What is Capital Expenditure (Capex)?

Capital expenditures (Capex) refer to the funds a company uses to acquire physical or tangible assets. Companies engage in Capex for two primary reasons: firstly, to upgrade and maintain their business by investing in new and improved assets, and secondly, to facilitate business growth.

A business capitalises its capital expenditures by recording them in the balance sheet as non-current assets. Capex is also shown in the cash flow statement under the head cash flow from investing activities.

A company buys numerous assets to attribute them to capital expenditure. Examples of capex are equipment, land, buildings, patents, vehicles, etc.

We must also know that sometimes companies include investments in intangible assets in the capex calculation.

Formula:

| Capital Expenditure (Capex) | = Net increase PP&E + Depreciation |

PP&E stands for Property, Plant and Equipment. They are long-term tangible assets which are vital for fundamental business operations. PP&E includes plants, property, buildings, equipment, machinery, etc. PP&E does not have intangible assets.

To calculate the value of Net PP&E, we subtract the value of the opening value of PP&E from the closing PP&E.

| Net PP&E | = PP&E at the end of the year – PP&E at the beginning of the year |

Depreciation is the decrease in the monetary value of an asset over time due to wear and tear or obsolescence. Companies show depreciation as accumulated depreciation. Therefore, to calculate the depreciation for a year, we subtract accumulated depreciation at the beginning from accumulated depreciation at the end.

| Depreciation | = Closing value of Accumulated Depreciation – Opening Value of Accumulated Depreciation |

Real-Life Example of Capital Expenditure (Capex):

To better understand capital expenditures, we will look at two companies: AT&T Company and Verizon.

Capex Calculation for AT&T Inc.

AT&T Company operates in the telecommunications, technology and media service industry. It offers services like wireless networks, cell phones, digital television, internet, and landline telecommunication services to customers worldwide.

Let us now examine the capital expenditure that AT&T Inc. incurred in the fiscal year that concluded on December 31, 2023.

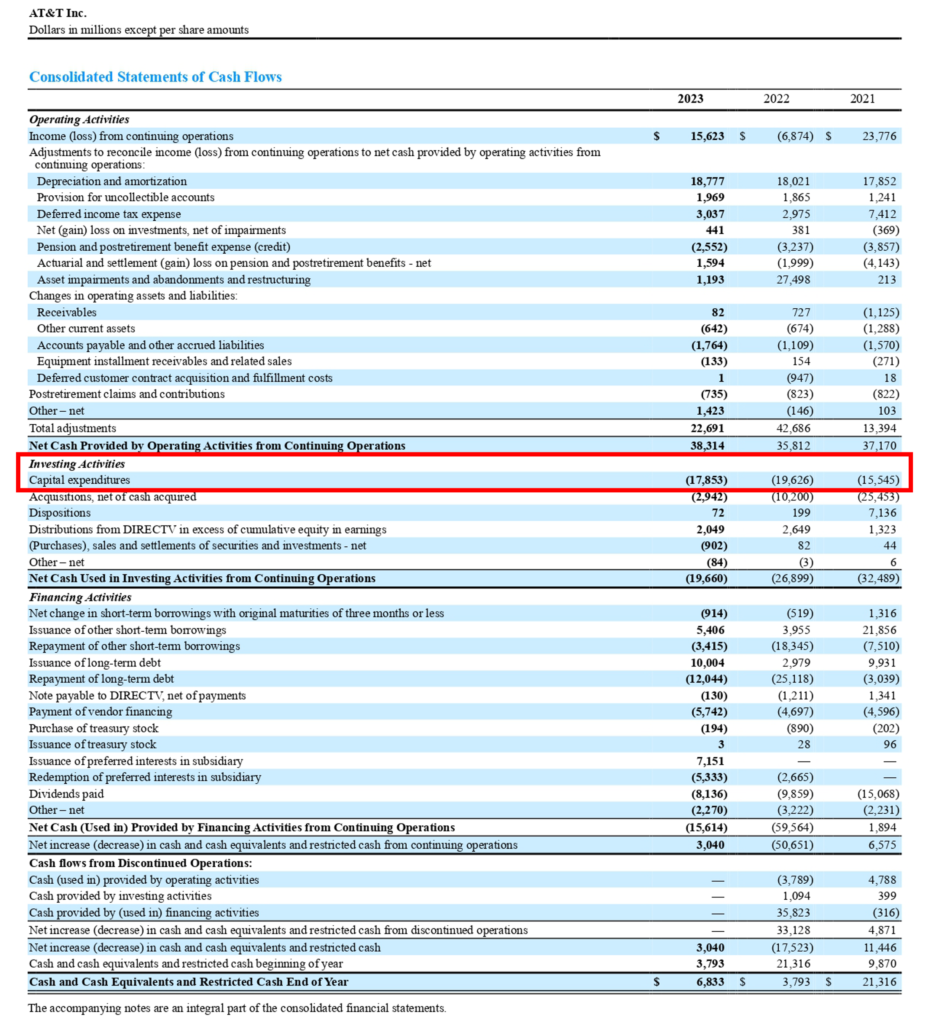

Consolidated Statements of Cash Flows

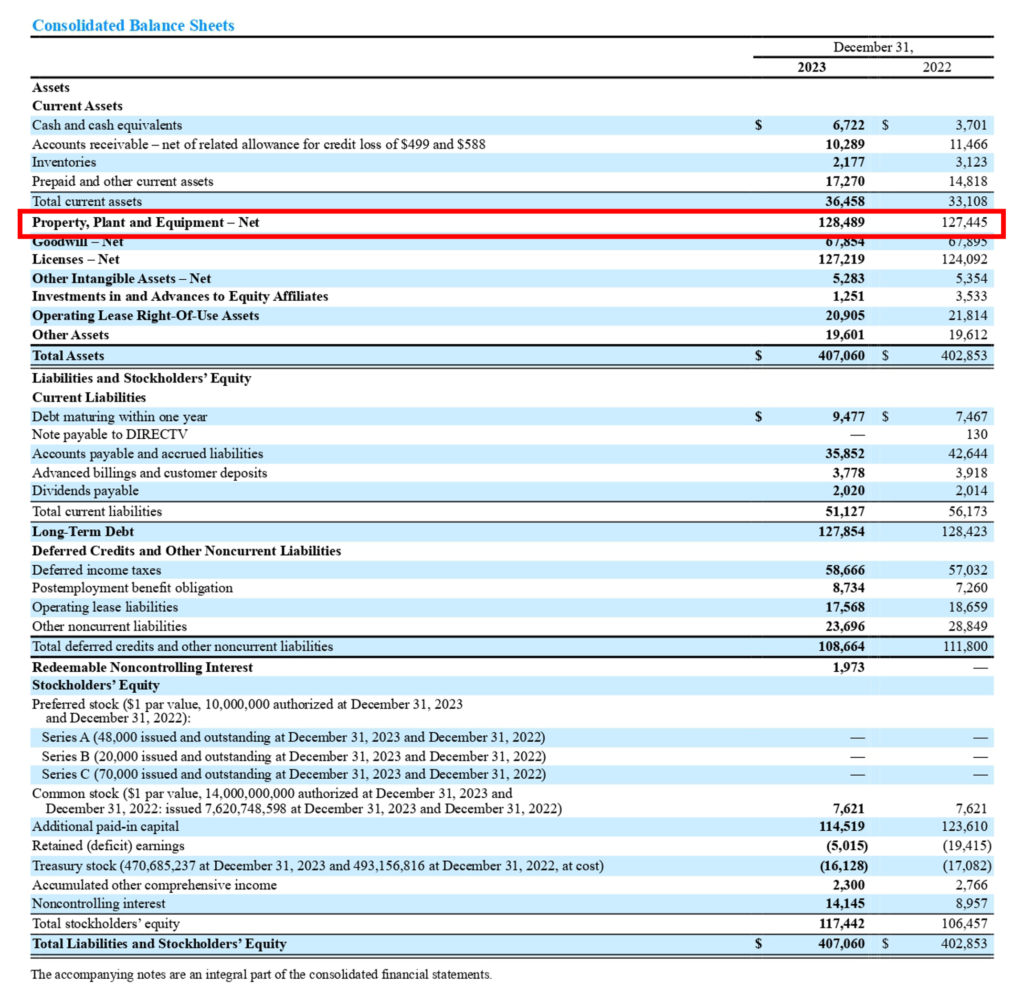

Consolidated Balance Sheets

In the Cash Flow Statement of AT&T, the company made a capex of $17,853 million in 2023, which is visible under the investing activities head.

But, by examining the opening and closing values of the balance sheet, we hardly see any increase in the property, plant and equipment value. So, we go deeper to figure out the capital expenditure of AT&T for 2023.

Management Discussion and Notes to Accounts:

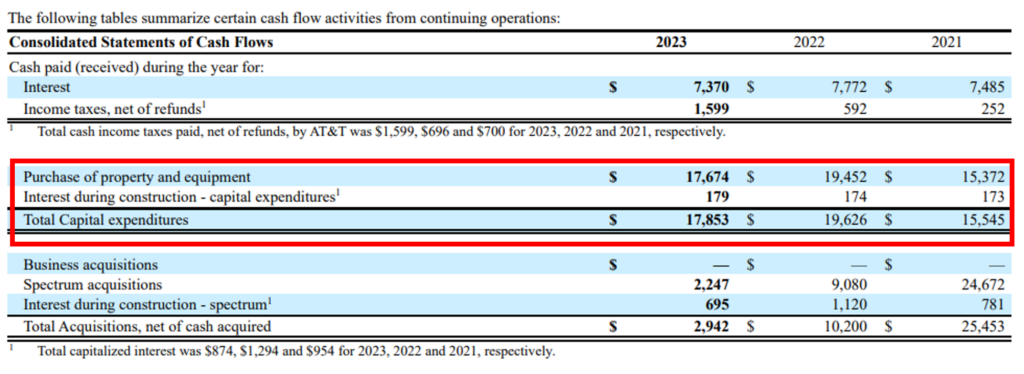

Notes to Accounts Page: 93

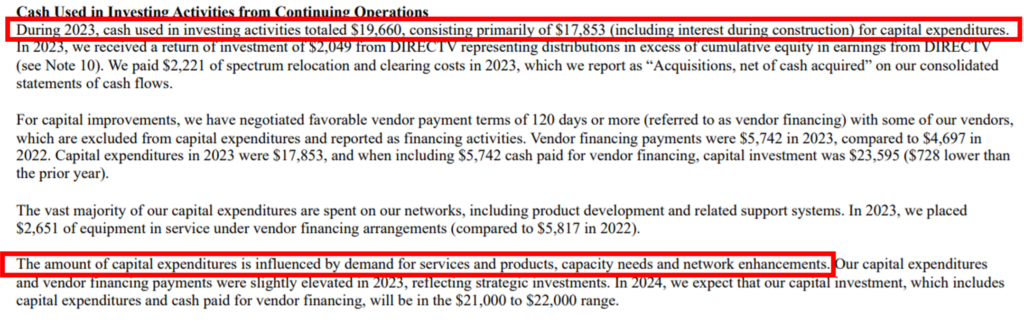

Management Discussion Page: 38

After reading the management discussion and notes to accounts, we concluded that AT&T invested $17,853 million in capital expenditure for 2023. The company shows a cash outflow of $17,674 million on the purchase of property and equipment, along with capitalising the interest of $179 million.

The company has also shown the breakup of its capex of $17,853 million in the management discussions section of the annual report. The company spent the capex of $17,853 million on networks, product development and related support systems. The company further explains that the capex was influenced by the demand for services & networks, capacity needs and network enhancements.

Capex Calculation for Verizon

Verizon Communications Inc. is an American multinational telecommunications conglomerate providing communications, technology, information and entertainment products and services to customers. The company offers wireline & wireless communication services, networking solutions, data centre & cloud services, security services and voice services.

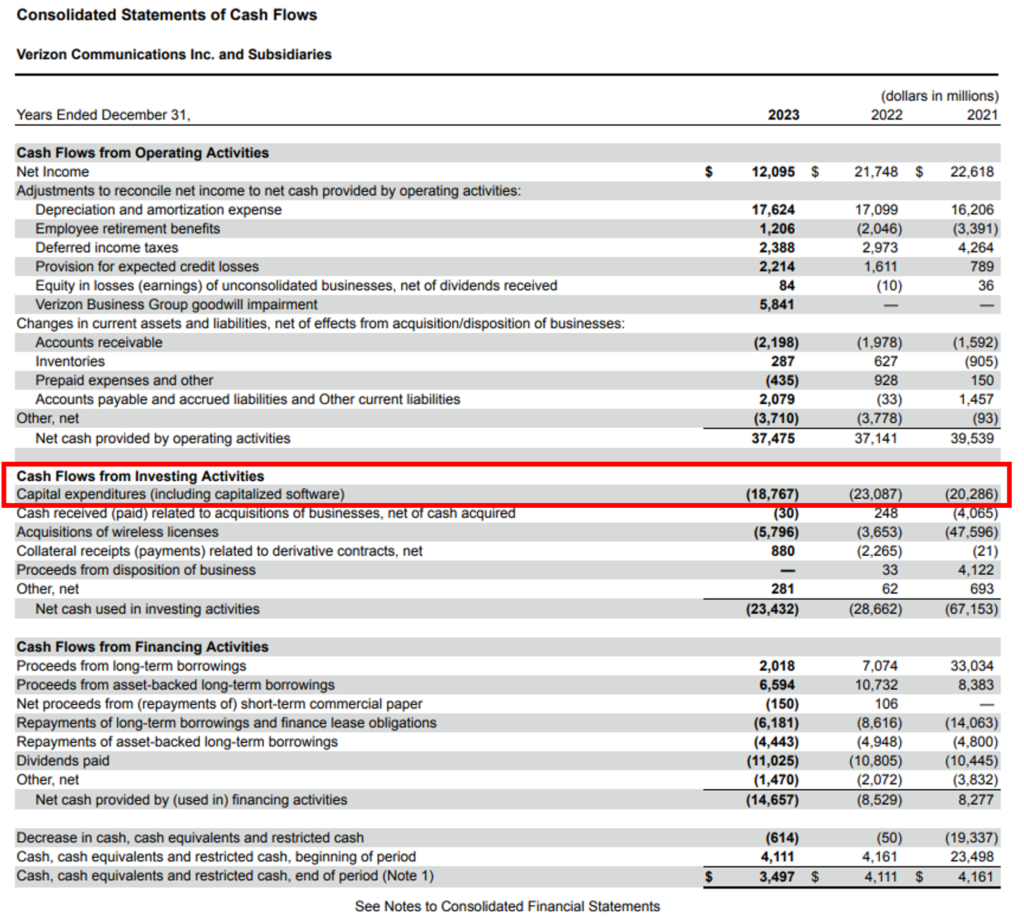

Consolidated Statements of Cash Flows

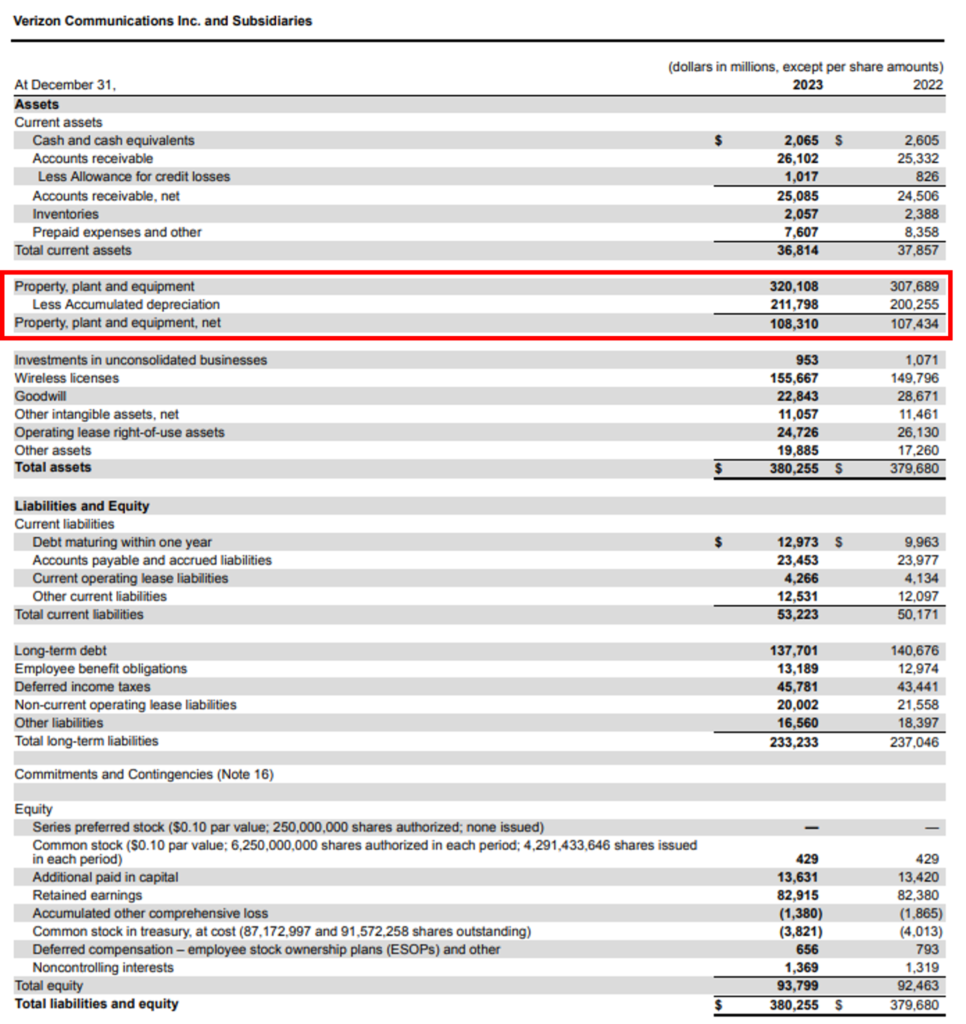

Consolidated Balance Sheets

Source: https://www.verizon.com/about/investors/sec-filings (10-K Annual Report)

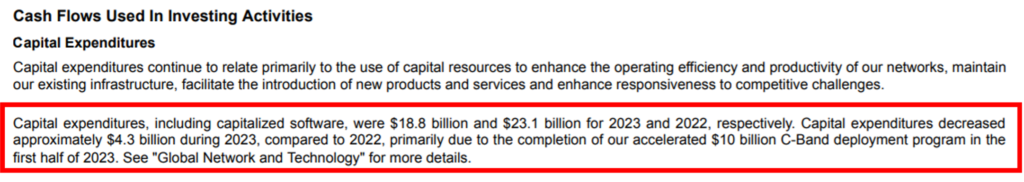

In the cash flow statement, the company is showing a capex value of $18,767 million under the investing head.

Management Discussion and Notes to Accounts:

Management Discussion Page: 39

The company has made capital expenditures of $18,767 million in areas like software, wireless networks, high-speed fibre and advanced technologies. The company also explained the fall of $4.3 billion in the capex from 2022 to 2023 is due to the completion of the C-Band deployment program.

What is Capitalisation?

A company incurs numerous expenses in daily operations, which are recorded in the income statement. However, when an expense is recorded in the balance sheet, it becomes an asset. Capitalization is the process of recording an asset and gradually charging its value as an expense over its useful life.

Depreciation or amortization charges the value of assets as expenses over time. Depreciation applies to tangible assets, while amortization is used for intangible assets. Both are recorded as expenses on the asset in the income statement.

Recording of Capital Expenditure (Capex) in the Financial Statements

Capital expenses are recorded in two financial statements:

- Balance Sheet

A balance sheet, also called a Statement of Financial Position, records capital expenditure. As Capex are long-term assets, they fall under non-current assets recorded as Property, Plant and Equipment (PP&E).

- Cash Flow Statement

Capital expenditure is also shown in the cash flow statement under the head cash flow from investing activities. They can be recorded as the purchase of property, plant and equipment or addition to property and equipment or payments for property & equipment or acquisition expenses.

Types of Capex

As we know, capital expenditure is made by a company for two purposes: one is maintenance, and the second is growth.

Similarly, Capex is also classified into two types:

- Maintenance Capex: Expenditure made by a company to sustain the current level of operations. Examples of maintenance capex are repairs and refurbishment of existing assets.

Maintenance Capex relation with depreciation in AT&T Inc. and Verizon example:

It is interesting to note that the capex values of AT&T and Verizon are close to the depreciation values of both companies. The Capex of AT&T Inc. is $ 17,853 million and depreciation equals $18,777. The capex of Verizon for 2023 was $18,767 million and depreciation was recorded as $17,624.

Therefore, it can be concluded that most of the capex done by AT&T and Verizon was maintenance capex.

- Growth Capex: It focuses on the expenditure made by a company to expand the course of business in future. In growth capex, new assets are purchased to increase the business’s production capacity. An example of growth capex is the purchase of PP&E.

Relation of Capex with Depreciation

Depreciation is a non-cash expense which records the wear and tear of an asset. It acts as an expense on the asset over its entire useful life. Capital expenditure is the expenditure made by a company to acquire an asset. Capex records the expense by capitalizing it as an asset, and with the help of depreciation, the overall cost of the asset is spread across the lifespan of the asset.

In short, capex is a huge expense which a company makes in a particular year, but its effect is dispersed by breaking that huge expense into smaller chunks which are subtracted from the revenue in the form of depreciation.

How can we distinguish Capex from Opex?

Capital Expenditures are the expenses made by the business on assets for the long term, i.e. more than a year. Capital expenditure is done to acquire fixed assets like machinery, equipment, buildings, etc.

Operating Expenditures, also termed Revenue Expenditures, are the short-term expenditures incurred by a company to meet its day-to-day operations. These expenses extend to the current financial period only, i.e. of- 1 year. Operating expenses include employees’ salaries and wages, rent, taxes, selling, general and administrative expenses (SG&A), research and development (R&D), and other utilities.

Capital expenditures are recorded on the balance sheet and shown in the cash flow statement under the investing activities head. Opex is deducted from the revenue earned by the business. They are recorded in the income statement.

Capex-to-Cash Flow Ratio

Capex-to-cash flow ratio is a financial metric used to assess the percentage of cash generated from operations that are diverted to make the capital expenditure. This ratio helps decipher how much a company is focusing on its future growth. It helps investors and managers assess how efficiently a company uses its operating cash flow in purchasing long-term assets. It also assesses the company’s financial risk and the capital investments made in cash.

To calculate the Capex-to-Cash Flow Ratio we divide the total capex done by a company in a year by the operating cash flow of the same year.

Formula:

| Capex-to-Cash Flow Ratio | = (Capex/ Cash Flow from Operations) * 100 |

Cash Flow from Operations shows the revenue generated from the core activities of a company during an accounting period.

Analysts have noted that a young company generally has a high capex-to-cash flow ratio. A mature company tend to reflect a low capex-to-cash flow ratio because it has reached its maximum expansion potential.

Calculation of Capex-to-Cash Flow Ratio of AT&T Inc.

| Cash Flow from Operations | = 38,314 |

| Capex | = 17,853 |

| Capex-to-Cash Flow | = (Capex/ Cash Flow from Operations) * 100 |

| = (17,853/ 38,314) * 100 | |

| Capex-to-Cash Flow | = 46.6% |

Calculation of Capex-to-Cash Flow Ratio of Verizon

| Cash Flow from Operations | = 37,475 |

| Capex | = 18,767 |

| Capex-to-Cash Flow | = (Capex/ Cash Flow from Operations) * 100 |

| = (18,767/ 37,475) * 100 | |

| Capex-to-Cash Flow | = 50% |

The Capex-to-Cash Flow ratio of AT&T Inc. is 46.6% and Verizon is 50% for 2023. By comparing both values we can say that Verizon diverted more of its operating cash revenue to capital expenditure than AT&T in 2023.

Conclusion

Capital expenditure (Capex) is a critical aspect of a company’s financial operations. It represents investments in long-term tangible assets aimed at maintaining or expanding business operations. Capex includes expenditures on property, plant, and equipment (PP&E), which are essential for sustaining and growing the business. The calculation of CapEx involves the net increase in PP&E and depreciation expenses. By recording expenses as assets on the balance sheet, companies spread the cost of assets over their useful life. Capital expenditures are classified into maintenance and growth Capex, with each serving distinct purposes in supporting business operations and expansion. Moreover, the distinction between Capex and operating expenditures lies in their time horizon and nature, with Capex focusing on long-term asset acquisition and OpEx covering day-to-day operational expenses. Finally, the Capex to Cash Flow ratio provides insights into a company’s investment focus and financial risk. It gives a clear picture of how much operating cash is being invested in the company’s capex or long-term assets. Hence, we can say that Capex is an important aspect of sustaining and growing a business.