Imagine you’re the CEO of a company like Apple or General Electric, standing at the crossroads of a critical decision. You’ve just posted record profits, and now the question looms large: What do you do with that cash? Do you distribute it to shareholders as dividends, signaling financial health and providing immediate gratification? Or do you reinvest it back into the company, fueling innovation, expansion, and long-term growth? This is where retained earnings come into play, a vital yet often under appreciated component of a company’s financial strategy.

WHAT ARE RETAINED EARNINGS?

Retained earnings are the portion of net income a company chooses to keep rather than distribute to shareholders as dividends. This financial reserve is accumulated over time and is a key indicator of a company’s ability to generate profit and sustain growth. Unlike cash flows or profit margins, retained earnings offer a glimpse into the company’s strategic decisions about reinvestment versus distribution.

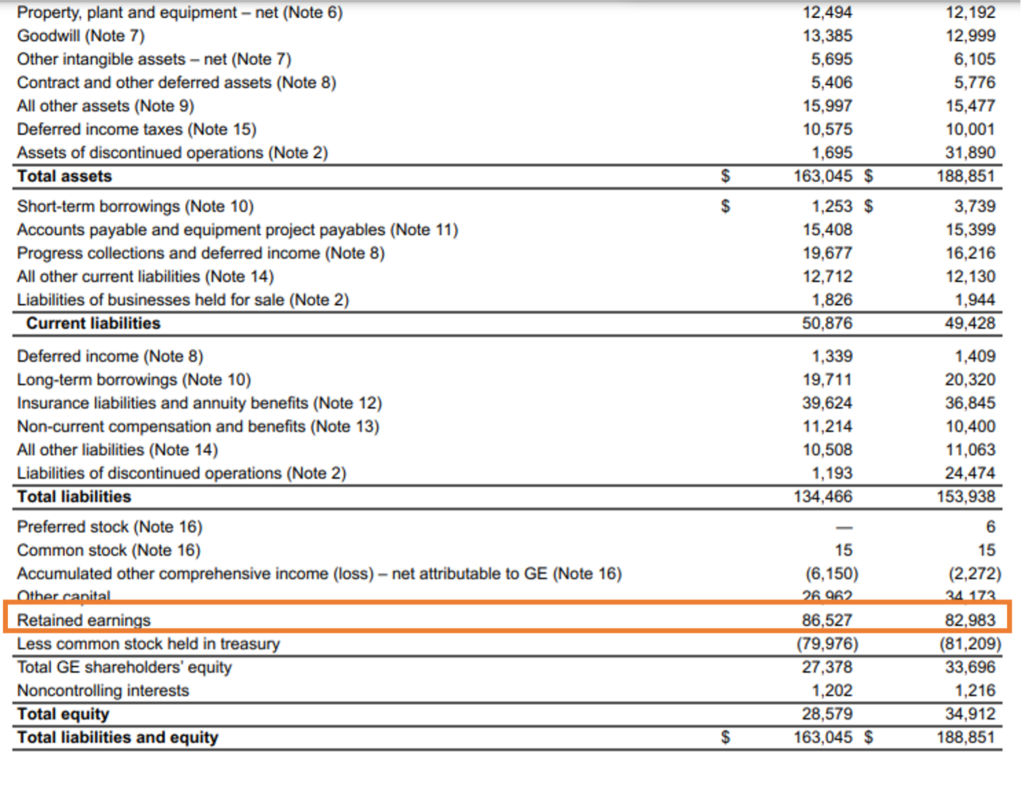

Below is the Snapshot of the Balance Sheet of General Electric

Source: Annual Report https://www.ge.com/sites/default/files/ge_ar2023_annualreport.pdf

From above we can see that retained earnings are found in the equity section of a company’s balance sheet. This financial statement provides a snapshot of a company’s financial position at a specific point in time, detailing its assets, liabilities, and shareholders’ equity. Retained earnings are typically listed under shareholders’ equity, reflecting the cumulative amount of net income that has been retained by the company over time, rather than distributed as dividends. These earnings accumulate from year to year, increasing with net income and decreasing with dividend payouts or net losses, providing insight into how much profit the company has reinvested into its operations.

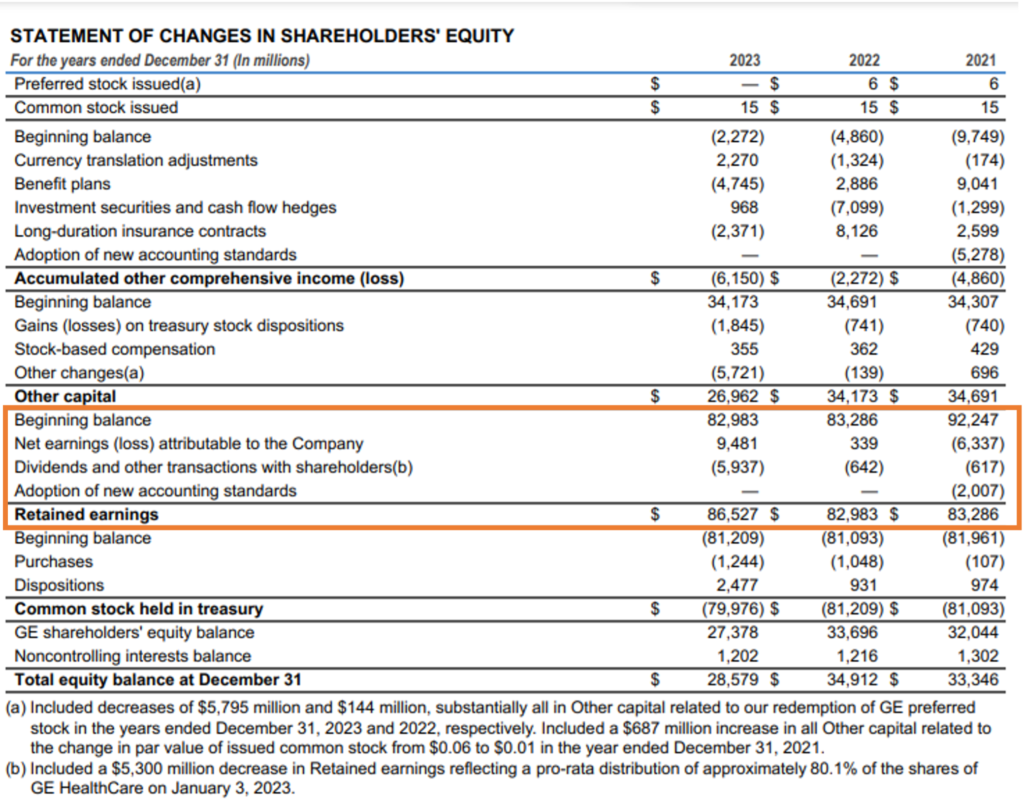

A detailed working of Retained Earnings is found in the Statement of Changes in Shareholders Equity as below:

Source: Annual Report https://www.ge.com/sites/default/files/ge_ar2023_annualreport.pdf

General Electric Co. (GE), a company with a long history of innovation and industrial leadership, has often faced critical decisions regarding the allocation of its earnings. During periods of transformation, GE prioritized reinvesting its earnings into restructuring efforts, technological advancements, and debt reduction. This strategy, powered by retained earnings, allowed GE to navigate complex challenges, such as the shift from traditional industries to digital and renewable energy sectors, and to reposition itself for future growth.

FORMULA TO CALCULATE RETAINED EARNINGS

Let’s look at how the Retained Earnings are calculated below.

Retained Earnings = Beginning Retained Earnings + Net Income – Cash Dividends – Stock Dividends

The retained earnings for General Electric for fiscal year 2023 is $86,527 million. Let’s understand each of the components of the formula in detail.

- Beginning Retained Earnings: This is the retained earnings balance from the end of the previous period. It represents the accumulated amount of profits that the company has kept and reinvested over time. The beginning balance of retained earnings for General Electric for the fiscal year 2023 is $82,983 million.

- Net Income: This is the profit the company earned during the current period after deducting all expenses, taxes, and costs from total revenue. A positive net income increases retained earnings, while a net loss decreases it. Net Income for General Electric for the fiscal year is $9,481 million.

- Dividends

– Cash Dividend: These are payments made to shareholders in the form of cash. When a company distributes cash dividends, it reduces its retained earnings since a portion of the profits is being paid out rather than reinvested.

– Stock Dividends: These are dividends paid to shareholders in the form of additional shares of the company’s stock, rather than cash. Stock dividends reduce retained earnings because they represent a distribution of value to shareholders, even though no cash is involved. However, they don’t reduce the total equity, as they simply transfer a portion of retained earnings to the common stock account.

The total dividend for General Electric for fiscal year 2023 is $5,937 million.

Below is the Retained Earnings calculated for General Electric.

This formula provides a more detailed view of how retained earnings are affected not only by profits and losses but also by the company’s decisions on cash and stock dividends.

HOW TO CALCULATE RETAINED EARNINGS DURING THE YEAR BASED ON DIVIDEND PAYOUT RATIO

If for a company, the dividend payout ratio (dividend/net income) is known then the retained earnings for that particular year can be easily calculated as:

Retained earnings for the year= Net Income- Dividend

Where, Dividend = Dividend payout ratio* Net Income

Let’s understand this with the help of a hypothetical example of a company.

| Year | Net Income (in $ millions) | Dividend Payout Ratio (%) | Dividends Paid (in $ millions) | Retained Earnings (in $ millions) |

| 2022 | 500 | 40% | 200 | 300 |

| 2023 | 600 | 30% | 180 | 420 |

| 2024 | 750 | 50% | 375 | 375 |

WHY DO RETAINED EARNINGS MATTER?

- Growth and Expansion: Companies like Tesla and Netflix often rely on retained earnings to fund new projects, expand operations, or enter new markets. These retained earnings can be used to purchase new equipment, invest in research and development, or acquire other companies—all of which can lead to increased revenue streams and higher market valuations.

- Financial Cushion: Retained earnings serve as a safety net during economic recessions. Companies with healthy retained earnings can weather financial storms without resorting to excessive debt or diluting their equity. For example, during the 2008 financial crisis, companies with substantial retained earnings were better positioned to navigate the challenges, while others struggled to stay afloat.

- Investor Confidence: While some investors might prefer immediate returns in the form of dividends, others look at retained earnings as a sign of a company’s long-term vision. A company that reinvests its earnings is often seen as committed to growth, which can attract investors who are in it for the long haul.

WHY DO COMPANIES CHOOSE TO RETAIN EARNINGS?

Retained earnings are retained for various reasons some of them being as follows:

- Reinvestment in the Business: Companies can use retained earnings to finance new projects, open new locations, or enter new markets without taking on additional debt. It can also be used for investing in R&D. R&D helps companies innovate and stay competitive by developing new products or improving existing ones.

- Debt Repayment: Retained earnings can be used to pay down existing debt, reducing interest expenses and improving the company’s balance sheet. This strengthens the company’s financial position and creditworthiness.

- Capital Expenditures: Companies often use retained earnings to purchase new equipment, upgrade technology, or improve infrastructure, which can enhance productivity and efficiency.

- Acquisitions and Mergers: Retained earnings can fund the acquisition of other companies or investments in strategic partnerships, allowing the company to grow its market share and diversify its operations.

- Stock Buybacks: Companies might use retained earnings to repurchase their own shares from the market. This can increase the value of remaining shares, boost earnings per share (EPS), and signal confidence in the company’s future.

- Dividend Payments: While dividends are typically paid from current earnings, a company can also choose to distribute a portion of retained earnings as dividends, especially if it has a strong financial position.

- Financial Cushion: Retained earnings serve as a reserve that can be used during economic downturns or periods of lower profitability, helping the company sustain operations and avoid taking on costly debt.

For example, General Electric Co. (GE), for instance, retained earnings to preserve cash for restructuring and debt reduction. This move was aimed at stabilizing the company.

WHICH TYPE OF COMPANIES KEEP RETAINED EARNINGS?

A growth-focused company often keeps its cash close to its chest, using retained earnings to fuel its next big leap. These companies might forgo paying dividends or offer only modest amounts because they’re all about reinvesting profits into exciting ventures like research and development, aggressive marketing, capital projects, and strategic acquisitions. By pouring money back into the business, they aim to ignite innovation and drive substantial growth, resulting in a high accumulation of retained earnings over the years.

In contrast, a maturing company, with fewer high-return opportunities on the horizon, might choose a different path. Instead of holding onto surplus cash, it may prefer to share it with shareholders through dividends. With fewer compelling projects to invest in, these companies often have lower retained earnings, opting to reward investors with immediate returns rather than reinvesting for future expansion.

Let’s have a look at the Net Income, retained earnings, and the dividends paid by a growth-focused and maturing company.

| Type of company | Company Name | Net Income | Retained Earnings | Dividend paid | Retained earnings as a % of Net Income | Dividend paid as a % of Net Income |

| Growth-focused | Tesla | 14,997 | 14,997 | 0 | 100% | 0% |

| Maturing | Exxon Mobil | 37,354 | 21,882 | 15,472 | 59% | 41% |

Source: https://ir.tesla.com/_flysystem/s3/sec/000162828024002390/tsla-20231231-gen.pdf

https://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_XOM_2023.pdf

CONCLUSION

In the dynamic world of business, retained earnings are more than just numbers on a balance sheet—they represent a company’s commitment to its future. Whether it’s Tesla investing in new technologies or Apple refining its product lineup, retained earnings are the fuel that drives innovation, growth, and resilience. For investors and company leaders alike, understanding the power of retained earnings is crucial to navigating the complexities of the modern economy.