WHAT IS TERMINAL VALUE?

The Terminal Value is the estimated value of a business, asset or a project beyond the final year of the explicit forecast period in a Discounted Cash Flow (DCF) model. Professionals and investors use the Terminal value to determine the long-term value of a company or project and is used to forecast an organization’s future financial stability. The terminal value formula can help us monitor the financial status of the company to help make better decisions about business operations and informed investment decisions in any company.

Around three-fourth of the total implied valuation derived from a discounted cash flow (DCF) model is contributed by the terminal value and hence for the valuation to be usable for professionals or investors, it is important for the estimated value of a company’s free cash flow beyond the initial forecast period to be fair and reasonable.

It is important to calculate the valuation of any business or project to find whether it is feasible in the long run and to make some major finance decisions. However, as the time horizon gets longer, it becomes difficult to value any business or project accurately due to presence of many unforeseen events and company external and internal factors. To solve this issue, analysts and investors use finance models like the Discounted cash flow model(DCF). The DCF model is used to derive the total value of a business or project based on certain assumptions.

REAL LIFE EXAMPLE OF TERMINAL VALUE

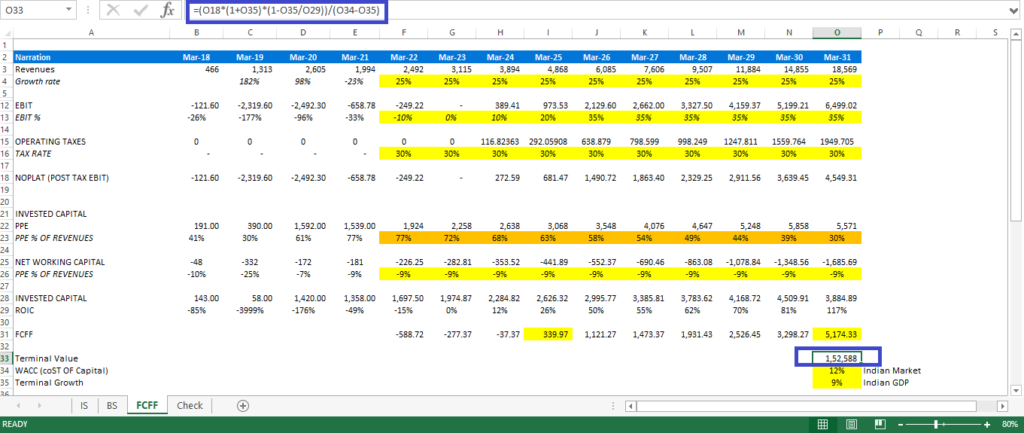

Below you see a screenshot of the terminal value calculation of Zomato, a high growth food delivery company in India. As you can see, it requires to forecast the future cash flows of the company for an explicit period of 10 years. Beyond 10 years, we calculate the value of the company using a value driver formula.

Source : Zomato financials

You will notice that the terminal value of the company does explain a larger proportion of the overall value since the explicit year cash flows are not that high. This may be a risky thing for a business since the high value comes from what the business will be able to do 10 year later and not based on more short term performance.

HOW TO CALCULATE THE TERMINAL VALUE?

As stated above the terminal value is the estimated value of an asset, business or a project beyond the initial forecast period in a Discounted cash flow model.

Discounted free cash flow model is popularly used by investors, analyst and finance professionals to conduct feasibility studies, valuation of stock market or while undertaking major acquisition decisions.

The DCF approach states that an asset (i.e., a company or a project) is equal to the sum of all of its future free cash flows (FCFs) discounted to the present day at a discount rate representing the cost of capital, such as the interest rate. Since a dollar received today is worth more than what is received on a later date as per the time value of money concept the projected cash flows must be discounted to their present value. Since it is not possible to forecast a company’s free cash flow for an indefinite period the DCF is calculated in two stages.

- Calculation of the explicit free cash flow forecast (for approx. 5-10 years)

- Calculation of the terminal value

While performing the DCF analysis two methods are used to calculate the terminal value:

- Growth in Perpetuity Method or Gordon growth model: It assumes that a business will continue to generate cash flows at a constant rate forever.

- Exit Multiple Method: It assumes that a business or project will be sold off for a multiple of some market metric (example: sales, EBITDA)

WHY IS A TERMINAL VALUE USED?

Two major components as discussed above while a Discounted Cash Flow model are

- Calculation of the explicit free cash flow forecast (for approx. 5-10 years) and,

- Calculation of the terminal value

For any normal business the forecast period is generally taken as 3-5 years but can be longer for some businesses such as mining or oil and gas companies. To make detailed assumptions this time period is a reasonable amount of time. However, making assumptions beyond this time period becomes difficult due to future uncertainties and this is where the terminal value comes into play. Most of the companies assume they will not stop operations after a few years and continue to grow forever or at least for a long period of time. Hence, Terminal value allows to anticipate a company’s future value and find its present value through discounting.

TYPES OF TERMINAL VALUE

The terminal value can be calculated using two main approaches:

- Growth in Perpetuity Method or Gordon Growth Model

This method is based on the assumption that the business will grow and continue to generate free cash flow at a consistent rate in the future and also assumes that the cash flows are re-invested into the company thereby enabling the company to grow at a consistent growth rate. Since there is a mathematical theory behind this method it is the most preferred among the academics.

Formula:

Terminal value = (Final Year FCF * [1+ Perpetuity Growth Rate]) / (Discount rate – Perpetuity Growth Rate)

Or,

Terminal value = (FCF * [1+g]) / (WACC –g)

Steps to calculate Terminal value using Perpetuity Method:

- Calculation of Free Cash Flow (FCF)

For a stable growth terminal value calculation of the company first the free cash flow for the final year needs to be calculated. The final year free cash flow is then multiplied by the sum of the stable long term growth rate (g) or the perpetuity growth rate and 1. Theoretically, the long-term growth rate should be the such that the company can sustain into perpetuity. Often, GDP growth or the risk-free rate is used as the growth rate in the Gordon growth model. Usually a growth rate between 2% to 4% is considered to be realistic. This gives us the first part of the equation:

Final year FCF * (1+Perpetuity growth rate)

Or,

Final year FCF*(1+g)

- Find the Discount Rate

In the second step we need to determine the discount rate. If the projected cash flows are unlevered free cash flows, then it would be correct to take the weighted average cost of capital (WACC) as it incorporates both cost of debt and equity and the ending output is going to be the enterprise value. But if the projected cash flows are levered free cash flows then discount rate should to be used should be the cost of equity and the resulting output is the equity value. Once we get the discount rate, the stable growth rate is subtracted from it. This yields the another part of the formula as below:

(Discount rate -Perpetuity growth rate)

Or,

For unlevered cash flow: (WACC – g)

Or,

For levered cash flow: (Cost of Equity-g)

- Divide Step 1 by step 2

We get the terminal value by dividing the step 1 with step 2 as below:

Terminal value = (Final Year FCF * [1+ Perpetuity Growth Rate]) / (Discount rate – Perpetuity Growth Rate)

Or,

Terminal value = (Final year FCF * [1+g]) / (WACC – g)

Or,

Terminal value = (Final year FCF * [1+g]) / (Cost of Equity – g)

Example: ABC Ltd. has free cash flow of $500, weighted average cost of capital of 9% and stable growth rate of 4%. The terminal value of ABC Ltd. Is calculated as below:

Terminal value= ($500*[1+0.04]/ (0.09-0.04)

= ($500*[1.04]/ (0.05)

= ($520/0.05)

= $10,400

- Exit Multiple Method or Terminal Multiple Method

Under this method, a valuation multiple is applied to a metric of the company like Sales or EBITDA to estimate its terminal value. This method does not assume indefinite growth and predicts the value of a company assuming that another company will acquire it. This method is more popular among investors and Investment bankers. Some analysts also use the average of terminal value calculated from both the above discussed methods.

Formula:

Terminal value = Final year financial metric (e.g. Sales or EBITDA) * Exit Multiple

Steps to calculate Terminal value using Exit Multiple Method:

- Assumption that the Business or project is sold off mainly on the basis of any measurable financial metric

Under the exit multiple method, the terminal value is calculated by assuming that a company will be sold off mainly on the basis of some measurable financial metric. This metric could be anything reasonable and measurable like the annual sales, EBITDA, Interest, Taxes, EBIT, etc. EBITDA is the most commonly used financial metric. It is important to use values prior to any deductions irrespective of the metric being used.

- Ascertaining the Multiple of the Financial Metric

Second step after deciding on the financial metric to be used, determine the multiple of the statistic the company is likely to be sold off. Based on the data from other companies that have been sold off the exit multiple is determined.

- Determining the Terminal Value by Multiplying Step 1 and Step 2 result

Once we get both the financial metric and the multiple we must multiply both to get the terminal value.

Terminal value = Final year financial metric (e.g. Sales or EBITDA) * Exit Multiple

Example: ABC Ltd. has total annual sales of $2,000 and other companies have been sold off for an average equivalent to 11 times their annual sales. The terminal value of ABC Ltd. Is calculated as below:

Terminal value= 11* $2,000

= $22,000

HOW TO FIND THE PRESENT VALUE OF TERMINAL VALUE?

In the DCF analysis, all the future free cash flows and the terminal values are discounted to find the present value of the future cash flows. The purpose of DCF analysis is to analyze whether the Net present value of the business or project is positive or negative. Net present value (NPV) of any business or project is calculated by discounting all future cash flows to the present value using a discount rate and then subtracting the initial investment. The present value of the terminal value is calculated as follows:

Present value(PV) = Terminal value / (1 + k) n

Or,

Present value(PV) = Terminal value / WACC

Where,

K= cost of capital

WACC= weighted average cost of capital

N= number of years

WHAT DOES A NEGATIVE TERMINAL VALUE MEAN?

If the cost of future capital exceeds the assumed growth rate, then the terminal value would be negative. However, in practice negative terminal value cannot last for very long. In case investors come across negative terminal value, it would be best for them to rely on other fundamental tools to value a company.

BENEFITS OF THE TERMINAL VALUE CALCULATION

Some of the benefits of the terminal value calculation are as follows:

- It helps the investors and analysts take better business decisions: The Terminal Value is the estimated value of a business, asset or a project beyond the final year of the explicit forecast period in a Discounted Cash Flow (DCF) model and helps make it possible to assess the value of investments or business that are long term in nature and make better decisions as to whether the business is viable in the long run.

- It helps to determine the value of an investment or project: The terminal value calculation is a part of overall DCF analysis. In DCF method net present value of any investment is found by subtracting the present value of all future cash flows over the explicit forecast period and present value of the terminal value and subtracting it with the initial investment cost. Hence, having the NPV of the project makes investors make better investment decisions as they get to know whether the investment will return positive or negative returns.

- It uses up-to-date market information to calculate the future value of cash flows: The terminal value uses important market information like the growth rate based on risk free rate of return or GDP rate and the most recent discount rates. If the exit method is used it uses the exit multiple based on the most recent used multiple in a similar transaction in the market. This makes it possible for the company to calculate future value of investments based on most recent market trends and to adjust the valuation based on this information.

LIMITATIONS OF TERMINAL VALUE

Some of the limitations of the terminal value calculation are as follows:

- All Predictions in calculation might not be accurate: Since the Terminal value calculation depends on future factors like growth rate, discount rate or exit multiple some of these predictions may be inaccurate due to inherent uncertainties attached. Some factors may be hidden that may impact the calculations. Hence, the terminal value cannot be considered as an ultimate guide since future values cannot be guaranteed and hence the terminal value should be recalculated frequently to adjust for any changes in these factors in the future.

- Multiples in the exit multiple method may change frequently: The Multiples used in the exit method may change frequently as the companies may sell at different multiples over time in similar kind of transactions and hence companies valuation shall remain relevant only if the terminal value is recalculated frequently by conducting market research of the most recent transaction.

Conclusion : In closing, we can conclude Terminal Value is an important aspect of the overall valuation of a company which can be sometimes more than 100% of the total value. While it is a scientific approach to valuation, it is sometimes criticized because of the long term assumptions that is needed to calculate the value. For growth stage companies with negative cash flows in the short term, it is tricky to arrive at the terminal value of these companies. None the less, it is still a robust methodology to calculate the value.