What are Treasury Bills?

Treasury Bills, commonly called T-bills, are short-term debt financial instruments. The government issues treasury bills to raise short-term funds from the firms, institutions, banks and the public. Investors consider T-bills one of the safest instruments because they are backed by the government, and have a guaranteed return. T-bills are typically sold at discount prices, and when the T-bill matures, the government redeems them at par or face value. The difference between the issued price and the maturity or redemption value is the interest earned by the investors. T-bills are issued with maturities ranging from a few days to one year, offering flexibility to investors.

How to buy T-Bills?

There are two ways for investors to buy treasury bills. The first one is competitive bidding and the other is non-competitive bidding.

- Competitive Bids

Brokers or banks organise competitive bidding. In competitive bidding, there are two necessary aspects. One is the discount rate established by the auction, and the second is the discount rate the investors are willing to pay. If the investor places a bid which is better than the auction’s discount rate, then the investor’s bid will be filled. Or else the bid will be rejected or partially placed.

- Non-Competitive Bids

Non-competitive bids are organised by governments, banks or brokers. Here, unlike competitive bids, investors agree to purchase the treasury bills at the discount rate determined at the auction. In non-competitive bidding, investors have a guarantee of getting their bids placed.

Apart from these two ways of purchasing in T-bills. Investors can also look for them in the Secondary market as many other investors trade them.

Redemption of Treasury Bills and Accrued Interest

Treasury Bills are short-term debt instruments issued by the government at a discounted price. Discounted price refers to the cost of acquiring a financial instrument or an asset for less than its par or face value. Face or Par value is the nominal price assigned to a financial instrument.

Hence, treasury bills are issued at a discounted price for a short period. The short-term generally extends for one year or less. Different countries have different maturity periods for T-bills.

On maturity, the T-bills are redeemed at par value, thus generating an interest income. Because T-bills are debt instruments the return, they generate is called interest, and not dividends.

Treasury Bills in Different Economies

Governments of different economies issue treasury bills to meet their short-term fund requirements or to reduce the financial deficit. Let’s see how governments of various countries issue T-bills and their maturity period:

- United States of America

In the United States, Treasury bills are issued by the Department of the Treasury through regular auctions. T-bills are issued with six types of terms or durations which are counted in weeks. These are 4-, 8-, 13-, 17-, 26-, and 52-week terms. The yield of the 26-week and 4-week T-bill recorded on April 1st 2024 is 5.34% and 5.38% respectively.

- India

In India, T-bills are issued by the Reserve Bank of India (RBI) on behalf of the government. RBI issues T-bills with maturity periods counted in days, 14-, 91-, 182-, and 364-day T-bill. The 182-day T-bill yield as of February 2024 was 7.16%.

- United Kingdom

The UK government issues Treasury bills through the Debt Management Office (DMO) to meet its short-term funding requirements. DMO issues T-bills with maturities of 28 days, 91 days, or 182 days. The 6-month bond rate of the UK for April 2024 was recorded as 5.19%.

- Singapore

The Government of Singapore issues T-bills to meet the short-term fund requirement. The investors earn interest upon maturity, which can range from 6 months to 1 year. The 6-month and 1-year T-bill rates recorded as of April 2024 were 3.75% and 3.48% respectively.

- France

The French Debt Agency, Agence France Trésor (AFT) issues T-bills. In France, T-bills (BTFs) are short-term fixed-rate discount instruments. They have a maturity of less than or equal to one year. The maturity of T-bills is expressed in weeks, like 13-, 26-, and 52-week BTFs. The AFT also issues half-year T-bills with maturities of 20-24 weeks.

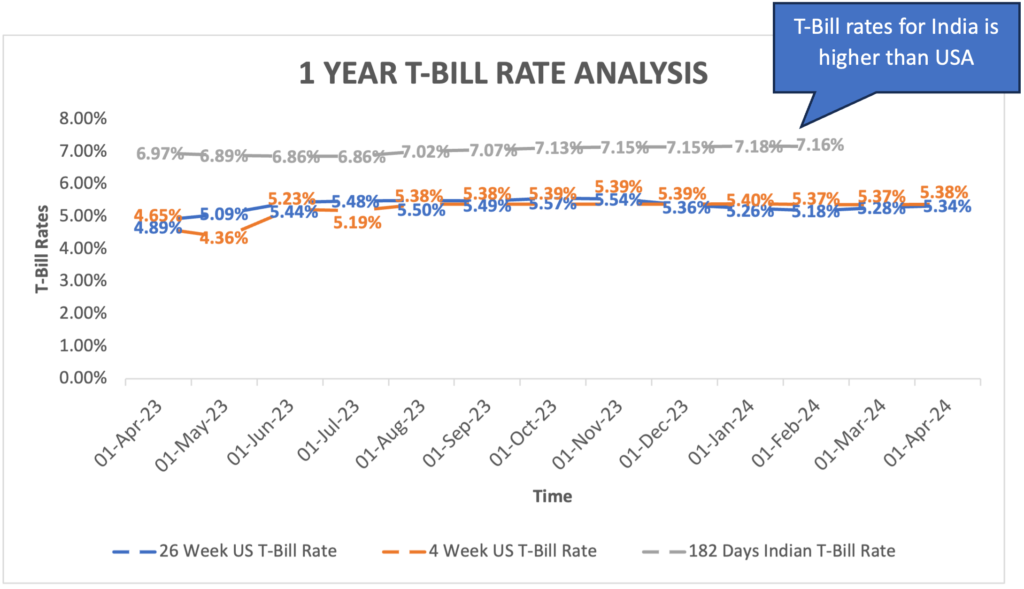

One-Year Analysis of Treasury Bill Rates of the United States and India:

We have performed a one-year analysis of 26-week and 4-week T-bills issued by the US Government and 182-day T-bills issued by the Indian Government.

| Date | 26 Week US T-Bill Rate | 4 Week US T-Bill Rate | 182 Days Indian T-Bill Rate |

| 1-Apr-23 | 4.89% | 4.65% | 6.97% |

| 1-May-23 | 5.09% | 4.36% | 6.89% |

| 1-Jun-23 | 5.44% | 5.23% | 6.86% |

| 1-Jul-23 | 5.48% | 5.19% | 6.86% |

| 1-Aug-23 | 5.50% | 5.38% | 7.02% |

| 1-Sep-23 | 5.49% | 5.38% | 7.07% |

| 1-Oct-23 | 5.57% | 5.39% | 7.13% |

| 1-Nov-23 | 5.54% | 5.39% | 7.15% |

| 1-Dec-23 | 5.36% | 5.39% | 7.15% |

| 1-Jan-24 | 5.26% | 5.40% | 7.18% |

| 1-Feb-24 | 5.18% | 5.37% | 7.16% |

| 1-Mar-24 | 5.28% | 5.37% | |

| 1-Apr-24 | 5.34% | 5.38% |

The Graph shows the trendline of the rates of 26-week, 4-week and 182-day T-bills from April 1st 2023 to April 1st 2024. It shows how the rates of these three T-bills fluctuated in the span of one year. The 26-week T-bill shows a 0.5% increase in the rates of April 2023 and 2024. The 4-week T-bill issued by the US government experienced a 0.73% increase when the values of April 2023 and 24 were compared. Finally, the 182-day T-bill issued by the Indian Government hiked by 0.19% from April 2023 to 24.

The Risk Associated with Treasury Bills.

T-bills are considered the safest financial instruments to invest in because they are backed by the government which guarantees to repay the principal, along with a fixed interest. But even these instruments are subject to fluctuations resulting from macroeconomic elements like demand & supply, inflation, interest rate risk, market risk, etc.

- Inflation: Inflation refers to the sustained increase in the prices of commodities. In inflationary conditions, the investors lose interest earned to the continuously growing prices.

Example: If an investor bought a 26-week T-Bill at a 3% yield and the inflation rate is at 4%. Then, the interest earned by the investor is lost due to higher inflation.

- Interest Rate Risk: Interest Rate Risk refers to the probable change in interest rates that negatively affects the values of fixed-income securities. T-bills, a fixed interest-yielding debt instrument, can experience the effects of interest rate fluctuation. If the interest rates increase, the interest on T-bills falls as investors receive less than face value. And if the interest rates decrease, investors yield more interest on T-bills.

- Market Risk: Market Risk when considering T-bills is associated with returns earned by other securities present in the market. When it appears to investors that other financial instruments like equity, commercial paper, preference shares, etc, are less risky and give better returns. Then, investors tend to put their money in those securities. Similar behaviour happens when other securities appear to be riskier. Investors put their funds in T-bills to secure the principal and return.

Are Treasury Bills tradeable?

Yes, treasury bills are tradeable securities. Investors who purchased T-bills can either hold them till maturity or sell them in the secondary market. Investment banks, retail banks and licensed brokers offer the sale of T-bills in the secondary market. They charge a price between the issued price and face value to make a profitable trade.

Treasury Bills and Taxation

Interest earned on T-bills is subject to taxation at the federal or central level. It means that the State and Local governments cannot charge taxes on the interest income of the investors. As Interest on T-bills is subject to Federal Income Tax in the US, Short-Term Capital Gains (STCG) in India and the UK the income earned from T-bills is taxed as income and not capital gains.

Conclusion

Treasury bills offer investors a safe and reliable investment option with guaranteed returns. The simplicity, high liquidity, and government backing make T-bills attractive for investors looking to preserve capital and earn a competitive yield. With their widespread availability and ease of access, T-bills remain a cornerstone of investment portfolios across different economies.

References

- US 1-month (4-week) treasury rate – https://www.cnbc.com/quotes/US1M

- US 6-month (26-week) treasury rate – https://www.cnbc.com/quotes/US6M

- India 182-days T-Bill data – https://www.ceicdata.com/en/india/treasury-bills-yield/treasury-bills-yield-182-days

- Singapore 6-month T-bill rate – https://www.mas.gov.sg/bonds-and-bills/treasury-bills-statistics

- UK 6-month Bond Yield – https://www.worldgovernmentbonds.com/bond-historical-data/united-kingdom/6-months/#:~:text=The%20United%20Kingdom%206%20Months,%3A23%20GMT%2B0).