Whether you’re an employee or self-employed, you will most likely need to deal with income tax at some point. Income tax laws are a standard practice and the IRS requires all citizens to pay taxes on their earnings. If you’re not automatically being deducted for your taxes, there’s probably a good reason why.

Most people get an annual W-2 from their employer, which outlines how much they earned and how much they owe in taxes. There are various deductions available that can help reduce your tax burden, but it’s important to understand the rules before filing or you could end up owing more than what’s recommended. We have compiled a list of important facts that will give you an understanding of IRS laws regarding income tax, deductions and other pertinent details regarding your personal situation:

10 Important Facts About IRS Income Tax

If you earn money, you will have to pay taxes on it. The Internal Revenue Service (IRS) collects taxes for federal and state governments, and the way the system works varies somewhat depending on the type of income you have. There are two main types of taxes: income taxes and payroll taxes.

Income taxes are imposed on most types of income, and payroll taxes are imposed on your employment earnings. Income tax rates vary based on your filing status, which is determined by things like your employment status, marital status, and the number of dependents you have. Payroll taxes are withheld from your earnings. The amount of tax withheld from your earnings will vary based on a number of factors, including the amount of income you have and the number of dependents you have.

Deductions Are A Way To Reduce Your Taxes

If you earn money and have to pay taxes on it, it makes sense that you’d want to reduce your taxes as much as possible. This is where deductions come into play. A deduction is an amount that you can subtract from your gross income to determine your taxable income.

In many cases, deductions reduce your overall tax liability — which means you pay less in taxes. There are various types of deductions, but the most common ones are for things like paying for your healthcare, paying for your mortgage or rent, and making charitable donations. Deductions are outlined in the tax code and are specific to certain situations.

You’re Probably Owing Taxes If You Have An Annual W-2

If you earn a salary, you’re probably being paid on an annual W-2. If you receive a 1099, however, it means you’re self-employed and responsible for paying your taxes. As we mentioned above, the IRS requires all citizens to pay taxes on their earnings.

If you are employed, you’re most likely being deducted for your taxes through payroll. You’re responsible for submitting a W-2 form to your employer by the end of February for the previous year. Self-employed individuals are responsible for paying taxes quarterly or on an annual basis.

How To Know What Amount To Deduct?

While deductions are intended to reduce your total taxable income, you’ll need to understand what amount you should deduct. This will be dependent on your situation. We’ve already discussed that filing status and income are two important factors that determine how much you have to deduct. Another significant factor is whether you have dependents. People with dependents are eligible for deductions, whereas people without dependents are not.

IRS Penalties For Filing And Paying Late

While it’s important to file your taxes on time, it’s also important to pay what you owe. If you fail to pay your taxes, you will incur interest and penalties, and the IRS will likely take action. If you owe more than $25,000 in taxes, you are required to pay the taxes in full when you file your return.

If you owe less than $25,000, you have the option to pay in full or file a payment plan with the IRS. People who file tax returns more than 30 days after the due date are generally assessed a penalty, and the amount of the penalty is 5% of the amount owed. The penalty amount is often less than the amount of taxes owed.

Which Taxes Are Included in Income Tax?

Income taxes are the taxes that are imposed on earnings that are reported on your W-2 or Schedule C. Income taxes are calculated based on your taxable income, which is your gross income minus all allowable deductions. The taxes included in income tax are federal income taxes, state income taxes, and FICA taxes. Federal income taxes are imposed on all types of income, with rates that vary based on your filing status. State income taxes are imposed by state governments and are based on your taxable income. FICA taxes are payroll taxes that are imposed on earnings.

Standard Deductions vs. Itemized Deductions

You can either itemize your deductions or claim a standard deduction on your tax return. Most people will opt for the standard deduction, but it’s important to understand that this does not reduce your taxable income. The standard deduction is a set amount that is subtracted from your annual income, whereas itemized deductions are specific deductions that reduce your taxable income. People with higher incomes who have multiple dependents and significant medical expenses may be better off itemizing deductions.

Who is Responsible for Paying Taxes?

Generally, the person who earns the income is responsible for paying taxes. For example, if you are employed by a company and receive a W-2, your employer is responsible for paying half of the taxes owed on your salary. If you’re self-employed, you are responsible for paying all taxes owed to the IRS. This includes paying both federal and state taxes, as well as any applicable payroll taxes.

Tax Credits vs. Deductions: What’s the Difference?

Tax credits reduce the amount of taxes you owe, whereas deductions reduce the amount of income that is considered taxable. Tax credits are usually more generous than deductions, but both are extremely important in the tax process. People with dependents may be eligible for tax credits, whereas those without dependents may be eligible for deductions. Deductions are subtracted from your total taxable income, whereas tax credits are subtracted from the amount of taxes you owe.

Conclusion

Income taxes are a standard practice in most countries where people earn a regular income. The taxes you owe are based on your income, deductions, and credits. It’s important to file your tax return on time and correctly to avoid penalties.

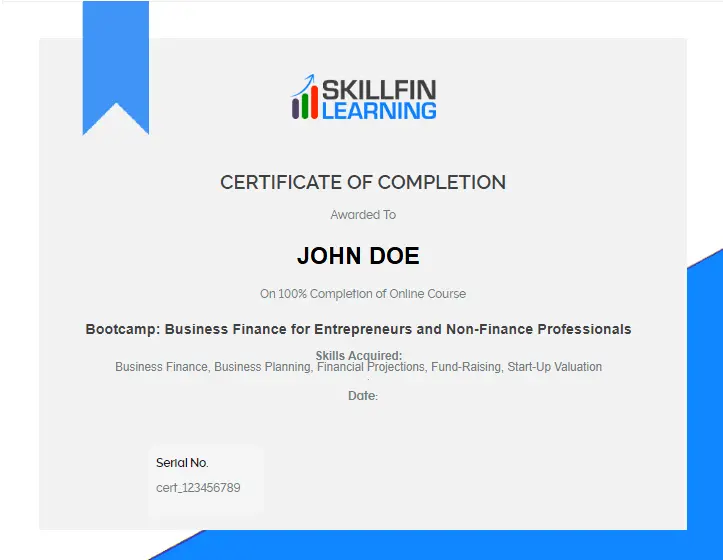

Related Courses: Start-Up Planning, Forecasting and Valuation Courses

30 thoughts on “10 Important Facts About Income Tax Laws”

… [Trackback]

[…] Read More here to that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Find More Information here on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Here you will find 33136 additional Info on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Read More Information here on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Here you can find 31361 additional Info on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Read More here on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Find More on on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Find More Info here to that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Read More on to that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Find More Information here on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Info on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] There you will find 96627 more Information on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Information to that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Information on that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] Find More to that Topic: skillfine.com/income-tax-laws/ […]

… [Trackback]

[…] There you can find 56042 additional Info on that Topic: skillfine.com/income-tax-laws/ […]

great

Thanks for the blog. Want more.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

753366 968935Extremely fascinating subject , appreciate it for putting up. 235533

908459 249119Hello, Neat post. Theres an problem together with your website in internet explorer, might check this? IE still may be the marketplace leader and a huge component to folks will omit your wonderful writing because of this difficulty. 211938

Your article helped me a lot, is there any more related content? Thanks!

509661 434245Some genuinely good and utilitarian information on this web website , likewise I believe the style and design contains superb features. 32171

318282 166255There is noticeably plenty of dollars to comprehend about this. I suppose you made specific good points in functions also. 966739

942845 438062Oh my goodness! an exceptional write-up dude. Thank you Nonetheless Im experiencing problem with ur rss . Do not know why Cannot register for it. Could there be any person getting identical rss difficulty? Anybody who knows kindly respond. Thnkx 87851