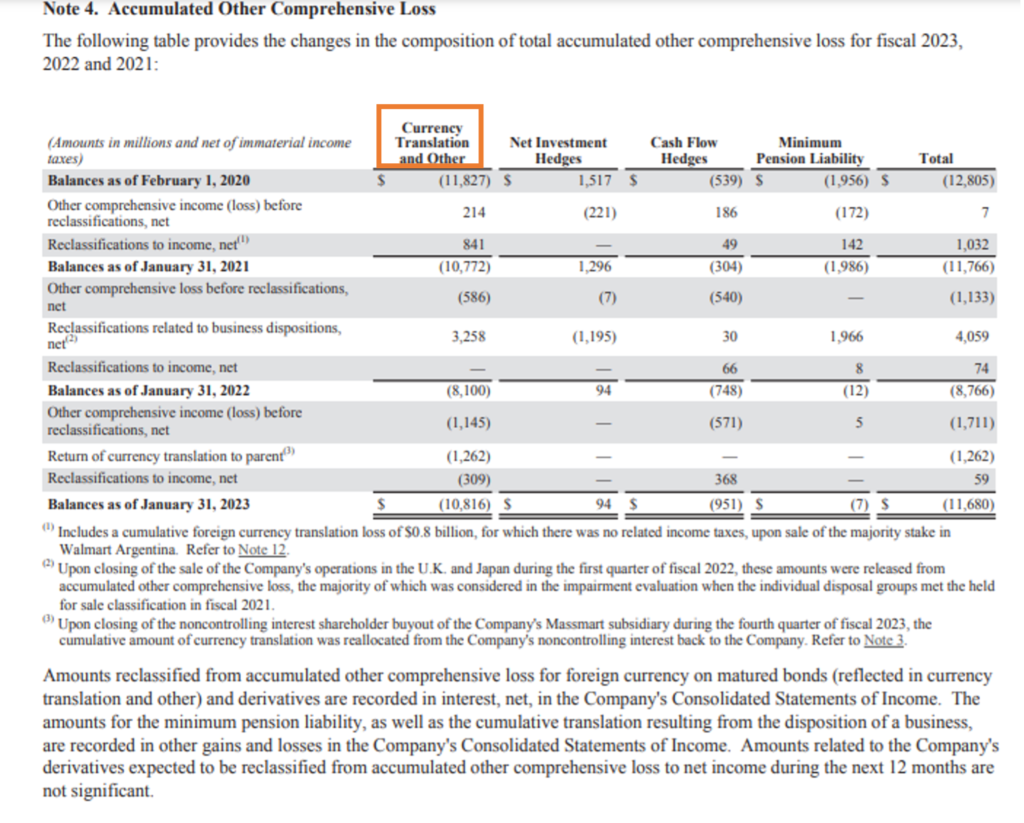

We can observe that Other Comprehensive Income also forms part of the Consolidated Statements of Shareholders’ Equity. The closing balance of OCI -$11,680 in the statement of shareholders’ equity can also be found in the balance sheet of the company.

Source: Annual Report https://s201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

***

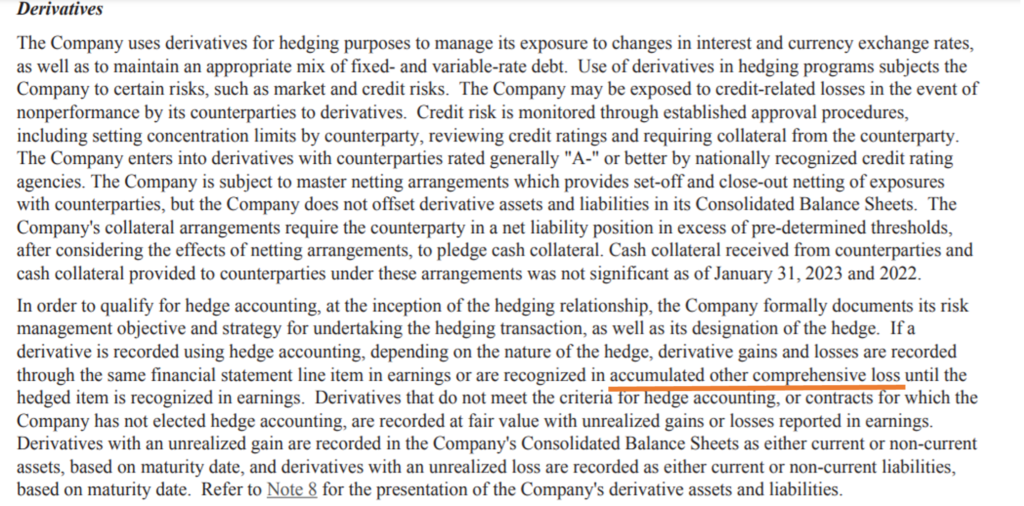

The company above states how it records the fluctuation in derivatives through AOCI until the hedged item is recognized in earnings.

Source: Annual Report https://s201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

***

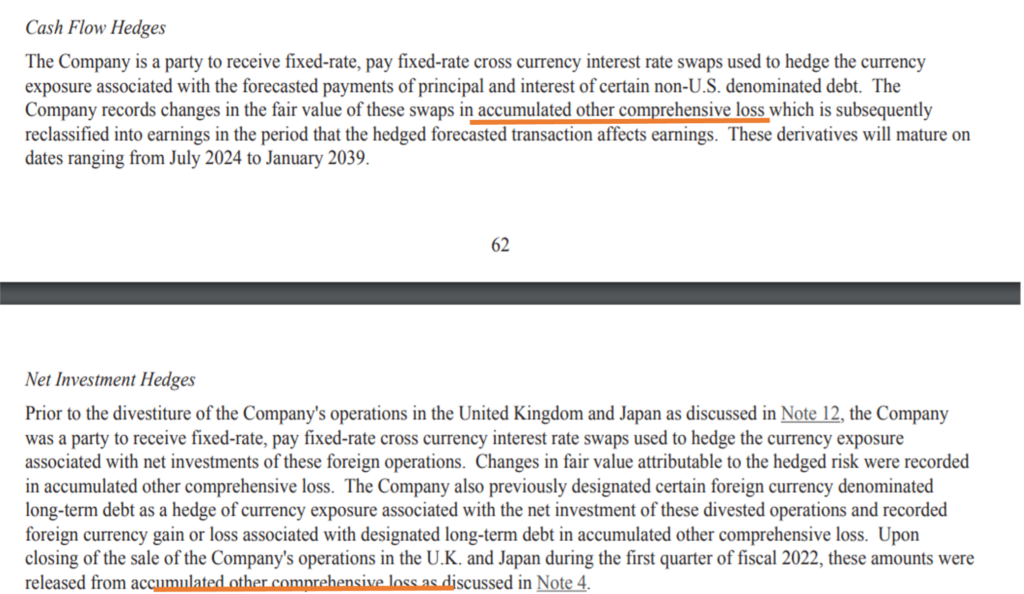

The company is exposed to the risk of currency value fluctuation. It uses interest rate swaps to hedge against the risk and hence records the changes in the fair value of these swaps in AOCI until hedged forecasted transactions affect earnings.

Source: Annual Report https://s201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

***

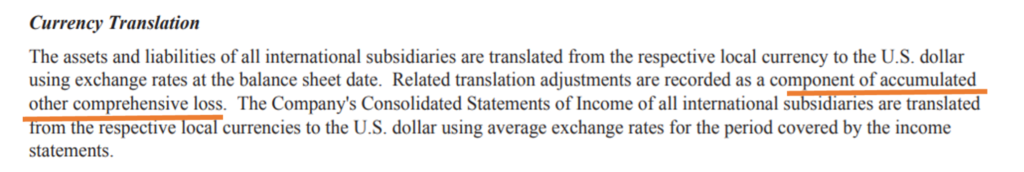

Here the company mentions that since it has subsidiaries outside the U.S. all the assets and liabilities of the foreign subsidiaries are translated to the local currency and the related translation adjustments are recorded through the AOCI. Similarly, the Income statement items of the subsidiaries are also converted to the local currency are translation difference is transferred to the AOCI.

Source: Annual Report https://s201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

***

The company in Note 4 of the Financial statements has disclosed the Accumulated Other Comprehensive Income (Loss) Table. It shows the year-wise opening and outstanding balance in AOCI from different components of OCI. We can see that the Currency translation is the main OCI component above. The stakeholders of the company need to study the impact of foreign transactions on the profitability of the company.

Source: Annual Report https://s201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

CONCLUSION

Other Comprehensive Income is an essential element of financial reporting that captures the broader impacts of financial activities on a company’s equity. By understanding and analyzing OCI, investors, and analysts gain valuable insights into the full spectrum of financial performance and risk. This comprehensive approach enhances transparency and supports more informed decision-making in assessing a company’s long-term financial health.