Financial planning is not a one-time event. It’s an ongoing process that involves making financial decisions every day. Whether you’re just starting out in your career or about to leave the workforce for retirement, it’s important to understand how money works and how you can manage your personal finances to improve your quality of life.

In an ideal world, we would all have sufficient resources to cover any unexpected expenses and maintain a comfortable standard of living throughout our lifetime. However, as real-life experiences have shown us time and again, this is rarely the case — which is why effective money management should be at the top of everyone’s priority list. Fortunately, there are several money management tax strategies that can help you achieve your personal financial goals. Here are 5 tax tips that will help you manage your money better:

Pay your taxes on time

One of the most basic money management rules is to pay your taxes on time. If you’re self-employed and regularly file a tax return, then you should set up a separate bank account to hold the funds that you will use to pay your taxes. This is important because otherwise, you might end up spending your taxes rather than letting them remain in your bank account until the day you actually file your return. This is particularly true for small business owners who should be able to choose when and how to pay their taxes.

If you have a consistent source of income, then you can set up a tax payment plan so that you don’t have to pay your taxes all at once. The key is to always make sure your taxes are paid on time. Otherwise, you might be charged a late fee, incur penalties or even see your business shut down due to tax-related issues.

Don’t ignore your investments

If you don’t have a savings account, then you are not managing your money effectively. The bottom line is that you need a savings account where you can safely stash your money so that you can use it for future expenses, such as retirement, emergencies or major purchases. However, a savings account is not the only investment you can make.

You can invest in a variety of assets, including stocks, bonds and real estate. The key is to diversify your investments so that you minimize risks and maximize your return. Investing is not only a great way to make more money — it is also a powerful money management technique that allows you to grow your assets faster. Remember: money that you don’t invest is money that you don’t earn.

Understand the benefits of tax deductions

One of the biggest challenges to effective money management is knowing which expenses you can deduct from your taxes. The good news is that the majority of people can deduct mortgage payments, health insurance premiums and child care expenses.

Depending on your annual income and filing status, you might also be eligible for other deductions related to job-related expenses, charitable donations, interest paid on your student loans, state taxes and home maintenance costs. You should claim as many deductions as you can because it will ultimately help you reduce the amount of money you owe in taxes.

This is particularly true if you are currently employed and are expecting a significant pay raise next year. You can use a 1040 tax form adjustment to increase your current tax deduction, which will help reduce the amount of tax you will pay next year.

Know the difference between an asset and a liability

An asset is anything that will earn you money in the future. Examples of assets include real estate, stock shares, gold or a business that you own. A liability, on the other hand, is a financial obligation that will require you to pay money.

Common examples of liabilities include a mortgage, a car loan or credit card debt. A good rule of thumb is to make sure that your assets are greater than your liabilities. This will help you achieve financial stability and effectively manage your money. If you want to improve your financial situation, then you need to start investing in assets. The more assets you have, the more money you will make and the less money you will spend. The more assets you have, the less likely you will run out of money during your retirement years.

Estimate your tax liability and plan your finances accordingly

If you are self-employed or if you expect to earn more money in the upcoming year, then you should start preparing for your taxes now. This means estimating the amount of taxes you will have to pay and setting aside this money in a separate account until tax season arrives. If you receive a salary, then you can estimate your taxes by completing a 1040 tax form worksheet. Alternatively, you can use a tax calculator to help you estimate your taxes.

You can also use a tax software program that can automatically estimate your taxes based on your situation. Once you know how much money you will owe in taxes, you can create a budget and start saving money so that you can pay your taxes without incurring penalties or interest charges. Taxes often take people by surprise because they are not prepared for them. If you prepare for your taxes and plan for them, then you will be less likely to encounter financial problems.

Lock in your interest rate

One of the best ways to manage your money is to lock in your interest rate on loans, including student loans, home loans and credit card debt. This means that you will be able to secure a fixed interest rate, regardless of economic conditions and fluctuations in the financial market.

You can lock in your interest rate by applying for a fixed-rate loan or by asking your credit card company to provide you with a fixed-rate card. The key to successfully locking in your interest rate is to make sure that you are financially prepared for the loan payments. Otherwise, you might end up defaulting on the loan, which will only make the situation worse.

Conclusion

Making smart financial decisions is not easy, but it is possible with the right mindset and a little bit of effort. Follow these money management tips, and you will be well on your way to a more secure financial future. The best time to start managing your money is today. Don’t dither — make a decision to make positive changes in your financial situation today.

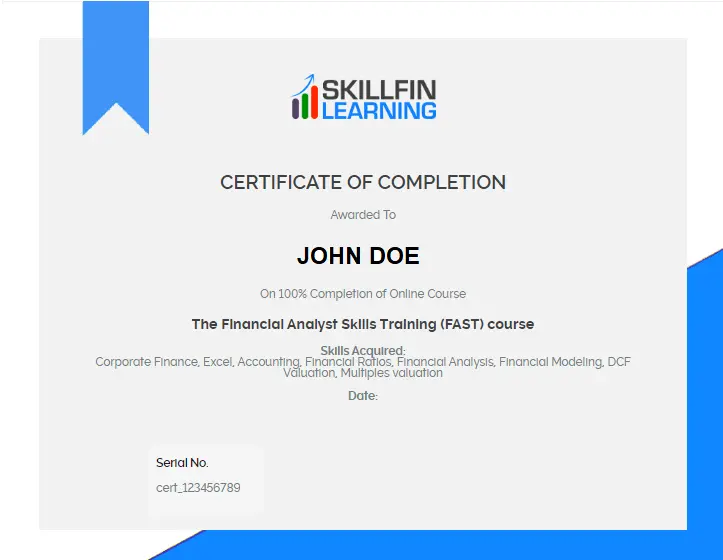

Related Courses: Financial Modeling Skills Course

15 thoughts on “5 Tax Strategies for Better Money Management”

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

734328 860361good day, your web site is truly unquie. Anways, i do appreciate your work 519965

955279 843633I feel other internet site proprietors should take this website as an model, really clean and fantastic user friendly style and design, as properly as the content material. You are an expert in this subject! 429616

575801 470094Hey! Do you know if they make any plugins to help with SEO? Im trying to get my blog to rank for some targeted keywords but Im not seeing extremely great results. In the event you know of any please share. Thanks! 209424

305786 477991Im not sure why but this weblog is loading extremely slow for me. Is anyone else having this concern or is it a issue on my finish? Ill check back later and see if the difficulty nonetheless exists. 640528

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!