What is interest expense?

Interest is the cost a business incurs for borrowing funds from external parties. Interest is the non-operating expenses, which means interest is not directly related to the core activities performed by a business for revenue generation. The amount of interest paid reflects the debt capital raised by the company. The relation is simple higher the interest, the greater the debt amount and vice versa.

Companies show their interest expense in the statement of profit and loss after the calculation of operating income. The interest expense in the income statement is the interest accrued during the financial year, not the interest paid.

Interest, also called Finance Cost, is calculated on the principal value of the outstanding debt in a given period. Interest expense equals the outstanding principal debt multiplied by the interest rate.

| Interest | = Principal * Interest Rate |

Outstanding Principal is the remaining value of the original debt added in the capitalised interest.

Interest Rate is the rate at which the lender agrees to loan the money to the business.

Internet or Finance cost is the expense of inducing funds into the business through borrowing. These funds are raised either for expansion or for the purchase of assets.

Real-life Example of Interest Expense – Tesla

Tesla leads the automotive industry with groundbreaking electric vehicles, championing sustainability and renewable energy. Its visionary approach transcends traditional car manufacturing, shaping the future of transportation.

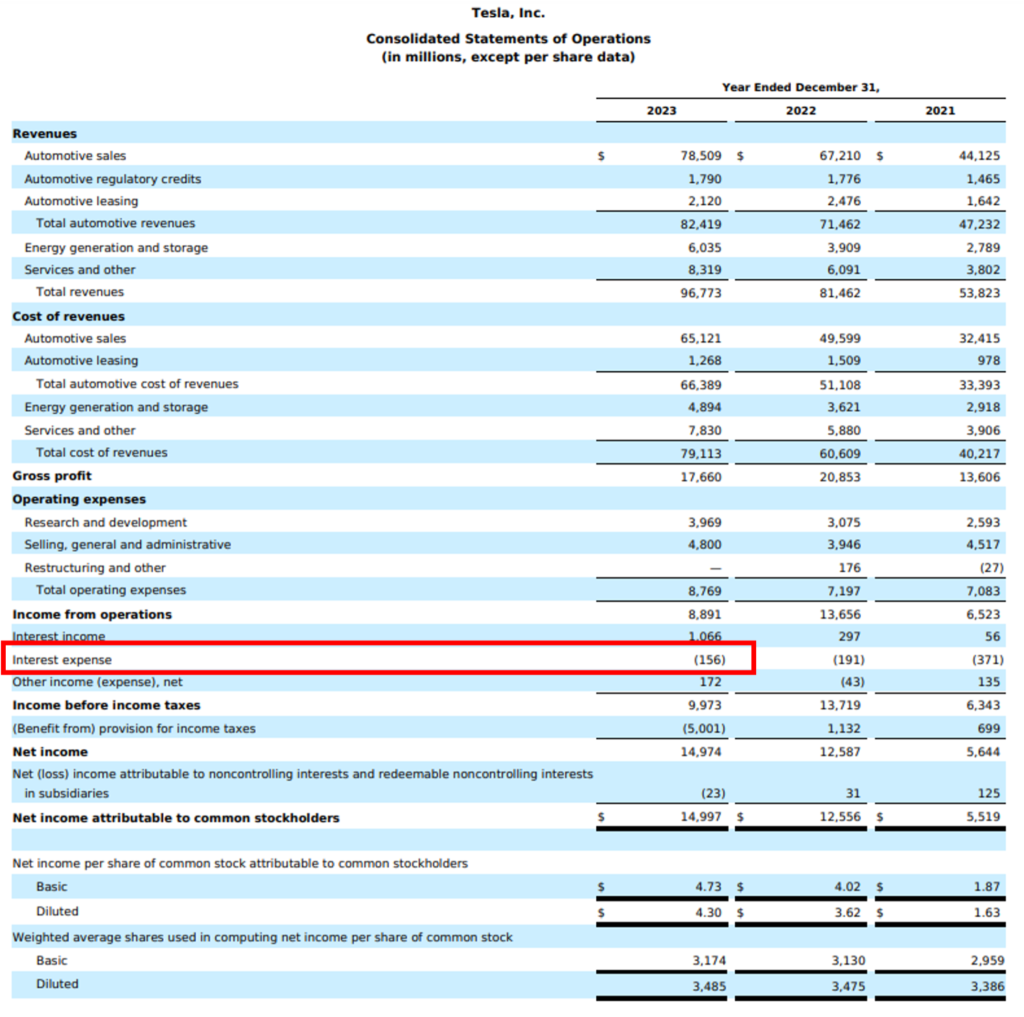

Let’s understand the Interest expense of Tesla for the year 2023:

Source: https://ir.tesla.com/_flysystem/s3/sec/000162828024002390/tsla-20231231-gen.pdf

Tesla has recorded an interest of $156 million in 2023, which contributes to tax saving

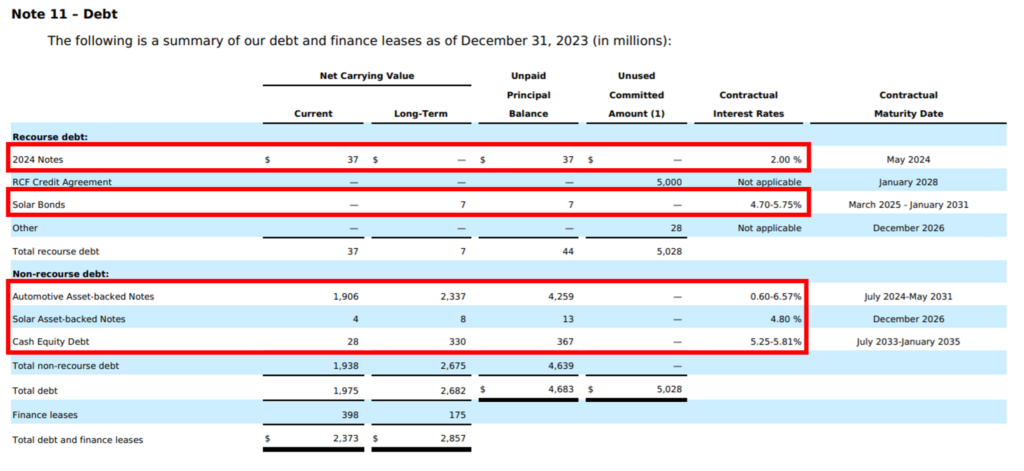

Following is the list of debt and financing lease of Tesla along with the interest rate

Notes to accounts: Page – 74

From the above table, we get a rough understanding of Tesla’s sources of debt and the interest rates related to them.

Real life example of Interest Expense – General Motors

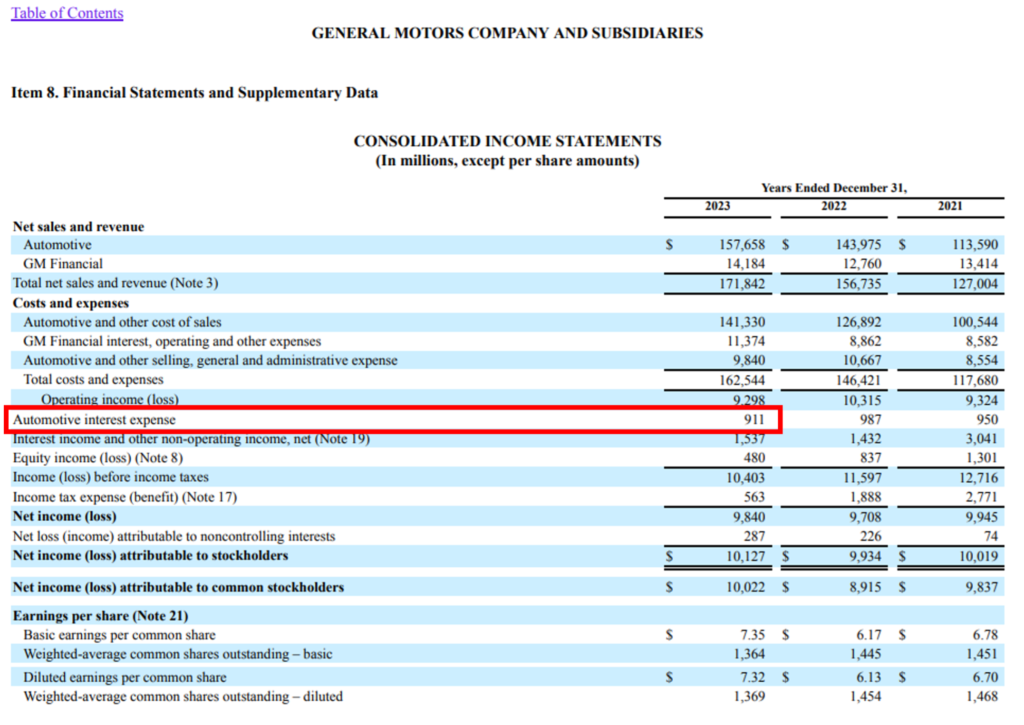

Now let’s look at the Interest expense of General Motors for the year 2023:

General Motors drives innovation in the automotive sector, offering a wide range of vehicles and advanced technologies. With a legacy of excellence, it continues to redefine mobility and shape the automotive landscape.

Source: https://investor.gm.com/static-files/0a93534d-729c-41ea-9d5e-e69ccad16803

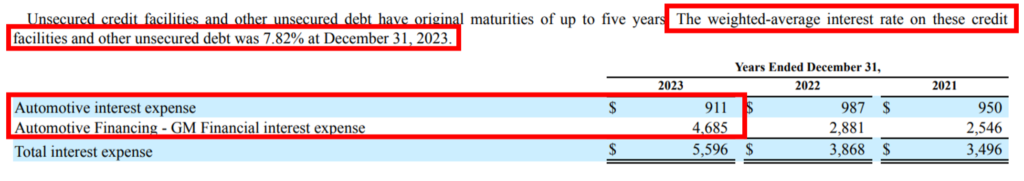

Note: The above table also shows the interest expense of GM Automotive and GM Automotive Financing separately. Page – 79

GM has shown an interest amount of $911 million on its Statement of profit and loss for 2023 from its automotive segment.

It is interesting to see that in the supplementary notes on page – 79, GM has shown the calculation of the total interest expense for 2023. By adding the interest expense of the GM

Automotive segment and GM Financing hand.

GM calculates the weighted average interest rate. The weighted average interest rate for 2023 was 7.82%.

Capitalisation of Interest expense

Interest that has accumulated on eligible assets is added to their capital cost during the period. Capitalization of interest expense, increasing the asset’s total worth. This accounting method allows businesses to spread the interest cost over the useful life of the asset, aligning expenses with revenue generation. By incorporating interest expenses into the asset’s base, capitalization enhances financial transparency and reflects the true economic cost of asset acquisition. Therefore, capitalization of interest expense serves as a strategic tool for optimizing financial management and asset valuation.

Examples of Interest Capitalisation

Tesla has capitalised its interest expense by including the interest expense with Property, plant & equipment and then is amortised over the life of the related assets. This is talked about in notes: 2 Summary of significant accounting policies, page – 66.

General Motors has also capitalised its interest expense with property, plant & equipment and then the capitalised interest is slowly amortised with the life of the respective asset.

Interest Expense recording in the Balance Sheet

The balance sheet records all the assets and liabilities of the company. Hence, the debts taken are also recorded in the liabilities side of the balance sheet.

Companies sometimes also record interest expense in the balance sheet, but why?

Companies record interest as a liability and asset. When interest, is the amount of interest accrued and not paid. The company records it as outstanding interest under current liabilities. When the company has paid the interest value in advance, it is recorded as prepaid interest under current assets.

How is Interest Expense and Tax deductibility connected?

Interest is called a tax-deductible expense. This happens because the interest reduces the profit earned by the company during the period. Interest acts as a shield for a company to reduce its tax liability. Hence, the term Interest Tax Shield.

An Interest Tax Shield is a deduction a taxpayer avails to reduce the taxable income. Therefore, interest is considered as a tax-deductible expense.

Relationship between Interest expense and Inflation

Interest and inflation share an interesting relationship. Macroeconomic factors can increase or decrease the burden of interest on an organisation. When inflation rises, the purchasing power diminishes, leading to higher borrowing costs or interest. It happens as lenders hedge their funds against depreciating currency value. During periods of low inflation, interest expenses may decrease, as the purchasing power of consumers increases. And the interest rate falls. Thus, providing relief to borrowers.

Difference between Interest Expense and Dividend

It is easy to get confused between interest and dividends while studying accounts. Here are the key differences between interest and dividends:

- Interest is the charge on the company for the money borrowed from external parties. A dividend is a part of the profit offered by the company to its shareholders.

- Interest is a charge against profit. While the dividend is the appropriation of profit.

- Interest is mandatory to pay even if the company is making losses. Dividend distribution depends upon the company.

- Interest is paid to lenders, creditors, banks, and debenture holders. While Dividend is payable to equity and preference shareholders.

- Interest is subject to tax benefits but dividends do not yield tax benefits.

What is the Interest Coverage Ratio?

Interest Coverage Ratio measures a company’s ability to meet its interest payments on outstanding debt. The interest coverage ratio is calculated when a company’s operating profit or EBIT (Earnings Before Interest & Tax) is divided by its interest expense.

| Interest Coverage Ratio | = Earnings Before Interest & Tax (EBIT) / Interest Expense |

Operating profit or EBIT is the profit earned by the business through its core operating activities minus direct and indirect expenses except for interest and tax.

Interest is the cost of raising funds from external sources.

A company with a high-interest coverage ratio shows that it has enough earnings to pay its accrued interest. While a low-interest coverage ratio questions the ability of the company to pay interest.

Let’s understand the calculation of Tesla and General Motors and compare which company has a higher interest coverage ratio:

Interest Coverage Ratio of Tesla

| Operating Income/ EBIT | = 8,891 |

| Interest expense | = 156 |

| Interest Coverage Ratio | = Earnings Before Interest & Tax (EBIT) / Interest Expense |

| = 8,891/ 156 | |

| Interest Coverage Ratio | = 57 times |

The interest coverage ratio of Tesla is 57 times which is much higher than the bare minimum of 1.5 to 2 times. This shows that Tesla is much more capable of meeting its interest obligations.

Interest Coverage Ratio of General Motors

General Motors has two business segments one is GM Automotives and the other is a financing arm called GM Financials. In the Consolidated Statement of Profit & Loss GM has considered the revenue and costs of GM Financials. But for the calculation of the Interest Coverage Ratio, we are taking the figures related to GM Automotives only.

Therefore, we have to subtract the operating income of GM Financials from the total operating income of GM Motors to get the operating income of GM Automotives.

| Total Operating Income of GM | = 9,298 |

| Operating Income of GM Financials | = Revenue of GM Financials – Costs of GM Financials |

| = 14,184 – 11,374 | |

| Operating Income of GM Financials | = 2,810 |

The Operating profit of GM Financials is $2,810 million.

Now we will subtract the GM Financials operating profit of $2,810 million from the total operating profit of $9,298 million to get the operating profit of GM Automotives.

| Operating Income of GM Automotives | = Total Operating Profit – Operating profit of GM Financials |

| = 9,298 – 2,810 | |

| Operating Income of GM Automotives | = 6,488 |

For the calculation of the Interest Coverage Ratio of GM Automotives, we will consider the operating profit of $6,488 million.

| Operating Income of GM Automotives | = 6,488 |

| Interest expense of GM Automotives | = 911 |

| Interest Coverage Ratio | = Earnings Before Interest & Tax (EBIT) / Interest Expense |

| = 6,488/ 911 | |

| Interest Coverage Ratio | = 7.12 times. |

General Motors has also maintained a great interest coverage ratio of 7.12 times.

But when we compare Tesla and GM, Tesla wins the game by sustaining a higher interest coverage ratio.

Conclusion

Interest expense, the cost incurred for borrowing funds, plays a pivotal role in a company’s financial landscape. Serving as the price for leveraging external capital, interest expense reflects the debt capital raised, influencing a company’s financial health and tax liabilities.

Interest expense is recorded in the profit and loss statement and showcases its impact on profitability during a financial period.

Furthermore, interest expense finds its place in the balance sheet, under the liabilities as outstanding interest and assets as prepaid interest. Understanding the nuances of interest expense, its capitalisation, and its implications on inflation and tax shields, provides profound insights into financial management.

Moreover, assessing interest coverage ratios unveils a company’s capacity to meet its debt obligations, highlighting its financial stability and operational efficiency. Thus, interest expense stands as a vital element of corporate finance, shaping strategic decisions and financial performance.