Netflix stock (NASDAQ : NFLX) has seen a huge upside in the last 1 year with a share price of USD 416.03 as on closing of August 25, 2023. Around a year back, the stock was trading at USD 224.57 on August 29, 2022. This is an increase of 85.26% over a 1 year time frame which is a phenomenal return for any company.

If you look at the chart below, it captures well the phenomenal rise in the share price of the company.

Data Source: Google.com

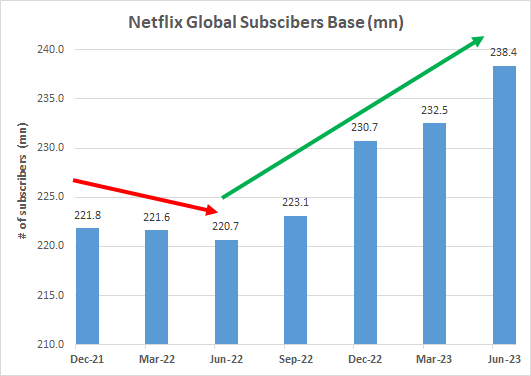

The question is what has triggered this massive jump in share price? For a subscription business like Netflix, the share price is very highly correlated to the number of subscribers of the company. While the company saw a decline in the number of subscribers in the first half of 2022 for the first time in 10 years (except for the quarter of June 2021), it has done well to recover very sharply since then.

Data Source: Netflix Investor Relations

From December 2021 to June 2022, the number of paid subscribers reduced from 221.8 mn to 220.7 mn. This was a big drop from Netflix perspective since it had never happened in last 10 years time frame (except for June 2021 quarter). As a result, the stock had tanked almost 50% in 1 month alone at the time.

However, they have now recovered quite well over the last 1 year with the total number of paid subscribers at 238.4 million in June 2023. Netflix has indeed done well to see this huge increase in the subscribers which is a reason why the stock price has jumped tremendously well in this time frame.

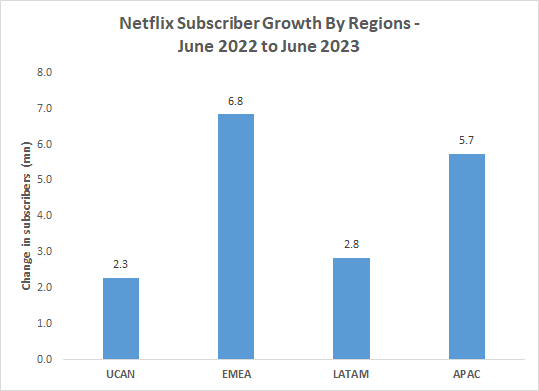

So, where did they gain the subscribers from?

As opposed to the first half of 2022, where Netflix lost paid subscribers in UCAN region (United States and Canada) and EMEA (Europe, Middle East and Africa), they have gained across all geographies in the last 1 year.

Data Source: Netflix Investor Relations

Not only have they net new additions in UCAN and EMEA markets, they continue to grow the paid subscribers in LATAM (Latin America) and APAC (Asia Pacific) as well. EMEA and APAC regions have seen the highest new subscribers growth over the last 1 year. The overall increase in the total subscribers is 17.7 million which is a good 8.0% increase year on year – a very health growth rate in the number of subscribers.

What a great comeback by Netflix.

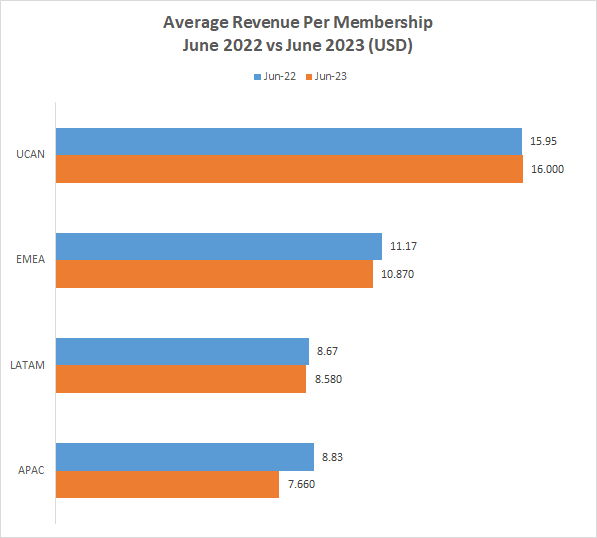

How about the pricing?

That is the second most important factor for a subscription business like Netflix. In a streaming subscription business like Netflix, the ability to keep on increasing the subscription price every quarter is limited. This is a very competitive space with other players like Amazon Prime etc who are very aggressive in their pricing strategy. As such, Netflix will find it very difficult to compete on pricing with these competitors. In fact, in one of their high growth markets i.e. India, they have recently announced a price cut in their subscription service.

Data Source: Netflix Investor Relations

As we can see in the above graph, pricing per subscriber has marginally improved for Netflix only for UCAN region but for other markets there is a decline in the membership price. This is understandable given the competitive landscape of the industry. However, some of these changes are due to currency fluctuations. So it is best we look at the change in pricing on a constant currency basis where the % change in all the markets was positive except for APAC which was negative at 6%. UCAN and LATAM were positive growth in pricing where EMEA was flat in that perspective. So overall, pricing remains stable without a lot of scope to increase it in the future.

Why is all this a big deal?

You may wonder if increase in user base is reason enough for the stock to react so favorably. That is a fair question. Let us try and understand this with some valuation principles.

Any company valuation is fundamentally dependent on the future cash flows in the business. The higher the future cash flows that the company can potentially generate, the better it is. Cash flows is in turn a function of Revenue Growth and Profitability Margin of the company. We would argue that fundamentally the higher the growth and profitability, the higher is the company valuation in the markets.

If we apply this principle in the case of Netflix, an increase in its paid subscriber base directly affects it Revenue Growth rate potential. Revenue is a function of number of paid subscribers that Netflix has and the Average subscription price per subscriber per month that the user pays. So, for the Revenue to grow, either or both these drivers should increase.

In case of Netflix, with aggressive pricing increase relatively difficult to achieve in this competitive space, the only driver to grow revenues aggressively is then showing net new additions in paid subscribers. Now the fact that the paid subscribers have increased in most the markets (as we saw earlier), the resultant effect of that translates into a proportionate increase in revenues. That is good news for Netflix given that the stock price typically factors in a 10-15% growth in future revenues. As against the market expectation if the revenue growth continues to improve for Netflix, it will lead to a significant increase in the company valuation which is why we saw almost a 86% increase in share price over the last 1 year.

In Netflix’s case, it seems that the increase in subscribers base is structural with scope of aggressive price increases very limited. As such, growth in number of paid users bodes well for the Netflix stock in the future as well.

P.S. This analysis is not meant to be stock recommendation for Netflix. It has been undertaken by our team purely from a research perspective and no information is here should be deemed to be investment advice.

For a more visual read, check out this post on our LinkedIn page below:

35 thoughts on “Netflix Stock Price: Key Factors Affecting Valuation”

… [Trackback]

[…] Read More on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Read More on on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More here to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More Information here on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More here on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Read More on on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Info to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Read More Info here on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] There you will find 57414 more Information to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More Info here on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] There you will find 11478 additional Information on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Read More to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Find More on to that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] There you can find 93319 more Information on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/netflix-stock-price-key-factors-affecting-valuation/ […]

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

339996 811859The planet are in fact secret by having temperate garden which are typically beautiful, rrncluding a jungle that is definitely definitely profligate featuring so several systems by way of example the game courses, golf method and in addition private pools. Hotel reviews 274505

192350 851702There is clearly a lot to know about this. I believe you produced various good points in functions also. 248065

924511 79073Its really a cool and beneficial piece of information. Im glad which you shared this helpful information with us. Please keep us informed like this. Thanks for sharing. 948702

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

132646 620418This internet web site is normally a walk-through its the data you wished concerning this and didnt know who ought to. Glimpse here, and youll undoubtedly discover it. 184062

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.