INTRODUCTION

When evaluating a company’s financial health, most people zero in on operating income, focusing on how efficiently the core business functions. However, another crucial factor that can significantly sway profitability is non-operating expenses. These hidden costs often fly under the radar but can dramatically alter a company’s financial landscape. Understanding them is vital for investors and business leaders alike.

WHAT ARE NON-OPERATING EXPENSES?

Non-operating expenses are costs that arise from activities unrelated to a company’s core business operations. They include expenses such as interest payments on debt, losses from the sale of assets, and costs related to currency exchange fluctuations. While these expenses are separate from day-to-day operations, they can still have a profound impact on the bottom line.

WHERE DO NON-OPERATING EXPENSES LIE ON THE INCOME STATEMENT?

Non-operating expenses are usually listed below the operating income (or operating profit) line on the income statement. Here’s how they fit into the overall structure:

- Operating Income: The income statement initially determines Operating Income, also referred to as Operating Profit or Earnings Before Interest and Taxes (EBIT). This is derived by subtracting operating expenses (like COGS, SG&A, and R&D) from total revenue.

- Non-Operating Expenses: After operating income, the income statement lists non-operating items, which include Non-Operating Expenses. These can include interest expenses, losses on investments, foreign exchange losses, or any other expenses that are not directly related to the company’s primary operations.

- Income Before Tax: Non-operating expenses are subtracted from operating income to calculate Income Before Tax (also known as Earnings Before Taxes (EBT)).

- Net Income: After factoring in taxes, the Net Income (or Net Profit) is calculated, representing the bottom line of the income statement. In summary, non-operating expenses are located after operating income but before income before tax on the income statement.

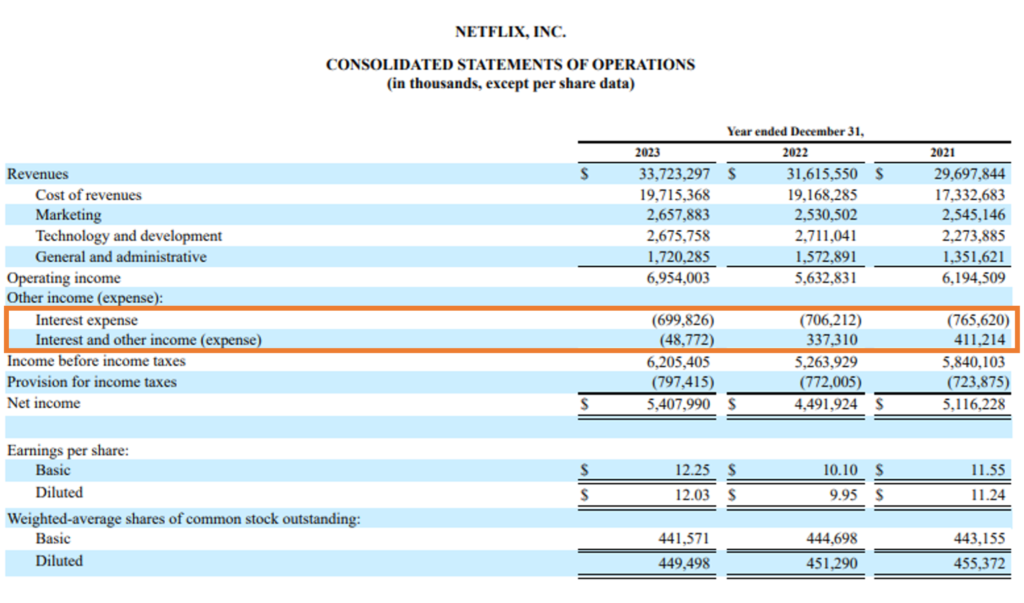

Let’s see how Non-operating income appears on the Income Statement of Netflix. We can see that the Other Income (expense) which is non-operating in nature lies below the operating income in the Income Statement.

REAL-WORLD EXAMPLE: NETFLIX

Netflix, the streaming giant, incurs hefty interest expenses due to the billions of dollars it has borrowed to fund its original content production. Although Netflix’s core operations are thriving, these non-operating expenses can sometimes dampen its earnings.

Source: Annual Report https://abc.xyz/assets/43/22/5deefff4fbec54014ae97b340c22/34ac6dab5f586b2e6e008b99fe683e35.pdf

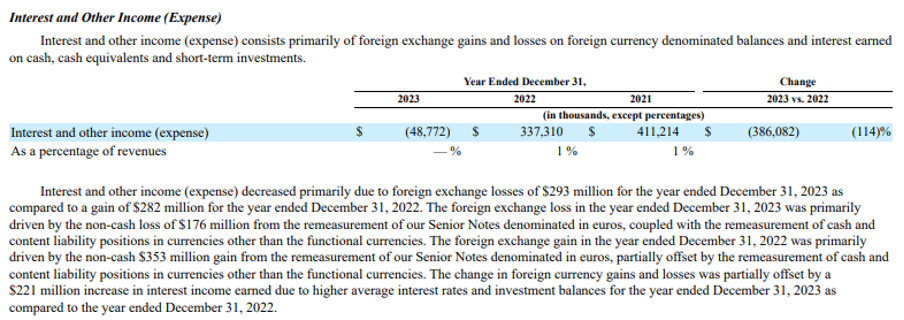

Interest and other income (expense) decreased primarily due to a major change in foreign exchange outcomes, resulting in a $293 million loss in 2023, compared to a $282 million gain in 2022. The 2023 loss was largely driven by a non-cash $176 million loss from remeasuring Senior Notes in euros and adjustments to cash and content liabilities in other currencies. In contrast, the 2022 gain was primarily due to a $353 million non-cash gain from remeasuring these euro-denominated notes. The impact of these foreign currency changes was partially offset by a $221 million increase in interest income in 2023, driven by higher interest rates and investment balances.

Source: Annual Report https://abc.xyz/assets/43/22/5deefff4fbec54014ae97b340c22/34ac6dab5f586b2e6e008b99fe683e35.pdf

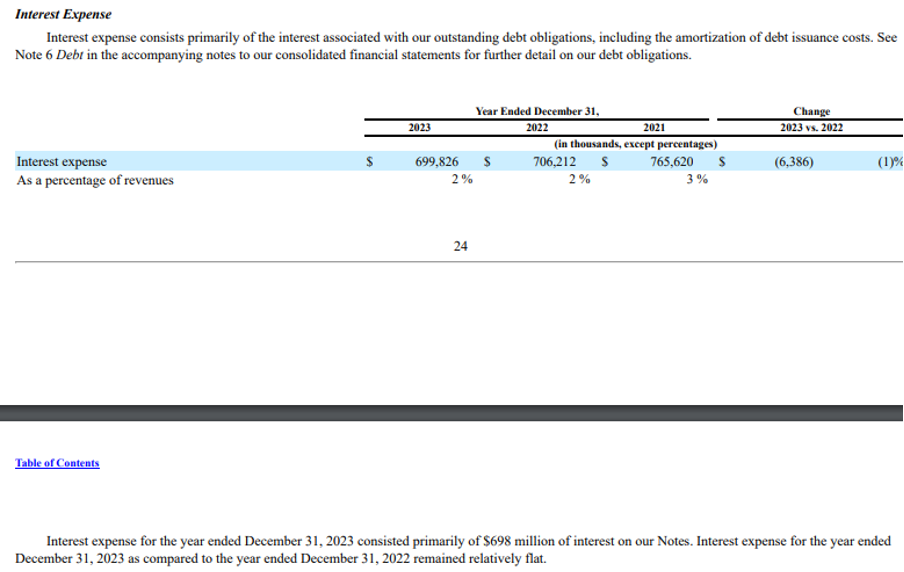

Interest expense for the fiscal year 2023 remained almost the same as compared to the fiscal year 2022 as can be seen below.

Source: Annual Report https://abc.xyz/assets/43/22/5deefff4fbec54014ae97b340c22/34ac6dab5f586b2e6e008b99fe683e35.pdf

REAL-WORLD EXAMPLE: VERIZON COMMUNICATIONS INC.

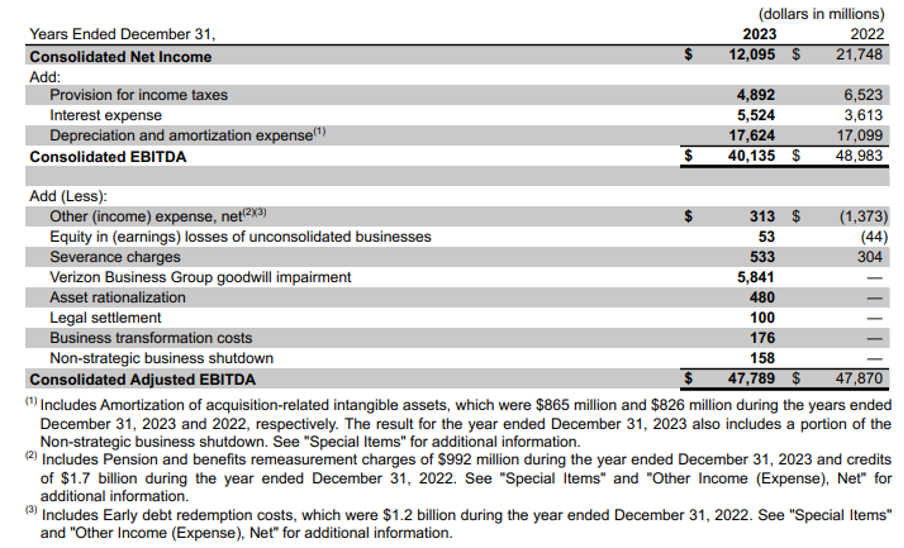

Verizon Communications Inc., a telecommunications leader, faces substantial interest expenses stemming from the significant debt it has taken on to expand its network infrastructure and invest in 5G technology. While Verizon’s core operations are robust, these non-operating expenses can occasionally weigh on its overall earnings. Let’s see how Verizon adjusts for these non-operating items in its Non-GAAP reported EBITDA to arrive at the Adjusted EBITDA.

Source: Annual Report https://www.verizon.com/about/sites/default/files/2023-Annual-Report-on-Form-10k.pdf

We can see from above that since Interest expense of $5,524 million is non-operating in nature it is added back to net income to give EBITDA. Further to calculate adjusted EBITDA other non-operating expenses like Severance charges, Goodwill Impairment, Asset rationalization, Legal settlement, business transformation cost, and non-strategic business shutdown are added back to Net Income.

COMMON NON-OPERATING EXPENSES IN ANY COMPANY

Some of the common non-operating expenses found in any company are as follows:

- Interest Expenses: Interest expenses are costs associated with borrowing money, such as interest payments on loans, bonds, or other debt instruments. These expenses can significantly reduce a company’s net income, particularly if the company relies heavily on debt to finance its operations or growth. We can refer to the Netflix example above which is reporting $699.83 million in the year 2023 as a non-operating expense.

- Losses on Asset Sales: Losses on asset sales occur when a company sells an asset for less than its recorded book value. Such losses can reduce overall profitability, especially when disposing of significant assets like real estate, equipment, or investments. We can refer to the Verizon example above which is reporting $480 million as asset rationalization.

- Currency Exchange Losses: Currency exchange losses arise when exchange rates move unfavorably for a company operating internationally. These losses can erode profits, especially for companies dealing with multiple currencies, as financial swings due to exchange rate fluctuations can be substantial. We can refer to the Netflix example above which is incurring a loss of $293 million in the year 2023 and reported as a non-operating expense.

- Litigation Expenses: Litigation expenses, including attorney fees, settlements, and judgments, are costs related to legal disputes outside of normal business operations. These are often unexpected and substantial costs that can affect a company’s financial stability and overall profitability. We can refer to the Verizon example above which is reporting $100 million as legal settlement.

- Restructuring Costs: Restructuring costs are expenses associated with reorganizing a company, such as severance pay, facility closures, or changes in business strategy. Although these costs might result in long-term savings, they can have a substantial effect on short-term profitability. We can refer to the Verizon example above which reports restructuring costs in the form of Business transformation costs of $176 million, Non-strategic business shutdown of $ 158 million, severance charges of $533 million, and Equity in (earnings) losses of unconsolidated businesses of $53 million added back to the EBITDA.

- Impairment Charges: Impairment charges happen when an asset’s market value drops below its book value, forcing the company to record a loss. These charges can substantially reduce a company’s net income, especially when involving large assets like goodwill or real estate. We can refer to the Verizon example above which reports $5,841 million as goodwill impairment.

- Investment Losses: Investment losses happen when a company’s investments, such as stocks or bonds, underperform and are sold at a loss. These losses can have a significant impact on overall financial results, particularly if the investments are substantial.

- Write-offs: Write-offs occur when a company determines that an asset or a portion of an asset is no longer recoverable and removes its value from the books. This can lead to direct reductions in net income, as seen with bad debts or obsolete inventory.

HOW IS NON-OPERATING EXPENSES DIFFERENT FROM OPERATING EXPENSES?

Here’s a table that outlines the key differences between operating and non-operating expenses with examples:

| Aspect | Operating Expenses | Non-Operating Expenses |

| Nature | Expenses directly related to the company’s core business activities. | Expenses unrelated to the company’s core business activities. |

| Purpose | Necessary for daily operations and producing goods/services. | Arise from financing, investing, or other activities outside normal operations. |

| Impact on Operations | Directly affects the company’s ability to generate revenue. | Does not affect core revenue generation but may impact overall profitability. |

| Financial Statement Location | Listed above operating income on the income statement. | Listed below operating income on the income statement. |

| Examples | – Content production costs | – Interest expenses |

| – Salaries and wages | – Foreign exchange losses | |

| – Streaming delivery expenses | – Loss on sale of assets | |

| – Marketing expenses | – Litigation costs | |

| Analysis Focus | Used to evaluate the efficiency and profitability of core operations. | Analyzed separately to understand their impact on net income and overall financial health. |

| Company Example | Netflix’s expenses for creating original content and paying employees. | Netflix’s interest payments on debt or losses from currency fluctuations. |

WHY NON-OPERATING EXPENSES MATTER?

While non-operating expenses don’t reflect the efficiency of a company’s operations, they are crucial for understanding the full financial picture. For instance, a company may report strong operating profits but end up with a net loss due to high non-operating expenses. This scenario underscores why investors must consider these costs when assessing a company’s profitability and risk. Some of the other reasons why non-operating expenses matter are as follows:

- Impacts the Valuation: Non-operating expenses play a critical role in valuation. When calculating financial ratios like the Price-to-Earnings (P/E) ratio, analysts use net income, which includes non-operating expenses.

- Managing Non-Operating Expenses: Companies can take steps to manage non-operating expenses by refinancing debt to secure lower interest rates, hedging against currency risks, or strategically timing the sale of assets. By efficiently controlling these expenses, companies can enhance their financial performance and minimize volatility.

WHY NON-OPERATING EXPENSES ARE SEPARATED FROM OPERATING EXPENSES?

Non-operating expenses are separated from operating expenses because they represent costs that are not directly related to the core business activities of a company. Financial analysts, accountants, and other professionals make this distinction for several key reasons:

- Clarity in Performance Evaluation: Separating operating and non-operating expenses helps in accurately assessing the company’s core operating performance. Operating expenses, including costs of goods sold (COGS) and selling, general, and administrative expenses (SG&A), are directly linked to the production and sale of goods or services. Non-operating expenses, like interest payments, losses on investments, or restructuring costs, do not reflect the day-to-day operations and could distort the evaluation of the company’s main business efficiency.

- Decision-Making: Investors and management use this separation to make better decisions. For example, when evaluating a company like Netflix, investors want to know how well the company is performing in its core business of streaming entertainment content, including movies, TV shows, and original productions, to a global audience independent of any interest expenses or gains/losses from investments. This helps in making informed decisions regarding investments and business strategies.

- Comparison with Peers: By separating non-operating expenses, companies can be more easily compared with peers within the same industry. Since operating expenses reflect the cost structure of a company’s core business, comparing these across companies provides insights into operational efficiency. For instance, comparing Netflix’s operating expenses with those of another streaming service offers a clearer view of their relative cost efficiencies.

- Transparency and Reporting: For financial reporting, separating these expenses ensures transparency and accuracy in financial statements. It provides a clearer picture of where the company’s profits or losses are coming from, aiding stakeholders in understanding the sources of financial performance. This separation is particularly important when unusual or one-time non-operating expenses occur, such as litigation costs or foreign exchange losses.

CONCLUSION

Non-operating expenses might not capture the same attention as revenue growth or operating income, but they are vital to understanding a company’s true financial health. Ignoring these costs can lead to an incomplete assessment of a company’s viability. By paying close attention to the costs that reside outside core business operations, investors and business leaders can gain a clearer, more comprehensive view of a company’s long-term sustainability.