Introduction

Operating expenses form the backbone of every business, encompassing essential costs incurred to sustain daily operations. Understanding operating expenses is paramount for investors and analysts, offering valuable insights into a company’s financial health and operational efficiency.

Through this article, we will develop our understanding of operating expenses, its components, operating ratio and how it differs from capital and non-operating expenses.

What are operating expenses?

Operating expenses refer to the cost of doing business. Opex is the cost incurred by the company to perform its operating activities. OpEx involves all the indirect expenses incurred by the business such as selling, general and administrative expenses and research and development expenses.

Investors and business analysts study the operating expenses of a company to understand its performance and financial position. It also explains how efficiently a company is allocating its financial resources.

Operating Expenses include rent, inventory costs, insurance, salaries, bank charges, etc.

Components of operating expenses

Classification of operating expenses is as follows:

- Selling Expenses are the costs associated with selling, marketing and distribution of goods and services. Selling costs include wages, commission, etc. Marketing cost sums up the advertisement of products, and distribution cost involves insurance, shipping and logistics expenses.

- General & Administrative Expenses are related to the efficiency of the business. General and administrative expenses involve the necessity of doing business. It includes rent, salaries, office supplies, employee perks, etc.

- R & D Expenses revolve around the research and development of the goods and services of the business. A company incurs R&D expenses to develop new and improved goods for the customers to satisfy their needs.

What are operating activities?

As the name suggests operating activities are the actions undertaken by a business to perform its day-to-day operations. In other words, operating activities are the day-to-day functions performed by the business to sell its goods and services. These activities form the major source of cash generation of a business as they are the core business activities. These activities involve production, marketing, distribution and selling of goods and services.

What is the Operating Ratio?

The operating ratio is calculated by dividing a company’s operating expenses by its net sales. It is used to measure the efficiency of a business in managing its expenditures.

A lower operating ratio signifies that a company is spending less on its operational activities and generating high profits, while a high operating ratio tells that a company’s operating expenses utilize a major portion of its net revenue. Hence, it implies that the business should control its expenses to normalize its ratio and increase its net income.

Formula:

| Operating Ratio | = (Operating Expenses/ Net Sales) * 100 |

Real Life Example

Let’s perform a comparative analysis of the operating expenses of the two tech giants Samsung, and Apple for the year ending 2023:

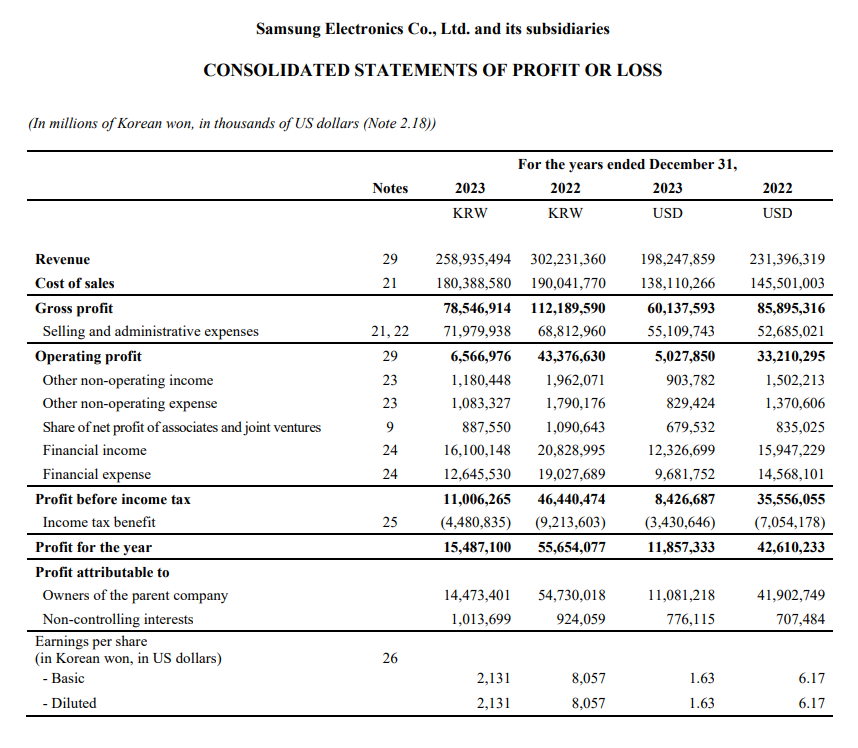

Statement of Profit & Loss of Samsung:

Source: https://www.samsung.com/global/ir/financial-information/audited-financial-statements/

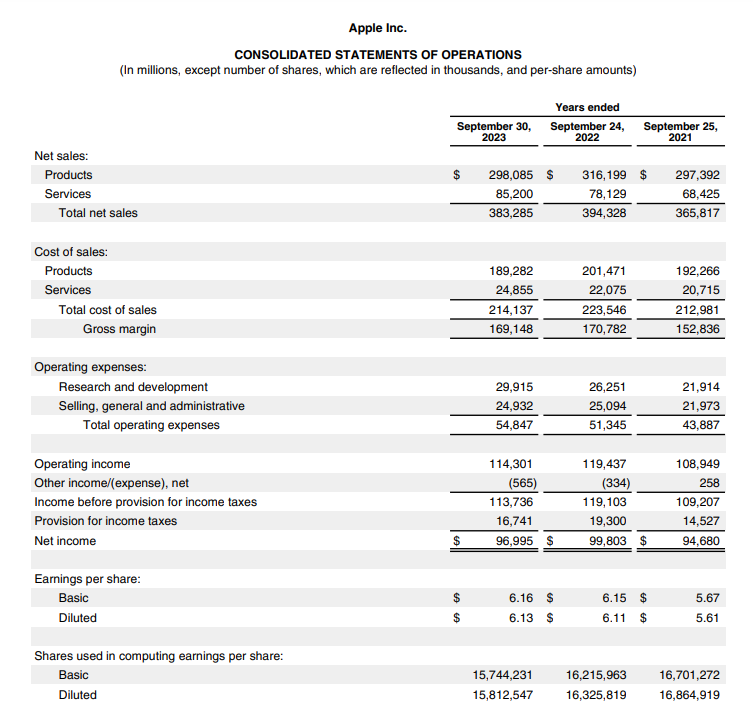

Statement of Profit & Loss of Apple Inc:

Source: https://s2.q4cdn.com/470004039/files/doc_earnings/2023/q4/filing/_10-K-Q4-2023-As-Filed.pdf

The operating expenses of Samsung for 2023 were 71,979,938 million Korean Won and for Apple Inc. were $54,847 million.

Let’s calculate the operating ratio to get a clear picture of what percentage of revenue earned by Samsung and Apple is spent on incurring their operating expenses.

| Operating Ratio | = (Operating Expenses/ Net Sales) * 100 |

Operating Ratio of Samsung

| Operating Ratio | = (Operating Expenses/ Net Sales) * 100 |

| = (71,979,938/ 258,935,494) * 100 | |

| Operating Ratio | = 27.79% |

Operating Ratio of Apple Inc.

| Operating Ratio | = (Operating Expenses/ Net Sales) * 100 |

| = (54,847/ 383,285) * 100 | |

| Operating Ratio | =14.30% |

Samsung spends 27.79% of its net revenue on its operating expenses and Apple Inc. contributes 14.30% of its net sales to its operating expenses.

By comparing the operating ratio of Samsung and Apple Inc. we can say that Samsung sends 13.49% more on its operating activities than Apple.

Difference between Capex and Opex

Operating expenses are the recurring expenditure incurred to perform daily business activities.

Capital expenditures (CapEx) are one-time payments carried out to acquire long-term physical assets. These assets form a part of business operations. Examples of CapEx are the purchase of machinery, investment in technology, etc. CapEx is essential for a company’s growth and expansion.

As we know, companies record operating expenses in the Statement of P & L. Capital expenditure is recorded on the asset side of the balance sheet. Similarly, operating expenses are shown as a part of operating activities in the cash flow statement, and Capital Expenditures are recorded as cash out-flow in the cash flow statement under the head Cash flow from investing activities.

Operating Expenses vs Non-Operating Expenses

As we have seen, operating expenses are associated with core operational business activities.

On the other hand, non-operating expenses are the costs that are not related to core business activities. It includes recurring transactions like interest payments and one-time payments like inventory write-downs.

Hence, the primary difference between operating and non-operating expenses is that operating costs are revenue-generating charges, while non-operating expenses are not associated with revenue generation.

Is depreciation an operating expense?

The answer to this question is yes, that depreciation is a non-cash operating expense. It’s non-cash because it does not have any impact on the cash balance when we subtract depreciation as an expense. We can also note that when calculating Cash flow from operating activities, we add back depreciation in net profit to eliminate its impact. We do this because depreciation is a non-cash expense.

Depreciation is the wear and tear of an asset in the daily course of business operations. An asset loses its value because of its daily usage in business. Therefore, it is considered an operational expense. Hence, we can say that depreciation is a non-cash operating expense.

Conclusion

In conclusion, operating expenses are vital to analyse a company’s financial performance and reflect the costs incurred in its day-to-day operations. Understanding and managing operating expenses is crucial for investors and analysts to assess a company’s efficiency and financial health. These expenses encompass various categories such as selling, general and administrative, and research and development costs, each playing a unique role in supporting business operations.

Additionally, operating activities encompass the functions performed by a business to sell its goods and services, driving revenue generation and growth. It’s essential to differentiate operating expenses from capital expenditures (CapEx) and non-operating expenses, as they have distinct implications for financial analysis and decision-making. While depreciation is considered a non-cash operating expense, it still impacts a company’s profitability and cash flow.

Thus, effective management of operating expenses is crucial for businesses to optimise profitability, enhance operational efficiency, and achieve long-term success in today’s competitive business environment.